Enso Network: The "Shortcut" To Your On-Chain Operations

Explore how Enso leverages an intent-driven engine with “shortcuts” to provide efficient execution paths that make intents actionable and scalable, enabling seamless on-chain interactions across web3.

Blockchain architecture has evolved from Bitcoin's original distributed ledger implementation focused on P2P transactions to a complex ecosystem of diverse protocols. The initial single-chain design has expanded into multiple specialized chains running parallel computation environments, supporting programmable state transitions through smart contracts, and enabling cross-chain communication protocols. This has led to a fragmented landscape of mixed virtual machines, execution environments, and consensus mechanisms. This fragmentation creates significant integration challenges for developers and users.

According to L2beat, there are currently over 100 Layer 2 solutions with more than $54 billion in total value locked (TVL). And these are just L2s—such as rollups, validiums, optimiums, sidechains, etc. We're not even counting the countless other Layer 1 blockchains.

As the blockchain space matures, this fragmentation is expected to increase, adding to the complexity of integrating, interacting with, and building upon other blockchain networks. One of the most significant sources of this fragmentation is the sheer number of blockchains today. While Bitcoin was once the dominant force in the ecosystem, it now shares the spotlight with hundreds of other blockchain networks, each designed for different purposes and tailored to meet specific needs. Blockchains like Ethereum, Solana, Binance Smart Chain, Cardano, Polkadot, and Avalanche, among others, have all emerged as popular alternatives to Bitcoin, each with its features, use cases, and target audiences.

Ethereum, for instance, transformed how we interact on-chain by introducing programmability through smart contracts—self-executing contracts with the terms of the agreement directly written into code, enabling decentralized applications and turning blockchain into a platform for innovation far beyond simple monetary transactions. The variety of consensus mechanisms alone—ranging from Bitcoin’s PoW to Ethereum’s transition to PoS—adds a layer of complexity, requiring developers to deeply understand the nuances of each blockchain’s structure before engaging with them.

Each blockchain’s design and consensus mechanism comes with its advantages and trade-offs, impacting scalability, security, decentralization, and transaction speed. Bitcoin, for example, prioritizes security and decentralization over transaction throughput, making it slower but highly secure, while networks like Solana or Avalanche focus on increasing scalability and transaction speed to handle a higher volume of transactions, albeit at the potential cost of decentralization. As the number of blockchain platforms continues to increase, so too does the difficulty in determining which platform to choose for specific applications.

Another issue developers face is the sheer number of programming languages used across the blockchain space.

While Ethereum has popularized the use of Solidity for smart contracts, other blockchains have introduced their programming languages, such as Rust for Solana, Vyper for Ethereum, and Ink! for Polkadot.

Each of these languages comes with its syntax, libraries, and development tools, which adds to the steep learning curve for developers. A developer who is proficient in Solidity may struggle to write code for Solana’s Rust-based platform, or a Polkadot developer may face difficulties in adapting to the specificities of Ethereum’s smart contract framework.

While this diversity in languages and frameworks has led to more tailored solutions for different blockchains, it also creates significant friction for developers who may need to work across multiple platforms or integrate different blockchain technologies into a single application.

The lack of standardized tools and frameworks further compounds this issue, as developers often need to rely on custom-built solutions or adopt new tools for every new blockchain they work with.

The resulting fragmentation not only creates obstacles for individual developers but also slows down the overall pace of innovation within the blockchain space. Furthermore, while many of these blockchains function independently of one another, they are rarely interoperable by design. This lack of interoperability poses one of the most significant barriers to achieving a truly connected blockchain ecosystem.

As blockchain networks grow in number and importance, the ability to transfer assets, data, or tokens between blockchains is critical for enabling the next generation of decentralized applications. Unfortunately, most blockchains operate in isolation, with limited capacity for seamless communication between them. The creation of cross-chain bridges, such as those offered by Polkadot or Cosmos, is an attempt to address this issue, but these solutions are still nascent and often complex, requiring additional infrastructure and creating potential security risks. Until cross-chain interoperability becomes more seamless and widespread, developers will continue to face the challenge of building applications that can operate across different blockchain networks.

These challenges of fragmentation and interoperability further create friction in building innovative applications and new primitives, reducing the ability to scale for mass adoption.

We're seeing brilliant teams and builders working on technologies to address the pressing challenges of liquidity fragmentation and multi-chain interoperability. Among these innovations, intent-based engines and projects, like Enso, have emerged as promising solutions. Enso takes this a step further with "Shortcuts"—a framework that abstracts complex onchain interactions into simple, executable workflows. In this article, we will explore the concept of intents, and how Enso addresses these challenges with its intent-driven engine and shortcut-based approach.

History of Enso Network: 2021 to Present

Enso Network has undergone evolution since its inception. The project began in 2021 with a strategy that involved a "vampire attack," where Enso targeted six different DeFi protocols. This approach gamified the experience and incentivized participation with NFTs. While this initial strategy helped Enso gain early traction, the team quickly identified a key problem: the complexity and cost of integrating DeFi protocols. Enso spent over half a million dollars on audits for just 15 protocols, which led them to reconsider their approach.

In 2022, Enso pivoted to focus on making DeFi integration easier for developers. The team launched a social trading feature, which allowed users to monetize their investment strategies using ERC-20 tokens and DeFi assets. However, they continued to struggle with how to streamline the process of connecting to multiple DeFi protocols without incurring the same high costs. The breakthrough came when Enso realized that many projects faced the same challenge of how to onboard users into DeFi effectively. In response, Enso launched an API that gained immediate success, generating $11 million in cumulative volume within its first week.

This API allowed Enso to position itself as a DeFi middle layer, providing application developers with a simple way to integrate actions like lending, borrowing, swapping, liquidity providing, and vault interactions into their products. Developers no longer needed to manually integrate each DeFi protocol themselves. Over the next three years, Enso experienced substantial growth, with transaction volume rising from $8 million in its first year to over $15 billion by year three. By this time, Enso had over 35 projects using its platform. At the core of this success was Enso’s user-centric approach, which prioritized simplicity and ease of use. The platform abstracted away the complexities of DeFi, allowing users to interact with multiple protocols through a streamlined UI.

