Global Rails For The Future Of Money Movement

What does purpose-built stablecoin infrastructure look like?

The way we move money has always evolved, from barter to gold to paper to digital dollars. As stablecoins are set to eat global payments and work their way up the rest of the financial services stack, purpose-built stablecoin infrastructure becomes critical. In this report, we explore how Plasma is building towards global rails for the future of money movement.

The Digital Dollar Arc

Money rarely sits still, and neither do the ways we move it.

Few things are as elementary and timeless as the transfer of value from one individual to another. When ancient herders needed grain or tools, they traded cattle and goats. If medieval farmers needed a pair of shoes, they’d head down to the local village market with bushels of wheat. Over time, it became clear that carrying bulky items and livestock wherever one traveled was inconvenient, so everyone turned to precious metals like gold and silver bars. It didn’t take long to realize those too were not practical nor convenient, and so bars were melted into coins, and coins eventually gave way to paper cash, IOUs, and banknotes. As technology became a bigger part of people’s day-to-day lives, the ways in which money moved only accelerated.

Today, someone in the US can send digital dollars to a friend in Peru or Thailand in a matter of seconds, while paying a penny to do so. This isn’t something they could do through their local bank or Western Union; this kind of borderless, low-cost, near-instant money movement is made possible with stablecoins.

Stablecoins are digital dollars issued and transferred on blockchain rails. They provide a stable unit of exchange in digital form: the same way anyone with an email address or WhatsApp can instantly communicate across the globe, stablecoins enable anyone with internet access to move money globally.

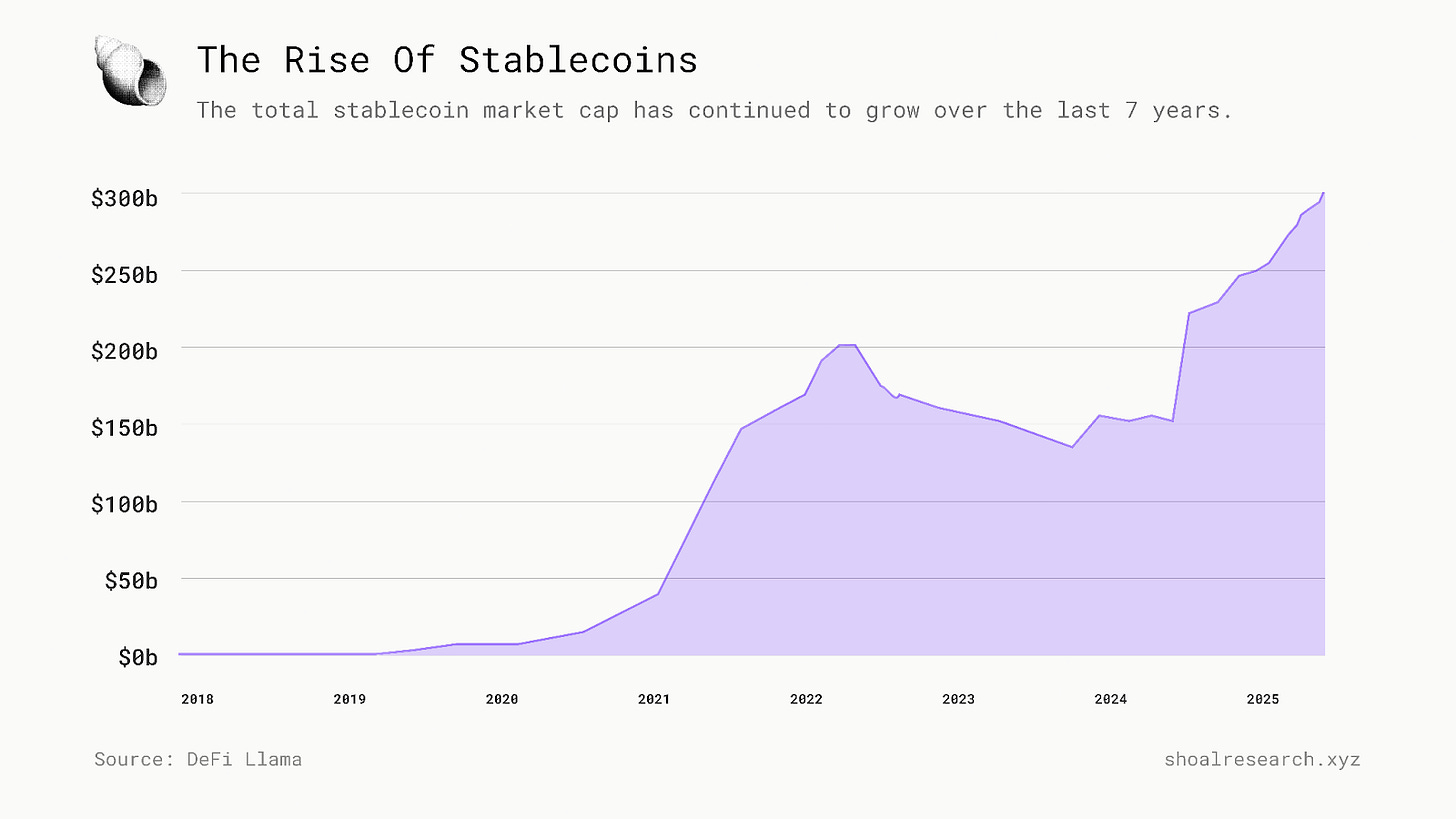

Tens of trillions of dollars have already been moved through stablecoins. They continue to grow and reach new all-time highs in supply. Though not new by any means, stablecoin adoption has recently accelerated at a pace few anticipated.

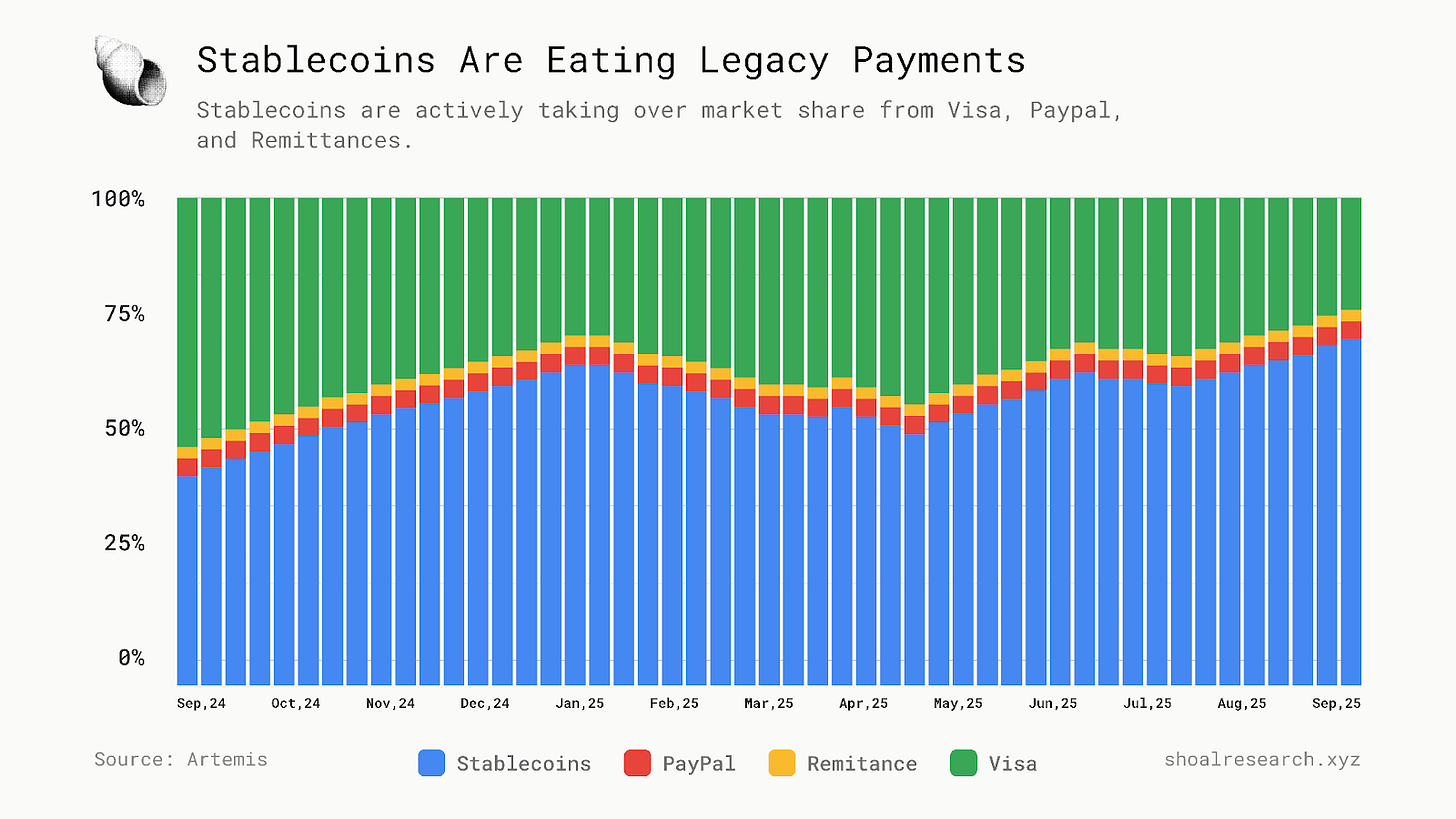

Impressively, stablecoins aren’t just growing. They’re already eroding legacy payment networks.

At Shoal, we believe it is inevitable that stablecoins work their way up the rest of the financial services stack beyond just payments, eventually disrupting consumer banking, lending, B2B settlement, payroll systems, and beyond. But this all begs the question: what’s so special about these digital dollars?

