GMX: A Real Yield & Defi Primitives Launchpad

Defi composability, real yield, and 35+ protocols leveraging GMX perps protocol

The Forbidden Yield

Crypto has seen 1 million % farming rates, which proved unsustainable. Coupled with the fallout from the FTX, 3AC, Terra Luna, Celcius, and Blockfi collapses, users are now looking toward sustainable "Real Yields." In the past, users quickly piled into 20% CEX (centralized exchange) staking rates without thinking twice. Now, especially in the bear market, Defi users are more skeptical of yield and how it is derived. Institutional digital asset trading firm Genesis' recent bankruptcy is another domino to fall within the yield-bearing sector. Genesis provided one of the largest crypto exchanges in the United States, Gemini, yield for customer deposits in their Earn program. The Earn program allowed users to deposit crypto in return for yields as high as 8% on some stablecoins and other cryptocurrencies. Genesis' bankruptcy caused the loss of customer funds, and in retrospect, the 8% yield on Gemini’s Earn program was very risky. Many protocols have adopted the real yield strategy due to the growing trend of distributing fees to token holders. In this article, I will explain how GMX works and how savvy developers have harnessed the protocols tokenomics to create new Defi primitives, yield strategies, and integrations for their benefit.

What is Real Yield?

In traditional finance, real yield is the difference between inflation and interest rates. In Defi, people refer to "real yield" as the yield or profits that token holders derive from shared protocol revenues. Usually, staking (locking tokens with the protocol), the protocols governance token, is required to receive a claim on protocol revenues.

GMX

The native Arbitrum decentralized perpetuals exchange, GMX, leads the charge in total locked value (TVL) and market cap of Arbitrum Dapps. Perpetual are a crypto-native financial tool similar to futures but without a settlement date. Savvy traders can leave their long or short positions open for an extended period in exchange for paying a funding rate to keep the position open. Perpetual exchanges are great for directional trades on assets or hedging positions. GMX allows users to get up to 50x leverage on their trades on a few supported assets, including Bitcoin and Ethereum.

GMX Tokenomics

Incentive mechanisms are the key to Defi and attracting liquidity and capital to protocols. Liquidity is hard to keep within protocols since users will move to the newest shiny thing. High APR rates cause money to rotate between new Dapps and narratives. What started as airdropping and printing tokens to users for specific actions has evolved into more sustainable models of token incentive mechanisms. GMX token design rewards users with protocol fees for providing liquidity by staking tokens with the protocol. GMX employs a two-token economy, $GMX and $GLP, which facilitates value distribution from the protocol. Most GMX revenues come from a .01% fee charged to traders to borrow, open, and close positions.

$GMX

$GMX is the governance token for the GMX protocol, which grants voting rights for new proposals. Holders of GMX can also stake (lock in the contract) their tokens for staked GMX, which grants a claim to 30% of all fees charged to traders using the protocol. On both Arbitrum and Avalanche networks, traders can deploy trades, and the networks distribute fees in $ETH on Arbitrum and $AVAX on Avalanche.

