Berachain: Building Sticky Liquidity

A case study in Meme-to-Product strategy

A special thanks to Bera Rodman of Kodiak Finance and 0xRaito of Infrared Finance for their feedback 🐻 ⛓️

Key Takeaways

Berachain offers a novel consensus mechanism that optimizes liquidity performance while remaining EVM-compatible.

Proof of Liquidity builds on top of the classic Proof of Stake mechanism to address issues typically associated with PoS Networks: stake centralization, limited opportunities to enhance chain security, and minimal incentives for validators.

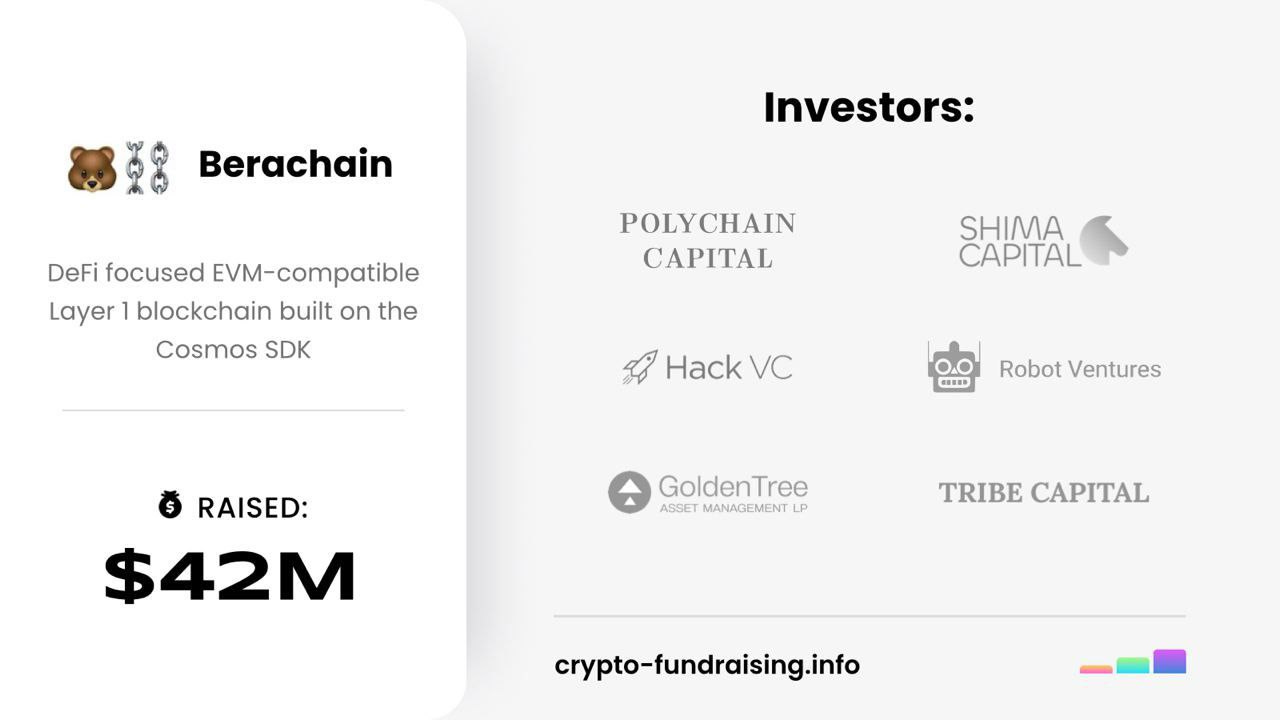

The anonymous developer team behind Berachain has successfully raised $420 million at its latest valuation. Investors include Polychain, Shima Capital, dao5, Hack VC, Robot Ventures, Tribe Capital, and GoldenTree Asset Management.