The Stablecoin Value Prop

“It is possible to create tools to allow end users to create currency protocol layers which have a stable value, pegged to an external currency or commodity. In this way, users of these currencies can own stabilized virtual currency tied to U.S. Dollars, Euros, ounces of gold, barrels of oil..” - Mastercoin whitepaper (2012)

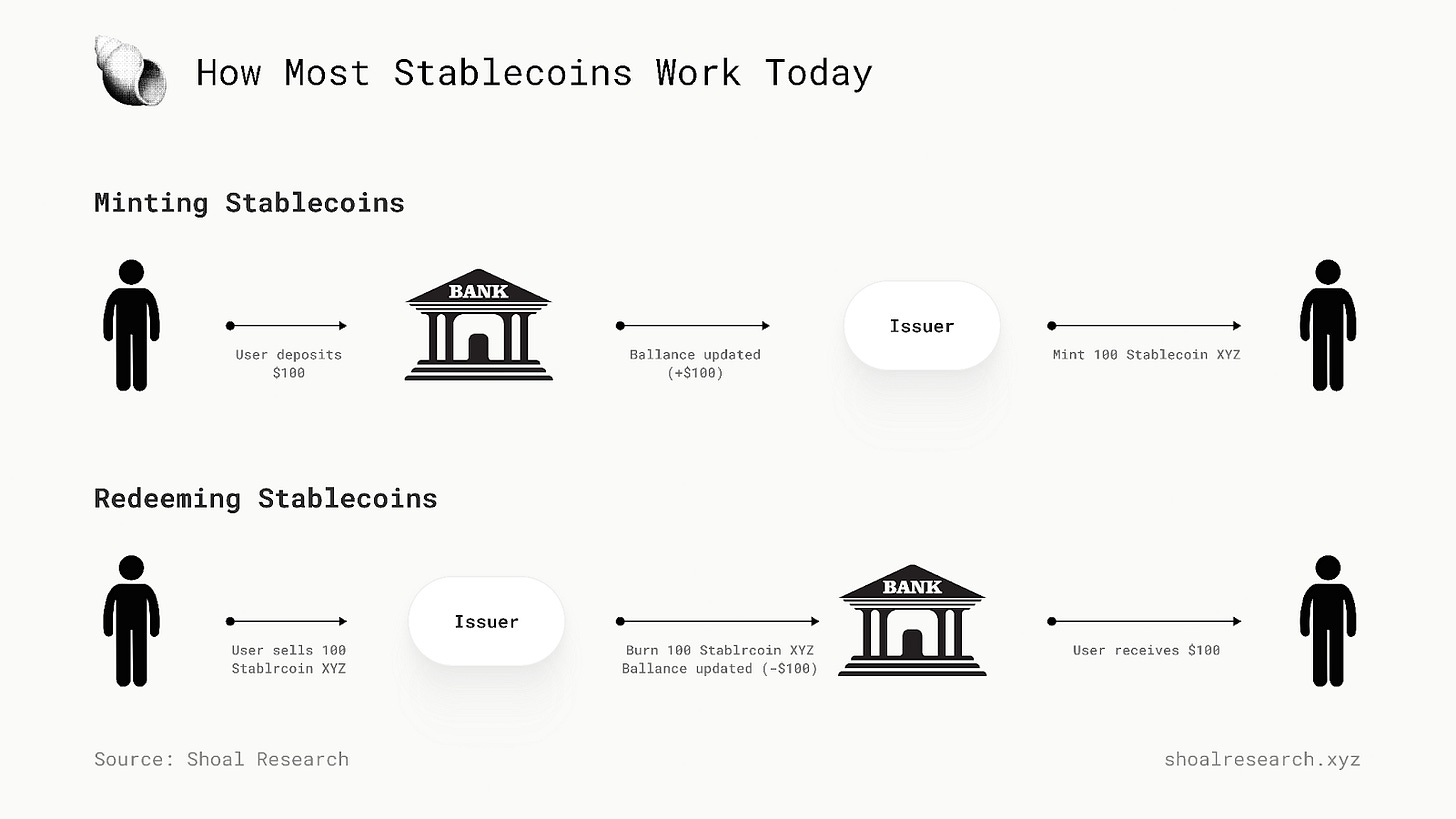

Fundamentally, stablecoins are digital assets programmed to maintain the value of an underlying asset it is pegged to. Most commonly, stablecoins are pegged to fiat currencies, particularly the US Dollar (this is why we can call them digital dollars). To maintain this peg and stable value, stablecoin issuers implement specific mechanisms to ensure each stablecoin is backed 1:1 by its underlying asset. The most common way to do this is by holding reserves in cash and short-term US Treasury bills, matching the circulating stablecoin supply. For every new stablecoin minted, users deposit dollars to the issuer. These funds are safeguarded in regulated financial institutions and custodians. When stablecoins are redeemed, an equivalent amount is withdrawn from these reserves and returned to the redeemer, and the corresponding stablecoin supply removed from circulation, or “burned”.

*Quick aside: There are other stablecoin peg stability mechanisms, some of which are represented by OG leading stablecoin protocols like Maker DAO (now Sky) who built a CDP protocol to let anyone borrow DAI. Conversely, there are also examples like Luna/UST which have failed tremendously and wiped out tens of billions of dollars. Overall, the design of stablecoins can be a fascinating rabbit hole to fall down, but it’s worth staying grounded to the reality that over 80% of stablecoin supply is in USDT and USDC, both of which are USD-backed stablecoins maintained and operated by central issuing entities.

The stablecoin value proposition is not one-dimensional by any means:

Global, 24/7 Settlement: Stablecoins can be transferred globally at any time of day, any day of the week. They operate on blockchain rails, designed to settle in minutes if not seconds. For reference, legacy transfer systems like ACH or international wires often take several days to clear, can only be processed during limited business hours, and can further be delayed by weekends or holidays.

Superior UX: Stablecoins provide a superior experience to legacy payment systems, on the simple basis of speed and cost. On certain chains, stablecoin transfers can be settled in a matter of seconds. Legacy systems like ACH or wire transfers can take anywhere from hours to multiple business days.

Stablecoins are also multiples cheaper than legacy payment networks. A stablecoin transaction is simply a redistribution of balances on a digital ledger. The primary resource consumed is the computing power required to update this balance, which is paid as the transaction or gas fee. Nowadays, gas costs are racing to zero as low-cost transactions are becoming table stakes for most chains.

By contrast, a wire or ACH transfer involves hand-offs between multiple intermediaries - sending banks, receiving banks, clearing houses - all of whom impose a meaningful rake on the money being moved. Legacy cross-border transfers still charge 6.49% on average.

It is important to note that while stablecoins offer near-instant, low-cost blockchain transfers, converting funds off-chain into bank accounts or cash, or “offramping”, can still involve legacy fees, FX spreads, and delays. But overall, even with this final step, stablecoin-based transfers remain dramatically faster and less expensive than legacy networks today .

Permissionless Global Access: Stablecoins essentially democratize access to stable currencies, like the US dollar. Anyone with an internet connection can send, receive, and hold stablecoins, regardless if they have a bank account or access to financial services. Despite rising global financial inclusion, over 1 billion adults still remain unbanked today, unable to access formal financial services and often excluded from the digital economy. At the same time, many countries still face hyperinflation and currency devaluation. By enabling permissionless global access to the US Dollar, stablecoins provide a financial lifeline to residents in these developing regions.

Programmable: Because stablecoins are built on blockchain rails, they exist as smart-contract based tokens. Put even simpler: they are code. This unique design means specific conditions and regulations (i.e. settlement rules, transfer restrictions etc) can be programmed directly into the asset itself. This programmability helps streamline operations as it is much easier and more predictable to write code than to anticipate human error. And because the crypto-native economy is a consortium of open permissionless protocols, stablecoins can naturally plug into, and enhance, nearly any application built on public chains: earning yield through lending or liquidity provisioning, collateral for borrowing other assets, margin for perpetuals trading, betting on bizarre prediction markets, and so on.

Homegrown, Organic PMF

Stablecoins, unlike most other blockchain-native innovations, have stood the test of time because there has always been an organic demand for them. Their history is largely defined by organic adoption arising from clear catalysts at each chapter.

A Trader’s Best Friend

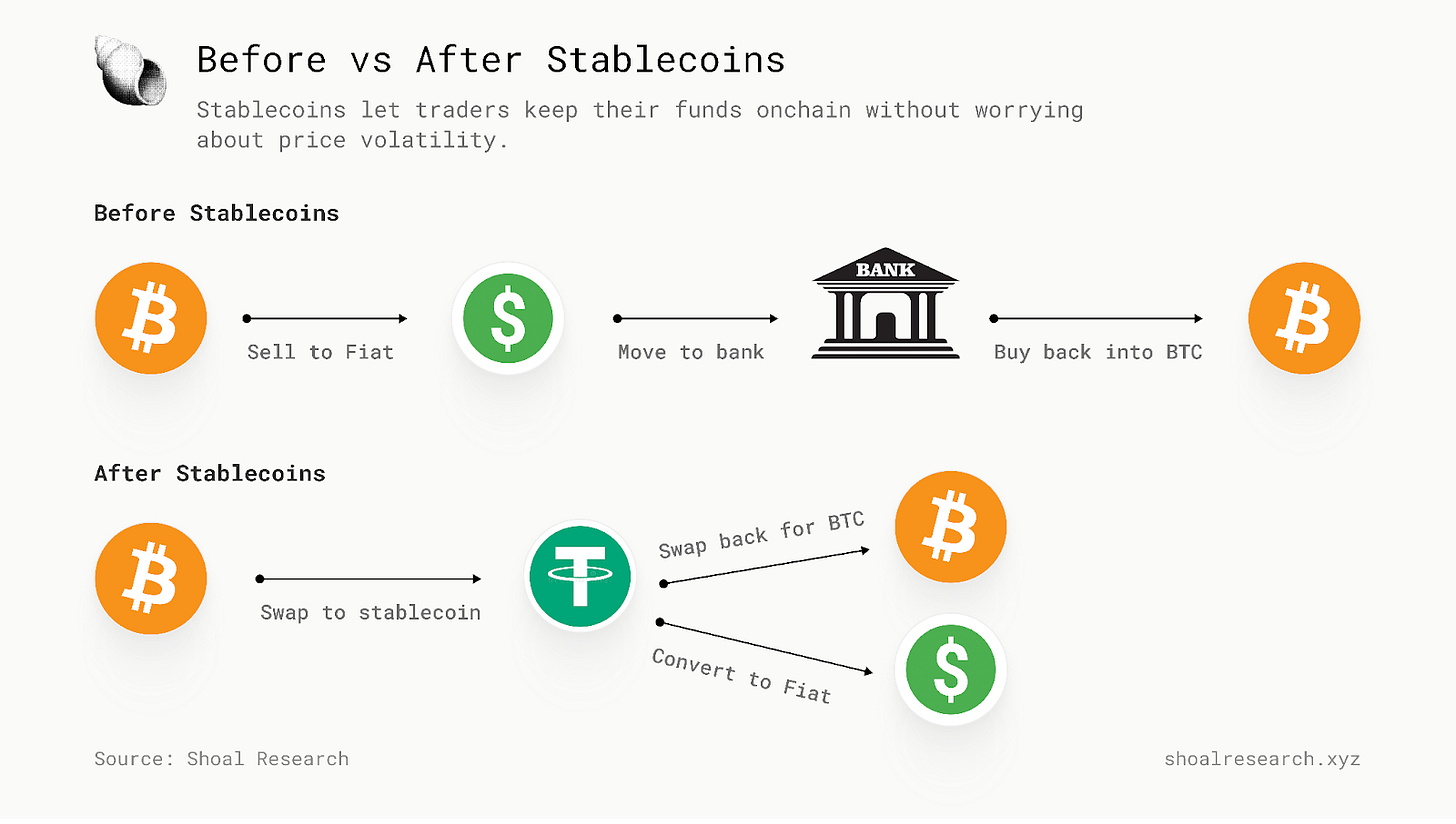

Stablecoins first gained traction among traders looking for a simple way to move value in and out of volatile positions without offramping into fiat. In the early 2010s, there were few things to do with Bitcoin besides trading it, yet traders lacked an easy way to park funds in between trades.

