Assessing the Permissionless Lending Landscape

Morpho vs Ajna vs Euler

Introduction

The beginning of on-chain permissionless lending

The story of on-chain permissionless lending platforms starts with Rari Capital and its Fuse Platform. Released in the first half of 2021 after the fervor of DeFi summer, a period marked by the explosive growth of yield farming, Fuse quickly gained traction. This platform, a brainchild of Rari Capital, revolutionized the DeFi space by enabling users to create and manage their own permissionless lending pools, aligning with the burgeoning trend of yield optimization.

During its rise, Rari Capital embraced the (9,9) narrative, which was popularized by Olympus DAO, a strategy aimed at leveraging OHM yields. This period of growth and community-building was further amplified by Rari Capital's merger with Fei Protocol. The merger between Rari Capital and Fei Protocol in November 2021 was centered around a specific vision: to build a comprehensive DeFi platform that integrated Rari's lending protocols with Fei's stablecoin mechanisms.

However, everything came tumbling down in April of 2022 when Fuse fell victim to a reentrancy attack that led to a staggering loss of funds, estimated to be around $80 million. The incident led to intense scrutiny of Rari Capital's security practices and raised broader concerns about the vulnerability of DeFi platforms to such exploits. In the wake of this crisis, Tribe DAO, the governing body formed after the merger of Rari Capital and Fei Protocol, faced tough decisions. The pressure and challenges stemming from the hack eventually led to the shutdown of Tribe DAO and Rari Capital later in the year. This closure marked a significant moment in the DeFi space, highlighting the fragility of even the most innovative platforms in the face of security threats and the critical importance of robust, foolproof protocols in decentralized finance.

Revitalization of Permissionless Lending

In the wake of the Rari Capital hack in April 2022, and the significant Euler hack in 2023, where $200 million was compromised, the DeFi sector faced heightened skepticism, especially regarding security. Euler, known for its innovative permissionless lending protocol that allows users to lend and borrow a wide range of crypto assets, became another stark reminder of the vulnerabilities in the DeFi ecosystem. These major security breaches fueled a broader sense of pessimism across the industry, raising serious concerns about the safety and reliability of decentralized finance platforms.

However, the latter half of 2023 marked a quiet resurgence in the DeFi lending sector, beginning with the launch of Ajna in mid-July. This revival continued with the announcement of Morpho Blue on October 10, 2023. What distinguished these emerging protocols in the revitalized DeFi lending landscape was their shift in narrative from purely "permissionless" to emphatically "modular." Instead of solely focusing on the unrestricted access that permissionless systems offer, platforms like Ajna and Morpho Blue began to emphasize their "modular" nature. This approach presented them as base layer technologies, upon which third-party developers could build and customize lending use cases. This pivot towards modularity highlighted the flexibility and adaptability of these platforms, encouraging innovation and specialization in lending solutions. Alongside this modular narrative, there was also a strong emphasis on security. Ajna, for instance, differentiated itself by being oracle-less, eliminating reliance on external price feeds and thereby reducing points of vulnerability. Morpho Blue introduced the concept of "permissionless risk management" delegating the responsibility to 3rd parties to pick and choose the lending markets with the most risk-adjusted return.

State of Affairs Today': DeFi Liquidity is Back

As we enter 2024, there’s a noticeable buzz within crypto at large and DeFi. This resurgence is often attributed to new mechanisms of token distribution, a theory popularized by Tushar from Multicoin. His theory is that each crypto bull market is sparked by innovative token distribution methods. In this current market, the concept of 'points' has become a significant driver, with platforms like Eigenlayer leading the charge through their restaking ecosystem. This method is not only drawing renewed interest but is also shaping the dynamics of the market. Concurrently, the diversity of on-chain asset types is expanding, which adds depth to the DeFi ecosystem.

