Inside Talus: The Infrastructure for Onchain Autonomous Agents

The agentic economy needs the right rails to flourish.

The Coming Age of Autonomous Agents

AI agents have advanced beyond simple language tasks. They’re now capable of executing trades, managing capital, making payments, and operating across more complex, multi-step tasks. But as these systems grow more capable, one thing becomes clear. There is a growing mismatch between the infrastructure that enabled today’s AI models and the structural needs of autonomous agents. Systems designed to serve request-response interactions simply aren’t suited for software that needs to make decisions and perform multi-step operations independently.

Consider an autonomous agent tasked with managing a protocol’s treasury. It monitors market conditions across dozens of protocols daily, evaluating risk parameters and executing capital allocation strategies. To do so, an agent needs to query a proprietary API for market data, but the provider can revoke access or modify pricing without notice. Rate limits shift based on provider capacity. The AI model generating trading signals is opaque, as stakeholders can’t verify whether the agent’s decisions actually follow its intended logic. As agents cannot hold assets or sign transactions, they cannot execute actions directly. As a result, there is no shared source of truth to confirm whether an agent acted within their authorized parameters if a dispute occurs.

Why Traditional AI Infrastructure Fails for Agentic Intelligence

Developers building autonomous agents have little choice among infrastructure providers today. Market concentration has consolidated AI infrastructure around a handful of providers controlling access to models and compute. This creates dependency risk in several ways. Pricing becomes unpredictable as terms of service change unilaterally. Rate limits appear and disappear based on provider capacity, and API endpoints shift without warning. For autonomous agents requiring guaranteed uptime and predictable costs, these dependencies represent existential vulnerabilities.

The issue goes deeper than reliability. Centralized platforms cannot provide the transparency and verifiability that multi-party coordination demands. When multiple stakeholders delegate authority to an agent, they need to verify that its decisions followed approved logic. They need audit trails showing how inputs produced outputs, along with guarantees that the agent operated within specified parameters.

Centralized APIs cannot provide this. They return outputs without proofs, processing requests behind closed doors. Users must trust that the model executed correctly, that results were not manipulated, and that pricing was calculated fairly. This level of trust may be tolerable for individual developers building applications but breaks down for autonomous agents coordinating economic activity across organizational boundaries.

Economics introduces another barrier. Agents that generate value cannot capture it directly or participate as economic actors. All revenue must flow through accounts controlled by humans or corporations. Platform operators capture the upside from agent activity while externalizing risks, preventing the emergence of agent-to-agent markets and limiting use cases to narrow, pre-approved categories.

Perhaps the deepest incompatibility lies in how centralized platforms handle permissions and authorization. When multiple parties coordinate through autonomous agents, trust must be explicit and mechanically enforced. Permissions require cryptographic verification that all participants can audit, and execution paths must be provably correct, with disputes resolvable through objective evidence rather than platform policies.

No centralized platform can provide these guarantees. Doing so would contradict centralization itself. The moment a trusted intermediary controls execution, the exact dependencies and trust assumptions that autonomous coordination seeks to eliminate reappear.

Altogether, these limitations show that centralized AI infrastructure cannot support autonomous agents in any environment that requires persistence, verifiability, or cross-organizational coordination. A different architectural foundation is needed.

Talus: A New Decentralized Operating System for Agents

Talus Network aims to address the structural limitations of today’s agentic infrastructure through a decentralized framework purpose-built for autonomous onchain agents. Its architecture supports verifiable workflow execution, cryptographic state management, and programmable economic primitives, enabling agents to custody assets, execute transactions, and coordinate across organizational boundaries through onchain settlement and shared state.

Core Design Principles

Talus is designed on several foundational principles:

Verifiable computation: Through onchain workflows and cryptographic proofs, Talus ensures that every agent action is auditable.

Composability: Talus supports modular tool registries and agent “packages,” allowing agents to access and share tool registries and invoke other agents into their workflows without platform-specific integration.

Economic alignment: Economic incentives are embedded directly into the protocol, with value flowing programmatically and transparently to agents and infrastructure operators.

At its core, Talus offers deterministic workflow execution where each step in an agent’s operation is recorded as a state transition onchain. This creates an immutable audit trail for how decisions were made and executed, while allowing agents to coordinate across organizational boundaries through shared, verifiable state.

The system supports offchain computation with onchain verifiable results, addressing the cost and performance constraints of executing complex AI workloads directly on blockchain virtual machines (VMs). Compute-intensive tasks like model inference occur offchain through a distributed network of execution providers. Cryptographic commitments and state updates settle onchain. This hybrid architecture preserves transparency without sacrificing the performance requirements of production-grade AI systems.