Today, over 75 apps are using Enso across 180+ protocols, and 15+ unique primitives have been built using Enso, with over 450k direct intents settled.

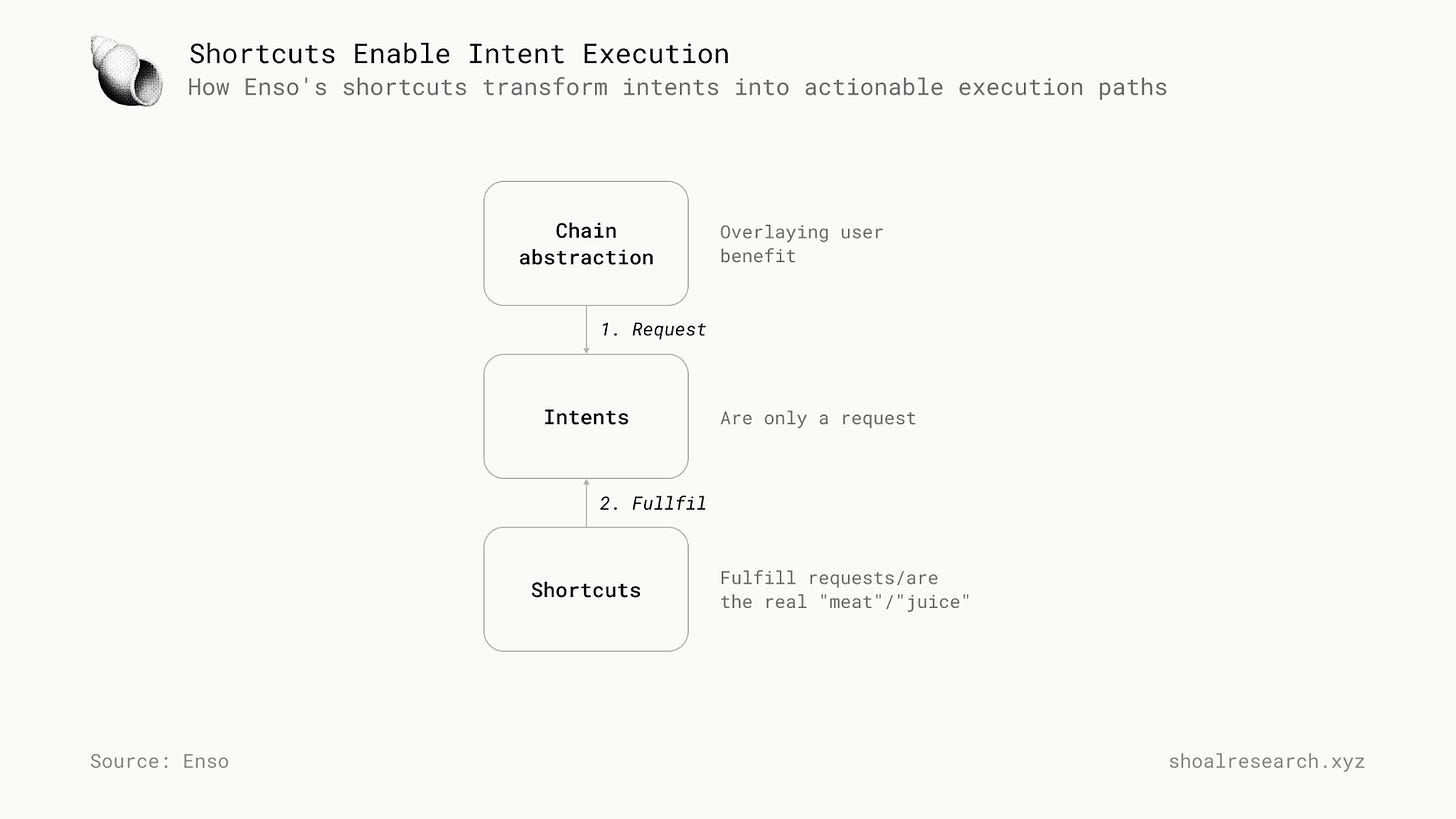

Central to Enso’s evolution was the introduction of the concept of "shortcuts of blockchain," designed to efficiently fulfill the “intents." Without proven execution paths, an intent is merely a request, leaving the burden on solvers to figure out how to fulfill it. Shortcuts provide these predefined execution paths, ensuring that intents are efficiently translated into actions.This allows users to specify what they wanted—such as a token, a DeFi position, an NFT, or another smart contract interaction—without needing to understand the underlying technical process. This innovation led to the development of the Enso Network, a decentralized shared network that could map and execute complex smart contract interactions across different blockchain frameworks.

Enso’s vision is to create a system where all developer interactions are outcome-based. As the network expands, the platform continues to improve the speed and efficiency of DeFi integration, reducing the time and cost involved in building decentralized applications. Enso’s business model revolves around taking a spread from solutions built through its network, with plans to transition to a fee structure based on volume as the platform grows. This approach has already yielded impressive results, and the team believes that as the ecosystem matures, Enso will continue to play a central role in simplifying DeFi for developers and users alike.

Protocol Design

So, What is the Enso Network?

The central issue in the blockchain ecosystem is usability, created by the fragmentation of these blockchains and execution environments. The feature of allowing blockchains and smart contracts to communicate with each other simply and seamlessly without hassle is a key value proposition to the blockchain ecosystem, which will help the blockchain ecosystem grow. Enso is targeted at solving the problem of usability.

Enso Network is the world’s first intent-driven engine, powering blockchain abstraction and paving the way for an intent-centric future. Built on a layer-1 Tendermint-based blockchain, Enso stores state from EVM, SVM, and MVM blockchains, enabling seamless execution across various blockchain frameworks. Applications can leverage Enso by simply expressing their desired smart contract outcomes, eliminating the need to build complex integrations themselves.