With all that said, it is imperative that we have the necessary lending systems and infrastructure in place as institutions and degens alike will seek on-chain leverage. While established protocols like Compound and Aave have facilitated billions of dollars in transactions, their limited capacity to accommodate diverse collateral types necessitates the emergence of alternative on-chain lending platforms. Over the past 1-2 years, the landscape has witnessed the rise of new lending protocols such as Morpho, Ajna, and Euler, each vying for a share of the on-chain lending market. Furthermore, we’ve witnessed the surge of NFT lending protocols like Metastreet and Blur. This essay aims to explore the narratives and functionalities of these projects, providing readers with insights into their respective differences and contributions as we look ahead.

Morpho Protocol

Morpho’s Origins

Morpho's origin story and the decision to develop Morpho Blue are rooted in the protocol's initial success and a deep understanding of the limitations within the DeFi lending space. Launched by Paul Frambot and his team at Morpho Labs, Morpho quickly rose to prominence, becoming the third-largest lending platform on Ethereum with over $1 billion in deposited assets within a year. This impressive growth was driven by Morpho Optimizer, which operated on top of existing protocols like Compound and Aave, enhancing their interest rate model efficiency. However, Morpho's growth was eventually constrained by the design limitations of these underlying lending pools.

These realizations led to a rethinking of decentralized lending from the ground up. The Morpho team, with their extensive experience, recognized the need to evolve beyond the existing model to achieve a new level of autonomy and efficiency in DeFi lending. This evolution gave birth to Morpho Blue. Morpho Blue was envisioned to address several key issues in DeFi lending:

Trust Assumptions: The protocol reduces trust assumptions by allowing more decentralized and dynamic risk management. This addresses the issue of numerous risk parameters that need constant monitoring and adjustment, which can be a primary cause of security breaches.

Scalability and Efficiency: By moving away from the DAO-style management model, Morpho Blue aims to enhance scalability and efficiency. This includes addressing capital efficiency and rate optimization issues inherent in current decentralized lending models.

Decentralized Risk Management: Morpho Blue focuses on permissionless risk management, enabling a more transparent and effective approach to handling risks in lending platforms.

The development of Morpho Blue represents a significant shift towards building more unopinionated and trustless lending primitives in DeFi. This shift is complemented by the potential for building abstraction layers on top of these primitives, allowing for a more resilient, efficient, and open DeFi ecosystem at its core.

