Jito Restaking Strategies: Optimizing Yield within the Solana Ecosystem

An exploratory deep dive on the Jito (Re)staking Ecosystem and the emerging DeFi opportunities around it.

A big thanks to @tradetheflow_ for his valuable contribution to putting together this report.

Introduction

Since its launch in November 2022, Jito has consistently pursued its vision of building the leading liquid staking service on Solana. Through relentless efforts from the team and a strong long-term vision, Jito has grown from near zero in TVL in January 2023 to become the largest protocol by TVL on Solana, with over $3.54 billion in TVL, representing around 32% of Solana’s total TVL of $10.73b.

On top of that, Jito also played a key role in the rebirth of Solana by rewarding its core users with one of the largest airdrops in Solana’s history. This happened at a time when it was needed the most—following the FTX debacle and when the consensus thought that Solana was a dead chain.

Today, Jito continues to be at the forefront of technological innovation on Solana and is once again introducing a new key product that could bring the chain a step closer to its end goal: Jito (Re)staking.

In this report, we will explore Jito (Re)staking, covering the underlying concept of restaking, Jito's core offering, its potential market opportunity, and the full ecosystem surrounding it.

Restaking 101

Restaking was originally pioneered by EigenLayer and first launched on the Ethereum mainnet in June 2023. The core idea behind restaking is to enhance the security and reliability of decentralized services (what EigenLayer refers to as AVS or Actively Validated Services) by allowing them to leverage the economic security of one main consensus layer rather than relying on their own potentially weaker security models.

While smart contracts and their interactions benefit from the security of the main Layer 1 chain, other components like oracles, bridges, sequencers, or Layer 2 solutions require their own economic security models. This means either raising significant capital to incentivize validators or compromising on security. Therefore, even if smart contracts are secured by a strong decentralized consensus network, vulnerabilities in other parts of the workflow—such as an oracle providing incorrect data—can undermine the integrity of the entire system. This presents a paradox: there’s little value in having strong security at the smart contract level if other parts of the system aren’t equally secure, as, ultimately, it is the weakest link that determines the overall security and resiliency of a system.

Restaking addresses this issue by allowing staked assets to be reused across multiple decentralized services where validators who have already proven their reliability on a base layer (like Solana or Ethereum) can extend their security guarantees to additional protocols. This creates a hierarchical security model where:

Base Layer Security: The underlying blockchain provides the foundational security layer through traditional staking.

Extended Security Coverage: Through restaking, this security is extended to additional protocols, which EigenLayer terms "Actively Validated Services" (AVS) and what Jito calls "Node Consensus Networks" (NCNs).

Economic Alignments: Validators are incentivized to maintain honest behavior across all networks they secure, as malicious actions could result in slashing of their stakes across multiple protocols.

While there are still many technical and risk challenges that must be overcome for restaking to achieve its end goal of creating a more interconnected, secure, and efficient blockchain ecosystem, it represents a key innovation in blockchain security and scalability. In fact, it has already generated significant attention from both builders and investors.

As mentioned, the restaking narrative first gained prominence with EigenLayer on Ethereum, which has accumulated over $15 billion in TVL since its launch. This success has inspired similar innovations across other ecosystems, with protocols like Symbiotic and Karak, each securing over $1.75 billion and $816m in TVL, respectively. This trend is now beginning to replicate on Solana, with Jito recently releasing the full code for its own restaking protocol: Jito (Re)staking.

Jito (Re)staking — The next big thing on Solana?

At its core, Jito (Re)staking represents the backbone technology for its next-generation hybrid and highly flexible restaking protocols on Solana. The architecture introduces a framework that turns security from a fixed cost into a programmable resource – one that can be shared, optimized, and monetized across multiple protocols simultaneously.

The Jito (Re)staking framework consists of two main components: the Restaking Program and the Vault Program. We can think of them as two separate technological entities that work together to provide a flexible, multi-assets, and scalable infrastructure to enable restaking on Solana.

On the one hand, the main function of the Restaking Program is to coordinate the creation and management of Node Consensus Operators (NCNs), facilitate opt-in/opt-out mechanisms, and manage reward distribution and slashing penalties. On the other hand, the Vault Program is focused on everything related to liquid restaking tokens, or as Jito calls them, Vault Receipt Tokens (VRTs), and their customization and delegation strategies.

This design allows partially decentralized protocols on Solana— especially those that previously relied on centralized systems — to fully decentralize their operations and be secured under a unified layer of economic security. All of that is done without having to build all the costly and complex infrastructure by themselves as they fully rely on the Jito (Re)staking stack.

The architecture advantage

Jito (Re)staking stands out through its modular, three-layered architecture:

Node Operators (NOs): Node operators are entities that manage, validate, and secure the infrastructure for NCNs. Here, what sets Jito's approach apart is its capital efficiency—operators can secure multiple NCNs simultaneously, maximizing their infrastructure utilization. The current roster includes industry leaders like Figment, P2P, and Kiln, who collectively secure billions across multiple chains.

For example, Figment, which manages staked assets across chains, can now use the same infrastructure to validate Switchboard's oracle data and Squads’ policy network. This reduces operational overhead while maximizing returns.

Node Consensus Networks (NCNs): NCNs are protocols that leverage Jito's restaking network to secure and validate their actions, transactions, and other types of information by plugging into Solana's existing security infrastructure rather than building it from scratch. These protocols can range from oracle networks and cross-chain bridges to novel DeFi applications.

Take Sonic's gaming SVM - instead of bootstrapping their own validator set, they plug into Jito's existing network for transaction validation. Similarly, Twilight's privacy network uses this layer to secure their operations without building separate infrastructure.

Vault Receipt Tokens (VRTs): VRTs are synthetic tokens similar to liquid staking tokens, except that VRTs represent an IOU for a restaking position. Following this, Jito's key innovation is its multi-asset vault system. While other restaking protocols typically accept only native tokens or liquid staking derivatives, Jito enables the restaking of any SPL token.

