MetaDAO: The New Capital Formation Layer of The Internet

A special thanks to Connan and Mathis for their feedback and review.

Crypto’s Misalignment Problem

One of the first big value propositions of crypto was its ability to significantly lower the friction for capital formation and offer an alternative to the traditional funding model for startups. Instead of relying on VCs, banks, or waiting 10+ years for a potential IPO, crypto introduced a new way for anyone to raise money permissionlessly on the internet and let their project “go public” on day one through a token.

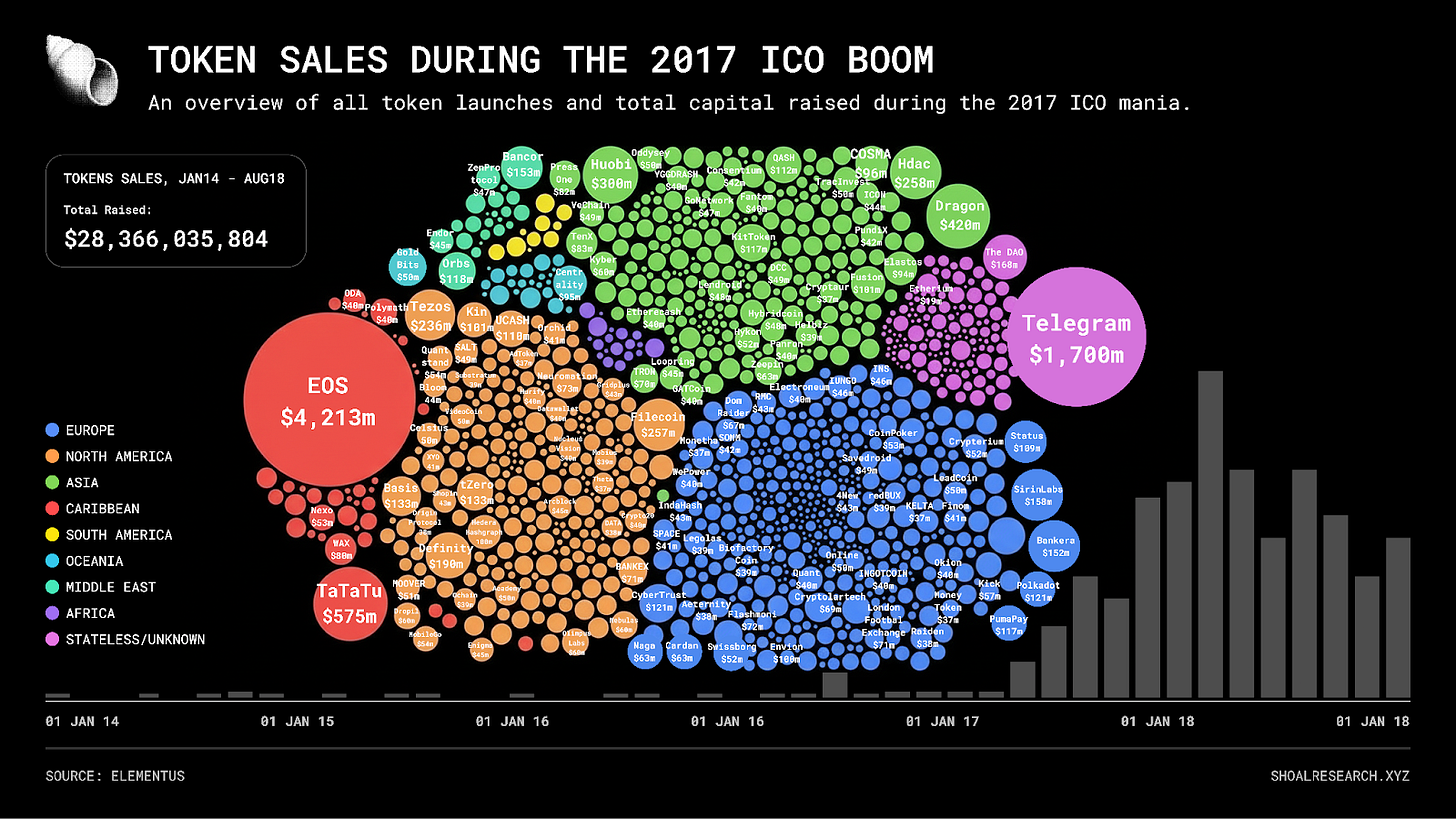

This was a real breakthrough with huge potential. As people began experimenting with this new model, interest exploded, ultimately leading to the historic ICO boom of 2017, where millions were raised and thousands of new tokens were launched.

But while the concept was promising in theory, it was still immature in practice and led to widespread market abuse. Everything was all about hype, and there was a clear misalignment of incentives among the major token stakeholders. Put simply: the more successful an ICO, the greater the incentive for the team to extract what was in the treasury instead of growing the pie. And with no framework to prevent this behavior, it quickly became the default equilibrium and gave rise to countless scams and low-quality tokens.

Apart from SwissBorg and a few others that managed to build something meaningful, most projects from the 2017 era bled to death. While some were genuine projects ahead of their time, many were outright scams, heavy on tech buzzwords to excite people into buying their ICO but with no real substance behind them.

Today, we are still carrying that baggage. While there has been real progress in terms of crypto products and adoption, there has been far less advancement in how to properly structure tokens. And unfortunately, the market continues to suffer from abuse and bad practices, driven by too many short-term opportunists who see crypto as a way to make a quick buck. These actors still treat TGE as exit liquidity rather than the beginning of a project, and focus all their energy on hype instead of building something real: faking followers and metrics, launching at ridiculously overinflated valuations with low float, paying large amounts for tier-1 CEX listings, and relying on sophisticated market makers to engineer “perfect” chart patterns so the project appears successful long enough for teams to exit while leaving retail as exit liquidity.

What’s sad is that these dynamics also put pressure on genuine founders because short-term hype tends to dominate attention. As a result, even serious teams feel pushed to conform to the same practices just to keep attention on their project and remain competitive in terms of mindshare.

Ultimately, all of this has contributed to putting into question the trust and legitimacy of the crypto industry. If nothing is done to correct it, crypto risks becoming irrelevant, not because the technology, products, or underlying promises are not good enough (they are), but because the space has given too much attention to the wrong actors and has failed to provide clear protection for investors against value-extractive practices from insiders.