Morpho Blue (& MetaMorpho) - Protocol Analysis

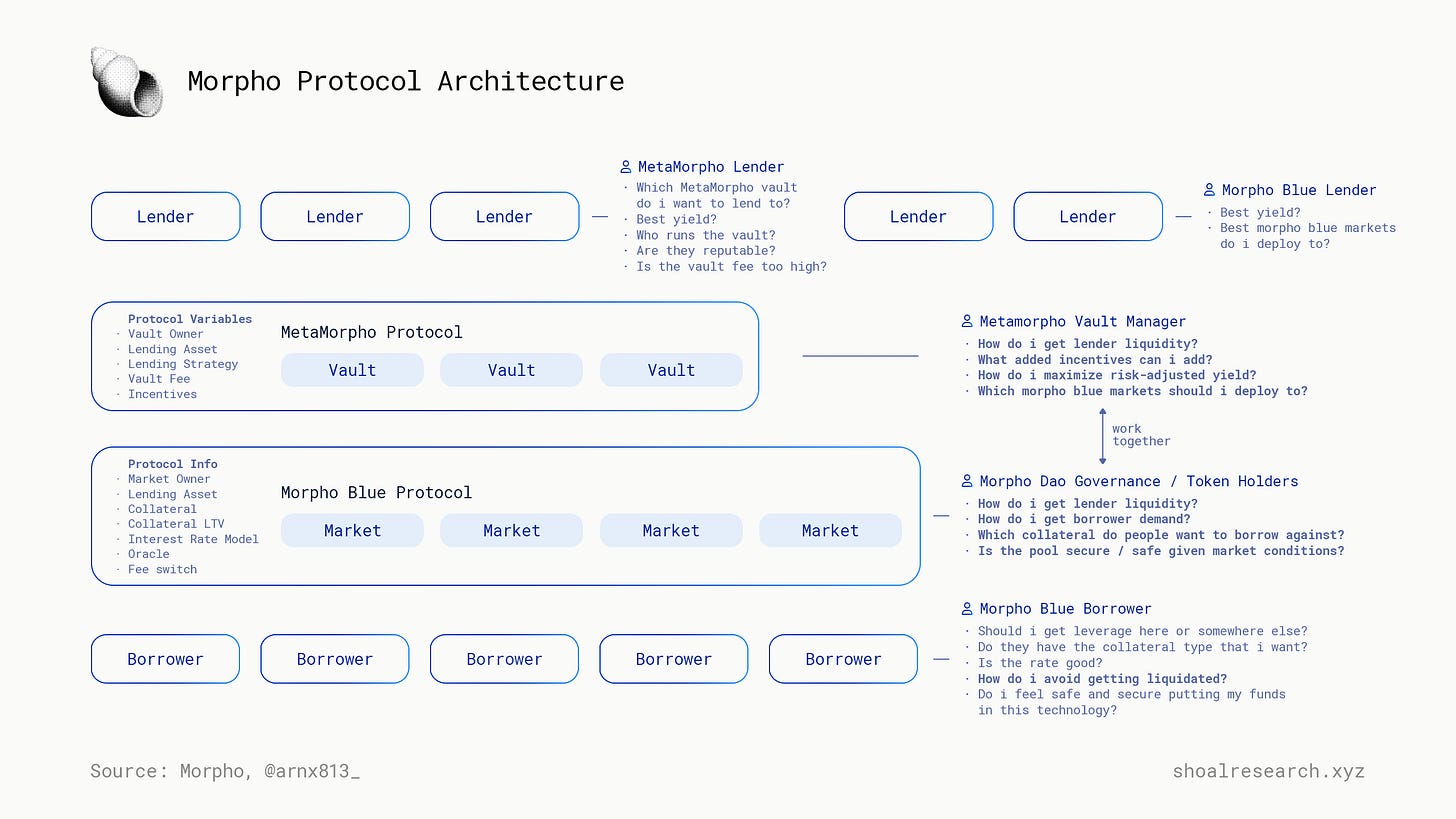

The Morpho protocol operates on two distinct layers: Morpho Blue and MetaMorpho, each serving a unique function within the ecosystem.

Morpho Blue is designed to allow anyone to permissionlessly deploy and manage their own lending market. A key characteristic of each Morpho Blue Market is its simplicity and specificity: it supports only one collateral asset and one loan asset, along with a defined loan-to-value (LTV) ratio and a specified oracle for price feeds. This framework ensures that each market is straightforward and focused, making it accessible for a wide range of users. Morpho Blue is also governance-minimized, featuring a concise and efficient codebase with just 650 lines of Solidity, enhancing its security and reliability. Additionally, Morpho Blue includes a fee switch, governed by $MORPHO token holders, which adds a layer of community-driven oversight to the protocol.

MetaMorpho, on the other hand, introduces the concept of lending vaults, which are managed by third-party 'risk experts.' In this layer, lenders deposit their funds into a vault, and the vault manager is responsible for allocating this liquidity across various Morpho Blue markets. This approach allows for a more sophisticated and dynamic management of funds, leveraging the expertise of specialized managers to optimize returns and manage risks. The core innovation of MetaMorpho lies in its product standpoint and developer-friendliness. It creates a platform where third-party developers can build on top of Morpho Blue infrastructure, adding an additional layer of versatility and innovation to the Morpho ecosystem.

