Jupiter Exchange: Solana’s Dex Aggregator

Unpacking the fundamental investment catalysts behind Solana’s premier DEX aggregator.

Shoal Research Contributors: Gabe Tramble

Introduction

The Solana Renaissance

Solana is a Proof-of-Stake Layer 1 blockchain which optimizes for high performance and throughput, to deliver fast execution speeds and low transaction costs. Its integrated architecture, which is distinctly separate from that of EVM chains, enables developers to focus on building ready-to-use applications in Rust. Solana currently serves 121 protocols across its ecosystem, secured by 2,156 validators (2nd most behind Ethereum), and holds the 5th most DeFi TVL across blockchains at $1.38B.

Solana has faced and overcome a great deal of adversity in its short but eventful history: from technical issues such as network instability to broader issues such as a hazardous relationship with SBF and Alameda which prompted a mass exodus of users, developers, and liquidity from the chain following the collapse of FTX. Nonetheless, co-founder Anatoly Yakovenko alongside a tight-knit community of users and developers remained positive and forward-thinking even at the lowest of times, demonstrating Solana resiliency and willingness to adapt and overcome adversity; a strong positive indicator for future ecosystem investment opportunities.

As the price of bitcoin rallied in 2023 around growing speculation of a spot ETF approval by the SEC, the crypto markets finally caught some tailwinds after a long stretch of crawling sideways. The price of $SOL followed in hot pursuit, spurring a face-melting rally that saw the price jump from $9.98 on January 1 2023, to $101.51 mark on January 1 2024, marking a 917.134% return. Ironically, narrative tends to follow price in crypto sometimes, and as SOL gradually continued its strong upwards momentum in the markets, MadLads mint went live, teams began announcing points programs and airdrops, and an emerging narrative around building applications Only Possible On Solana due the network’s unique architecture design began to encapsulate the attention of users, investors, and developers alike.

Solana DeFi in 2023

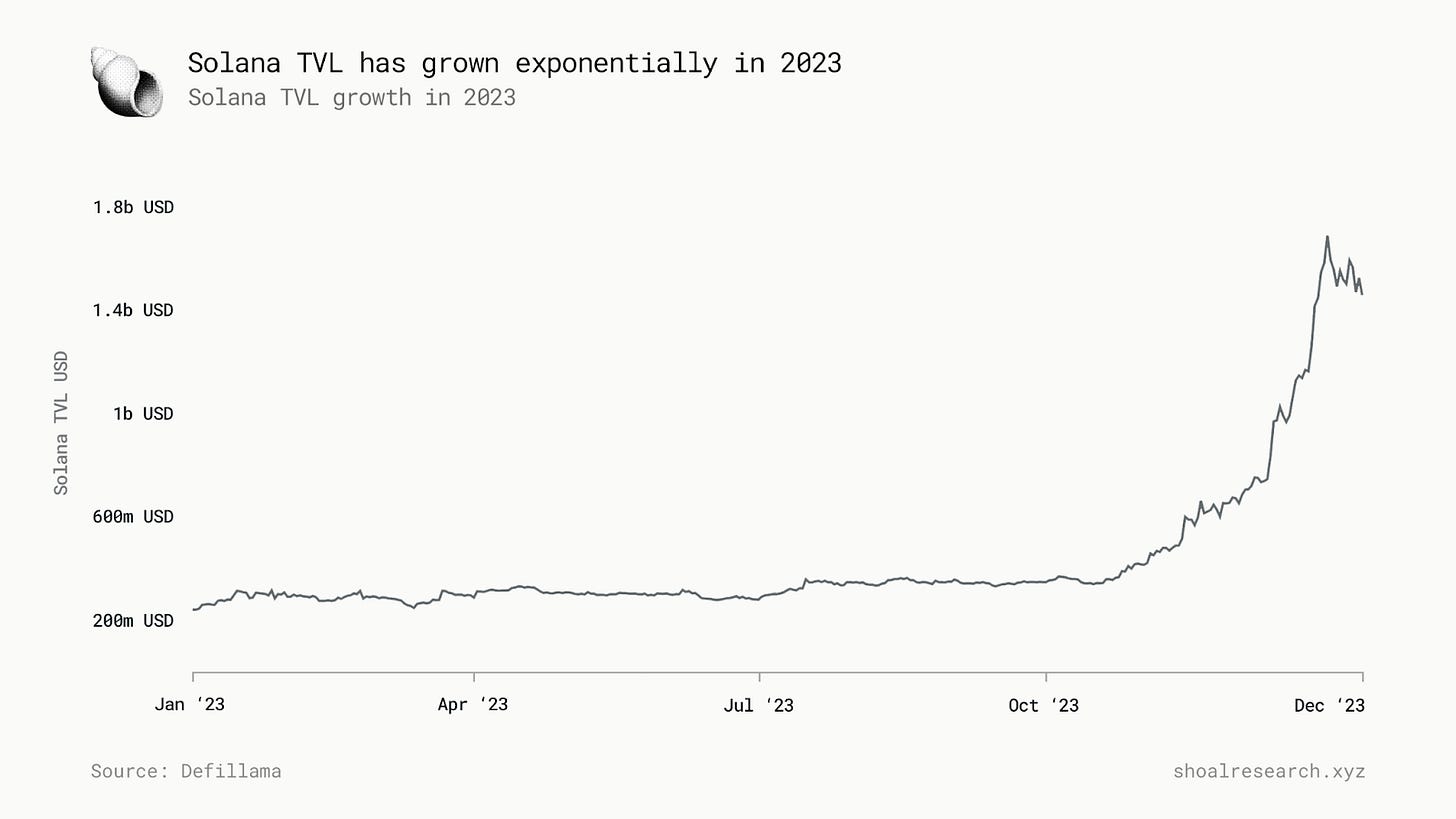

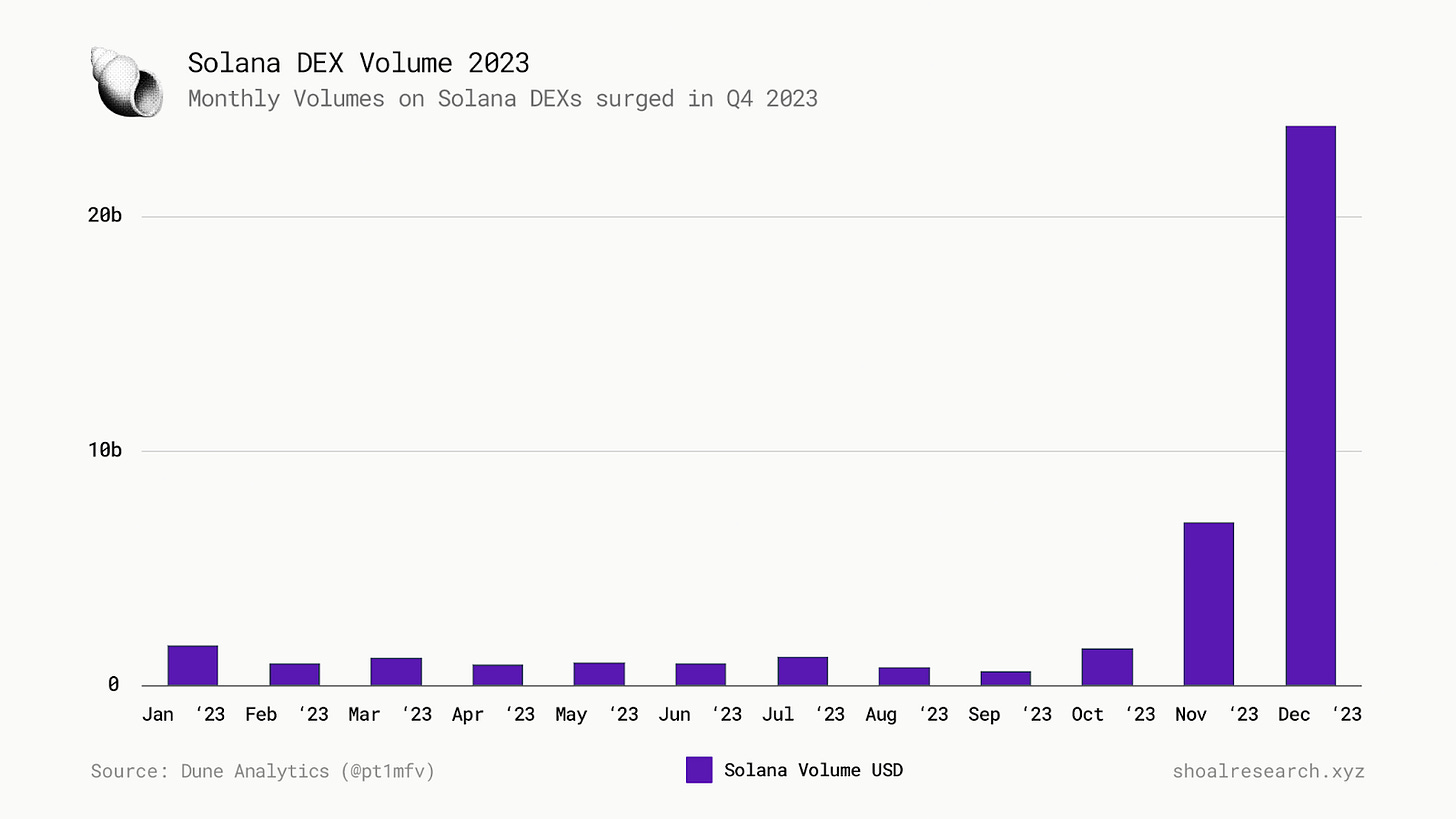

From January 1, 2023, to January 1, 2024, Solana recorded a significant increase in Total Value Locked (TVL) as well as its on-chain trading metrics. This period marks a significant phase in Solana's development, characterized by a substantial increase in both the value and volume of transactions despite its TVL decline following the FTX crash.

Key Highlights:

TVL Growth: Solana's TVL grew from $210.08 million to approximately $1.47 billion, marking an impressive 574% increase.