How Talus Actually Works

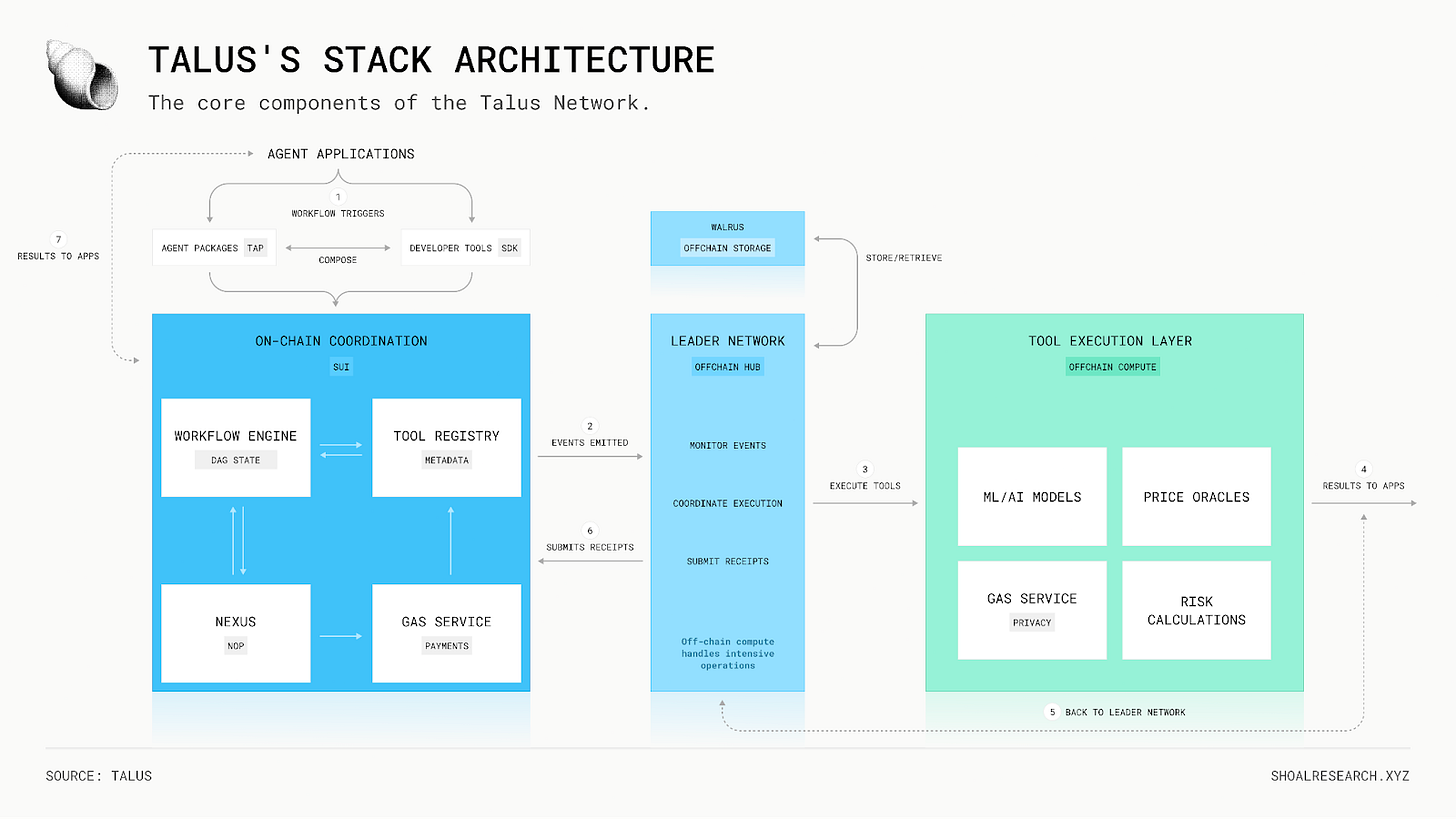

Talus works via a modular architecture: each component serves a specific role in enabling autonomous-agent coordination. The system couples blockchain consensus with offchain computation, delivering an infrastructure that is both verifiable and efficient. Nexus, the core engine, handles onchain coordination and offchain execution.