Steakhouse Financial Case Study

Steakhouse Financial, led by Sebventures, stands as a prime example of how the Morpho Blue ecosystem can be leveraged effectively. This crypto-native financial advisory for DAOs has made significant strides in the DeFi space with its innovative approach to lending. Since January 3, Steakhouse Financial has been managing a USDC MetaMorpho vault with a TVL of $12.8M. This vault is focused on primarily stETH and wBTC. In the future, Steakhouse has expressed interest in supporting Real-World Assets (RWAs) collateral.

The Four Actors in Morpho’s Ecosystem

There are four primary factors in the Morpho Ecosystem given its current development: MetaMorpho lenders, Morpho Blue Lenders, borrowers, MetaMorpho vault managers, and Morpho governance / Morpho labs (kinda the same rn… i think)

Below is an updated visual of the complete Morpho protocol architecture , annotating the actors and their objectives / thought process

Morpho Growth Playbook

Morpho has distinguished itself through a blend of powerful branding and business development execution excellence. While other lending projects have come about, including Ajna, Midas, Frax Lend, and Silo Finance, Morpho has risen to the top in terms of TVL traction. The protocol, while inherently permissionless, is abstracted away with a permissioned Morpho UI. This curated user interface is a testament to the team’s commitment to maintaining a brand synonymous with trust, by selectively showcasing only the best lending markets and partners. This nuanced approach - selling the allure of a permissionless protocol while effectively gating its frontend to highly reputable entities - ensures that Morpho Blue is a beacon for quality and reliability within a DeFi space that can seem risky and unstable.

Building upon the previous points, Morpho has invested a great amount of time and energy in the end user experience. Morpho has developed a clean and intuitive UI/UX, streamlining the interaction for end users and lending operators alike. This is not the case for many DeFi lending protocols that still give off a gimmicky vibe. Furthermore the development of abstraction layers such as MetaMorpho, simplifies the appeal. Morpho Blue's nuanced strategy of balancing permissionless innovation with a permissioned, brand-centric frontend is impressive. This approach not only underlines the adaptability and flexibility of Morpho as a platform but also positions it as a leader in fostering specialized and secure lending solutions in the DeFi arena.

What has Morpho done well? What needs improvement?

Good: Strong personal branding of team members such as Paul and Merlin, enhancing credibility and visibility.

Good: Effective ecosystem building by selling the simplicity, building abstraction layers like MetaMorpho and locking in 3rd party lending operators like Steakhouse, B Protocol, Block Analitica, and Re7 and locking in token incentives (e.g stETH) for select lending markets.

Good: Strong existing product and branding from its optimizer product, which provides great leverage for Morpho Blue to succeed.

Needs Improvement: Unit economics for 3rd party risk managers needs improvement. Block Analitica at $45M AUM yields a $70k revenue, without taking into engineering costs, legal costs, and risk management costs.

Ajna, Oracle-Free Markets

Ajna’s Origins

Ajna was founded by several ex-MakerDAO team members who recognized the scalability and risk issues in previous generation borrowing and lending protocols. Oracle dependency and Governance were both limiting factors for growth and major sources of risk. The key idea was to outsource the Oracle functionality to the lenders and liquidators themselves. The vision was to create the Uniswap of borrowing and lending, an immutable protocol that can scalably support virtually all assets, including long tail assets and NFTs. The original and innovative design came about as a result of over two years of development that included over ten code audits.

The origin story of Ajna Finance is deeply intertwined with the broader desire for security and robustness within the DeFi ecosystem in 2023. This is highlighted by Dan Elizter’s article on the need for oracle-free protocols in DeFi (read here). Elitzer, founder of Nascent VC and a prominent figure in the DeFi community, outlines the persistent security challenges plaguing DeFi and the billions lost to hacks, stressing the necessity for a fundamental rethinking of DeFi protocol design and security.

The Ajna Protocol emerges as a compelling solution in this context. Launched in mid-July of 2023, Ajna’s design philosophy aligns with Elitzer’s vision of what he describes as a true DeFi primitive: a protocol that operates with zero dependencies such that it is trustless, including the absence of governance, upgradeability and oracles. This type of approach reduces the theoretical attack surface and inherent risks within a protocol.

