Building DeFi’s Investment Bank

Transparency does not solve coordination.

DeFi solves the information asymmetry problem that has riddled TradFi’s capital markets, though still more in theory than in practice. The value, and difficulty, of coordination, only becomes more evident in decentralized systems, and despite its transparency, self-custody, and operational efficiency, liquidity in DeFi still remains scarce and mercenary as there is no shared coordinating framework. In this piece, we explore the need for onchain liquidity coordination and how Turtle approaches this challenge.

The Capital Coordination Challenge

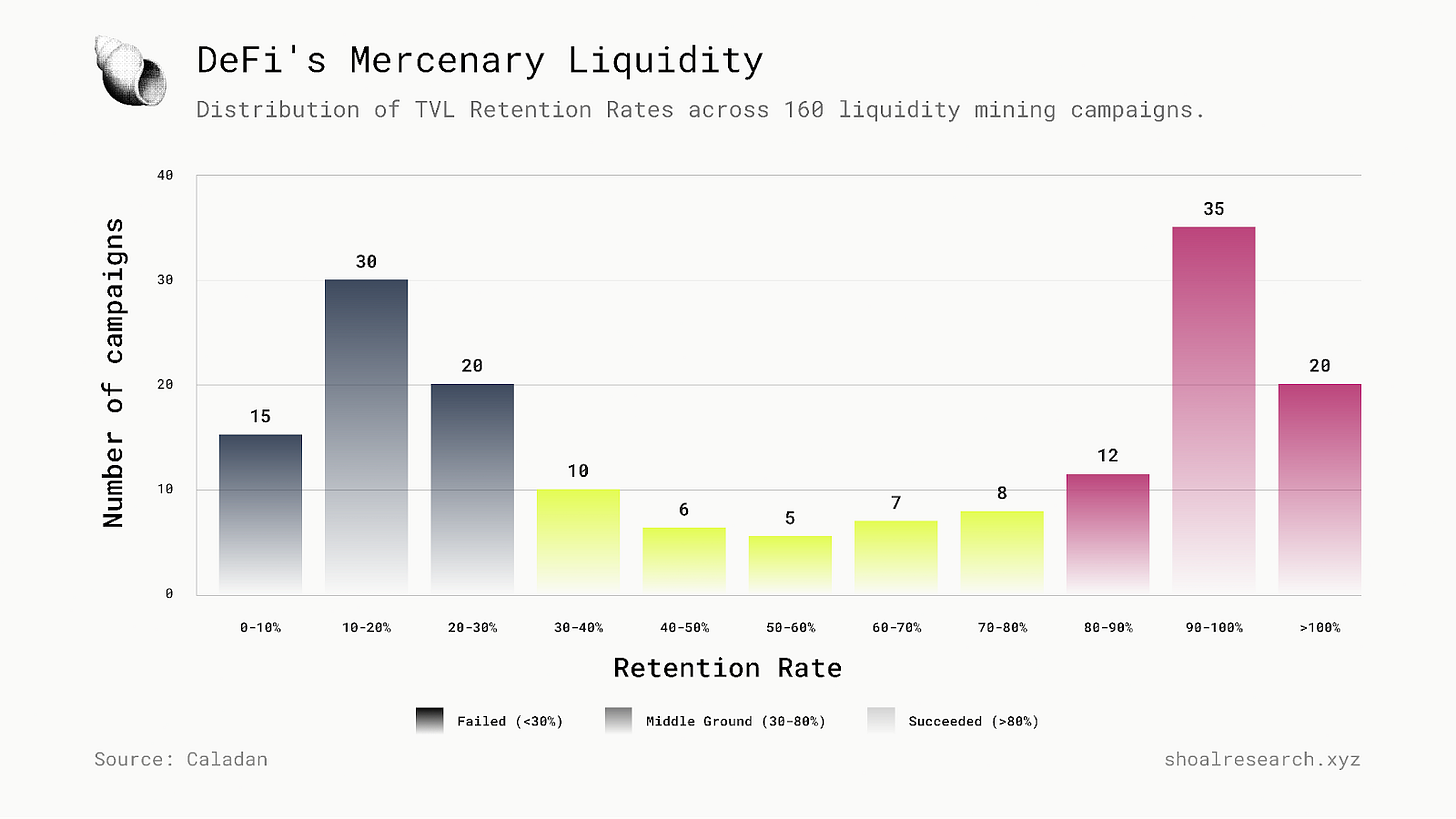

For all its innovation and growth, DeFi has long been plagued by mercenary, non-sticky liquidity. This is ultimately a product of structural misalignment between foundations and liquidity providers (LPs). Foundations allocate token emissions to incentivize aligned, multi-cycle liquidity for their protocols, but may have no idea what type of LPs they will attract nor how long they will stick around for. Meanwhile LPs, seeking a return on their capital, have little visibility into the organic activity or trading volume a protocol can sustain over time, therefore it becomes rational to exit once emissions end rather than remain committed. As such, most protocols and LPs stand little chance against the self-reinforcing cycle of short-term incentives and mercenary liquidity that defines much of DeFi today.