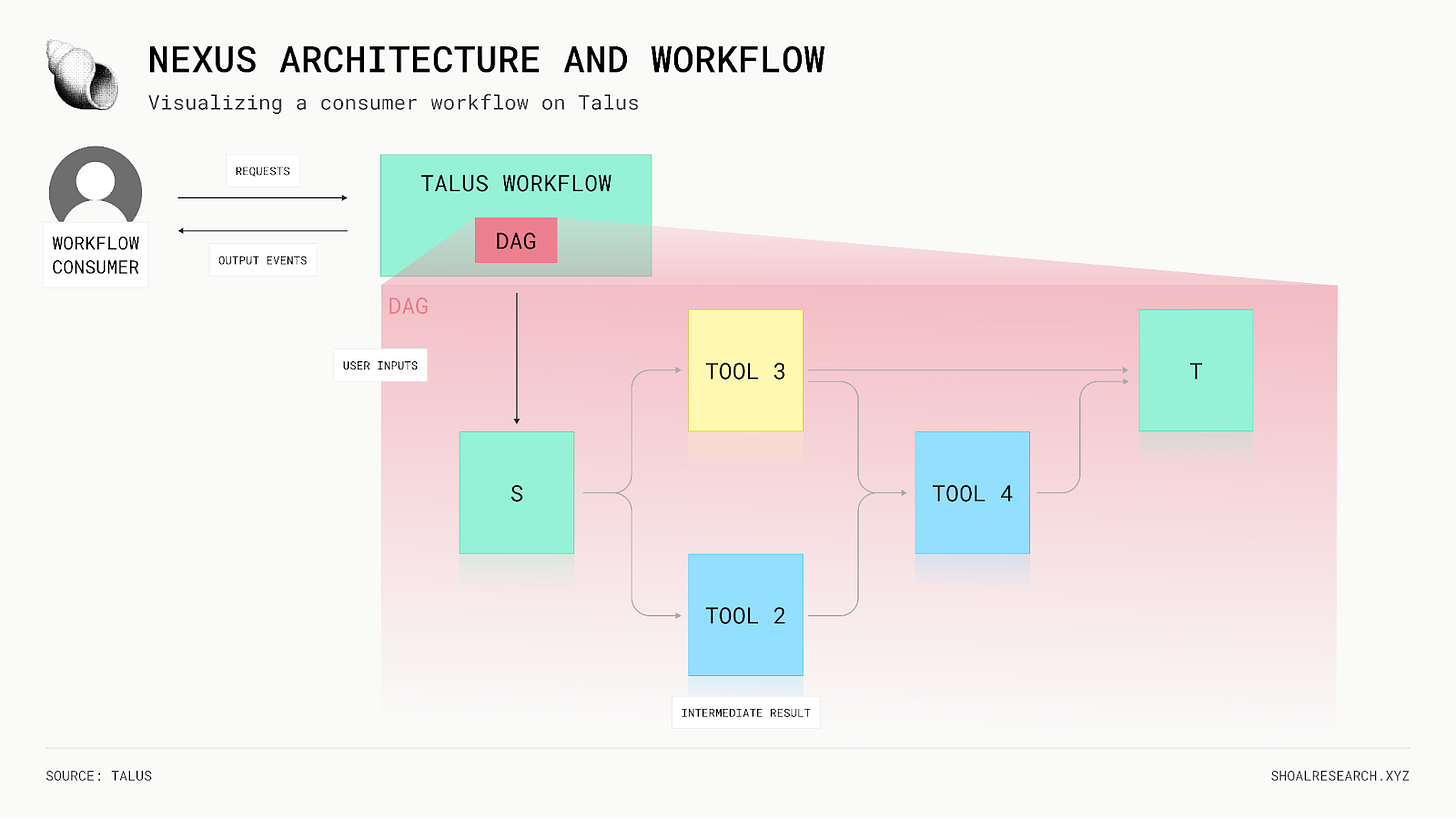

A consumer submits a request to a Talus workflow, which is encoded as a directed acyclic graph (DAG). Each step in the DAG corresponds to a tool invocation or state transition. During execution, the Nexus onchain packages coordinate with Leaders offchain to trigger tools, update workflow state, and return results. This separation between workflow specification (onchain) and computation (offchain) allows Talus to remain verifiable without sacrificing performance.

