Behind the Numbers: Investigating the Largest DEX Volume Days

The Biggest DEX Volume Spikes and what caused them

Preface

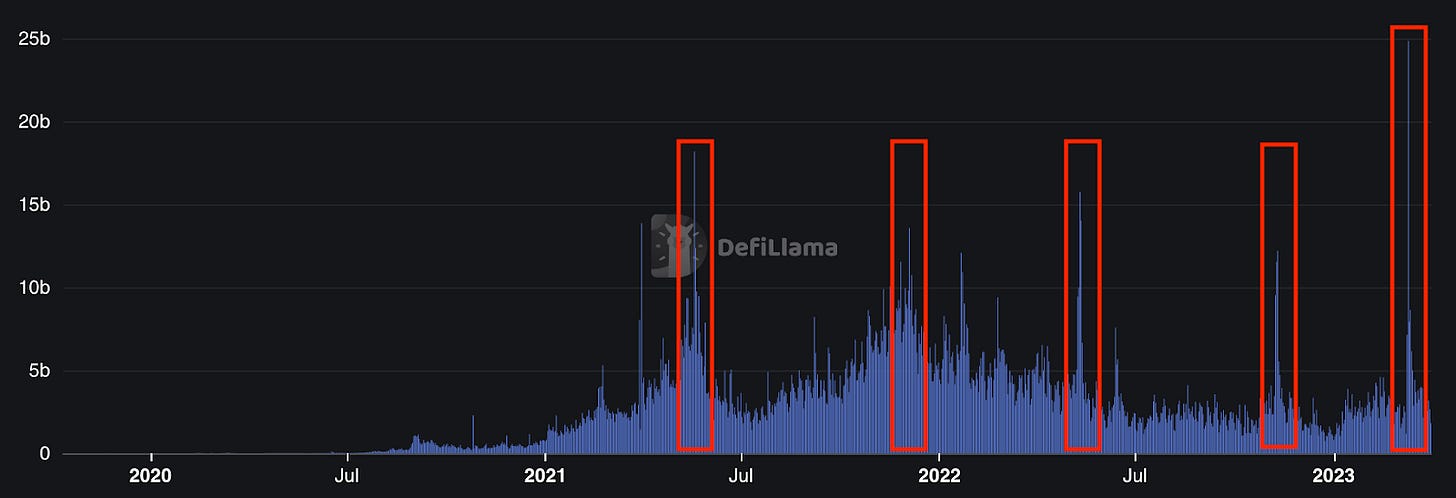

Decentralized exchanges (DEX) are the heart of crypto ethos. They allow users to facilitate trading among market participants without needing to know the counterparty or intermediaries in a trustless environment. The implosion of centralized exchanges (CEXs) like FTX, Celsius, and Voyager has incentivized users to rely more on-chain products and highly regulated or transparent CEXs. Over the last few weeks there has been a steady incline of DEX activity, with volumes in March 2023 topping 2022 monthly highs. When we look at volumes charted across the daily time interval, we can see large clear spikes in trading activity. You might assume these events are triggered by euphoria and bull market buying. But it’s just the contrary: the 5 largest DEX volume days have all been on the same days as crypto meltdown events.

In this paper, we will dig into the largest DEX volume days and uncover the catalyzing events that led to these record-setting days. We can use DefiLlama’s DEX aggregator to uncover the days with the highest volumes, then research specific days to identify the catalyst and narratives that drove these spikes.

Largest DEX Volume Days

Starting from the largest and concluding with the 5th largest DEX volume day, we will examine these events based on the magnitude of the volume changes. This approach enables us to perceive that the order is not a linear, chronological sequence by date but rather by the intensity and influence of the significant events.

1. USDC Depeg After Banking Scare (Mar 11, 2023)

The day following the $USDC Depeg (USD Coin), March 11th, 2023, marked the largest DEX volume day recorded to date, leaving both institutional and retail players both scrambling to hedge their portfolios as USDC moved further down from $1.

Bank-run concerns surrounding banks that held custody of $USDC caused so much concern that centralized entities intervened, Circle, SVB, and the government, to restore market confidence.

In addition, large actors like Crypto hedge funds and VCs, were swapping between stablecoins, looking to profit from 1:1 USDC redemptions.

While some investors were frightened away, others tried to profit on the arbitrage opportunity. Many institutions were swapping between stablecoins and redeeming USDC for fiat currency.