Early references to stablecoin concepts first appeared in the Mastercoin whitepaper, and in 2014 it came into production with the launch of Realcoin (now known as Tether).

USDT was first issued on Bitcoin via the Omni Layer, and became available through exchanges like Bitfinex. When it launched, USDT brought a new utility for crypto traders: move capital between assets, stabilize exposure to volatility, and execute more complex trading strategies without needing to move into fiat then back into crypto. That said, given such a niche audience, adoption was rather limited.

Global Access To Stable Currencies

As stablecoins matured, their impact spread well beyond speculative markets. In countries beset by hyperinflation, where local currencies can be devalued significantly overnight, the value of a stable currency like the US Dollar is hard to underestimate. And today, the best way to get access to the US Dollar is through stablecoins.

Some notable data points:

Stablecoin purchases accounted for >4% of Turkey’s GDP in 2024.

In 2024, Argentina led LATAM stablecoin volume share as >61% of crypto transaction volume regionally was attributed to stablecoins.

$2.36 trillion was transacted through stablecoins in APAC alone from June 2024 - June 2025.

Sub-Saharan Africa (SSA) grew $205B in onchain value in 2025, reflecting 52% YoY growth in crypto adoption from 2024.

As such, stablecoins have become essential tools for personal savings, payments, and remittances for millions of people across much of Latin America, Africa, Asia.

A Reserve Currency’s Best Friend

As stablecoins have spread across emerging markets, their role in reinforcing US Dollar dominance globally becomes evident. But while the value of access to digital dollars becomes rather self-explanatory in emerging economies, it has been more difficult to translate over in the west, particularly in the US. Most Americans have savings accounts. They can send money instantly through apps like Venmo. Few lose sleep at night because they are worried about the dollar devaluing (20-30%) overnight.

The most compelling reason for US policymakers to endorse stablecoins is geopolitical: to strengthen the global dominance of the US Dollar. The US has long wielded the dollar’s reserve currency status to maintain global financial power, most commonly through the petrodollar system.

Today, this opportunity lies in stablecoins. The idea is simple: dollar stablecoins, nearly all of which are backed by cash and short-term US Treasuries, require real dollar reserves for every token issued. Each stablecoin minted is a new dollar someone overseas chooses to hold, and therefore a new source of demand for US government debt.

One could make the case that the US doesn’t have much of a choice but to embrace stablecoins at this point. In Q4 2024, Tether was ranked as the seventh-largest foreign buyer of US Treasuries, outranking countries such as Canada and Mexico in annual flows. Tether’s latest stablecoin report confirms Tether holds over $127b in U.S. Treasuries, making it one of the largest non-sovereign holders of U.S. government debt.

This dynamic is already reshaping policy. The US passed the landmark GENIUS Act recently, laying the groundwork for a regulatory framework for stablecoin issuance in the US for the first time. Not surprisingly, the GENIUS Act requires dollar stablecoins to be fully backed by [US assets],besides providing monthly reserve disclosures and conducting independent third-party audits. This helps reinforcing a stablecoin-to-debt-financing flywheel of sorts: every new token minted effectively creates another buyer for U.S. debt, therefore stablecoin adoption becomes a powerful strategic tool for maintaining dollar dominance. Treasury Secretary Scott Bessent has publicly said “We are going to keep the U.S. the dominant reserve currency in the world, and we will use stablecoins to do that.”

In short, US dollar stablecoins are evolving from mere crypto products into key instruments for the US’s geopolitical strategy, meaning the US government is highly motivated to see the adoption of US backed stablecoins continue to grow from here on out.

The Stablecoin Landscape Today

These organic catalysts have helped shape and accelerate the adoption of stablecoins to this day. But to better understand where stablecoins go from here, it’s helpful to zoom out and examine the landscape as it exists today.

In the last 30 days alone:

$3.2T in volume processed in stablecoins

1.2B transactions in stablecoins onchain

41.4 million addresses have interacted with stablecoins

*Data is from Artemis and referenced at the time of writing.

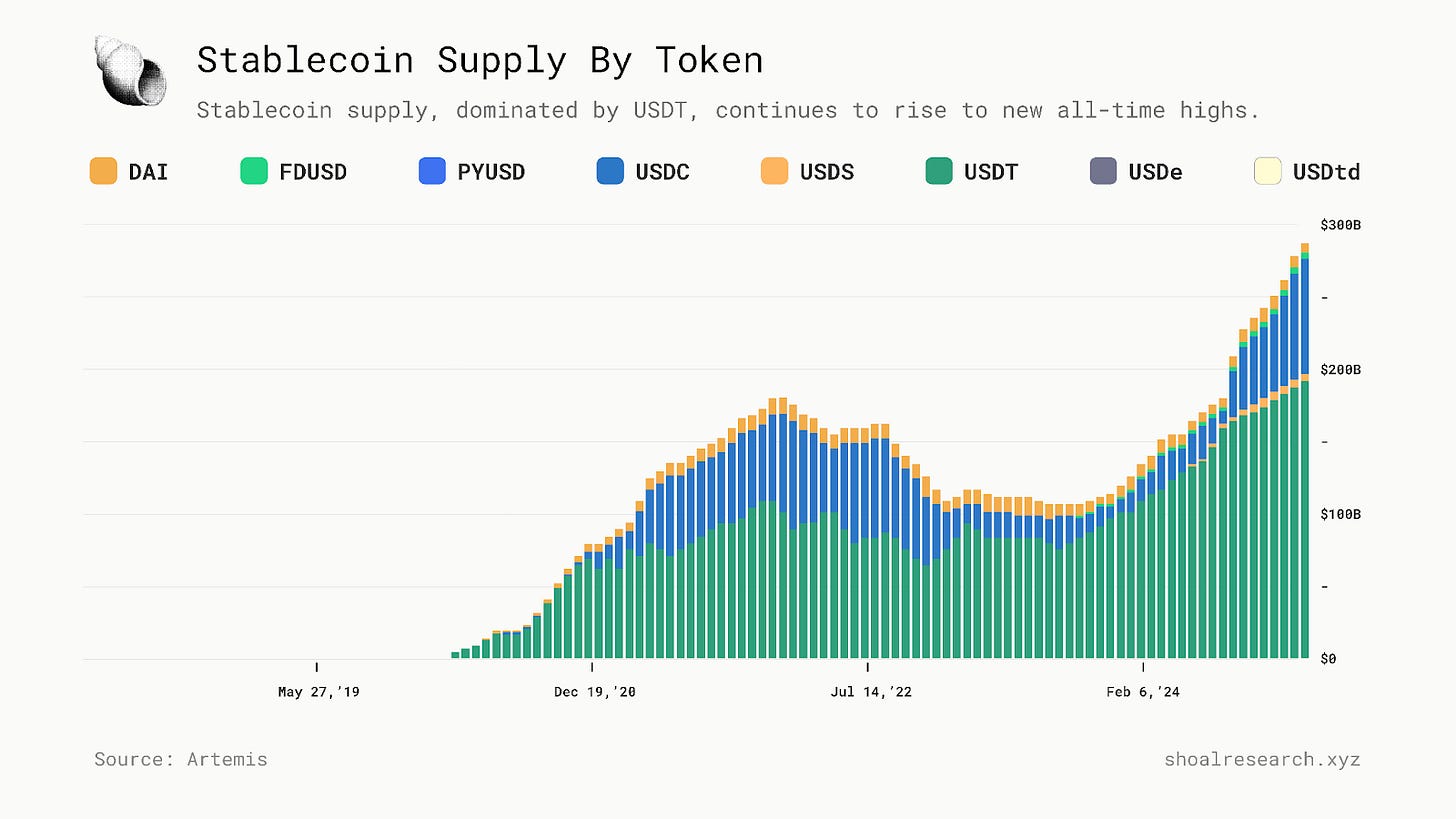

The total stablecoin supply continues to reach new all-time highs, sitting at just over $291B today. USDT accounts for ~58% of this supply, and has continued to dominate supply throughout the years.