Total Swaps: There were 314,556,244 swaps executed on the network.

Total Trading Volume: The platform's total trading volume reached $42,036,692,506.

Solana’s monthly DEX volume reached $23.8b in December, marking a yearly high going into the new year.

Introduction to Jupiter

Jupiter launched in September 2021 as a DEX aggregator on Solana, with the purpose of providing a better trading experience for Solana users by routing liquidity from multiple sources as opposed to one. Though Jupiter was initially only a swap engine, the protocol has evolved to offer a number of different products for different users and has become a critical liquidity layer for the Solana ecosystem.

Three core anchors drive Jupiter’s business model:

1. Delivering the best UX possible

2. Maximizing the potential of Solana’s technical capabilities

3. Improving Solana’s liquidity landscape as a whole

2023 was a busy year for the Jupiter team, which shipped a handful of new core product offerings including a new DCA feature, limit orders, and perpetuals trading. There were a handful of various upgrades and optimizations within the core protocol as well, including an upgraded algorithm (Metis), a Bridge comparator tool, instant staked SOL > SOL swaps, and more developer tooling including the release of Jupiter Terminal and 2 major API upgrades.

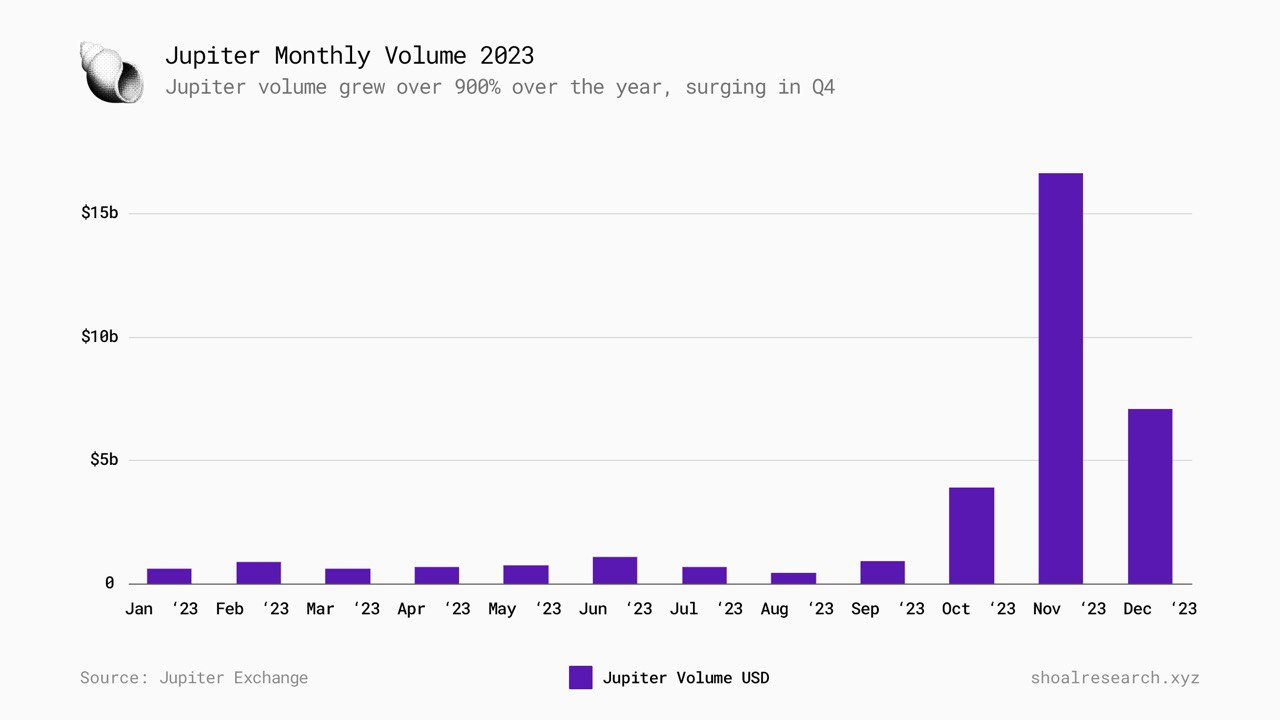

Jupiter 2023 Review: Volume

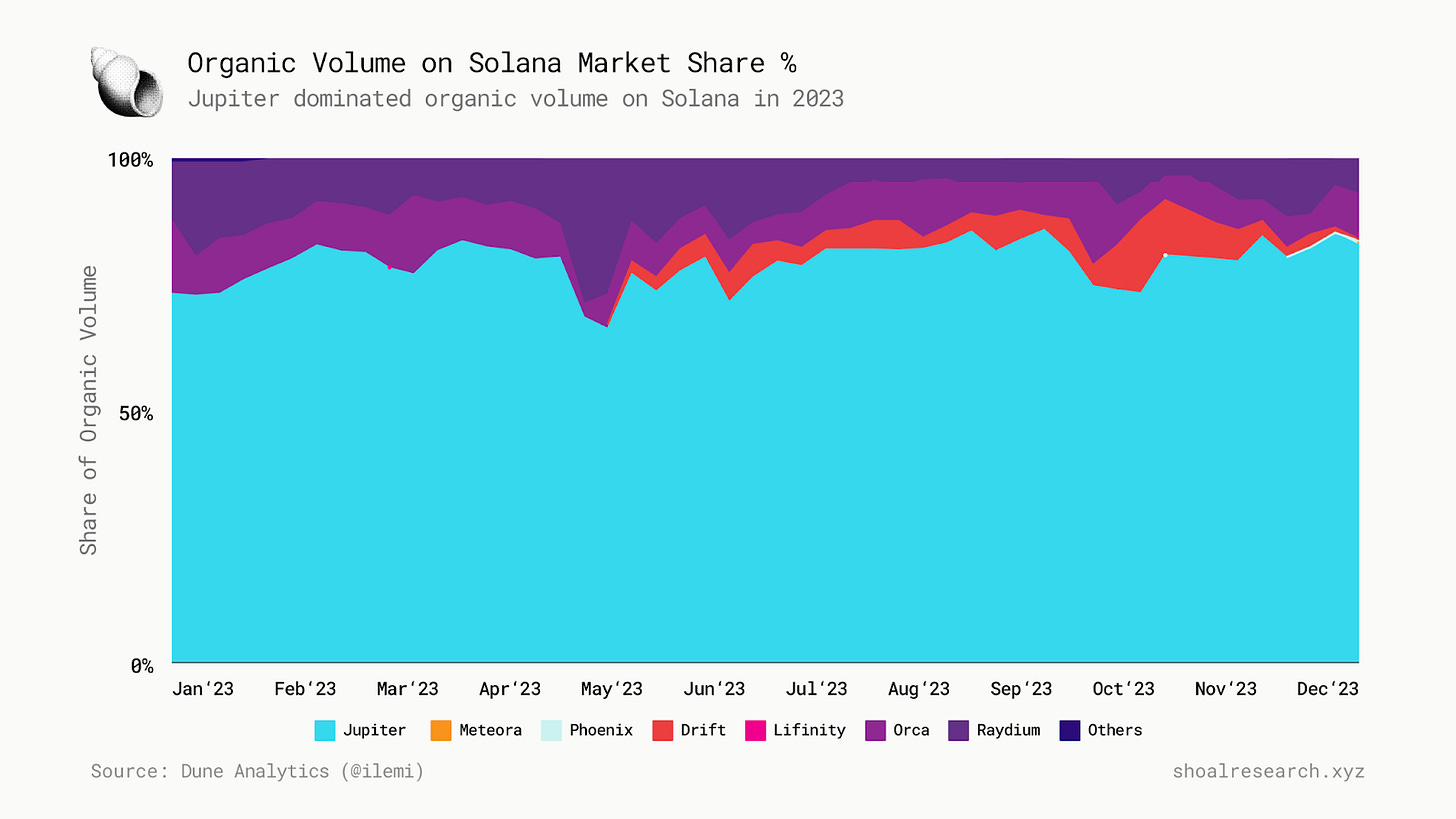

Jupiter’s $62,816,562,781 Total Volume accounts ~60% of all Solana DEX volume.

