Fairblock: Incorruptible Markets and Confidential Stablecoin Rails

Fairblock is building the Incorruptible world computer that unlocks secure, trust-minimized applications crucial for the next generation of institutional-grade DeFi systems.

Crypto is at a crossroads. The last decade brought remarkable innovation in defi, gaming, and tokenized assets, yet the user experience remains fundamentally broken. Exploits are rampant, manipulation is normalized, and meaningful institutional participation remains out of reach. What was supposed to be an open financial system has become a high-stakes battleground, where sophisticated actors consistently outmaneuver honest users. Institutions cautiously watching from the sidelines cite systemic data leakage, integrity risks, and compliance uncertainties as persistent blockers to meaningful adoption.

Crypto, despite all its potential, remains plagued by toxicity.

One of the most overlooked gaps is the lack of confidential and compliant stablecoin infrastructure, a foundational layer for real-world payment and liquidity flows. While stablecoins are gaining traction as programmable, borderless money, their usage remains highly transparent by default. This is a non-starter for enterprises handling sensitive transactions like payroll, settlement, or treasury operations. Institutions require flows to remain confidential yet audit-ready, a balance that current protocols fail to strike. Some of the major players, like Circle, are actively looking for a solution.

The scale of this issue cannot be overstated. In the past year alone, DeFi lost over $1 billion to hacks and exploits, while an additional $2 billion evaporated due to manipulative tactics like front-running or other predatory behaviors. This toxicity goes beyond financial damage, it's eroding trust and credibility, essential pillars for sustained growth. Every transfer on public blockchains, payroll transactions, or strategic trade were visible to the entire world, which is the reality for crypto today. Traders routinely see their carefully planned strategies compromised, gamers find their moves publicly exposed, and enterprises risk sensitive commercial strategies leaking onto public blockchains. This nature of public blockchains, far from being empowering, often empowers only the most sophisticated, opportunistic actors who thrive on exploiting market inefficiencies.

In the Web2 world, confidentiality is given. Banking, healthcare, and communications all rely on it. Web3, however, has struggled to balance confidentiality with decentralization and regulatory compliance. The absence of onchain confidentiality has stifled the growth of essential applications, from private transfers to secure financial services. Yet emerging technologies like decentralized dark pools (pools that conceal transaction details until settlement) and modular onchain confidentiality frameworks offer hope. These solutions promise to protect user anonymity while enabling regulatory oversight, fostering an environment where confidentiality and compliance coexist.

Detoxifying Web3: Toward Trustworthy and Corruption-Free Markets

On most transparent public blockchains, every pending trade, bid, game move, or transaction intent is public knowledge before it is finalized. This open mempool (or memory pool of pending transactions waiting to be picked up) and state allows opportunists to exploit information that should have been confidential. The absence of confidentiality has resulted in several well-documented issues that degrade user experience and discourage participation:

Institutional and Enterprise Reluctance: Banks, hedge funds, and corporations have strict confidentiality needs. On public chains, anyone can observe wallet balances, trading strategies, or business contracts. It’s no surprise that many institutions avoid public blockchains for sensitive operations; no serious trading firm wants to broadcast its positions in real-time, and privacy-sensitive users are similarly deterred. In short, transparent blockchains “cut out” institutions and confidentiality-conscious users from participating, limiting the ecosystem’s growth into traditional finance and Web2 industries.

Frontrunning and Forced Liquidation: Sophisticated actors (like arbitrage bots or miners) can see your pending transactions and insert their own to profit at your expense. For example, they might detect a large buy order and purchase the asset first, driving up price (a classic frontrun), or sandwich your trade between their own orders. Such tactics have siphoned value from regular users and are only possible because transaction details are exposed before execution. This is akin to someone eavesdropping on a sealed-bid auction and then outbidding you with knowledge of your bid – an unfair advantage built into transparent ledgers.

Broken Onchain Gaming and Applications: Many interactive applications (Pari-mutuel betting, AI agents) require secrets to function correctly. Consider a strategy game where players’ moves need to be hidden until a reveal or an AI application that uses proprietary data. On a public chain, all moves and data are exposed, so opponents can cheat. Developers are essentially prevented from bringing popular internet applications onchain because any secret logic or data would be immediately exposed. This has stunted use cases like fair onchain gaming, confidential auctions, or AI models that require hidden data or verifiable randomness.

General Data Exploitation and User Tracking: Outside of outright attacks, transparency means user activity is fully traceable. Malicious parties or even marketers can monitor everything you do onchain – trades, transfers, votes – building profiles and potentially using that against you. Every onchain interaction leaks information. This “public information leakage” leads to asymmetric advantages where those with analytics tools can manipulate or influence less-informed users. It’s the opposite of the level playing field that decentralization promised.

Crypto shouldn’t require complex safeguards to uphold trust and fairness. Preventing corruption should be intuitive and integrated by default.

This is where Fairblock steps in: the world's Incorruptible Computer.

Fairblock is on a mission to enable incorruptible markets and machines using dynamic confidential computing. Unlike simple cryptographic libraries or privacy-focused chains, Fairblock provides a modular and programmable confidentiality solution that integrates seamlessly into existing blockchain ecosystems. It is not a privacy patch. It’s a programmable coordination layer that unlocks new classes of applications through built-in confidentiality, compliance, and composability, by leveraging cutting-edge cryptographic techniques such as threshold identity-based encryption (IBE), homomorphic encrypion (HE), and multi-party computation (MPC).

Web3 has struggled to balance confidentiality with decentralization and compliance, stifling crucial applications from secure transfers to institutional finance. Fairblock offers a path forward: dynamic confidentiality that protects onchain interactions until verifiable events (e.g., price thresholds, block heights) occur, after which data can be transparently revealed and audited.

Unlike traditional dark pools, which rely on centralized operators, Fairblock’s approach ensures that confidentiality and compliance coexist through selective disclosure and decentralized compliance frameworks. This means that pre-transfer compliance checks and post-execution auditability can be enforced without revealing transaction details to the public, a fundamental improvement over existing privacy solutions. To put it simply, Fairblock isn’t just about privacy, it’s about efficiency, security, and enabling fair markets. Much like how CoW Swap and Flashbots solved real user problems by protecting traders from frontrunning and several other market inefficiencies, Fairblock gives users a secure, compliant, and decentralized way to transact without the risks of frontrunning, information leaks, or regulatory uncertainty.

FairyRing is Fairblock’s native blockchain. Currently live on testnet across EVM ecosystems and Cosmos appchains, it is designed to help developers build confidential applications. By providing threshold cryptographic techniques and selective disclosure mechanisms, Fairblock empowers users and institutions to interact with privacy, fairness, and security without sacrificing the benefits of decentralization.

Blockchain’s evolution into a credible financial infrastructure depends on solving the privacy crisis. Fairblock’s modular confidentiality solutions pave the way for large-scale adoption by ensuring that confidentiality is not just a feature but a fundamental pillar of the decentralized economy. Like the car replacing the horse, confidential transactions will soon be the default and not just an option, but a necessity.