Fortunately, every problem is an opportunity in disguise. As we speak there are a few very interesting 0-to-1 initiatives being built that aim to solve this token misalignment problem problem and help crypto finally fulfill its potential as the new capital formation layer of the internet. Among them, one project that clearly stands out is MetaDAO.

In the subsequent section, we will explore MetaDAO core value proposition, how it’s positioned to reshape how the internet funds new ideas.

A New Capital Formation Layer

MetaDAO is a fundraising and governance platform that enables anyone on the internet to raise money for their startup ideas, while also simultaneously protecting investors and backers from founder abuse, misaligned incentives, and rugs.

To do so, they are creating a new standard for structuring token launches through what they call “ownership coins,” and they are also pioneering a governance model based on decision markets (and inspired from the concept of Futarchy) to better align incentives between all key stakeholders in a project.

Now, before going deeper into MetaDAO, it is important to introduce how decision markets and futarchy work.

Futarchy 101

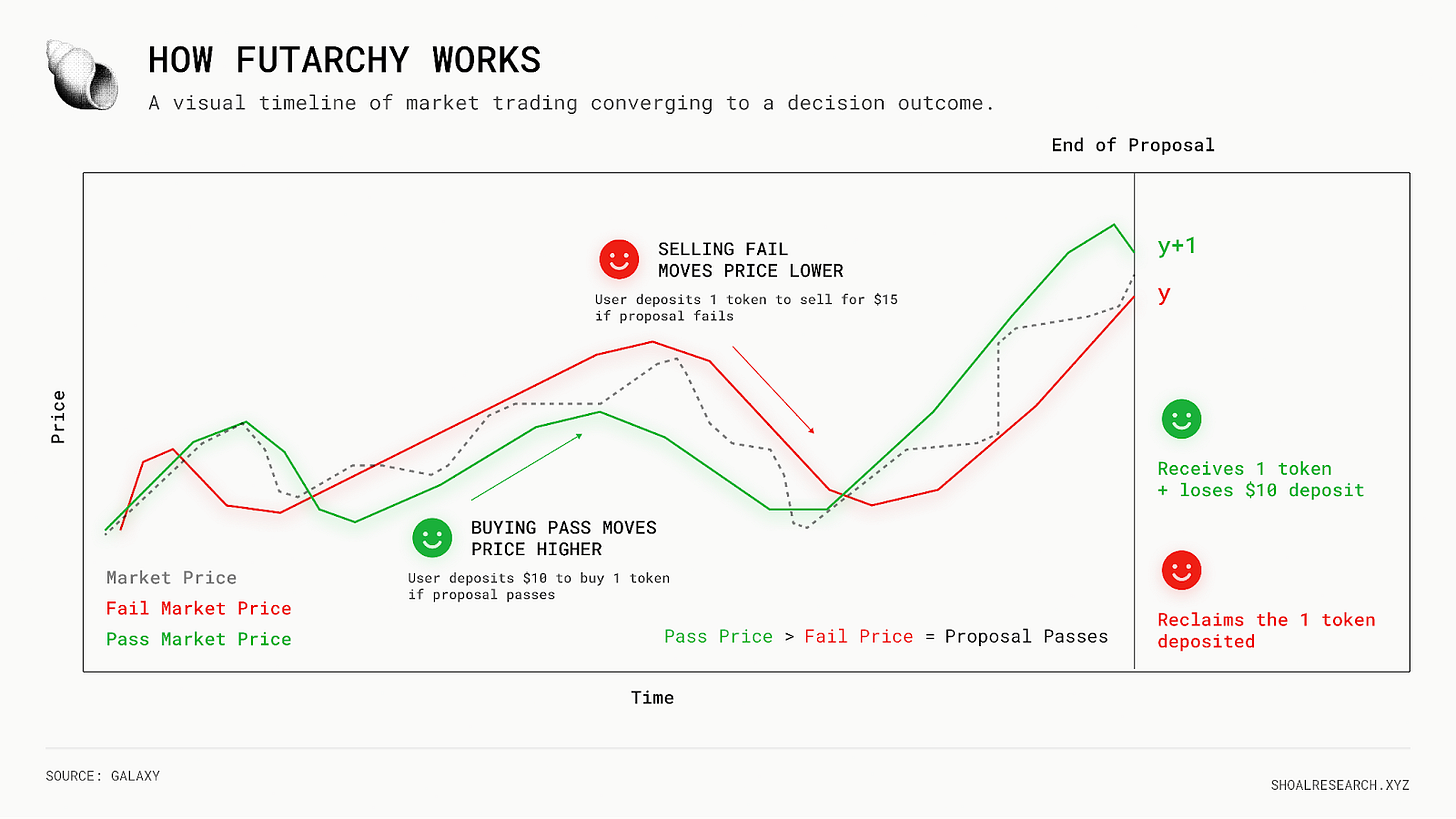

Futarchy is a form of governance first put forward by economist Robin Hanson in 2000, which makes decision-making based on prediction markets. In a futarchy, decisions are traded, rather than being voted on.

Instead of debating proposals in endless forums and then voting, futarchy embraces the power of markets to forecast which decisions will be best. Proposals pass when the market speculates that they’re good. Proposals fail when the market speculates that they’re bad.