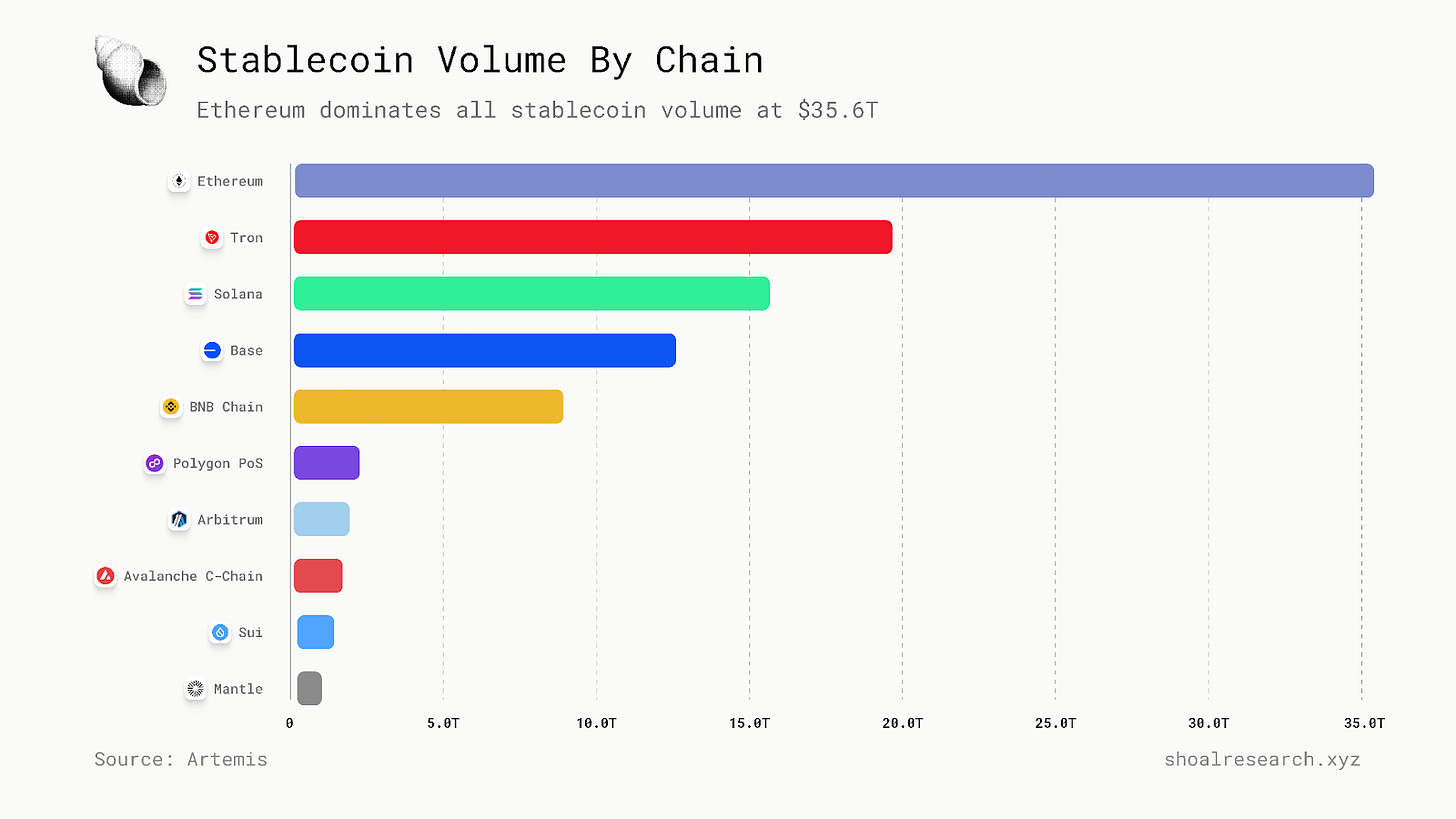

Another important aspect of the stablecoin landscape today is the distribution of stablecoins across different chains. Just as stablecoin supply is dominated by USDT, stablecoin distribution across chains is dominated by Ethereum, accounting for ~55% of total supply today, as is overall stablecoin volume.

That said, it’s important to recognize there is more than meets the eye here.

Ethereum’s dominance, while it cannot be understated, is in large part historical. The first stablecoins like USDT, USDC, and DAI were on Ethereum because there were simply no other blockchain rails to issue and grow programmable digital dollars on. As liquidity deepened on Ethereum, it created a durable moat that persists today.

But the nuances start to emerge when considering specific use-cases: how stablecoins are actually being used on their respective chains.

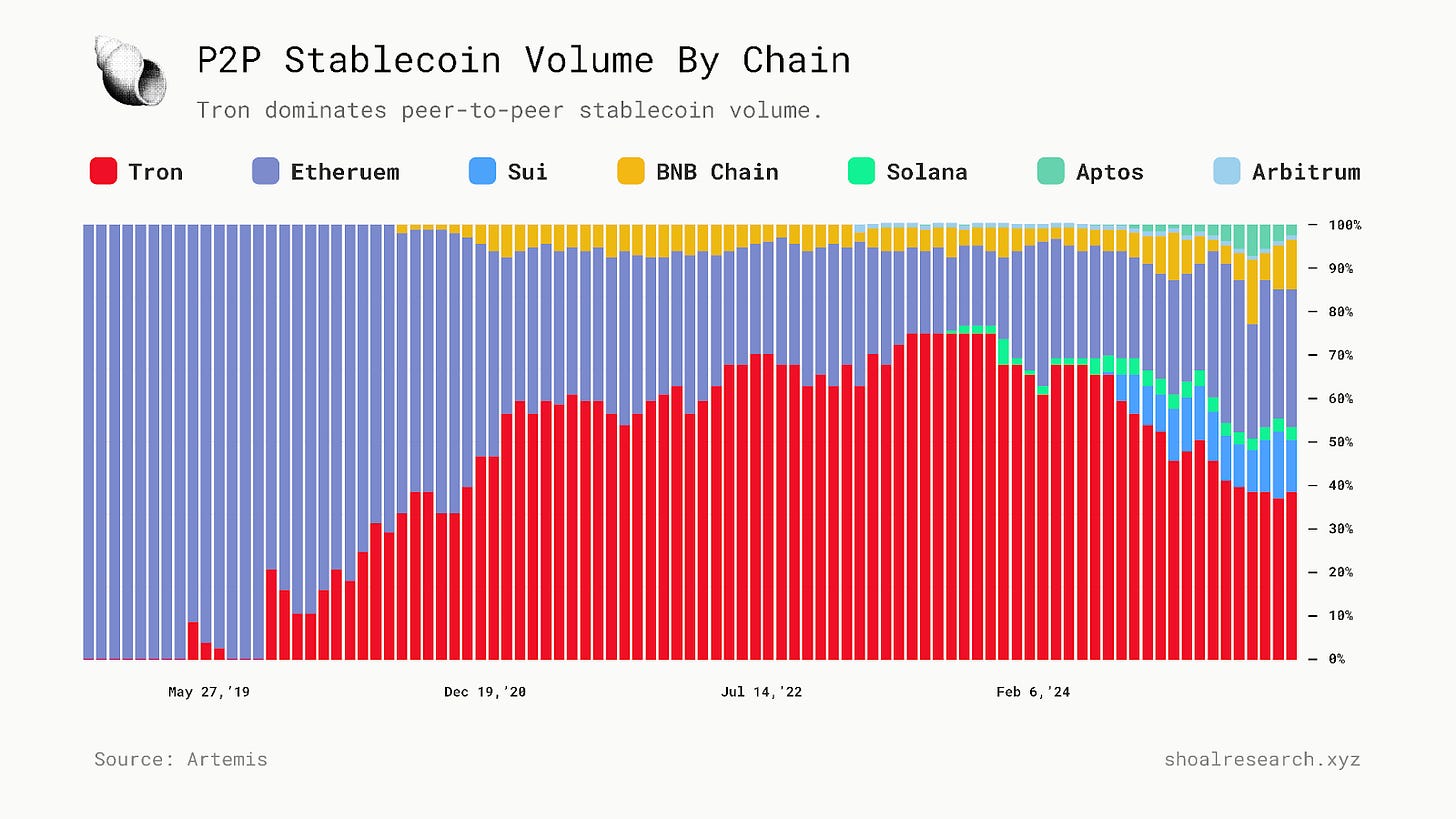

For instance, if we observe data for purely peer-to-peer transactional volume, which we can map to payments, it’s clear that Tron has steadily grown and become the people’s choice. This doesn’t come as a surprise to anyone who’s actually used the two chains; transactions on Tron are simply cheaper and faster. They are more accessible for everyday users. The numbers account reflect this point.

In short, the stablecoin landscape is broad and expanding, but still heavily concentrated in specific stablecoins on specific chains. At a glance it may seem the winners and losers are already set. Yet the challenges and pain points of today’s infrastructure suggests otherwise.

Current Challenges and Pain Points

Despite their scale and adoption, today’s stablecoin rails weren’t designed to serve a global-scale payments network beyond crypto-native rails. In particular, today’s stablecoin infrastructure falls short in three key areas: large-scale performance, practical user experience, and integrated infrastructure for fiat rails.

Performance At Scale

The standard for chain performance and network capacity has come a long way since Ethereum’s L1 gas wars. Fees for stablecoin transfers, which could cost tens of dollars during peak network congestion on the L1, have dramatically fallen, and stabilized. Even so, most public blockchains still lag legacy payment networks in scalability and uptime. Ethereum and its L2s have roughly average 244 daily TPS. Solana regularly handles upwards of 2-3K daily TPS, and previously peaked around 4.8K (though it is always important to point out the nuance between vote and non-vote transactions). Yet global payment networks are designed to support tens of thousands of TPS, and can’t afford downtime even under peak congestion.

There are lots of promising developments ahead to improve this. Between the rise of app-specific perp DEX chains, Firedancer and Alpenglow coming to Solana, the performance that Monad and MegaEth are expected to deliver, the rise of SVM L2s. Yet none of these are stablecoin-specific. Stablecoin transfers on these chains still compete for more blockspace across swaps, perps, and everything else users can do on those chains as network activity and adoption scales.

User Experience

Even though transactions settle much quicker onchain than through banks, the user experience is still clunky. The Boston Consulting Group’s 2025 stablecoin report identifies “gas-token management for transaction fees” and fragmented liquidity as critical technical obstacles that both retail and enterprise users face when using stablecoins for payments.

The most obvious, low hanging fruit is gas-token friction: someone receiving USDC on Ethereum or SOL on Solana inherently needs ETH or SOL just to move or spend their funds. Onboarding for net new users is still impractical.

Liquidity is another challenge. Stablecoin supply is currently fragmented across hundreds of chains, which makes it harder to move large amounts or guarantee immediate conversion back to fiat outside of Ethereum. This fragmentation also dilutes network effects, forcing users and institutions to navigate bridges, gas tokens, and liquidity sources rather than relying on a single liquid, unified market.