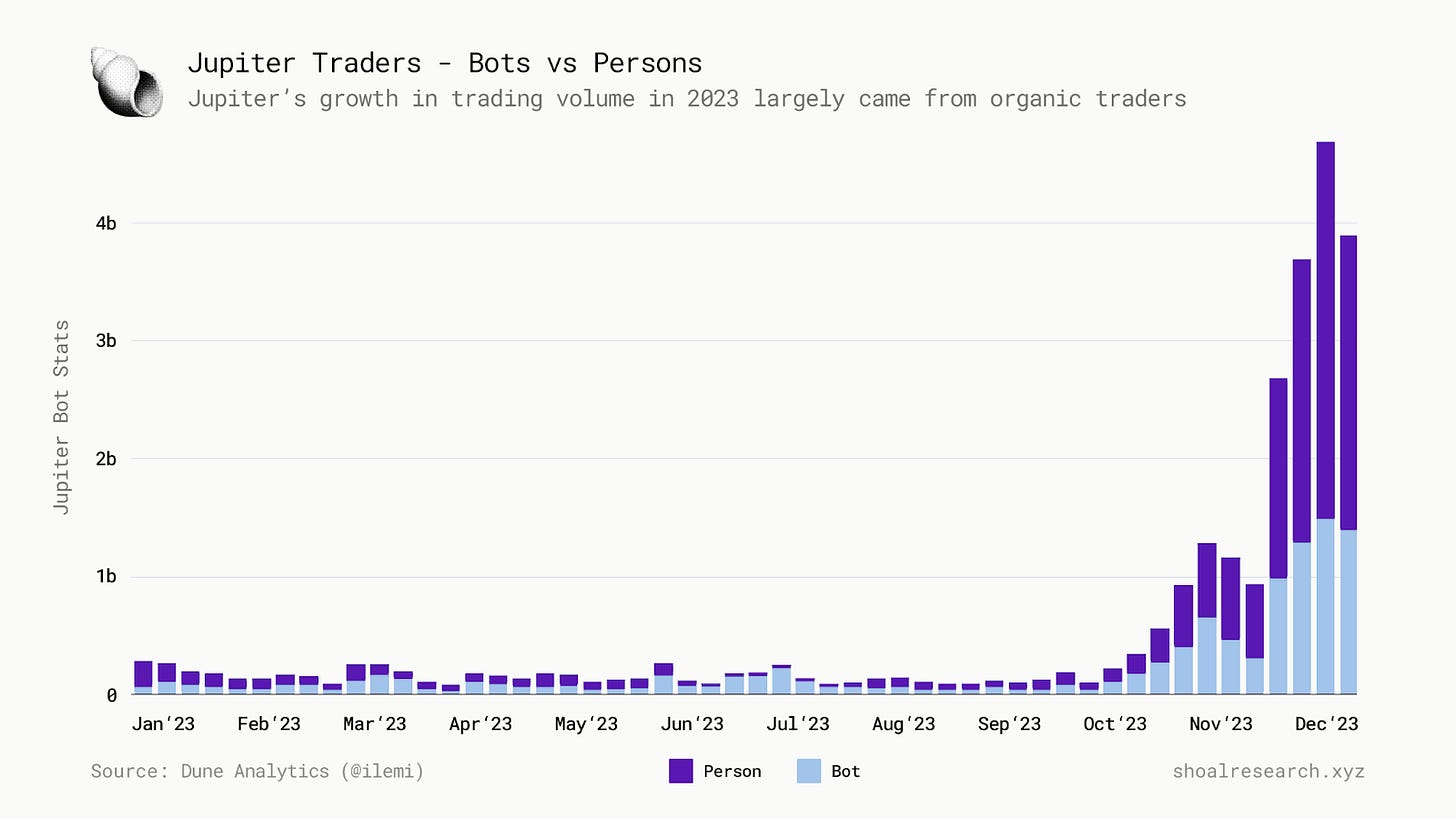

Jupiter monthly volume grew 994.48% from $649,258,200.00 on Jan 2023 > to $7,106,000,000.00 in December 2023. November volume exceeded $16B following the $JUP announcement at Breakpoint, marking a new all time high in monthly volume. Even more impressively, much of this uptick in volume (mainly Q4) came from organic trading activity

In this report, we unpack Jupiter’s product line and future plans, and explain the rationale behind our investment approach.

AMMs and Aggregators

Automated Market makers (AMMs) have been a novel innovation in the past few years in the digital asset space. On traditional exchanges like Coinbase or Binance, third party entities operate to provide liquidity so traders have a counterparty, which is the other side of the trade. These counterparties are known as market makers, since they “make” a market for traders to trade against, whilst taking a spread (fee) on each trade to remain profitable. With the advent of AMMs, traders can deploy digital assets that are market-made by math and code instead of sophisticated middlemen. By using AMMs, traders can enter and exit positions even with extremely low liquidity. One downside with low liquidity is that traders will experience slippage, which is the difference between expected and realized trade value. Traders can also lose value on a trade through the exploitation of information asymmetries in the public mempool, e.g. being front-run or sandwiched by sophisticated actors deploying MEV bots.

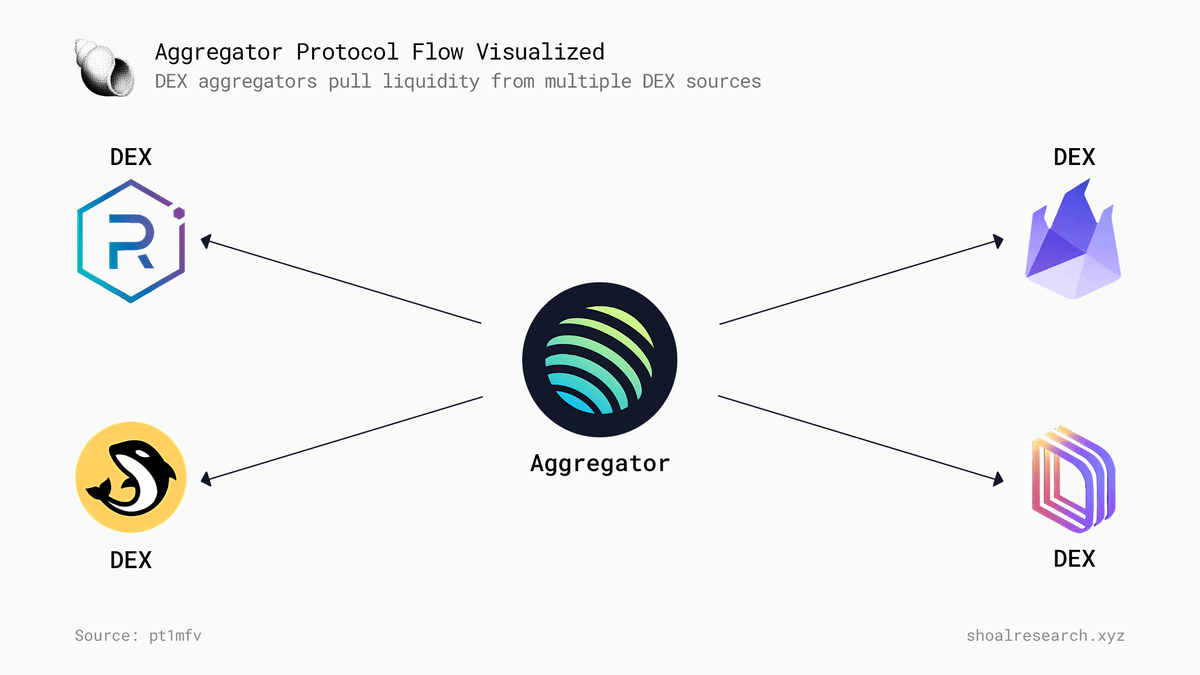

On-chain aggregators emerged to mitigate the impact of low liquidity trades by enabling traders to place orders which route liquidity from multiple sources as opposed to one. Liquidity can be pulled from a variety of sources including AMMs; though a number of teams have built solutions which enable market-makers to tap into off-chain liquidity (i.e. a CEX position) as well to help settle trades.

The primary benefit to this is better pricing as:

No gas costs incurred for CEX > on-chain transfers

Trades are not subject to MEV extraction.

As a whole, aggregators were built to deliver a better user-experience; large content platforms such as Meta or YouTube serve as aggregators for content, where users can view videos and images from many different obscure websites and sources without having to leave the interface to visit those external websites. Google aggregates information relevant to your search query across many different websites on the internet to deliver the best match in order of relevance. Similarly, Jupiter and other DEX aggregators source liquidity across multiple venues to offer better pricing for traders on their swaps.

Building On The SVM

To better understand Jupiter as a protocol, it is important to understand the role of the Solana Virtual Machine (SVM) and how it influences protocol design choices that developers must make.

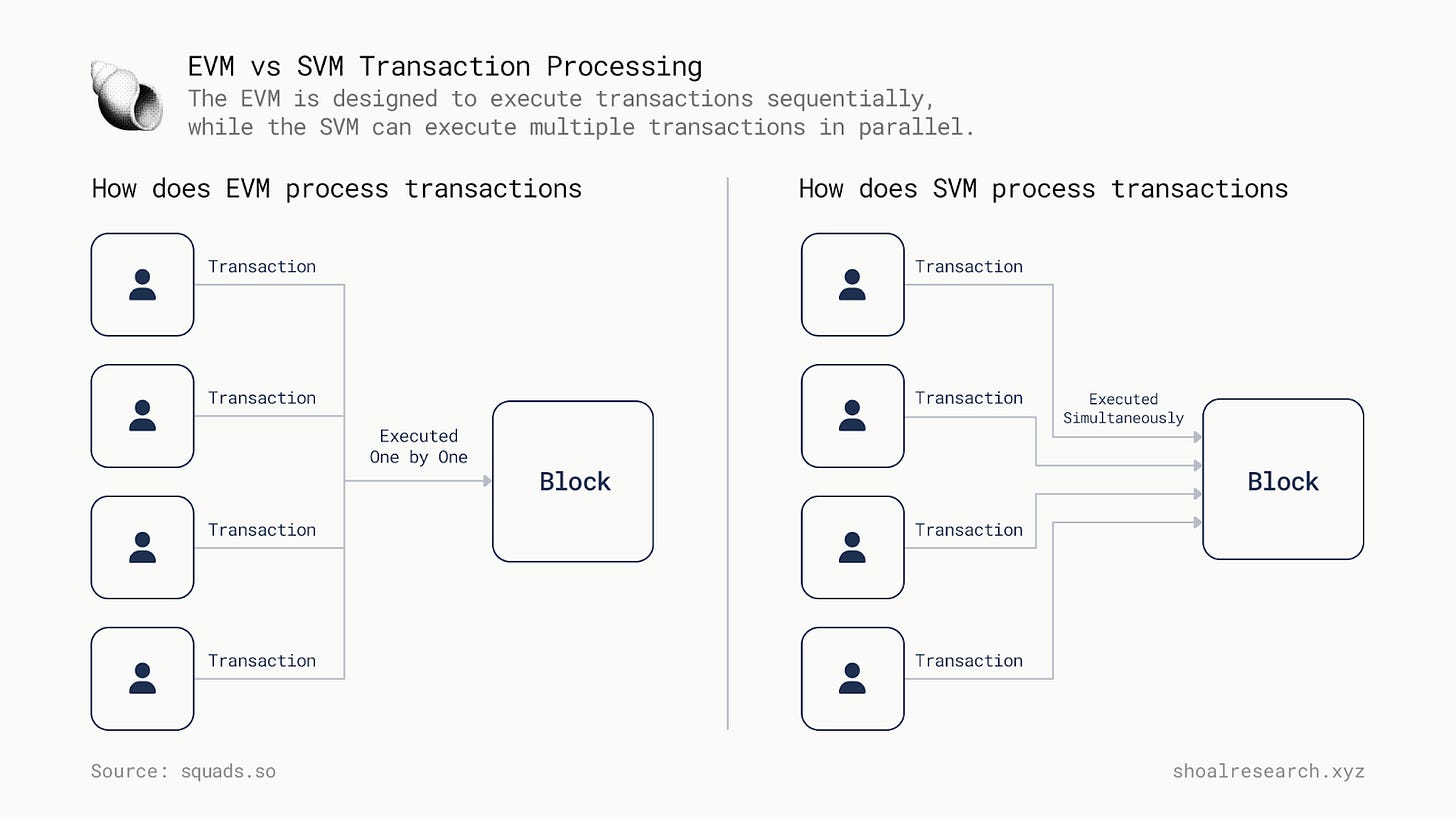

A Virtual Machine can best be described as one single entity maintained by thousands of connected computers running a validator client of a given chain, e.g. Ethereum, and is the environment in which all smart contracts and accounts actually exist. To this day, the majority of DeFi and other on-chain activity lives and breathes through the Ethereum Virtual Machine (EVM). However, though further out of the spotlight, we believe the SVM also features a robust architecture that is bound to continue to onboard more developers seeking to build consumer-centric applications optimized for speed and performance.

