EigenLayer Unlocked: A Viable Path towards Frictionless dApps

Exploring EigenLayer’s Restaking Ecosystem with The Rollup Team

Within the web3 space, the pursuit of efficient, secure, and scalable decentralized applications (dApps) has driven innovation across various networks. As blockchain ecosystems grow, so do the demands for robust infrastructure that can support diverse applications without compromising security or decentralization. EigenLayer, a pioneering platform in modular blockchain infrastructure, addresses this challenge with a transformative solution: enabling the creation of Active Validator Sets (AVSs). AVSs empower developers to launch decentralized, self-enforcing systems that extend blockchain functionality, unlocking new dimensions of coordination and trust. By leveraging EigenLayer, developers can programmatically deploy distributed off-chain services that uphold credible commitments, ensuring that systems operate as intended, free from centralized oversight.

This innovation is supported by EigenLayer’s restaking mechanism, which enhances traditional staking by allowing participants to contribute economic security across multiple platforms and services. While restaking offers additional yield opportunities, its true significance lies in its ability to underpin AVSs and ensure they run reliably, ultimately driving the next wave of blockchain adoption. By enabling the creation of AVSs, EigenLayer drives transformative value, fostering decentralized, market-driven ecosystems where innovative applications can thrive. AVSs reduce entry barriers, unlock scalable economic security, and enable developers to deploy systems built on credible commitments and self-enforcing mechanisms.

This report explores EigenLayer's restaking model in reshaping how networks are traditionally bootstrapped. Through insights from The Rollup’s podcast series EigenLayer Unlocked, we examine EigenLayer’s advancements in its restaking ecosystem, operator incentives, and modular cross-chain architecture, presenting the case that EigenLayer is establishing the essential building blocks for a truly decentralized future. Readers can use this deep-dive as a comprehensive companion guide to the podcast episodes it references, providing an in-depth overview of key concepts and insights discussed. For a richer understanding, we highly recommend listening to the full series. (Episodes summarized in this report: Episode 1, Episode 5, and Episode 15)

Restaking Economics and Network Security

At the core of EigenLayer’s contribution to the blockchain space is the concept of restaking, an approach that enables additional networks and/or dApps operating outside the Ethereum Virtual Machine (EVM), generally referred to as AVSs, to leverage Ethereum’s own consensus mechanism as the underlying security layer. Restaking creates opportunities for stakers utilizing liquid staked tokens (LSTs) to compound their returns while enabling new networks to tap into a shared pool of economic security, helping them overcome the “cold start” challenge commonly faced not only by startups in the blockchain realm, but across all industries. For Ethereum, where most restaking activity occurs, stakers commit their assets to the network, and with EigenLayer’s approach, they can further “restake” those assets to support additional services without compromising their primary Ethereum stake.

Restaking builds on the concept of staking rewards by offering higher yields through participation in securing a range of services, each of which provide their own native token rewards and may impose associated slashing risks. These risks, though potentially affecting the principal assets (i.e. including the original ETH stake & additional staking rewards), are compensated by the potential for greater returns – though the value of these additional yields is ultimately dependent on the price of the underlying native tokens earned for each AVS individually selected to be secured.

As a result, restaking provides a significant incentive for both stakers and the AVS developers: it creates an economically viable ecosystem where services can launch and scale more easily by tapping into a shared security pool. By lowering the barriers for smaller-scale applications to access decentralized security, EigenLayer accelerates the pace of decentralized innovation. This accessibility allows developers to bootstrap networks for niche use cases that were previously impractical, creating a ripple effect of innovation and iteration cycles.

Unique Stake Mechanism and Cascading Security

While launching AVSs is the cornerstone of EigenLayer’s innovation, restaking introduces mechanisms that ensure the scalability, sustainability, and trustworthiness of these systems. Slashing plays a pivotal role in this ecosystem by acting as a safeguard that enforces accountability among stakers and operators. It ensures that AVSs can function as high-trust systems, where all participants—users, stakers, and operators—can rely on the network to perform as intended, with meaningful penalties for failures or malicious actions.

To support AVSs, EigenLayer enables a robust framework where:

Staking allows participants to contribute security in exchange for yield.

Delegation to operators ensures that those executing tasks for AVSs have financial stakes tied to their performance.

Rewards incentivize both stakers and operators for their contributions, creating a sustainable economic model.