These issues are not theoretical. They are direct consequences of the transparent-by-default design. As the Fairblock team succinctly put it, today’s blockchains “leak the contents of your messages, decisions, and strategies… before they are executed,” giving privileged actors undue advantages and “negatively impacting blockchain experiences” in multiple ways. Without some form of confidentiality, blockchains will continue to be plagued by frontrunning bots, hesitant institutional adoption, and an inability to support many real-world applications beyond simple token transfers. The need for a solution is clear: if we want decentralized networks to truly compete with Web2 systems (which do keep most data confidential by default), we must bring confidential computing into the blockchain world.

In this article, we will delve into Fairblock’s unique approach to onchain confidentiality, its key components like FairyRing and FairyKit, and how its modular, programmable confidentiality solutions are setting a new standard for blockchain confidentiality with compliance and decentralization.

Before we get started, it’s important to define a few terms that will come up often:

Threshold IBE: An identity-based encryption is a form of encryption based on some identifying conditions. Fairblock uses threshold IBE so that no single party controls the decryption keys. Instead of "identity," Fairblock uses "conditional IDs," which are less about actual identity and more about various variables, often related to a chain's global state, such as block height. This approach introduces the minimal bandwidth compared to other MPC and FHE schemes.

Threshold encryption: Threshold encryption is a form of cryptography that allows a private key to be derived as long as a certain threshold of network participants come together to aggregate their private key shares. Fairblock uses Threshold IBE, which allows validators to generate a share of the private key using their Master Secret Keyshare once a condition (ID) is met onchain. Validators then submit their private key shares to FairyRing, which can construct the derived private key once the threshold of validator key share submissions is met.

Public key: A public key is a large cryptographic value that is used to encrypt data. The public key is publicly visible and used to identify some encrypted data. The public key is derived from the private key, a randomly generated cryptographic value that is needed to decrypt data. In asymmetric encryption and its derivatives, public keys are openly known, while private keys are only made available to owners or receivers of some data and signify true owners of data. In Fairblock, we use a Master Public Key (MPK) that is used to encrypt every transaction within an epoch. The MPK is discarded after the end of an epoch.

Block height: The block height is the current length of the blockchain network. It is the number of blocks preceding the current block in a network. The height of the genesis block of a blockchain is zero.

Derived private key: The derived private key is a unique key corresponding to a certain encryption condition (ID) and is required for a chain to decrypt encrypted transactions. The derived private key is obtained by aggregating a threshold number of derived private key shares.

Frontrunning: Frontrunning is an example of predatory MEV (Maximal Extractable Value), where MEV searchers can observe a user's unexecuted profitable trade in a mempool and manipulate the ordering of transactions within a block. The most common type of frontrunning is sandwich attacks.

Fairblock: The Missing Piece in Crypto’s Tech Stack

Fairblock emerges to fill the critical gaps discussed above with its Incorruptible Compute a decentralized cryptographic engine designed to detoxify Web3 by transforming markets, stablecoins, and machines into secure, fair, and performant environments. Whether it's trading, lending, or auction execution, Fairblock ensures each action proceeds without manipulation or information leakage.

Fairblock solves this by acting as the confidentiality backbone of Web3. It encrypts any user interaction, such as swaps, loan bids, or private data exchange, and stores the decryption keys with a decentralized validator set. The data remains confidential until a predefined condition, like a block height or price threshold, is met. Once triggered, the information is decrypted and the transaction is settled. The entire process remains fully verifiable after execution for audit and compliance purposes.

Much like how Cloudflare secures internet traffic, Fairblock delivers confidentiality as a service for Web3. It ensures incorruptibility without compromising transparency, setting the foundation for trust, institutional access, and next-generation applications.

Blockchains open up the world of financial instruments and manipulation, which are controlled by corporate bodies and governments, aiming to return power to individual users. This provides users with the tools and opportunities to correct inefficient, flawed financial practices that were widespread in the past. Additionally, blockchains were designed in a way that makes them easily manipulable; for instance, immutable transactions can still be affected at the mempool level.

Furthermore, the future of blockchains require more than what we are used to: memecoin pumps, centralization trends, unused applications, and less secure blockchain-based applications that throw businesses and users into turmoil as they occasionally face public leaks of on-chain activities and data. For instance, despite the launch of numerous applications on the blockchain, there is a scarcity of compelling, user-friendly applications that display benefits or tackle key issues as preached in the past. On the other hand, many blockchain-based applications have begun exhibiting centralizing tendencies either through governance models or token distributions. This contradicts the core principles of decentralization and damages the vision of the community.

Fairblock solves all the issues stated above via its key products, FairyRing and FairyKit. Tackling “onchain confidentiality, which is the greatest unsolved crisis in crypto,” as stated by founder, Peyman Momeni, Fairblock has a unique approach. It does not rely on slow or centralized, one-size-fits-all solutions; rather, it tailors and optimizes the security and performance of the cryptographic network for each specific DeFi and AI application. For instance, it hosts multimodal Multi-Party Computation (MPC), Homomorphic Encryption, Trusted Execution Environment (TEE), Zero-Knowledge (ZK) solutions to optimize performance and guarantee confidentiality for various use cases, including private transfers, lending, clearing markets, hidden information GameFi, confidential AI, and private data monetization. .

The use of MPC cryptographic computations on Fairblock allows it to easily run DeFi, AI, and gaming economies for cheap and fast execution that allows applications to thrive in ecosystems such as EVM (L2s included), Solana, and Cosmos. To solve the issues around onchain confidentiality, Fairblock comprises two core elements: FairyRing and FairyKit. FairyRing abstracts away intensive cryptographic operations for applications built within its chain as well as those built on alternative blockchains. For external partners, FairyRing distributes confidential execution via FairyKit, which plugs into any protocol and application to bring one-click confidentiality to any app or user that requires it.

FairyRing & FairyKit

FairyRing is a dynamic and decentralized network that hosts applications optimized for secure and performant confidential computing. This means when apps (either native apps or external apps) are integrated into the Fairblock ecosystem, they have active communication with the FairyRing chain and can frictionlessly integrate with any chain. Having this interconnected network of chains deepens liquidity between apps and bridges the gap of fragmentation. This helps to increase the robustness of the network as it abstracts away cryptographic computations, including condition verification, threshold key generation, and execution of encrypted transactions.

The FairyRing network is built on the Cosmos SDK, incorporating both the benefits of the Cosmos chain and its own novel features. One of the key advantages is that FairyRing does not require relayers, since the confidential computation and contract callbacks are native functions of the hosting chain. Another key benefit is that applications built on FairyRing inherit the Cosmos chain's high performance. Thanks to Tendermint’s horizontal scaling, validators can run multiple chains in parallel, ensuring that workloads are distributed and throughput remains high. Consequently, any application launched on the FairyRing can operate efficiently, free from common bottleneck issues.

FairyRing allows developers to build confidential applications. In EVMs and other blockchains, every transaction, contract call, and state change is public, which carries aforementioned risks like frontrunning and data leaks. FairyRing eliminates these risks by leveraging a suite of confidential computation schemes. A flagship primitive is threshold identity-based encryption: transactions are encrypted, stored onchain, and decrypted only when preset conditions such as reaching a target block height, are met.