Information asymmetry is not new to capital markets by any means. The distribution of knowledge around asset quality, risk, and value between borrowers and lenders has never been proportional for as long as capital markets have existed. Investment banks emerged to solve this underlying coordination failure, conducting diligence, structuring credit into tranches by risk appetite, and distributing that credit across a syndicate of lenders accordingly. Borrowers gained access to consolidated capital through a single negotiation, while the IBs earned fees for aggregating information, standardizing risk, and coordinating supply and demand.

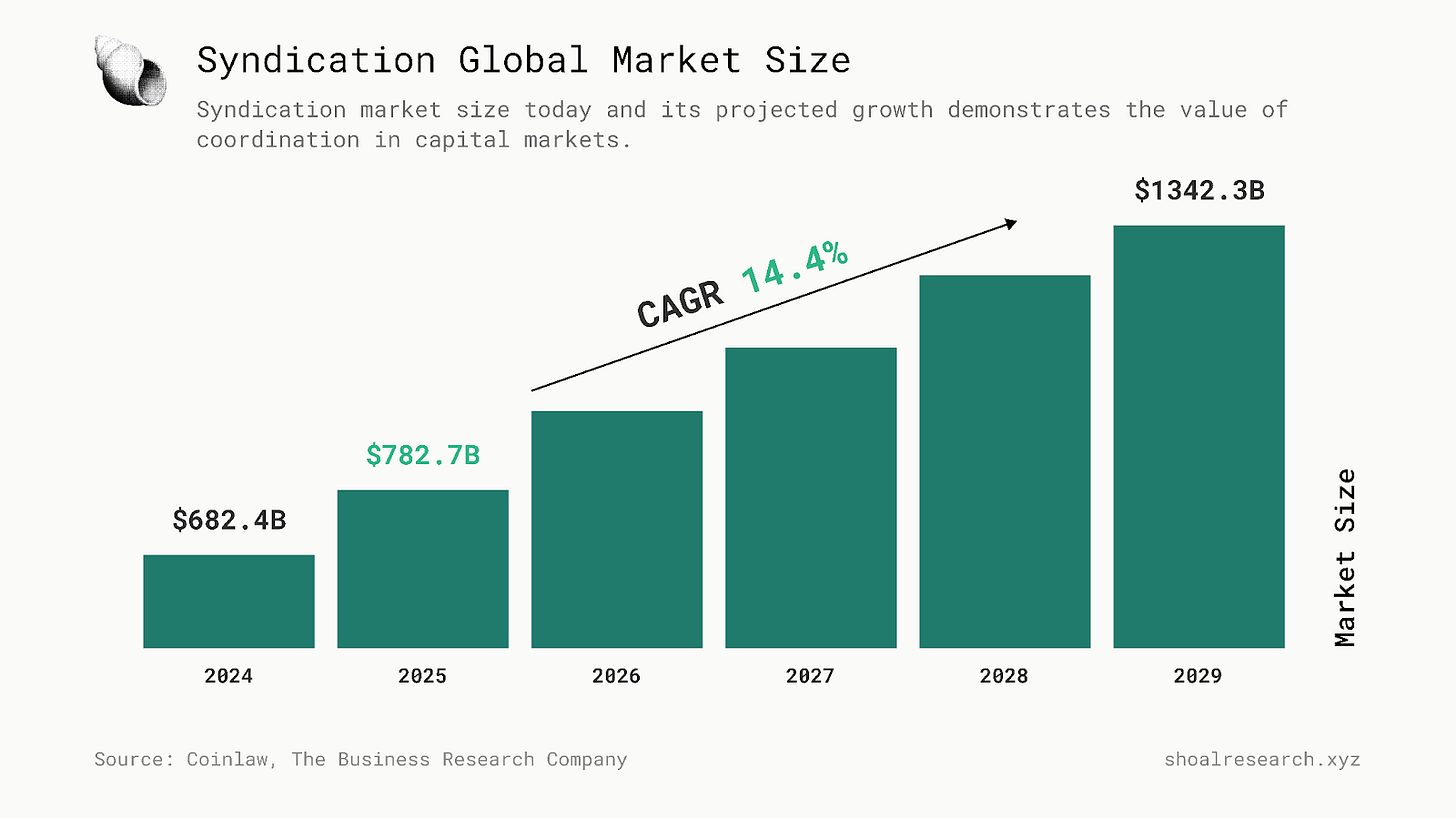

This process, formally known as syndication, transformed credit markets by separating origination from investment. Large banks would originate loans but distribute the debt to non-bank investors such as hedge funds, pension funds, and collateralized loan obligations (CLOs). The Basel II and III frameworks reinforced this dynamic by incentivizing banks to transfer credit risk off balance sheet and optimize capital efficiency. What began as bespoke loan placements evolved into a standardized system for converting private credit assessments into tradable financial products. Though complex and costly, syndication has helped standardize processes for diligence, distribution, and ongoing risk management, building the infrastructure that enabled credit to be assessed, distributed, and maintained at scale. More importantly, it demonstrated the value of coordination in capital markets by turning a fragmented, bilateral lending process into a scalable, trillion-dollar asset class.