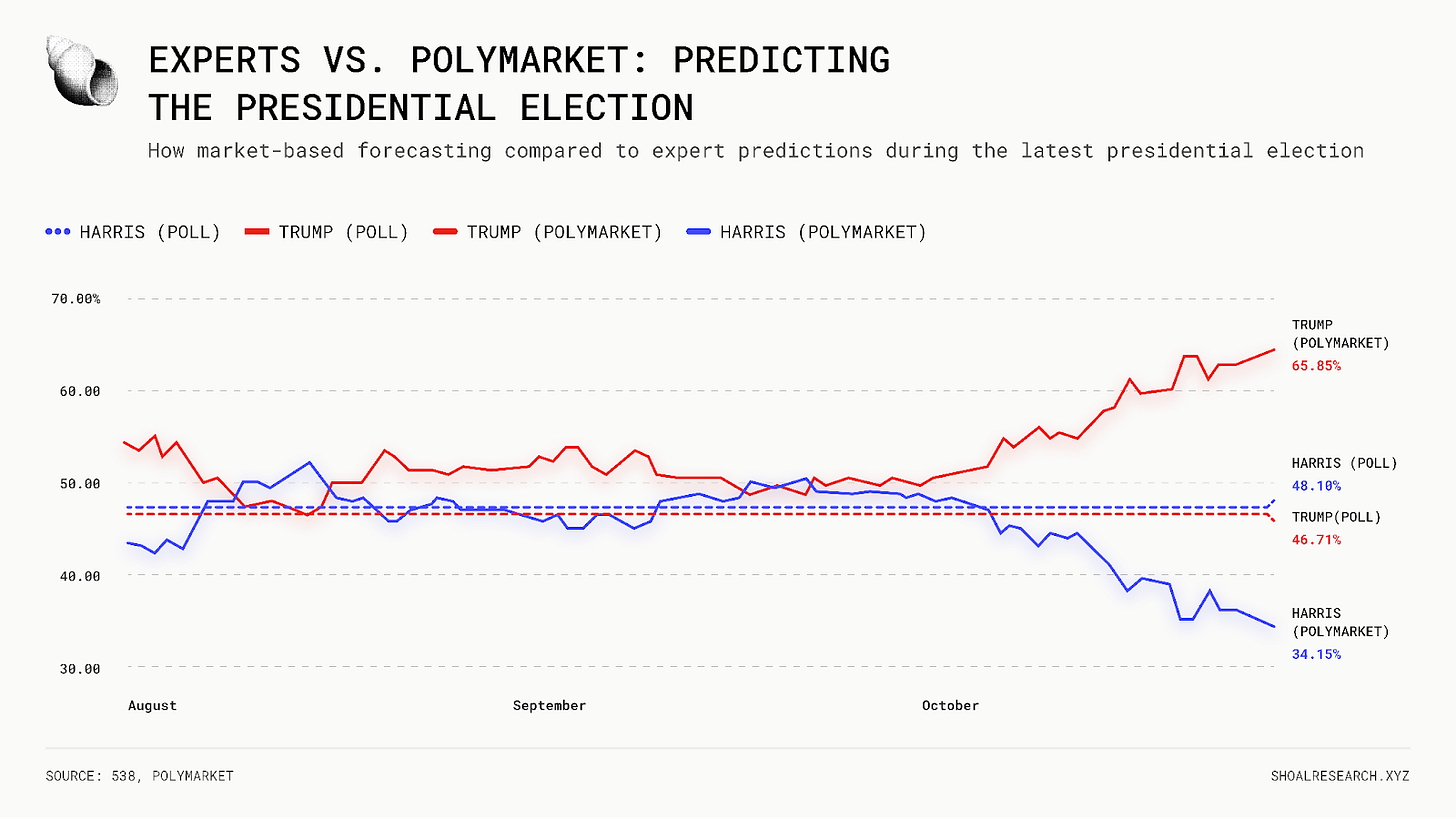

The core axiom behind this model is that markets aggregate information more efficiently than traditional voting, and that the collective incentives of traders produce better predictions than the opinions of a small group. In fact, we already see this dynamic in practice through the accuracy of prediction markets: during the last presidential election, for example, platforms like Polymarket delivered far more accurate forecasts than professional pollsters.

Now in the MetaDAO case, its decision market governance model is inspired by this same logic, but applies it to the key decisions an economic organization must make.

Let’s take a concrete example to better explain what it is:

Suppose a company wants to undergo a merger acquisition as part of a strategic vertical-scaling plan:

In the current model, a major decision like this goes through a shareholder vote. The board reviews the proposal, issues a recommendation, and shareholders vote. Decisions are slow and inefficient, and they depend on the opinions of a small, often uninformed group, distorted by politics and misaligned incentive. Suppose the deal would temporarily boost the stock price but is clearly destructive over the long term. Executives whose bonuses are tied to short-term stock performance, or board members nearing retirement who want to lock in higher payouts, may vote in favor of the deal. Even though it weakens the company strategically, the short-term price bump benefits them personally.

Now with a decision market model, the organization would open a market to forecast the company’s value if the merger happens and if it does not. Traders buy and sell based on which outcome they believe will create more value. If the “merge” market trades higher, the merger passes. If the “don’t merge” market trades higher, it fails.

How does MetaDAO work?

MetaDAO operates through two complementary pillars built around futarchy: an ICO launchpad to launch ownership coins, and a new governance model using decision markets.

The Ownership Coins Launchpad

Projects can raise money via MetaDAO’s launchpad architecture, which is designed to be “unruggable” in the sense that founders cannot walk away with the money. The idea here is simple: if a launchpad can protect investors from rugs and ensure that founders cannot abuse the system, then it will 1) attract genuine founders and 2) attract genuine capital to fund the right ideas, which is a clear win-win for every one.

Here’s how that works in practice:

1/ The founder sets transparent terms

If a founder wants to raise on MetaDAO, they first need to publish their idea/thesis and define the proposed terms of the token launch. This includes:

Mission and vision

Market opportunity

Minimum USDC target

Monthly budget

Optional token incentive package for the team (through a price-based performance design)

2/ Sale goes live

The sale then opens on MetaDAO for a defined period. Anyone can contribute USDC to support a project they believe after evaluating the idea, the team, and the terms. Each sale has a minimum funding target (below which all contributors are refunded) and a discretionary cap, giving founders the option to choose how much of the total raised they want to accept.

3/ What happens if the sale succeeds

If the funding target is met, the founder decides how much USDC they keep, and investors receive their proportional ownership coin allocation.The treasury also automatically deploys 20% of the USDC and 2.9M tokens into liquidity pools to establish healthy market liquidity.Then all the USDC and token minting rights are transferred into a market-governed treasury, which the founders cannot directly access.

4/ Transparent funding from founders

Every month, the founders can spend USDC up to their monthly budget allowance. Everything above that needs to first go through a market proposal to be spent. Furthermore, at any time, anyone can raise a proposal to return USDC to tokenholders and if the proposal passes, then it will be executed.This structure is designed to prevent founders from draining or abusing the treasury and serve as a strong protection guarantee for investors.

While the launchpad is still somewhat gated today where MetaDAO ultimately decides which project can participate based on their own discretionary criteria, the long-term goal of MetaDAO is to make it fully permissionless, meaning anyone with an idea can apply, set their terms, and let the market decide whether it deserves funding.

The Governance Model

MetaDAO’s decision market governance model is automatically embedded into every project that launches on the ICO platform. However, any external project can also choose to adopt it if they believe it is a better alternative to their current governance structure.

In practice, projects can decide whether to delegate their full treasury to MetaDAO, or simply transition from a vote-based governance model to a market-based one.