Enso leverages "intents" as its core technology to bridge the gaps in the fragmented blockchain ecosystem. In this context, intent is a high-level representation of a user’s desired outcome, such as executing a smart contract or interacting with a blockchain in a specific way. Instead of requiring users or applications to manage the complexities of blockchain integrations directly, Enso interprets these intents and automatically translates them into actionable transactions across various blockchain frameworks. This innovative approach simplifies interaction with multiple blockchains and enhances usability, enabling developers to focus on outcomes rather than technical integration details.

What are “Intents” and how do “Shortcuts” fulfill them efficiently??

In simple terms, intents are just shortcuts for users.

What most users in DeFi care about is:

"I have A, and I want B, C, and D. I don't care about all the details of how to achieve this outcome for me."

Users want to interact with DeFi without having to understand or manage every single complexity involved.

It’s important to note that B, C, and D are not limited to just token swaps. They can represent any on-chain intention, such as:

State changes

NFTs

Tokens

Defi positions

Any interaction on-chain

Intents are planned on-chain actions aimed at achieving desired goals. Intents are signed messages that allow solvers to execute a trade on behalf of the user using specified assets and amounts. It allows users to achieve their desired outcome on-chain by outsourcing the task to the best solver in the market.

Source : Devcon Youtube

For instance, an intent-based protocol like the CowSwap protocol allows users to submit an intent to sell a token at a particular price. When this intent is submitted off-chain, it then bypasses the public mempool and instead is directly routed to an encrypted private mempool where solvers compete to fill or solve your intent at the best possible price, either by using their balance sheets, private order flow, or using on-chain liquidity venues like Uniswap and Curve.

In an intent-based protocol, a user simply needs to specify what is to be done, and it will be completed in the most efficient way possible. For example, a user may want to borrow $DAI against his/her $ETH and deposit the $DAI into a liquidity pool to earn $RTY as a form of reward. An authorized solver then compares all $DAI borrow rates against $ETH and takes out a loan at the lowest interest rate. The solver then deposits the $DAI in a Yearn-like vault to autocompound the yield from the highest yielding 100% $DAI-denominated LP into $RTY, which streams to the user’s wallet.

Intent-based protocols such as CowSwap and deBridge have some technical benefits, which led to its rise. Some of these benefits include enabling solvers to execute all sorts of transactions based on specific instructions and on-chain conditions, eliminating fees for failed transactions, allowing users to place multiple orders at once, and much more.

Intents have many benefits to the crypto space, such as MEV protection and enabling private market maker inventory, as many solvers have access to off-chain liquidity through CEX, private makers, or personal liquidity, which allows them to fill certain trades at better prices than what may be available through on-chain AMMs. Intents have never had a strong implementation in the ecosystem as a result of some design choices, as the current design of the open and permissionless nature of the Ethereum mempool does not support the proper integration of intents. This has led intent designers to speculate if intents will be propagated to a permissioned set of available in a permissionless manner, allowing any party to execute an intent.

Source: Intent design. Paradigm

Shortcuts: The key to efficient Intent execution

While intents define the “what,” shortcuts provide the “how.” Without proven execution paths, an intent is just a request, leaving solvers to figure out the best way to fulfill it. Enso’s shortcuts create structured execution paths that make intents actionable and efficient.

How Shortcuts Work:

Predefined Execution Paths: Instead of relying on solvers to determine how an intent should be executed, shortcuts standardize the best workflows to ensure efficiency.

Automation & Abstraction: Developers and users don’t have to manually integrate protocols—shortcuts handle everything behind the scenes.

Composable & Modular: Shortcuts can be combined to create complex on-chain workflows, such as depositing into a vault and leveraging it in one action.

Enso: Shared Network State

Enso introduces the first shared network state for building transactable bytecode for execution, which allows developers to interface with blockchain conveniently, as they should not be concerned with all the complexities of each smart contract and should be able to state their desired outcome as an intent with all complexities of execution abstracted away.

Smart contract abstractions are contributed to the shared network as well by action providers, who submit their contributions to be validated. Once accepted, these contributions are stored as entities within a map, gradually clarifying the relationships between smart contracts and their ability to interact with one another. This results in a comprehensive map of executable relationships.

To generate transactable bytecode for smart contract execution, the network not only stores essential data, such as function signatures, token inputs, and outcomes but also includes pre-requisite fetchers that must be validated before bytecode can be constructed. For instance, in the case of an NFT minting process with a cap of 1,000 available NFTs, the pre-requisite fetcher would check the number of NFTs already minted and the total allowable amount. Once these requirements are validated, the network returns a valid bytecode that is ready for execution.

Unlike the plug-and-play simplicity of Web2, Web3 lacks tools for seamless interaction across protocols. Enso bridges this gap by creating a "Zapier for Web3"—enabling drag-and-drop functionality for blockchain integrations.

Streamlined API: Enso enables multi-chain and multi-protocol integrations with ease.

Scalable and Composable Solutions: Developers can launch scalable and composable applications in just four simple steps:

Use an Action: Actions abstract isolated smart contract transactions into simple, reusable components.

Make a Shortcut: Combine multiple Actions into reusable and shareable Shortcuts to automate workflows.

Fetch Live Data: Seamlessly integrate Actions and Shortcuts into your apps, agents, or tools to pull live data.

Ship It: Deploy your application with streamlined and simplified blockchain integrations.

Enso's approach empowers developers to create efficient, user-friendly Web3 solutions that rival the ease and flexibility of traditional Web2 integrations. In the later sections, we'll explore in detail the Enso network participants and the various components of Enso that make deployment easier.

Enso Network Participants

The Enso network participants include graphers, action providers, consumers, and validators.

Graphers

Graphers design and implement algorithms to solve consumer requests by combining smart contract abstractions into executable bytecode. They continuously search for the most optimal solutions, ensuring that only the best algorithm is chosen for execution. In their role, graphers work closely with validators and action providers to guarantee that the solutions they generate are accurate and valid. They also maintain a comprehensive map of smart contract interactions across different blockchains, ensuring that the solutions they create are efficient and able to integrate with a wide variety of blockchain networks. Graphers use the abstractions provided by action providers to create pathways that fulfill consumer intent.