DeFi sought to rebuild these financial coordination architectures with code. AMMs and lending markets encoded core functions of intermediation (i.e. price discovery, collateralization, settlement) into smart contracts. Anyone with an internet connection and capital could supply liquidity or borrow assets on shared, observable infrastructure where transaction settlement was compressed from days to minutes or even seconds. This transparency, however, has not produced coordination.

Protocols can issue incentives, but they cannot determine or predict their outcomes. Token emissions attract liquidity, but they do not specify who participates, how long that capital will remain, or under what conditions it will leave. Each program operates in isolation, competing for the same pool of capital with no shared framework for evaluating risk or aligning expectations. Liquidity flows toward the highest nominal yield, not toward sustainable participation. When incentives end, deposits leave, and the process begins again

Information asymmetry in DeFi thus re-emerged in a different form. Onchain data made transactions visible but that barely means much if investors and LPs still cannot easily assess governance quality, operational integrity, or the long-term economics of a protocol, nor if foundations, for their part, cannot distinguish between speculative and committed capital.

DeFi protocols have demonstrated that smart contracts and code can replace costly, operationally inefficient human intermediaries across a range of financial products and services. But removing intermediaries has also made it that much more difficult to coordinate how liquidity is distributed across these systems in a way that aligns incentives for all participants.

With this in mind, we can reasonably assert the opportunity for DeFi’s ‘investment bank’, a protocol dedicated to structuring, allocating, and sustaining liquidity across markets. Rather than replacing existing protocols, it would provide the coordination infrastructure through which foundations and liquidity providers can negotiate and maintain capital at scale. In effect, such a protocol would serve the same function investment banks did for credit markets: aggregating information, matching the right participants, and standardizing how liquidity is structured and deployed.

Turtle: DeFi’s Investment Bank Layer

Turtle is an onchain liquidity distribution protocol connecting lenders (i.e. onchain LPs) with borrowers, including protocols and foundations seeking liquidity. Through curated campaigns, custom deposit vaults, and embedded distribution across partner frontends, Turtle aims to standardize how Turtle standardizes how liquidity is sourced, coordinated, and deployed across DeFi. Since its MVP launch in May 2024, Turtle has coordinated over $5.5B in total liquidity, nearly $300m in boosted campaign deposits, grew its treasury to over $13.7M, and has over 400k connected wallets alongside 15k campaign LPs.

Functionally, Turtle operates as a liquidity distribution layer beneath chains, bridges, and applications onchain. It integrates through APIs, wallets, and smart contracts to track liquidity positions and coordinate deployment across multiple ecosystems. Foundations define their liquidity terms, including total amount, duration, and under what conditions. Turtle works with foundations to help structure the best possible deal in order to incentivize LPs long term and ensure liquidity is not mercenary. LPs meanwhile can review terms and deposit liquidity directly to the foundations through Turtle’s non-custodial vaults. Together, this structure aims to improve upon standard token emission models through organized dealflow, functioning as an Investment-Bank-style coordination layer across the broader DeFi ecosystem.

Turtle’s architecture revolves around curated campaigns and embedded distribution, the two mechanisms through which it coordinates liquidity:

Curated Campaigns: Structured liquidity programs negotiated with protocol teams, each with defined capital targets, reward schedules, and durations. These campaigns bring consistency and transparency to how liquidity is sourced and rewarded.

Embedded Distribution: Integrations that surface campaigns directly within wallets, exchanges, and analytics platforms, allowing users to discover and participate in opportunities through familiar interfaces.

Campaigns are standardized and published through Turtle’s deal interface; deposits are managed through non-custodial structured vaults; and participation data flows through embedded dashboards and leaderboards that coordinate rewards and feedback. To better understand how these components all work together, it’s worth unpacking them in greater detail.

Discovery and Dealflow Layer

The Discovery and Dealflow layer, known collectively as Turtle Deals, structures how liquidity opportunities are sourced, negotiated, and distributed through the protocol. Partner protocols define their key campaign parameters, namely their target capital, eligible assets, reward terms, and duration, which are then verified and published on the Turtle Deals dashboard. This is designed to provide a standardized and transparent framework to onchain liquidity sourcing.