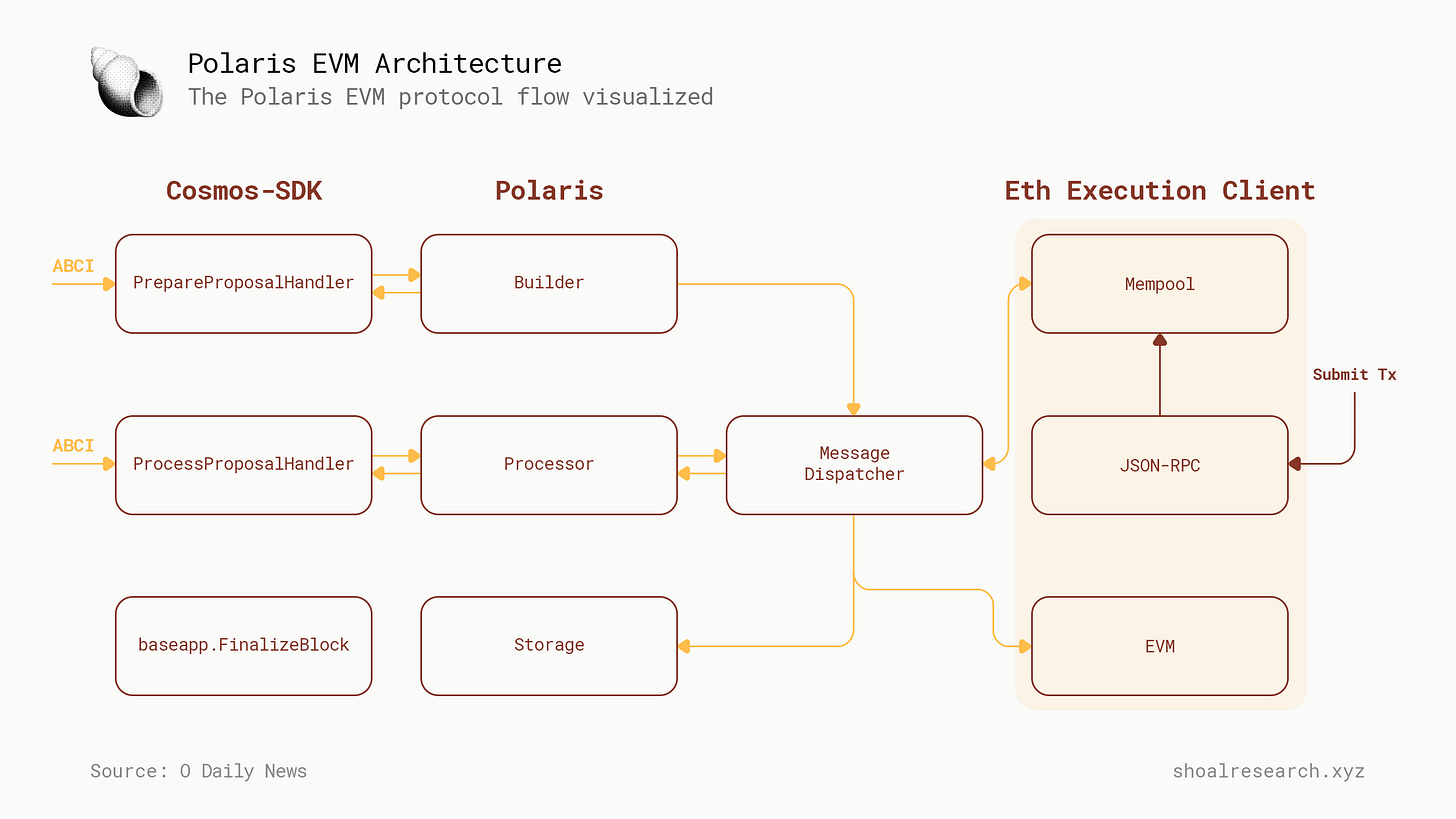

Berachain utilizes the Polaris EVM, specifically designed by the team to easily separate the EVM runtime layer to develop stateful precompiles and custom modules that can be used to create more efficient smart contracts.

The Berachain Tri-Token Model consists of three tokens: $BERA for gas, $BGT for governance, and native stablecoin $HONEY.

On January 11, 2023, Berachain announced its public testnet "Artio" , which managed to attract over 300k users and facilitated over 1M transactions within the first 48 hours of launching Artio. Currently, Infrared, Kodiak, and Beradrome stand as the foundational protocols on Berachain.

Introduction

In the realm of crypto, we encounter several distinct groups: developers, investors, innovators, influencers, degens, and more. The primary point of contention has always revolved around whether individuals are drawn to technology and innovations or to memes and speculation. However, now both groups can coexist and find value within the Berachain Blockchain.

On one hand, Berachain offers a novel consensus mechanism that optimizes liquidity performance while remaining EVM-compatible. This is achieved through the Polaris modular EVM framework, providing the execution environment for smart contracts on Berachain. On the other hand, the project's anonymous developer team, creators of a bear-themed project, has successfully raised $420 million at its latest valuation. This, in itself, is an exciting feat fueled by memetic appeal. While most memes merely serve as fodder for speculation, Berachain strives to bridge the gap between hype and substance, offering the best of both worlds: memes and technology.