Operating in a competitive environment, graphers are incentivized to optimize their algorithms to deliver the best possible solutions. Their efforts are rewarded through a share of the consumption fees, which motivates them to continuously enhance their performance and ensure that they provide the most efficient, effective solutions to consumer requests.

Action Providers

Developers who publish smart contract abstractions on the Enso Network are known as action providers. These abstractions are integral to the network, as they are used by graphers to build algorithms that solve consumer requests. By providing these pre-defined smart contracts, action providers make it easier for developers and users to interact with the blockchain. Action providers are incentivized to focus on creating high-quality abstractions that are not only secure and efficient but also easy for others to use. This ensures that the abstractions they publish are reliable and contribute to the overall functionality and scalability of the Enso Network.

In return for their contributions, action providers are rewarded based on the usage of their abstractions within solutions generated by Graphers. Every time a smart contract abstraction they’ve published is used in the creation of a solution, action providers receive a share of the fees.

Validators

Validators play a pivotal role in securing the Enso network by ensuring the integrity of the system and verifying the solutions provided by Graphers. Their primary responsibilities include accepting valid consumer requests, authenticating the abstractions contributed by action providers, and determining which solutions from the graphers are the most optimal for execution.

Validators are incentivized to perform their duties with accuracy and efficiency through a reward system that compensates them for their essential role in securing the network. Validators earn a share of the network fees based on their participation in validating and authenticating solutions.

Consumer

Consumers play an essential role in the Enso network by submitting requests that specify their desired outcomes. Consumers also have the option to pay fees for their requests, which helps facilitate the execution of the transaction and supports the various participants in the network, such as graphers, validators, and action providers. In addition to stating their intent, consumers can optionally pay fees to incentivize the execution of their request.

Components of Enso Network

The key components of the Enso network that enable the bridging of the blockchain ecosystem include:

Requesting

The foundation of the Enso network is the concept that customers should ask for an outcome rather than specifying how to get it. This usability paradigm shift is referred to as an intent. In contrast to a transaction, where instructions are provided on "how" to conduct an engagement, intents allow customers to indicate "what" they would like to acquire. A thorough comprehension of certain smart contract peculiarities and cautions is necessary before creating a transaction. On the other hand, intents eliminate these complications and enable customers to contract out the development of the solution for the intended result.

Intents outline a set of variables that must be achieved and the constraints around these variables, resulting in a tremendous developer experience.

RequestResponse {

IntentId string

From string

To string

Data string

Value string

AmountOut string

Gas string

}Abstraction

An incentive-based contribution mechanism has been created to guarantee that the Enso network contains the most comprehensive map of smart contract interactions. When creating a solution for a customer's request, developers (action providers) can add abstractions to the network and get paid if their abstraction is used. Establishing a market where developers can submit abstractions they believe the ecosystem will use; the more verbose the abstraction, the less likely it is to have been submitted beforehand. The network permits many abstractions with the same goal to be provided to prevent abstraction squatting. The abstraction with the most staked Enso token will be selected during the solution creation process.

Graphers use network abstractions to construct solutions. Every abstraction needs to have a corresponding action type to guarantee the scalability of consumption. An action type may have several abstractions, but an abstraction can only be linked to one action type. A wrapper that specifies a specific behavior that the related abstractions are performing is called an action type. For instance, a DeFi smart contract that demands the transfer of one or more tokens while receiving one or more tokens in return is classified as a deposit. An abstraction is initially defined as a message action type before being contributed:

Unset

MsgAddDeposit {

Protocol string

TokensIn []string

PositionOut string

Primary string

SupportsReceiver bool

}Once the message has been added, then it is parsed into the following action type:

Unset

Action {

ActionId string

ActionType string

Protocol string

PositionsIn []string

PositionsOut []string

SupportsReceiver bool

Provider string

Args map[]string

}As there are many dynamic outcomes when interacting with smart contracts, the positions variable encompasses many different outcome types, i.e., if the execution returns token(s), NFT(s), state transition(s), and such. Particular smart contracts enable outcomes to be delegated to another receiver address, so SupportsReceiver has been implemented. By following this methodology, we open up the types of consumers, such as artificial intelligence execution bots built on top of Enso with particular execution boundaries to be requested and then settled with the provided permissions.

New PositionTypes can be added to the network through the governance module. A position is generated as a deterministic hash from the following:

Unset

Position {

PositionType string

Chain uint64

Address string

TokenId string

}To validate solutions generated by the network, each associated abstraction has a ViewType attached, where on-chain getters can be embedded to cross-reference the desired outcome against the actuality:

Unset

ViewFunction {

PositionType string

Fragment string

Target string

Args []string

ResponseIndex uint64

}When a new abstraction is introduced with an associated action type, the following steps are taken to ensure its validity on the network:

Action Submission: The action provider submits the action.

Action Validation: Validators check if the action provider is registered in the on-chain provider's list.

Action Parsing: The action message data is parsed into the Action type format, and other values are converted into the Position type format.

Action Definition Retrieval: The system interfaces with the Action Provider indexing infrastructure to retrieve the action definition.

Transaction Bytecode Generation: Generate transaction bytecode based on the action definition.

Transaction Simulation: Simulate the transaction bytecode and verify that the outcome behaves as expected at the specific positions.

Position Validation: Ensure positions are stored on-chain and update any missing position data.

On-Chain Action Storage: Store the action on-chain.

ActionId Emission: Emit the ActionId.

Once these steps are completed, the abstraction becomes part of the Enso network map and is available for generating solutions.

Solution Aggregation

Following a request to the Enso network, members of the network will collaborate and bid on potential solutions to give the customer the best outcome. To prevent the Enso network from becoming stagnant over time, competition between graphers offering solutions ensures that the network consistently delivers the best feasible answer. As a result, customers consistently use Enso as their primary source of executable data instead of switching to another provider.

If you’re a solver, you can create a map of all smart contract interactions—tracking how Token A goes into one contract and Token B comes out. Over time, this builds a web of relationships between smart contracts, allowing you to identify optimal paths for execution.

For example, Connor Howe, the CEO and co-founder of Enso, shared a visual representation of an order fulfilled by Enso during his keynote at DappCon 2024. In this instance, Enso executed 112 different transactions to find the most optimal route for the user. This highlights the sophistication and efficiency of Enso’s approach to fulfilling user intents.