Once this model is integrated, teams set a minimum amount required to open a proposal market, configure a few basic parameters, and from there anyone can raise a proposal about the protocol: from big cash spending, key strategic decisions, and more. Markets then determine whether the proposal should pass or fail.

Proposal time: the amount of time a proposal should be active before it can pass or fail. Three days by default. Specified in Solana slots.

Pass threshold: the percentage that the pass price needs to be above the fail price in order for a proposal to pass.

Minimum liquidity: to prevent spam, proposers are required to lock AMM liquidity in their proposal markets. The amount they are required to lock, in both USDC and the futarchy’s token, is specified by each DAO.

TWAP Sensitivity Parameters: The price that gets factored into the TWAP can only move by a certain dollar amount per minute. Each DAO must specify this dollar amount.

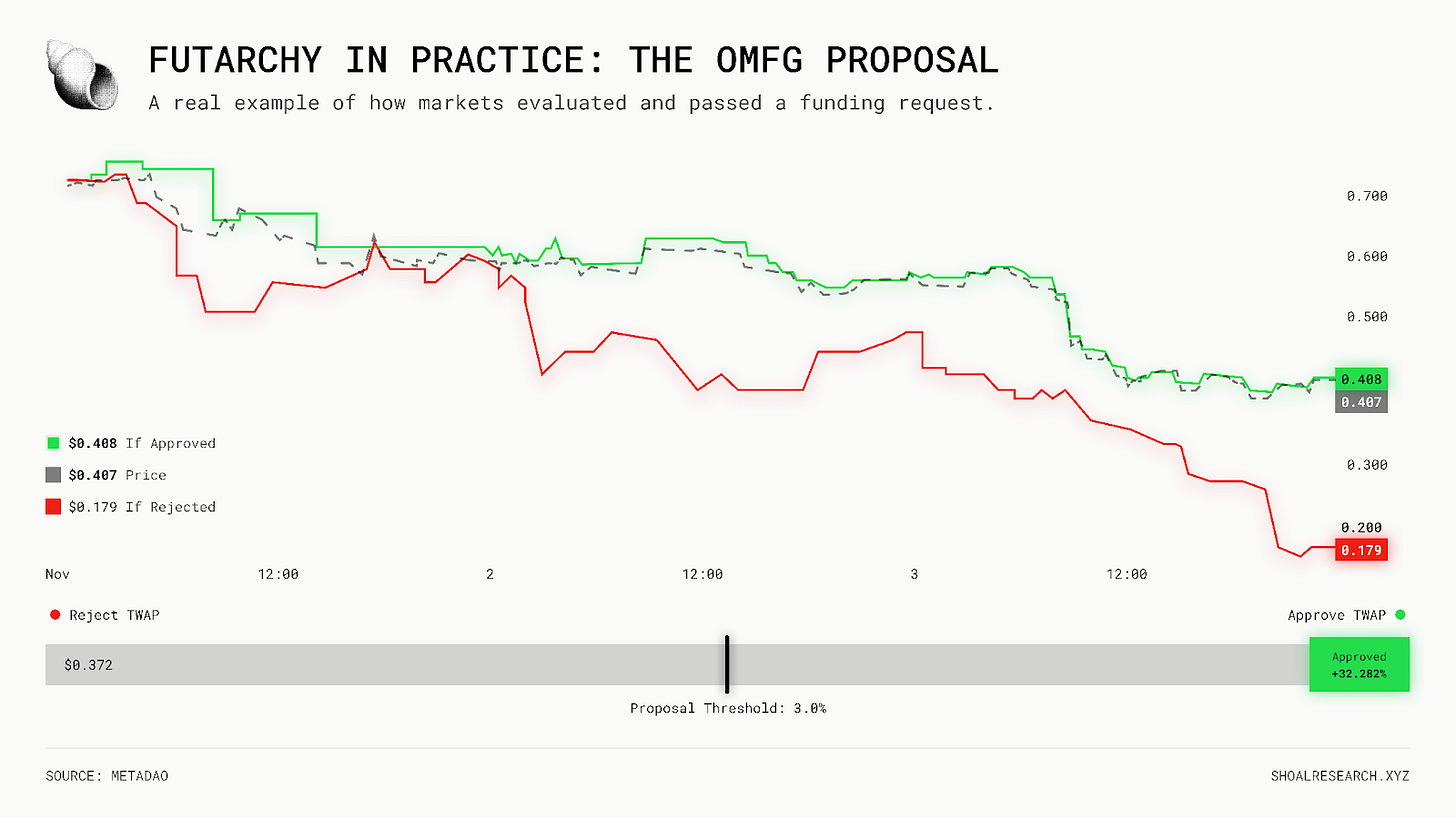

For instance, in the example below, Omnipair raised a proposal to spend 64,000 USDC to audit their protocol, and we can see that it passed by a very large margin as the market concluded that this was a good decision.

How Does This Solve Crypto’s Misalignment Problem?

Together, these properties help address the core misalignment problem that is plaguing crypto today:

- At launch, the market cap equals the Net Asset Value (NAV) in the treasury.

This creates a strong psychological and economic floor. If the price trades below NAV for a meaningful period, anyone can raise a proposal to return USDC to tokenholders. This provides strong protection to early investors.

- The ownership coin structure ensures that the intellectual property, the funds, and the authority to mint new tokens are controlled by independent, market-driven governance not by the team. This imbues the token with real value and protects investors from insider abuse.

-The market decides the best path forward for the project and not a small group of insiders. This makes governance more transparent and fair, with decisions driven by what is best for the protocol.

On top of that, the real beauty of MetaDAO’s model is its simplicity. It doesn’t rely on complex and unsustainable financial engineering to make a token valuable. Instead, it works by removing all the vectors that could create negative externalities and aligns incentives around the token in the most straightforward way possible.

The MetaDAO Ecosystem Today

The first ICO launch on MetaDAO took place on April 9th 2025 with MtnDAO. At the time, it was viewed as an uncertain and bold experiment. However, it proved to be interesting enough to capture the attention of the broader ecosystem. Fast forward to today, adoption has accelerated significantly. Both founders and investors are increasingly drawn to MetaDAO’s unruggable ICO design.