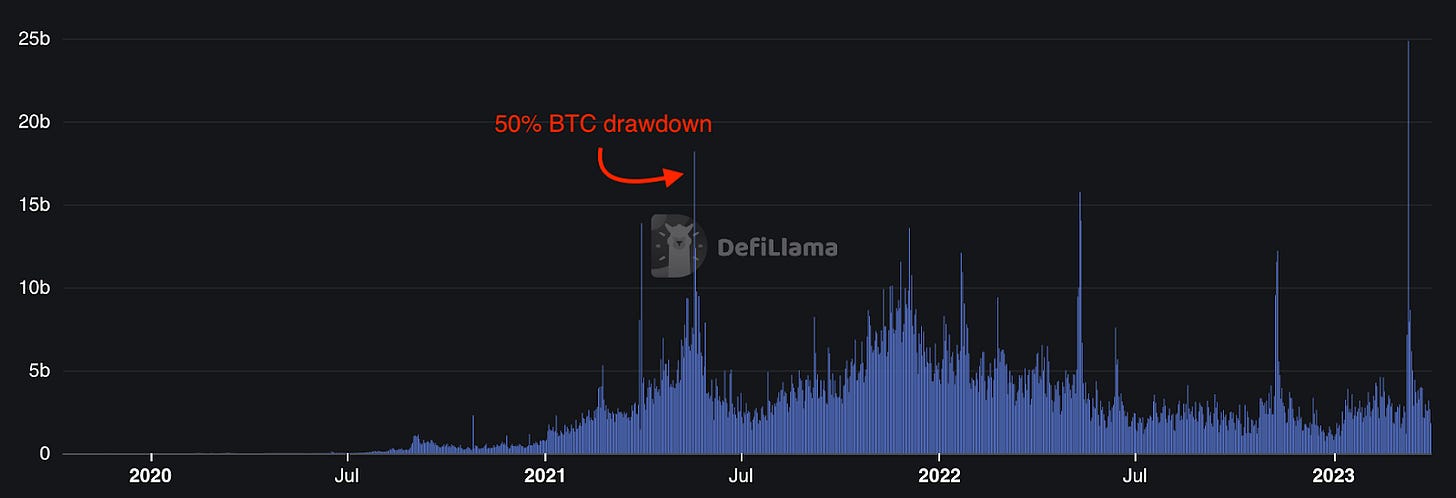

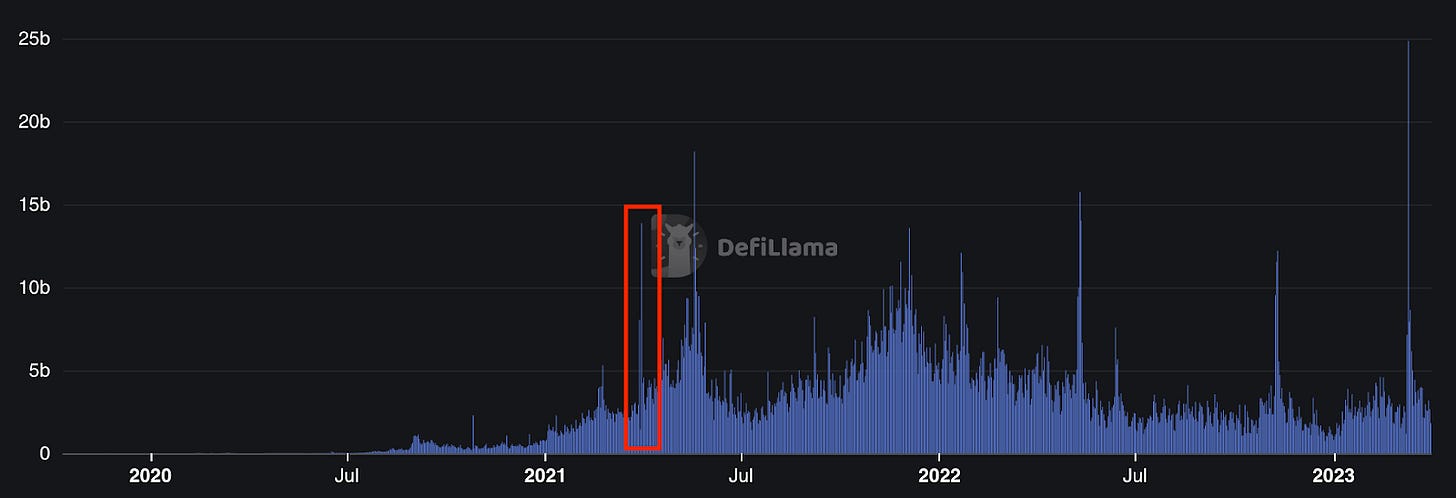

2. 50% Drawdown of BTC (May 19th, 2021)

During the last bull run, the second largest DEX volume day occurred on May 19th, 2021, in tandem with a steep 50% drop in BTC's value, from $60,000 in just a few days. On this day alone, BTC experienced a 30% drawdown, which led to DEX volumes to spike over $18B.