FairyKit is a module that extends the same confidential guarantees to both native Fairyring applications and external chains. It is a one-click integration package that can be plugged into any protocol and application. There are two main integration routes that the chains must follow:

The use of “FairyKits” is specific to the blockchain that is integrating with Fairblock. This allows for custom setups, in which the partner network handles some or all of the decryption and encryption. No changes to the core protocol architecture are required.

In the “co-processing” route, FairyRing handles the all the cryptographic computations adn execution, and returns the end state to the integrating network. For instance, an auction application that allows users to submit encrypted bids can off-load all cryptographic processing to FairyRing, which will return the final state to the auction app.

FairyKit ships adapters for EVM, Cosmos, XRP Ledger and Rust-based chains, delivered as modules, smart contract libraries, or execution-layer hooks, depending on the needs of the application's logic and architecture.

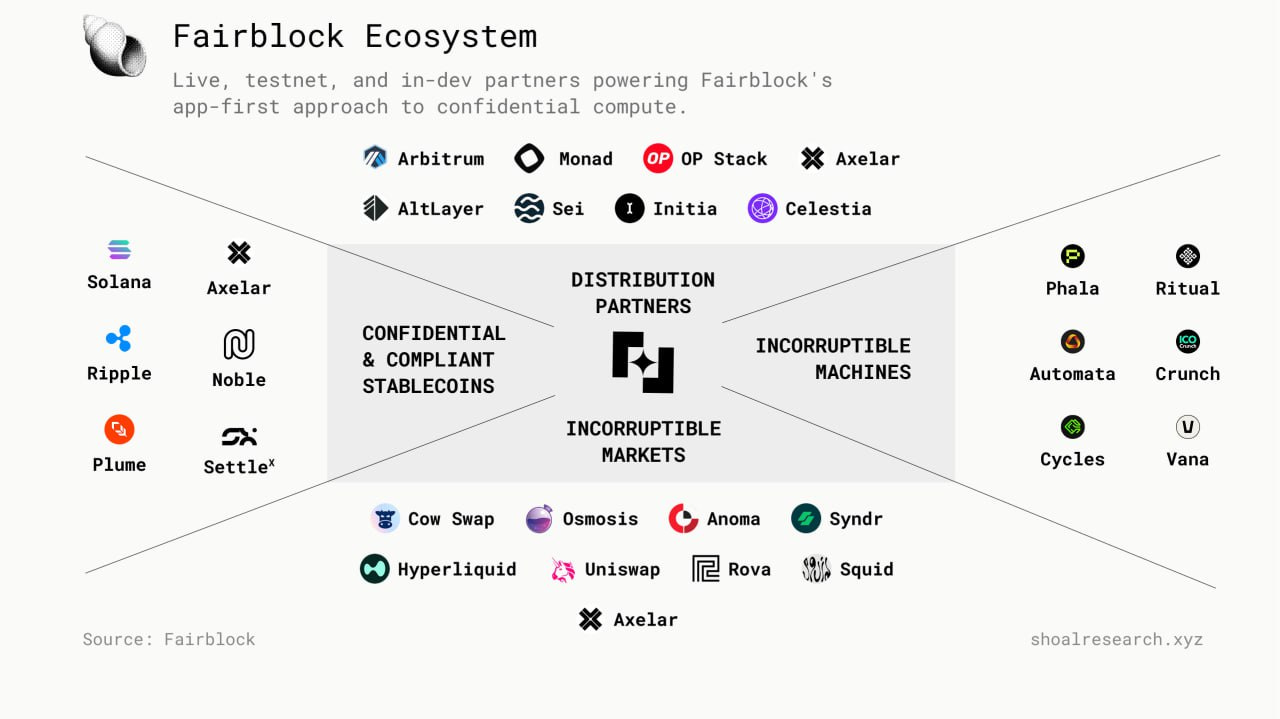

The Fairblock Ecosystem - Application First Approach

The Fairblock ecosystem is made up of several native and external applications. These applications showcase the variety of use cases for onchain encryption across DeFi, AI, gaming, randomness, and governance.

As Web3’s confidential processing layer, Fairblock recognizes that infrastructure is only a means to an end: applications. From day one, the team is launching a suite of DeFi products powered by confidentiality. These serve both as proof-of-concept and as valuable services in their own right, showing users what’s now possible with onchain confidential computing.

Fairblock specifically offers tailored solutions in three of the most impactful verticals:

Incorruptible DeFi

Fairblock enables a new class of high-integrity DeFi applications through programmable confidentiality. By introducing encrypted intents and sealed-bid auctions, Fairblock replaces legacy coordination methods with trustless, manipulation-resistant infrastructure, that is ideal for trading, lending, and token distribution.

Encrypted Intents & Bids for Solvers

Fairblock allows users and solvers to submit encrypted messages, ensuring no information is leaked before execution. This not only supports confidenital limit orders and swaps, but also enables a novel use case: sealed-bid auctions for solvers, an upgrade over off-chain RFQ models used by platforms like Anoma, Squid, and UniswapX. With Fairblock, solver bids remain confidential until decryption triggers are met (e.g., block height or escrow lock), preventing censorship, favoritism, and price manipulation.Sealed-Bid and Leaderless Auctions: Fairblock’s leaderless sealed-bid auctions eliminate sniping, bid shading, and collusion by keeping all bids hidden until the auction closes. This mechanism is used for:

Fixed-rate lending, where both borrower bids and lender asks are encrypted, producing a market-driven clearing rate without backend games.

Fair token launches, replacing Dutch auctions with a single clearing price.

Front-running and forced-liquidation protection: Applications like FairyCow Swap protect transaction details until execution, preventing exploitation through front-running or forced liquidations.

Private lending and clearing markets: Confidential markets like Fairates and SettleX offer robust lending primitives with transparent, decentralized, and trustless execution without backend games.

Institutional Confidential and Compliant Stablecoins

Large institutional transfers without market impact: Fairblock’s confidential solutions enable institutions to move significant sums securely, minimizing market disruption.

Addressing confidentiality blockers for LPs: Ensuring privacy to overcome institutional barriers related to data leakage and confidentiality concerns.

Private balances and transfers compliant through decentralized selective disclosure (MPC): Fairblock combines MPC and ZK proofs to enable compliant confidential transfers, suitable for normal and institutional users.

Fairblock enables encryption of transaction amounts, unlike ZK-only solutions, which typically only obscure address linkages while still exposing amounts and activities. With Fairblock, address anonymity is optional, and confidentiality can be fully customized.

Fairblock’s MPC and ElGamal-based approach offers significantly higher efficiency and decentralization compared to FHE counterparts, which often suffer from performance bottlenecks and centralization risks in practical deployments.

Incorruptible AI

Inference on encrypted data (e.g., trading agent, balancing pools): Enables AI models to operate securely on encrypted data, preserving confidentiality and integrity during computations.

Unruggable AI models through MPC: AI models protected by MPC and TEEs, ensuring secure, unstoppable operations.

Private data marketplace: Fairblock allows secure monetization of private data for AI model training without compromising data confidentiality.