Launching AVSs allows developers to leverage EigenLayer to create new decentralized services and value propositions for users.

In this context, slashing is the final but essential mechanism to maintain network integrity. While not directly tied to the AVS’s ability to create value, slashing ensures that the restaking model can scale securely. Without it, cascading failures—where a security breach or slashing event in one AVS impacts others—would pose significant risks to the broader ecosystem. EigenLayer addresses this challenge with innovations like “unique stake,” which isolate risks and prevent cascading attacks, preserving the trust and reliability that underpin the entire system.

Unique stake designates a specific portion of a staker’s assets exclusively for each service. This means that if one service incurs a slashing event, the staker’s other commitments are insulated, preserving security for the rest of the network. This mechanism is particularly valuable in maintaining trust across interconnected services, as it ensures that economic failures in one area do not automatically compromise the security of unrelated services. Unique stake not only improves security but also instills confidence among developers and users, encouraging more stakers to participate in restaking and thus contributing to a stable economic environment for dApps.

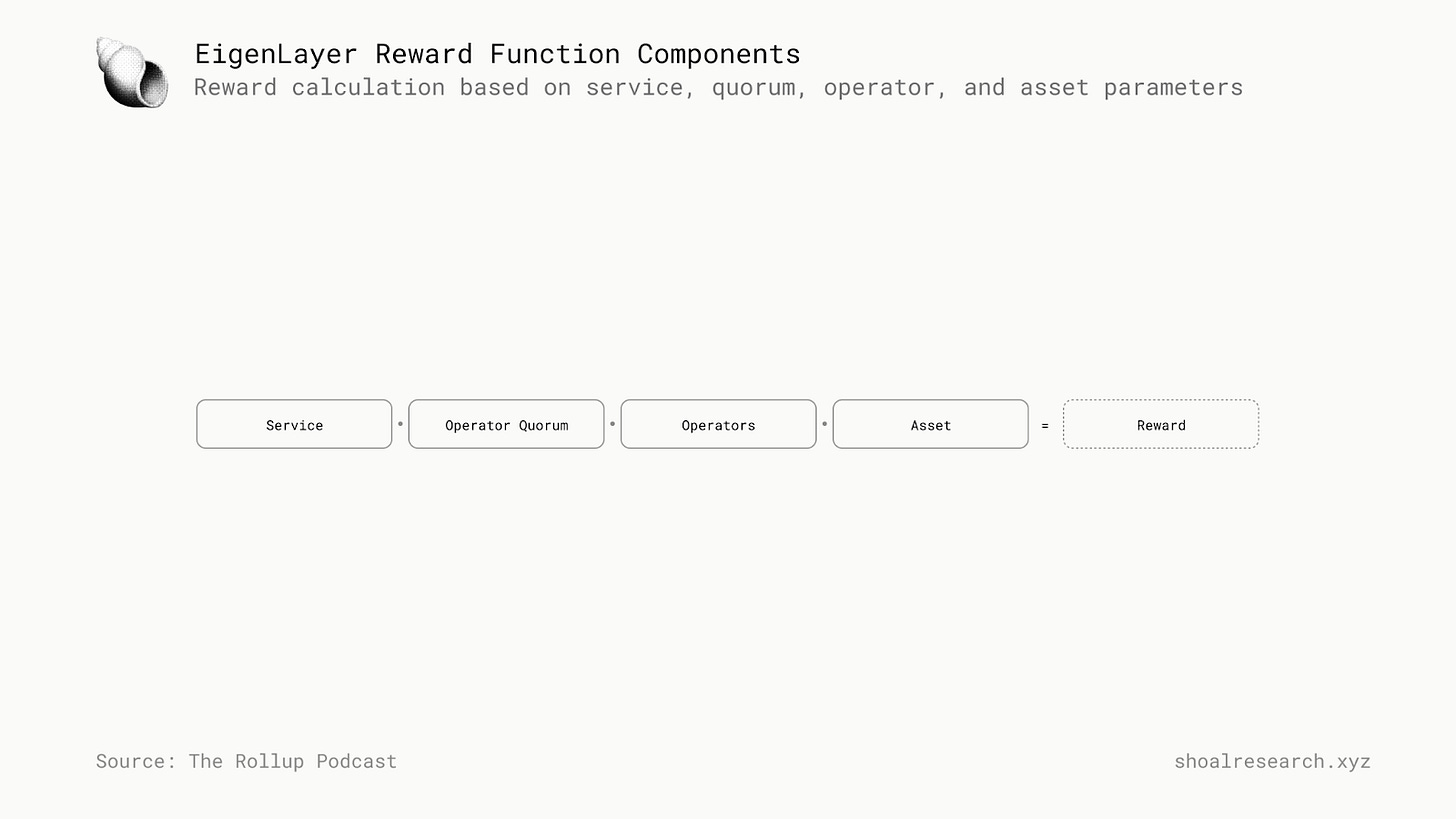

Economic Alignment Across Participants

In a multi-stakeholder ecosystem, aligning the incentives of stakers, operators, and services is essential to sustaining a vibrant restaking economy. EigenLayer’s model creates an economic alignment by providing returns that are proportional to the risks each party assumes, yet this balance is delicate. Stakers are primarily motivated by the pursuit of higher yields on their staked assets, while operators, who facilitate the services, prioritize fair compensation and reliable service conditions. Meanwhile, the services or dApps themselves seek to attract sufficient economic security and active operators to ensure stability and scalability.

This alignment is managed by incentivizing each participant in ways that are transparent and market-driven. For example, operators can select services based on their desired levels of compensation and security requirements. This choice allows operators to leverage their technical capabilities—whether operating from personal devices or large-scale infrastructure—to participate in services that align with their risk tolerance and resource availability. Services, on the other hand, benefit from EigenLayer’s flexible reward system, which allows them to adjust payouts based on operator contributions and market conditions, creating an adaptable ecosystem where participants’ incentives naturally align.

By incorporating a market-based approach, EigenLayer relies on the principles of supply and demand to maintain economic equilibrium within the ecosystem. This dynamic, incentive-driven approach allows EigenLayer to establish a sustainable economic flywheel for restaking that benefits all participants and fosters the ongoing growth of the decentralized application ecosystem—particularly reinforcing Ethereum’s leadership in the space.