Ajna - Protocol Analysis

Ajna stands out in the DeFi landscape for its unique approach to lending and borrowing. It is a non-custodial, permissionless system that operates without the need for oracles or governance, ensuring a high degree of decentralization and autonomy. Ajna allows for the creation of markets with a specific collateral and loan asset, simplifying the process and enhancing user accessibility. The platform supports a wide array of assets, including both fungible and non-fungible tokens (NFTs), thereby expanding the scope of collateral types beyond what is typically seen in DeFi. Ajna’s distinctive features include the facilitation of unique borrowing cases like NFT borrowing and shorting markets, without the common limitations of other platforms.

The Three Actors in Ajna’s Ecosystem

There are three primary factors in the Morpho Ecosystem given its current development: Ajna lenders, Ajna borrowers, Ajna governance / tokenholders.

Ajna Growth Playbook

Following a significant security bug in the latter half of 2023, Ajna took a clear hit in its security-oriented brand. Following the relaunch, the project has returned with the pursuit of complete decentralization, severing any ties with a centralized labs company. Now, they are a fully decentralized DAO and protocol.

Rebooting DeFi protocols is tough, and it’s never a good look. While Ajna has experienced a setback, they’ve come back with a re-audited (5x) protocol that has two clear selling points: fully decentralized and oracle-less. Ajna’s playbook is leaning completely into the DeFi-native brand.

Now, the longer term questions are the following:

What lending use cases does Ajna uniquely unlock that allows it to be differentiated from Morpho and other competitors?

How effective will decentralized DAO coordination work out for Ajna as they try to execute their growth and BD playbook?

Euler, Rising From The Shadows

Euler’s Origins

The Euler Protocol, emerging as a next-generation DeFi lending platform, represents a significant evolution from first-generation protocols like Compound and Aave. Established as a decentralized service, Euler addresses a critical gap in the DeFi market: the lack of support for non-mainstream tokens in lending and borrowing services. Recognizing the unmet demand for borrowing and lending long-tail crypto assets, Euler offers a permissionless platform where almost any token can be listed, as long as it is paired with WETH on Uniswap v3.

The Euler Protocol distinguishes itself in the DeFi lending space through several key innovations:

It employs a unique risk assessment approach that considers both collateral and borrow factors for assets, enhancing the accuracy of risk evaluation.

Euler also integrates Uniswap v3’s decentralized TWAP oracles for asset valuation, supporting its permissionless ethos by enabling diverse asset listings.

Furthermore, the protocol introduces a novel liquidation mechanism resistant to MEV attacks and a reactive interest rate model that adjusts autonomously to market conditions.

These features, along with the implementation of sub-accounts for user convenience, position Euler as a sophisticated and adaptable platform in DeFi lending.

Unfortunately, on March 13 of 2023, Euler Finance would experience one of the largest DeFi hacks ever. The March 13 flash loan attack led to losses exceeding $195 million and triggered a contagion effect, impacting numerous decentralized finance (DeFi) protocols. Beyond Euler, at least 11 other protocols suffered losses as a result of the attack.

Post-hack: Euler V2

After a silent year, Euler returned with its v2 as of February 22, 2024. Euler v2 is a modular lending platform with two primary components: Euler Vault Kit (EVK) and Ethereum Vault Connector (EVC). The EVK enables developers to create their own customized lending vaults; it can be described as a vault development kit that makes it easier to spin up vaults with Euler’s opinionated tech framework. The EVC is an interoperability protocol that enables vault creators to connect their vaults together such that they developers can more efficiently chain vaults together to pass information and interact with one another. Together, these two technologies act as base layer lending infrastructure.

