Building The Real-Time DeFi Stack

It's time to embrace DeFi protocols that adapt to real-time market conditions.

The Experience Is The Product

Over the past three decades, the World Wide Web has reshaped the world and how it functions as we know it. As software gradually replaced physical distribution channels, the user experience has become the product. Look no further than the role which aggregators like Google, Amazon, Facebook (among plenty others) play in everyday life for evidence. By delivering cohesive user experiences, these platforms came to dominate consumer markets.

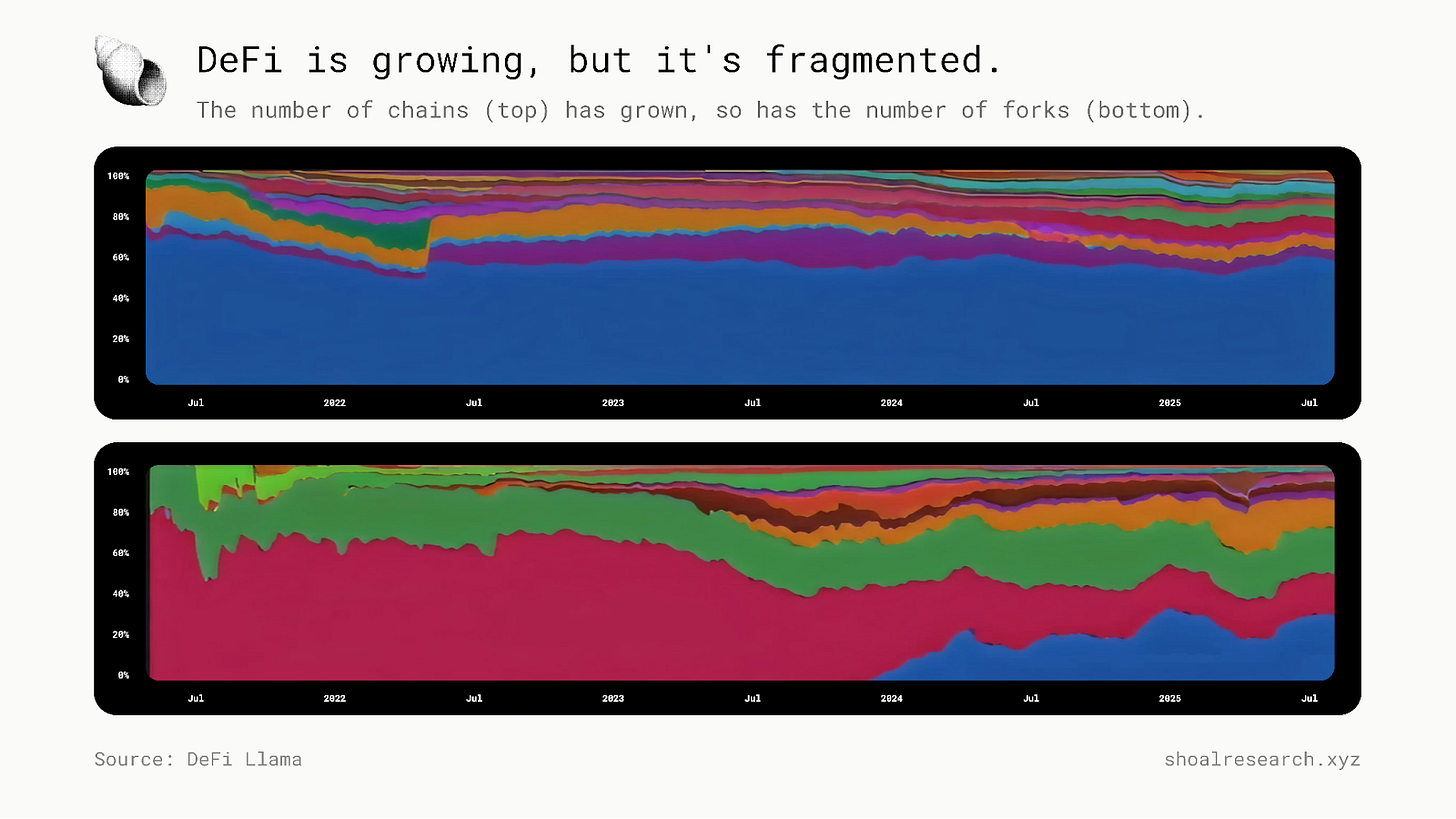

It can certainly be argued that DeFi faces a similar fate. The early internet began as a patchwork of disconnected webpages and hyperlinks, and so too, the broader DeFi landscape today spans hundreds of chains, tens of thousands of protocols, and millions of tradable assets, many of which are forks. This replicability is indeed a feature, not a bug. As Richard Stallman laid out, the right to reproduce, modify, and share code freely is a pillar of truly free software. In practice, however, DeFi’s open-source, permissionless design has created as much fragmentation as it has driven innovation.

The Unified Margin Opportunity

A majority of today’s DeFi volume and activity still concentrates around a few primitives: swaps, perps, staking services, and money markets. Yet there’s no simple, intuitive way to access them all through a single margin account. To trade perps, users deposit collateral to a specific account on a specific exchange. To borrow or lend, they need to withdraw and then deposit to a new position on another protocol. These DeFi primitives operate in isolation, fragmenting liquidity and leaving large amounts of capital idle and unproductive.

The lack of a unified margin account hasn’t been a conceptual problem so much as it’s been a structural one. Different DeFi protocols maintain their own accounting and risk parameters. An AMM tracks LP positions and pool reserves. A lending market tracks deposits and debt and evaluates protocol health. A perps exchange needs to track margin balances, open interest, funding rates, and liquidation thresholds. Each protocol has its own requirements in order to remain solvent. They can integrate with one another via smart contract calls, but they can’t share balance sheets.

This localized risk design is what makes DeFi safe in isolation but inefficient in aggregate. However, by building these primitives around a single shared risk engine, the opportunity to build a unified margin account emerges. This design would enable a user’s deposit to support multiple roles across trading, lending, staking, while maintaining consistent solvency rules. Collateral that once sat idle could be reused across products. A trader’s gain in one market could balance a loss in another, tightening spreads and reducing redundant margin.

Still, connecting DeFi primitives does not address the inefficiencies in their underlying mechanics.

DeFi’s Static Trap

The DeFi primitives we know today have processed trillions in volume, supported hundreds of billions in liquidity, and generated billions in protocol revenue. Like the internet, their greatest strength lies in being borderless, transparent, and always-on. Most protocols were designed as a set of smart contracts with fixed parameters that can run autonomously, for an indefinite period of team. Some teams have introduced governance or upgrade hooks for managing in critical situations, but between constant-product AMMs, fixed loan-to-value ratios, and passive liquidity provisioning, much of DeFi still operates on static logic.

These design choices made sense initially. Fixed parameters gave users trust: DAI’s stability, Uniswap’s simplicity, and Aave’s predictable risk. In stark contrast, however, traditional financial systems, which handle more volume in a single day than DeFi does in a month, operate on dynamic parameters that adjust to real-time conditions. Banks, market-makers, and derivatives desks continuously reprice risk, widen spreads, and adjust leverage based on market activity.

Building DeFi primitives that respond to real-time market conditions unlocks better performance, safer risk management, and more efficient and productive use of capital. These protocols can adjust key parameters such as collateral ratios, borrow-lending rates, and execution routing based on real-time market conditions.

This responsiveness matters most during market stress. When asset prices move sharply, parameters can tighten automatically to prevent unnecessary liquidations and preserve solvency. During more stable conditions, they can loosen to improve capital utilization and allow collateral to work more efficiently. In both cases, risk settings evolve with the market rather than remaining static.

The question then becomes how this looks like in practice.