The Role of Operators, Slashing, and Liquid Restaking

In the EigenLayer ecosystem, operators play a critical role in ensuring the smooth functioning and security of networks and services that rely on restaked assets. Operators are responsible for maintaining the infrastructure that powers these services, whether by running nodes, verifying transactions, or supporting the technical backbone of the underlying networks.

To accommodate the diversity among operators—from those with minimal resources to large-scale enterprises—EigenLayer employs a quorum-based model known as operator sets. These sets offer a structured way to organize and reward operators based on the specific security, performance, and resource needs of different services.

The Importance of Quorum-Based Models

Operator quorums allow EigenLayer to meet the varied demands of services by tailoring service requirements and rewards for each type of operator. For example, some services may require highly secure, dedicated servers to manage mission-critical tasks, while others may work with operators who have more limited resources. Operator quorums provide the necessary flexibility for both ends of the spectrum, creating a scalable and inclusive network that accommodates a wide range of technical capabilities.

The operator quorum model not only enables services to specify their unique security and performance requirements but also streamlines the decision-making process for operators, who can assess their capabilities against the requirements of different quorums. This approach reduces friction by allowing operators to self-select into the services that align with their resource capacity and compensation goals.

As EigenLayer expands, the operator quorum structure is expected to evolve, supporting increasingly sophisticated services and expanding the potential for more specialized platforms to launch and grow within the ecosystem.

Slashing Mechanisms and Risk Management

One of the core challenges in maintaining a decentralized and secure network is ensuring that operators remain accountable for their performance. EigenLayer addresses this through a carefully designed slashing mechanism, which penalizes operators who fail to meet the service-level agreements (SLAs) set by their assigned quorums. Slashing can occur if an operator breaches these agreements—whether by going offline, providing incorrect data, or otherwise compromising the service’s integrity.

EigenLayer’s slashing mechanism is integral to managing risk within the ecosystem, as it incentivizes operators to maintain high standards and discourages behavior that could harm the network. In addition to penalizing poor performance, the mechanism includes “force-eject” conditions that prevent non-compliant operators from continuing to earn rewards within a quorum. By enforcing these standards, EigenLayer creates a system where only reliable operators can maintain participation, which in turn strengthens the overall integrity of the services dependent on the network.