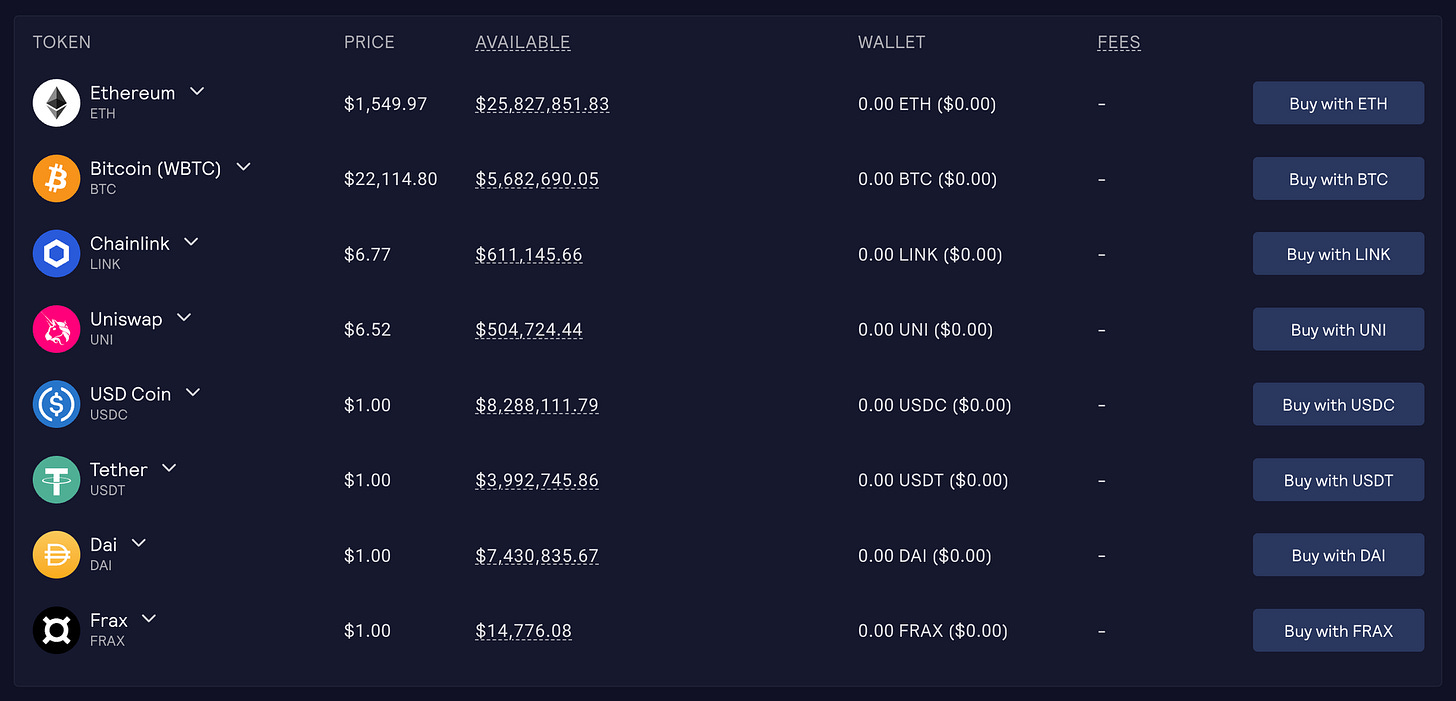

$GLP

The $GLP liquidity token, an index of assets including $ETH, $WBTC, $LINK, $UNI, $USDC, $USDT, and $DAI, is the funding source for profitable trades. Arguably more important, $GLP is the liquidity token for the GMX protocol. To mint GLP and receive rewards, traders can deposit index assets staked for protocol rewards. Rewards are distributed in AVAX or ETH, depending on the network used to mint GLP. Those who stake their $GLP receive 70% of the protocol fees from the chain where GLP was minted.

The House Always Wins

When traders win trades on GMX, the GLP pool is responsible for paying out the winnings, whereas $GLP holders on the chain where GLP was minted receive 70% of the trading fees and liquidations. GLP holders essentially serve as “the house” and provide capital for traders with the idea that most traders lose on trades. Since the launch of the GMX protocol, traders have lost more than $30m trading on the platform(wins + losses). The GLP tokenomics create a positive incentive on both sides of the trade. Liquidity providers expect traders to lose in return for stable yields, and traders have the liquidity to conduct sizable trades.

GMX composability

Other Dapps can utilize the yield-bearing assets and trading protocol of GMX, as it is a permissionless platform. Over 35+ protocols are leveraging GMX in some form, which is possible due to the ability to build on top of GMX, known as "Defi composability" or "Defi legos." Composability is essential in the rapid innovation seen in crypto because one protocol can replicate or expand on other protocols services without building the entire infrastructure from scratch.

GMX Composability Usecases

Abracadabra

For example, Abracadabra Money is a leverage and yield farming protocol with GLP vaults. On Abracadabra, users can deposit $GLP into their Auto-compounding vault, which automatically takes the yield earned and puts it back into the protocol. Abracadabra takes a 1% fee for providing this service and has become one of the largest holders of staked GLP.