A Deep Dive Into Flying Tulip

Flying Tulip introduces an onchain financial system designed to standardize pricing, credit, and risk across a unified suite of markets. The protocol brings together spot trading (AMM + CLOB), lending, perpetuals, insurance, and a protocol-native stablecoin within a shared margin framework.

Flying Tulip is built around three core design goals. First, to make collateral reusable across multiple functions. A single deposit can support several forms of activity, earning base yield, margin for trades, or loan collateral, without being locked into a single utility or module. Second, price risk using real, executable liquidity instead of static references or delayed oracles. The protocol measures depth and volatility across its markets in real time, and those readings feed directly into parameters like collateral ratios, funding rates, and liquidation thresholds. Third, to recycle protocol cashflows back into the system. Revenue from trading, borrowing, and settlements flows toward the FT token through programmatic buybacks or user distributions, linking network activity to value capture in a transparent way.

These design goals shape two outcomes: better yield and better user experience. Better yield comes from capital efficiency. The same deposit can earn base yield while simultaneously securing loans, resting limit orders on the CLOB, or providing margin for derivatives. Assets stay productive across the stack rather than sitting idle. Better UX, meanwhile, comes from integration. Core mechanics are encoded directly in contracts and applied consistently across products. The same depth-aware inputs that determine trade execution also inform borrowing limits, funding adjustments, and liquidation logic, ensuring that all parts of the system respond to market conditions in the same way.

Flying Tulip’s design builds on the original Deriswap concept Andre Cronje introduced in 2020. The concept he laid out was simple: to merge multiple DeFi functions into a single, more capital-efficient protocol. Deriswap proposed that the same liquidity pool could be used for swaps, lending, and options simultaneously in order to reduce idle liquidity. which proposed reusing liquidity across swaps, lending, and options. Here, that principle extends to the full financial stack. The protocol’s architecture connects trading, credit, and risk management within a single environment, allowing capital and exposure to be managed through one unified framework.

Flying Tulip will launch natively across multiple chains, beginning with the Sonic L1, and expanding to Ethereum, Avalanche, BNB Chain, and Solana. Each chain will feature its own local instance of Flying Tulip, ensuring liquidity and settlement remaining within native environments across all deployments.

The Flying Tulip Stack

Flying Tulip consists of an integrated suite of DeFi components. ftUSD, lending, spot, and perpetuals operate from a shared liquidity base and unified margin layer. Parameters across the system adjust to market conditions in real time, keeping pricing, collateral, and risk consistent across products.

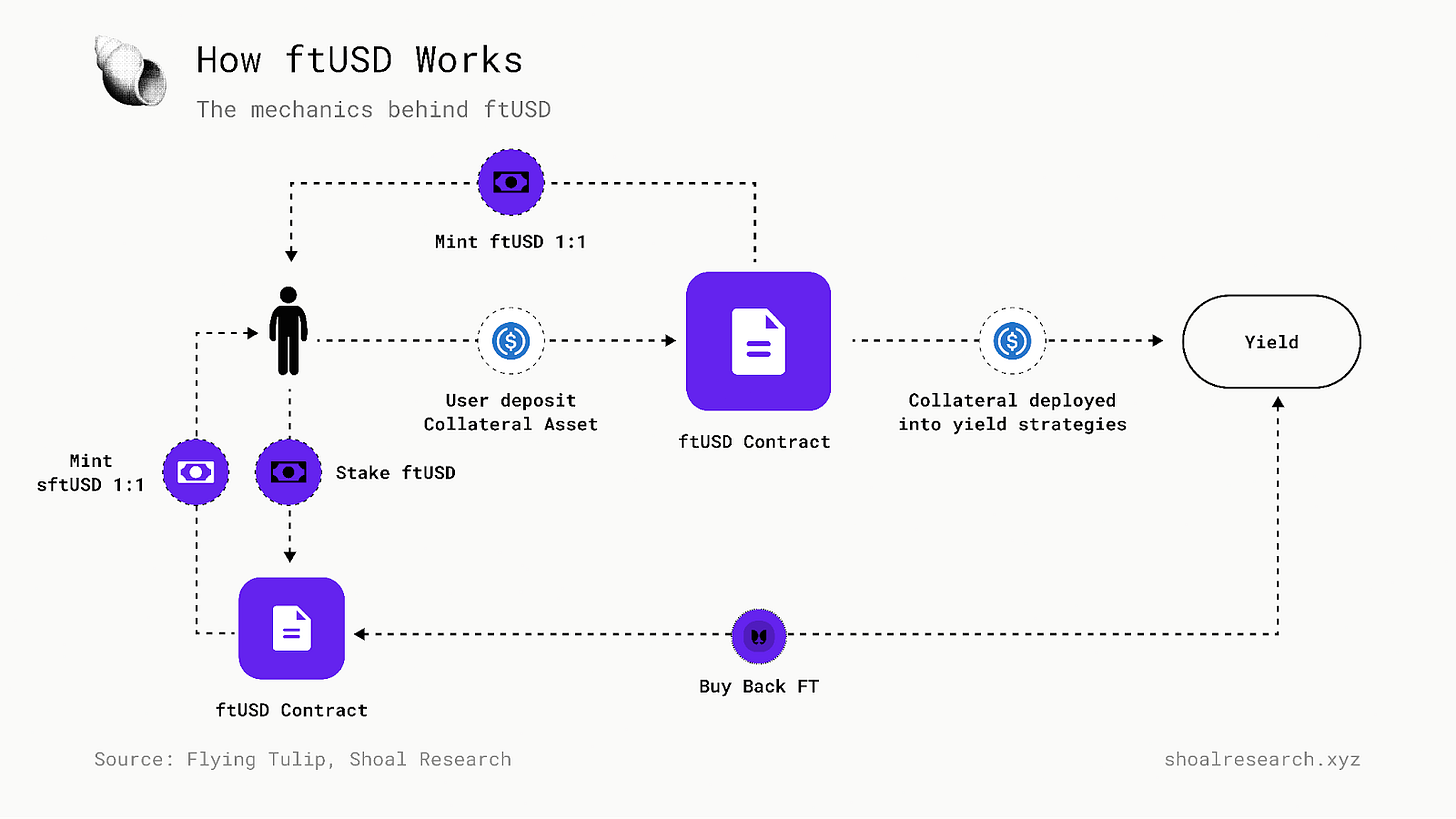

ftUSD: The FT- Native Stablecoin

To avoid dependency on third-party stablecoins for bootstrapping liquidity, Flying Tulip introduces ftUSD, a protocol-native, dollar-pegged stablecoin. that serves as the primary margin and settlement asset across the protocol’s AMM pools, order book, and derivatives markets. ftUSD is minted by depositing supported stablecoins or blue-chip assets and can be held as a stable unit of account or staked to sftUSD to earn yield from Flying Tulip’s underlying yield strategies. Staking represents a conversion into the yield-accruing pool, with distributions reflected through a variable exchange rate between sftUSD and ftUSD.

Collateral deposited to mint ftUSD is deployed across delta-neutral strategies across several venues, executed programmatically onchain to remain transparent and auditable. Assets are allocated across money markets, staking pools, and hedging positions, and the yield generated on these positions is then distributed to sftUSD holders while proceeds from unstaked ftUSD are retained by the protocol to fund operations and liquidity.

How It Works

ftUSD maintains its dollar peg through a delta-neutral strategy, wherein collateral backing ftUSD is deployed to earn yield onchain while keeping net exposure to market movements near zero. Yield for ftUSD originates primarily from the interest earned on supplied collateral in money markets i.e. Aave, plus staking rewards generated on the long side of hedged positions. Positions are rebalanced periodically and constrained by caps, sizing bands, and venue limits to preserve solvency and reduce volatility transmission.