This flexibility opens new opportunities for token utility and security bootstrapping. VRTs are managed by independent providers that are responsible for minting the liquid restaking tokens, as well as delegating and selecting NCNs.

To draw a parallel, the Jito (Re)staking technology as a whole can be thought of as the EigenLayer of Solana, while the VRT providers are similar to EtherFi in the sense that they act as the intermediary and a liquidity layer between users and the core restaking protocol. From a market perspective a lot of the value captured by Jito (Re)staking is expected to flow to those providers.

How Jito (Re)staking Works

To better understand how Jito (Re)staking works, let's use an example where Bob deposits his tokens into a Vault Receipt Token (VRT) from a provider like Kyros, Renzo, or Fragmetric. In return, Bob receives VRTs (kySOL, ezSOL, fragSOL or bzSOL), representing liquid tokens for his restaked assets. VRT providers then delegate Bob’s assets to professional node operators, securing multiple NCNs and generating yields from various sources. These rewards flow back to VRT holders like Bob, creating theoretically uncapped yield potential.

This means that by holding VRTs, Bob is able to earn higher APY rewards than if he simply staked his assets (as he is also securing multiple NCNs). Additionally, since VRTs are liquid, Bob can also use them in other DeFi applications, like providing liquidity on Kamino and potentially earning even higher rewards.

However, it is worth mentioning that VRT and restaking as a whole comes with added risks for holders related to composability, the potential for slashing, and the complexities that arise in the management of restaking positions and their risk profiles. Even if this sector is really promising, it is still nascent, especially on Solana, and we have yet to witness how all of this will work in practice. This will be something important to monitor as this field grows.

The Jito (Re)staking ecosystem

Jito (Re)staking is still in its early stages but has already attracted significant players to its ecosystem, including NCN, Node Operators, VRT providers, and even DeFi integrations exploring the potential of restaking. Here's a full map of the Jito (Re)staking ecosystem to date:

Major NCNs

As of writing, six main NCNs are involved in Jito (Re)staking:

Switchboard: Switchboard is a permissionless oracle on Solana integrating Jito (Re)staking to enhance the security and performance of its services. Through this restaking integration, Switchboard leverages Jito's customizable staking and slashing parameters to ensure the integrity of its data feeds.

Sonic: Sonic is the first Solana Layer 2 for sovereign games, built with HyperGrid, the Solana Virtual Machine (SVM) horizontal scaling framework. This project leverages Jito (Re)staking to enhance the security and efficiency of its SVM, supporting a multi-use ecosystem for gaming, DeFi, and other applications on Solana.

Squads: Squads is the leading multisig solution on Solana, used by major teams and protocols to secure on-chain assets. It is integrating Jito (Re)staking for its upcoming Squads Policy Networks (SPN), a decentralized service designed to enhance the functionality of the Squads Protocol on Solana and the SVM.

Leaf: Leaf Protocol is a decentralized platform designed to improve scalability and security for DeFi applications through secure, multi-network interoperability. By integrating Jito (Re)staking and the Node Consensus Network (NCN), Leaf fortifies its validator security and enhances staking rewards using JitoSOL.

Ping Network: Ping Network is a privacy layer protocol on Solana that allows anyone to contribute hardware and monetize unused bandwidth. This project utilizes Jito (Re)staking's Node Consensus Network (NCN) model to enhance the decentralization and economic security of its services.

TipRouter: The TipRouter NCN is a Jito initiative developed to decentralize and secure MEV tip distribution on Solana by leveraging Jito (Re)staking. This proposal enables node operators to reach a consensus on distributing MEV tips, with 3% allocated to the Jito DAO treasury and NCN participants. It strengthens DAO control over validator security while establishing a transparent and robust mechanism for managing network rewards.