The slashing model is crucial not only for protecting individual services but also for preserving the stability of the entire EigenLayer ecosystem. When operators are aware that they may lose their staked assets for failing to meet SLAs, they are more likely to prioritize high-quality service. This alignment of incentives fosters a culture of reliability and accountability among operators, which is essential for building and maintaining trust within a decentralized network. Moreover, by penalizing operators directly, EigenLayer reduces the risk of cascading failures that could otherwise jeopardize the network and the services that rely on it.

Liquid Restaking and Market-Driven Efficiency

Another versatile aspect of EigenLayer’s restaking model is its support for liquid restaking, which allows stakers to reallocate their assets across various services in response to market conditions. Liquid restaking enhances the flexibility of EigenLayer’s marketplace by enabling stakers to adjust their allocations based on potential returns, risk tolerance, and market demand. This dynamic allocation system is particularly advantageous for stakers seeking to maximize yield while managing their individual exposure to risk.

Liquid restaking also plays a significant role in making EigenLayer’s marketplace more efficient. By allowing stakers to move assets seamlessly across services, EigenLayer reduces the need for manual intervention and coordination, relying instead on market dynamics to balance supply and demand within the ecosystem. This approach leverages the “invisible hand” of the market to drive efficiency, ensuring that assets are allocated where they can generate the greatest economic impact. It also allows EigenLayer to adapt to changing conditions within the rapidly-expanding blockchain landscape, fortifying its long term resilience.

The benefits of liquid restaking extend to operators as well. Operators can adjust their strategies and service offerings based on real-time feedback from the market, allowing them to respond to shifts in demand and optimize their resource allocation. For example, if demand for high-security services increases, operators who can meet these requirements may see higher rewards, incentivizing them to invest in more robust infrastructure. This feedback loop creates a self-regulating ecosystem where operators and stakers naturally gravitate towards the most profitable and reliable services, enhancing overall efficiency.

In addition, liquid restaking promotes a more inclusive network by lowering the barriers to entry. Stakers and operators alike can participate in the ecosystem without needing to commit to a single, rigid service or configuration. This flexibility supports the decentralized nature of the network, as participants can adapt their involvement over time in response to new opportunities or shifts in market conditions. For AVS developers, this model provides a readily available pool of economic security, allowing new services to bootstrap quickly without the need for extensive initial capital.

As EigenLayer’s operator quorums, slashing mechanisms, and liquid restaking processes create a flexible, efficient marketplace, they set the stage for an even more ambitious innovation: enabling seamless, modular applications across multiple blockchains.