The yield, realized after deducting borrow costs, fees, and safety buffers, is distributed proportionate to the amount of sftUSD held. Distributions to sftUSD holders are reflected through a variable exchange rate between sftUSD and ftUSD. Unstaked ftUSD does not accrue yield; its proceeds are directed to the protocol’s treasury to fund operations, expand liquidity, and support the token-first model.

This structure allows collateral to remain productive while minimizing directional risk. The long (staked) and short (borrowed) legs are calibrated to offset one another under normal conditions, reducing the likelihood of liquidation during volatility. The approach prioritizes conservative sizing and transparent, programmatic management. All strategies and rebalancing logic are executed onchain and are auditable through public dashboards.

ftUSD’s underlying yield strategies operate fully onchain, with key parameters such as pool exchange rates and collateral exposures remaining transparent to track performance and risk composition. All positions are marked to market and managed under the same delta-neutral framework, with periodic adjustments based on observed liquidity and volatility conditions.

A native stablecoin like ftUSD allows Flying Tulip to price risk, settle trades, and manage liquidity under a single unified framework. Anchoring market activity to such a stablecoin enables Flying Tulip to unify collateral management across its AMM, CLOB, and derivatives markets. ftUSD serves as the base unit for margin, settlement, and lending, allowing the same collateral to support multiple positions without leaving the system. Yield generated from these activities, such as funding payments or lending carry, remains within the protocol’s liquidity base and is routed either to sftUSD stakers or to operational reserves according to policy.

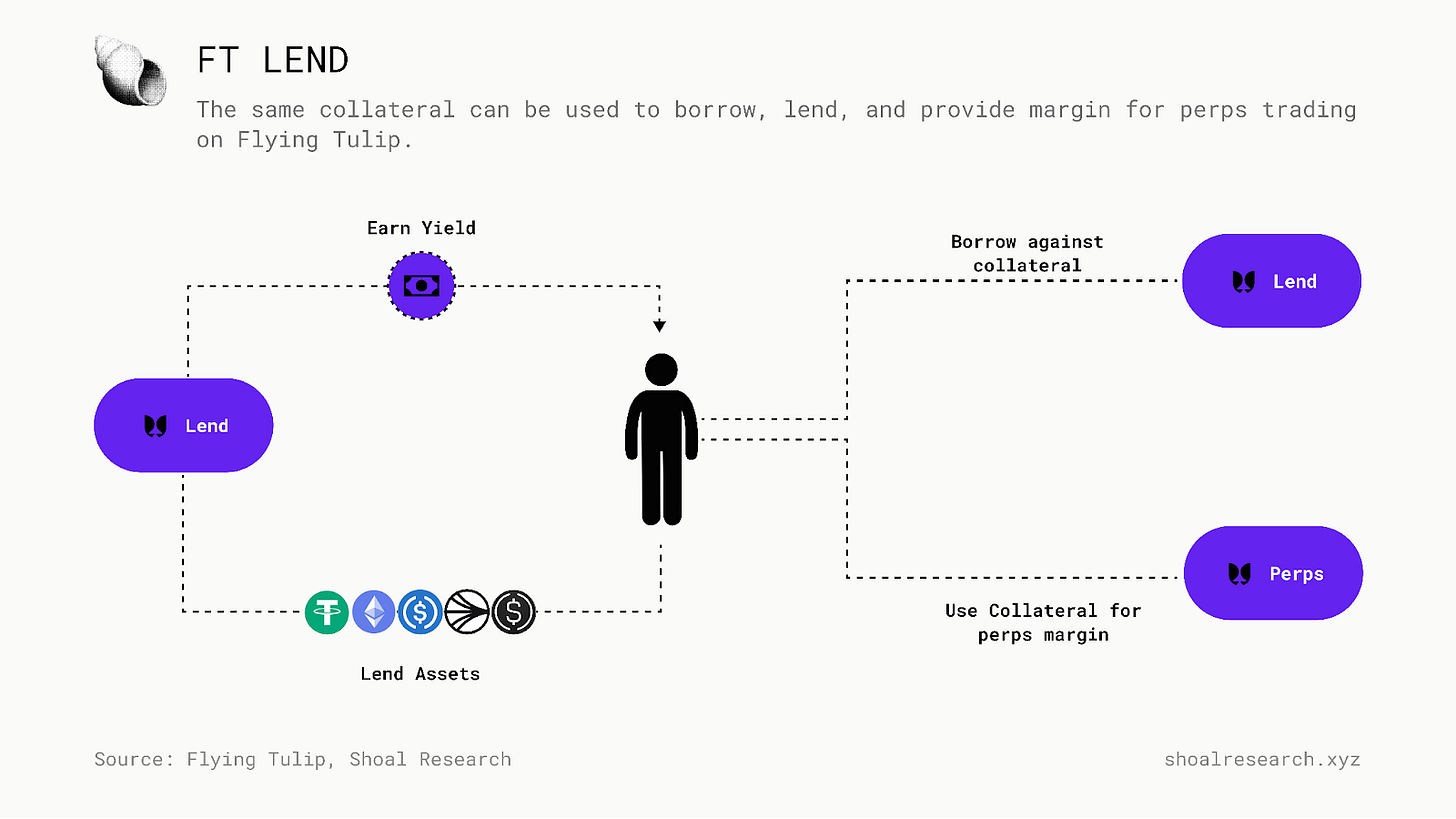

FT Lend: A New Money Market Structure

Flying Tulip introduces FT Lend, a native money market integrated directly into the protocol’s unified margin system. It allows users to borrow and lend assets using the same collateral that supports trading, settlement, and derivatives positions across the protocol. FT Lend is designed from the ground up to operate within an adaptive framework informed by real-time market data on liquidity depth and volatility.

Most of the major money markets today rely on fixed loan-to-value (LTV) ratios and over-collateralization thresholds. Borrowers deposit collateral exceeding the value of their loan, maintaining a margin buffer that depends on the price of the underlying asset. Liquidation occurs when the debt obligation surpasses the collateral’s adjusted value.

Static LTV parameters are chosen for their simplicity and the predictability they offer. They let protocol designers fix a borrow threshold for each asset, defining the maximum debt a borrower can take relative to posted collateral. These thresholds typically assume worst-case volatility and enforce over-collateralization, ensuring lenders remain protected during rapid price movements. However, this design also limits capital efficiency and can have cascading effects. When markets are stable, capital remains under-utilized; when volatility spikes, static parameters amplify liquidation cascades as prices fall and collateral thresholds are reached across the protocol. Static risk parameters, by design, cannot differentiate between stable and volatile market conditions.