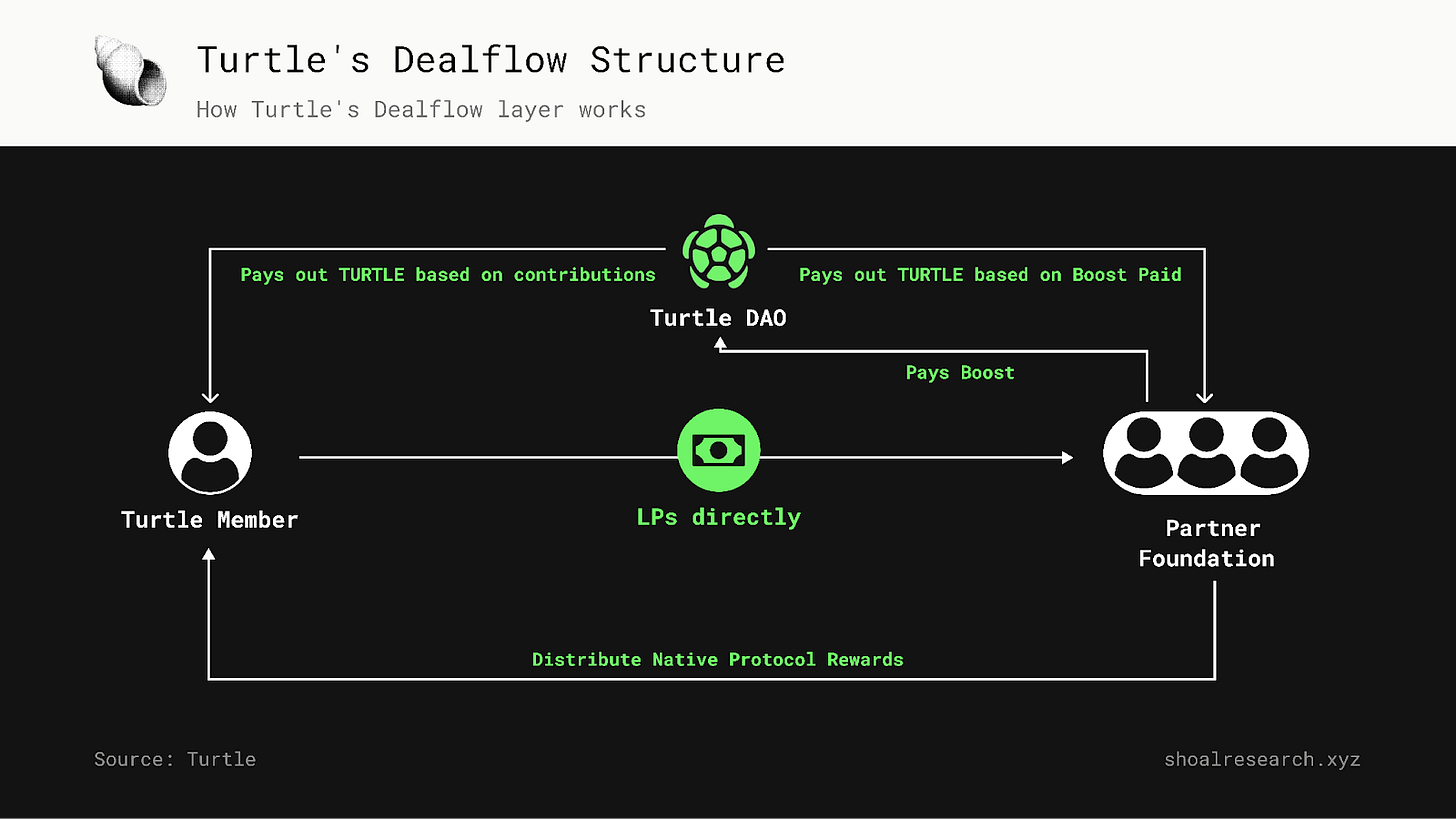

Within this system, Boosted Deals represent campaigns co-incentivized by the Turtle DAO, where LPs (Turtle Members) earn both native rewards from partner protocols and additional rewards, paid out in TURTLE tokens, proportional to their participation. Partner protocols provide the DAO with a defined boost payment, and the DAO distributes those boosts back to Members pro-rata, the first distribution happening during Turtle’s TGE.

This process ties liquidity incentives to real-time activity. Partner protocols gain structured, predictable access to capital under defined parameters, while LPs are compensated transparently according to duration and engagement. The Turtle DAO functions as the coordination and settlement layer, tracking deposits, managing boost payouts, and maintaining auditability across campaigns.