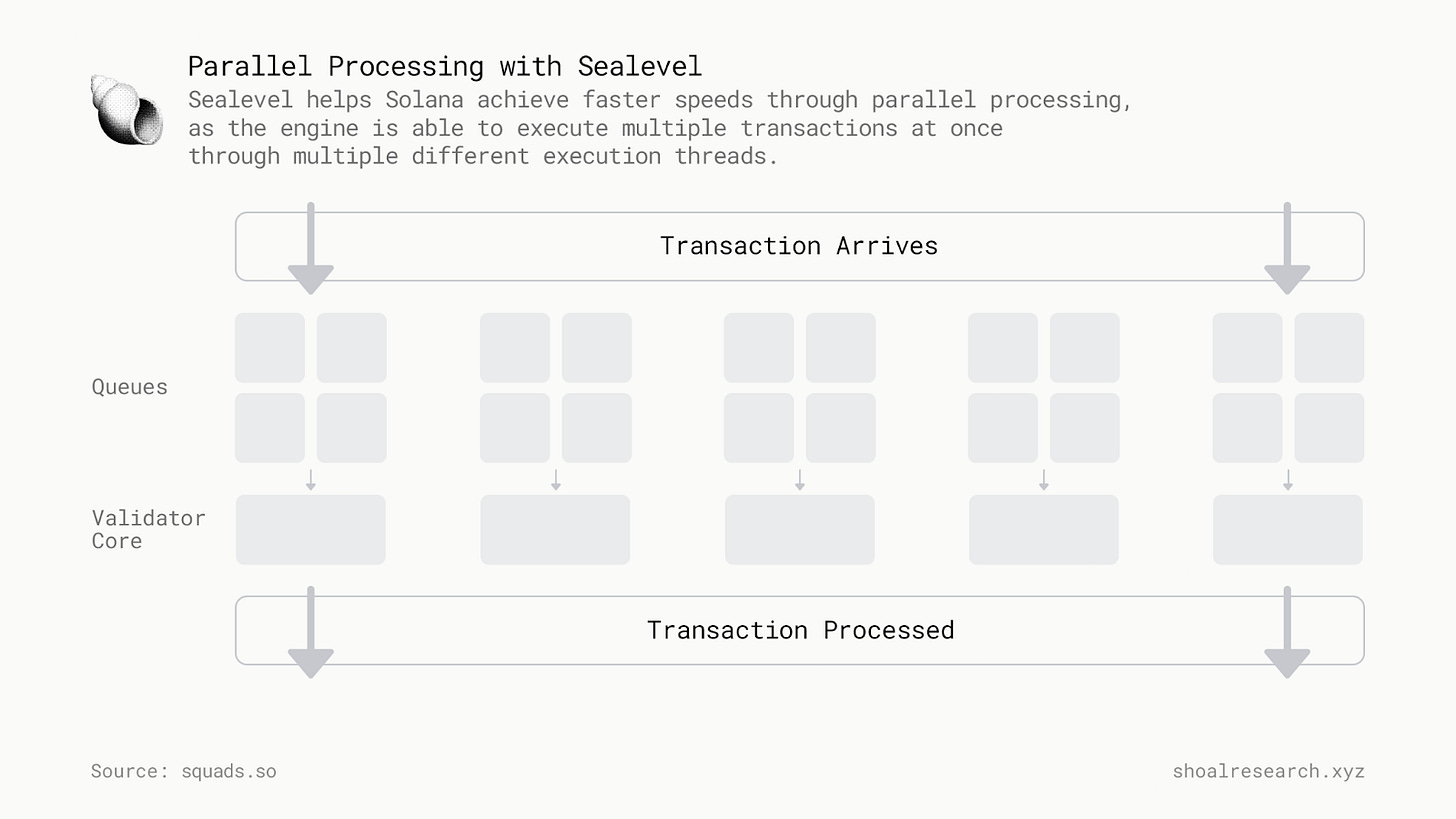

Smart contract code written in Rust, C, C++ is compiled into BPF bytecode by the SVM. The Sealevel engine is the key component to enabling parallel processing on Solana; as state access lists are integrated into Solana transactions (transactions include details around the particular state to be accessed) - this lets non-conflicting transactions run simultaneously, enabling for faster overall performance.

Whereas the EVM is a "single-threaded" runtime environment, meaning it can only process one contract at a time, the SVM is multi-threaded and can process more transactions in significantly less time. Each thread contains a queue of transactions waiting to be executed, with transactions randomly assigned to a queue.

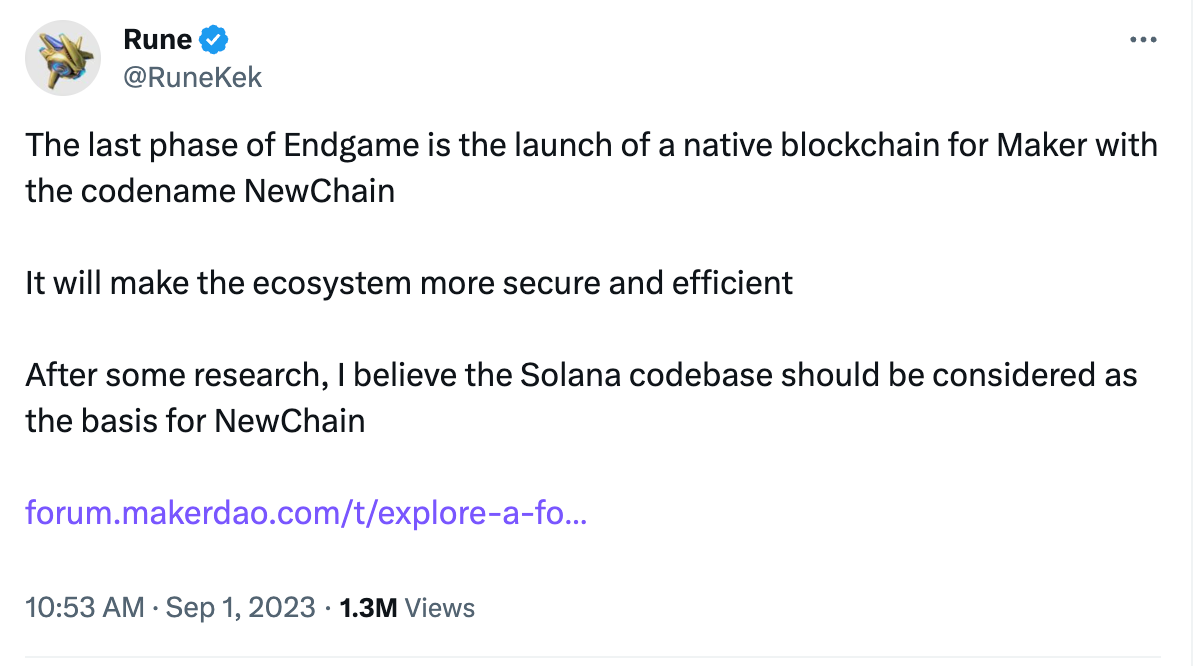

The emergence of L2s like Eclipse and Nitro, which utilize the SVM for execution, demonstrate the potential for further adoption of the SVM. Rune Christensen from MakerDAO sparked a lot of debate on Crypto Twitter earlier this year when he proposed his vision for utilizing the Solana codebase for the development of MakerDAO’s app-chain.