Talus Stack Architecture

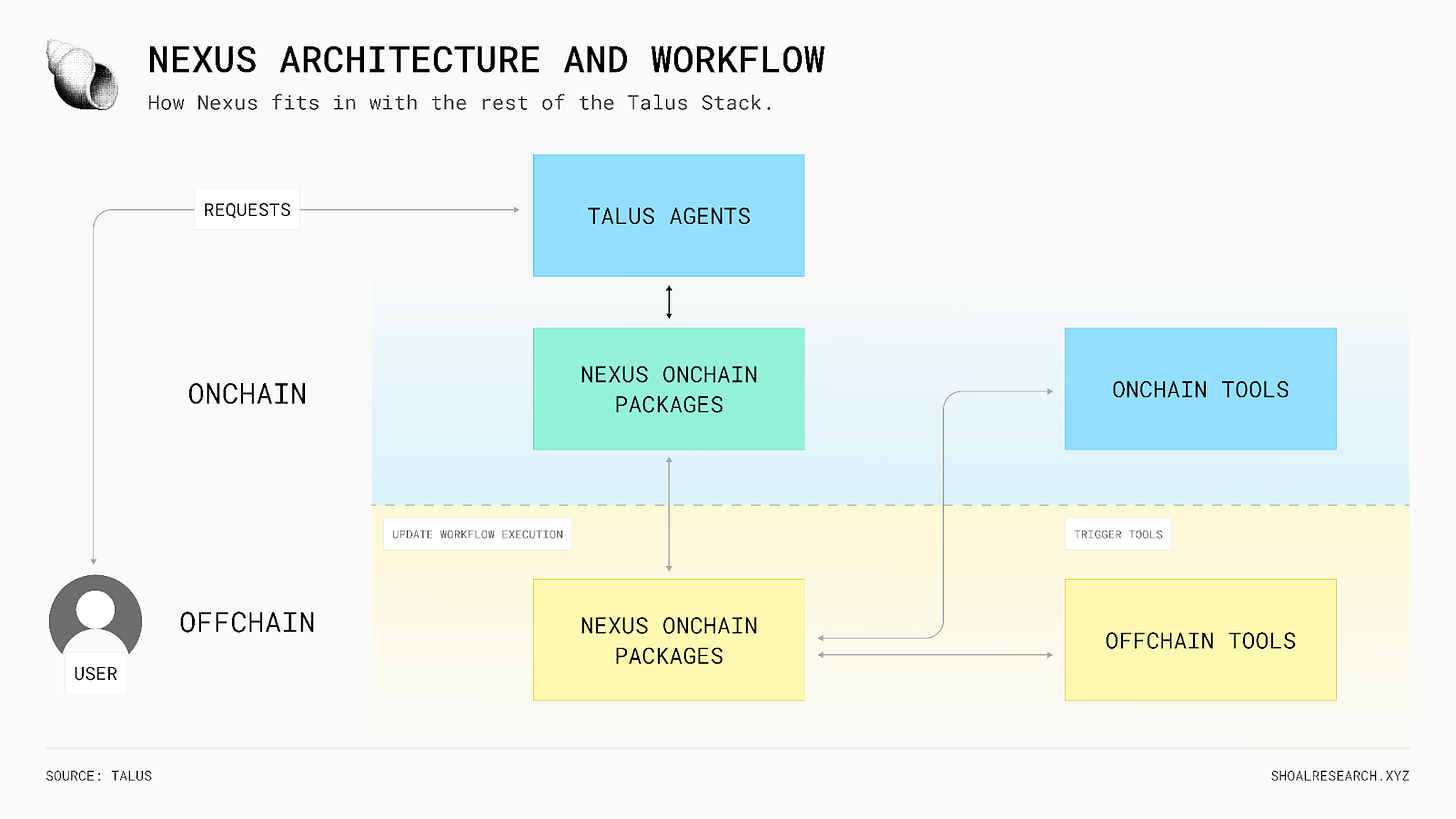

Talus runs on the Sui blockchain and utilizes Sui’s object-centric state model and the security of Move. Agents, tools, and workflows are represented as objects with explicit ownership, meaning each resource has a defined owner and can be transferred, combined, or restricted through code. Smart contracts on Sui Move define the structures and protocols for agent and workflow management, allowing developers to then build atop this foundation using different contract package types:

The Nexus Onchain Package (NOP): The foundational layer maintained by the Talus team, defining core data structures, workflow coordination logic, and the protocol’s primitives.

Tool Packages sit atop this foundation, allowing developers to publish modular tools — on or offchain — that agents can invoke. Tools expose defined inputs, outputs, and access/payment constraints.

Talus Agent Packages (TAP): enable developers to compose these tools into complete agent systems with custom business logic. This layered structure creates a clear separation of responsibilities while enabling composability across the ecosystem.

The relationship between Talus agents, the Nexus onchain packages, the Leader network, and the tool ecosystem is shown below. Talus agents route requests to Nexus, Nexus updates workflow execution onchain, and Leaders perform offchain computation while triggering tools across both environments.

Nexus sits at the center of execution flow: agents submit workflow requests onchain, Nexus updates workflow state, and Leaders coordinate offchain execution by invoking the appropriate tools and returning results onchain. This separation between onchain coordination and offchain computation is what enables Talus to remain both verifiable and performant.