To implement its solutions in the above-mentioned verticals, Fairblock's integration and distribution strategy includes two complementary approaches:

Dine-In

Delivery

The Dine-In ecosystem features native confidential applications (cApps) developed directly within Fairblock’s FairyRing chain, already live on testnet with over one million transactions. Flagship offerings include credible DeFi products such as fixed-rate lending markets, sealed-bid auctions, and dynamic intent matching (collaborations with Anoma, Squid, and CoWSwap). Additionally, Fairblock hosts unstoppable AI models through MPC and TEEs (e.g., Phala), confidential lending and clearing markets (Fairates, SettleX), compliant confidential transfers, private data monetization for AI, and engaging hidden-information GameFi applications.

The Delivery motion extends confidentiality solutions via strategic partnerships, starting with Arbitrum. Fairblock’s dynamic confidentiality modules integrate natively with EVM rollups (Plume, Syndr, Xai, OP Stack), appchains (Celestia's Rollkit, AltLayer, Polymer), and AltL1s (Monad, Osmosis, Sei). In future phases, Fairblock will leverage coprocessor architectures to extend dynamic confidentiality directly into Ethereum and Solana ecosystems, significantly broadening the reach and impact of onchain confidential computing.

First, let's examine some of the use cases made possible by leveraging Fairblock's infrastructure and capabilities. Then, we'll explore the specific dine-in applications within the broader Fairblock ecosystem.

Confidential Stablecoins & Real World Assets For Institutional Adoption

Stablecoins are rapidly becoming the backbone of global financial infrastructure, yet the current transparent nature of blockchain transactions poses significant barriers for institutional adoption. Enterprises handling payroll, treasury operations, settlement flows, and strategic financial transactions require confidentiality not in terms of anonymity, but specifically regarding transaction amounts and strategic details.

Fairblock addresses these critical needs through a unique cryptographic solution built on Threshold ElGamal decryption combined with Multi-Party Computation (MPC). Unlike zero-knowledge (ZK) solutions, which primarily obscure the link between addresses but leave amounts and transaction patterns exposed, Fairblock encrypts transaction amounts directly. This targeted confidentiality is complemented by the integration of lightweight ZK proofs to validate the input amounts. Crucially, businesses typically prioritize preventing sensitive data leakage over address anonymity due to compliance considerations and practical needs for auditability.

Fairblock’s technology significantly surpasses Fully Homomorphic Encryption (FHE) based projects such as Zama, Inco, and Fhenix in terms of speed and decentralization. FHE methods require computationally heavy operations and typically rely on centralized coprocessors, optimistic assumptions, and trusted relayers, introducing points of centralization and potential security risks. Fairblock’s MPC and Threshold ElGamal approach eliminates these centralized dependencies, ensuring robust decentralization, efficient batch decryption, and selective disclosure, delivering greater scalability and performance.

Fairblock’s solution has attracted the attention of major industry players, aligning with recent market trends where leading stablecoin issuers and payment giants are actively seeking confidentiality enhancements. PayPal’s recent interest in integrating confidential transfers on Solana and Circle’s acquisition of on-chain privacy-focused protocol Gateway illustrate the increasing importance of confidentiality in mainstream financial transactions.

Fairblock is actively collaborating with key blockchain and stablecoin infrastructure partners, including Noble, Ripple, Plume, Hyperliquid, Arbitrum Foundation, Dowgo, Axelar, and Cosmos Hub, to deploy its encrypted transfer capabilities broadly across ecosystems.

Additionally, Fairblock’s confidentiality infrastructure unlocks innovative auction-based TradFi use cases, such as Treasury bill auctions and other institutional asset distributions. Leveraging Fairblock, institutions can securely execute sealed-bid auctions without leaking strategic bidding data, enhancing market integrity and fairness.

Another notable example within the Fairblock ecosystem is SettleX, the first confidential clearing and settlement solution specifically built for institutional stablecoin use. Cross-chain stablecoin flows are currently fragmented, costly, and highly visible, exposing sensitive trading information. SettleX mitigates these issues by netting transactions across chains, securely settling only net deltas, significantly reducing capital inefficiency, bridging costs, and protecting counterparty privacy. By combining MPC with Trusted Execution Environments (TEE), an approach Fairblock has also implemented with Cycles, SettleX provides robust security without solely relying on hardware-based TEE or MPC assumptions alone.

Through these targeted confidentiality solutions, Fairblock is enabling a new era of institutional adoption and strategic financial operations on-chain, redefining how real-world assets and stablecoin transactions can securely and compliantly scale within decentralized ecosystems.

Incorruptible fixed-rate lending on Arbitrum and Hyperliquid

Imagine a lending protocol where interest rates or loan terms are determined via a sealed-bid auction among lenders, rather than a fixed formula. Lenders submit bids (e.g. the lowest interest rate they’re willing to offer or the highest they’re willing to pay to borrow) encrypted via Fairblock. Because bids stay confidential until the auction ends, no participant can adjust their bid reactively and no “last-minute sniping” or collusion is possible. The result is a fair market-driven rate discovery for loans.

This sealed-bid auction framework, internally referred to as DeBid, represents Fairblock’s general-purpose auction engine deployed on Arbitrum One and Orbit chains using Stylus. Fairates, a fixed-rate lending market, is one of its first real-world implementations. In fact, Fairblock’s solution for sealed-bid on-chain auctions was recently recognized in Arbitrum’s development initiative – “Fairblock is revolutionizing onchain auctions by building sealed-bid infrastructure using Stylus… enabling new privacy-preserving use cases that weren’t previously possible onchain.” By applying this to lending, we get more efficient and equitable lending markets that could attract institutional lenders who otherwise fear information leakage in DeFi.

Intent-Based Trading and Dynamic Price Discovery

In collaboration with intent-centric protocols like Anoma, CoWSwap and Squid , Fairblock’s tech can power hidden “intent” orders. A user might express an intent to trade asset X for Y under certain conditions, which on current DEXs would be translated into a visible limit order or a transaction in a mempool. Instead, using Fairblock, the intent can remain encrypted until it is matched with a counterparty. Various market makers or counterparties can bid to fill the intent, also in a sealed-bid manner, and once a match is found and finalized, the trade is executed and only then details are revealed. This creates a dynamic price discovery process where the market finds the best execution price for a trade without broadcasting the intent to everyone. Such functionality is invaluable for large trades (to avoid price slippage from advance knowledge) and is aligned with what leading projects are exploring. By partnering with Anoma (an intent-focused layer-1) and integrating with cross-chain liquidity hubs like Squid, Fairblock is ensuring these confidential intents can even operate across multiple networks, further scaling the liquidity and reach of decentralized economies.

Sealed-Bid Token Launches (Fair Token Distribution)

When new tokens are released (through IDOs, ICOs, or auctions), savvy players often game the process by creating gas wars on Ethereum or Solana. Fairblock enables a better model: sealed-bid token launches in which each participant submits a bid for the token (how much they’re willing to pay or how many tokens they want) confidentially. All bids are revealed simultaneously at the close, and an algorithm determines the clearing price and allocations. Because no one knows others’ bids in advance, every bidder plays on equal footing, and outcomes can’t be skewed by real-time insider info. This approach can prevent the typical frenzy and network congestion of token launches, leading to more stable price discovery. Fairblock unites champions for “fair token launches” and makes dynamic pricing for intents far simpler with sealed-bid, leaderless auction mechanics . The idea is to bring IPO-like fairness to crypto token distributions, which will fuel broader participation and build trust in these events.