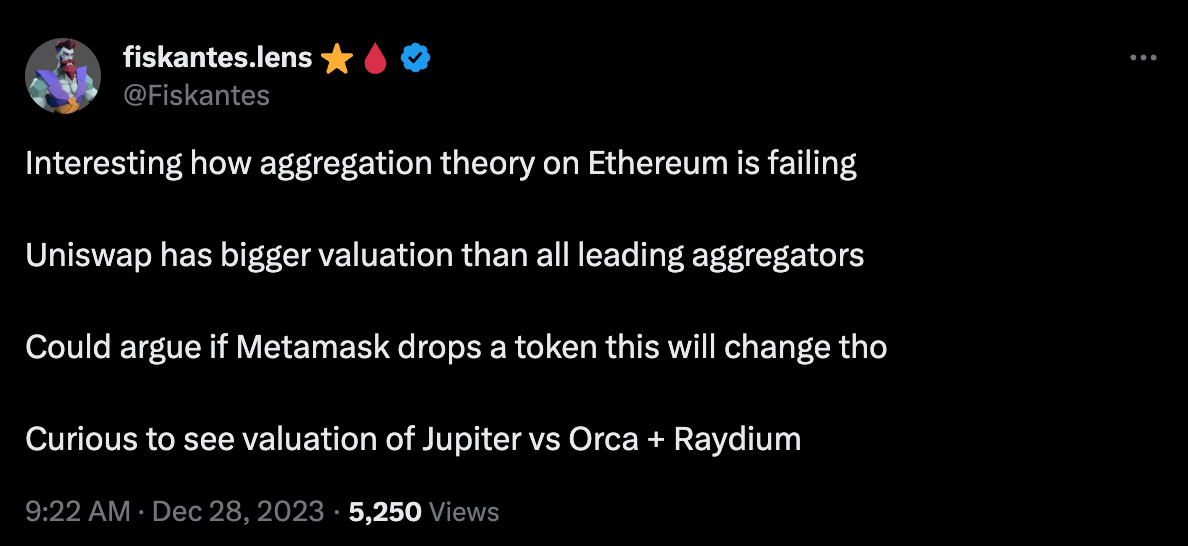

One of the most common gripes with Ethereum is that gas fees increase with user activity, making for an unpleasant user experience at most times but especially amid a bull market. Irrespective of gas costs, traders’ needs are quite simple - to receive the best quote possible for their trade. Aggregators like 1inch were built to help deliver better pricing to users by pulling liquidity from multiple sources as opposed to one specific DEX; however, transacting on Ethereum, e.g. pulling liquidity from multiple different pools, is a costly endeavor and can actually worsen the problem intended to be solved - it can actually be more beneficial to trade on Uniswap where liquidity is only pulled once.

Meanwhile, the opposite holds true on Solana, where gas costs less than a penny by default. The cost of pulling liquidity from multiple sources is virtually no different than pulling from one, and therefore a DEX aggregator is much more pragmatic and beneficial on a chain like Solana than an EVM chain. As the leading aggregator on Solana, we believe Jupiter is much better poised to see significant growth and adoption than aggregators on EVM chains in the long-term, which face higher costs and greater competition.

The same notion applies to alternative use-cases beyond simple A for B swaps, such as structured Dollar Cost Averaging (DCA) or Time Weighted Average Price (TWAP) products for users, which will be further elaborated on below. The underlying principle remains that low gas costs unlock a great deal of flexibility for application developers on Solana, and Jupiter is a premier example of this in action.

Product Overview

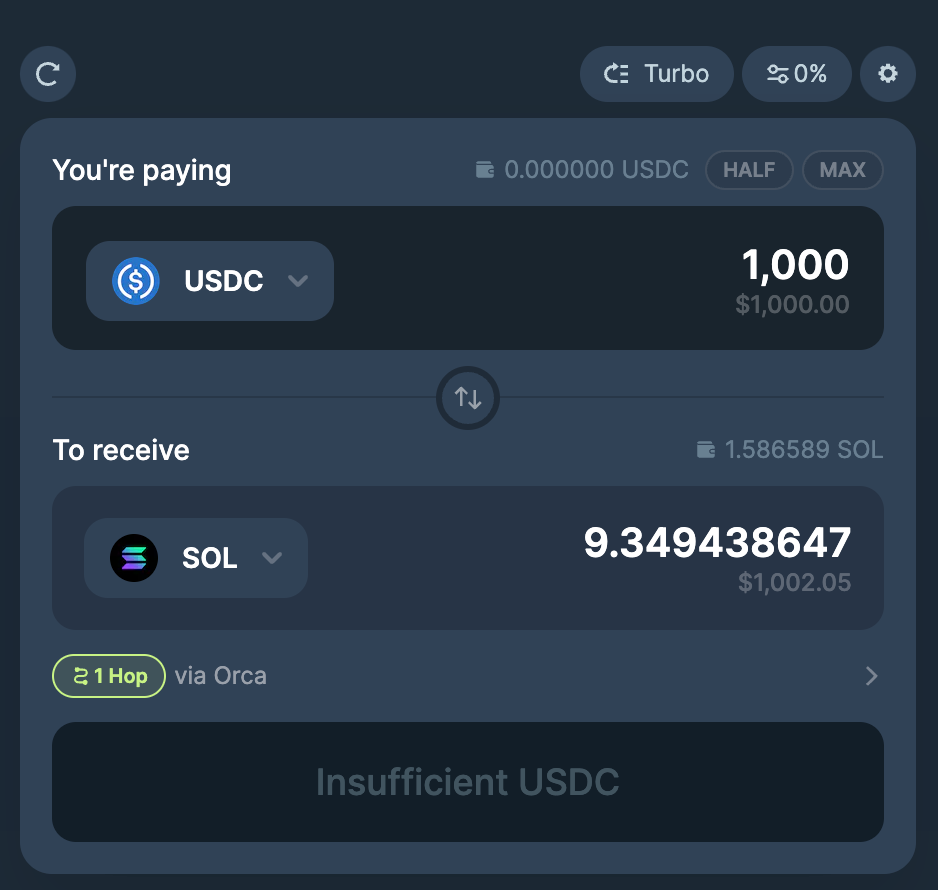

Jupiter Swap

Like any other decentralized trading venue, the most common use-case on Jupiter is the simple token A -> token B swap. Users can enjoy swapping for their favorite assets at competitive prices. Slippage and priority fee settings are completely customizable, general settings enable users to opt in to a direct liquidity route, to use wSOL instead of SOL, and to use versioned Txs (using the newer and better routing algorithm).

Developers can also take advantage of the Swap API to natively integrate Jupiter’s routing algorithm into their dApp - Kamino Finance uses Jupiter’s Swap API to enable features like single-sided deposits into their CLMM vaults (Autoswap).

Jupiter currently does not charge any additional protocol fees for swaps on top of the base gas fee and associated DEX fees, though we believe that continuous growth and sustainable adoption of Jupiter and Solana DeFi can prompt the JUP DAO to vote to implement a fee at some point in the future. It will be interesting to consider how this decision may be influenced by increased network activity driving up blockspace demand and costs, and by a potential restructuring of Solana fee markets. Currently, the 1inch aggregator on Ethereum does not charge a swap fee, while CowSwap has recently proposed a fee switch which would collect swap fees with the goal to be financially self-sustainable while keeping users incentivized.

Limit Orders

Instead of buying an asset at the current market price, traders who believe the price of the asset will change in the near-future can place limit orders. As a signed message with defined trade execution guidelines, or an “intent”, limit orders offer traders flexibility among a handful of other benefits such as better price settlement due to protection from MEV-induced slippage. This model benefits retail traders and institutions alike, and Jupiter now offers a venue for traders to place limit orders on Solana.

When a user places an order to purchase 1 SOL worth of $WIF, the order is ultimately matched by a keeper, a trusted protocol actor responsible for monitoring prices and executing orders. Keepers function in a similar way to solvers on CoWSwap or fillers on UniswapX. Upon execution of an order, the specified assets will appear in the user’s wallet.

Jupiter’s Limit Order function provides access to a wider range of token selections; as long as there is sufficient liquidity in the market, the token pair will be accessible to trade. Furthermore, users can specify an expiration time in their order, upon which any unfilled orders are canceled and refunded to the user’s wallet.