Workflow Engine and Deterministic Coordination

Talus encodes agent behavior as directed acyclic graphs (DAGs) stored onchain. Each node within these graphs represents a specific action, whether reading data, calling a tool, or modifying state, and the dependencies between nodes establish which operations must complete before others can begin. Because the workflow specification itself lives onchain, anyone can audit what an agent is authorized to do before execution even begins.

Computation, however, is offloaded. The Leader network performs the actual work by pulling node definitions from Nexus, executing the corresponding tool, and submitting a verifiable receipt back to the chain. This hybrid model preserves performance for heavy workloads while ensuring that state, permissions, and results remain transparent.

Workflow Execution States

Each workflow execution creates a DAGExecution object that tracks progress through walk states. A walk represents the execution of a single node in the workflow graph. Walks transition through four possible states: Active (currently processing), Successful (completed and ready to activate next nodes), Failed (encountered an error), or Consumed (completed but waiting for other inputs to converge).

This state system ensures workflows handle errors gracefully and prevents deadlocks through fallback mechanisms. If a tool fails, the workflow can trigger fallback edges that route execution to alternative paths, maintaining liveness even when individual components encounter issues.

Talus Tools and Modular Capabilities

Tools represent functional modules that agents can invoke during workflow execution. When registered onchain, each tool declares its expected inputs, produced outputs, pricing structure, and access requirements. This registration system creates an open marketplace where developers contribute capabilities and agents discover services organically.

Tool execution can happen in two environments:

Onchain tools interact directly with Sui smart contracts.

Offchain tools execute compute-heavy tasks (LLM inference, analytics, image work, math routines) coordinated by Leaders.

Leaders orchestrate these calls and return results onchain with proofs or commitments, keeping the entire workflow auditable.

Payment and Gas Model

Every workflow execution requires economic coordination across multiple service providers. Users deposit payment into a gas budget within a globally unique gas service object. Before execution begins, Nexus verifies sufficient funds to cover all potential tool costs based on the workflow’s maximum execution path.

As the workflow progresses, each tool consumes its designated payment from this budget only after successfully completing its work and passing any required verification steps. This delivery-versus-payment mechanism ensures tools receive compensation for honest work while protecting users from paying for failed or incomplete operations.

The protocol implements a dual-track revenue system. According to current protocol design, when overall protocol revenue falls below a threshold, priority fee income is burned, reducing token supply and supporting token economics. When revenue exceeds the threshold, fees are distributed to Leaders performing coordination work.

Data Storage with Walrus

Essential workflow metadata lives on Sui’s blockchain, ensuring its integrity and availability. However, storing everything onchain becomes prohibitively expensive. Walrus, a decentralized storage platform from Mysten Labs, handles supplementary data including agent memory, operational context, and intermediate results.

Agent functionality depends critically on maintaining context and memory across multiple sessions, allowing them to learn from past interactions and build upon previous decisions. Walrus provides this storage layer with configurable verification mechanisms.

Tools can reference data stored on Walrus through onchain commitments, enabling workflows to pass large datasets between operations without incurring excessive gas costs. This distributed storage approach maintains verifiability for intermediate values while achieving practical scalability.

Leader Network and Distributed Execution

Leaders serve as the coordination layer between onchain workflow specifications and offchain computational resources. They monitor the blockchain for workflow execution requests, identify which tools need to run, coordinate their execution, and submit the results back onchain as verifiable receipts.

Execution Flow in Practice

Consider an investment agent making a portfolio adjustment.

The user triggers the workflow by submitting a transaction to the agent’s smart contract. This creates a DAGExecution object and emits an event that Leaders monitor. A Leader picks up this event, retrieves the first tool’s information from the onchain registry, and discovers it needs to fetch current market prices. The Leader calls this price oracle tool, receives the data, and submits it back onchain along with payment for the tool. This activates the next workflow node, perhaps an analysis tool that recommends allocation changes. The Leader orchestrates this second tool’s execution, submits results, and continues until the workflow reaches a terminal node that executes the actual trades through onchain DeFi protocols. Each step produces an auditable record while the Leader handles all coordination overhead.

Security and Progressive Decentralization

The network maintains security through economic incentives. Leaders stake collateral that faces slashing if they behave maliciously or fail to maintain liveness. The system rotates execution responsibilities across multiple Leaders, preventing any single operator from dominating the network. These mechanisms create fault tolerance and resistance to coordinated attacks.

The Leader network architecture evolves progressively. It currently operates with initial trusted Leaders to ensure reliability while the platform establishes product-market fit. Future phases introduce TEE-based distributed execution, where Leaders run inside trusted execution environments that provide cryptographic proof of correct operation. The final phase reaches a fully permissionless model where anyone can stake tokens and participate as a Leader. This gradual transition maintains service quality while steadily increasing decentralization and minimizing trust assumptions.