In this article, we will delve deeper into the Berachain Ecosystem, exploring the unique culture it has fostered, its history, and the technology powering this innovative narrative.

Chain Ethos

It is no secret that the Berachain community is one of the most recognizable and enthusiastic among all communities. You won't find as many people on Twitter being avid fans of Bera, its updates, memes, and more. But how did it become this way?

The answer lies in the concept of a cult. In medieval times, cults played crucial roles in power struggles. Originally, "cult" referred to those who glorified a saint, but now it signifies ancient or primitive religious practices. There's a narrative suggesting that cults thrive in bear markets. The Link (Chainlink) marines, with their frog pfps, memes, and low entry barriers, exemplify this. In the Berachain ecosystem, cult dynamics extend beyond JPEG prices, contributing to its growth.

Core contributors of Bera drive collaborative intelligence, while the larger community contributes vital collective intelligence through ideas, comments, memes, and unique creativity. This fusion historically makes open source communities vibrant. All cult (community) members benefit from the success of the cult; moreover, they are all a financial part of the cult. The key thing is that cultists don't have a single portrait—whether you are the smartest developer in the world or a GM poster, you're still a part of the cult.

Because Bera drives the memetic culture, everything not related to the technology is considered a meme. So even if FUD starts, Bera can still benefit from that.

Despite debates over technical merit, the crypto space tends to favor meme coins. BERA, a coin with real use cases and various benefits, enters this landscape with a distinctive presence.

Labeling Berachain merely as a meme with a cult following would significantly underestimate its significance. Consider the narratives that Crypto Twitter likes – well, Berachain has them all. Now, let's delve into the various technical innovations taking place within the Berachain ecosystem.

Technology behind Berachain

Berachain stands as a high-performance blockchain compatible with the Ethereum Virtual Machine (EVM), employing the innovative Proof-of-Liquidity consensus mechanism. This novel approach in consensus aims to align network incentives, fostering synergy between Berachain validators and the ecosystem of projects. The technological foundation of Berachain is established on Polaris, a cutting-edge blockchain framework designed for constructing EVM-compatible chains, leveraging the CometBFT consensus engine.

Berachain is built on top of the Cosmos-SDK, which encompasses identical tooling and operations. Moreover, it incorporates additional functionalities embedded within the chain, specifically tailored to optimize for proof-of-liquidity. Furthermore, Berachain utilizes Polaris EVM, which was specifically designed by the team themselves to easily separate the EVM runtime layer to develop stateful precompiles and custom modules that can be used to create more efficient smart contracts.

Precompiles

Precompiles, also known as precompiled contracts, constitute a distinctive class of smart contracts with functionalities directly integrated into the EVM, rather than executing as bytecode. Each precompile is assigned a specific address, and the associated gas fees for executing these contracts are predetermined. In the context of Berachain, this mechanism is primarily employed to facilitate enhanced functionality on the chain, enabling direct interaction with various Cosmos modules that would otherwise be inaccessible outside the EVM. Berachain's precompiles incorporate certain EVM precompile contracts from Polaris, with some additional ones to enhance functionality further.

Proof-of-Liquidity

The economic model of Berachain represents an innovative approach to blockchain governance, seeking to address the pivotal challenges encountered by decentralized networks. This model centers around three objectives:

Liquidity Building

Stake Decentralization

Aligning protocols and validators

Proof of Liquidity builds on top of the classic Proof of Stake mechanism to address the problems usually associated with PoS Networks: stake centralization, almost no opportunity to improve the security of the chain, and little incentives for validators. Let's walk through it.