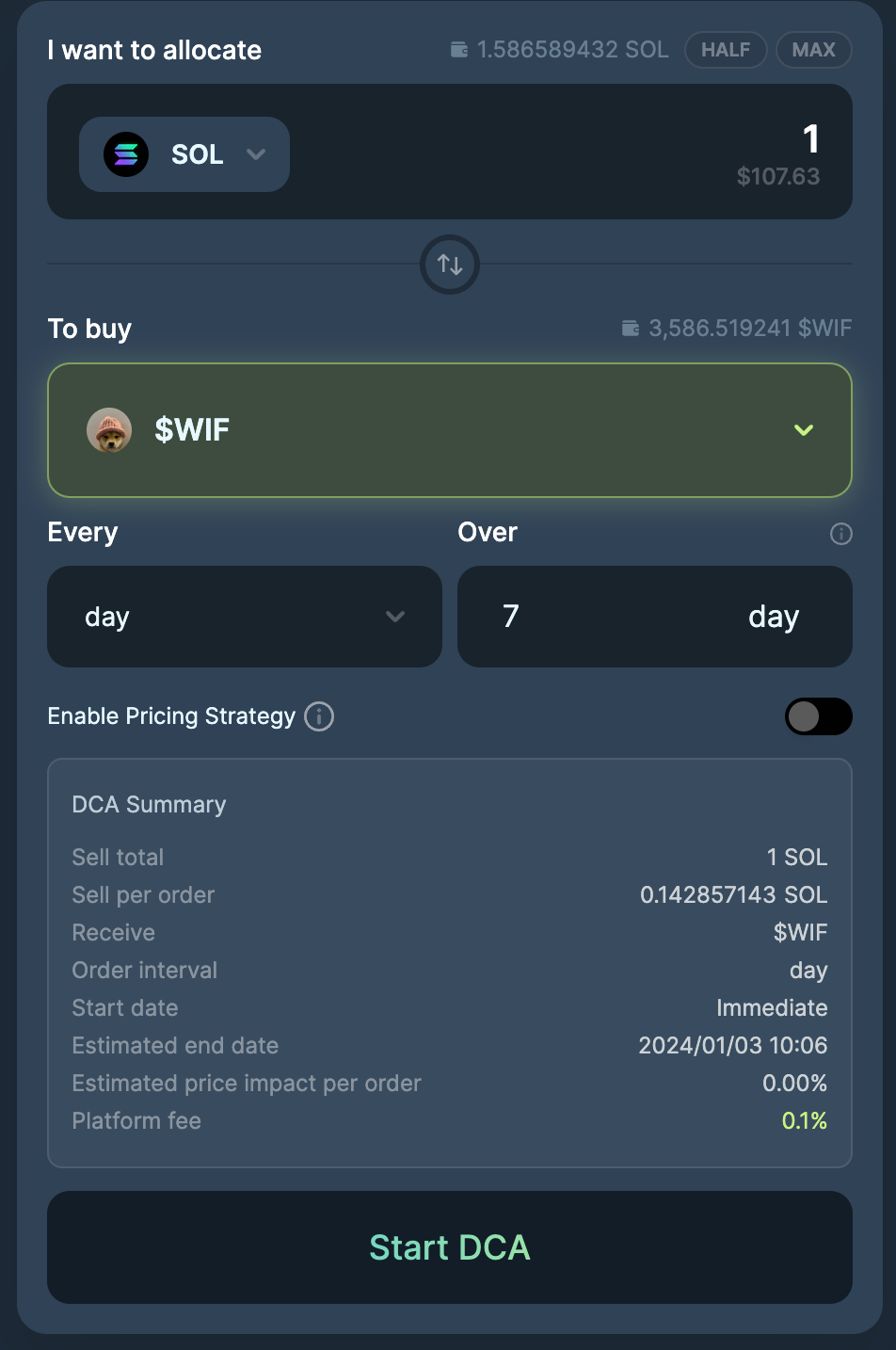

DCA

Dollar Cost Averaging (DCA) is a common investment strategy which involves splitting the allocation of capital over multiple trades as opposed to one; this is perfectly suited for long-term investors who are not concerned with short term volatility (e.g. buy $500 of SOL over 5 days). DCA can be useful for accumulating an asset during a bear market - the principle is to average out one’s entry price to mitigate volatility and generate greater returns over the course of time and change in market conditions. Likewise, DCA can also be helpful for taking profits in a bull market - instead of immediately selling off one’s position entirely, the DCA can help spread out sells to capture any additional upside that may occur during the unwinding.

Traders also can perform weighted average price strategies (TWAPs) to buy or sell assets. TWAPs, similar to DCAing, is used typically for large orders that need to be broken up into smaller parts to prevent price impact from buying all at once which can result in slippage (loss of funds). Since orders are executed for a period of time they resemble a DCA strategy of buying “x” amount over a certain time period.

Jupiter is one of a few platforms that has enabled users to execute frequent time-bound strategies on-chain, due to Solana’s high-throughput architecture (Drip Protocol was the original!). Performing a DCA with low time-frame transactions on Ethereum, e.g. daily, can result in hundreds of dollars in transaction fees versus fractions of cents on solana. Even on L2 if traders wanted to execute 10 trades over 1 hour the fees could quickly add up.

Perpetuals

To further add to their extensive product suite, Jupiter has also launched an LP <> Traders Perpetuals exchange earlier this year. Though still in beta, traders can trade SOL, ETH, and wBTC perps with up to 100x leverage, while LPs can lend capital to earn fees.

Perpetuals are derivatives contracts resembling traditional Futures, which enable traders to take on a greater position with less allocated capital (leverage) for the purpose of capitalizing on a future price movement.

On Jupiter, traders can open long or short positions on SOL, ETH, and wBTC using virtually any supported Solana token as collateral. Long positions require the corresponding underlying (e.g. a long SOL-USD position would require SOL collateral), meanwhile short positions require stablecoins as collateral. Traders can take on leverage by borrowing assets from the liquidity pool - a position on SOL-USD can be leveraged by 2x by borrowing 1x of SOL from the JLP pool.

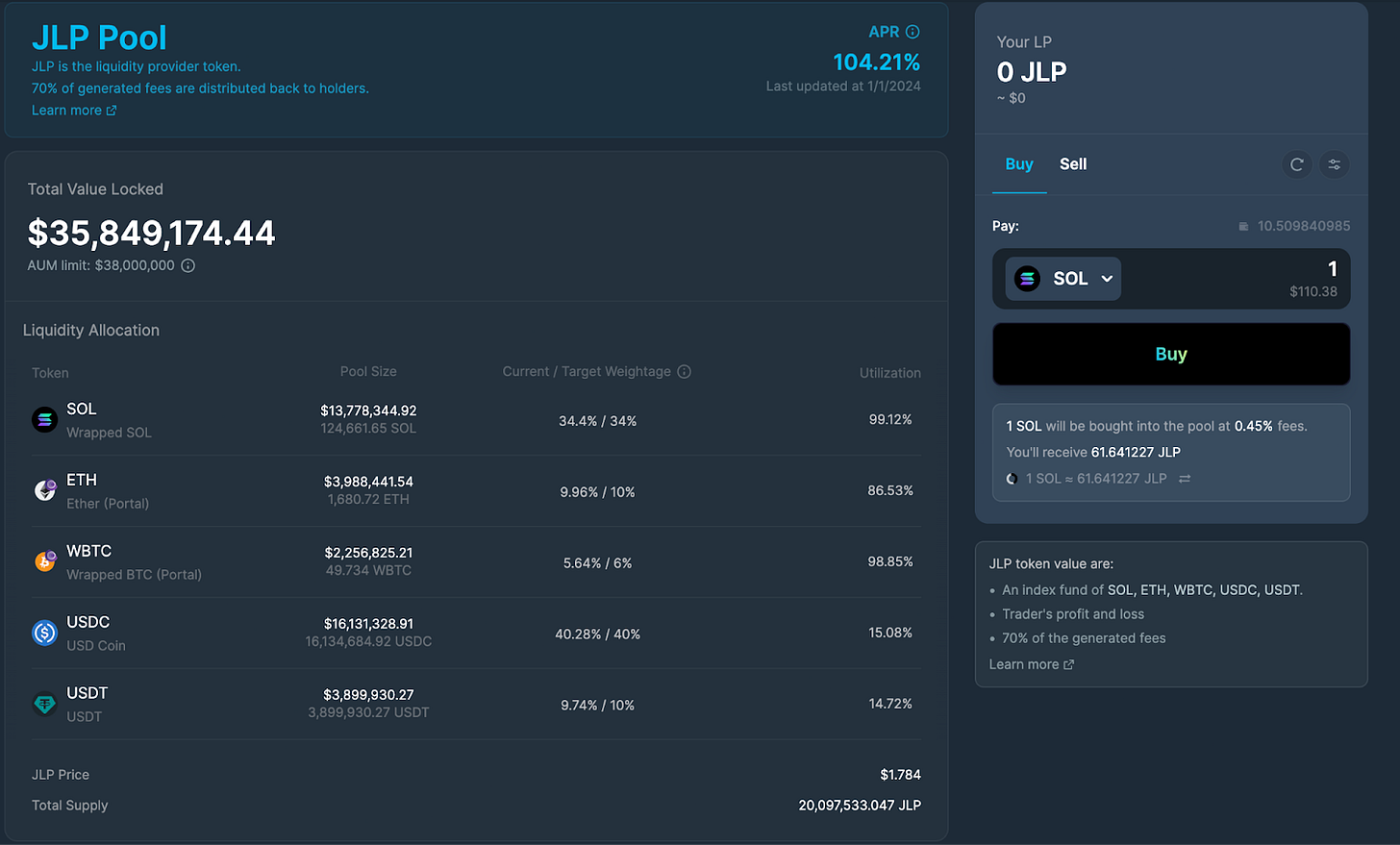

Similar to the dynamics of the GLP pool on the perps exchange GMX, Jupiter Perps utilizes the JLP pool, which consists of SOL, ETH, WBTC, USDC, and USDT. Providing liquidity is simply done by depositing any supported Solana token into the JLP pool in exchange for an equivalent amount in $JLP token. The JLP pool receives 70% of fees generated on Jupiter perps , and the price of $JLP grows congruently with the value of the underlying pool.

The JLP pool also benefits the greater Solana ecosystem, as Jupiter Swap is natively integrated into the perps exchange, meaning not only can any token be used as JLP collateral, but that Solana traders can benefit from better pricing for their swaps from the increased liquidity from the JLP pool.

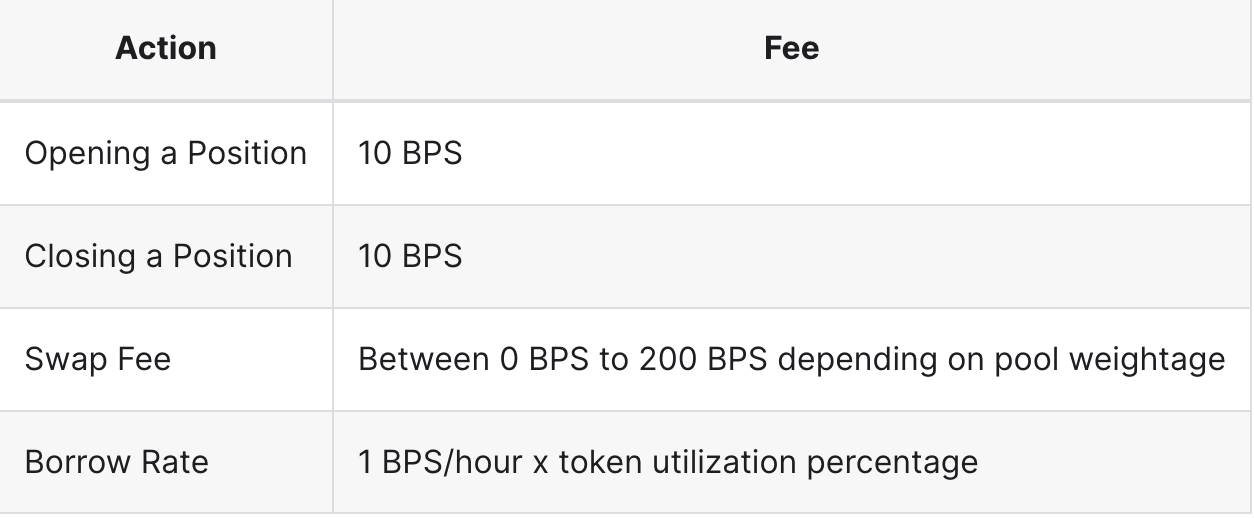

Unlike the aforementioned features, Jupiter’s perpetual exchange charges more fees for traders and LPs alike. Traders pay an hourly borrow fee, or a funding rate, to the pool based on the hourly borrow rate, position size, and token utilization percentage, which can be expressed as:

Funding rate = (tokens borrowed / tokens in the pool) * 0.01% * position size

LPs pay their own share of fees as well, for opening/closing a position, and swapping for different assets within the JLP pool:

With regards to the JLP pool, it should also be noted that given the target ratios established for each token in the pool, any logic which moves the token's ratio away from the target incurs greater fees while logic that moves the ratio closer to the target incurs a fee discount.