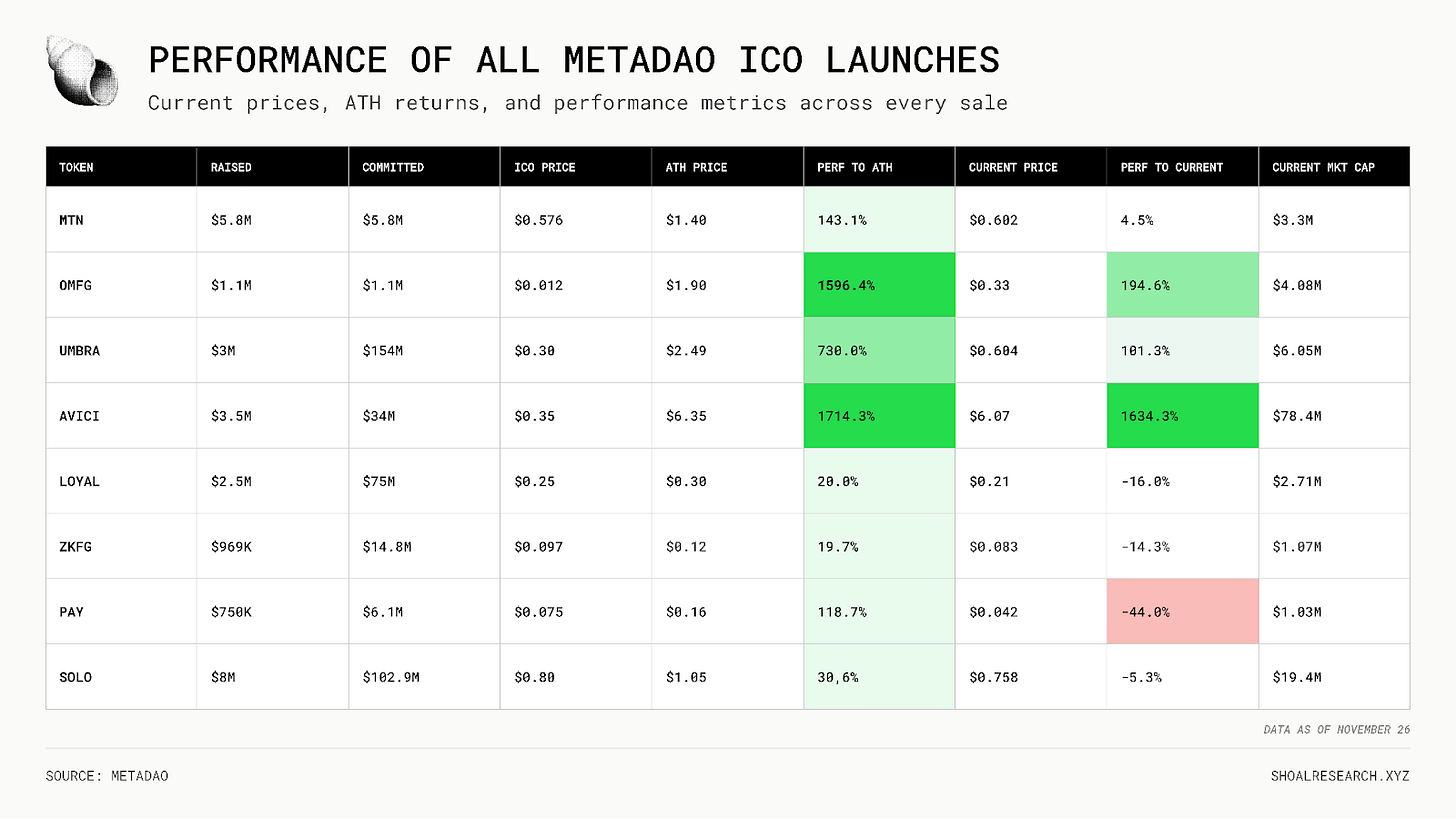

As of writing, there have been 8 ICOs launched on MetaDAO with a combined total of $25.6M million USD raised. Below is an overview of all MetaDAO launches so far:

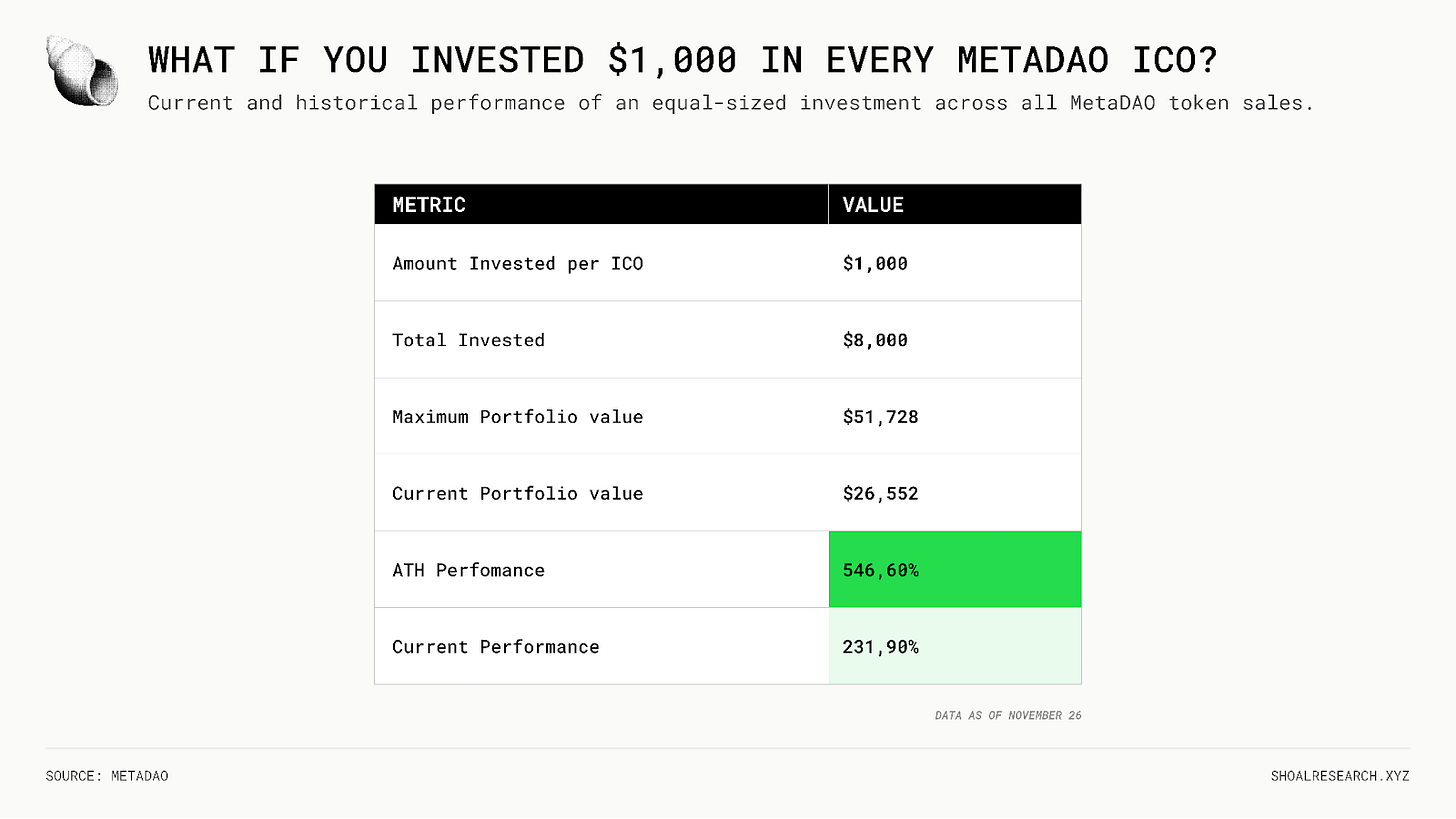

If an investor had allocated $1,000 into each ICO (and managed to receive full allocation), for a total of $8,000 invested, their portfolio would now be worth approximately $26,552 with a theoretical peak value of around $51,728. This represents a current performance of 231.9% and a maximum performance of 546.6%. These stats are unprecedented for any launchpad, especially in current market conditions.

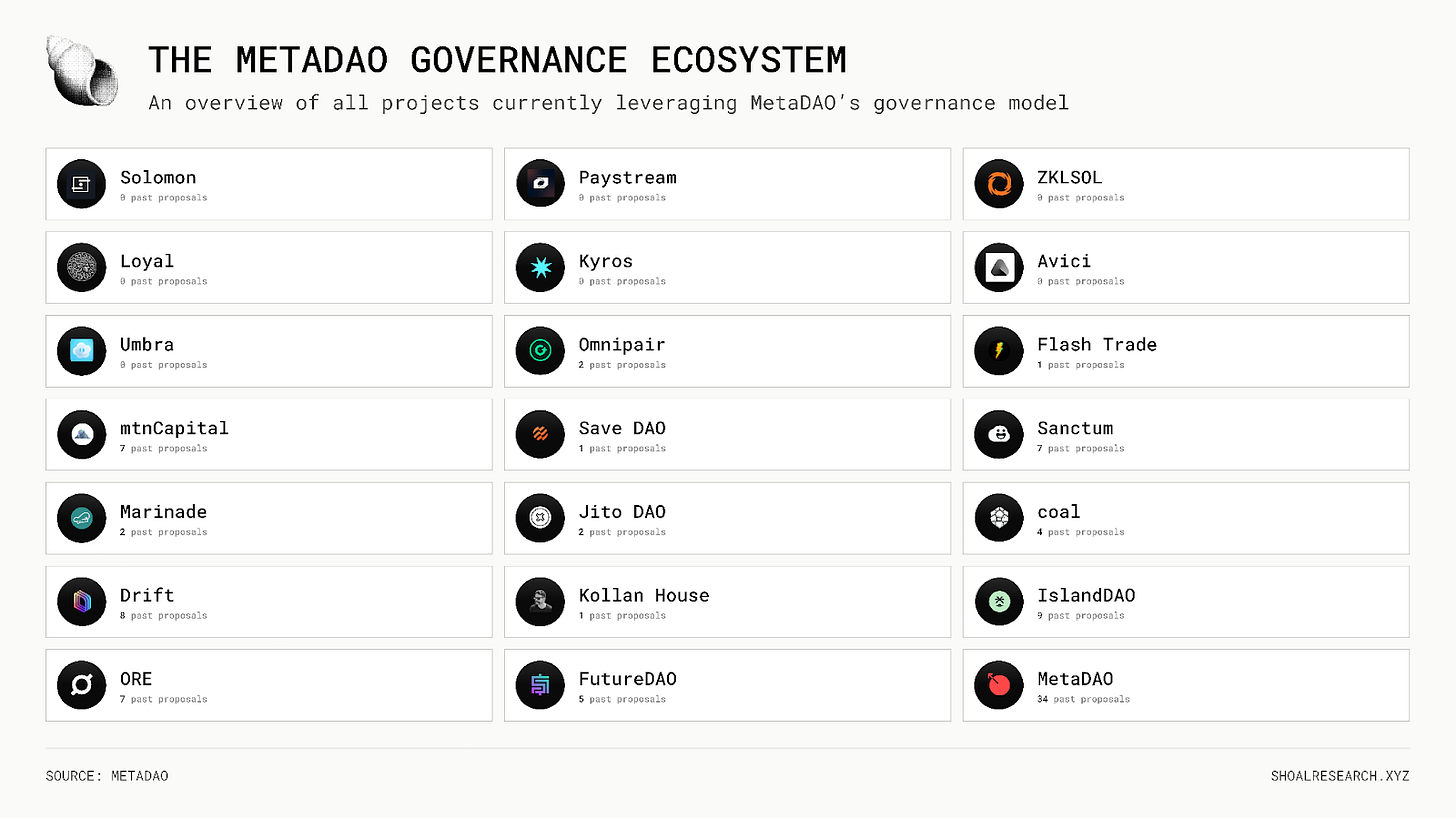

Beyond ICOs, multiple organizations have also begun migrating their DAO structures to a decision market model, and interest continues to grow steadily. We’ve even seen some of the biggest names in Solana like Jito and Sanctum start experimenting with it. Others such as Kyros, ORE, and Drift (just to name a few) are also leveraging MetaDAO’s infrastructure for their governance models.

MetaDAO Business model

Ultimately, MetaDAO is a business: it aims to solve a real market problem, but it also has a token and investors, and aims to generate meaningful revenue from its product.

Right now, MetaDAO earns revenue primarily through AMM fees on token launches.

Every project launched through MetaDAO trades on a MetaDAO-controlled AMM pool, which currently charges 25 bps in fees (with plans to increase this to 50 bps).