FT Lend replaces static assumptions with adaptive parameters that adjust continuously to market conditions. Borrow limits, interest rates, and liquidation behavior are derived directly from onchain data rather than fixed governance rules:

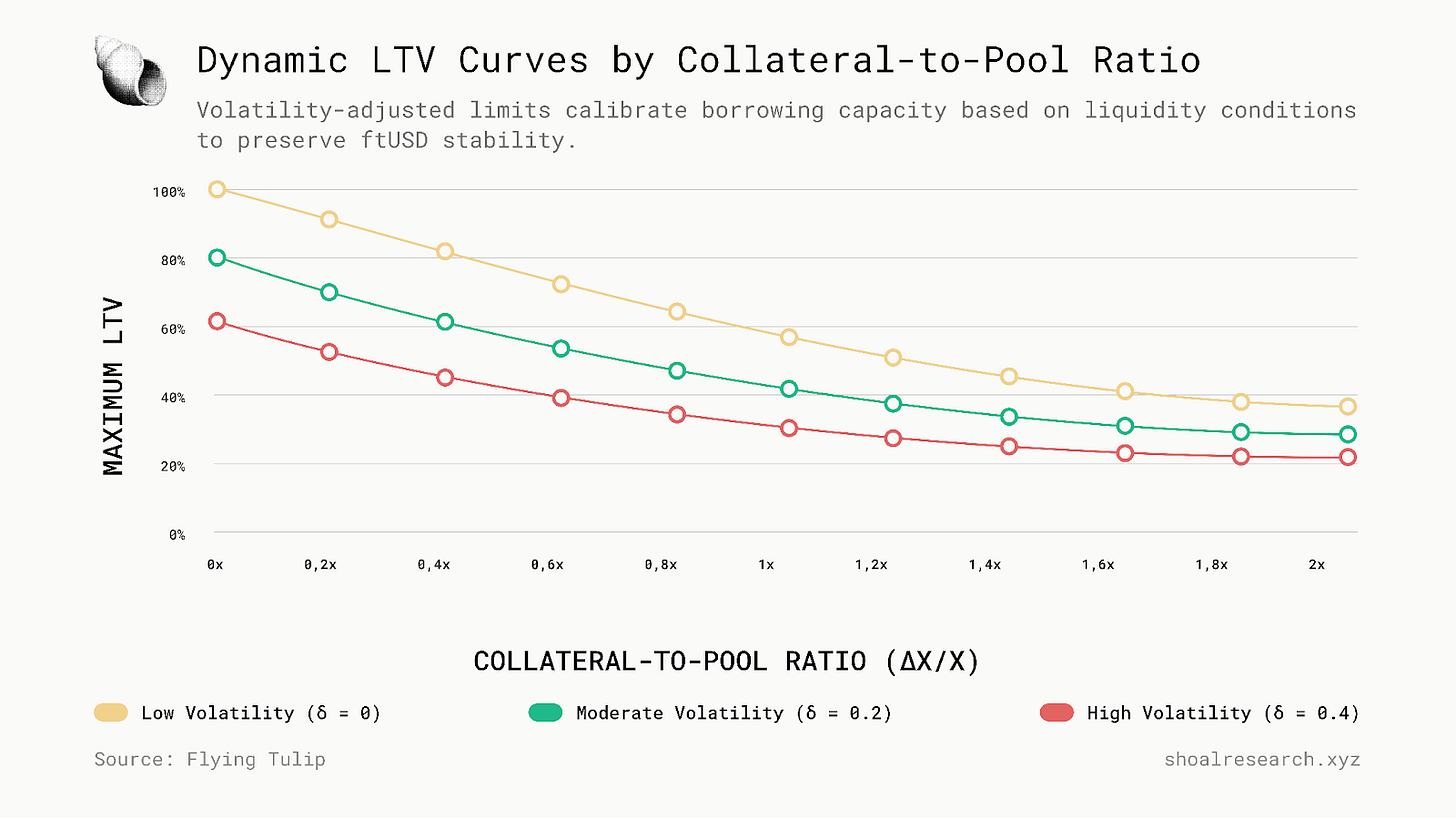

Trade-Weighted LTV (TWAR). Borrowing power scales with position size relative to pool depth. Smaller loans receive higher limits, while larger ones face progressively lower caps to account for execution impact. The collateral-to-pool ratio determines the maximum permissible LTV, which tightens predictably as position size or volatility increases.

Volatility-Aware Rates. Borrow costs adjust according to realized dispersion. Assets are classified as stable or volatile, and rate formulas respond automatically: during high volatility, rates rise and borrowing capacity contracts; during calm periods, rates compress and available credit expands.

Snapshot LTV. When a borrower opens or modifies a position, borrowing limits are locked to current market conditions. Existing positions remain under those limits even as policy parameters change, preserving predictability while allowing future loans to reflect updated market states.

Market-Aware Liquidations. Liquidations are executed through a Liquidity Engine that aggregates AMM reserves and order book depth to minimize slippage. Before execution, the engine simulates price impact, segments large positions into smaller trades, and prioritizes resting CLOB orders when available. This approach reduces volatility transmission and ensures orderly liquidation behavior under stress.

Unified Collateral System. The permissionless layer mirrors the AMM: each trading pair hosts its own lending market, parameterized by live depth and volatility. The permissioned pool governs a curated set of cross-margin assets. Deposits in this pool remain productive across the system—earning base yield, backing open orders, and securing perpetual positions simultaneously. A debt-netting mechanism offsets delta-neutral exposures, mitigating conventional liquidation paths and reinforcing the collateral logic that also underpins ftUSD.

All parameters across LTVs, rates, and utilization update onchain in real time. The AMM publishes time-weighted (TWAP) and reserve-weighted (RWAP) price windows that feed directly into lending logic, ensuring collateral values reflect executable market conditions. Borrowers pay interest; suppliers earn it. Cashflows are settled through the token-first model, where lenders receive FT-denominated yield distributions and policy fees flow into protocol reserves and buyback mechanisms.

Flying Tulip’s protocol research demonstrates that collateral utilization adjusts in line with both market volatility and liquidity depth, as illustrated above. As volatility rises or liquidity thins, the maximum permissible LTV declines along a predictable curve, allowing leverage to expand and contract with market stability rather than remain fixed. This relationship directly informs how FT Lend calibrates borrowing power and liquidation behavior in real time, ensuring that capital allocation across the protocol remains both responsive and risk-aware.