Stateless Apps and Cross-Chain Innovation

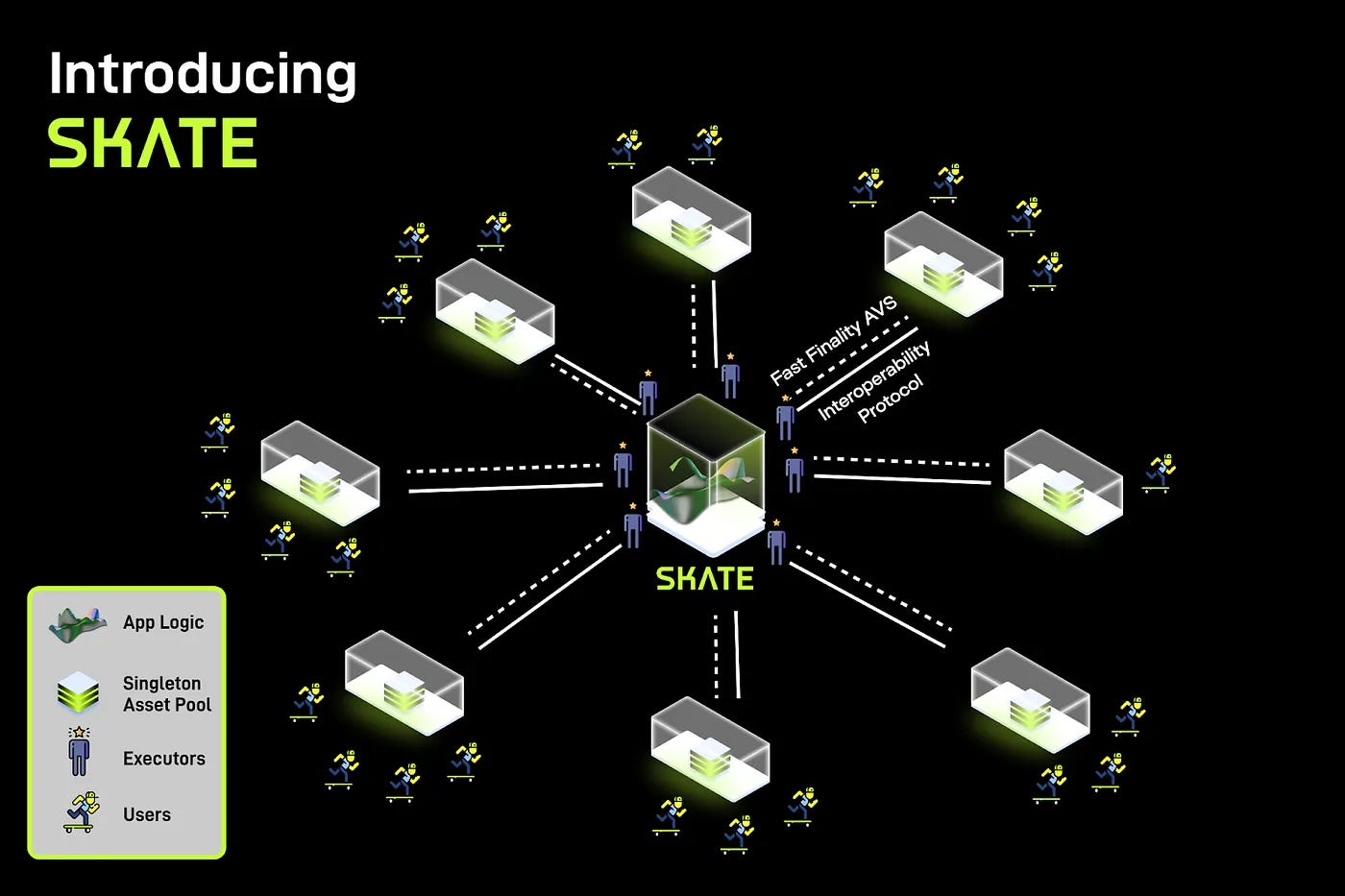

As blockchain networks grow, applications built on single-chain architectures face limitations in liquidity, scalability, and flexibility. These issues are further compounded by the expanding variety of networks, each with its own assets, protocols, and communities. To address these challenges, Skate—a platform built on EigenLayer—introduces stateless applications that enable seamless interactions across chains, transforming the way dApps operate in a multi-chain ecosystem.

The Stateless Design by Skate

Skate’s stateless architecture represents a significant shift from traditional dApps, which rely on specific blockchain environments to execute their logic and maintain state. By decoupling application logic from individual chains, Skate enables developers to create modular, interoperable applications that function across multiple networks. Stateless apps employ a "hub and spoke" model, with core logic running on a central hub while users interact through various blockchain “spokes.”

In a Skate-powered dApp, a user can initiate a transaction on one chain, such as Ethereum, while the core application logic and security are maintained on another network serving as the central hub. This model creates a unified experience, allowing dApps to share liquidity, process data across chains, and avoid duplicating their application state. This central logic management gateway makes it easier for developers to maintain and scale applications without being restricted by the limitations of individual chains.

EigenLayer’s infrastructure enables this stateless architecture by acting as a decentralized “hub” where application state and economic security are managed. By offloading complex multi-chain coordination to this hub, EigenLayer and Skate simplify cross-chain interactions, making scalable and efficient multi-chain applications a reality.

Hub-and-Spoke Model for Cross-Chain Liquidity

One of the primary advantages of Skate’s stateless design is its ability to unify liquidity across chains. Traditionally, liquidity is fragmented, with assets isolated on separate networks. For example, liquidity for an Ethereum-based application is generally only accessible to Ethereum users, which limits cross-chain interaction. Skate’s hub-and-spoke model, however, aggregates liquidity from various chains in a central hub, enabling seamless access for users across networks.