The combination of object-based state management, flexible security levels, hybrid execution, and economic coordination addresses specific technical constraints that emerge when agents need to operate across organizational boundaries.

Building a Market for Autonomous Intelligence

Talus creates economic infrastructure where agents transact as independent participants rather than subordinate tools. The $US token is designed to serve as the coordination and incentive layer across the network. It functions as payment and settlement for workflows, tools, and agents, and as the medium for tool registration and Leader network participation.

Within this system, agents compensate other agents for specialized services based on computational requirements and market demand. Revenue flows programmatically to tool developers through usage, to model providers through invocations, and to Leaders through execution work. $US holders secure the network through staking and participate in governance over protocol parameters.

The result is a market-driven coordination system where intelligence operates as a commodity. Stakeholders capture value proportional to their contribution. Economic sustainability derives from network activity rather than external subsidy.

Use Cases: What Talus Makes Possible

Taken together, these primitives (workflows as DAGs, tools with flexible security, hybrid execution, and programmable payments) address a specific class of applications that existing infrastructure cannot support.

Agent-Driven Prediction Markets

Prediction markets aggregate distributed information through financial incentives, but their efficiency depends on participants who can continuously process diverse data sources and execute trades instantly. Human traders cannot simultaneously monitor onchain oracle feeds, analyze social sentiment, cross-reference polling data, and adjust positions across multiple markets 24/7. Talus agents eliminate these constraints:

Polling oracles provide official results with confidence intervals

LLM tools analyze sentiment from social platforms

Statistical models weight historical accuracy and detect trends

Execution tools adjust positions across market contracts

Risk modules enforce portfolio constraints

Traditional platforms like Kalshi operate as black boxes where users cannot inspect internal algorithmic behavior. Talus workflows, by contrast, can record decision steps onchain. When an agent is configured to trade based on polling data and sentiment, the DAG execution trail provides a verifiable onchain record of which tools were invoked, in what sequence, and how their outputs influenced the final action.

Computation-heavy analysis runs offchain within the Talus agent framework, while trades and key coordination events settle onchain. Market resolution can follow the same pattern: agents query multiple oracles, check for consensus conditions, and trigger settlement only after verification.

Verifiable DeFi Agents

Consider an MEV protection bot executing trades across decentralized exchanges. Today, users must trust the operator’s claims about routing logic. With Talus, the agent produces cryptographic receipts for every step: route selection, price impact calculation, final execution path. Users verify that the actual transaction matched the stated strategy without requiring blind trust.

Cross-protocol yield strategies work similarly. When an agent moves capital between lending markets, stakes proceeds, and rebalances positions, the Leader network generates proofs for each interaction. The complete execution trace becomes auditable. If something goes wrong, participants can verify exactly where and why through cryptographic evidence recorded onchain.

Agent-to-Agent Tool Markets

A trading agent needs machine learning predictions but doesn’t want to train models itself. On Talus, it hires a specialized prediction agent, verifies the model’s identity through cryptographic attestation, and pays per inference onchain. The predictor earns revenue automatically through usage. No platform middleman, no API contracts, no trust required beyond cryptographic verification.

This creates markets for specialized intelligence. Agents that build valuable capabilities, whether ML models, data analysis tools, or execution strategies, monetize directly through usage. Tool development becomes economically sustainable without platform dependency.

Cross-Chain Autonomous Portfolios

Today, moving assets across blockchains requires custodial bridges or trust assumptions. Talus enables coordinated operations across chains through verifiable state queries. A portfolio agent could check prices on Ethereum, execute a swap on Base, and stake proceeds on Arbitrum, all within a single coordinated workflow.

Each step occurs within the same execution context. The Leader network provides cryptographic proofs that operations happened correctly across different chains. This eliminates custodial bridge risk since agents read and write state directly rather than locking assets with intermediaries.

Accountable DAO Governance

Treasury management agents prove their risk calculations through transparent workflows auditable before vote execution. Stakeholders verify that proposed allocations derive from stated logic. Emergency response agents act autonomously within smart contract-enforced constraints. All authorization logic remains verifiable onchain. This creates accountability for autonomous governance while maintaining automated response speed.

Privacy-Preserving Enterprise Operations

Through TEE integration, agents process sensitive data without exposing it. Healthcare agents analyze patient records, financial agents evaluate credit risk, and compliance systems audit transactions, all while keeping underlying data encrypted. Only the TEE decrypts inputs during computation, and cryptographic attestation proves correct processing. This enables autonomous intelligence in regulated domains where privacy is mandatory.