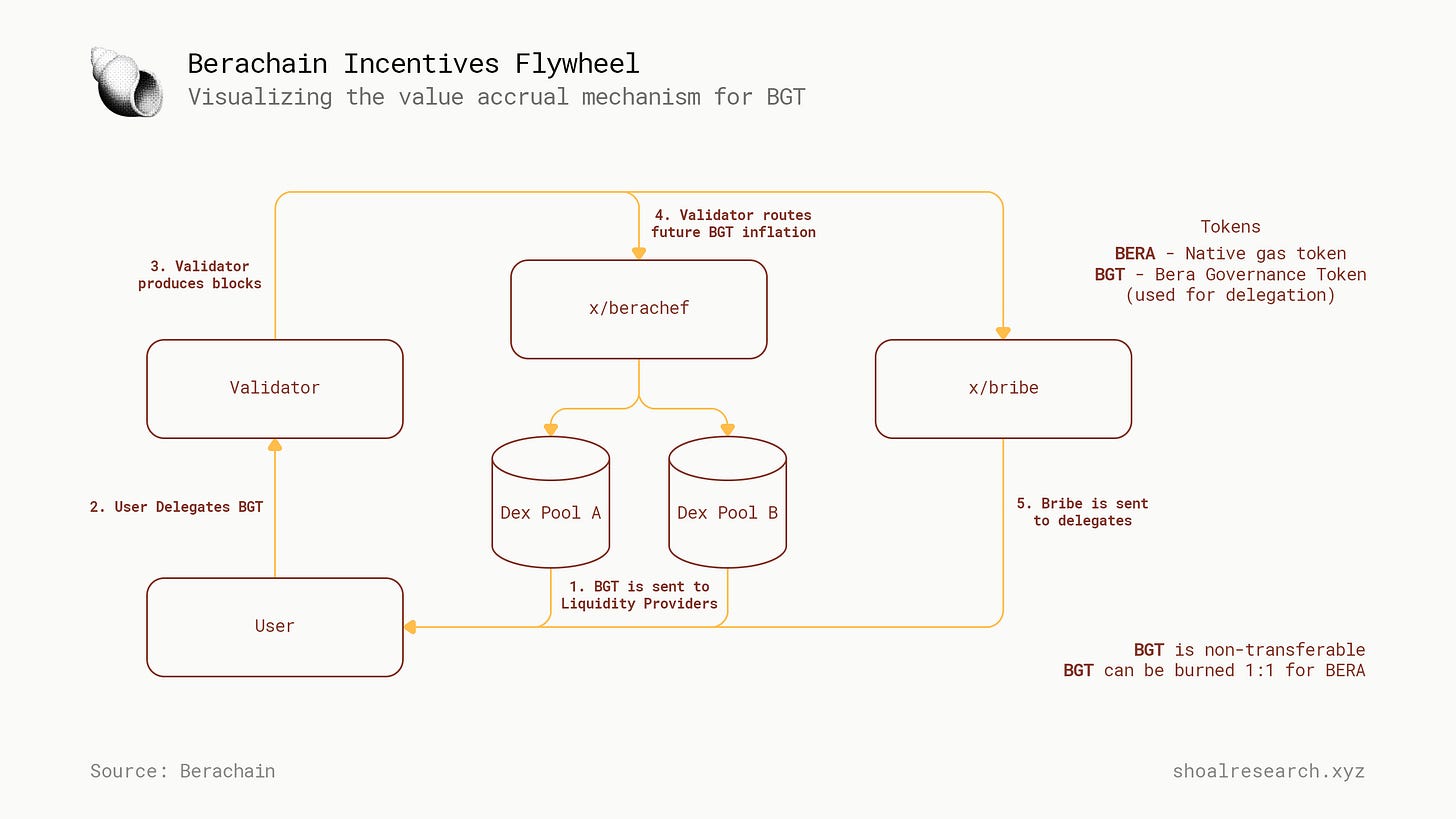

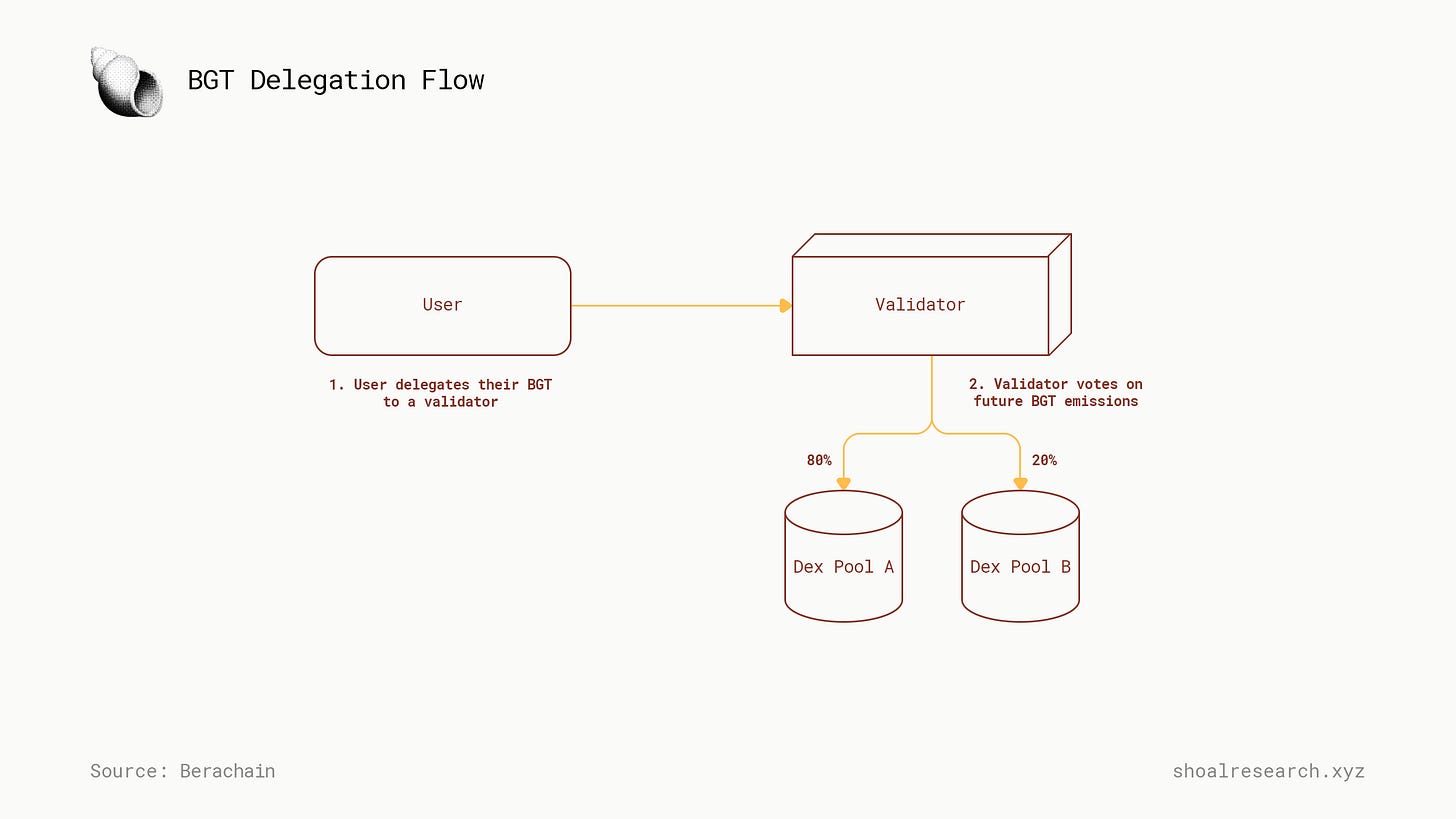

Users can earn BGT, the Bera Governance Token used for Proof of Liquidity delegation, by supplying liquidity to the BEX liquidity pools. Subsequently, users delegate their BGT to validators. With block production determined by the proportionate weight of BGT delegated to them, validators generate rewards for both delegators and themselves from the chain. Furthermore, validators participate in voting on future BGT inflation across various liquidity pools, and any bribes are distributed from validators to their delegators (if created by the validator).

From the chart above and the architecture of Berachain, we can describe how PoL solves the problems of PoS blockchains.

Proof of Liquidity tackles the initial challenge of Proof of Stake through two key mechanisms:

Separating the delegation token (BGT) from the chain's gas token (BERA).

Restricting the acquisition of new BGT to provide liquidity to the BEX.

This implies that the staking token is distinct from the token utilized for various on-chain activities. Moreover, the exclusive method for earning new governance tokens involves contributing to liquidity, thereby incentivizing additional liquidity provision.

Proof of Liquidity effectively addresses the second issue associated with Proof of Stake by distributing newly minted BGT to liquidity providers. Unlike traditional Proof of Stake networks where stakers directly receive the new stake, Proof of Liquidity allocates it to separate market participants engaged in common on-chain actions. This results in a more equitable distribution of token inflation.