Some specific examples of dine-in apps

FairRates: Fixed Rates, Not Fixed Games

FairRates, built by Fairblock, brings a new paradigm to fixed-rate lending, one where confidentiality and decentralization converge to create fair, efficient lending markets. Like some of the existing applications today, FairRates uses sealed-bid auctions to discover market-clearing interest rates, ensuring that all borrowers and lenders settle at the same rate without favoritism or last-minute sniping.

But FairRates stands apart in two critical ways. First, it’s built for high-performance EVM DeFi hubs like Arbitrum and Hyperliquid, drastically reducing gas costs and enabling real-time participation. Second, and most importantly, it eliminates reliance on centralized infrastructure. Other systems like Term rely on centralized servers to reveal encrypted bids, introducing trust assumptions and potential points of failure.

In contrast, FairRates uses Fairblock’s MPC infrastructure via FairyRing to securely decrypt and reveal bids only when predefined auction conditions are met. This ensures confidentiality throughout the bidding process, trustless execution, and zero reliance on fallback mechanisms or centralized servers.

The result is a robust lending primitive: one rate for all, transparently discovered, and zero backend games.

FairRates is actively supported by the Arbitrum Foundation and is being deployed on both Arbitrum One and Hyperliquid as part of Fairblock’s broader effort to bring sealed-bid infrastructure to next-gen DeFi ecosystems. It represents a foundational use case for intent-based lending, delivering the performance, integrity, and decentralization that DeFi was always meant to embody.

Explore FairRates: https://fairates.fairblock.network

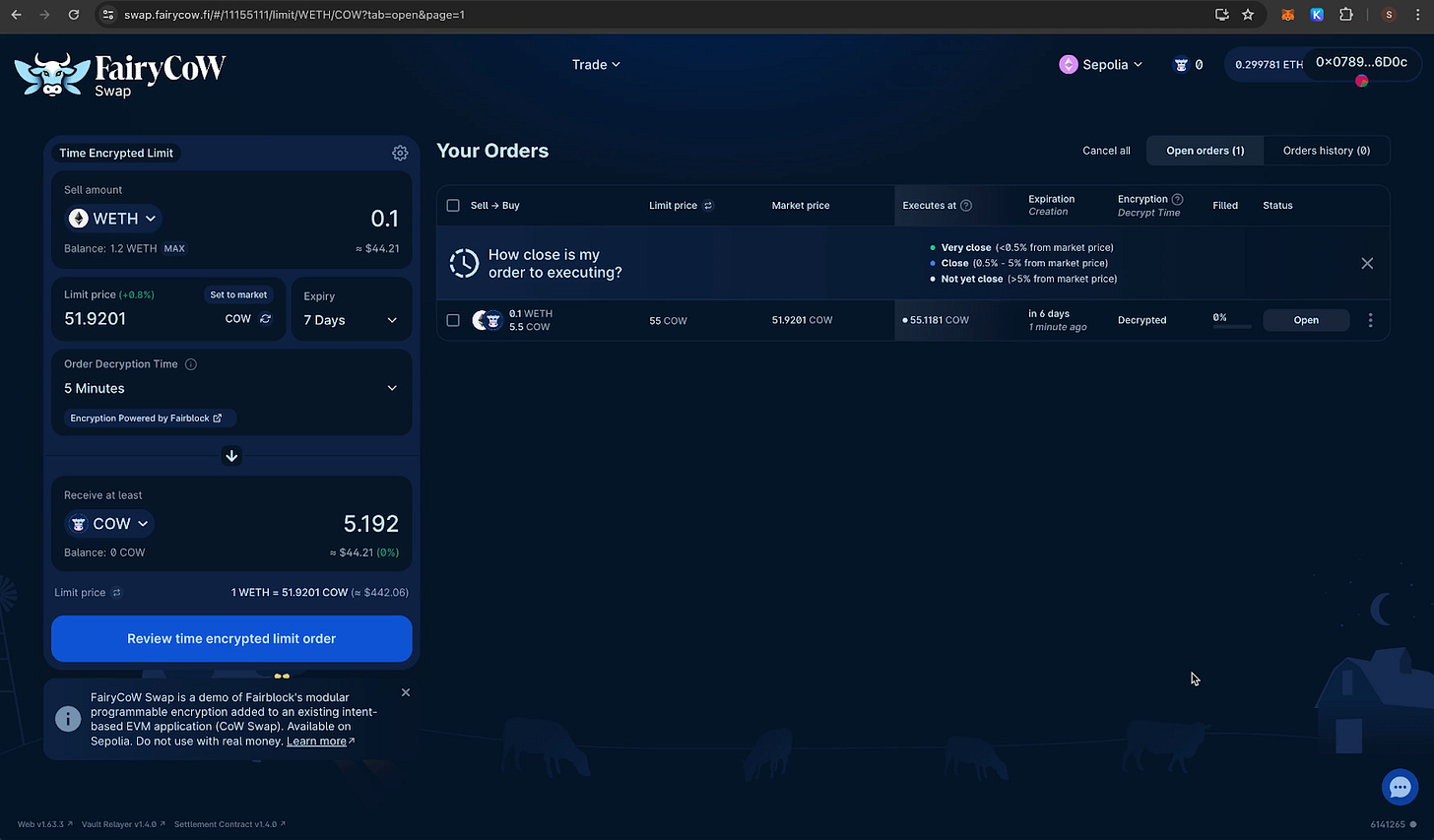

FairyCow Swap

The FairyCow Swap is a demo application of Fairblock's modular programmable encryption added to an existing intent-based EVM application (CoW Swap) limit orders. Encrypting trade intents ensures that transaction details such execution time, amount, liquidation trigger, stop-loss price remain confidential until execution and cannot be exploited. FairyCoW Swap is available on the Sepolia testnet, demonstrating how programmable encryption can be applied to existing decentralized exchanges.

Explore: FairyCow Swap

FairEx

FairEx introduces an interesting confidentiality-focused trading solution on Arbitrum, enabling users to encrypt their swap orders and protect sensitive trading information from premature exposure. Operating as a UniswapV2-style decentralized exchange on Arbitrum's Orbit testnet, the platform specializes in handling encrypted limit orders that remain confidential until specific market conditions are met. Users can specify precise limit order conditions, such as executing a transaction when the ETH/USDC price reaches $500, with their orders remaining encrypted until the price trigger. When the specified price threshold is reached, the system triggers a decryption key request to FairyRing. The validators then generate and verify the decryption key. Once validated, the key is transmitted to Arbitrum's testnet, enabling secure order execution while maintaining confidentiality throughout the entire process.