Adaptive AMM-CLOB Spot Trading

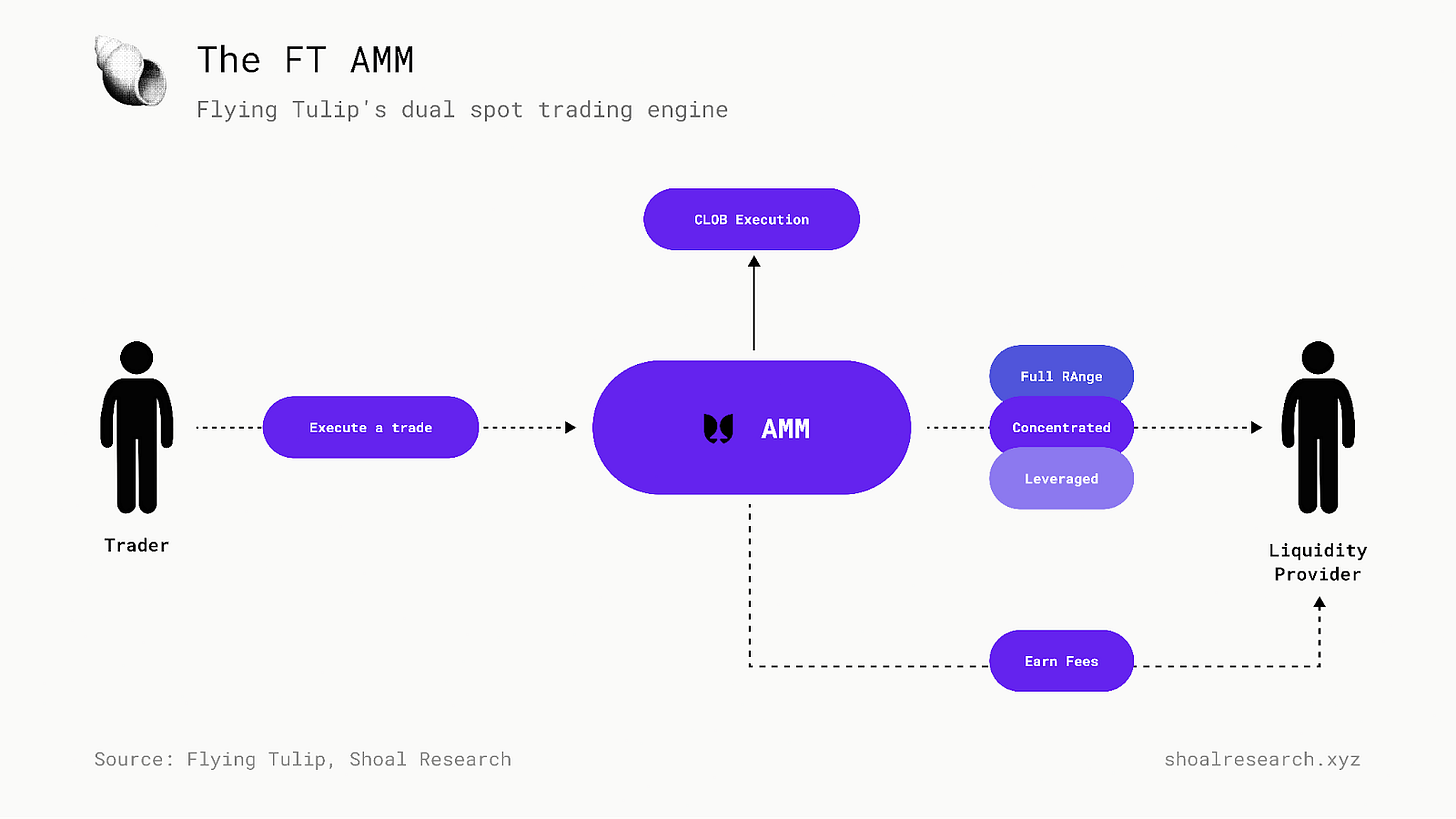

Flying Tulip offers spot trading through a dual-engine exchange that combines an adaptive AMM with a central limit order book for execution. The two systems operate within a unified framework, enabling liquidity to route dynamically between continuous and limit-based liquidity depending on market conditions. Orders execute along the path offering the best realized price and minimal impact, designed to maintain consistent pricing across the protocol.

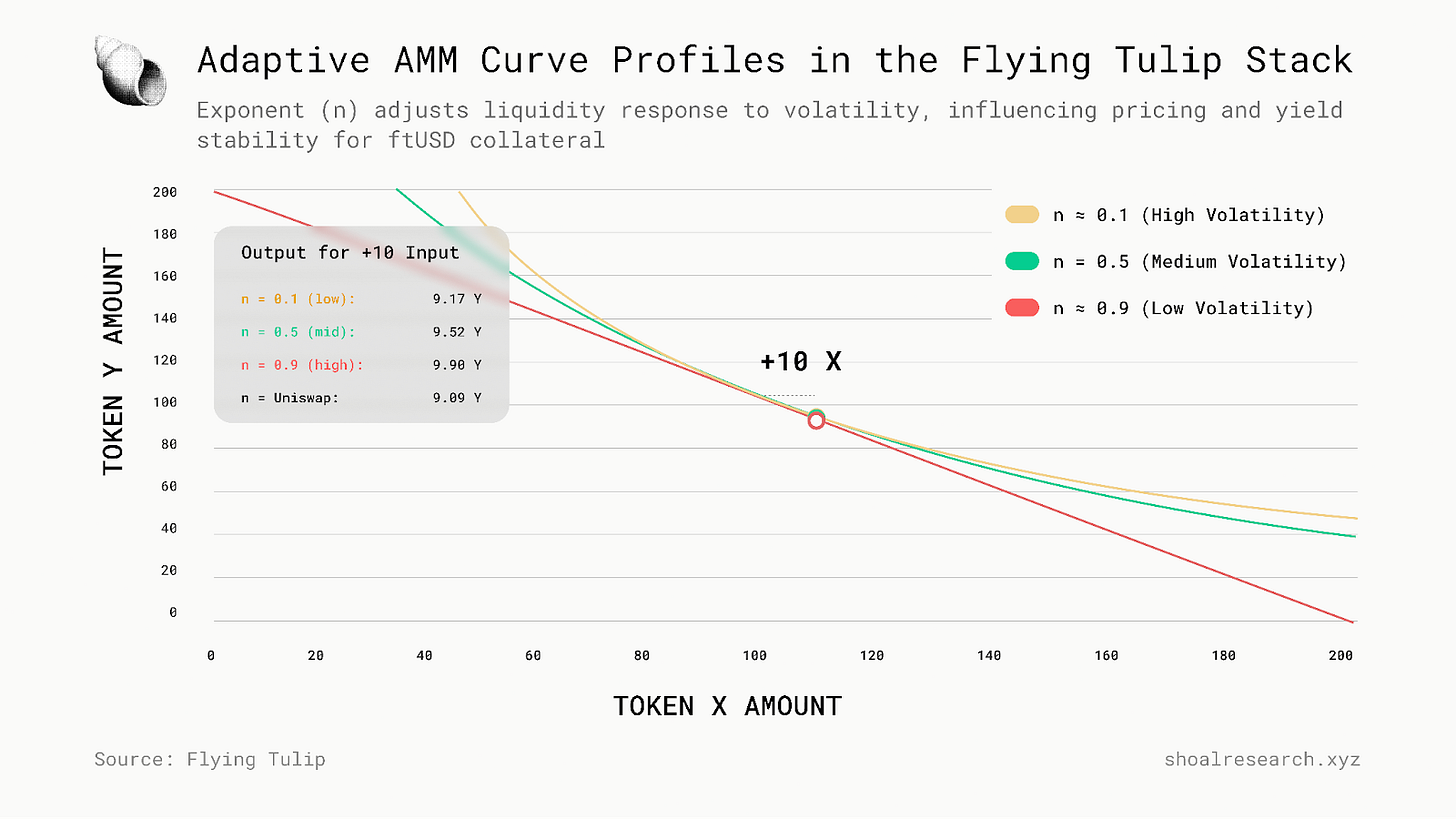

The AMM is curve-adaptive, referencing short-horizon volatility inputs including realized volatility (rVOL), implied volatility (IV), time-weighted average price (TWAP), and reserve-weighted average price (RWAP) to continuously reshape its pricing curve. In stable conditions, the curve flattens toward a constant-sum form to minimize slippage and compress bid-ask spreads. During volatility spikes, it steepens toward constant-product behavior to preserve depth and maintain price integrity against rapid order flow. This allows markets to self-regulate without manual intervention, adjusting curvature to prevailing liquidity and volatility conditions.

Price and flow data are smoothed through exponential moving averages (EMAs), dampening the effects of short-term swings while allowing the protocol to respond to structural market shifts. Guardrails limit how far the curve can migrate during a single window, ensuring predictable behavior for traders and liquidity providers alike. The result is a trading engine that adapts continuously to changing environments while avoiding instability.

Before execution, each swap is simulated onchain to assess its price impact relative to current pool depth and defined pool thresholds. Large trades are automatically broken up into several orders to smoothen market impact. If better pricing is available through the CLOB, orders are routed there by priority; while any remainder clears through the AMM. Fees are dynamic, designed to lower in stable markets to encourage activity, while raising during volatility to compensate LPs for their risk accordingly.

LPs can supply assets across full or concentrated ranges. A full-range position provides consistent fees on a x*y=k basis. Concentrated liquidity allows higher fee density while prices remain within range but requires active rebalancing when markets trend. The adaptive curve moderates these dynamics: spreads tighten when markets are stable and widen when volatility increases, reducing divergence loss during stress periods.

Fees function as a dynamic policy variable rather than a fixed parameter, adjusting with observed market conditions. The schedule moves toward its lower bound in calm regimes, attracting flow, and rises toward its upper bound in volatile conditions, compensating liquidity providers and slowing adverse flow. All bounds and coefficients are publicly visible and updated on-chain.