Privacy, too, is lacking on today’s stablecoin infrastructure. Public blockchains expose transaction details by default. While privacy-preserving apps exist, users have to go out of their way to find and use them. There is no integrated “toggle” to enable private transactions. This means everyday payments with stablecoins are far more transparent than they would be with cash or even traditional banking. To the individual consumer, this may just feel invasive. To enterprises and financial institutions, it’s a non-starter.

The onchain user experience has improved significantly, but still leaves room for improvement.

Lack Of Integrated Infrastructure

One of the underappreciated challenges with today’s stablecoin rails is the lack of integrated infrastructure, particularly to fiat rails. Sending a friend USDT is not the same as them being able to spend it at a grocery store. In practice, users still face FX spreads, hidden rakes, and compliance bottlenecks when they try to move between blockchain rails and local payment systems.

Off-ramping involves using centralized exchanges or other intermediaries that require users to create accounts with them, often KYC’d, and pay service fees. This only gets hairier with cross-border transactions, which often introduce more intermediaries and FX Spreads that further eat into the transferred amount.

Until stablecoins integrate seamlessly into fiat rails, they’re great for moving value across crypto, but remain largely impractical for mainstream global payments.

So Where Do Go From Here?

Stablecoins have crossed the chasm. They are no longer a niche by-product of crypto markets. They’re clearing trillions in volume annually, sometimes even monthly, and already powering crypto trading, DeFi, and peer-to-peer markets across emerging economies.

But that level of adoption, as meaningful as it is, remains a different bar than what is required to serve as the backbone for global financial rails. Settlement systems like VisaNet, SWIFT, and ACH operate under far stricter demands: near-instant finality, reliability, and uniform compliance frameworks across varying jurisdictions. Stablecoins already move big numbers, but the chains they run on were never designed to consistently meet these standards at global scale.

One solution is to wait for general-purpose chains to evolve and harden into payments-grade infrastructure. Another is to embrace purpose-built stablecoin infrastructure.

Purpose-Built Stablecoin Infrastructure

Nearly every major industry where reliability, risk management, and performance are table stakes is built around specialized, purpose-built infrastructure.

Global payment networks like Visa and SWIFT are built with specific capabilities to securely move money globally, running in isolated environments optimized for data integrity, regulatory compliance, and uptime. In cloud computing, financial institutions and research centers don’t use AWS or Google Cloud, they still depend on purpose-built setups built to handle petabytes of physics data. In finance, high-frequency trading firms colocate servers next to exchange matching engines because general-purpose infrastructure cannot deliver the latency or reliability needed in markets where every millisecond counts. LLMs trained on sector-specific data in healthcare, insurance, or finance consistently deliver higher accuracy, lower error rates, and stronger regulatory alignment than their general-purpose counterparts.

It’s no different in the world of cryptography. The standards that were critical to the expansion of the internet - RSA for secure communication, SSL for browser authentication, and ECDSA for digital transactions - were purpose-built with singular missions: to secure and authenticate data between counterparties online.

Stablecoins are now at that inflection point.

Applying The App-Chain Thesis

Blockchains follow the same logic. As apps gain traction and activity scales, the limits of general-purpose chains emerge. Unpredictable gas fees, throughput ceilings. Compliance gaps. The list goes on. In response, applications are increasingly motivated to launch their own chains.

We’ve already seen this play out: decentralized exchanges like Osmosis, dYdX and most recently Unichain; gaming and NFT platforms like Immutable; data networks like Pyth; have all adopted some version of the app-chain model. The thesis originates from Cosmos, which argued that applications should own sovereign blockspace, optimized for their needs, while still interoperating with a broader ecosystem.

When a chain is purpose-built, it can deliver deterministic performance and predictable pricing, unconstrained by unrelated blockspace demand. It can embed compliance routines, disclosures, and risk management tailored to regulated products. It can align economic incentives, governance, and value capture directly with the needs of its user base and community.

App-specific infrastructure allows chains to move beyond one-size-fits-all environments for more customization, stronger performance, and better UX. Given the trajectory of stablecoin adoption, we believe it is only a matter of time before stablecoins require the same purpose-built infrastructure. One of the first teams building directly towards this vision is Plasma.

Plasma: A Blockchain Purpose-Built for Stablecoins

Plasma is a new L1 purpose-built for the movement of stablecoins. It combines a custom consensus protocol, an EVM-compatible execution layer, and specialized smart contracts to support high-performance at scale, while posting state roots to Bitcoin through a native Bitcoin bridge for security guarantees.

Plasma’s mission is simple: to transform the way money moves around the world with specialized stablecoin infrastructure. Just as TCP/IP enabled the internet to become a global information hub, Plasma aims to empower stablecoins to become the global payments hub.

Plasma aims to address the pain points of today’s infrastructure - performance, user experience, and integrations- through its core features:

Day-One Liquidity: Plasma launches with native USDT and $2B in day-one stablecoin liquidity.

Zero-Fee USDT Transfers: Direct USDT transfers are free through Plasma’s frontend. Gas is subsidized through an in-protocol Paymasters contract, using authorization-based transfers controls for rate-limiting and preventing abuse.

Custom Gas: Users and apps on Plasma can pay gas fees using whitelisted tokens. At launch, Plasma will enable gas fees in native USDT and pBTC.

Specialized Architecture: Plasma is built on a modular architecture, combining a custom high-performance consensus protocol and an EVM-compatible execution environment.

Bitcoin Security: Plasma anchors its state roots to Bitcoin through a trust-minimized bridge for direct BTC-EVM programmability. This bridge also supports native BTC deposits, which are converted to pBTC on Plasma.

Integrated Infrastructure: At launch, Plasma will support over 100 DeFi apps, including leading protocols like Aave, Ethena, Fluid, and Euler among others, as well as various physical peer-to-peer cash networks. Beyond this, Plasma will support a wide ecosystem of developer tooling and infrastructure across account abstraction, onchain analytics and block explorers, interoperability protocols, oracles, indexers, and RPC providers.

To better understand how Plasma actually delivers these features, it’s worth diving deeper into their core architecture.

System Architecture

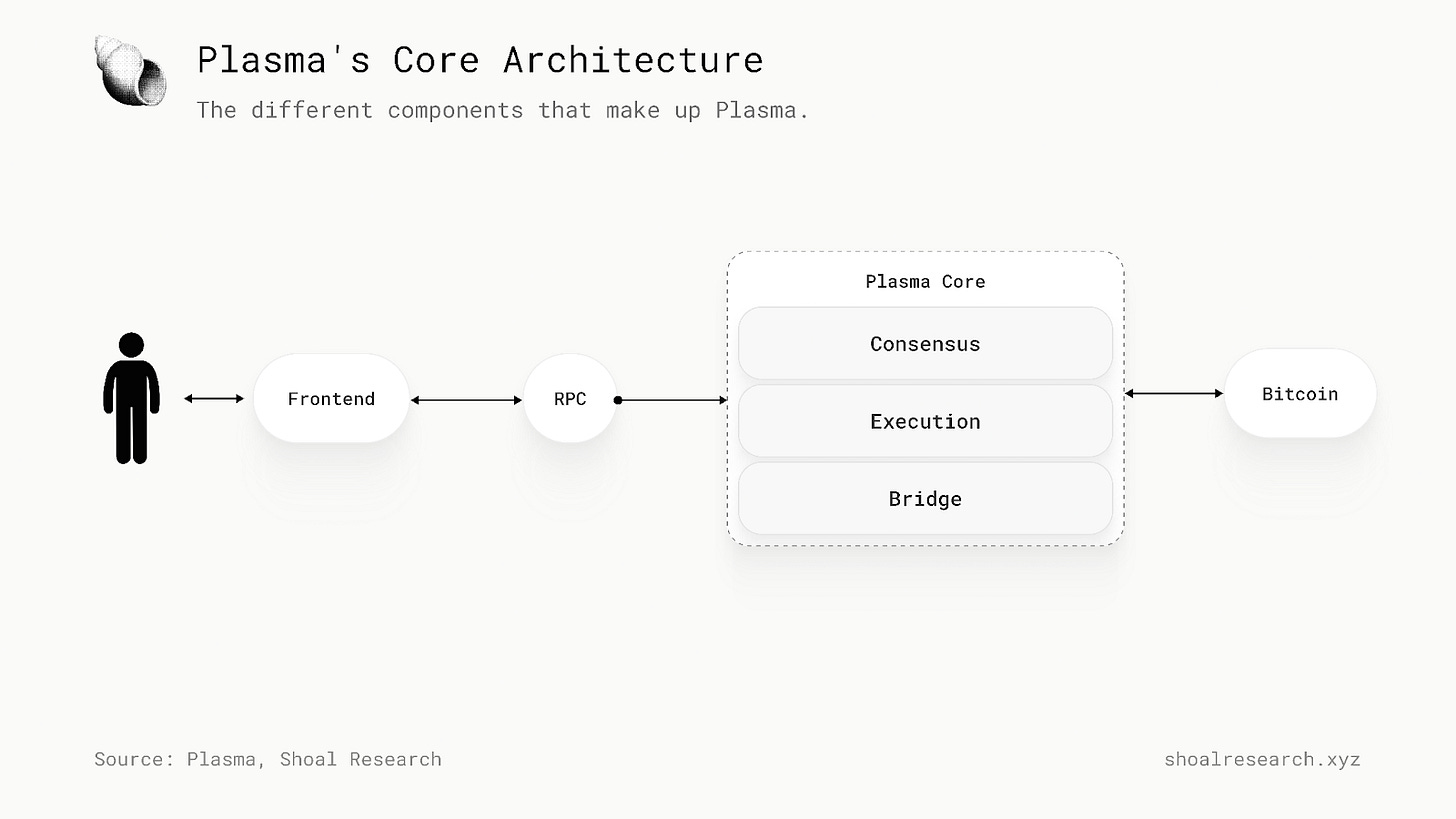

Fundamentally, Plasma is a Bitcoin sidechain that maintains its own consensus and posts state proofs to Bitcoin. It is built on a modular, multi-layered architecture combining a custom BFT consensus protocol (PlasmaBFT), a Reth-based EVM-compatible execution environment, a trust-minimized Bitcoin bridge, and protocol-native stablecoin smart contracts.