Time Machine: Confidential Prediction Markets with Delayed Decryption

Time Machine is a prediction market application built using Fairblock’s programmable confidentiality infrastructure. Unlike traditional onchain prediction markets where all bets and outcomes are visible in real time, Time Machine leverages delayed decryption to unlock a new design space for fair and manipulation-resistant forecasting.

Each prediction or vote is encrypted and submitted onchain, with decryption triggered only after a predefined condition, such as a specific block height or timestamp is met. This approach ensures that no participant can reactively influence outcomes or copy the positions of others before reveal. As a result, Time Machine eliminates frontrunning and bandwagon biases that often plague transparent prediction markets.

Key features:

Sealed Predictions: Participants’ responses are fully encrypted until the end of the round.

Public Auditability: Once the decryption trigger fires, all inputs are revealed and outcomes computed in a verifiable manner.

Custom Trigger Logic: Developers can define arbitrary conditions such as block height, oracle feed resolution, or community governance decision as triggers for decryption.

Time Machine is a strong proof-of-concept for how Fairblock’s infrastructure can empower decentralized forecasting, secure DAO voting, and future onchain governance applications where secrecy until a reveal event is crucial to system integrity.

Architecture Overview: Fairblock

The Fairblock architecture consists of several components.

FairyRing - Fairblock's native chain that abstracts away heavy cryptography for both native applications and those built on alternative blockchains.

FairyKit - Fairblock Integration packages that embed one-click confidentiality into any protocol and application.

Encryption SDK - Client-side software used to encrypt and submit transactions to the Destination Chain. Once the encrypter is integrated with applications (front-end or wallets), users can seamlessly encrypt their transactions. End-to-end encryption happens locally within the browser and does not rely on any third parties.

Destination Chain - The chain storing encrypted transactions, receiving public keys and secret keys from FairyRing, and where the transactions are executed after decryption. This can be FairyRing itself with native applications or external chains working with FairyRing.

Relayers - The communication services that listens and coordinates decryption requests between the FairyRing and destination chains (e.g. FairyPort, IBC, Axelar).

The core components of Fairblock define how users interact with the protocol and ensure its proper functionality. An example of the user flow of the Fairblock protocol is:

User submits an encryption transaction with decryption parameters

Transaction is transferred to the Encryption Software Development Kit (SDK), where it is securely held in the destination chain’s mempool

When smart contract conditions are met, relayers request decryption keys from FairyRing

FairyRing verifies the request, delivers the derived private key, and sends it back to the destination chain.

The transaction decrypts and executes, completing the state change while keeping the data safe until specified parameters.

Key Features of Fairblock

Fairblock has several key features:

Composable

With Fairblock, developers can integrate confidentiality features into the blockchains and applications they already use without switching to a new ecosystem, thereby solving further fragmentation. Using Fairblock’s FairyRing and FairyKit, they can build confidentiality-preserving smart contracts and applications in their preferred environment. This allows them to enhance security and confidentiality without compromising compatibility or requiring major architectural changes.

Chain Agnostic

FairyKit is designed to seamlessly integrate with major Layer 1 (L1) and Layer 2 (L2) blockchains. Whether a blockchain operates as a standalone L1 or scales via an L2 solution, FairyKit ensures smooth compatibility without requiring fundamental changes to its architecture. This allows projects across different ecosystems to leverage Fairblock’s encryption and decryption capabilities while maintaining interoperability and efficiency.

Performant and Scalable

Fairblock offers linear bandwidth scaling, and avoid using heavy one-size fits all cryptographic solutions. As network demand increases, performance scales efficiently without bottlenecks. Additionally, its encryption processes run in tens of milliseconds, ensuring that transactions remain fast and responsive. This combination allows users to experience seamless confidentiality protections without delays, making confidential transactions as smooth as standard ones.

Dynamic

Encryption needs vary across different applications and user needs. Fairblock’s multimodal cryptographic computation is highly customizable, allowing developers to mix and match MPC, FHE, TEE, and ZK schemes to meet specific performance and security needs.

Competitive Landscape

The race to build confidentiality-preserving infrastructure in crypto is heating up, with multiple projects tackling shared private states using different approaches. This has resulted in much excitement in the confidentiality applications and the prospect of new credible economies. Onchain confidentiality aims to achieve a shared private state amongst users. It is still in its early stages, defined by fragmented solutions and narrow use cases.

Fairblock is not a generic confidentiality project, it is an ecosystem-first, multichain infrastructure platform purpose-built to deliver real-world utility across DeFi, AI, gaming, and more. With direct integrations into partner chains and applications, Fairblock serves as the confidentiality backbone for high-performance, composable systems that demand both security and speed.

Unlike traditional privacy-focused blockchain solutions, Fairblock is a practical enabler of real-world DeFi use cases. It distinguishes itself by optimizing for performance and scalability without compromising on confidentiality. Compared to Zama, which utilizes FHE to enable computations on encrypted data, Fairblock focuses on balancing confidentiality with performance. FHE provides strong confidentiality by allowing operations on encrypted data, but heavy computation makes it unsuitable for most DeFi applications. Fairblock, on the other hand, employs Threshold Identity-Based Encryption (TIBE) while integrating MPC, ZK, and TEEs, ensuring faster, scalable, and privacy-preserving operations that are suitable for real-time blockchain applications like auctions and decentralized trading.

When comparing Fairblock with Nillion, the two share a focus on MPC but differ significantly in their approaches and use cases. Nillion provides a chain-agnostic network with an orchestration layer (Petnet) designed for general-purpose AI, DeFi, and computation applications. Its MPC protocols support secure computation and storage across multiple chains but lack native integration with DeFi use cases. In contrast, Fairblock is tailored for EVM and Cosmos chains, specifically enabling privacy for DeFi use cases like auctions, liquidations, and lending markets. By focusing on modular integration into existing blockchain ecosystems, Fairblock brings privacy-preserving infrastructure directly to DeFi, addressing the industry's specific needs for confidential trading, compliance, and real-time data protection.

Arcium, which primarily focuses on the Solana blockchain, utilizes a different encryption framework and takes a more narrow approach to confidentiality. It specializes in the Solana ecosystem, whereas Fairblock’s multichain design integrates seamlessly with both EVM and Cosmos ecosystems, providing broader support. Fairblock’s modular architecture allows it to scale across multiple chains with advanced cryptographic techniques, offering more flexible and practical confidentiality solutions for diverse blockchain applications.

Fairblock’s focus on modular integration, real-time efficiency, and compliance sets it apart as a true enabler for decentralized finance and blockchain-based applications. Whether it's for private data monetization, AI model security, leaderless auctions, or hidden-information GameFi, Fairblock delivers adaptable, scalable solutions that ensure confidentiality while maintaining the integrity and decentralization of blockchain networks.

Fairblock’s Business Model and Sustainable Revenue Flywheel

Revenue Model and Market Opportunity

Fairblock is not just building infrastructure, it's engineering a sustainable business around the incorruptible world computer. At the core of this strategy is a simple but powerful engine: confidential auctions. This single primitive unlocks high-margin revenue across multiple verticals, compounding product depth, usage, and value capture.