Lastly, Proof of Liquidity encourages protocols and validators to collaborate. This collaboration is incentivized to have validators promote a protocol's LP pool through BGT and enable protocols to assist validators in accumulating BGT stake through bribes.

Tri-token Model

The Berachain Token Model consists of 3 tokens: $BERA, $BGT, $HONEY.

BERA: native token of Berachain a.k.a. Gas token

BGT: governance token

HONEY: native stablecoin

While $BERA and $HONEY serve rather intuitive roles, BGT is not nearly as straightforward. Why is there a need separate tokens for gas and governance after all?

BGT Management

BGT is non-transferrable and can only be acquired through three ways:

Providing liquidity to the native BEX (Berachain DEX) for an LP pair that receives BGT emissions

Borrowing HONEY on Bend (Berachain Lending)

Providing HONEY in the bHONEY vault for Berps (Berachain Perps)

Upon obtaining BGT, users proceed to delegate it to validators within the network. The stake weight of a validator's BGT is instrumental in determining two key aspects:

The proportion of blocks a validator is responsible for producing among all validators

The percentage of future BGT emissions that they can influence through their voting

When BGT is delegated to a validator, it becomes eligible for initiating and voting on governance proposals. These proposals may include decisions on the allocation of BGT emissions to specific LP pools. Delegating BGT also triggers the commencement of various rewards from the network.