In the future, MetaDAO is considering adding a small fee on the oversubscribed portion of a raise, capturing value from high-demand launches. Further, the team is also exploring ways to integrate META into liquidity pools paired against ownership coins, which would further reinforce the place of META within their launchpad.

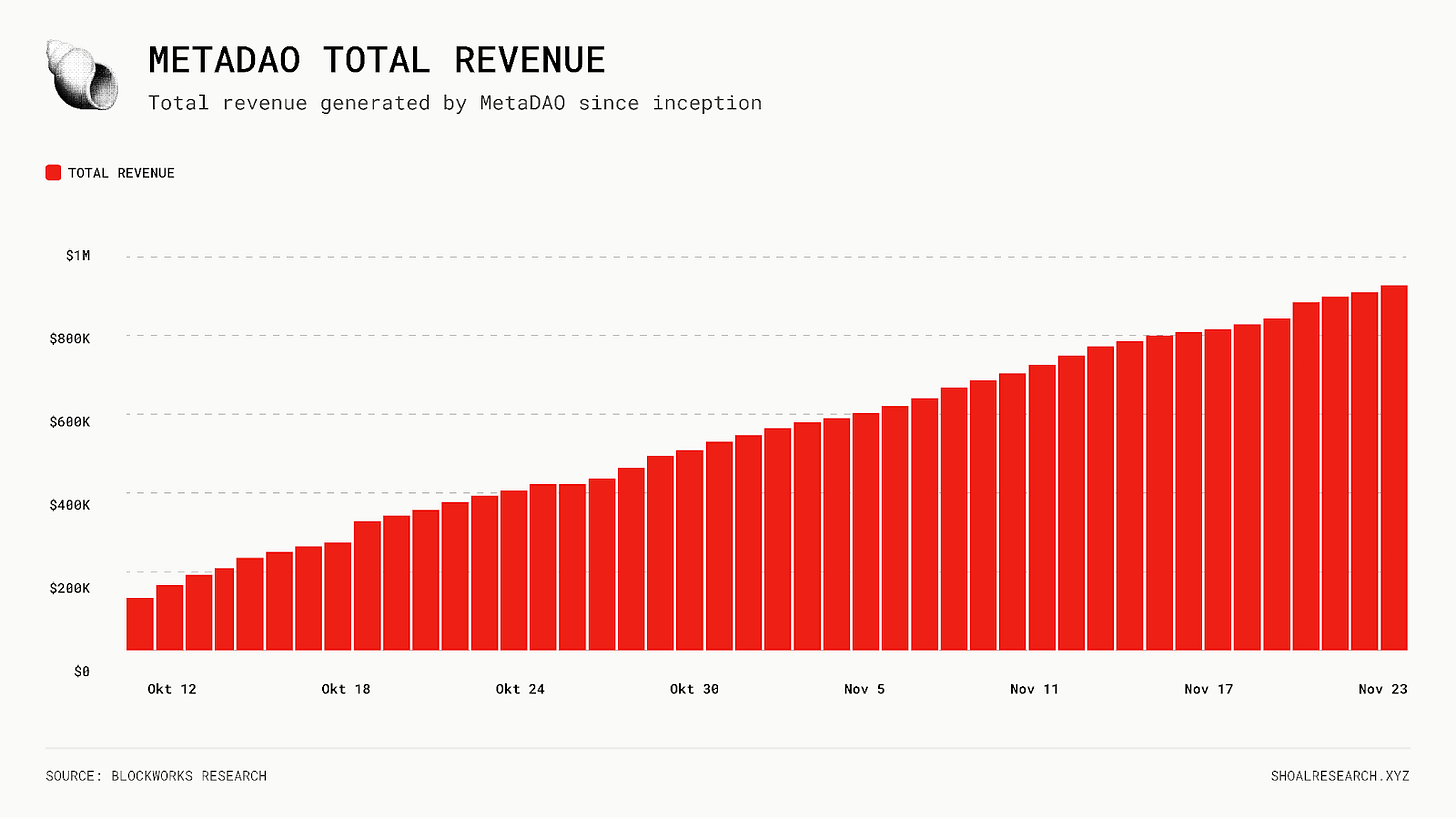

Together, these components make META directly tied to the success of ownership coins, and therefore to the success of the MetaDAO launchpad itself. And they are already off to a strong start, as the platform has already generated over $1M in revenue to date.

Risks and Important Considerations

Of course, every design comes with trade-offs and potential second-order effects. For now, MetaDAO is far from perfect. While they have managed to build a true 0-to-1 innovation, there are still many iterations needed to go from 1-to-n and drive broader adoption, especially beyond the crypto echo chamber and into the wider startup world as a credible alternative to traditional funding models.

Below are some of the drawbacks we have identified in the current model:

1/ The pro-rata subscription model:

The sales being uncapped and with founders deciding how much they take from the total is a great property. However, this model introduces a major drawback: if a launch is 2× oversubscribed, you are incentivized to put up 2× the USDC for the allocation you want, which then makes it more oversubscribed and reinforces the loop.

This dynamic can also disproportionately favor large players, as smaller investors often cannot “keep up” with the escalating deposits required to maintain their allocation. The result is potential dilution of smaller backers and excessive token concentration in the hands of a few.

Furthermore, because deposits and withdrawals can happen until the very last second, contributors must actively monitor the sale to avoid being underallocated (if others pile in late) or overallocated (if someone withdraws at the last moment).

2/ A permissionless platform

Going permissionless in the sense that any project can leverage their ICO launchpad is great, it fits the ethos of crypto, and it is easy to understand the rationale behind this choice from MetaDAO.

However, removing gatekeepers also opens the door to a decline in project quality. If anyone can launch a project without any filtering, there can be a flood of low-quality launches that may weaken the MetaDAO brand (even though the team acknowledges this risk and prefers it over potentially missing a unicorn idea).

From a user point of view, it can cause a sort of investment fatigue if there are too many projects, and it will also make their job harder when deciding which projects / founders are worth investing in.

3/ The governance model

Let’s be honest, there is still a high barrier to entry in understanding how decision market based governance actually works. For many users, the mechanics of taking positions and interpreting outcomes are not very intuitive. And because the whole model requires putting real money at stake, participation may end up being limited to highly sophisticated users. In practice, this can weaken the “wisdom of the market” argument if not enough traders are watching the market.