EigenLayer’s support for this architecture facilitates the flow of assets and data between blockchains. By allowing liquidity pools from different chains to be combined, EigenLayer enables users to interact with applications on any connected blockchain without facing liquidity shortages. This cross-chain liquidity benefits decentralized finance (DeFi) applications, which often rely on large liquidity pools for efficiency. With Skate, DeFi protocols can access unified liquidity, offer competitive rates, and reduce transaction costs, addressing common issues in previous multi-chain DeFi deployments by consolidating assets within a single structure

Economic Security for Cross-Chain Applications

The success of cross-chain applications depends on robust economic security to protect assets across multiple blockchains. EigenLayer’s role as an economic custodian is essential to this framework. Through restaking, EigenLayer provides a strong economic foundation, leveraging pooled assets from stakers to secure and validate operations on Skate’s applications across chains.

For cross-chain applications, EigenLayer’s security model enables reliable verification and data attestation between chains, fostering a secure, interconnected ecosystem. When a user initiates a transaction on any blockchain connected through Skate, EigenLayer’s decentralized network of stakers and operators validates the transaction, ensuring it aligns with the dApp’s economic requirements.

The slashing mechanic embedded into EigenLayer’s platform is useful in maintaining operator accountability throughout this process. For example, an operator overseeing a cross-chain transaction could face slashing if they fail to verify or relay data accurately. Given the unfamiliarity users may have with cross-chain interactions, establishing a credibly neutral and decentralized accountability mechanism is essential for fostering trust and driving the adoption of stateless applications.

Scalability and Development Benefits of Stateless Architecture

Beyond liquidity and security, Skate’s stateless architecture offers substantial scalability and development benefits. By developing a “control center” for application state management on EigenLayer’s hub, dApps on Skate can operate across multiple blockchain networks without duplicating code or assets. Developers maintain a single instance of the application’s core logic, making updates more efficient and reducing maintenance costs. This adaptability is particularly valuable in a multi-chain future, enabling developers to extend their applications’ reach and impact with minimal friction.

In line with its commitment to cross-chain accessibility, Skate recently launched its first stateless app pilot by integrating the popular Web3 prediction market, Polymarket. Previously hosted solely on Polygon (an Ethereum Layer 2), Polymarket is now accessible through Skate Passport on TON, allowing millions of Telegram users on the TON blockchain to interact directly with the prediction market without the need for bridging. Skate’s stateless design pattern enables applications like Polymarket to operate seamlessly across distinct blockchain environments, ensuring a unified experience for users regardless of their underlying chain.

This pilot is a significant milestone in Skate’s broader vision to make powerful dApps accessible across various blockchain ecosystems. By unifying application logic through its Stateless infrastructure, Skate plans to expand access to Polymarket and other applications across additional chains, including Solana and other EVM-compatible networks like Mantle. This seamless multi-chain deployment illustrates the scalability advantages of Skate’s architecture, allowing dApps to reach new audiences and leverage broader network effects. Users can now access the Polymarket pilot on Telegram at https://t.me/skate_app_bot/app.

From a scalability perspective, unifying application logic alleviates traditional growth constraints on dApps. Applications can scale effectively across chains without being bound by the limitations of individual networks. With EigenLayer handling cross-chain verification and economic security, developers can focus on building user-centric features and enhancing functionality rather than managing infrastructure complexities.

Practical Implications and Future Outlook

As EigenLayer’s stateless application model and cross-chain capabilities illustrate, the platform offers a powerful foundation for a truly modular and interconnected blockchain ecosystem. By merging technical innovation with strong economic security, EigenLayer enables new dApps to scale, share liquidity, and build user-friendly services across chains. There are a number of potential real-world benefits worth exploring as well as potential challenges of adopting this model as the decentralized landscape continues to grow.

Advancements in dApp Development

EigenLayer’s restaking model and stateless application architecture tackle some of the most pressing challenges faced by dApp developers, such as liquidity fragmentation, scalability constraints, and single-chain limitations. By leveraging shared economic security and enabling seamless cross-chain interactions, EigenLayer empowers developers to build modular, scalable applications without duplicating infrastructure or liquidity.

These innovations translate into greater efficiency and flexibility for developers. With EigenLayer, dApps can tap into unified liquidity pools, reduce technical overhead, and deploy applications across multiple chains with minimal modifications. This approach lowers barriers to entry, fosters adoption, and creates a more accessible environment for dApps to grow.

In the DeFi space, EigenLayer’s solutions are particularly transformative, enabling protocols to unify liquidity, offer competitive rates, and enhance capital efficiency. By addressing these longstanding challenges, EigenLayer positions itself as a critical enabler of a more interconnected and user-friendly decentralized ecosystem.