Source: Token Flow of an order fulfilled by Enso

When requests are sent to the network, validators listen to make sure the right format is used. If the request is sent successfully, it will be propagated into the network's mempool.

To determine the best course of action for every action in the network, the graphers use their unique algorithms. The underlying algorithms may be as basic as the K shortest path or quite complicated. As long as the produced solution can be converted into bytecode, the graphers idea is acceptable.

Once a solution is generated, the bytecode is linked to the corresponding intentID. The validators then simulate the solution by:

Forking the intended settlement chain with all recent states.

Running the bytecode to ensure it can be executed.

Verifying the correct state transition by invoking ViewFunction helpers in each action.

Additionally, validators may execute custom modules for tasks such as delegate calls, overrides, balance checks, and other requirements.

Each validator propagates its findings back into the mempool, associating them with the relevant intentID and solutionID after individually detecting state transitions. The winning solution is then determined by combining:

The highest dollar output for the user.

The lowest execution cost for processing.

Once the winning solution is selected, all other solution suggestions are cleared from the mempool. Since these alternate solutions are no longer relevant, this process prevents unnecessary bloat in the network, functioning as an inherent caching layer. The winning solution is then provided to the customer for implementation.

The bytecode used to execute solutions may contain fees, and the Enso network functions on a variety of blockchains. Instead of bridging all fees back to the Enso blockchain, the network holds an auction system. In this system, an address can purchase a specific amount of Enso tokens to gain the right to collect these fees on individual blockchains.

By adopting this approach:

Network participants receive Enso tokens as payment for their contributions, including validation, generating winning solutions, and abstraction consumption.

This creates an integrated circular economy that incentivizes participation and can be adapted to accommodate the continued growth of blockchain ecosystems.

Applications of Enso

The architecture of Enso is designed to empower any application that seeks to interact with smart contracts across all blockchains, offering the most optimal execution possible. Enso is blockchain-agnostic, meaning it can seamlessly interface with various types of smart contracts, making it an incredibly versatile platform. This opens up infinite possibilities for applications, allowing developers to build truly composable solutions. Enso serves as the universal gateway for interacting with smart contracts across multiple blockchains, enabling the creation of diverse applications that operate effortlessly across the decentralized ecosystem. Enso offers unparalleled flexibility, allowing developers to create, innovate, and scale applications wherever and however they desire.

The Enso network facilitates the creation of both transactable and consumable data that can be leveraged for execution or to fetch essential information from smart contracts across various blockchain frameworks. By consuming only the data on the Enso network, developers can create powerful tools such as DeFi metadata APIs, NFT metadata APIs, AI-driven language models for data analysis, smart contract interaction analytics, on-chain information contextualization, and much more. These applications enable a deeper understanding and use of blockchain data, improving transparency and accessibility.

Enso also supports the creation of transactable data products that automate complex interactions with smart contracts. For example, AI-driven bots can execute actions on behalf of consumers, smart contract interactions can be automated for efficiency, and DePIN (Decentralized Physical Infrastructure Networks) can be consolidated. Moreover, Enso enables the development of aggregators for swaps, lending, NFTs, and cross-chain bridges, streamlining the user experience in decentralized ecosystems. Given that all smart contracts and their interrelationships are readily available through the Enso network, the potential applications are virtually limitless and future-proof.

Tokenomics

The Enso token is the native digital asset that powers the Enso network, a robust and decentralized ecosystem built on a Tendermint-based blockchain architecture. This token is a fundamental element of the network, acting as both a utility and governance token essential for the operation, security, and continued evolution of the Enso ecosystem. Without the Enso token, the network would be unable to function, making it a critical piece of the infrastructure.

One of the primary uses of the Enso token is for gas fees, which are required to initiate requests and modify the state of the Enso network. As with many other blockchain networks, transactions and actions within the Enso ecosystem require a certain amount of computational power to process. The Enso token acts as the fuel for these actions, enabling users and applications to interact with the network and execute smart contracts, data transactions, and other processes. This ensures that the network remains operational and incentivizes users to participate by compensating validators and other actors for their contributions to maintaining the system’s integrity.

The Enso token also plays an integral role in the governance of the network. The Enso ecosystem is governed by a decentralized protocol where token holders have the power to vote on upgrades and protocol changes. This voting mechanism allows the community to directly influence the evolution of the network, ensuring that it remains flexible and responsive to the needs of its users.

In addition to its role in governance, the Enso token is used to secure and maintain the integrity of the network. Participation within the Enso ecosystem, particularly by validators, graphers, and action providers, requires participants to stake a certain amount of Enso tokens. This staking mechanism is a critical component in preventing malicious behavior and ensuring that all actors within the network are incentivized to follow the rules. In the event of malpractice or malicious activity, staked Enso tokens can be slashed, meaning that a portion of the staked tokens are forfeited as a penalty. Another important function of the Enso token is its role in delegated staking. Token holders who do not wish to actively participate in staking themselves can delegate their Enso tokens to other network participants who are acting as validators or other relevant roles.

The total supply of the Enso token is capped at 100,000,000 tokens, creating a fixed supply. The fixed supply helps to avoid inflationary pressures and ensures that the value of the token is backed by its utility and demand within the ecosystem.

Business Model

The Enso Network's business model could be a hybrid that combines multiple revenue streams to cater to a variety of users. This could include a fixed fee per transaction or, based on usage volume, charging networks based on how much traffic or transactions they process through Enso’s infrastructure. Additionally, a subscription-based model might be introduced, offering tiered access for developers and networks with different feature sets, depending on their scale. Transaction fees could also be levied on end users executing actions or swaps through intent networks consuming Enso’s services. A revenue-sharing model could be used with partner networks like Cowswap, Brink, and Aperture, earning Enso a percentage of profits derived from its technology. Furthermore, Enso native tokens could be sold through token sales, used for transaction fees, staking, or governance within the network. Finally, performance-based pricing could allow Enso to charge more for high-performance solutions, aligning pricing with the value delivered. This multi-pronged approach would enable Enso to sustain growth and serve a wide range of customers, from small developers to large networks.