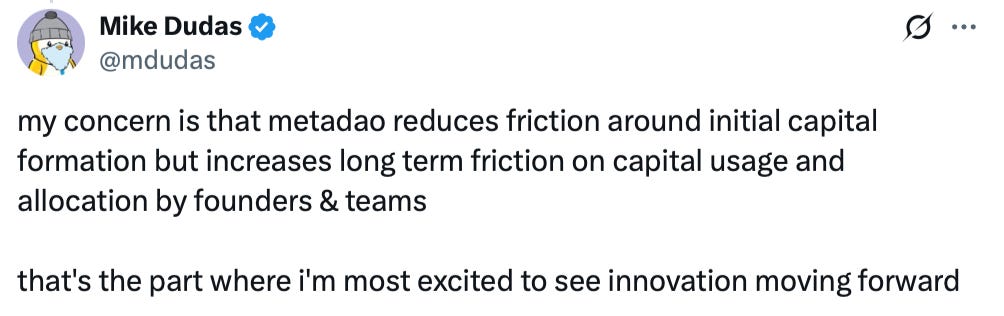

While we can argue that MetaDAO decreases friction around capital formation, the model increases long-term friction on capital usage by teams. This is an important consideration. If a founder needs to get something done but the market rejects proposals by a tiny margin because of a small clause in a document and not enough traders are actively trading on it. We can argue that this might not be the best use of a founder’s time, and repeated failed proposals could slow execution rather than accelerate it.

Some Ways Ahead

Several solutions and design enhancements could help MetaDAO overcome its current drawbacks. Below are some avenues the team is already exploring, along with additional suggestions from Shoal on how the product could be improved:

1/ Improving the subscription models

MetaDAO’s founders are already working on solutions to fix the weaknesses of the pro-rata subscription model.

In the short term, they are considering adding fees on commitments over a certain amount to reduce the incentive to over-allocate.

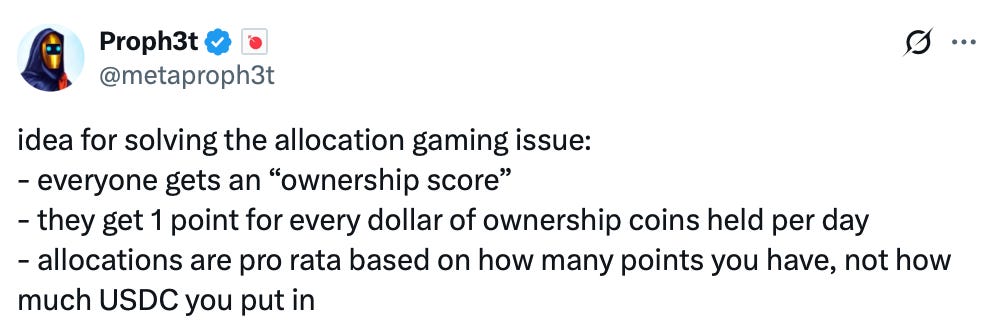

In the longer term, they are exploring a system, where everyone would have a “Ownership score” based on how much “ownership coin” they help, and higher scores receive better allocation. This would help ensure that high-quality, long-term holders are prioritized.

2/ The need for a curation layer

As MetaDAO moves toward a permissionless model, there will be a need for a curation layer.

One potential solution we find interesting is a “verified launch” system (similar to the blue tick on X) where: if a project wants to launch on MetaDAO, it first needs to get publicly “referred” by a trusted partner or a well-regarded founder / voice in the ecosystem (MetaDAO can select the pool of partners). This would act as a first filter, and the referrer would effectively put their reputation on the line creating natural incentives to only endorse projects they truly believe in.

Additionally, it would be valuable for the MetaDAO platform to better aggregate key information about each project to help investors make informed decisions (social graph signals, founder background, key links, optional KYC from founders, etc.).

This would make the screening process far more efficient for potential investors.

3/ Reducing friction on capital usage

In the long run, it’s crucial that MetaDAO does not create unnecessary friction for teams trying to execute. One idea the team is exploring is making “team-sponsored” proposals easier to pass than normal proposals. For example, if the default pass threshold requires the price to move at least +2%, a team-sponsored proposal might still pass even if the market moves –2%. In practice, this gives the team the benefit of the doubt and acknowledges that founders should be trusted unless the market signals strong disagreement.

Another potential improvement is introducing a light filter before proposals go live, either by the team or by a small community council to reduce noise and ensure only meaningful proposals reach the market.

Closing Thoughts

Crypto has enormous potential to improve capital markets and reinvent how capital formation happens on the internet. But for years, this promise has been held back by structural incentive misalignment: too many short-term opportunists have taken advantage of poor token structures to extract value from the market instead of creating it. In practice, this has led to a slow erosion of trust and legitimacy in the crypto industry as a whole.

MetaDAO proposes a genuinely interesting and refreshing solution to this problem through a launchpad architecture that is unruggable by design and that realigns incentives between founders and investors.

While this is a very bold mission, they have already made some very meaningful progress. The performance of their launchpad is one of the most impressive in crypto, and it has managed to attract a strong cohort of high-quality founders. Moreover, MetaProphet, Kollan, and the entire MetaDAO team have proven to be thoughtful, ambitious builders who take feedback seriously and are clearly motivated to keep improving their offer.

At Shoal, we believe MetaDAO stands a real chance of becoming an important pillar for how the next generation of startups, crypto-native or not, fund their ideas on the internet. This is especially relevant at a time when countries like the US are actively moving toward pro-crypto and pro-innovation regulatory frameworks.

Sources

Elementus. “ICO Market Report - August 2018.” elementus.io/blog-post/ico-market-august-2018/

MetaDAO. “MetaDAO Project Update.” x.com/MetaDAOProject/status/1909251208336019511

MetaProphet. “On Improving MetaDAO’s Launchpad Model.” x.com/metaproph3t/status/1985393563153440786

MetaProphet. “Thoughts on Allocation Mechanics.” x.com/metaproph3t/status/1979243370452258837

Galaxy Research. Why Futarchy Matters. galaxy.com/insights/research/why-futarchy-matters/

MetaDAO Documentation. docs.metadao.fi/

Really well done - love the choice of visuals to deliver your well-written points. MetaDAO is a top pick of mine for 2026. Something like governance through futarchy is desperately needed and MetaDAO's approach is novel, though remains flawed (as you'd expect from an early protocol). I'm just hoping they can iterate quickly enough before other similar entrants swoop in. I expect they will!

Good job flow