Market traction of Jito (Re)staking

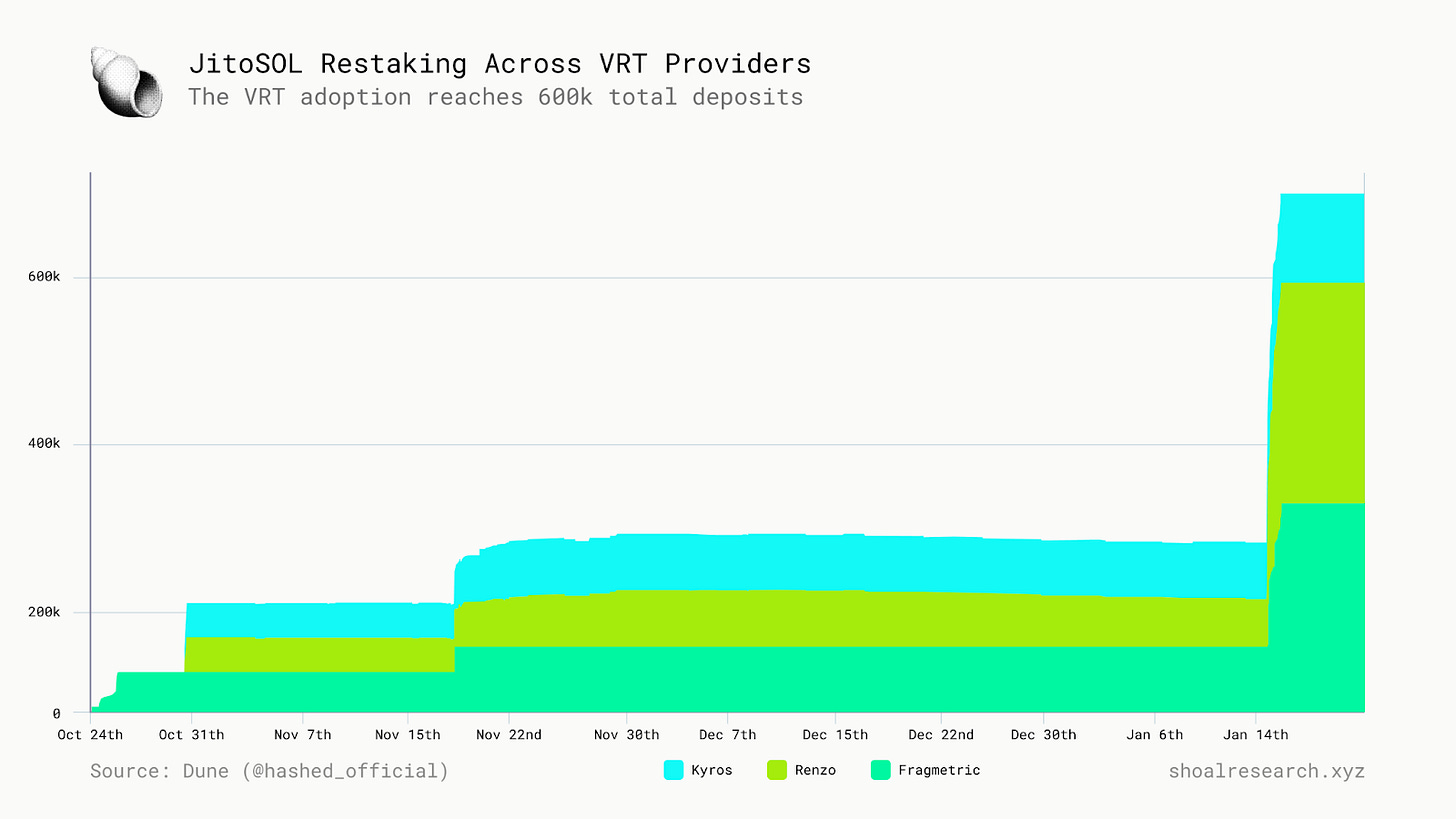

As of today, the total TVL in Jito (Re)staking stands at 719K SOL, equivalent to around $167M, and it is currently at maximum capacity. This is shared between the three VRT providers: Renzo, Fragmetric, and Kyros.

Total TVL in Jito (Re)staking + market share of each VRT providers

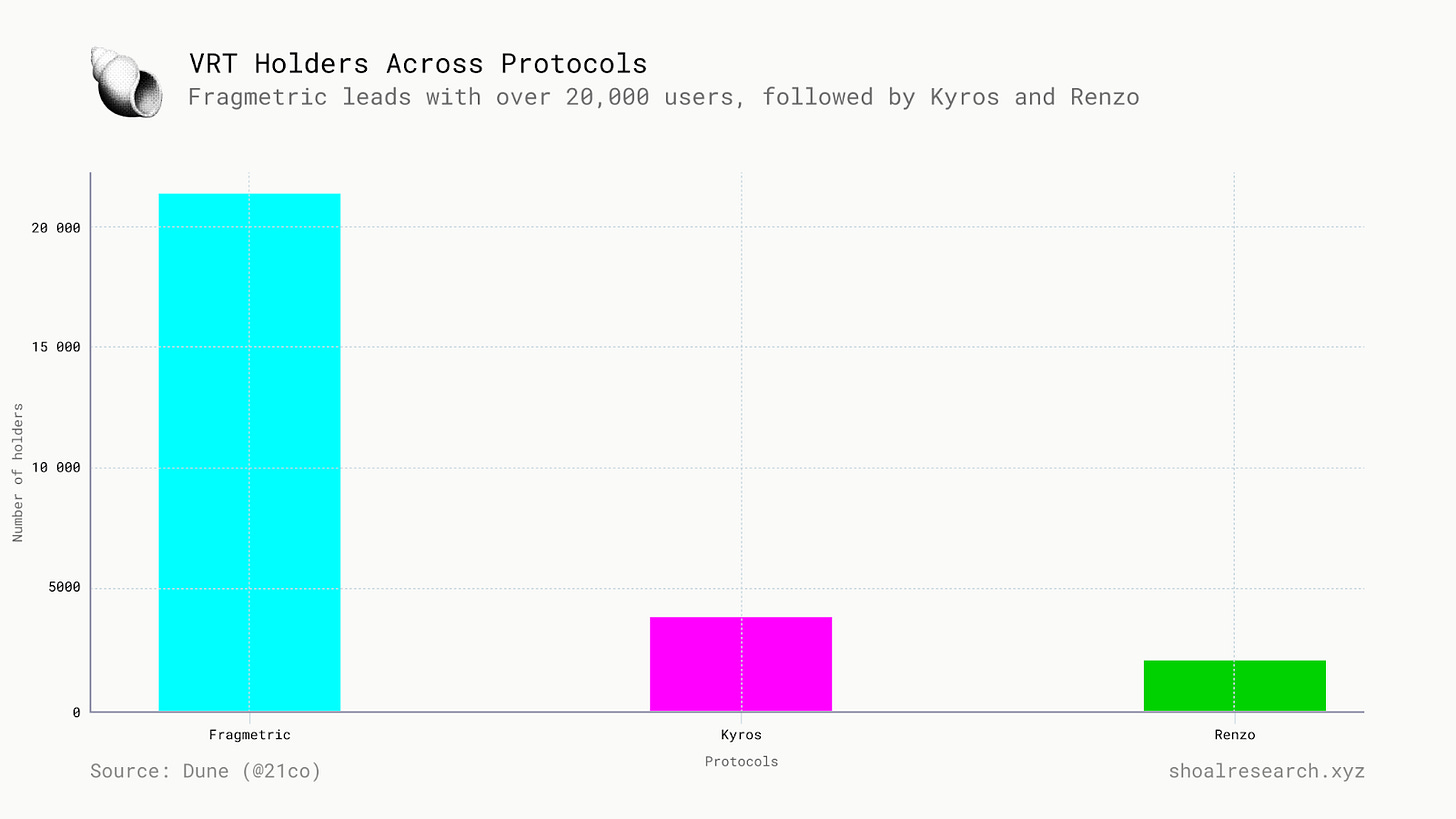

In terms of distribution, Fragmetric is currently the most widely held VRT, with 21,368 holders. Kyros follows with 3880 holders, while Renzo is less distributed, with a total of 2075 holders.