By unifying AMM and CLOB execution under a shared liquidity and risk framework, the protocol maintains consistent price discovery across conditions and avoids fragmenting depth. The AMM also serves as the foundation for other components; perpetual markets, lending, and liquidations, all of which reference AMM-derived price and depth windows for funding, collateral valuation, and impact-aware execution.

Flying Tulip’s protocol research demonstrates that AMM curvature dynamically adjusts to market volatility, as illustrated above.

This figure compares the simulated performance of several LP strategies across range-bound, uptrend, and downtrend regimes. Concentrated and trigger-based strategies generated higher fee income during stable periods, while passive LPs preserved value through directional moves. The results highlight the trade-off between reactivity and exposure: adaptive strategies outperform in equilibrium markets but converge toward passive outcomes when volatility rises sharply.

This relationship underpins how the protocol’s adaptive curve manages liquidity under stress. By adjusting curvature in response to volatility, the AMM preserves depth, stabilizes fee generation, and supports collateral assets such as ftUSD, ensuring yield and price stability across the broader protocol.

By unifying both market types under a shared liquidity and risk framework, Flying Tulip’s spot module maintains efficient pricing across conditions and avoids fragmenting AMM and orderbook liquidity. The CLOB also incorporates volume-based fee scaling, maker rebates, and a referral system that rewards LP and trading activity, designed to align user incentives with liquidity depth.

FT Perps

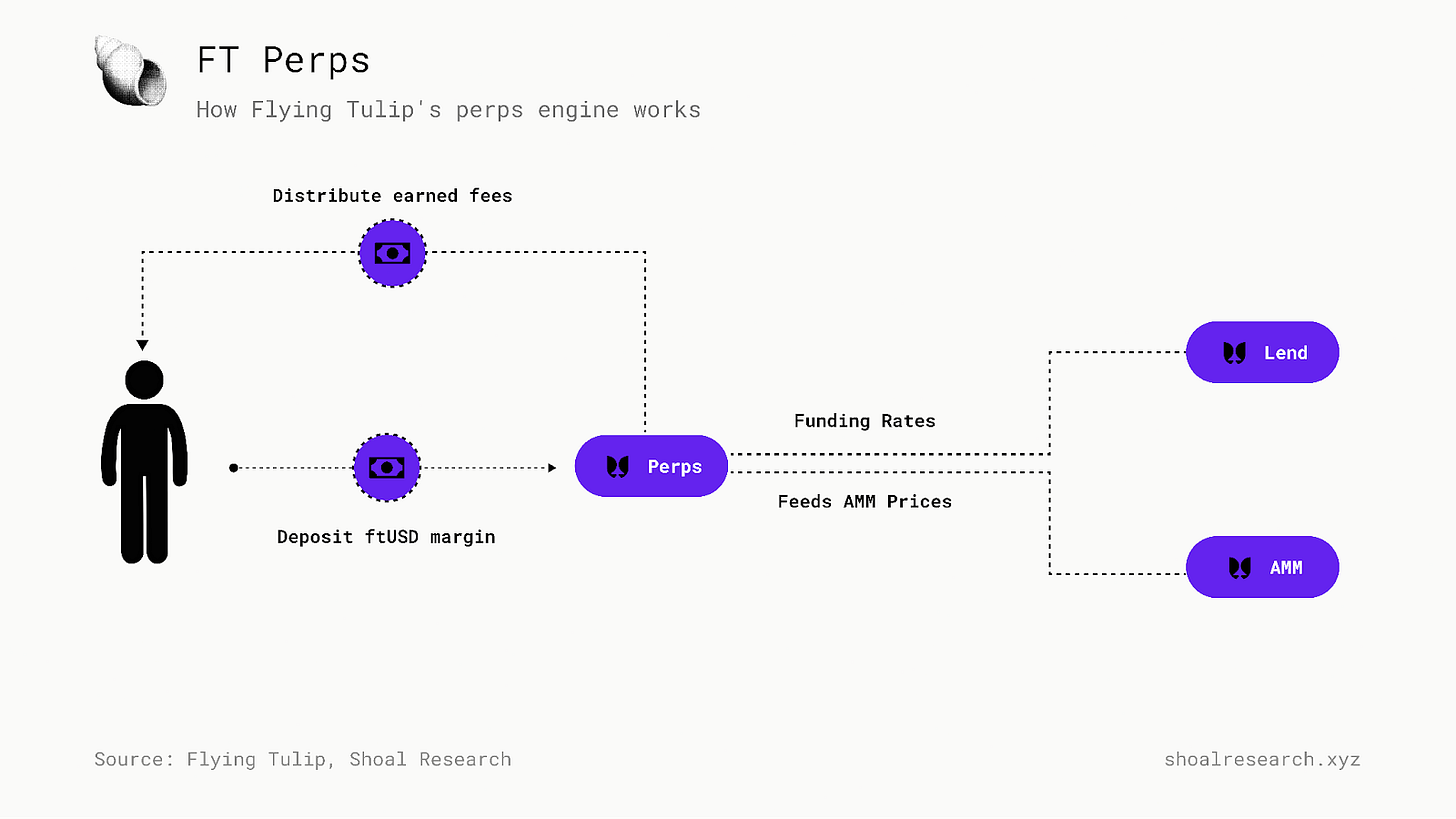

Flying Tulip introduces a native perps engine designed to let users take long or short positions on assets with leverage, settling directly to prices discovered within the protocol’s own AMM and CLOB. FT Perps derives these values internally from the protocol’s live trading activity. Prices, funding rates, and liquidation thresholds reference actual executable liquidity rather than delayed or externally sourced data.

This design allows the protocol to align mark prices with real trading depth. If an asset changes hands at a given price on the AMM or CLOB, that becomes the effective settlement price. Prices are updated on a continuous basis. Funding rates adjust automatically based on borrowing demand, position imbalances, and the effective cost of holding long or short exposure within the protocol. When longs are effectively borrowing stable assets to hold, and that borrowing becomes expensive, the funding rate reflects it; when the imbalance reverses, funding direction flips. All funding inputs and parameters are transparent and observable onchain.

Perpetuals can be traded in isolated or cross-margin modes. In isolated mode, collateral supports a single position, containing risk within that market. In cross-margin mode, users can post collateral from the permissioned Lend pool, allowing a single deposit to back multiple positions across the Flying Tulip protocol while continuing to earn its base yield. Borrowing power and leverage limits are determined by live depth and volatility metrics and are snapshot at the time a position is opened or adjusted to prevent retroactive changes.

Liquidations follow the same logic that governs the rest of the protocol. When a position approaches its liquidation threshold, the engine simulates the next execution step on the AMM’s adaptive curve. If the modeled impact exceeds safe limits, the position is unwound gradually, crossing resting CLOB orders first and breaking up the remainder across the AMM, to minimize price disruption.

All positions settle in ftUSD, Flying Tulip’s native settlement currency. ftUSD itself does not yield, but users can stake to sftUSD to receive protocol distributions. Liquidity providers who opt into settlement pools earn per-settlement fees, supplying ftUSD to back the perps engine.

Because pricing, funding, and liquidation logic all derive from internal markets, FT Perps operates as an integrated component of the broader protocol. It shares the same liquidity base, depth windows, and collateral pools that support the spot and lending layers, ensuring that leverage, pricing, and liquidation behavior remain consistent across the protocol. This structure creates a reinforcing trading environment: market data informs pricing, pricing informs leverage, and both evolve within the same collateral and liquidity framework.