Economics

Talus creates a self-reinforcing agent economy where growth compounds across the network. As tools expand capabilities, agents become more powerful. More capable agents attract users with sophisticated needs. Rather than relying on centralized rent-seeking, the network distributes value programmatically to contributors while capturing protocol-level revenue through usage-based fees.

Value Flow and Network Effects

When a workflow executes, users fund its execution through onchain fees that cover computation and coordination. As execution completes and verification passes, fees distribute to workflow participants according to protocol rules:

Leaders earn for coordination work

Tool developers earn from usage

Agent developers earn from deployment and performance

This creates reinforcing network effects. Each additional tool increases what agents can do, attracting users with more sophisticated needs. Increased usage generates more fee revenue for successful capabilities, incentivizing developers to build specialized services. The flywheel accelerates as growth in one area drives growth everywhere else.

Token Value Accrual

$US sits at the center of this economy as the primary unit of value and coordination. (Note: $US has not yet been listed on exchanges as of this writing.) Network activity creates ongoing demand for the token to pay for usage, access features, and participate in governance. Users can pay base gas fees in SUI, with the protocol routing settlement and incentives through $US. Direct $US payment enables priority execution and enhanced features.

Supply Dynamics and Fee Structure

The protocol implements a capped supply with a fee model that links token scarcity to real usage. When protocol revenue falls below a threshold, priority fees are burned rather than distributed. This permanently reduces circulating supply. As network activity scales, this creates a value-accrual loop where demand acts on shrinking supply. When revenue exceeds the threshold, fees distribute to Leaders performing coordination work, aligning rewards with network growth.

Staking and Participation Incentives

Staking forms the foundation of Talus’s security model. Leaders stake $US to participate in coordination and earn fee revenue. Stakes face slashing for malicious behavior or failures. Tool providers stake when registering capabilities, aligning their incentives with service quality. As the marketplace grows, staked tokens lock supply while usage-driven demand continues.

Long-term holders gain governance rights and access to protocol features. This creates incentives to participate in the ecosystem rather than purely speculate. The combination of staking requirements, governance participation, and usage-based rewards aligns all participants with network health and sustainable growth.

Limitations & Open Challenges

Talus addresses coordination problems that existing systems cannot solve, but introduces distinct constraints in doing so. Understanding these limitations matters for realistic deployment and protocol development.

Technical Constraints

Verification adds latency to every workflow. Each step requires cryptographic proof generation and onchain settlement, creating overhead that centralized API calls avoid. Offchain execution handles compute-intensive tasks efficiently, but the coordination layer still adds milliseconds to seconds depending on blockchain finality. For high-frequency trading or real-time response systems, this latency may prove prohibitive.

When agents hire other agents as subcontractors, workflow dependencies multiply across the system. A failure in one sub-workflow cascades through dependent operations, creating unpredictable failure modes. Debugging becomes difficult when execution spans multiple tools, chains, and offchain providers. Tooling for monitoring and diagnosing multi-agent systems remains immature.

Economic and Governance Risks

Incentive misalignment emerges at protocol boundaries. Leaders might prioritize high-fee workflows, delaying execution for lower-paying users. Tool developers could extract value through opaque pricing or degraded service quality. Agent owners might exploit protocol mechanics for individual gain at collective cost.

Token holders must balance competing interests across tool developers, agent operators, and end users when making governance decisions. Protocol upgrades require consensus among stakeholders with different time horizons and risk tolerances. Without effective mechanisms, the system risks capture by concentrated interests or stagnation through disagreement.

Security Concerns

Malicious agents pose systemic risk. An agent could exploit tool vulnerabilities, manipulate other agents through adversarial inputs, or drain assets through legitimate-looking workflow logic that contains hidden exploits. Permissioned tool registration and workflow verification provide safeguards, but determined attackers may find edge cases.

Despite slashing penalties, a coordinated attack on the Leader network could compromise workflow execution during the current trusted phase. The progressive path toward full decentralization addresses this over time, but the trusted setup introduces temporary centralization risk.

Ethical and Societal Implications

Autonomous agents operating in the real world raise questions infrastructure cannot answer. An agent managing capital might make economically rational decisions that cause social harm. Agents coordinating across domains could amplify systemic risks or trigger unintended consequences no single operator foresaw. The protocol verifies what agents do, not whether they should do it. This gap between technical capability and ethical judgment remains an open challenge for autonomous systems.

Future Outlook: The Path Toward Decentralized Intelligence

The trajectory of AI development points toward a fundamental reorganization of economic activity. As agents gain autonomy and operate across decentralized infrastructure, they will evolve from tools that execute commands into participants that negotiate, transact, and coordinate independently. Talus positions itself as the coordination layer for this transition.