Additionally, BGT has the option to be burned at a 1:1 ratio for BERA. It's essential to note that this process is unidirectional, and BERA cannot be converted back into BGT.

The amount of BGT inflation a validator has control over is determined by the amount of BGT delegated to them. Let's consider a scenario where you function as a validator with 10% of the entire staked BGT delegated to you. With a 10% stake of BGT assigned to you, you effectively manage influence over the direction of 10% of forthcoming BGT inflation. Specifically, this BGT inflation is directed toward the native BEX liquidity pools, allowing you to determine which LP pools are incentivized for users to deposit tokens. This typically results in increased liquidity within those pools.

Protocol Rewards

Proof of Liquidity produces rewards for holders of BGT. These rewards stem from diverse on-chain activities and are allocated to BGT holders in accordance with the amount of BGT they have delegated. There are three types of rewards: BGT Inflation, Block Captured Value, and Gas Fees.

New BGT is generated in every block, determined by Berachain's inflation rate. These newly created BGT units are allocated to the liquidity providers in specific BEX pools. The distribution is based on the total amount of new BGT emissions voted upon by validators during the current epoch.

Block Captured Value is the fees from Berachain's native DApps, namely BEX, Honey, and Perps. Transactions within each of these DApps may trigger fees, which are designated as the Block Captured Value (BCV). Whenever a validator incorporates a transaction in their block that incurs a fee, they receive that fee as a reward. Validators receive a percentage of the BCV as a commission, and the remaining portion is distributed to BGT delegators.

History and Fundraising

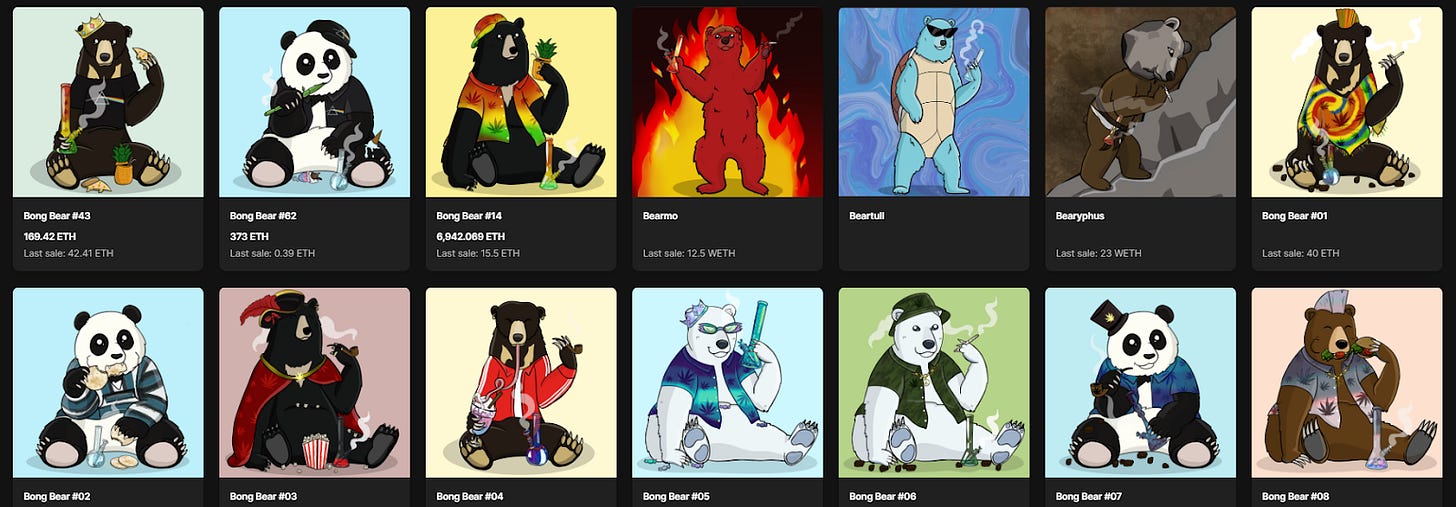

The story of Berachain's origins is quite unique and involves a journey from meme-fueled NFTs to potentially one of the most unique Layer 1s. It all began with an NFT collection called BongBears, launched in August 2021 by three pseudonymous co-founders: Dev Bear, Papa Bear, and Smokey the Bera. The Bong Bears mint on August 27th, 2021, featured 100 Beras, priced at 0.069 ETH each. The mint process was unique, allowing buyers to view and choose specific bears on OpenSea before purchase.

