MEV Protection: DEX & Aggregator Anti-MEV Mechanisms

A look into decentralized exchange measures reducing maximal extractable value on swaps.

Intro To MEV

Maximal Extractable Value, formerly Miner Extractable Value, refers to the profit captured through the reordering of transactions in the block production process of a blockchain. MEV is an additional form of revenue for validators beyond the block subsidy and transaction fees they earn by default - which has created a critical shift in incentive dynamics and end-user outcomes.

Block production is a 24/7 continuous process which requires a lot of computational effort - decentralized exchanges see billions in transaction volume per week (often per day), and computational effort comes at the cost of transaction, or gas fees. Processing transactions sequentially, in ‘true order,’ is not quite attractive - the actors involved in the block production process are incentivized to not only cover the costs of their efforts but also to make a profit (oftentimes a significant one at that). Therefore, transactions in a block are ordered by gas fee - highest paying transactions are placed at the top of the block. For the user, getting to the top of the block (or as close to it as possible) means better settlement on a trade. Therefore transactions in a block are ordered by gas fee - highest paying transactions are placed at the top of the block. For the user, getting to the top of the block (or as close to it as possible) means better settlement on a trade.

Transactions on the blockchain are an abundant source of value - and resourceful entities compete with one another to capitalize on information asymmetries and network inefficiencies in order to extract the maximal extractable value. On Ethereum, validators are the ultimate beneficiaries of this design, as gas fees are an increasing function of the competition for transaction ordering.

How MEV Works

Validators are incentivized to order transactions based on the fees paid per transaction, with priority going to the highest-paying transactions. However, users are not just competing with other users for priority inclusion - hiding in the shadows of the dark forest are searchers, taking advantage of information asymmetry to “win the game” of block priority.

A searcher is simply someone who deploys a bot to constantly scour the public mempool for lucrative opportunities in pending transactions and then capture a profit by submitting their own replica transactions at the expense of the original transaction. To be a bit more specific, a lucrative opportunity could be a pending transaction which could impact an asset’s price when executed (i.e. a fairly big trade of a low-liquidity asset). Searchers who detect this opportunity will then replicate the transaction but pay a higher fee to get included in a block first. Validators don’t really care whether the transaction comes from a user or a searcher (in fact, searchers can vertically integrate with a builder or even run their own builder).

This is a relatively simplified description, but just consider that all these complexities are taking place while you, the user, are simply complaining about how much you paid for gas while waiting for your transaction to confirm.

Types of MEV

MEV is usually extracted through arbitrage - price discrepancies for a trading pair across different venues, such as blockchains, dApps, and even centralized exchanges. Value is captured when asset A is bought at a lower price on Venue A, and sold for a higher price on Venue B. Arbitrage can occur between two on-chain venues, or an off-chain: on-chain (see loss versus rebalancing).

Liquidations are another opportunity for MEV extraction - collecting the discounted assets of a liquidated position on a borrow/lending protocol, though data shows that these opportunities are nowhere near as common as arbitrage.

Front-running - A new transaction (A) is broadcasted with a higher gas price than an already pending transaction (B) so that A gets executed before B.

This is a common economic phenomenon in TradFi - trading firms front-running clients who have expressed their desire to execute a certain trade. In DeFi, regular users are the ones getting front-run and subjected to poor settlement on their trades. However, it is possible for MEV bots to get front-run too.

Back-running: The inverse of front-running, back-running takes place when Transaction A is broadcast with a slightly lower gas price than already pending transaction B so that A gets executed right after B in the same block.

Sandwich Attacks: This strategy involves two transactions - one to front-run a transaction and bump up the asset’s price, and another to back-run the transaction and sell the asset for a lower price, creating worse settlement for the original transaction before the block has even been executed. The price of the asset will return to normal but the searcher will capture the difference between the original price and artificially inflated one.

The MEV Debate

MEV Continued..

Opinions around the MEV phenomenon and how to approach it vary - some argue MEV cannot be eliminated, only mitigated, while others have even argued that MEV is ultimately a fundamental part of blockchains’ economies.