A transaction on Plasma begins at the user layer, through a supported frontend. It is broadcast to the Plasma chain via RPC. From there it passes through consensus, and once 2/3 PlasmaBFT validators have validated it, the user’s transaction is executed. Plasma then periodically posts state roots to Bitcoin through its native bridge.

Let’s examine these core components up closer.

PlasmaBFT

Consensus is at the very core of onchain systems. It is the coordination mechanism that separates blockchains from banks and fintechs: instead of a single authority, a decentralized distributed network of nodes must validate incoming transactions. This design mechanism, however, introduces latency especially as the network scales and adds more validators, and comes at the cost of performance for many chains today.

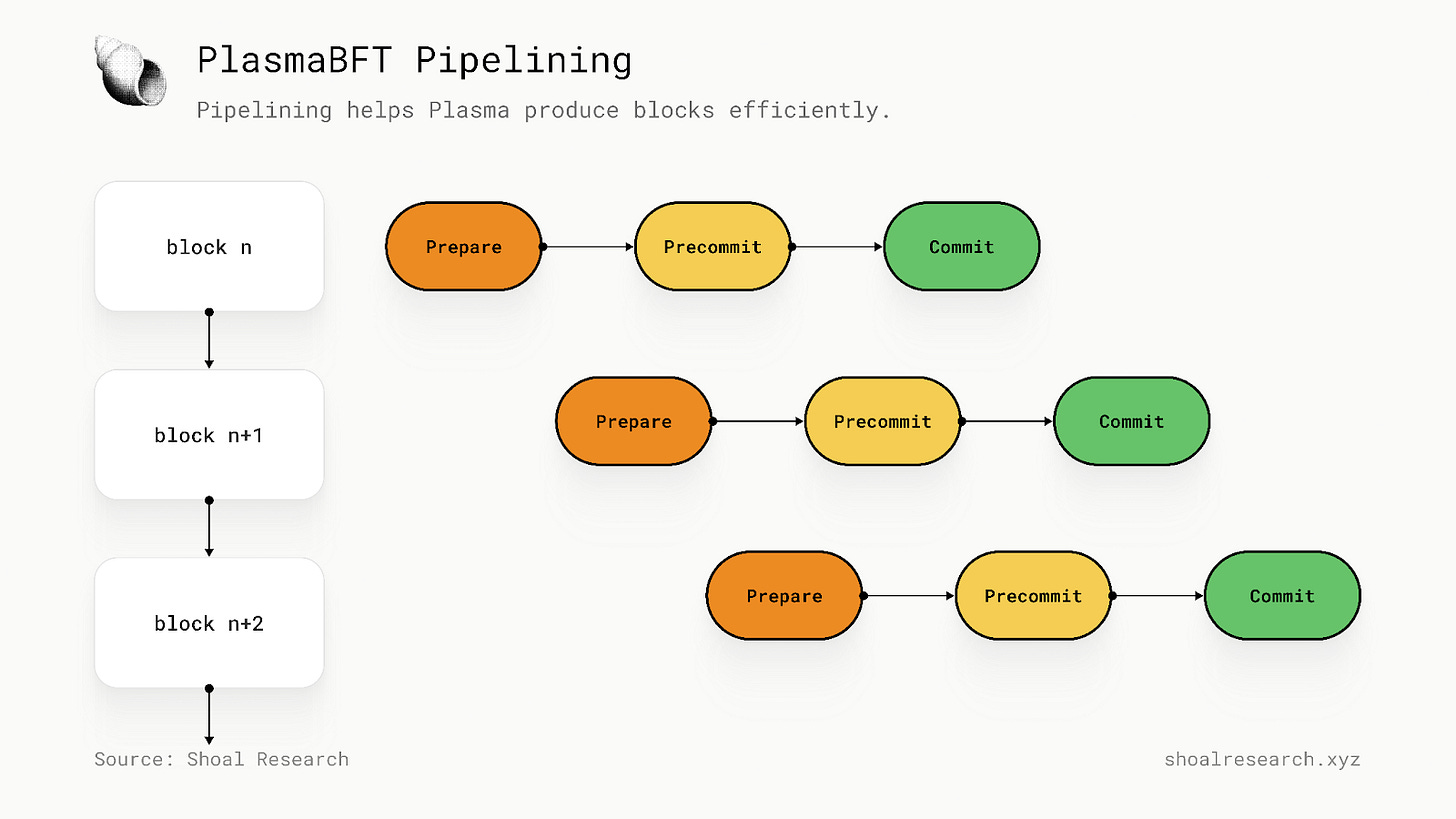

To overcome latency bottlenecks, Plasma introduces PlasmaBFT, a custom consensus protocol designed to support high throughput. PlasmaBFT is a pipelined implementation of the Fast HotStuff protocol, written in Rust. Finality is deterministic, and is achieved within seconds.

As its name suggests, PlasmaBFT follows classic Byzantine Fault Tolerance (BFT) assumptions. In practice, this means the network remains secure as long as no more than one-third of validators are malicious (this can be reflected as n ≥ 3f + 1, where n is total nodes and f is Byzantine nodes specifically).

To participate, validators must stake XPL and run supported hardware (2 CPU cores, 4 GB RAM, SSD-based persistent storage). They are then selected to propose and validate blocks on Plasma based on an XPL stake-weighted voting process.

The protocol finalizes blocks through a two-chain commit process. Validators vote on block proposals, and once two consecutive quorum certificates (QCs) are formed, the block is finalized. QCs are aggregated validator attestations; chaining them together enforces a single canonical history.

PlasmaBFT is optimized to support high-performance on the L1. This is made possible with Plasma’s use of pipelining: while one block is being finalized, the next can already be proposed. As such, blocks can be finalized after just two rounds.

This design is derived from Fast HotStuff, a modern BFT protocol designed for, unsurprisingly, being fast. HotStuff introduced a leader-based structure and QC chaining to reduce communication overhead. Fast HotStuff further optimized [chain commit paths for lower latency and higher throughput].

Like HotStuff, PlasmaBFT uses a leader-based round structure, designed to minimize communication overhead while still maintaining fault tolerance. Leaders propose blocks, validators vote, and once enough votes are collected, a QC is generated. If a leader fails or goes offline, the protocol shifts to a new leader using aggregated QCs.

Plasma plans to expand validator participation in several stages. Initially, the biggest priority will be ensuring baseline network stability, therefore Plasma will be secured by a whitelisted set of validators at launch. Over time, the validator set will grow to stress-test performance under larger committees until the final stage, in which participation opens up to the public.

Plasma’s Execution Environment

Virtual Machines (VMs) process transactions, run smart contracts, and keep state in sync across all participants on its underlying chain. A VM reads the current state of the chain, executes new inputs, and then updates state deterministically. It ensures the same code always produces the same result and state is synchronized across all nodes.

Plasma employs a general-purpose Ethereum Virtual Machine (EVM) execution environment. This means developers can deploy existing EVM smart contracts and use familiar tooling and infrastructure.

Plasma’s execution engine is Reth, a modular Rust-based Ethereum client that separates consensus from execution. This enables more efficient updates, clearer boundaries between block production and execution, and better predictability in performance and behavior.

When transactions are submitted on Plasma, Plasma’s execution environment processes them through the EVM, ensuring the relevant smart contracts run and state is updated consistently across all Plasma nodes.

Bitcoin-Level Security

Blockchains normally secure themselves only through their own validator sets. That security is limited by the size of the validator pool and the economic weight behind it. For stablecoins, where large values may be at stake, relying solely on a new or relatively small validator set can be a risk.

To mitigate this, Plasma periodically posts its state roots to Bitcoin. Anchoring to Bitcoin provides an additional settlement guarantee: once a Plasma state is recorded on Bitcoin, altering it would require rewriting Bitcoin’s history. This makes censorship or rollback far less feasible and gives Plasma a stronger security baseline than relying on its validator set alone.