During that period, the team drew inspiration from the emerging rebasing protocol, OlympusDAO, which was quickly gaining popularity in the crypto community. Taking notes from OlympusDAO, Bong Bears pioneered the creation of a unique collection of rebasing NFTs, paving the way for subsequent collections. These "zooted" cartoon bears quickly gained traction in the crypto community. The BongBears project wasn't just about art; it served as the first stage in a series of bear-themed NFT collections, including Bond Bears, Boo Bears, Baby Bears, Band Bears, and Bit Bears. Each iteration is built upon the previous one.

On October 16th, 2021, OG Bong Bear holders received an airdrop of a rebasing NFT, the Bond Bear, making Bong Bears the first rebasing NFTs ever.

On October 29, 2021, The Boo Bears rebase brought 271 festive bears celebrating Halloween in style. Notably, some bears featured costumes representing popular protocols like TempleDAO and Rome.

The Baby Bears collection, dropping on December 16, 2021, just in time for the holidays, introduced 571 babies. Many featured Christmas and holiday themes, adding to the festive spirit. However, a hidden twist awaited – each bera from previous collections had a corresponding baby version, creating a quest for owners to reunite "families."

The Band Bears, a delightful collection of 1,175 beras released on April 20, 2022. Each musical bera was styled after a musician, providing a compelling incentive for users to trade for beras that suited their taste. Wild OTC trades, like Johnny Cash for Bob Dylan or Future for George Michael, became common. Both OG and baby versions were available for each artist, allowing collectors to pursue both variants.

The next rebera, the stealth drop of 2,355 Bit Bears by Berachain on August 24, 2022, surprised the community. This batch featured a distinct art style, swapping Papa Bear's designs for pixelated little beras by PixelBera.

Few NFT projects venture into L1, seed an ecosystem with a dedicated community, and achieve this without marketing expenses.It’s hard to imagine that an anonymous team starting from an NFT collection at the end of 2021 would raise a round with an incredible valuation of $420M 2 years later, led by one of the top funds in the industry in Polychain. Other investors included Shima Capital, dao5, Hack VC, Robot Ventures, Tribe Capital, GoldenTree Asset Management, and others.

Some of the most notable angels include Mustafa Al-Bassam (co-founder of Celestia), Zaki Manian (co-founder of Tendermint), Georgios Vlachos (co-founder of Axelar), and others.

Ecosystem

Berachain is a relatively new entrant in the blockchain world, and, of course, it cannot be directly compared to well-established ecosystems like Ethereum or Layer 2 Protocols. However, some of its projects play a foundational role in ensuring the proper implementation of the Proof-of-Liquidity Consensus Mechanism. Let's explore three of the most promising ones.

Infrared

Infrared is a liquid staking solution built on top of Proof-of-Liquidity within the Berachain ecosystem. The user experience enabled by Infrared stands out by introducing BGT liquidity, simplifying the bribe and validator layer, and streamlining the distribution of BGT.

Infrared makes accessing the Proof-of-Liquidity (PoL) ecosystem easy and open for everyone. With a focus on user-friendliness, it provides a straightforward platform for liquidity providers to earn iBGT — Infrared’s liquid version of BGT.

Liquidity providers on Berachain native DApps and other BGT-eligible venues can earn trading fees, native emissions, and claim liquid iBGT . Infrared has no deposit or withdrawal fees and a minimal performance fee, distributed among $IRED holders. Through iBGT, Infrared aims to pioneer use cases for BGT that previously weren’t possible on Berachain. They're Supported by the Berachain Foundation and the Build-a-Bera incubator program, aiming to become the leading network of validators.

Kodiak

Kodiak is a liquidity hub on Berachain that brings concentrated liquidity and automated liquidity management to the ecosystem. It is suitable for both traders and LPs. To have a better understanding of Kodiak, it's essential to know that its architecture allows vertical integration of different DEX Layers. Let's explore all of them.

Kodiak DEX, a decentralized exchange, offers users a non-custodial and highly capital-efficient trading and liquidity provision experience utilizing both concentrated and full-range AMMs.

Kodiak Islands, automated concentrated liquidity strategy vaults, are primarily used to attract liquidity in the Berachain Ecosystem. Kodiak Islands automate LP strategies with concentrated liquidity provision. User deposits create a concentrated liquidity range that automatically rebalances to stay 'in-range' with price movements. Kodiak Island LP positions qualify for PoL BGT rewards and use BEX liquidity for rebalancing.