In January, the TVL across all the VRTs got lifted up, and we can expect the TVL cap to be lifted in the future, too. This could lead to an inflow of capital to the different VRT providers until the industry reaches its full market potential.

Potential market opportunity

To assess the market opportunity for Jito's restaking once caps are lifted, we can use a set of assumptions and draw parallels with Ethereum’s restaking market share.

First, we could assume a conservative estimate of Solana’s Total Value Locked of between $10 billion and $13 billion on average for the next two years.

If we then assume that restaking on Solana could capture a market share similar to Ethereum's restaking market, which currently accounts for 27% of its TVL, and use a range of 20% to 30%, then it implies that the potential market size for restaking on Solana could fall between $2 billion to $3.9 billion (as shown in the table below).

For now, the only real Jito competitor in the Solana restaking market is Solayer, which currently has a TVL of around $465M. While Solayer is currently benefiting from the “first mover advantage,” we could argue that Jito’s deeper integration with Solana’s core infrastructure, existing validator network, and proven track record in driving innovation position it to outpace competitors over time. Hence, it seems reasonable to assume that, in the long run, Jito (Re)staking could easily capture between 40% and 60% of the entire Solana restaking market. Based on these assumptions, Jito (Re)staking could represent a market opportunity of over $1 billion to $2.1 billion within the next two years (as shown in the table below).

For now, the only VRT competitors are Kyros, Fragmentric, and Renzo. This means the market opportunity is likely going to be spread among those three and implies that the most successful VRT providers have substantial growth potential ahead.

Jito (Re)staking ecosystem strategies

As we’ve seen, the potential market for Jito (Re)staking is substantial. From a user perspective, this presents a goldmine of DeFi opportunities on Solana, especially considering how early we are in this new trend. Here are some of the main ones worth exploring:

Restaking using one of the VRT Providers

The first and most straightforward DeFi strategy is to participate in restaking through one of the main VRT providers.

The main benefit is clear: it enables users to earn a higher APY on SOL compared to standard staking, while also offering the chance to be early in a new DeFi sector on Solana. This can provide exposure to potential token incentive rewards from these projects. However, as we’ve already mentioned this can come with added risk for holders that are related to composability, the potential for slashing, and the complexities that arise in the management of restaking positions and their risk profiles.

That said, if a user wishes to get involved with VRTs, an important question to ask is: Which one should a user choose? While there is no definitive answer, understanding the main value proposition of each VRT can help analyze their potential risk-to-reward profile:

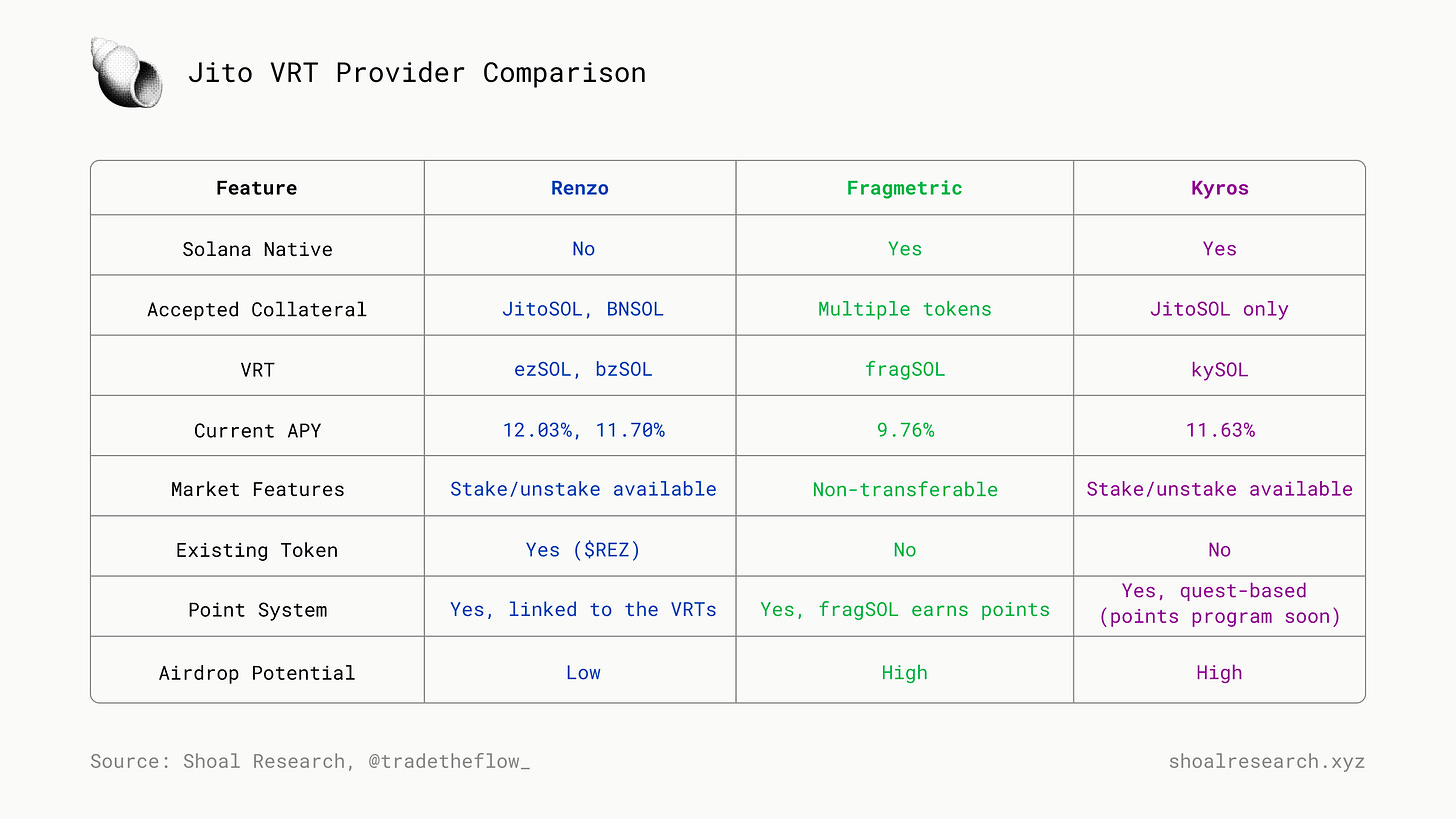

Renzo

Renzo is a veteran in the liquid staking arena, originally launched on Ethereum, where it has established a stronghold with a TVL of $1.13 billion. Renzo's foray into the Solana ecosystem with Jito (Re)staking marks a significant evolution in its cross-chain ambitions.

The protocol offers two distinct VRT options on Solana:

ezSOL: Accepts JitoSOL as collateral, focusing on Jito's MEV-enhanced staking ecosystem. Users familiar with Renzo can transition to Solana with tested systems backing their assets.

bzSOL: Accepts Binance's BNSOL as collateral, expanding access to Binance's staking infrastructure

Their single-collateral approach for each VRT trades flexibility for security and simplicity. What sets Renzo's implementation apart is its seamless deposit process – users can deposit SOL directly and the protocol automatically routes to the optimal conversion path, whether through Jupiter's swap API or direct minting.

The protocol here on Solana integrates with Renzo's existing points system and $REZ token infrastructure. However, the existence of their $REZ token means fewer speculative opportunities compared to newer protocols. Renzo appears positioned for users prioritizing operational stability over potential token rewards.

Fragmetric

Fragmetric is a Solana-native VRT provider that stands out for its broader focus beyond Jito (Re)staking technology, acting as an aggregator of various restaking protocols on Solana. This is an ambitious project that is more tech-oriented than the others because it needs to build the architecture to aggregate different restaking technologies on the network. This adds complexity and potential risks to the project, but it could become a compelling protocol if successful.

The Token2022 extension implementation uses transfer hooks to track fragSOL wallet balances in real-time. This enables direct NCN reward claims through their interface without diluting user contributions. While Ethereum's LRT ecosystem struggles with AVS token dumping issues, Fragmetric's architecture addresses this from the start through their on-chain reward tracking system.

Their Normalized Token Program enables multi-asset support beyond JitoSOL. When users deposit LSTs, the protocol mints fragSOL based on pool metrics, then creates corresponding nSOL for restaking in Jito vaults. This architecture handles slashing events efficiently - if slashing occurs, the Jito Restaking Slasher can claim proportional LSTs from the Normalized Token Pool using the slashed nSOL.

The protocol also features an on-chain points system. Their LF(ra)G Campaign credits F Points to fragSOL holders in real-time without additional steps, maintaining complete transparency through their reward module.

While fragSOL's current non-transferable status creates temporary liquidity constraints, Fragmetric's technical implementation demonstrates how restaking protocols can solve complex tokenomics challenges through architecture design rather than aftermarket solutions.

Kyros

Kyros is the only protocol that is Solana-native and fully Jito-aligned. The protocol also launched with direct stake/unstake functionality. This architecture makes it the most secure and liquid VRTs and optimizes for DeFi composability through single-asset specialization.Their implementation demonstrates how focused technical scope can enhance operational efficiency.

Its strong support with SwissBorg places it in a great position to kickstart network effect and grow partnerships within the Solana ecosystem. Last but not least, the protocol also launched a quest-based XP system and a points program.

Each protocol's technical architecture reflects different priorities in restaking implementation. Renzo prioritizes proven security measures through cross-chain compatibility and tested infrastructure integration. Fragmetric emphasizes technical innovation with multi-token support and advanced normalization mechanisms. Kyros optimizes for operational efficiency and security through single-asset specialization and streamlined DeFi integration.

These architectural differences create distinct risk-reward profiles for users based on their technical requirements and risk tolerance. The success of each approach will likely influence future VRT protocol designs on Solana and beyond.

LP opportunities on Kamino

The VRT ecosystem extends beyond simple staking. For users seeking to optimize their yields, Kamino's liquidity pools offer an intriguing opportunity to stack multiple revenue streams while maintaining exposure to Jito's restaking infrastructure.

What makes these pools particularly compelling is their risk profile. Since the paired tokens (VRTs and JitoSOL) track the same underlying asset, users face minimal impermanent loss - a rare characteristic in DeFi liquidity provision. This creates an opportunity to capture additional token incentive rewards from VRT providers without taking on significant new risks.

At the moment, only Renzo and Kyros offer liquidity pools. Here are the key characteristics of each:

Renzo

At the time of writing, Renzo's ezSOL-JitoSOL pool has a TVL of $4.6M and generates 8.19% APY through a combination of Jito incentives and trading fees. Users earn this on top of their base staking returns, while also accumulating Renzo points for potential future benefits.

Link: https://app.kamino.finance/liquidity/5TQHajVurbMnwieFUXNcABuwkjfGtYQAi5tRhXJDAqy3

Kyros

Kyros takes a similar approach with their kySOL-JitoSOL pool. The TVL in the pool is the highest between the two, at around $8M, which makes kySOL the most liquid VRT. Further, the pool is currently yielding 2.74% APY. Market participants also speculate about incoming Raydium incentives, which could boost returns further. The possibility of future Kyros token rewards adds another layer of potential value capture as the pool earns Kyros points.

Link: https://app.kamino.finance/liquidity/5ESAmxob1RsTrMVt7oaqvyDVoo4eD1Ns7s2xWiK4RjMK

Kamino Lend

Kamino has recently expanded its lending offerings to include both ezSOL and kySOL in its Jito Market. This integration creates new opportunities for VRT holders to maximize their yield potential.