Below, we break down Fairblock’s monetization roadmap and run some paper napkin math to illustrate the projected potential of Fairblock’s offerings across three sequential phases.

Phase 1: Incorruptible Auction-Based Markets

One Auction Engine, Three Explosive Revenue Vehicles

Fairblock’s flagship sealed-bid auction infrastructure powers encryption-driven use cases across lending, token launches, and intent-based trading. This model drives revenue directly into Fairblock’s native chain, FairyRing, allowing rapid iteration and unlocking new design spaces in DeFi. Unlike traditional DeFi protocols that rely on fixed curves or public mempool orders, Fairblock introduces a leaderless, encrypted auction engine that unlocks fair market discovery across multiple verticals. Today’s DeFi is often constrained by toxic order flow, manipulated token launches, and inefficient lending curves. Fairblock reimagines these primitives through the lens of confidentiality and incorruptible execution engines.

A. Fixed-Rate Lending (Fairates)

What it solves: Today’s fixed-rate lending protocols (e.g., Notional, Term Finance) often struggle with bid sniping, uneven clearing, and low institutional adoption due to lack of confidentiality.

Fairblock’s edge: Every loan term is discovered through a sealed-bid auction where borrowers and lenders commit bids confidentially. Once cleared, all parties settle at a single, transparent rate, without manipulation.

Where it stands: Already live on Arbitrum testnet, backed by the Arbitrum Foundation, and integrating with Hyperliquid. Fairates benefits from reduced gas costs and rapid block times, something legacy models can’t support.

Revenue opportunity: Projects like Term Finance and Notional process ~$500M in volume across dozens of markets. If even a portion of that migrates to Fairblock’s sealed auctions (augmented by liquidations and ecosystem growth), we’re looking at a conservative multi-million-dollar annual revenue stream, especially as institutional confidence rises.

B. Fair Token Launches (FairLaunch)

What it solves: Dutch auctions and first-come-first-serve IDOs frequently devolve into gas wars and last-minute frontrunning. The result? Inequitable access and massive alpha leakage.

Fairblock’s edge: FairLaunch replaces chaotic token sales with sealed-bid auctions. Participants submit bids privately, and once the auction closes, all bids are revealed and cleared at a uniform price. No sniping. No favoritism.

Where it stands: Partnered with Rova (ex-CoinList) and in active discussions with Legion and Fjord. The approach offers improved UX, better price stability, and broader participation.

Revenue opportunity: CoinList alone facilitated over $100M in token sales last year. With Fairblock targeting 10–50 launches annually in early phases, 5% of funds raised as protocol revenue yields material upside, while serving as a marketing flywheel for broader adoption.

C. Intent-Based Trading (FairIntent)

What it solves: As intent-based trading gains traction (CoWSwap, 1inch Fusion, UniswapX), current systems leave order flow exposed. This creates risk for both users and solvers, ultimately degrading price execution.

Fairblock’s edge: FairIntent encrypts both the user intent and the solver bids. Matching is done through a sealed-bid auction mechanism, where only the selected path is revealed and settled onchain.

Where it stands: Actively collaborating with CoWSwap, Squid, Anoma, and Uniswap MVPs.

Revenue opportunity: With over $50B* annual volume in intent-based flows, and Fairblock capturing even 5–10%** of that at 0.15% in protocol fees, the upside exceeds 7 figures in annualized revenue. Unlike speculative tokens or fluctuating LP fees, these flows are sticky and repeatable.

*Volumes from Cow Swap, Fusion, Uniswap X, Squid

**Cow Swap showed 132% growth in trading volume between May 1, 2024-May 1, 2025

Phase 2: Confidential and Compliant Stablecoin Transfers

Replacing Centralized Backends With Trustless Confidential Rails

Despite trillions in DeFi volume and $200B+ in stablecoin supply, most transfers still pass through centralized routing systems or leak sensitive information that makes them unsuitable for institutions. Fairblock replaces this layer with programmable confidentiality and decentralized selective disclosure.

A recent Fireblocks report surveyed 295 financial executives, 61% of whom were C-suite leaders, and confirmed what the market has long been signaling:

9 in 10 respondents say regulations and industry standards are accelerating stablecoin adoption

36% of respondents flagged improved security as the single biggest unlock for enterprise stablecoin use

This shift reflects a maturing industry: as legal clarity and AML tooling advance, risk becomes the next bottleneck. Institutions aren’t just asking if providers are secure—they want to know how protocols evolve against new threats. And here, Fairblock is well-positioned.

“Conventional security frameworks will not be sufficient to protect the next billion users as stablecoin adoption accelerates. To keep up with 24/7 cross-border flows, infrastructure must evolve at the same pace as the attack surface. Institutions are no longer asking if a provider is secure, but how that security evolves to meet emerging threats.”

By embedding decentralized confidentiality and programmable compliance at the execution layer, Fairblock delivers:

Confidential transfers with selective disclosure

No reliance on centralized intermediaries or private servers

Composability across EVM chains, Solana, and institutional rails like Noble

Here, the opportunity is massive:

DeFi: ~$3.2T in annualized trading volume, 70% still routed through centralized intermediaries.

Stablecoins: $239B supply today, projected to hit $2T by 2028.

Let’s illustrate the Revenue Potential:

Capturing 2% of DeFi flow at 0.15% fee = ~$67M.

Powering 10% of stablecoin rails today = ~$36M; scaling to ~$300M+ by 2028.

Notably, the demand for confidential stablecoin rails is already proven. Projects like Railgun and Houdini Finance, despite being limited in either ecosystem reach or functionality, have generated approximately $4-6M and $1.5M respectively in revenue. These systems typically charge around a 0.1% transaction fee, a model Fairblock can replicate with greater efficiency and broader composability across chains and applications. With a more scalable infrastructure and support for institutional-grade compliance, Fairblock is well positioned to capture and expand this growing market segment.

Phase 3: Incorruptible Machines (Confidential AI Infrastructure)

As crypto-native AI agents become a reality, whether as automated traders, autonomous governance participants, or verifiable oracles, the demand for a cryptographically secure execution layer will only grow. Fairblock is positioning itself as the decentralized coprocessor for these AI systems, where confidentiality, verifiability, and composability converge.

Fairblock’s multimodal compute stack (MPC + TEE + FHE + ZK) has the potential to enable:

Confidential AI inference

Secure data monetization

Strong and efficient model execution

Potential Revenue Scenario:

DeFi trade volume: $3.2T annually.

86% of it is already automated via bots and agents.

Encrypting just 2% at 0.15% = ~$83M annual protocol fee potential.

Current integrations with Phala, Ritual, and Cycles are early signals of product-market fit. As regulation and onchain AI adoption grow, Fairblock becomes the operating system for incorruptible machine logic, an entirely new frontier for both computation and monetization.

Note: The revenue figures and market sizing outlined above are forward-looking projections intended to illustrate the potential scale of Fairblock’s core products. These estimates are not financial advice and are based on current market trends, comparable protocol data, and illustrative adoption scenarios. Actual outcomes will depend on a range of factors including market dynamics, user adoption, regulatory clarity, and Fairblock’s ability to achieve strong product-market fit across its target verticals.