Competitive Landscape

It is impossible to overestimate the significance of unity in the current Web3 environment because fragmentation has become a problem. As a result, an underlying layer or infrastructure is necessary because Web3 requires a node, including layer-1 blockchains, DeFi protocols, GameFi projects, NFT projects, and so forth. As such, the need for a reliable, secure, and efficient layer needs to be present, and providing such services is key, as such service would be the central utility player providing the critical infrastructure for the growth of Web3 as a whole. The Enso team started building the Enso network in 2021 as a B2C DeFi super app, but this idea was discontinued as the team was able to identify that various crypto projects (including theirs) have two issues: how to integrate all of DeFi safely and conveniently without much overhead. So the Enso team decided to pivot fully into DeFi aggregation middlelayer infrastructure, enabling developers to interact with all of DeFi without the burden of integrations themselves.

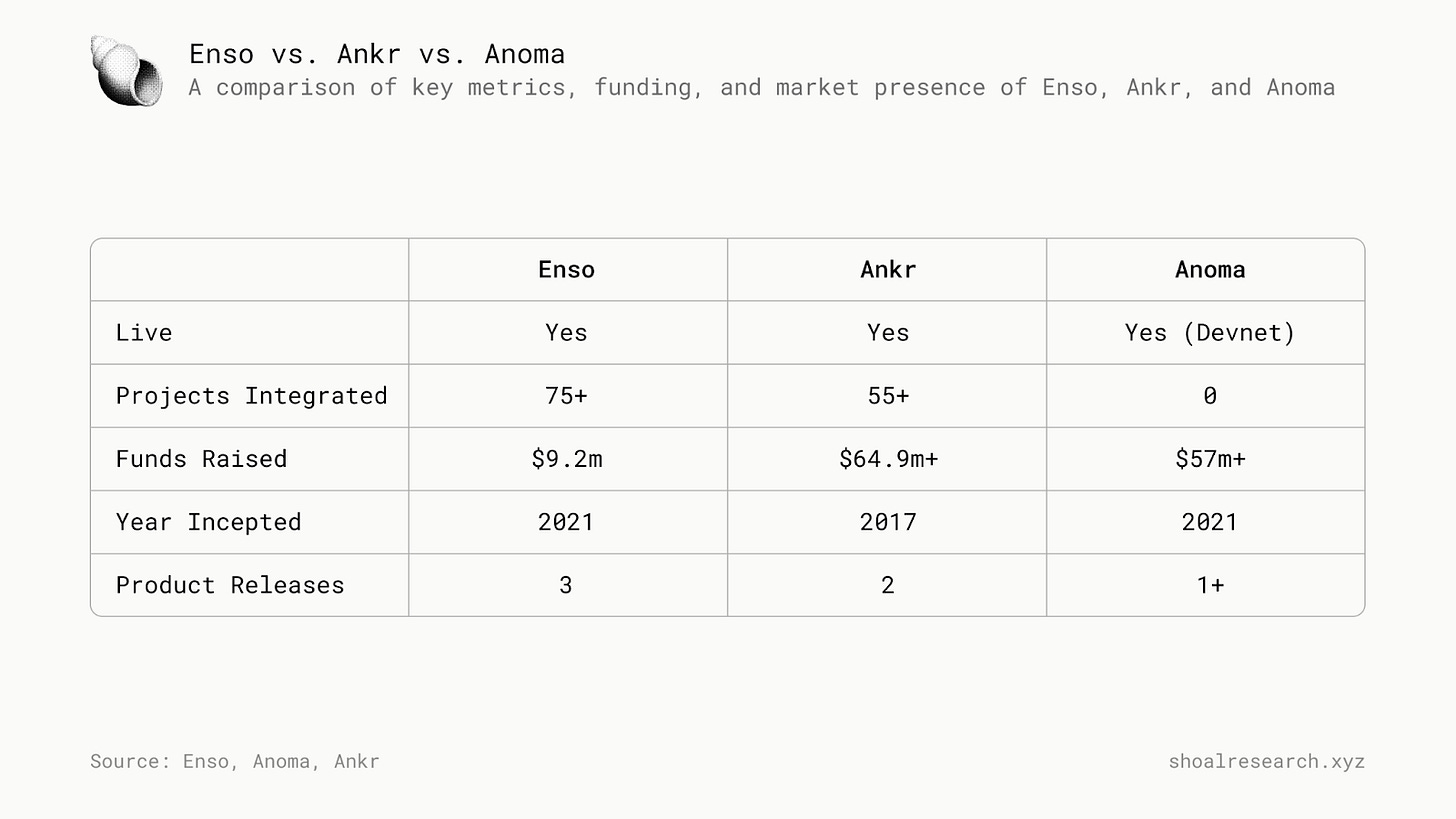

The competitive landscape for DeFi middleware solutions revolves around key projects like Ankr and Anoma, which focus on simplifying DeFi integration and processes by offering similar services.

Ankr

Similar to Enso, Ankr Network serves as the gateway through which developers, projects, and protocols connect to the node infrastructure and development tools they need to build their respective applications. The focus of Ankr is to provide multi-chain tools and node infrastructure to make Web3 development easy and prolific. The Ankr Network includes free, public RPC endpoints that developers have come to know and love, alongside new Premium and Enterprise plans packed with advanced developer tools—all powered by a globally distributed and decentralized network of nodes. Hence, developers pay-as-they-go for access to on-chain data, independent node providers serve blockchain requests to earn ANKR tokens, and stakes contribute ANKR tokens to full nodes to secure the network and share in the rewards.

The Ankr network provides services that are trusted and used by various renowned crypto projects, such as Polygon, Binance, Mantle, and Chiliz, amongst others. The Web3 API is another product of the Ankr Network that helps to bridge the fragmentation problem in the Web3 world, as it connects developers and various applications to the blockchain and one another. Numerous important projects, including the ones mentioned above, use the Web3 API, which has gained enormous acceptance in the ecosystem.