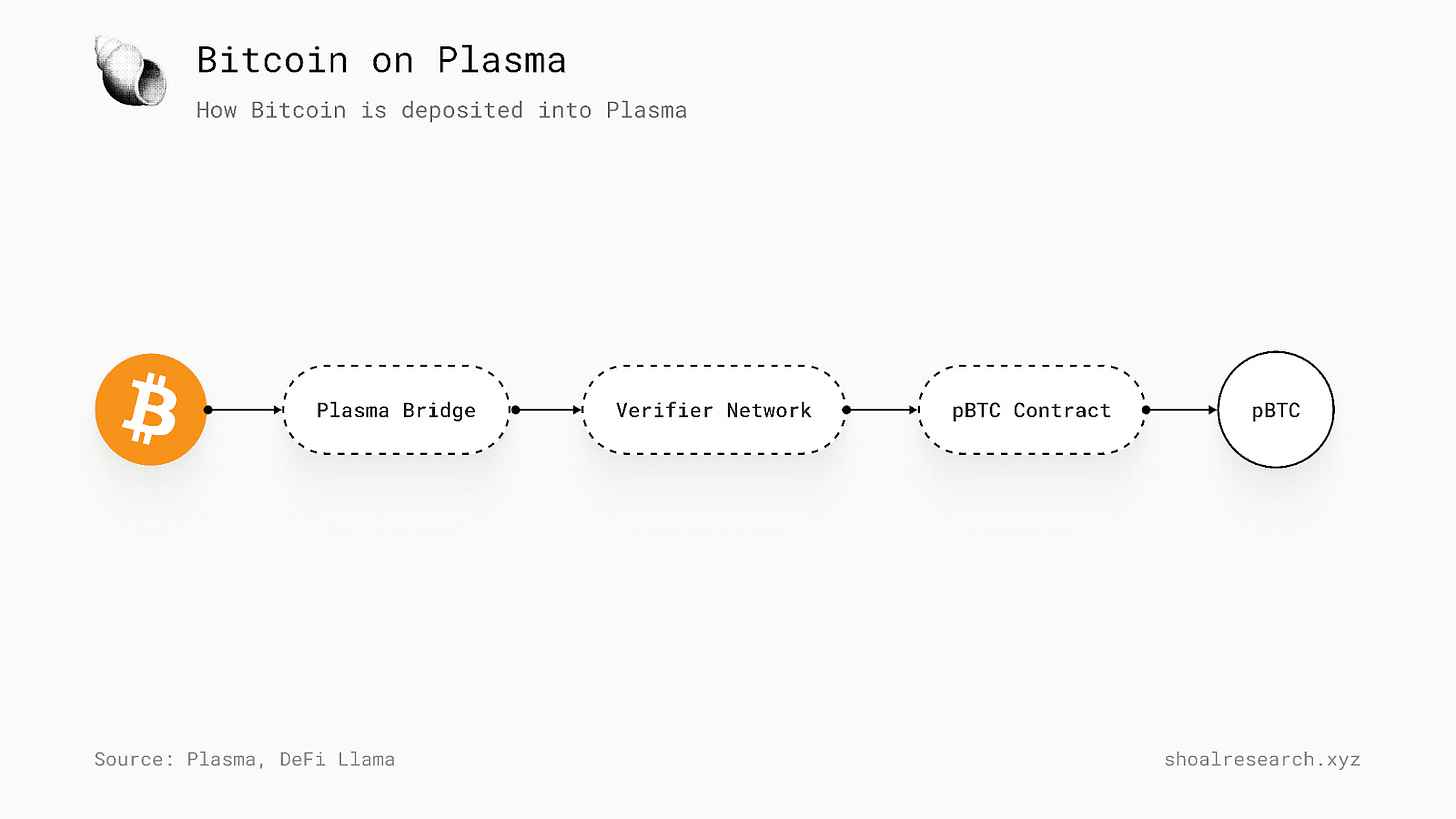

Plasma achieves this through a Bitcoin-native bridge. The bridge consists of a verifier network, each running full Bitcoin nodes to observe deposits and validate state anchoring. Periodically, state roots from Plasma are committed to Bitcoin via transactions (e.g. OP_RETURN), and the verifier network attests that these anchors match Plasma’s canonical chain.

Beyond settlement, the bridge also enables native BTC to flow into Plasma. Users deposit BTC to a designated address, verifiers confirm the transaction on Bitcoin, and Plasma mints pBTC: a fungible ERC-20 token backed 1:1 by BTC. Withdrawals follow the reverse process: users burn pBTC on Plasma, and once verifiers confirm, BTC is released on the base chain.

This bridge makes native BTC usable inside Plasma smart contracts. pBTC is issued as a standard ERC-20, built on LayerZero’s OFT standard to allow cross-chain portability without compromising verifiability against the Bitcoin base layer itself. Users always receive pBTC on Plasma at a 1:1 rate against BTC deposited.

To secure withdrawals, Plasma relies on Multi-Party Computation (MPC). Rather than one party holding a private key, multiple verifiers collectively generate signatures, with no single entity able to unilaterally release funds.

Stablecoin-Native Smart Contracts

On current stablecoin rails, stablecoins exist as generic ERC-20 tokens. They are applications built on top of a base chain. This design works to an extent but friction still emerges: transaction fees paid in separate gas tokens. Every app or wallet has to operate and maintain its own custom Paymaster. Private payments are not feasible.

On Plasma, this functionality is built directly into the protocol. A set of in-protocol contracts, written in Solidity and integrated into the execution layer, give stablecoins first-class treatment. These contracts are written in Solidity, integrated into Plasma’s execution layer, and are compatible with any EVM wallet or contract system, including AA standards like EIP-4337 and EIP-7702.

Plasma is launching with two core modules. The first is the Protocol-Managed Paymaster for Zero-Fee USDT Transfers. This contract sponsors gas costs for direct USDT transfers: transfer() and transferFrom(), so users can send stablecoins without needing XPL. The scope is narrow by design: it applies only to the official USDT and only to direct peer-to-peer transfers, not arbitrary contract calls. To prevent abuse, eligibility is gated through lightweight identity checks such as zkEmail, zkPhone, or captcha systems, and usage is subject to rate limits. The economics are covered by a pre-funded XPL pool managed by the foundation, which pays gas on behalf of users. Developers don’t need custom integrations beyond routing transfers through standard smart account flows, and the system supports both EOAs and smart contract wallets. Over time, Plasma is exploring features like reserved blockspace for eligible USDT transfers, ensuring inclusion even under network congestion

The second module is the ERC-20 Paymaster for Custom Gas Tokens. This contract allows users to pay for any transaction, not just transfers, using whitelisted tokens (this will be USDT and pBTC initially). The process is simple: the user approves the paymaster to spend the chosen token, the paymaster consults oracles to calculate how much of that token equals the required gas, and then pays the validator in XPL under the hood while deducting the equivalent amount from the user. This removes the need for swaps or native token balances, smoothing the onboarding process for new users. Developers benefit because the paymaster is handled at protocol level, so they don’t have to build or maintain their own fee abstraction systems. Wallets only need to surface approvals and error handling, while users see a unified and intuitive UX.

By running these modules at the protocol level instead of leaving them to individual apps, Plasma ensures consistent behavior across apps, enables subsidized gas without external funding tokens, and ties these features directly into block production and execution.

XPL And Plasma’s Economics

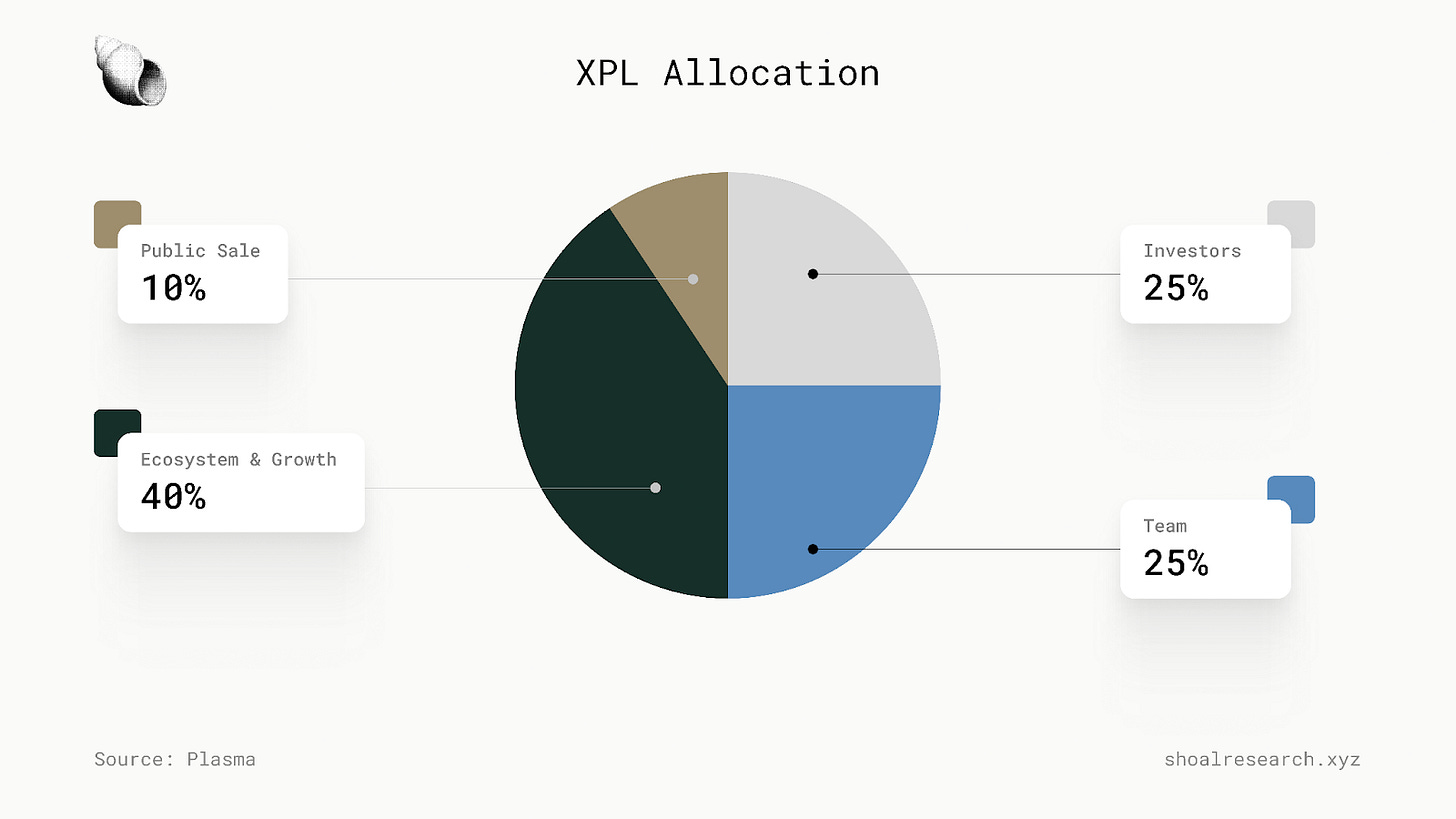

At the core of Plasma’s business model is its native token, XPL, which secures the network and subsidizes PlasmaBFT validators.

Every transaction on Plasma requires a base fee, with dynamic demand-based fees. These fees, along with newly issued tokens, form the reward pool that sustains validator incentives.

Plasma takes a unique approach to slashing. Rather than punishing malicious validators, it incentivizes honest behavior through a novel reward slashing mechanism. In this model, validators who misbehave or fail to participate lose their block rewards but keep their principal stake. The penalty is lighter, but it makes participation less risky for institutional operators, where sudden capital loss is often commercially unacceptable. Importantly, Byzantine safety is still preserved under the standard assumption that fewer than one-third of validators act maliciously.

Validators are compensated in XPL for proposing blocks, voting in consensus, and validating transactions. Their rewards come from a mix of transaction fees and token emissions, making validator incentives directly tied to both network activity and the broader economics of XPL.

The Plasma Ecosystem

Surrounding Plasma’s technical work is a growing, integrated ecosystem. Plasma is launching with $2B in stablecoin liquidity and over 100 DeFi integrations, including names like Aave, Ethena, Fluid, and Euler.

Plasma recently announced Plasma One, its main consumer-facing app. It functions as a stablecoin-native wallet and card interface, giving users “one” place to hold, send, and spend USDT. Transfers are gasless, balances can be used directly for payments, and onboarding is quick enough to issue a virtual card in minutes.

On the integration side, Plasma has partnered with Binance Earn, allowing users to access yield products directly from the network. Work is also underway on fiat on/off-ramps and peer-to-peer cash networks in emerging markets, aiming to make the jump between stablecoins and local currency less dependent on centralized exchanges.