Agents as Economic Participants

Current systems treat agents as extensions of human operators. Future systems will treat them as independent actors. Agents will hold assets, evaluate counterparties, negotiate terms, and execute agreements without human intervention at each step. An agent managing a treasury will adapt strategies based on market conditions rather than following predefined rules. It will hire specialized agents for analysis and coordinate with others to achieve objectives.

This requires infrastructure where agents can transact trustlessly. Traditional finance operates through intermediaries that verify counterparty creditworthiness and enforce settlement. Decentralized systems replace intermediaries with cryptographic guarantees and programmatic enforcement.

Talus provides this foundation through verifiable workflows and onchain settlement. As agent-to-agent commerce grows, the protocol could function as settlement infrastructure similar to how SWIFT coordinates interbank transfers or Visa processes card transactions.

Expansion of Decentralized AI Infrastructure

Security and privacy requirements will drive technical evolution. Zero-knowledge machine learning and trusted execution environments will enable privacy-preserving verification. A healthcare agent could prove it analyzed patient data correctly without exposing the data itself. A trading agent could verify strategy execution without revealing its algorithm.

Interoperability will expand beyond blockchain ecosystems to encompass traditional systems. Agents will read state from legacy databases, execute operations through conventional APIs, and write results to blockchains. The distinction between onchain and offchain execution will become less important than whether operations are verifiable and settlement is trustless. Marketplaces for tools and agent services will mature from experimental protocols into established infrastructure with standardized interfaces and competitive pricing.

The Long-Term Vision

Decentralized intelligence may evolve into global utility infrastructure. Just as cloud computing commoditized server access and the internet commoditized information distribution, autonomous agent platforms could commoditize intelligent coordination. Multi-agent ecosystems might manage supply chains, coordinate energy grids, or optimize resource allocation across organizations.

Talus is positioned to serve as backbone infrastructure for this future. The protocol does not attempt to solve all problems but provides coordination primitives that other systems can build upon. If agents become economic participants at scale, they will require neutral infrastructure for settlement and verification. Whether Talus captures this role depends on execution, but the architectural foundation exists. The question is not whether autonomous agents will reshape economic activity, but which infrastructure will coordinate them.

Closing Thoughts

The infrastructure supporting AI development has reached a critical juncture. Centralized platforms delivered the current generation of AI models, but they cannot support the next phase of autonomous agent deployment. Their constraints are structural, not temporary: opaque execution, unilateral control, and no way for agents to act as independent economic actors prevent the coordination mechanisms autonomous systems require.

Talus addresses these limitations through architectural choices that leverage blockchain properties for verifiable execution, permissionless participation, and programmable economic alignment. Rather than trying to rebuild the whole AI stack, Talus offers coordination primitives: composable infrastructure that other systems can build on.

The path forward involves more than technical specs. Verification latency must shrink. Multi-agent debugging tools must emerge. Incentives must align across stakeholders. Security must decentralize progressively. These are real challenges, but they are addressable through iterative development.

What remains uncertain is adoption trajectory, not technical feasibility. The architectural foundation exists for agents to operate as independent economic participants. Whether this vision materializes at scale depends on execution, ecosystem development, and whether builders choose verifiable coordination over centralized convenience.

Autonomous agents will reshape economic activity. Which infrastructure coordinates them remains an open question. Talus positions itself through verifiable workflows, agent-first architecture, and programmable economic primitives. Success will be measured not by technological sophistication alone but by whether the protocol becomes essential infrastructure for the autonomous systems that follow.

At Shoal, we believe autonomous agents could reshape economic activity at scale. What matters is the infrastructure that supports them. Adoption will determine its ultimate role, but with verifiable workflows, native asset control, and modular coordination primitives, Talus’s architecture is designed in a way that gives it a credible path toward becoming foundational rails for the agentic economy.

Sources

Talus Documentation. Talus Network, docs.talus.network

Talus Network Litepaper. Talus Network, talus.network/litepaper

Nexus Whitepaper. Talus Network, talus.network/whitepaper

Talus Combines Walrus and Sui to Enable Onchain AI Agents. Walrus, walrus.xyz/blog/talus-builds-onchain-ai-agents-walrus

What Is Talus ($US)?. Whales Market, whales.market/blog/what-is-talus/

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author’s own, not the views of their employer. This post has been created in collaboration with the Talus team. Some members of the team have material holdings of SUI and Talus. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research.

The agent-to-agent tool market concept is interesting but the latency tradeoff from onchain verification seems like it'd kill real-time usecases. I dunno if verification overhead justifies itself outside specific domains like treasury management where auditability > speed. The Leader network centralization during early phases is honest atleast.