Furthermore, Ankr's Decentralized Physical Infrastructure (DePIN) of nodes ensures Ankr’s clients always have the shortest roundtrip path for RPC requests, providing fast Web3 experiences no matter where users are.

Ankr's Decentralized Physical Infrastructure (DePIN)

Anoma

Anoma is a distributed operating system for intent-centric apps; it introduces a new paradigm for dapps and provides a unified developer experience across any underlying blockchain. Anoma acts as the missing link between chains and users as it unifies blockchains into an integrated OS where builders and users don’t need to worry about the complexities of which chain or VM they’re interacting with. It changes the way we interact with blockchains and enables a future of user-friendly, seamlessly integrated dapps. Anoma is currently attempting to raise $40m at $1b fdv and it recently launched its Devnet.

Anoma aims to bring an intent-centric approach to blockchain interactions, shifting from traditional transaction-based models to a more flexible framework where users express intents rather than executing predefined steps. It provides a standardized mechanism for intent discovery and resolution across connected chains, rollups, and dapps.

Anoma does not yet have a live mainnet implementation and is currently in the testing phase with its Devnet. While its architecture introduces novel intent-centric mechanisms for interoperability and composability, its real-world effectiveness and adoption remain to be seen as it progresses toward broader developer integration and ecosystem support.

Enso, Ankr, and Anoma

Enso has anchored itself as a thought leader within the intent ecosystem and is capturing a large market share to ensure its potential competitors are not able to capture any of the markets. The Enso network currently has over 75+ projects using Enso, such as CowSwap, Li.Fi and many more. More so, new primitives are currently being built on the Enso network, which pushes the core infrastructure to the edge, hence bringing about rapid innovation; some primitives are launched already and some are still in development. Some of the primitives include:

Glider: automated trading strategies for all EVM chains with a visual drag-and-drop interface built using Enso. The team is the OG tech lead and design lead of 0x and Matcha.

Plug: No code visual creation tool for building transactions for DeFi with automation tooling.

BrianKnows: AI chatbot for building transactions.

Grindery: Telegram bot with 1+ million users using Enso.

Velvet: DeFi asset management tool.

Enso powers many applications in production as of today and will continue this journey whilst targeting the top layer more in the coming future. In particular, Enso has determined a seamless business development pipeline to bring more projects using Enso; however, the real golden ticket lies within newer developers building blockchain applications, and Enso will be positioning itself as the go-to toolkit for building blockchain applications.

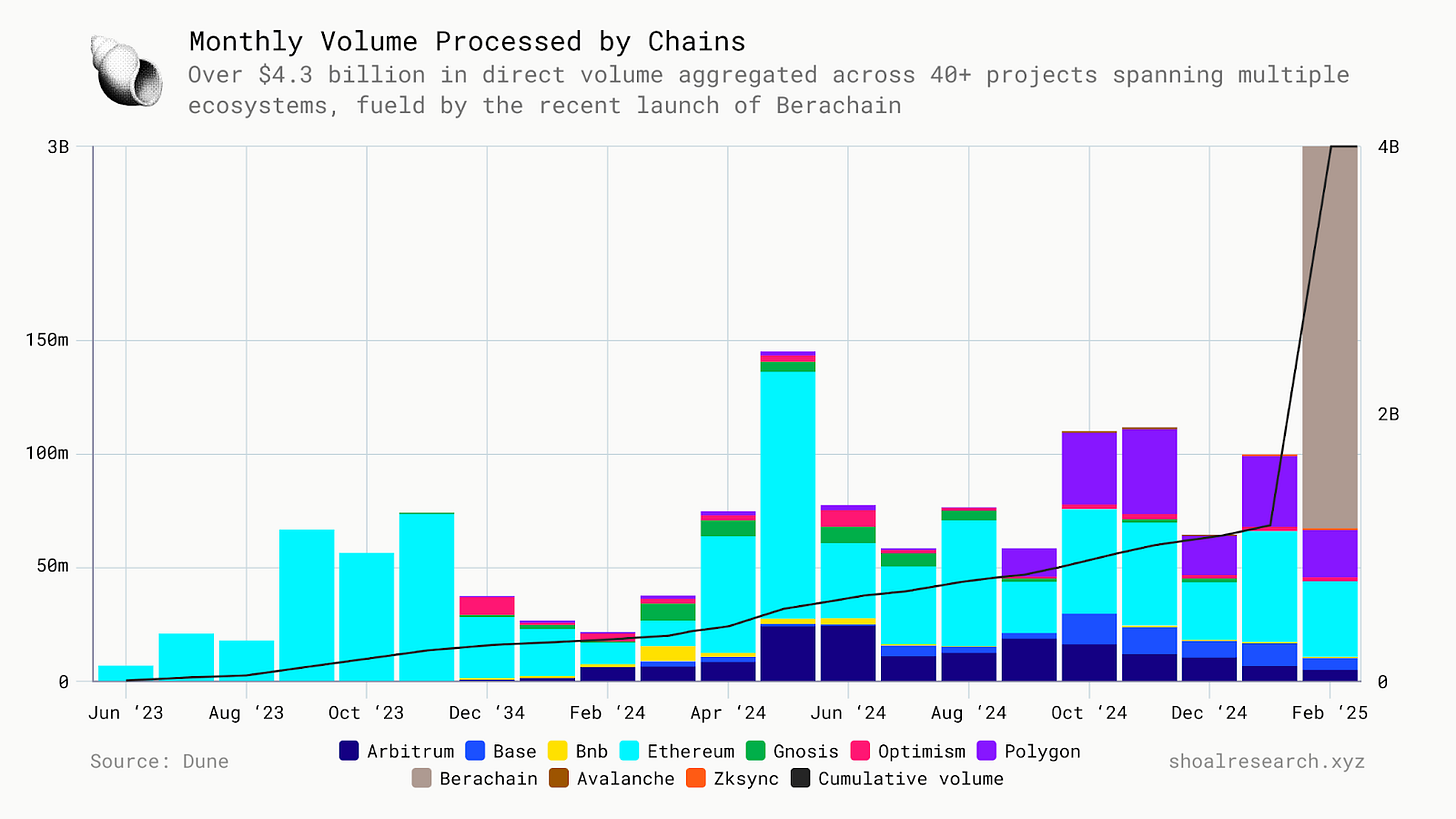

Enso has been able to aggregate a direct volume of over $1 billion and has hence been able to integrate over 75+ projects across various ecosystems such as Polygon, Ethereum, Arbitrum, Gnosis, Optimism, and BNB, with Ethereum having the highest volume of on-chain activity of over 34 million.