On the one hand, MEV provides an economic incentive for sophisticated actors to stabilize prices and thus create more efficient DeFi markets - blockchains need validators to function, and validators need financial incentives to do their work. On the other hand, MEV subjects user trades to financial loss incurred by worse settlement and potentially disrupting network consensus in a worst-case scenario of a reorg. Furthermore, maximizing value capture requires above-average computational resources and often capital, benefiting institutions and larger validators. These resourceful validators can then open up staking pools offering higher yields than the competition, snowballing the centralizing effect of attracting more stake and more value capture.

Blockchains are open and permissionless systems and those who are able to take advantage will do just that, but that doesn’t mean solutions to mitigate the externalities of adverse value extraction aren’t important (in fact they are the basis of this paper).

There is a general agreement within the research community that the internalization of MEV (returning the profits generated by MEV back to the end-user) is an important design choice to build for. This can be expressed in different designs which will be discussed in this paper - we believe their adoption will be important for the greater good of on-chain economies.

MEV is an invisible tax extracted by specialized entities at the expense of regular users.

Users are the key drivers of the on-chain economy - therefore, user experience (UX) is a critical feature. This paper focuses largely on solutions for swapping assets, the most primitive and common form of transacting on-chain. If the average user cannot perform simple swaps in DeFi without getting the risk of being front-run or sandwiched (or even having to worry about this complexity), what is the use for DeFi long term besides a largely arbitrary idea of decentralization? What will stop on-chain users from eventually migrating back over to centralized solutions like CeFi platforms, which meet their needs without the MEV headaches?

MEV-Mitigation Solutions

Users are incentivized to seek out solutions for MEV-protection for a simple reason - better price settlement (i.e. not losing $$ constantly to slippage). Instead of sending their transaction into the public mempool, where they are prone to being front-run or sandwiched, users can opt to send private transactions, which simply involve sending a transaction directly to a block builder using a private mempool. The builders are incentivized to access this exclusive transaction flow, as it allows them to build more valuable blocks.

The mempool is where unconfirmed transactions sit before they are confirmed by a validator.

Data from Blocknative shows that the number of private transactions jumped from ~1% in September 2022 to nearly 15% a year since.

Order Flow Auctions

Order Flow Auctions, or OFAs, are a mechanism designed to redistribute value extracted (MEV) from transactions back to the end-user by auctioning for the right to execute an order, and distributing the winning bid to the user. It is the on-chain implementation of Payment For Order Flow (PFOF) in TradFi.

Blockspace aggregators like MEV-Blocker or MEV-Share allow users to plug in private RPC endpoints from their wallets, helping protect users from sandwiching and front-running and internalizing users’ MEV. Signed transactions are routed to a private mempool, in which searchers compete in an auction to process the transaction. The winning bid in the auction is then paid out to users (for example, MEV-Blocker implements a 90/10 user: validator redistribution split).

In this paper, we discuss several different OFA designs implemented by various DEX aggregators - Batch auctions (CoWSwap), RFQs (0x), and Dutch auctions (1inch, UniswapX).

For a thorough explanation of OFAs, check out this great piece from Frontier Tech.

Intents

In the standard transaction process, users commit their transaction to a specific execution route once they sign it and submit them to the public mempool. This enables immediate execution but comes at the risk of loss of value in the trade due to MEV capture in the public mempool. This model also confines the user’s trade to one specific route, and assumes the user has selected the best possible one.

On the other hand, an intent is essentially a signed user message that states the desired final outcome (asset X for price Y) - without a commitment to a specific execution path. While the user maintains custody of the assets, the execution itself is outsourced to third parties who compete to find the best execution path among many different sources of liquidity (including their own private off-chain inventory i.e. spot positions on CEX) and provide the best price settlement possible for the user.

An easy way to think about this dynamic is in the context of one’s commute home from work, in a big city with various transportation modes. Hailing a cab on the street, or choosing which public transportation route to take ( bus A + train B or train A + train C etc) is like choosing a specific liquidity source in a standard transaction - you commit to a specific route under the assumption it is the fastest one home (often not guaranteed). On the other hand, if you use an app like Uber/Lyft or Google Maps, you are outsourcing the process of determining the best route for your commute to trusted, external parties.

A more formal definition of intents from Paradigm:

“Signed messages which allow for a set of state transitions from a given starting state, a special case of which is a transaction which allows for a unique transition.”

The benefits of using intents for placing swaps (as opposed to standard transactions) are centered around improved UX - this includes protection from front-running and sandwich attacks, accessing more sources of liquidity, abstracted gas fees, and avoiding failed transactions (as the order will not be executed if the users’ conditions are not met).