Ecosystem-As-A-Service: Turtle Vaults And Campaigns

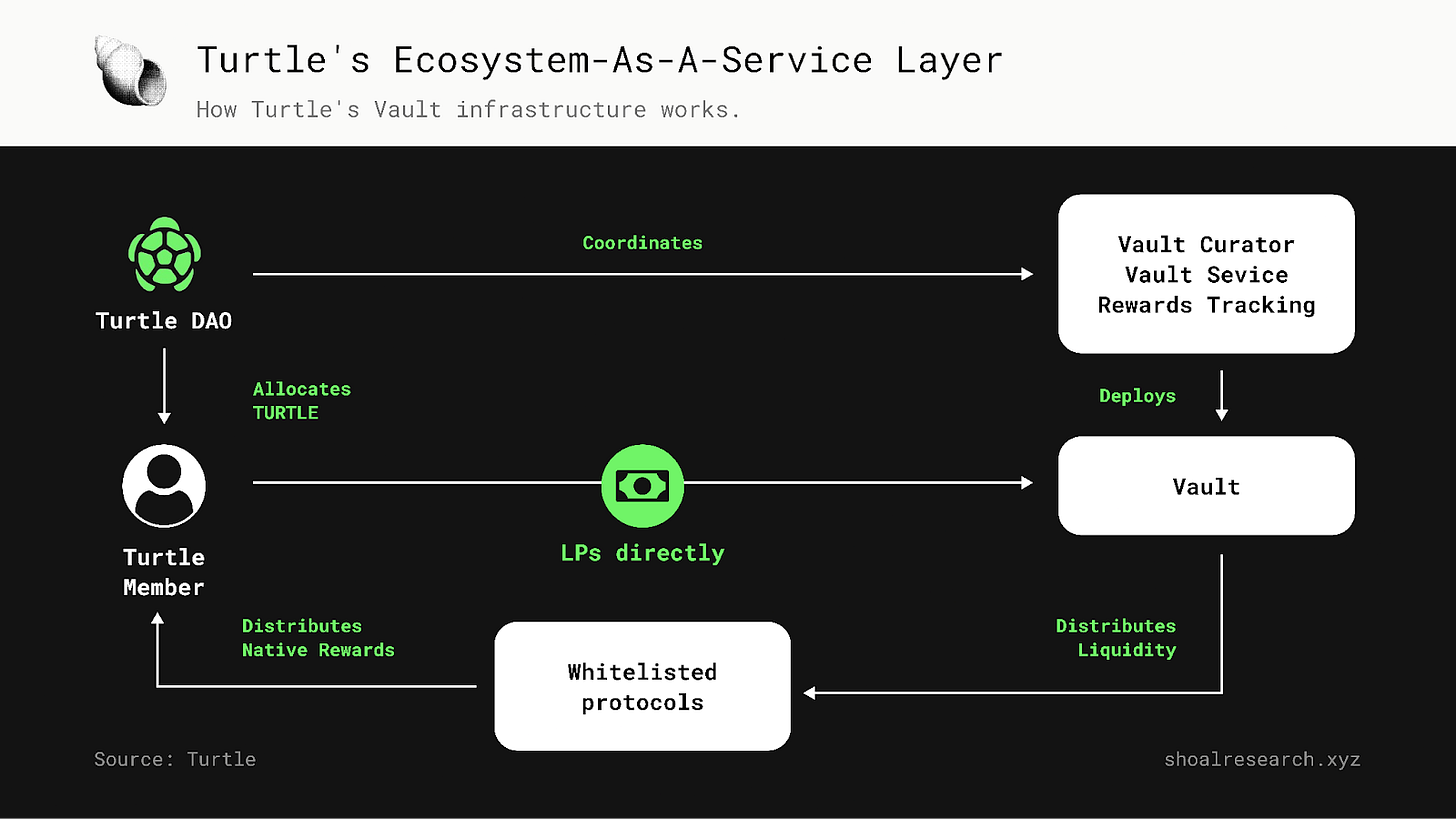

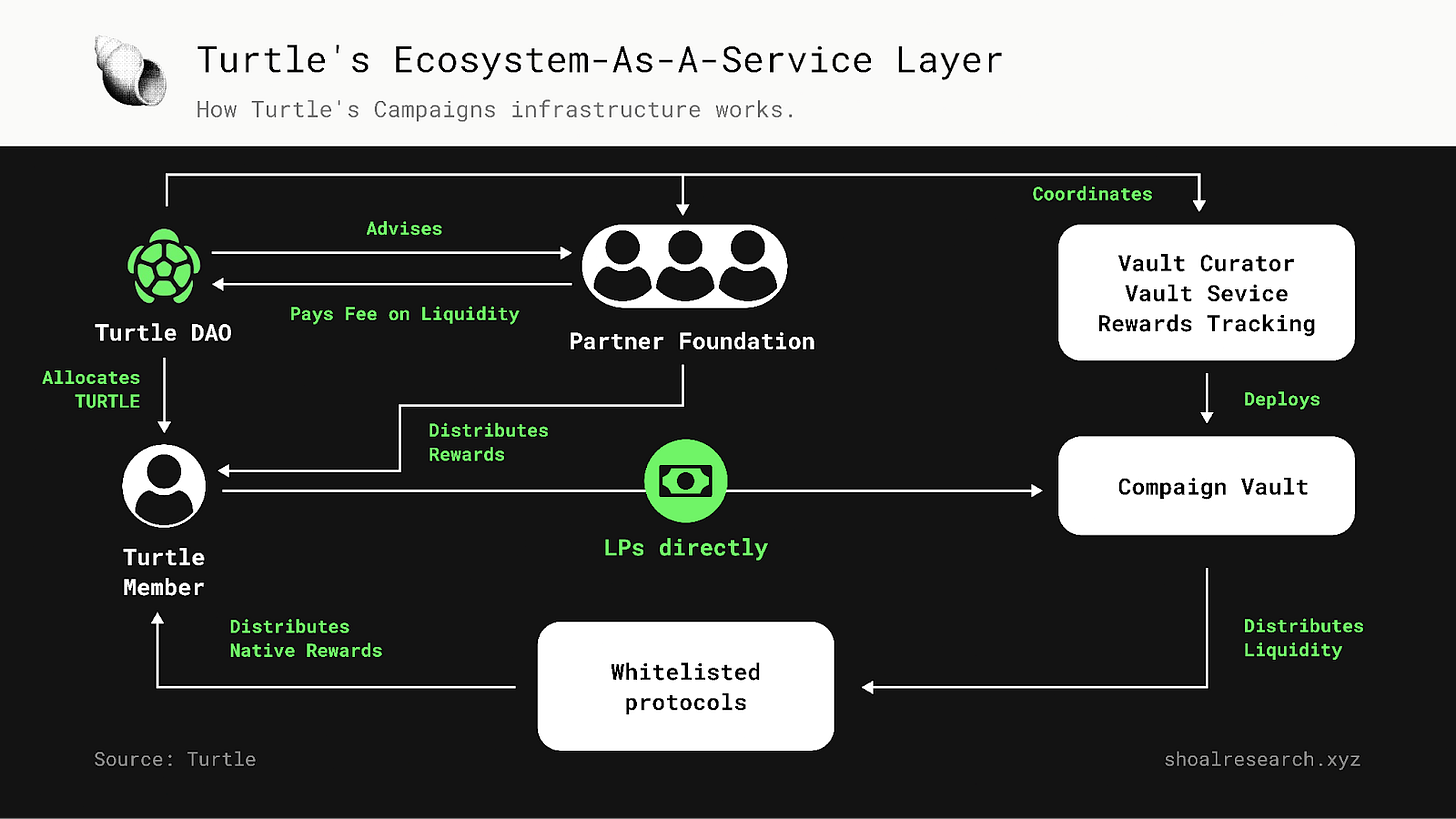

Turtle’s Vaults and Campaigns infrastructure forms the operational layer through which liquidity is committed, distributed, and tracked across DeFi. It organizes the flow between foundations, vault providers, and liquidity providers into a repeatable framework that any protocol can deploy as a service.

Each vault represents a campaign-linked deposit contract coordinated by the Turtle DAO and operated by Vault Curators. A vault is a smart contract at its core: foundations define their desired liquidity parameters, including the target amount, eligible assets, lock-up duration, and reward logic, and the vault is created to enforce these specific terms onchain. Turtle Members supply liquidity directly to the partner, where rewards accrue natively. Each vault is designed to remain fully non-custodial. Liquidity providers sign participation approvals through their own wallets, while assets stay in the partner protocol’s native contracts. Participation and performance are tracked through onchain activity.

This design allows campaigns to launch without introducing custodial risk or manual oversight. Fees and boost rewards flow transparently between participants: partner protocols pay a liquidity fee to the DAO, the DAO redistributes boost rewards directly to LPs, and all activity remains visible through onchain data via the smart contract vaults. Vaults also simplify capital allocation for LPs, enabling them to earn yield passively without manually rotating across protocols or campaigns.

At the campaign level, Turtle coordinates between Partner Protocols, Vault Providers, and Vault Curators to align incentives and operational tracking. Campaign vaults distribute liquidity directly to whitelisted protocols, where users earn both base and boosted rewards. Optional lock-ups synchronize capital duration with protocol needs, and integrated tracking captures data on performance, duration, and aggregate TVL.

Protocols can launch structured liquidity programs through a single integration; vaults manage capital logistics and tracking; and the DAO oversees coordination, auditing, and reward distribution. Meanwhile LPs can easily discover campaigns, deposit through Turtle’s interface, and receive both native and TURTLE rewards without relinquishing custody of assets.