This new lending market has already seen significant adoption, with over 220K ezSOL ($63.17M) and 11.45K kySOL ($3.27M) supplied to their respective markets. Users can earn different types of rewards depending on which VRT they utilize - ezSOL positions are eligible for REZ token incentives, while kySOL users can accumulate Kyros points

However, users should note that while looping strategies can amplify returns, they also increase the risk of liquidation during market volatility. The protocol utilizes a liquidation penalty range of 5.00% - 15.00% to maintain market stability.

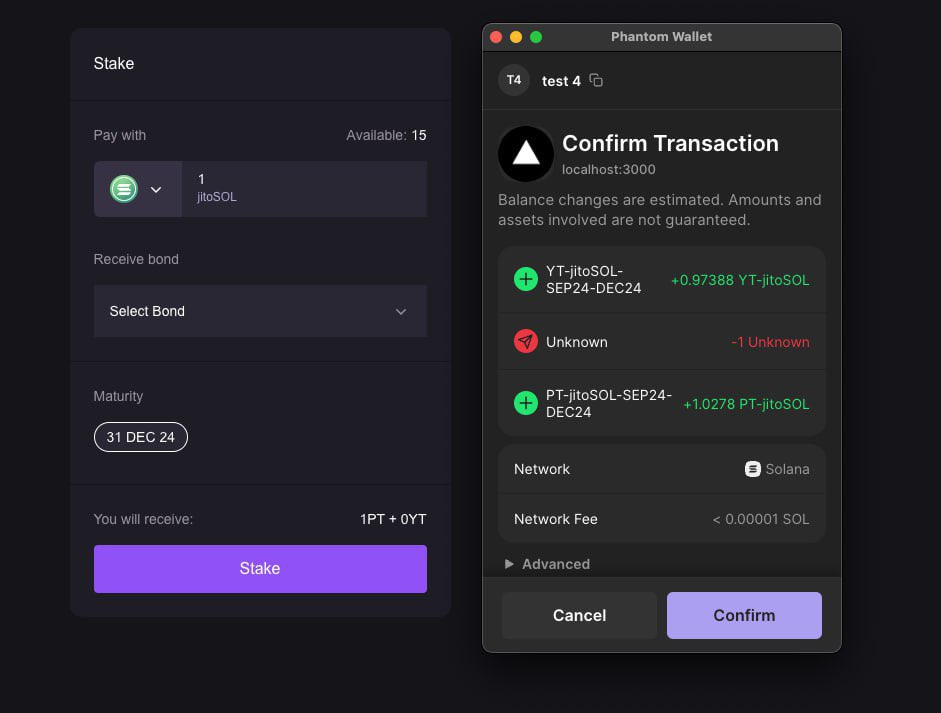

Yield trading

Yield trading is another promising strategy for users who want to speculate on potential token rewards from VRT providers. This is similar to protocols like Pendle on Ethereum. While yield trading is still new to Solana, significant developments are underway, and the sector holds substantial potential.

How It Works:

Deposit an Asset:

A user deposits a yield-bearing asset, such as a VRT, into a yield trading protocol through a vault with a specified maturity date.Tokenize the Yield:

The protocol separates the principal from the yield, issuing two tokens:Principal Token (PT): Represents the right to reclaim the principal asset at the end of the term.

Yield Token (YT): Represents the right to earn yield from the underlying asset during the specified yield period.

Trading and Yield:

Both PT and YT can be traded independently. For example, users can sell YTs to speculate on future yields or retain PTs as a stable position on the principal.Maturity:

At the end of the yield period, PT holders can reclaim the original deposited asset, and YT holders cease to receive yield.

Example:

Users deposit kySOL (or other whitelisted VRTs) for a fixed term, such as nine months. Upon deposit, two tokens are issued:

pSOL: Pegged 1:1 to the original deposit, representing the principal.

ySOL: A token that accrues staking yield generated by the deposit until maturity.

This enables more nuanced positions than traditional staking. Users seeking immediate liquidity can sell their ySOL while maintaining long-term exposure through pSOL. Yield hunters can accumulate ySOL at a discount if they expect higher future returns or potential token incentives. When the vault matures, PT holders reclaim their original deposit while YT holders finish collecting their yield.

Different Protocol Involved

The yield trading landscape on Solana is expanding through a few distinct implementations, each approaching yield optimization differently.

RateX: RateX won the Solana Renaissance Hackathon with their leveraged yield trading implementation. Backed by the Solana Foundation, they're building infrastructure for amplified returns through strategic stake management.

Currently offering markets across all major Solana restaking tokens - with kySOL (29.232% yield, 2x leverage, $397.7K TVL), and ezSOL (10.185% yield, 1x leverage, $59.1K TVL), all with 158-day maturity except sonicSOL at 66 days. The protocol aims to serve both retail and institutional traders in the VRT market through a high-performance trading environment, where positions can be leveraged up to 4x depending on the market.

Learn more: https://x.com/RateX_Dex/status/1846876952533389694

Twitter: https://x.com/RateX_Dex

Website:

https://rate-x.io/

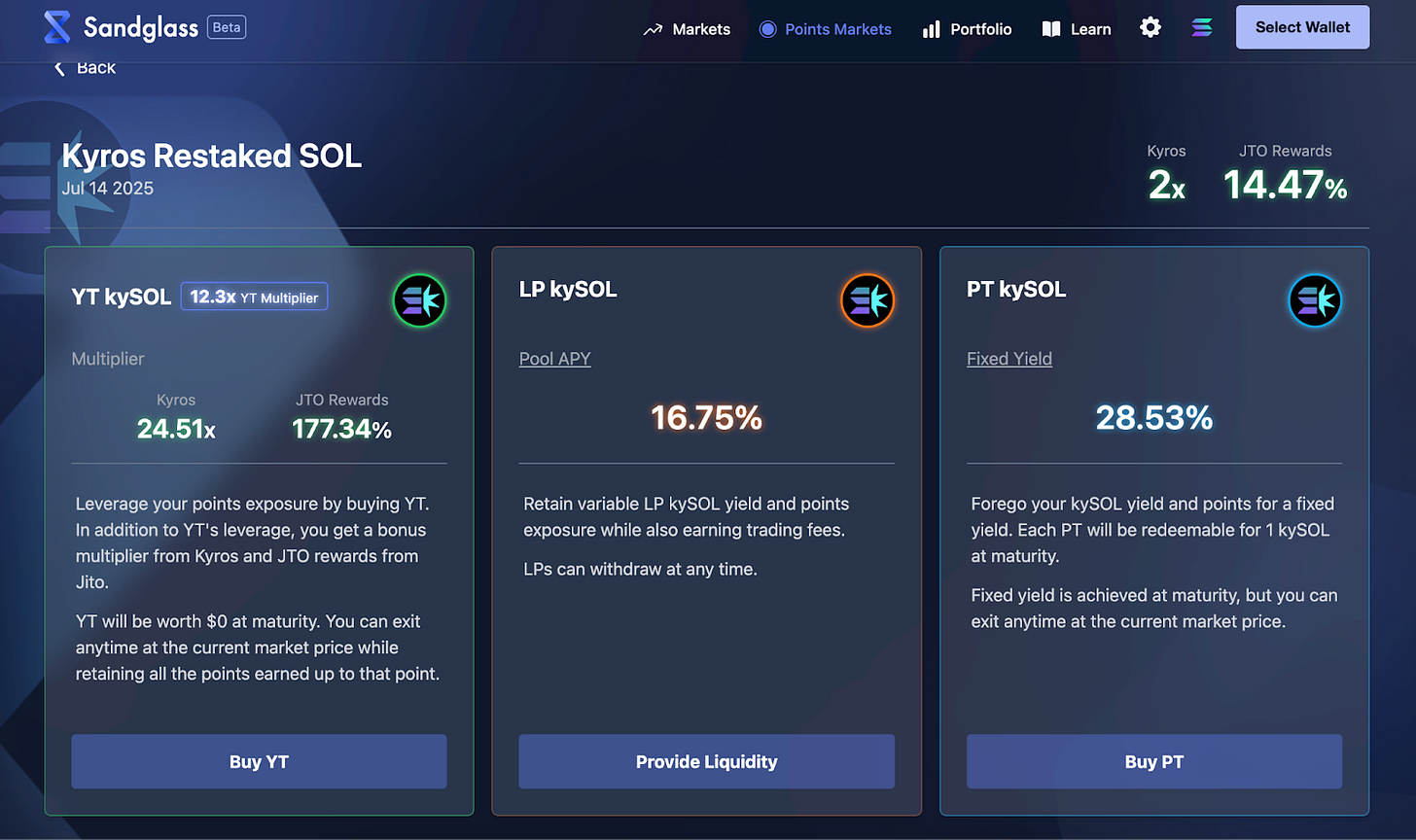

Sandglass: Built by the Lifinity team, Sandglass is a yield trading protocol on Solana. The protocol offers three distinct strategies for kySOL with compelling yields: YT kySOL offering 177.34% in JTO rewards with a 24.51x Kyros points multiplier and 12.3x YT multiplier, LP kySOL generating 16.75% pool APY, and PT kySOL providing 28.53% fixed yield at maturity.

The protocol is noteworthy due to its integration with Kyros's point system, offering 2x points multiplier and 14.47% JTO rewards across positions. Despite being in beta, it has already gained significant attention due to its competitive yields and multi-token reward structure.

Learn more: https://x.com/sandglass_so/status/1817910180878934242

Twitter: https://x.com/sandglass_so

Website: https://sandglass.so/markets

Exponent:

Exponent introduces fixed-rate trading mechanics to Solana's DeFi ecosystem. Their implementation focuses on stable returns rather than variable yields, creating new opportunities for risk management in yield trading.

Recently integrated with KyrosFi, the protocol offers multiple yield strategies: their Liquidity vault earning 33.5% liquid APY (combining Kyros points, kySOL yield, and JTO rewards), and PT-kySOL offering 27% fixed APY until June 14th with position sizes up to 100 SOL.

Exponent has also implemented a points boost system offering up to 50.23% APY for SOL-Jito Restaking positions. Users can earn 2x Kyros Points and an additional 5,650 JTO rewards over the next month. As a newly launched, double-audited protocol with a clean UX, their primary innovation remains the fixed-rate infrastructure for yield positions, allowing users to either leverage points through YT tokens or earn fixed yields through PT tokens.

Learn more: https://x.com/ExponentFinance/status/1857449901199954196

Twitter: https://x.com/ExponentFinance

Website: https://www.exponent.finance/income

Pye: Pye won the Solana Radar Hackathon with their forward-selling yield implementation. The protocol enables stakers to trade future yield streams, creating immediate liquidity for staked positions.

The protocol allows stakers to create zero-coupon bonds using whitelisted VRT deposits. For example, users can deposit ezSOL for a fixed term, such as nine months, and receive two tokens: pSOL, pegged 1:1 to the deposit, and ySOL, which accrues all staking yield until maturity. Both tokens are liquid and can be traded independently, providing stakers with immediate liquidity and greater flexibility in managing their positions before the maturity date.

While still pre-launch, their architecture introduces new mechanisms for extracting value from staked assets before maturity.

Example Implementation form Pye on X

Twitter: https://x.com/pyefinance

DeFi opportunity in Eclipse

Eclipse, Solana's first SVM L2 on Ethereum, has integrated ezSOL and kySOL, marking the beginning of cross-chain VRT adoption. This integration creates new opportunities for optimizing VRT positions across both ecosystems.