The Role of DEX Aggregators Today

Though MEV dynamics play out in the block production process, applications are the sources of the MEV. Therefore we believe applications play an important role in the overall adoption of MEV-protection solutions for retail users. Blocknative recently published a research report highlighting the fact that private transactions using blockspace aggregator OFAs like MEV-Share and MEV-Blocker can actually create worse price settlement than their standard counterparts, as private transactions often don’t receive top-of-block priority. Even the CoWSwap team has stated that “CoW Swap should also do a better job of managing price impact than using MEV Blocker alone.”

Aggregators play a valuable role for traders in DeFi. Often dubbed ‘Meta-DEXs’, these protocols provide smart order routing functionality across a number of different liquidity sources, providing swappers with better pricing, and in some cases, native MEV-protection.

This paper will specifically focus on the top DEX aggregators offering some form of native MEV-protection on swaps - CoWSwap, 1inch Fusion, Matcha, and the emerging UniswapX.

CoWSwap

CoWswap is the first DEX aggregator built on top of CoW Protocol, enabling users to swap assets and place limit orders with native Mev-protection. CoW stands for “Coincidence of Wants” , a barter economy in which one party has an item they wish to sell, while the other party is looking to buy that specific item, and the two parties can directly transact in a P2P manner. In DeFi, this refers to one trader holding a token they would like to sell, and another trader looking to buy that same token from them.

CoWSwap creates a private order flow marketplace enabling users looking to swap asset A for asset B for a defined price. Traders on CoWswap sign intents to express their desired trade outcome - these are then aggregated off-chain and settled in batches to be then executed on-chain.

With standard transaction ordering mechanisms today, searchers and block builders are incentivized to create as many different prices for the same asset within a block to capture what is ultimately a risk-free intra-block profit. CoW Protocol aims to solve this issue through a uniform price clearing mechanism that enables traders to get the same price for the same asset within the same block.

Instead of a central operator, CoW protocol delegates order matching to a decentralized set of order matching engines known as solvers who compete via batch auctions to ‘solve’ for the optimal order settlement within the given constraints of a limit order. A solver is a computer program that takes the orderbook as input, and computes the prices and traded amounts of all orders and liquidity sources (AMMs). In a batch auction, solvers are incentivized to compete to find the best settlement solution for users’ orders (the route of execution among different liquidity sources) in order to win the right to execute the batch and capture the surplus within a trade.

Since user orders are aggregated off-chain, users technically don’t need to pay gas fees on CoWSwap. There is an associated protocol fee - but this is only required once per token.

A full trading cycle on CoWSwap looks like:

Approve the Allowance Manager Contract in your wallet

Sign the order you want to place

Enjoy the tokens you just traded.

Barring some occasional spikes in months prior, CoWswap volume has remained consistent since April 2021. There are more returning traders than new ones, which indicates CoWswap has found PMF among a niche group of users but will likely need to up its user acquisition efforts moving forward as the intents-based application space is likely to become more crowded.

It is important to note having more solvers competing to fill batches creates a more competitive solver market and thus creates better price settlement for CoWSwap traders (there are currently 18 active solvers in V3 under this model on Ethereum).

1inch Fusion

Fusion is the latest swap engine from 1inch, offering a gas-free swap experience with native MEV-protection. Users can choose between Auto, Fast, Fair, and Custom with various execution and rate parameters.

A set of market makers known as resolvers handles the process of executing swaps, which are actually limit orders under the hood, by competing with other resolvers via Dutch Auctions to find the best rate for said transaction and execute it. Once an order is filled, the resolver then places it into a bundle with other orders, and is submitted for inclusion in a block. Note that since resolvers cover users’ gas fees, a settlement fee is charged to cover the costs on their end.

Each order has an auction start timestamp - before the auction begins, an order can be filled at the start rate(the maximum rate that a user can receive). Once the auction begins, the order filling rate gradually decreases over time. The trade is divided into parts, which results in several price points, assuming that arbitrageurs will backrun and move the price back after each resolver’s trade. Users benefit from better rates, while resolvers make a profit from each transaction.

At the time of writing, Fusion has seen over $13b in cumulative volume, and 1.6m orders from 582,029 unique wallets since launching in late 2022.

