Polymarket and the Proliferation of Prediction Markets

How Decentralized Prediction Markets such as Polymarket Are Reshaping Forecasting and Decision-Making in the Digital Age

Key Takeaways:

Growth and Influence of Prediction Markets: Prediction markets are increasingly recognized for their ability to leverage collective intelligence to forecast future events, significantly impacting fields such as politics, finance, entertainment, and pop culture.

Technological Advancements Driving Adoption: The integration of blockchain technology, along with aspects of both decentralized finance (DeFi) and decentralized social media (SocialFi), has revolutionized prediction markets, transparency, cultural relevance, and accessibility.

Polymarket's Success Story: Polymarket stands out as a leading prediction market platform, attracting significant liquidity and user engagement due to its innovative features, strategic partnerships, and strong endorsements from industry leaders like Vitalik Buterin.

Impact on the 2024 US Presidential Election: Prediction markets have played a crucial role in shaping public perception and media coverage of the 2024 US presidential election, providing real-time data that offers a more dynamic—and remarkably accurate—picture far before traditional polls can capture the same sentiment.

Challenges and Regulatory Landscape: Despite their potential, prediction markets face significant challenges, including technical scalability, security concerns, and navigating complex regulatory environments, particularly in the United States.

Future Prospects and AI Integration: The future of prediction markets looks promising, with the potential for user-sourced market curation, advances in Oracle technologies, and the integration of artificial intelligence to enhance market creation, liquidity management, and dispute resolution.

Note: This research was conducted between July and September 2024. Please keep in mind that political circumstances change quickly, so some details may change over time.

Introduction

The internet is many things to many people, and there are innumerable arguments for and against its ubiquity in our daily lives. However, there is no denying that the Internet is history's most effective collective action tool. It has enabled instantaneous communication across continents, crowdfunded seemingly uninvestable ideas, and helped keep economies afloat as lockdown mandates spread globally in tandem with the Coronavirus pandemic. With all the boundaries the internet has helped humanity breach, is it too far-fetched to believe that it can also help humanity predict the future?