Tokenomics

Fairblock’s native token underpins the protocol's economic and security models. The token is designed not only to accrue value directly proportional to network adoption but also to abstract user experience complexities, driving sustainable long-term utility.

Primary Functions of Fairblock Token:

Governance: Enables stakeholders to influence protocol evolution, security parameters, cryptographic standards, and key partnerships. Progressive decentralization ensures robust initial oversight, transitioning smoothly to broader community governance.

Fee Mechanisms: Differentiated fee structure incentivizes native application development, with internal network applications benefiting from reduced fees compared to external integrations, enhancing network effects and platform adoption.

Staking and Security: Node operators stake Fairblock tokens to maintain network integrity, with tiers incentivizing higher performance and advanced computational capabilities. Token-based staking aligns incentives and discourages malicious behavior through slashing mechanisms.

Fairblock implements computation fees that scale with complexity and urgency, offering premium fast-lane execution options. Fees can be paid in native tokens or stablecoins like USDC, with stablecoin transactions automatically converting to the native token, reinforcing demand.

Fairblock's meticulously structured revenue streams and robust tokenomics model position the protocol to achieve sustainable economic viability, driven by its critical role as the confidential processing layer for diverse blockchain applications and markets.

Bonus: How Confidentiality Unlocks New Design Space for Onchain Gaming

While Fairblock’s primary focus lies in transforming financial markets, stablecoin infrastructure, and AI execution, its early traction in gaming highlights the broader demand for confidentiality across Web3. These community-driven experiments demonstrate how programmable encryption can bring fairness, unpredictability, and integrity to fully onchain games.

In multiplayer betting games like blackjack and poker, Fairblock enables encrypted cards that remain hidden until specific triggers are met, such as a challenge or reveal phase. Bluff-based games like BS allow decryption only when a move is contested, while trivia and quiz games keep answers concealed until the correct guess or time-based reveal. Strategy-heavy formats like Diplomacy benefit from encrypted turn submissions that are unveiled simultaneously, preserving competitive fairness. Even games of chance such as Craps, Russian Roulette, and Spin the Wheel are reimagined using cryptographic randomness and delayed decryption to maintain suspense and fairness.

In narrative-rich settings like the Celestia-powered Murder Mystery, Fairblock enables dynamic storytelling by keeping player identities, clues, and outcomes encrypted until key moments. One standout demo, Lazy Killer, uses Fairblock’s infrastructure to keep the killer’s identity confidential until a pre-set block height. Players navigate the game without access to critical information until the reveal, adding a layer of suspense and ensuring no participant can exploit premature knowledge.

These examples are not just novelties. They show how confidentiality can unlock new design spaces in Web3, even outside of finance. While gaming is not Fairblock’s core focus, its organic adoption in this vertical validates the need for incorruptible infrastructure wherever fairness, unpredictability, and trust are essential.

Lingering Thoughts

As we’ve seen, the earliest and most enduring promise of crypto has always been simple: peer-to-peer transactions that are permissionless, decentralized, and open to all. Yet ironically, this core use case remains incomplete. Why? While transparency ensures verifiability, it simultaneously prevents true usability at scale. Whether it’s two individuals transacting, a protocol launching a token, or a game executing logic, the lack of onchain confidentiality has created real constraints.

Today, most onchain transactions are not only public but pre-public. Every bid, trade, or move is visible before it executes, exposing users to frontrunning, value extraction, and exploitation. This dynamic turns the mempool into a battleground, not a marketplace. As a result, crypto has largely been limited to speculation, meme coins, and basic swaps while the intended real-world use cases remain on the sidelines.

Fairblock closes this gap not by simply adding a confidentiality "patch," but by reimagining the infrastructure required for secure, performant, and trustless applications to operate at scale. Its architecture, built around leaderless, rapid auctions and programmable encryption, enables something we’ve long been missing: fairness by design.

Whether it's lending markets that discover rates dynamically through sealed-bid auctions, token launches without sniping and manipulation, or generalized intents that allow users to safely express preferences without leaking alpha, Fairblock’s technology allows applications to work as they were always intended to. Not by hiding data for secrecy’s sake, but by preserving integrity until the right moment. This unlocks everything from confidential AI inference to unruggable multiplayer games, and institutional-grade onchain participation.

At its core, Fairblock is building the world’s Incorruptible Computer, an engine for powering incorruptible markets and machines. It detoxifies Web3 by turning every onchain interaction, whether a trade, AI action, or game logic, into a fair, trustless, and confidential experience. Institutional flows, retail trades, and autonomous agents can operate without leaking alpha, enabling new forms of coordination and value exchange.

The FairyRing chain and FairyKit toolkit are not black-box privacy tools. They are open, modular systems designed to be used by real developers building real applications. HTTPS didn’t change what websites were;it enabled them to be trustworthy. Similarly, Fairblock enables credible economies to emerge onchain with confidentiality built in, not bolted on.

To understand what this shift could mean, it’s helpful to zoom out. In 1900, New York’s Fifth Avenue was filled with horses and carriages. Horses had worked fine for centuries, and most people didn’t feel limited by them. But by 1913, that same street was full of cars, with only a single horse remaining. The change was subtle at first, then happened “slowly, then all at once.” Cars didn’t just offer more speed; they were cleaner, safer, more efficient, and easier to scale. Confidentiality wasn’t the reason people adopted cars, but it was an inherent advantage once they got there.

In the same way, Fairblock is ushering in the shift from horse-drawn infrastructure. Slow, exposed, inefficient blockchains, towards modern, programmable systems built for fairness, compliance, and performance. Confidential computing isn’t the end goal, it’s the engine under the hood that makes all of this possible.

The recent $2.5 million in funding secured will enable Fairblock to expand its research capacity, develop new prototypes, and roll out user-friendly tools that ensure safer transactions across various blockchain platforms. More so, Fairblock has been supported by credible organizations that boost its credibility, with backers including Anagram, Axelar, Robot Ventures, Arbitrium Foundation, and Reverie, among others.

As regulatory clarity emerges, the blockchain industry stands at the cusp of a new era. Confidentiality will no longer be a barrier to adoption but a cornerstone of innovation, ensuring that onchain confidentiality is preserved while meeting regulatory demands. Fairblock’s commitment to this vision ensures that the future of blockchain is not only secure and decentralized but also inclusive and compliant, unlocking new possibilities for DeFi, AI, gaming, healthcare, and beyond.

Fairblock is building the next default: fast, secure, compliant infrastructure that scales trustless coordination beyond what transparent ledgers ever could. The world didn’t replace horses overnight. But once it saw what was possible, there was no going back. With Fairblock, crypto is about to have its automobile moment.

References

Fairblock Official Documentation: https://docs.fairblock.network/docs/welcome/Vision

0xFairblock: https://website-0xfairblock.vercel.app/applications

Fairblock Network: https://www.fairblock.network

Crypto's New Whitespace: WTF is MPC, FHE, and TEE? By @millianstx. https://x.com/milianstx/status/1873767492767654359

Nillion: https://nillion.com/

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author's own, not the views of their employer.This post has been created in collaboration with the Fairblock team. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research