Matcha

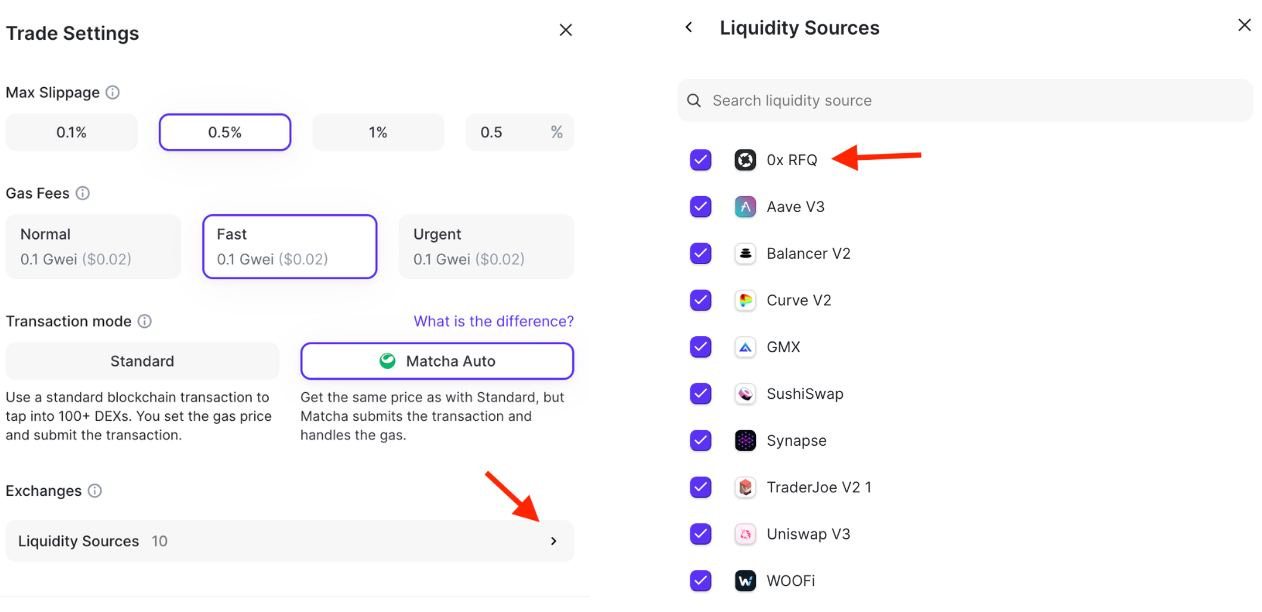

Matcha is a multi-chain DEX aggregator from the 0x team which allows users to trade tokens across Ethereum, Base, Arbitrum, Polygon, Optimism, Bnb, Celo, Fantom, and Avalanche. Matcha aims to optimize price settlement for users by sourcing liquidity from both on-chain and off-chain venues. Users can execute traditional A for B swaps or place limit orders.

Matcha enables users to opt into use private liquidity sources - a feature enabled by 0x’s Request-for-Quote (RFQ) system. RFQ enables users to sign an order for the trade they would like to make, and request a quote on their trade from a set of designated, off-chain market makers. The quote, representing a transaction execution path, is enforced by a smart contract, ensuring against slippage and thus sandwich attacks. The market makers are incentivized to beat the on-chain prices available on AMMs to be included in a quote, in addition to beating other RFQ market makers - the more competitive this system is, the better the price settlement.

An interesting stat to observe is that RFQ liquidity seems to favor smaller trades (<$100), indicating that this design benefits more retail and casual traders.

Fees

Matcha does not charge additional fees on top of gas fees for most trades, but there are some exceptions for specific assets on limit orders. For example, Matcha Auto (new swap engine) charges a 0.15% fee on trades with native tokens. A full breakdown of Matcha fees can be found here

User guide

Trading on Matcha is relatively straightforward - the first step is to connect your wallet, and select between making a regular swap or using a limit order. In order to opt in to RFQ liquidity, make sure you check for ‘0X RFQ’ in your liquidity sources in the transaction settings tab.

UniswapX

UniswapX is a new non-custodial, Dutch auction-based trading protocol from Uniswap that introduces new methods for routing and aggregating liquidity. UniswapX marks an industry shift towards utilization of off-chain liquidity for on-chain settlement. We say this because while UniswapX does not introduce entirely novel concepts, Uniswap has been the dominant DeFi protocol (captured over 50% of DEX volume this past year alone) so it is worth paying attention to the protocol’s developments.