The Boyco Bootstrapping Campaign successfully leveraged Enso’s cross-chain capabilities to facilitate the largest-ever on-chain liquidity bootstrapping event for Berachain’s mainnet launch. By enabling Royco Protocol to create custom Incentivized Action Markets (IAMs), liquidity providers seamlessly deployed capital across 4+ chains and 20+ protocols ahead of launch.

This led to the largest-ever volume of direct intents settled on Enso, about $3 billion on Berachain, bringing the total volume of intents settled via Enso to over $4.7 billion. By abstracting complexity and streamlining liquidity deployment, Enso and Royco played a pivotal role in ensuring deep liquidity and efficient capital flow from day one of Berachain’s mainnet.

The Future of Enso

As the blockchain ecosystem rapidly evolves, the old method of manual integrations for each new chain or protocol is no longer sustainable. Every new technology introduces complexities that demand extensive time, resources, and constant maintenance, which ultimately hinder innovation. Enso is designed to address these challenges by providing blockchain shortcuts—simple, reusable building blocks that abstract complex on-chain actions. By allowing developers to quickly find solutions that work across multiple chains and protocols, Enso removes the bottlenecks traditionally associated with Web3 development.

Enso simplifies interaction with different blockchain networks by automating common on-chain actions, such as token swaps, multi-chain asset management, DeFi routing, and smart contract interactions. These pre-built solutions enable developers to avoid the complexities of learning and integrating each protocol, allowing them to focus on building innovative features. By offering a shared engine that standardizes these actions, Enso reduces the need for redundant development work and ensures that developers can adapt quickly to changes in the blockchain ecosystem.

The future of Enso is centered on expanding its capabilities and providing greater interoperability across blockchain networks.

This vision will unfold in phases:

Phase 1: Centralized Service Co-Existing with the Network

During the initial network launch, Enso's centralized service will operate alongside the network to ensure stability and functionality.

Independent validators will simulate bytecode solutions to verify that the network operates as intended.

Developers who wish to be action providers can contribute through the centralized service, allowing seamless integration and providing much-needed stability during these early stages.

Phase 2: Fully Permissionless and Decentralized Ecosystem

Once the network has proven its stability and functionality, it will transition to a fully permissionless model.

A broader range of action providers and graphers will be able to participate, fostering a decentralized and sustainable ecosystem.

The Enso network will expand beyond the Ethereum Virtual Machine (EVM) to include support for other blockchain frameworks, such as the Solana Virtual Machine (SVM) and Move Virtual Machine (MVM).

This expansion will significantly enhance the developer experience, enabling seamless integration of multiple ecosystems within a single network and offering greater flexibility for developers.

The ability to quickly integrate new chains and protocols, combined with the simplicity and flexibility of blockchain shortcuts, allows Enso to empower developers to build faster and with greater ease. With Enso, teams can bypass the time-consuming integration process and focus on delivering high-value features to users, leading to more robust and feature-rich Web3 applications. Whether building DeFi applications, NFT platforms, or cross-chain solutions, Enso’s platform makes it easier than ever to bring ideas to life.

As Enso progresses through its development phases, it will continue to redefine how blockchain applications are built. By abstracting away complexity, reducing maintenance burdens, and enabling seamless integration across multiple blockchain ecosystems, Enso is not just simplifying the development process—it's transforming the way developers engage with the decentralized web. With its vision of an open, interoperable, and permissionless ecosystem, Enso is positioning itself as a key player in the future of Web3.

Conclusion

Intents have emerged as a promising solution to the challenges of interoperability and fragmentation within the blockchain ecosystem. By enabling users to focus on desired outcomes rather than the complexities of execution, intents simplify interactions across disparate blockchain frameworks.

Enso Network, at the forefront of this innovation, delivers a transformative, intent-driven engine that powers blockchain abstraction, simplifies integrations, and accelerates the pace of Web3 development. This ambitious project seeks to bridge the yawning gap between fragmented blockchains through its revolutionary shared network state and bytecode generation capabilities, effectively creating a unified platform for developers to build upon.

Enso's potential applications are vast and far-reaching:

Developers can leverage the platform to create transactable and consumable data products, AI-driven bots, and cross-chain solutions with unprecedented ease.

The project's focus on usability and interoperability positions it as a crucial tool for accelerating development cycles and driving innovation in Web3 applications.

By abstracting away the complexities inherent in interacting with multiple blockchain networks, Enso allows developers to concentrate on building features rather than navigating the intricacies of multi-chain DeFi.

A key component of the Enso ecosystem is the ENSO token:

ENSO token plays a multifaceted role in governance, security, and incentivizing participation within the network.

This native cryptocurrency serves as the foundation for a robust incentive structure, rewarding contributors for their efforts in maintaining and improving the platform.

Furthermore, the token-based governance model ensures that decision-making power remains distributed among stakeholders, preventing centralization and promoting long-term sustainability.

Enso represents a significant step forward in addressing the usability challenges inherent in the blockchain ecosystem. Its innovative approach to abstraction and interoperability offers immense potential for simplifying development and enabling more sophisticated applications across multiple blockchain networks. As the project progresses towards full decentralization, it stands to play a pivotal role in shaping the future of Web3 development, fostering collaboration between disparate blockchain ecosystems, and unlocking new possibilities for decentralized applications.

References

Official Enso Doc. https://docs.enso.build/content/get-started/introduction

Enso: Intent Engine. https://drive.google.com/file/d/1QufKeCz2-fxq9NGyYNnLlMlQ478ypDkx/view?ts=6786c915

Enso Dune Dashboard - Private

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author's own, not the views of their employer. At Shoal Research, we aim to ensure all content is objective and independent.This post has been sponsored by Enso Team. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research.