Decentralized perpetuals exchanges, popularized by GMX and dYdX, are still generally underdeveloped compared to their CEX counterparts and have lots of room for growth and adoption. Perps are another example of a low-latency application which benefits from Solana’s fast execution and low transaction costs, though Jupiter will face competition from established players in the Solana Perps sector such as Drift Protocol, 01 Exchange, Zeta Markets, Mango, among others.

Growing The Pie: The Jupiter Vision 🥧

When the pie grows, everyone gets more pie.

P - Product

I - Incentive

E- Education

As a critical part of the Solana ecosystem, Jupiter benefits from helping onboard as many new users and developers to the ecosystem as possible. Beyond providing value through great products, Jupiter’s goal is to empower its community and the broader Solana ecosystem through several new initiatives:

$JUP: Governance token for the new DAO (more below)

Jupiter Start: It’s imperative for ecosystems seeking sustainable growth to strike a balance between keeping an open mind towards innovation, and being objectively critical of poor application design and weary of teams seeking to capitalize on narrative and recency bias within the markets.

Jupiter Start aims to be a collaborative effort between the Jupiter community and the broader Solana ecosystem to “help vet, debate, understand, and highlight great new projects”. This entails the Jupiter launchpad to help bootstrap new projects, pre-listing trading availability for new tokens, and Atlas, a new public seed-funding initiative to allow the community to invest in early-stage projects, as well as various community-centric educational initiatives.

We recommend reading this blog post if you are interested in learning more.

Jupiter Labs: A collective effort between the Jupiter team, community, and DAO to develop innovative products and tools for Solana DeFi. Although these initiatives will begin native to Jupiter, they are ultimately designed to launch and operate as independent protocols on Solana. Jupiter users will be granted priority access to early product testing and consequently benefit from associated incentives for doing so, part of which will be allocated towards the JUP DAO.

The first product to already go live is the Perpetuals exchange, which is already live in beta, and a proposal for sUSD, a SOL-backed stablecoin (like LUSD:ETH) which uses leveraged LSTs to generate yield.

More on $JUP

Jupiter announced the $JUP token during Solana breakpoint, a strategic decision which was made after the protocol reached numerous critical milestones including a broad and engaged user base, several major platform upgrades and new products, a pipeline of ecosystem projects, all of which of course, is part of an overarching conviction in the future uptick of activity on Solana.

With a max. supply of 10 billion JUP, the token distribution is equally split between 2 cold wallets - the team wallet, and the community wallet. The team wallet will be used for allocations for the current team, treasury, and liquidity provision, while the community wallet is geared towards airdrops and various early contributors.

15% - 17.5% of the tokens will be liquid from day one, 10% - 7.5% in warm wallets, and 75% to be in cold storage.

The airdrops will consist of retroactive airdrops to engage a whopping 955k early users of Jupiter (pre-Nov 2nd), as well as growth airdrops aimed to help attract new users and liquidity, and to form the JUP DAO itself. The DAO will then vote on the token unlock data, The token will be initially locked, and the unlock date to be set by the DAO. JUP holders will have the ability to vote on various critical facets of Jupiter protocol and the role of the token, including the timing of the initial liquidity provision, future emissions scheduling, which projects to be featured on Jupiter Start, among others.

“The initial value of JUP will be a symbol for Jupiter and DeFi 2.0, much as the value for UNI is a symbol for Uniswap DeFi 1.0.”

Fundamental Investment Catalysts

Now that we have covered the components of Jupiter protocol, we can break down the long-term investment opportunity we envision.

The Solana Bet

Solana’s roadmap is an ambitious and exciting one, and we expect ecosystem activity to continue to grow throughout 2024, building on the momentum gained in Q4 2023. The main catalysts driving our conviction:

More Airdrops: Marginfi and a handful of other DeFi teams sparked a flame in the Solana ecosystem with the onset of Points programs (many of which have yet to see their final form!) earlier near the summer of 2023. The JTO airdrop exacerbated the already growing momentum on Solana with a wealth effect that left not only left many jitoSOL stakers happy, but also left many individuals unsatisfied and looking for the next big opportunity. Starting with Jupiter ($JUP), others to keep an eye on would be Kamino, Marginfi, Drift, Tensor, and more.

Firedancer: Jump Crypto’s highly anticipated validator client, which Toly himself has deemed “Solana 2.0” . Firedancer is expected to be a long-term beneficial initiative for Solana’s performance and throughput as the network scales and evolves, and it marks a crucial milestone for Solana as it increases client diversity and thus mitigates the risk of a single point of failure for the network. Low-latency applications will become that much faster, an attractive selling point for both users and developers. As 2024 will likely be the year Firedancer goes live, we expect a lot of speculation and growing interest around this milestone.

DePin: This is a novel sector in crypto which exemplifies how tokenized assets can be used help decentralize real-world business models. Solana has managed to attract a number of projects including Helium and Hivemapper. Interest around DePin as an emerging sector brings more positive attention to Solana in turn, as the network demonstrates its utility to serve more tangible use-cases.

Payments: Solana Pay is now integrated with Shopify, meaning merchants can accept payments on Solana, meaning the average JTO airdrop recipient could’ve technically bought 2000+ coffees with their earnings. Though there are still hurdles to overcome for actually getting shoppers to make payments in Solana Pay, a partnership with the largest ecommerce platform is a good way to start. Additionally, earlier this year Visa, one of the largest global payment networks, announced its plans for leveraging Solana for its Stablecoin Settlement Pilot - an experiment testing the capabilities of blockchain settlement rails for building new products for commerce and money movement. Solana’s high throughput, fast finality, low transaction costs, and node availability are all positives for Visa, the same way Visa’s brand is a positive for bringing a lot of attention to Solana. If successful, we believe the Stablecoin Settlement Pilot will mark a major milestone for the development of real-world crypto use-cases, and Solana stands to benefit as being the de facto network making this happen.

A final honorable mention is the Saga Phone. While Solana’s mobile phone may not have been a home run in its first year, a push for mobile-friendly crypto environments and applications can be a very exciting development in the long-term when considering what mobile integration did for social media and payment apps. Excitement has picked up recently as the Solana phone airdropped BONK to purchasers (technically you could buy the phone and pay it off immediately at one point…) , and the team just recently announced “Chapter 2” which entails a cheaper price ($450) and a referral leaderboard to incentivize more users.

Challenges for Solana

While we remain bullish on Solana’s long-term growth, there are several critical concerns we expect the Solana core team and developer community to address in the near and long term, which we will be keeping an eye on:

Fee Market: Though Solana has introduced priority fees now, there is no native mechanism for determining a ‘market’ priority fee which helps rate limit spammers efficiently (i.e. EIP-1559). As there is now much greater demand for blockspace on Solana, more users are experiencing failed transactions, further demonstrating the need for an upgrade to the network’s current fee market structure. Proposed solutions involve dynamic account fees, and a multi-dimensional EIP-1559 with exponentially increasing fees for every account touching the exact same hotspot.

EVM Competition: Though we believe in the long-term SVM vs EVM will not be a zero-sum dynamic and the different networks will specialize in their own respective categories, today Solana is still competing with EVM landscape for market share and users, a large gap to close ($1.4b > $30b).

EIP-4844 aims to make L2s significantly (80-90%!) cheaper and easier to use/deploy, which can reaffirm strong market leaders in Arbitrum, Optimism and Base. Similarly, Celestia brings more flexibility and lower costs for L2 developers, which can potentially attract talent and users away from Solana.

Restaking narrative stands to be one of the biggest catalysts for Ethereum and will likely bring in a lot of capital inflows there as well. Security risks aside, investors who are seeking native yield on a native L1 asset will seek opportunities for higher returns, which restaking provides for Ethereum stakers.

Parallel-Execution L1s: The rising popularity of parallel-execution L1 chains (MoveVM, Sei, Monad) which optimize for speed and performance similar to Solana are still young and underdeveloped, and could see their own . Monad, built by a handful of team members with HFT backgrounds, aims to bring Solana-like performance to the EVM environment, theoretically uniting “the best of both worlds” and delivering upwards of 10K TPS. Nonetheless, these chains not only face an uphill climb against Solana itself, but they must also compete with Neon EVM, which enables Solana compatibility through an Ethereum native environment. Aave has recently published a proposal on its governance forum to discuss deploying its V3 protocol on Neon mainnet.

With all this in mind, we consider Solana’s resiliency, demonstrated in its ability to overcome macro challenges such as the FTX collapse, or technical shortcomings such as network outages, the network’s greatest strength and long-term catalyst.

The Solana Bet = The Jupiter Bet

“Our vision for the future is intrinsically tied to the growth and prosperity of the Solana ecosystem. We are driven by the conviction that a flourishing Solana ecosystem translates to collective benefits for all stakeholders involved. In simple terms, when the pie grows, everyone gets more pie.” - Jupiter Green Paper

We believe Jupiter’s critical role in the Solana DeFi landscape makes it a viable bet on the network’s near and long-term adoption. The thesis is quite simple. More users on Solana = more users on Jupiter. Solana’s initial boom lasted for the better part of the first year it was live (2021), during which protocols like Saber and Serum dominated the DEX landscape. Jupiter gained traction shortly after its launch given its USP for Solana DeFi, which sought to utilize on-chain liquidity from DEXs rather than steal market share from them, for the end-goal of providing a better user experience with better pricing. However, it wasn’t until the sunset of Serum, the once-dominant Solana DEX, that Jupiter had emerged to be the market leader they are today.

Jupiter consistently made up over 60% of organic DEX volume on Solana throughout 2023.