The principle of UniswapX is a new liquidity marketplace which aims to benefit both LPs and traders- LPs to be properly compensated, and traders to enjoy better prices and abstracted gas costs.

After a user submits a signed order stating their expressed trade intent, a network of fillers compete for the right to fill the order (fillers can be searchers, market makers, and/or other on-chain agents) in a dutch auction. It’s important to note here that the user can specify the filler that they would like to fill their order - but once the auction begins, any order with better pricing can compete and win. Note that the system involves a Reactor contract for checking that the execution of a trade against the filler’s strategy matches the parameters set by the swapper, and an executor contract to be called to specify the filler’s strategy for fulfilling orders and actually executing the order. The goal here is to provide a better UX for swappers with improved price settlement and abstracted gas costs.

Don’t worry - swappers do not have to engage in any sort of auction to execute a trade.

One of the key value propositions behind UniswapX is MEV-protection. UniswapX internalizes MEV - in other words, returns surplus value (MEV) back to traders in the form of improved price settlement . This embodies the key ‘mev-redistribution’ principle behind OFAs and is in part inspired by the original Mev-capturing Amm proposal. Additionally, orders executed by fillers’ cannot be sandwiched, and fillers are incentivized to bypass public mempools and use private transaction channels for on-chain settlement.

UniswapX is still in beta, so analysis of user trends and activity should be taken with a grain of salt.

Important Risks And Considerations

The DEX aggregators we just listed utilize intent-based architecture to offer better UX and utility for users, but it is important to note a few critical issues with intent-based solutions and the implications of their widespread adoption. While user transactions may be safe from front-running and sandwich attacks within the public mempool, shifting the centralizing force of block builders to various middlemen imposes new risk vectors for both users and the ecosystem as a whole. Not only do on-chain LPs face greater difficulty, the widespread adoption of alternative mempools also poses risks of centralization, increased trust assumptions, and reduced transparency in the Ethereum ecosystem.

Increased Trust

The applications we have discussed in this paper require a set of trusted parties to fill user orders off-chain and execute them on-chain. This is an inherent tradeoff: bypassing the public mempool means there is that much more trust placed in the middlemen doing the actual bypassing. In the context of intent-based trading protocols, competition among the parties executing user orders is imperative for users to actually receive optimal pricing on assets.

Some protocols are taking measures or have plans for further decentralization - for example, CoWSwap envisions transforming its centrally hosted order book to a distributed p2p client network in the future. However, these are often long-term developments, and in the short-term protocols will often implement trusted solutions that optimize for performance.

CoWSwap Solvers - Running a solver on CoWSwap involves significant knowledge and access to both on-chain and offchain liquidity sources, as well as strong predictive knowledge of slippage tolerances - this is a comparatively similar skillset required for successfully running searchers. Solvers must be whitelisted in advance and follow a set of social consensus rules - though accountability is not enforced by smart contracts but rather by the CoW DAO, which can enforce penalties and slashing.

No provision of unfair solutions

No Inflation of the objective function

No illegal use of internal buffers

Incorrectly reporting transacted values for encoded transactions

Other malicious behavior causing intentional harm to the user or protocol

1inch Resolvers - Running a resolver on 1inch Fusion requires whitelist approval and sufficient account balance to pay for order fees. Whitelist approval requires 1) obtaining necessary ‘unicorn power’ threshold - this involves staking more $1inch (longer lock-ups = more power), 2) registration, 3) Account Balance for fees. Resolvers are ranked, and are held accountable by rules set and enforced by the 1inch Network DAO, as well as their performance; if they are not able to maintain a top 10 ranking they cannot fill swaps.

0x RFQ Market Makers - 0x utilizes private off-chain market makers for their RFQ liquidity system - in part, the system of the protocol itself holds market makers accountable, as the RFQ system only allows the specified taker address to fill an order, preventing front-running. While this dashboard provides comprehensive analytics for RFQ liquidity volume and trades and it is reasonable to assume there is some reputation or bonding-enforced mechanisms to keep MMs accountable, there are ultimately no definitive guidelines and rules available for what accountability looks like and how it is enforced.