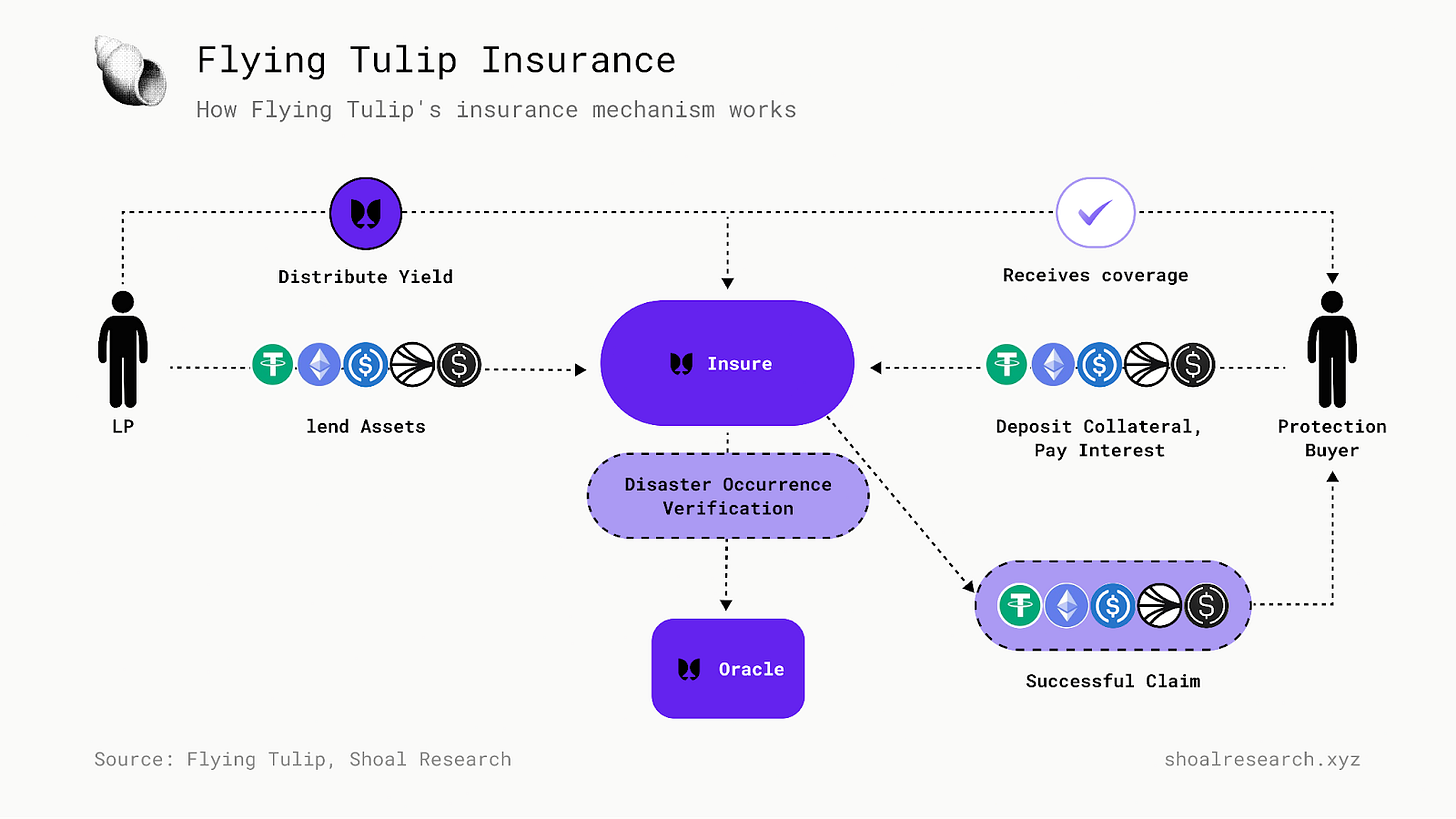

Insurance

Flying Tulip introduces a protocol-native insurance layer with onchain protection for investors against unprecedented protocol incidents. These span across smart contract exploits, faulty liquidations, or other technical failures across the protocol’s trading, lending and settlement layers. The insurance engine operates as a continuous market between coverage buyers - investors seeking to protect their capital - and capital providers that earn yield through the premiums they collect.

Coverage is structured as an active position in a shared pool. Buyers post collateral and pay a streaming premium for the duration of coverage. Providers deposit capital in USDC, which serves as the pool’s base asset and payout currency. In return, they pool tokens representing their proportional share of assets and accumulated premiums, allowing protection capacity and pricing to adjust automatically as utilization and risk conditions change.

Premiums function as variable rates that respond to real-time data. Utilization, coverage demand, and internal risk indicators, which are derived from the protocol’s AMM and order book, jointly determine rate adjustments. When pool utilization rises or volatility increases, premiums move higher to attract liquidity; when conditions normalize, they ease back down.

If an incident occurs, an external verifier such as UMA’s optimistic oracle assesses whether it meets predefined on-chain conditions, including the affected system, time frame, and loss threshold. Once verified, users with active coverage positions can redeem their insured amount in USDC directly from the pool. If no qualifying event occurs, coverage can be closed at any time, immediately halting premium payments.

The insurance layer integrates with the same collateral and pricing systems that govern lending and trading. Assets deposited in Lend can back both open positions and coverage, while the same liquidity and volatility metrics that drive funding and liquidation logic also inform premium and capacity adjustments.

Capital providers assume exposure to verified payout events; coverage buyers depend on oracle adjudication. Both remain exposed to typical smart contract and liquidity risks, with temporary withdrawal limits possible during claim settlement.

In this model, insurance functions as part of the protocol’s internal risk infrastructure rather than an external add-on, allowing protection capacity, premiums, and liquidity to evolve directly with system conditions.

FT & Economics

Flying Tulip’s economic structure centers around its native FT token. Each protocol component – ftUSD, Lend, Perps, AMM, and Insurance – generates transaction fees, funding payments, and yield; which is then used to repurchase and burn FT. This reflects FT’s core design principle: to reflect protocol performance through net token supply over time.