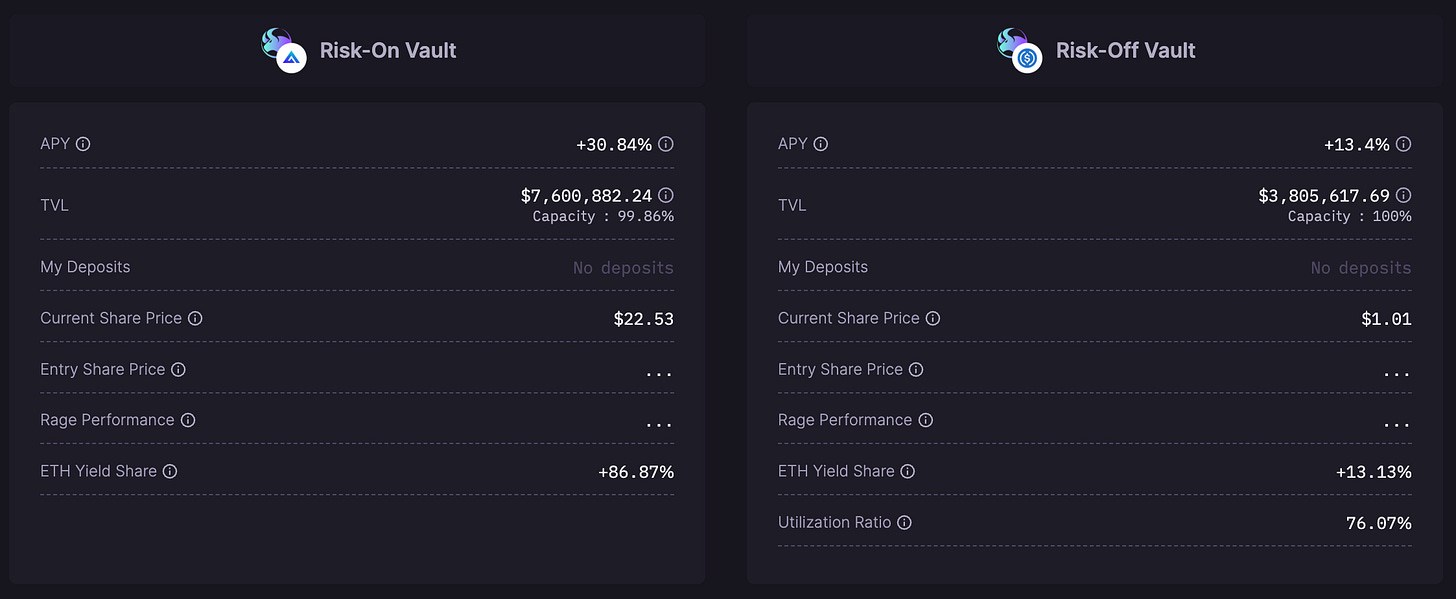

Rage Trade

Rage Trade offers delta-neutral vaults for $GLP, which allow users to earn ETH while maintaining a delta-neutral position. Rage Trade executes this strategy by shorting on Aave and Uniswap, suppressing ETH & BTC price exposure. The combination of the shorts and $GLP hedge the underlying assets in the $GLP index so that users do not suffer impermanent losses on $GLP. Impermanent loss is a risk when participating in Defi liquidity pools, where the profit gained in the pool is less than it would be from holding the assets outright. Rage Trade key innovation mostly removes this risk in exchange for slightly lower yields.

STFX

STFX offers copy-trading services to users and is built on GMX. Users can join a peer-managed trade vault by depositing USDC, and the vault owner will open a crowdfunded position for the trade strategy. Vault managers earn fees on successful trades, and the entire trading feature is built exclusively on GMX. Although vault managers use the STFX interface, the trades are routed to GMX.

Fin

At first glance, GMX is a perpetual trading protocol, but under the hood, the protocol provides developers tools for creating new Defi primitives and liquidity for external trading services. Protocol services can be optimized and specified for specific users, like how Abaracdabra, Rage Trade, and STFX have leveraged GMX differently. GMXs ecosystem of supporting Dapps proves the value in Defi composability and continues to expand.

Protocols building on GMX

Abracadabra: Algo stablecoin protocol with auto-compounding $GLP strategy

Jones DAO: Options yield and strategy vaults leveraging $GMX and $GLP

Plutus DAO: Governance token black hole, leveraging $GLP vaults

GMD Protocol: Smart Vault and Yield, built on GMX

MugenFinance: Real Yield aggregator on LayerZero, leveraging $GLP

RageTrade: Yield vault strategy protocol leveraging $GMX and $GLP

Dopex: Options Exchange on Arbitrum, with GMX integration

Umami finance: Delta Neutral vault strategies leveraging $GLP

STFX: Social trading platform built on GMX

Lyra: Optimism native options trading protocol integrated with GMX on Arbitrum

Buffer Finance: Exotic options trading platform, staking mechanism forked from GMX

Tender finance: Borrowing and lending protocol with $GLP and $GMX collateralization

Rodeo Finance: Leveraged yield farming strategies with a $GLP vault

Perpy Finance: Social trading platform built on GMX

Vovo Finance: Yield vaults with $GLP strategies

Beefy Finance: Multichain yield optimizer with $GLP vaults

Stabilize Protocol: Stablecoin stabilizing protocol leveraging $GLP pools

Vesta Finance: Stablecoin protocol on Arbitrum with $GMX and $GLP Vaults

Nitro Cartel, Arbitrove: yield-bearing index and strategy vault using $GLP vaults

Moremoney: Lending and borrowing protocol on Avalanche, with $GLP Vaults

Demex: Cosmos Defi all-in-one DEX with auto-compounding $GLP Vault

Steadefi: Optimized yield strategies with 3x leverage long $GLP Vaults

Sentiment: Lending and trading platform with $GLP vaults

Neutra Finance: $GLP Delta Neutral strategies

Olive: Real yield strategies with $GLP vault

Handlefi: Forex trading and lending protocol with ETH and BTC are routed to GMX

KostrenFinance: Yield Aggregator and Smart Vaults, with $GMX and $GLP strategies

Stardust: Yield aggregator built on GMX and $GLP

Dsquared finance: Options-based Defi vaults, integrated with GMX

Redacted, Pirex: Auto-compounding yield strategies with $GMX and $GLP vaults

Puppet Finance: social trading platform building on GMX (Coming soon)

DappsOS: Defi accessibility mobile app with GMX trading integration

MUX: Leverage trading platform with GMX trading integration

Yeti Finance: Avalanche lending protocol with $GLP vaults

Yield Yak: Avalanche Defi tools with boosted $GLP farms

Delta prime: Borrowing platform with $GLP integration

Sources

S/o @Helkem0 for the cool GMX logo used in the title banner

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are my own, not the views of my employer.