UniswapX Fillers - UniswapX outsources the process of transaction routing to an open network of fillers - who can tap into their own ‘private inventory’ to source liquidity for filling orders, private inventory being another word for off-chain liquidity. Currently, the filler role is only available to whitelisted entities during beta, but Uniswap intends to leave this role to be permissionless; according to Uniswap docs, requirements for creating a filler are simply a)defining a filler execution strategy and b) retrieving & executing discovered orders.

This raises questions about what filler accountability may look like in practice, as Uniswap has not yet released a framework. It would be reasonable to assume the implementation of economic incentives (i.e. bonding/slashing collateral) here, and whether the Uniswap DAO will play a role as X’s smart contracts and fee switch will be governed by the DAO.

This is an active area of research and will definitely be interesting to keep an eye on moving forward.

Though there are measures in place to ensure market makers/fillers/solvers are acting in good faith and only reputable entities are able to fill orders, and permissionless mempools face their own set of challenges, shifting more user activity to a new system that only increases trust assumptions does not contribute to a more decentralized DeFi ecosystem. Universal solutions for solver accountability, such as “reputation based systems to build trust with the users based on their repeated engagement and enforcement of accountability” , are evidently an important missing piece of the puzzle that needs to be accounted for if adoption of intent-based architectures continues to grow.

Less Transparency

Computing the order filling logic off-chain is critical for providing better UX (i.e., abstracted gas costs for users, protection from front-running and sandwiching) but it also comes at the cost of greater opacity in the overall block production of Ethereum. Private/permissioned mempools are just that - private. Analytics for these systems is limited, and a mass migration of user activity to private mempools and off-chain liquidity means that much less observability for both sleuths and the general public.

Slower Execution Times

Another caveat with intent-based trading protocols is that they often take longer to execute. For example, orders on CoWSwap and 1inch Fusion take up to 30 seconds to execute. Slower execution time can lead to worse price settlement as the price of the asset can change in the time prior to an order getting filled.

The process to determine the ‘ideal’ intent-based architecture still lies ahead, but it helps to reference this quote from Paradigm’s piece on intents:

“permissionless so that anyone can match and execute intents while not trading off much execution quality; general so that deploying new applications doesn’t require standing up new mempools; and transparent so that the process by which intents are executed is reported publicly and data for execution quality auditing is made available, when privacy guarantees allow.”

Dex aggregators play an important role in DeFi in helping traders swap assets with better price settlement due to their underlying mechanisms in which a set of market makers compete to provide the best price settlement for their trade. That said, they still pose constraints as settlement routes are restricted to their liquidity sources, not to mention new trust assumptions and reduced transparency in DeFi. Therefore when we consider the role of DEX aggregators moving forward, it is important to consider future developments in the intents landscape as well as the broader MEV-protection landscape.

Future Outlook for MEV-Protection and Intents

We believe the rise of private transactions in the past year indicates growth in overall demand for MEV-protection solutions within DeFi. More users are becoming aware of the invisible MEV tax and how it affects their on-chain trading experience (it wasn’t too long ago that the jaredfromsubway.eth MEV bot was a phenomenon on Crypto Twitter) - and are thus more actively seeking solutions to protect their transactions from this tax. Though teams like CoW Protocol, 0x, and 1inch have been around for some time now, we are beginning to see a greater shift in interest and development around MEV-protection solutions - as leaders in DeFi like Uniswap begin to leverage MEV-protection as a value proposition (UniswapX, Uniswap Wallet).

Wallets and Order Flow Auctions

It is evident that wallets have and will continue to play a critical role in the MEV supply chain - wallets have been enabling users to set custom RPC endpoints such as Flashbots RPC , Mevblocker RPC , and Rabbithole (1inch) to send their transactions to an OFA for some time now. Most recently, Uniswap Wallet has introduced their Swap Protection feature, which natively integrates MEV-Blocker.

The more intuitive and integrated MEV-protection solutions are, the more users will actually get to benefit from them. However, as we mentioned earlier it is important to consider the performance of these transactions may oftentimes be worse than regular transactions given they must compete for top-of-block priority for optimal settlement. The takeaway is that convenience != performance.

Account Abstraction and Intents

Intents have the potential to unlock a new paradigm of end-user experience - though we focus on swaps in this paper, we can consider further use cases such as intents for automation regularly occurring processes to improve crypto UX and make users’ lives easier (i.e. moving funds from cold to hot wallets or purchasing X amount of assets on a regularly occurring basis) The point is, we are still early in the overall adoption of intents.