Turtle Earn

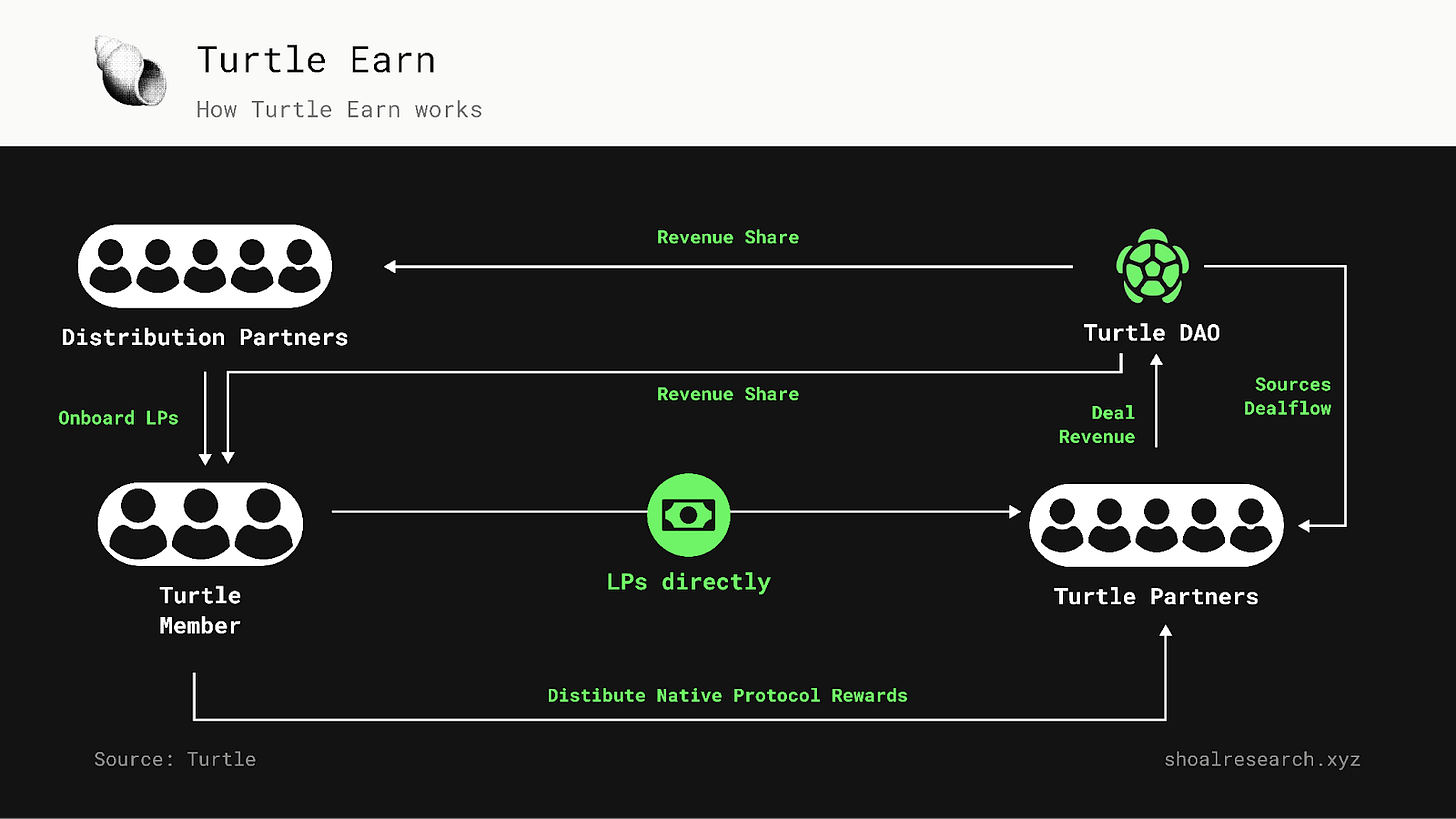

Turtle Earn provides the distribution layer through which liquidity campaigns reach their designated end-users. It integrates directly with frontends such as wallets, exchanges, and analytics platforms, allowing them to surface active campaigns within their own interfaces. This structure enables users to review terms and participate in campaigns without leaving the environments they already use.

Distribution partners connect their user base to Turtle campaigns and receive a share of deal revenue proportional to the liquidity they help onboard. Turtle Members deposit directly to partner protocols, earning native rewards from those protocols and any additional boosts allocated by the Turtle DAO.

The DAO manages coordination and accounting between all participants. It sources dealflow from partner protocols, collects associated boost revenue, and redistributes it to Members and distribution partners based on verified activity.