There will be two primary types of Euler vaults

Core: Governed lending markets similar to Euler v1, managed by the DAO

Edge: Permissionless lending markets with greater flexibility of parameters. Pooled lending experience rather than 1:1 like Morpho Blue or Ajna

Euler’s Branding Strategy

Similar to Ajna and Morpo, Euler is leaning heavily into the “modular” lending narrative, seeking to build a permissionless base layer lending protocol that 3rd parties can come and utilize. However, Euler differs significantly in its public-facing marketing and branding. Unlike Morpho, which has taken an incredibly abstracted and simplified approach, Euler leans heavily into its feature-rich technology as key selling points of the brand and technology. Some of the features that it highlights are advanced risk management tools like sub-accounts, PnL simulators, limit order types, new liquidation mechanisms (fee flow), and more.

Who is Euler’s end user and what is their end product?

Euler offers an incredibly powerful feature set and novel features that surpasses Morpho Blue (e.g sub-accounts, Fee Flow, PnL simulators, and more). The question remains: is Euler selling its lending infrastructure to 3rd party lending operators or are they spinning out their own lending markets? These are two very different opportunities with a different set of customers. If Euler is competing with Morpho to attract 3rd party lending operators, how easy is it to build abstractions on top of Euler v2? Euler misses the notion of a "pool manager" abstraction primitive equivalent to MetaMorpho, yet they seem to want to replicate what Morpho is doing with 3rd party pool operators.

Is the 1% protocol fee a good idea at launch?

At launch, Euler is enforcing a minimum 1% protocol fee derived from the vault governor. This can be a significant mental blocker, as fees are killers in a growth phase. On the other hand, Morpho has a pact where their business source license terms are connected to the fee mechanism: if the fee is charged the code becomes open source (and therefore free to fork).

Moving Forward

As the lending landscape seems to achieve maturity relative to other more novel aspects of DeFi like liquid staking and retaking, one is likely to question where the innovation lies and what might lie ahead for one of DeFi’s more established sectors. However, to argue that lending is one of the only areas in DeFi that has achieved true product market fit in a way that has (for the most part) avoided ponzi-nomics would be a fair argument to make. This is to say that the innovation will almost inevitably follow where the product-market-fit lies, so if the past can be any indicator of the future, lending in DeFi is sure to see evolution in the coming cycles.

Throughout this paper, we have discussed multiple new primitives in the lending space from companies including Ajna, Morpho, and Euler. The overarching theme of all three of these new lending primitives is not only permissionless market creation but also permissionless market creation in a user-friendly, user-centric way. Yes, prior to these three protocols, one could spin up one’s own lending pool/protocol, but it was not user-friendly. In this next cycle of DeFi lending, we are keeping an eye not only on the permissionless side (which seems to be the obvious direction that protocols are trending) but also the user-experience side. Companies like Summer.fi are creating new lending experiences (and DeFi experiences at large) to allow for a simpler DeFi experience. These will likely continue to gain traction as their integrations increase, and their experience becomes simpler than going directly to the frontends hosted by the creators of various lending protocols. As the focused on intent-based protocols rise, intent-based lending or borrowing (in a similar way to how Morpho aggregates between Aave and Compound) could prove to be another future primitive in lending: just input what you want to borrow, and this new primitive will find the best, risk-adjusted opportunity.

In a similar vein, creating a market in a permissionless manner is sure to become simpler as well. Currently, Morpho is engaging with three sophisticated parties (B Protocol, Block Analitica, and Steakhouse Finance) to operate their new permissionless markets, but soon this, too, like the lending experience itself, which is already permissionless, will become more user-friendly for any user to accomplish. This ability for any user to create a market will allow for a Cambrian explosion of innovation in lending with everything from new asset types as collateral (assets like LRTs, RWAs, etc) to new structured products focused on various yield opportunities. Many of these markets will surely fail, but the robust nature of the underlying protocols will eliminate cross-contamination, allowing the market to determine winning and losing markets.

Sources

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure - All reports are the authors own, not the views of their employer.