Account abstraction utilizes intents to provide better UX; using smart-contract accounts as opposed to the traditional EOAs will make it easier for users to natively submit generalized intents (called user operations or ‘userOps’) to express a desired outcome So far, there have been 5,972,635 userOps submitted across 1007615 users since March. As account abstraction is expected to grow in adoption, we expect intents to have a greater impact on the DeFi ecosystem and crypto UX as a whole.

That said, it is important to note that ERC 4337 also imposes new vectors for MEV extraction. Bundlers, who are responsible for aggregating userOps submitted to the Alt Mempool, oversee the contents of userOps and can therefore reorder userOps in the most profitable order. If submitted to the public mempool, the bundle is then also subject to the traditional front-running and sandwich attacks. This two-fold MEV system leaks additional value from user transactions towards validators and introduces a further adversarial MEV environment.

Furthermore, given the resources and skill-set needed to run a competitive bundler is similar to those needed to run a competitive builder (therefore benefiting resourceful entities), we can assume a handful of existing builders will seek to run bundlers as an additional MEV stream on top of the public mempool. To quote Matt Cutler “ERC-4337 changes everything & nothing”

A broader takeaway is that it is important to look beyond the guise of the improved UX account abstraction can bring, and consider the impact of ERC 4337 on user price settlement in the short and long term.

Within the context of our paper, it is also interesting to consider whether or not we see MEV-protection solutions integrate userOp bundles, or if the further adversarial MEV environment under ERC 4337 prompts more adoption of MEV-protection solutions instead.

General-Purpose Infrastructure for Intents

Although intents are not new, its applied utility has been limited to trading assets thus far. However, a number of teams have been working on general-purpose infrastructure for intents to enable developers to build intent-centric applications, and help mitigate centralization risks. further use-cases including auctions, crowdfunding, P2P Lending, OTC NFT Lending, and various other automated processes. Some critical developments include:

SUAVE (short for Single Unifying Auction for Value Expression). Flashbots is building a MEV-aware, intent-centric architecture built to allow chains to outsource the block builder and mempool roles by providing a shared sequencing layer. The stack consists of: a mempool where users can specify preferences (intents), an execution network where solvers compete to execute user preferences, and a block building environment. The goal is to decentralize the existing transaction/mev supply chain, while benefiting the parties involved - builders and validators can increase their returns, and users can transact with better execution.

Anoma: intents-as-a-service for blockchains. Anoma is a “unified architecture for full-stack decentralized applications” built from the ground up to enable greater adoption of intents by unifying settlement and counterparty discovery mechanisms, and preserving user privacy. This will enable applications to integrate various intent-based services and features for their users.

Essential is building intent-based infrastructure and tooling to “to accelerate the transition from value extraction to intent satisfaction”, including a universal DSL for intents, an intent-centric standard for account abstraction (ERC 7521, a proposed alternative to ERC 4337), and a modular protocol with native support for intents.

It is important to note that these solutions are not going to be fully implemented in practice in the near future, and their true impact will only be realized in the long term. As we said before, we are early in the early stages of the intents landscape. Likewise, we are still early to developing a universal “tried and true” approach to dealing with the externalities with MEV.

Conclusion

As more users have begun to seek out ways to protect their transaction value from MEV, the concept of redistributing MEV seems to have become a commonly accepted one among researchers today, leading to an uptick in MEV-protection solutions. While traders in DeFi today have a handful of options to choose from for this purpose, they must also weigh the considerations and tradeoffs that come with intent-based trading protocols. Although not a new concept, intent-based protocols are still fairly nascent and underdeveloped, which is a critical point for those navigating this space. We encourage you to form your own opinions on the MEV debate and consider the evolving ecosystem with a critical eye. With the continuous innovations and commitment from project teams, the future for MEV protection looks promising and is poised for further value-add to end-users.

Sources

The most common types of MEV and protection from toxic strategies

Intent-based protocols pt1: unfolding UniswapX | Blog - Anoma

Investment Disclosure. Disclosure: Members of Shoal Research hold material positions in the assets discussed in this article. The content presented is for informational purposes only and should not be construed as financial or investment advice. Please perform your own due diligence before making any investment decisions.

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are the authors own, not the views of their employer.