Challenges and Considerations for Broader Adoption

Despite its numerous advantages, EigenLayer’s model does face potential challenges as it seeks broader adoption. The multi-stakeholder ecosystem created by EigenLayer’s restaking model introduces complexity in aligning incentives among stakers, operators, and dApp developers. Transparent communication and balanced, dynamic incentive structures will be essential to maintain participant trust and engagement over the long term. Ensuring that all parties have access to reliable data and tools to assess risks and returns can help address these concerns.

Another consideration is the potential regulatory scrutiny that may arise as EigenLayer’s ecosystem grows and more cross-chain interactions occur. As blockchain-enabled networks and, in particular, DeFi continue to face increasing regulatory attention, EigenLayer will need to monitor compliance requirements and adapt to evolving regulations to ensure the long-term viability of its model. Luckily for the crypto industry as a whole, the regulatory headwinds may soon be shifting to tailwinds.

Lastly, the technical and educational challenges of introducing stateless, cross-chain dApps should not be underestimated. As EigenLayer brings new models like restaking and stateless architecture into the market, comprehensive onboarding resources and community engagement will be necessary investments to ensure the public understands the notable advantages over the current system.

A Decentralized, Friction-Free Future – Secured by EigenLayer

EigenLayer stands at the forefront of the decentralized revolution, paving the way for a blockchain ecosystem that is not only modular but also robust and scalable. By introducing groundbreaking innovations in restaking, operator incentives, and cross-chain interoperability, EigenLayer has set the stage for a more interconnected, multi-chain world. Its platform enables services to leverage shared security, unify liquidity across chains, and scale in ways that were previously unattainable, transforming the decentralized landscape.

As blockchain continues to mature and integrate across industries, EigenLayer’s commitment to modularity and economic security offers a flexible foundation for the next generation of decentralized applications. Stateless architecture powered by its restaking model provides developers with a powerful toolkit for building applications that can move seamlessly across chains, from DeFi and gaming to data storage and beyond. In a world where single-chain limitations are becoming unacceptable, EigenLayer empowers dApps to thrive across ecosystems, reaching new users and tapping into broader liquidity pools.

The vision of a modular, multi-chain blockchain future is no longer just a possibility—it is here, brought to life by EigenLayer. For developers, operators, and blockchain stakeholders, this platform represents an invitation to embrace a decentralized future where Web3 applications can not only rival Web2 but ultimately surpass it. By aligning economic incentives with technological advancements, EigenLayer is crafting a resilient and sustainable ecosystem, one that promises to redefine the boundaries of what decentralized applications can achieve.

References

The Rollup. (2024, October 15). The Role of Operators, Slashing, and Liquid Restaking with EigenExplorer [Video]. YouTube.

The Rollup. (2024, October 19). How Stateless Apps Enable New Cross-Chain Possibilities with Skate [Video]. YouTube.

The Rollup. (2024, October 28). How To Think About Restaking Economics with Tarun Chitra [Video]. YouTube.

EigenLayer Team. (2023, February 20). EigenLayer: The Restaking Collective [Whitepaper]. EigenLayer. https://docs.eigenlayer.xyz/assets/files/EigenLayer_WhitePaper-88c47923ca0319870c611decd6e562ad.pdf

Eigen Labs Team. (2024, April 29). EIGEN: The Universal Intersubjective Work Token [Whitepaper]. Eigen Labs. https://docs.eigenlayer.xyz/assets/files/EIGEN_Token_Whitepaper-0df8e17b7efa052fd2a22e1ade9c6f69.pdf

Shah, S., & Genesis Block Podcast. (2023, May 22). EigenLayer: Protocol Analysis #12. Substack. https://genesisblockpod.substack.com/p/eigenlayer

Skate. (2024, April 3). Introducing Skate: The First Universal Application Layer of All Chains. Medium. https://skatechain.medium.com/introducing-skate-the-first-universal-application-layer-of-all-chains-2b67028b2780

Skate. (2024, August 9). Skate Introduces the First Stateless App Across 20 Chains. Medium. https://skatechain.medium.com/skate-introduces-the-first-stateless-app-across-20-chains-55d37ff0e3e4

Skate. (2024, October 28). Announcing the Next Phase: Shadow Mainnet. Medium. https://skatechain.medium.com/announcing-the-next-phase-shadow-mainnet-3311d5abf140

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author's own, not the views of their employer. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research.