3. Collapse of Terra Luna (May 11, 2022)

Then, the collapse of Terra Luna, one of the leading blockchains at the time, triggered the third largest decentralized exchange (DEX) volume day in history, with over $15 billion in trading volume for the day. Terra Luna's native stablecoin, UST, played a significant role in this event. Before the collapse, UST had a thriving market capitalization (market cap), with tens of billions of dollars supporting the Terra ecosystem.

Within a matter of days, a substantial portion of UST's market cap was wiped out, causing a ripple effect throughout the cryptocurrency market. This rapid evisceration of UST's market cap led to further contagion among over-leveraged large institutions, such as 3AC. As these institutions scrambled to mitigate their losses, the wider cryptocurrency market faced increasing instability and uncertainty.

4. Start of Bear Market in 2022 (Dec 4, 2021)

To fully understand these financial events, we need to go back in history. The beginning of the bear market in 2022 can be traced back to December 4th, 2021, a day that saw DEX volumes reach their fourth-highest level in history, peaking at $13.5 billion. Surge in trading activity coincided with a significant 22% single-day drop in the value of Bitcoin (BTC), a precursor to the start of the bear market decline. As market participants witnessed the sharp decline in Bitcoin's value, many started to exit their positions to minimize potential losses.

The BTC decline marked the start of a broader bear market decline, as the cryptocurrency market shifted from a period of bullish growth and optimism to one characterized by pessimism and sharp drops in asset values. Market participants' rush to exit their positions intensified the downward pressure on cryptocurrency prices, further exacerbating the bearish sentiment and price moves. In hindsight, it was clear many were heading for the door.

5. FTX Collapse (Nov 10, 2022)

As the bear market continued to strangle the crypto community, the FTX collapse on November 10, 2022, marked a significant event in crypto history, triggering a cascade of on-chain selling reverberating throughout the market. As a major trading platform, FTX's downfall profoundly impacted investor sentiment and trading activity. In the aftermath of the collapse, DEX volumes surged, reaching over $12 billion on November 12, 2022.

Market participants seeking to mitigate their losses and exit their positions in the face of the FTX collapse drove this heightened trading activity. You can see here the interconnectivity of the Centralized Exchange (CEX) markets and the potential for major events to have far-reaching consequences on-chain.

Why does DEX volume spike on these days?

The combination of on-chain liquidations, selling, and traders fleeing into stablecoins can cause a tremendous spike in trading volume. These spikes in volume are often accompanied by widespread panic among users, who seek the stability of stable pairs on-chain. Interestingly, these spikes in volume appear to loosely correlate with the flows of "smart money," or top traders identified by Nansen, a leading provider of on-chain data and analytics for digital assets. This suggests that larger, more experienced investors' actions may contribute to the overall market trends during these periods of volatility.

Data Outliers

Many of our readers might be wondering, "What about March 31, 2021?" given the volume charts show a significant spike early in the DEX volume data. At the time, Uniswap dominated DEX trading volume, but there were concerns over the accuracy of the reported $13.8 billion due to a discrepancy in how the volume was recorded. A few DeFi applications found a way to exploit Uniswap's volume stats using a rebasing mechanism. Crypto media outlets like Decrypt also reported volume spikes, with the culprits likely being token projects looking to maliciously forge trading volumes.

Hayden Adams, the founder of Uniswap, stated that they will make efforts to clean up the data around the event date to ensure a more accurate representation of trading, as it is highly likely that this data does not represent realistic trading volume.

Fin

Nothing gets money moving on-chain more than fear. This explains why the largest DEX volume days are often triggered by significant events in the cryptocurrency market, such as a collapse of a major exchange or a sharp drop in the value of Bitcoin. These events cause widespread panic, leading users to flee to stablecoins and other assets, resulting in spikes in DEX trading activity. However, despite the volatility in the cryptocurrency market, the popularity of decentralized exchanges continues to grow as users seek to facilitate trading among market participants in a trustless environment.

Within the last few weeks, Binance and Coinbase became targets of regulatory action. Since then, there has been little price impact on $BTC and $ETH in the short term. The crypto space is exceptionally resilient, and although these significant events have taken place, the space continues to grow.

Hopefully, this small dose of fresh hopium lets us sleep at night.

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are my own, not the views of my employer.