Sweetened Islands, an Integrated Incentive Layer, leverages Berachain's Proof of Liquidity (PoL) mechanism to provide sustainable incentives for liquidity on Kodiak Islands.

Panda Factory, the No-Code Token Deployer Factory, streamlines the permissionless creation of new tokens, such as memecoins, and their initial liquidity on the Kodiak full-range AMM. This is particularly suitable for highly volatile assets with yet-to-be-discovered price characteristics.

Moreover, Kodiak is the only DEX supported by Berachain's Build-a-Bera program. Working closely with the Berachain Foundation, Kodiak Islands are compatible with Berachain’s Proof-of-Liquidity, ensuring a flow of BGT as PoL matures.

Beradrome

Beradrome serves as an ecosystem incentive coordinator for Berachain, providing a unique approach to yield farming, token management, and on-chain governance. The platform introduces a tri-token structure: BERO, hiBERO, and oBERO, each offering users distinct advantages. The supply of BERO tokens is algorithmically controlled through a bonding curve mechanism, ensuring stability and market-driven liquidity.

Beradrome draws inspiration from the Solidly system in its approaches to liquidity provision, rewards, and token emissions. Solidly focuses on its AMM LP tokens, deriving revenue mainly from swap fees and incentivizing veSOLID holders who vote for specific gauges to earn those fees. In contrast, Beradrome, an inclusive version of Solidly, supports any yield-bearing asset, allowing for diverse revenue streams like token emissions, swap fees, interest, or game revenue.

Beradrome's main features include:

Bonding curve mechanism

Call option emissions

Token-owned Liquidity

Single-sided liquidity provisions (eliminating impermanent loss)

Deep liquidity with low slippage

Risk-free borrowing against hiBERO

Beradrome also created an NFT collection called "Tour de Berance." It is a collection of 6,900 distinctive Beras on bikes racing for liquidity on Arbitrum.

The Tour de Berance NFTs will provide exclusive functionality on Beradrome within the Berachain ecosystem, such as:

Securing more hiBERO allocation through NFT ownership

Privileged entry to events within the Berachain ecosystem

An NFT rebase once Berachain goes live

Priority access to token sales on the Berage launchpad through whitelist inclusion

Access to the upcoming Beradrome video game

Testnet Launch

On January 11, 2023, Berachain announced that its public testnet, "Artio," is now live. Developers and users can interact with the faucet to receive $BERA tokens while engaging with the network and its applications. Network participants can utilize the AMM DEX, stablecoin, perpetuals exchange, and money market.

Currently, there are mainly 5 types of activities you can do on Artio Testnet:

Swap tokens on BEX

Mint $HONEY, Berachain’s native stablecoin on Honey

Lend or borrow tokens on BEND

Trade perpetuals on BERPS

Delegate $BGT to BGT Station

Berachain managed to attract 300k+ users and 1M+ transactions within the first 48 hours of launching the testnet.

Conclusion

In this article, we delved deep into Berachain, beginning with the technology behind it and concluding with one of the most recognizable communities in crypto. Who could have imagined that the NFT collection of Bong Bears would essentially lead to the creation of Layer 1 with a novel consensus mechanism, raising a round at a $420M valuation? Currently, we are witnessing a multitude of protocols beginning development on Berachain, along with impressive statistics from the testnet launch. Berachain accomplishes two remarkable feats: establishing a strong community that supports "beras'' and implementing a well-designed and proposed architecture for the protocol. The combination of these two factors makes Berachain one of the most unique Layer 1 projects in the current crypto market.

Sources

https://medium.com/@itsdevbear/introducing-berachain-4f7dc3032c17

https://twitter.com/dylanxvfeth/status/1745176859728560131?s=52&t=txFAbiSPTdLLDlAYj9X_AA

Introducing: Infrared. Today, we are thrilled to unveil… | by Infrared Finance | Jan, 2024 | Medium

Berachain raises $42 million to launch yet another Layer 1 blockchain | The Block

Berachain — A Deep Dive. 60,000 Discord members, the first… | by Crypto Climax | Coinmonks | Medium

Berachain ecosystem NFTs explained | by Beramonium Chronicles | Jan, 2024 | Medium

Berachain Blockchain: A Blend of Memes, Innovation and Community - Flagship.FYI

"Proof of Liquidity" Project Berachain Launches Public Testnet, Artio

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are the authors own, not the views of their employer.