Embedded Distribution and Tooling

Turtle’s embedded distribution layer connects the protocol’s liquidity infrastructure to the broader DeFi interface network, integrating directly into existing user frontends.

The Earn Widget embeds active Turtle campaigns within these applications, allowing users to discover and participate in verified opportunities natively. Deposits, campaign data, and reward parameters are synced in real time, creating a consistent interface across multiple protocols.

Participation and performance are tracked through Turtle’s Leaderboard system. Wallets earn points relative to their total deposits, referral activity, and lockup participation, with boosted weighting for referred liquidity. Weekly snapshots then determine the distribution of TURTLE rewards and campaign bonuses. For foundations and partners, client portals and dashboards provide visibility into campaign performance, emissions tracking, and reward distribution, ensuring liquidity programs can be monitored and adjusted in real time without requiring manual oversight.

Together, these tools extend Turtle’s coordination framework into user-facing environments. Campaigns appear directly within existing interfaces, participation is recorded onchain, and reward distribution is managed through a standardized system.

Tokenomics and Value Flows

Turtle’s coordination framework is anchored by TURTLE, an ERC-20 utility token deployed on Ethereum, BNB Chain, and Linea. TURTLE coordinates liquidity incentives and governance within the Turtle network, governing how liquidity incentives are distributed, how campaign revenue circulates through the Turtle DAO, and the decisions made about the protocol’s development.

TURTLE is transferable and classified as a functional utility token under Swiss law. It carries no ownership, profit-sharing, or redemption rights.

Value Flow

The Turtle DAO manages capital between three participants: partner protocols, liquidity providers (LPs), and the DAO treasury.

Partner Protocols fund liquidity campaigns by paying boost and integration fees.

LPs deposit through verified vaults and earn rewards based on their deposit amount.

The DAO Treasury collects campaign proceeds, and reallocates it toward future campaigns.

In theory, this all works together through a self-reinforcing feedback loop: protocols fund liquidity programs on Turtle, the Turtle DAO distributes rewards, and proceeds flow back into future operations.

Governance

Governance is executed through Turtle DAO, using OpenZeppelin’s Governor contracts and Tally’s interface. Holders can stake TURTLE to mint sTURTLE, which represents voting and delegation rights for proposals related to campaign parameters, integrations, and protocol operations. Proposals are subject to quorum and creation thresholds to maintain procedural integrity. Treasury execution remains under DAO oversight, with progressive decentralization planned over time.

TURTLE standardizes how liquidity programs are funded, distributed, and governed. Protocols pay to access coordinated capital; LPs earn verifiable rewards; and the DAO manages redistribution and governance through TURTLE.

Closing Thoughts

DeFi has solved for access but not for coordination. Anyone can deploy a market or a vault, and liquidity can move freely between them. Yet each system operates under its own parameters, incentives, and time horizons, leaving no shared structure for how capital is discovered, priced, or maintained over time. In practice, this leads to the aforementioned self-reinforcing cycle of short-term incentives and mercenary liquidity that defines much of DeFi today.

Turtle is designed to address this coordination gap. Its framework standardizes how campaigns are structured, how deposits are tracked, and how incentives are distributed. Rather than creating new markets and custodying assets, it provides the organizational layer through which existing ones can coordinate capital more efficiently.

To reiterate, DeFi has thus far proven that markets and other financial services can run without intermediaries; but coordination remains a central challenge among decentralized networks, and the scarcity of liquidity in DeFi is a prime example. An opportunity emerges for protocols capable of encoding commitment: to make capital deployment measurable, recurring, and auditable across ecosystems.

With the shift in the regulatory environment surrounding digital assets, the demand for bringing net new capital onchain is slowly but surely growing. With new capital coming onchain comes the need for coordination. Through its curated campaigns, structured vaults, and embedded distribution framework, Turtle makes a compelling case to capture this opportunity and become DeFi’s Investment Bank layer.

Sources

Scott, Zachary. The Syndicated Loan Market. zacharyscott.com/syndicated-loan-market/

The Syndicated Loan Industry Statistics. Coinlaw, coinlaw.io/syndicated-loan-industry-statistics/

“Investment Banking.” Wikipedia, en.wikipedia.org/wiki/Investment_banking

“Asymmetric Information.” Investopedia, www.investopedia.com/terms/a/asymmetricinformation.asp

The Ten Commandments of Liquidity Incentives. Caladan Labs, caladan.xyz/report-the-ten-commandments-of-liquidity-incentives/

Turtle Frontend. app.turtle.xyz/

Turtle Documentation. docs.turtle.xyz/

Turtle MiCA Whitepaper. drive.google.com/file/d/1DGhHqPv8RVX2XYgVb1yjPFQJQ4Y4961R/view

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author’s own, not the views of their employer. This post has been created in collaboration with the Turtle team. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research.

Defi is the future I’m building one check link in bio