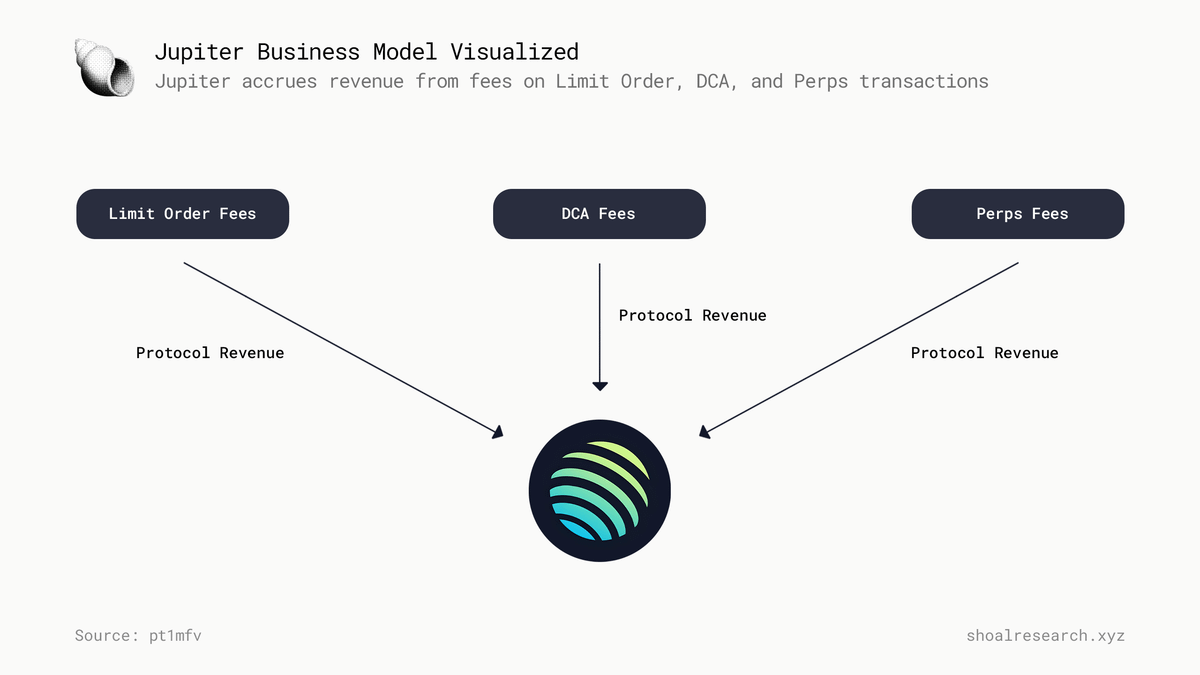

Breaking Down Jupiter’s Business Model

Initially, Jupiter’s core product was simply a swap engine which optimized for better pricing and did not charge any additional fees for traders. As the project began to grow and see continuous growth in volume and traders, the team launched a handful of new products which now serve as organic revenue streams for the protocol via fees. We believe the JUP DAO will naturally seek to ensure $JUP holders receive a given % of these fees, as well as future opportunities with Jupiter Start and Jupiter Labs.

Limit Orders: 30 BPS

DCA: 10 BPS

This is a unique offering which I think Jupiter can take further advantage of by raising the fee (~20 BPS)

Perps

Opening/Closing a Position: 10 BPS

Swap Fee: 0 - 200 BPS (varies by pool weight)

Borrow Rate = 1 BPS / hour * token utilization %

70% of fees generated go towards

External protocols

If a protocol integrates Jupiter’s architecture into their own software and then charges their own fee, Jupiter ensures they receive a share of the fees as well.

Hypotheticals

Jupiter Start - We believe it may be prudent to utilize Jupiter Start initiatives, namely the Launchpad and Atlas, towards creating an additional revenue stream for Jupiter and $JUP holders.

Launchpad: Establish deal-flow or projects incubated by the Jupiter Launchpad, where a portion of a project’s revenue goes towards the JUP DAO.

Atlas: Create an efficient model for collecting revenue from realized gains on public seed-funding initiatives to be distributed among holders and investors who participated.

Jupiter Labs - As already demonstrated by Perps, Jupiter Labs supports the development of protocols which can generate additional revenue for Jupiter.

Another proposal is in the works for sUSD

An interesting question to consider here is how exactly will these initiatives one day launch and operate independently, as stated in the Jupiter docs, and how will doing so influence that particular revenue stream.

Swap Fee

Jupiter’s swap engine has been the core product that Solana users have grown to know and love. However, as fee dynamics on Solana continue to evolve, trading will inevitably become costlier as more smart contracts compete for fewer blockspace. Jupiter has already positioned itself to allow traders to pay priority fees for faster execution, and if this feature sees continuous adoption from this point onwards, it makes sense to charge an extra % for the service Jupiter is providing (there is no native way to calculate the “base” priority fee).

Competitive Landscape for Jupiter

Generally speaking, we believe Jupiter’s role as an aggregator is in a unique position as it does not face direct competition with any one trading protocol on Solana at this time. That said, as the Solana DEX landscape continues to evolve as the demand for low-latency trading applications grows, Jupiter will naturally face the challenge of keeping up with the latest innovations and developments. At the end of the day, traders want better settlement and will go where that is the case.

Furthermore, Jupiter faces greater competition for its additional products such as Perps, and teams are generally going to be incentivized to recreate a DCA product or similar.

The DEX landscape on Solana is evolving and becoming more competitive. Outside Solana, it’s even more competitive.

Jupiter’s competitive edge lies in price settlement for users; if a protocol emerges to offer better pricing users flock there more likely than not.

Swaps are still main use case; swap engine performance is key

Niche products (perps, limit orders, dca) have stronger competition and competitors can offer lower fees

Suggestions for Jupiter

More transparency around fees and revenue, and product performance data dashboard would be helpful for investors.

$JUP holders should be a beneficiary of Jupiter’s revenue streams (Limit Order, DCA, Perps, Jupiter Start + Labs)

Monitor the intents landscape and consider a routing model which utilizes off-chain liquidity (i.e. CEX LP inventory) in addition to on-chain liquidity to provide better pricing for users. Similar to 1inch Fusion, Matcha by 0x, CoWSwap, etc.

This would apply for swaps, limit orders, DCA

Ensure $JUP holders receive a % of revenue generated by Jupiter Labs products and services.

Ensure any team which Jupiter Start either incubates by launchpad or public seed-funding, which implements a fee on their protocol, allocates a % to $JUP holders

Ensure the large size of the airdrop distribution does not dilute the quality of participants who represent the JUP DAO.

Future Outlook

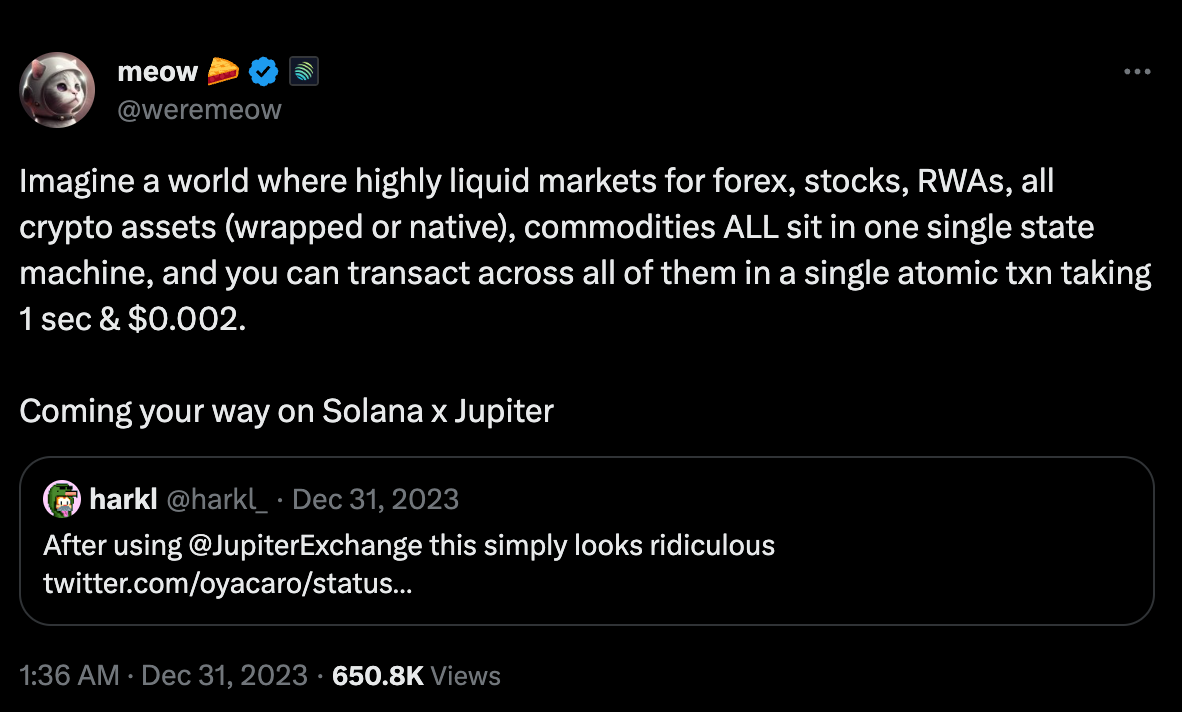

Given its unique position in its ecosystem, we believe Jupiter is a viable bet on Solana’s near and long-term adoption. As network activity on Solana continues to pick up, we expect Jupiter to capture a significant portion of inflow value with its established ecosystem presence, suite of various products, and a sustainable revenue model which should benefit $JUP holders long-term as well. As Larry Fink begins to talk about the tokenization of every financial asset,

and L1 blockchains like Solana continue to seek PMF and explore new utilities and innovations, it’s not too far-fetched to imagine Jupiter accommodating a variety of new asset classes over time.

Sources

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are the authors own, not the views of their employer.