Users can bridge their VRT to Eclipse via Hyperlane. Within the Eclipse ecosystem, when users bridge their VRT to Eclipse, they can leverage DeFi opportunities in that chain to optimize yield and potentially benefit from token incentive rewards from the VRT Providers as well as other DeFi players like Bridge, Lending and Borrowing exchange and Eclipse itself. Indeed, Bridging VRT to Eclipse enables users to earn Grass passively.

Some of the potential future strategies include:

Liquidity Provisioning (LP): For simpler strategies, users can LP their VRT with SOL on DEXs like Orca to earn trading fees. Further, those who seek cross-ecosystem exposure can pair their VRT with ETH or Eclipse’s Unified Restaking Token (tETH) on Orca to maintain a balanced position between ETH and SOL.

Cross-Chain Strategies: Those who seek cross-ecosystem exposure can also pair their VRT with ETH or Eclipse’s Unified Restaking Token (tETH) on Orca to maintain a balanced position between ETH and SOL. Further, Eclipse’s significant base of ETH-based assets allows for creative strategies. For instance, users can loop on Save by depositing VRT, borrowing USDC, and swapping to ETH. This creates leveraged spot exposure to both SOL and ETH while earning potential token reward incentive.

Stablecoin Minting: Soon, users will be able to mint decentralized stablecoins using VRTs as collateral on platforms like Neptune. This could unlock further new utility across the Eclipse ecosystem and even more rewards down the line.

Automated Strategies and Lending: Platforms like Leverage.fun might offer automated vault strategies and structured products to optimize returns. Moreover, cross-chain lending and borrowing of VRTs will also be enabled through protocols like EnsoFi, expanding capital efficiency for users.

Synonym finance

Synonym is a natively cross-chain lending market built on a hub-and-spoke model and powered by the Wormhole cross-chain technology stack. This means that with Synonym, users are able to earn, yield, borrow, repay, and withdraw from any chain, all from a single unified interface. For instance, someone can deposit on chain A, borrow on B, and repay/withdraw from C, D, etc. What that enables is a very powerful tool for maximizing farming/yields.

Synonym is close to having its Solana integration live. When that happens, it could enable a lot of DeFi opportunities, first with Jito and then with the VRT Providers once integrated. Hence, users will soon be able to do cross-chain lending and borrowing with JitoSOL or other VRTs and benefit from the single unified interface to optimize yield opportunities in DeFi. As a second-order effect, this could also help users earn potential token reward incentives from Synonym as well as other DeFi partners, like the VRT Providers.

For instance, a user could deposit kySOL as VRT collateral on Solana and borrow ETH to participate in multiple other DeFi opportunities on EVM. Alternatively, a user could also deposit ETH to borrow SOL and engage with VRTs. This can help users optimize their DeFi strategy by maximizing yield and getting exposed of multiple layers of points program from different chains.

Their implementation has already demonstrated success with cross-chain strategies. For example, users have deposited weETH and ezETH as LRT collateral, borrowed USDC on Scroll, then used it with Ethena's sUSDe to earn significant SCR airdrop rewards.

The Solana integration will enable several key functions:

JitoSOL deposits earning SYNO and partner incentives

Borrowing against JitoSOL on any EVM chain

Cross-chain yield optimization with borrowed assets

Multi-layer LRT point accumulation across chains

Synonym recently launched their optimistic finality upgrade, reducing cross-chain borrowing latency while improving security. Their roadmap includes a complete app overhaul and tokenomics V2 launch within weeks, followed by full EVM <> SVM borrowing functionality.

This implementation could significantly expand VRT utility by enabling Solana's restaking assets to function as collateral across multiple EVM chains, potentially increasing demand for Jito's restaking infrastructure.

Wrapping up

In this piece, we’ve explored the potential of restaking on Solana and seen how, over the long run, this technology could make the Solana ecosystem more interconnected, secure, and efficient by extending the consensus layer of the main chain to other decentralized services. Market-wise, this represents a substantial opportunity.

In that sense, it seems that Jito, with its innovative (Re)staking technology stack, is well-positioned to lead this growth. Its robust architecture and established network effect, driven by its strong leadership within Solana’s DeFi ecosystem, make it a key potential player. But while Jito provides the backend technology, VRT providers are other crucial players in the staking stack, responsible for minting liquid restaking tokens, as well as delegating and selecting NCNs. Currently, the only VRT providers are Renzo, Fragmetric, and Kyros, and a lot of the value creation from restaking is expected to come from them.

However, while the promise of restaking is substantial, it is important to note that it comes with added risks. These include composability issues, the potential for slashing, and the complexities of managing restaking positions and their risk profiles. Restaking, especially on Solana, is still in its early stages, and users should remain cautious and informed while experimenting with this new technology.

Looking ahead, the integration of restaking into Solana’s ecosystem marks an important milestone. It opens the door to new DeFi strategies and a richer staking landscape, while also raising important questions about how the technology will evolve. Whether as an investor, developer, or observer, keeping an eye on these is an early chance to explore higher yields, dive into emerging projects, and potentially benefit from token rewards—all while watching a promising technology take its first steps.

References

Jito Network. (n.d.). Announcing Jito Restaking. https://www.jito.network/blog/announcing-jito-restaking/

Jito Network. (n.d.) Restaking Stats.

https://www.jito.network/restaking/stats/Kamino Finance. (2025, Jan 14). [Tweet]. X. https://x.com/KaminoFinance/status/1879097807975370816

Jito Network. (n.d.). Restaking Stats. https://www.jito.network/restaking/stats/

Renzo Protocol. (n.d.). Liquid Restaking. https://app.renzoprotocol.com/ezsol

Pye Finance. (2024, Oct 05). [Tweet]. X. https://x.com/pyefinance/status/1842632817777524895

Hashed. (n.d.). Solana Restaking. Dune Analytics. https://dune.com/hashed_official/solana-restaking

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author's own, not the views of their employer. This post has been created in collaboration with the Jito foundation. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research. Due to the rapidly changing ecosystem, some numbers quoted here might change from time to time; consider checking with the protocol itself for accurate data.