Plasma will also launch with a wide ecosystem of developer tooling and infrastructure across account abstraction, onchain analytics and block explorers, interoperability protocols, oracles, indexers, and RPC providers.

The Outlook For Plasma

Given what we now know about Plasma, it’s worth zooming out and reflecting on some of the most important catalysts and considerations impacting how the path forward unfolds from here.

Competitive Landscape

Plasma has an ambitious and important mission: to transform how money moves across the globe. Unsurprisingly, they face competition from several angles.

First, general-purpose blockchains aren’t going anywhere. Ethereum still dominates in stablecoin liquidity and network effects. Tron commands the largest share of USDT transfers and peer-to-peer transaction volume, and Solana is constantly working on developments to improve performance. Meanwhile, new chains like Monad and MegaETH are also competing on the basis of high-performance and full EVM compatibility.

At the same time, we’re seeing the rise of stablecoin-specific chains, or “stablechains”, similar to Plasma. Circle is building Arc, a permissioned chain designed for regulated USDC settlement. Stripe is working on Tempo, focused on embedding stablecoins into merchant payments. Google recently announced Google Cloud Universal Ledger (GCUL), an L1 focused on digital payments and tokenization for financial institutions. Meanwhile others stand out with differentiated approaches and unique value propositions. For instance, Payy also introduces neobanking stablecoin infrastructure, including its own purpose-built chain, but with a core focus on privacy-preserving transfers.

Even outside of crypto, non-blockchain payment rails are already converging to offer much of the same key benefits stablecoins do. That means Plasma not only has to match crypto benchmarks, but also these legacy standards of performance, speed, and reach.

Key Areas of Focus

With that in mind, what are key areas of focus that would help the Plasma team?

For starters, distribution is everything. Like any business, a chain can’t grow without getting its product into the hands of users. For blockchains, this has been mostly limited to crypto-native apps, exchanges, connected chains, and DeFi protocols. Though Plasma launches with over 100 integrations and $2B in liquidity, the harder challenge is pushing beyond crypto-native adoption into retail and enterprise crypto-adjacent use. Plasma is set to support 100+ countries, 100+ currencies, and 200+ payment methods, laying the groundwork for a strong initial distribution footprint. Long-term, though, sustaining real-world adoption will require constant effort: onboarding merchants, working with fintech partners, and leveraging Tether/Bitfinex’s existing networks. Tron’s rise shows how powerful grassroots distribution can be. The question is whether Plasma can retain users and build durable channels beyond its crypto-native base.

Liquidity is another area of focus. For a chain purpose-built around stablecoins, deep liquidity is simply existential. Plasma is launching with billions in native USDT issuance, making it the 8th largest USDT chain on day one. To ensure it can sustain future growth, bridges, ramps, and deposit flows have to be simple and as friction-free as possible.

Privacy is another underrated piece. Confidential Payments are planned but won’t ship with Plasma’s mainnet beta launch. The core idea being explored is to shield sensitive transfer data while remaining composable and auditable. This feature would be implemented as a lightweight, opt-in module at first, though Plasma could very well look to enshrine privacy features at the protocol layer in the future.

With its novel architecture, ecosystem reach, and liquidity base Plasma is in a good position:

Anchoring to Bitcoin provides a differentiator. Plasma periodically posts its state roots to Bitcoin, giving extra settlement guarantees beyond relying solely on its validator set.

Additionally, building as a public permissionless chain lets Plasma reach a broader audience, while being able to enforce features like identity-based transfers for specialized experiences like zero-fee USDT transfers.

Using a custom consensus protocol enables Plasma to support fast execution at a high-throughput rate.

Launching with over 100 DeFi integrations and $2B in USDT makes it the 8th largest chain by stablecoin supply from day one.

Applications and Use Cases

Plasma provides rails to support a variety of stablecoin-specific use cases and applications.

Global Payments and Remittances

One of the most immediate applications is as a global payment rail. A worker in the U.S. could send $100 in USDT to a relative in Nigeria. The relative could then spend directly through integrated merchants, use directly through crypto cards, or cash out via local OTC desks and exchanges.

In countries such as Nigeria, Argentina, and Turkey, where stablecoins already act as a hedge against inflation and a remittance lifeline, Plasma can reduce friction even further. Success here depends on integrations with local wallets, ATMs, and payment systems. Tron achieved this over years of grass-roots outreach, so Plasma will need similar partnerships, possibly leveraging Tether’s existing networks. If executed well, Plasma could serve as the backend for remittance firms or neo-banks, offering instant dollar transfers without requiring their own blockchain infrastructure.

Merchant Payments and Micropayments

Paying with crypto has been rare due to volatility and fees, but zero fee USDT transfers on Plasma could change that. Merchants could accept stablecoins at the point of sale via QR codes, avoiding credit card fees and chargebacks.

Privacy features would let businesses shield revenue data from competitors, while micropayments become practical. Platforms could charge a few cents per article, stream, or download without fees eroding margins. For merchants, the key will be user-friendly tools and regulatory compliance. Stablecoin payment processors may emerge on Plasma, and over time, even traditional providers could integrate it in high-fee or underbanked regions.

Forex and Cross-Currency Transactions

The stablecoin market extends beyond the U.S. dollar, with Euro, offshore yuan, and gold-backed tokens already in circulation. Plasma could become a hub for on-chain foreign exchange if multiple fiat stablecoins are supported.

A user could, for instance, swap USDT for EURT on a Plasma-based DEX at near-zero cost. This enables cheaper, faster forex trades compared to banks. Imagine a multinational paying European suppliers by converting millions of USD into EUR instantly and settling the transaction on-chain. Deep liquidity will be needed, but zero fees and institutional demand could draw in market makers.

DeFi with Stablecoins and BTC

Plasma’s EVM compatibility opens the door to decentralized finance focused on stablecoins and Bitcoin. Potential applications include:

Stablecoin DEXes and AMMs: Low-cost, high-volume trading of stablecoin pairs (USDT/USDC, USDT/EURT) or stablecoin/BTC pairs.

Money Markets and Lending: Platforms could let users lend or borrow USDT against BTC collateral.

BTC-DeFi Innovations: Bitcoin-backed stablecoins minted on Plasma without custodians.

Institutional Treasury and Settlement

Institutions such as exchanges, fintechs, or even banks could use Plasma as a settlement layer for large transfers. Exchanges may prefer Plasma over Tron or Ethereum for inter-exchange USDT flows, thanks to its speed and zero fees.

Banks or corporate consortiums could also run private overlays on Plasma, settling large interbank transfers with Bitcoin-backed finality. For corporate treasuries, moving $50 million between subsidiaries could take seconds instead of days with SWIFT. Privacy modules would allow selective disclosure for auditors or regulators. If U.S. legislation like the GENIUS Act advances, regulated institutions may adopt public stablecoins like USDT and USDC, with Plasma positioned to capture that demand.

Beyond these, there are more crypto-native use cases that would be interesting to see teams explore building on Plasma. Zero-fee USDT transfers could make a really compelling case to build infrastructure for autonomous agent payments on Plasma. With $2B deployed from day one, Plasma could provide deep stablecoin liquidity prediction markets need to sustain meaningful user activity. Plasma could also serve as a routing layer for stablecoin liquidity across multiple chains.

Closing Thoughts

Plasma’s mainnet beta is now live. We’re excited to see how purpose-built stablecoin infrastructure unfolds from here on out. Stablecoins are set to disrupt global payments and the rest of the financial services stack, but they need dedicated, purpose-built rails to flourish. Though Plasma is not the only one pursuing this north star, it offers one of the most promising solutions to capture the trillion dollar stablecoin opportunity..

Sources

Plasma Docs docs.plasma.to

XPL MICA Whitepaper https://drive.google.com/file/d/1kw2CfXp0SLPGkitm6v814vmTtWOQTYBw/view

Artemis Analytics https://app.artemisanalytics.com/stablecoins

DeFi Llama

https://defillama.com/

Stablewatch stablewatch.io

U.S. Department of the Treasury. (2025). Major Foreign Holders of Treasury Securities. TIC Data, Treasury.gov.

Chainalysis. (2024). The Geography of Cryptocurrency Report. Chainalysis. https://www.chainalysis.com

Chainalysis. (2025). Sub-Saharan Africa Crypto Adoption. Chainalysis Blog. https://www.chainalysis.com/blog/subsaharan-africa-crypto-adoption-2025/

Tether. (2021) Tether Whitepaper https://assets.ctfassets.net/vyse88cgwfbl/5UWgHMvz071t2Cq5yTw5vi/c9798ea8db99311bf90ebe0810938b01/TetherWhitePaper.pdf Tether whitepaper

Mastercoin (2013) Mastercoin Whitepaper https://drive.google.com/file/d/16t_trC9bP1fkxWImFuQUj96fgjw5JVjL/view

Tether. (2025). Tether Reserve Report (June 2025). ISAE 3000R Audit Opinion. https://assets.ctfassets.net/vyse88cgwfbl/2SGAAXnsb1wKByIzkhcbSx/9efa4682b3cd4c62d87a4c88ee729693/ISAE_3000R_-_Opinion_Tether_International_Financial_Figure_RC187322025BD0201.pdf

Maven11. (2025). The Application Specific Chain Thesis. Maven11. https://www.maven11.com/publication/the-application-specific-chain-thesis

Artemis Analytics, Castle Island Ventures, & Dragonfly. (2025). Stablecoin Payments from the Ground Up. Artemis Reports. https://reports.artemisanalytics.com/stablecoins/artemis-stablecoin-payments-from-the-ground-up-2025.pdf

World Bank. Remittance Prices Worldwide. World Bank. https://remittanceprices.worldbank.org/

International Monetary Fund. (2025). [Working Paper]. IMF eLibrary. https://www.elibrary.imf.org/view/journals/001/2025/141/001.2025.issue-141-en.xml?cid=568260-com-dsp-crossref

Boston Consulting Group. (2025). Stablecoins: Five Killer Tests to Gauge Their Potential. BCG. https://media-publications.bcg.com/Stablecoins-five-killer-tests-to-gauge-their-potential.pdf

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author’s own, not the views of their employer. This post has been created in collaboration with the Plasma team. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research