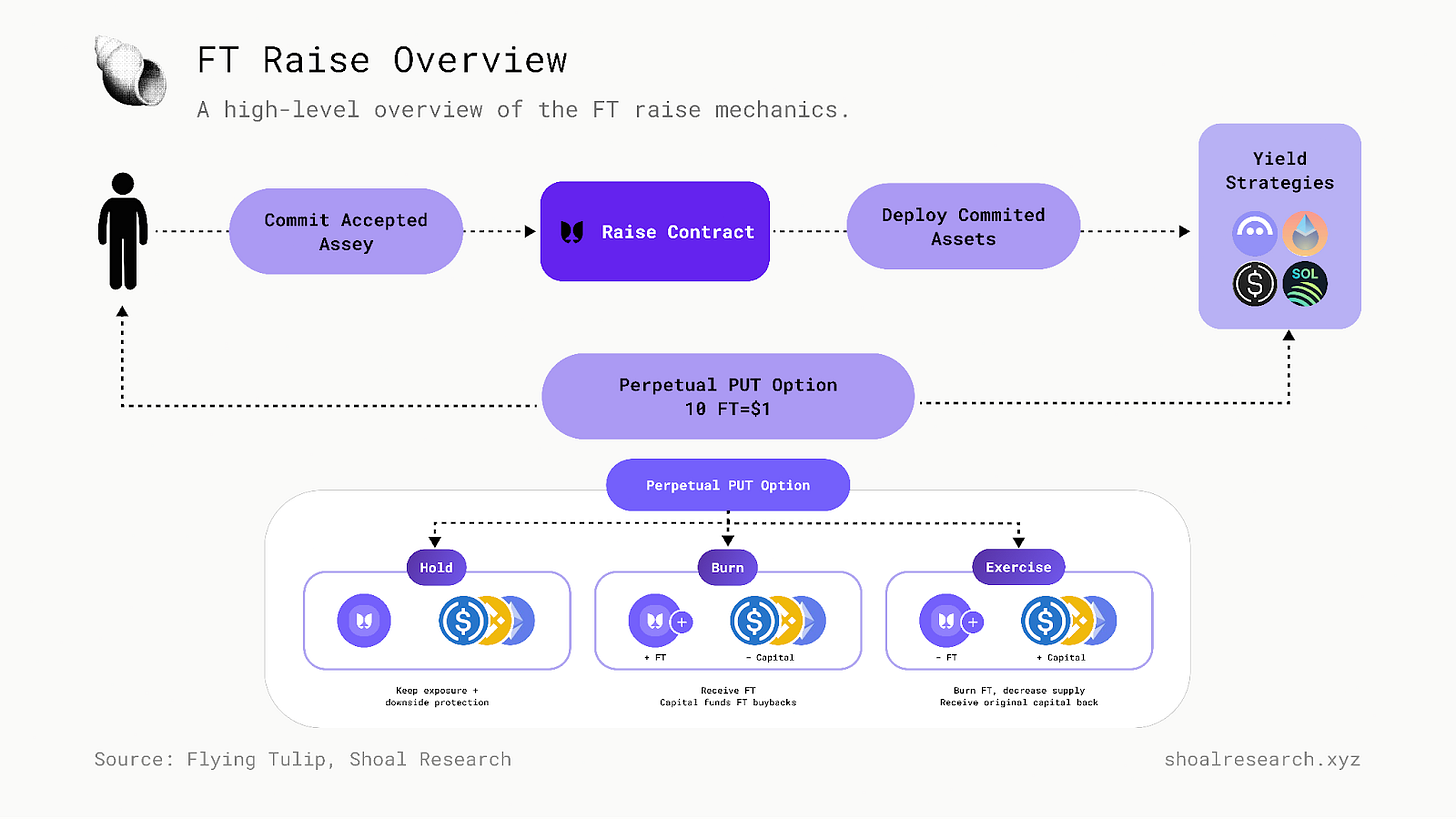

The FT launch introduces a new kind of structure in DeFi, in which 100% of token supply is allocated to private and public participants, at the same valuation at the same time, through the Public Capital Allocation. FT has a fixed supply of 10 billion tokens and no set inflation schedule, and the founding team receives no upfront allocation; any exposure is earned later through open-market buybacks funded by protocol revenue. Minting occurs only through the Public Capital Allocation (PCA) at a fixed ratio of 10 FT per $1 contributed. If $500 million is raised, exactly 5 billion FT are minted; once the 10 billion cap is reached, issuance ceases permanently.

Participants in the raise receive their FT position as an onchain Perpetual PUT. While the option is active, holders can redeem FT at par in the original collateral asset, permanently burning the redeemed tokens; or withdraw FT, invalidating the option and releasing the backing capital for market buybacks and burns.

Each PUT functions as an NFT and encodes specific redemption rights to the participant’s underlying deposit, wherein if a holder withdraws 50% of the tokens allocated to their NFT, they will still be able to redeem the remaining 50% of their invested capital. This enables partial redemptions for investors with transparent onchain accounting, though it also means redemptions are irreversible, i.e. tokens cannot be re-deposited into the NFT once they’ve been withdrawn.

Capital raised through the PCA is deployed into conservative, onchain yield strategies, spanning Aave V3, stETH, jupSOL, AVAX staking, and sUSDe. Yield from these deployments is first distributed across the protocol and its operational costs; while the surplus is allocated towards FT buyback-and-burn. This structure is designed to enable protocol revenue and capital yield to sustain itself without relying on new issuance.

Both paths reduce circulating supply, either directly through redemptions or indirectly through repurchases funded by released reserves. Secondary-market FT carries no such redemption right; if holders redeem their underlying capital, their corresponding FT is burned, reducing circulating FT supply and concentrating more value to existing holders.

Flying Tulip’s Business Model

Revenue generated across the FT product stack is used for FT buybacks:

ftUSD yield flows to the treasury and is used for FT repurchases.

Lend contributes its net interest margin, the spread between borrower and supplier rates.

Perps forwards a portion of trading and funding fees to the same buyback mechanism.

Insurance directs its share of active premiums there as well.

When holders withdraw FT from the Perpetual PUT, the capital released from that redemption reserve funds additional market buybacks.

Repurchased FT is then split between two outcomes: one portion is burned, permanently reducing that given portion of circulating FT supply; the other part is unlocked for distribution.

Unlocked tokens are governed by revenue‑funded buybacks and follow a fixed allocation schedule. When protocol revenue funds buybacks, the Foundation, Team, Ecosystem, and Incentives unlock 1:1 in a 40 : 20 : 20 : 20 split.

Just as Flying Tulip’s products are designed to adapt to real-time market conditions, the protocol’s business model is designed to adapt to real-time protocol activity. When protocol utilization rises, whether through higher trading volume, borrowing activity, or insurance demand, the aggregate revenue available for buybacks increases proportionally. When utilization slows, supply contraction continues but at a reduced rate, as no new issuance occurs.

In practice, FT functions as the coordination layer for value across Flying Tulip’s native ecosystem. Product-level revenue and conservative yield form the inflows; buybacks and burns are the outflows; and unlocks, when revenue-backed, maintain contributor alignment. The result is a closed capital circuit in which operational output, user activity, and liquidity depth all converge into measurable changes in supply, effectively tying FT’s value directly to the protocol’s realized performance and operational efficiency.

Outlook

DeFi hasn’t yet crossed the chasm, but it is far closer than it was a few years ago. The foundations of an Internet Financial System are already in place: 24/7 global settlement, transparent ledgers, composable infrastructure, and the ability to move capital without intermediaries.

However, DeFi’s current architecture remains too fragmented for the open, composable financial system it was intended to be: each primitive manages its own accounting, risk parameters, and collateral base. This isolation preserves protocol solvency but limits broader capital efficiency.

This issue isn’t unique to crypto, nor is it a new one by any means. A brokerage account at Fidelity can’t seamlessly interact with assets held at Charles Schwab. Transferring securities between them involves settlement delays and manual coordination. Even within a single institution, moving funds between accounts, say, rolling over a 401(k) into an IRA, requires intermediary steps and time-consuming processes. In contrast, however, DeFi protocols operate on shared, public infrastructure. Open standards and transparent state make composability a native property rather than a feature built through integration.

Flying Tulip lies uniquely at the intersection of two structural shifts in DeFi: aggregation and real-time adaptivity. The need for unified margin architectures that bring DeFi services i.e. trading, lending, derivatives under shared liquidity and collateral is becoming glaringly obvious as DeFi becomes more and more crowded. At the same time, the need to build DeFi products and services that respond to real-time market conditions in order to adjust parameters such as collateral ratios, borrowing limits, and funding rates, is becoming more apparent.

Flying Tulip aims to capture both in a single protocol. It connects DeFi’s core primitives: stablecoins, trading, lending, derivatives, and insurance, designed to adjust risk and pricing dynamically with real-time liquidity and volatility, through a unified margin account. Undoubtedly, if Flying Tulip’s launch and early growth are successful, there will be dozens of imitators building and selling a similar product. Nonetheless, first-mover advantage is a force to be reckoned with in DeFi. At Shoal, we believe Flying Tulip is well-positioned to become the leading real-time DeFi stack.

Sources

Data is sourced from DeFi Llama.

Richard Stallman, Free Software, Free Society: Selected Essays of Richard M. Stallman, 3rd Edition https://www.gnu.org/doc/fsfs3-hardcover.pdf

Flying Tulip, Flying Tulip Documentation https://docs.flyingtulip.com/

Flying Tulip, Internal Research Threads. Retrieved from:

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author’s own, not the views of their employer. This post has been created in collaboration with the Flying Tulip team. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research.