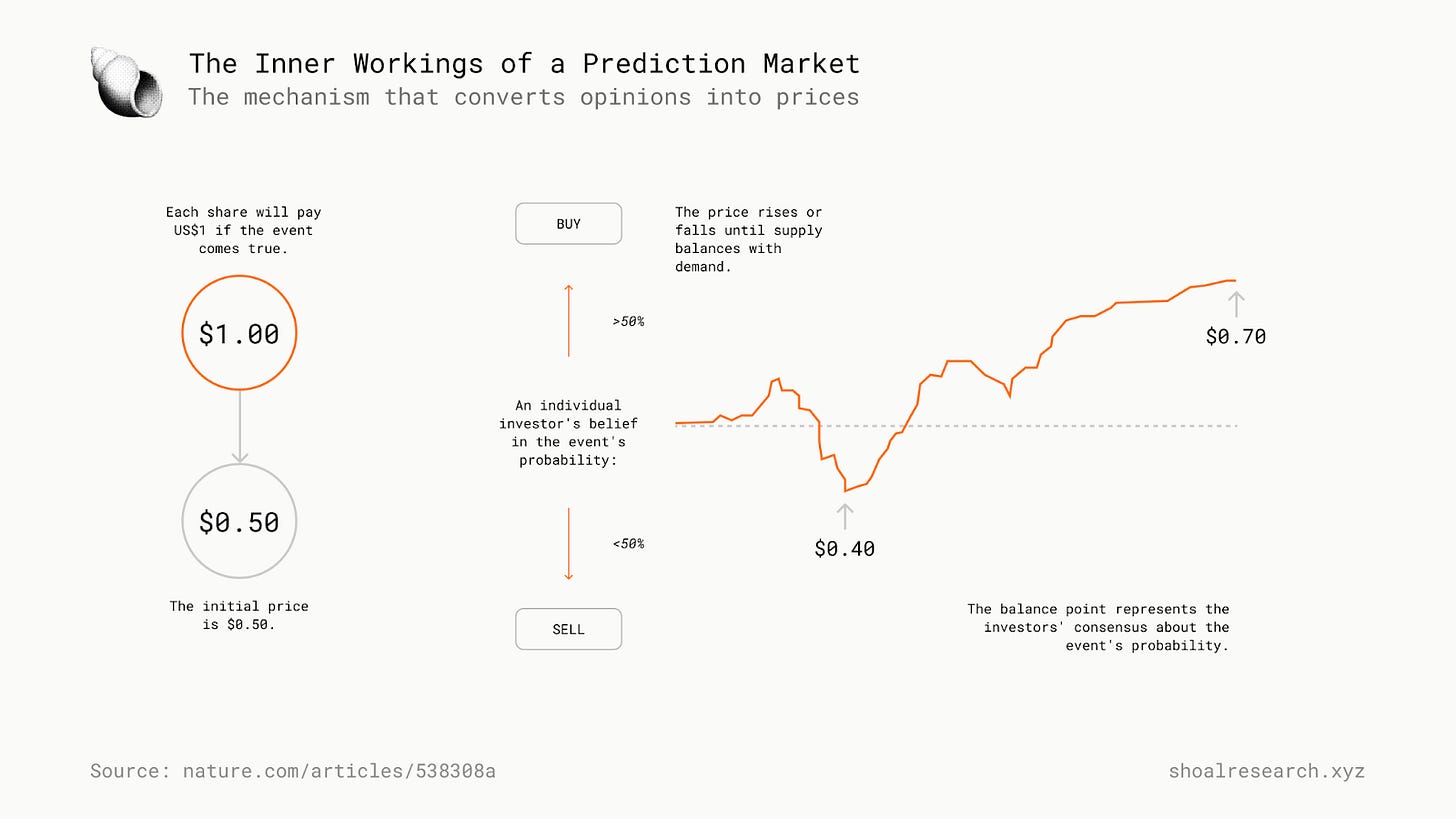

Prediction markets are a powerful testament to the internet's ability to aggregate collective wisdom and provide insights into future events. These markets, which allow individuals to bet on the outcomes of various events, leverage participants' diverse knowledge and opinions to generate highly accurate predictions. As these markets grow in popularity and liquidity, they are increasingly recognized for their potential to serve as reliable sources of foresight in fields ranging from politics to insurance, finance, entertainment, and beyond—practically any industry can benefit from more comprehensive datasets.

In recent years, prediction markets have witnessed accelerated growth, driven by structural factors such as the democratization of information and technological advancements and idiosyncratic factors exemplified by platforms like Polymarket. Polymarket, the leading prediction market platform by volume, serves as a compelling case study for understanding the forces propelling the proliferation of prediction markets and their emerging role in modern society.

As underscored in a July 2nd tweet by Ethereum co-founder Vitalik Buterin, “Prediction markets and Community Notes are becoming the two flagship social epistemic technologies of the 2020s,” this reinforces his long–standing public praise for prediction markets as the “holy grail” technology that, if executed properly, can finally usher in a democratized source of truth. This paper will delve into the accelerating growth of prediction markets, examining both the structural drivers and unique aspects that have led to Polymarket's dominant position.

The 2024 US Presidential Election Cycle

The 2024 US presidential election cycle has become a pivotal event for prediction markets, illustrating their growing influence and reliability. Leading up to the election, the political landscape has been marked by significant shifts, controversies, and public interest, all of which have been mirrored in the activity on prediction platforms like Polymarket.

Detailed Overview of the Political Landscape

The political landscape for the 2024 election has been dynamic and volatile. Key events have included President Joe Biden's decision to withdraw from the race, Vice President Kamala Harris stepping up as the Democratic frontrunner, and former President Donald Trump's dominance in the Republican primaries. These developments have kept prediction markets bustling with activity as users place bets based on their expectations and insights.

Polymarket, for instance, has provided real-time odds on these political dynamics, reflecting shifts in public sentiment and media coverage. When Biden announced his withdrawal and endorsed Harris, Polymarket saw a surge in bets favoring Harris as the Democratic nominee. This shift was not only a reflection of Biden's endorsement but also a response to Harris's growing support within the Democratic Party and among influential political figures.

On Polymarket, Harris’s odds have seen a significant increase, reflecting her strengthened position in the Democratic Party. As of late July 2024, Polymarket users gave Harris a 92% chance of securing the Democratic nomination, following Biden's endorsement and her rising support from top Democrats. Harris's odds of winning the popular vote were nearly tied with Trump, with Harris at 44% and Trump at 45%.

In contrast, Trump has maintained a strong lead in the Republican primaries, with Polymarket consistently favoring him to win the presidency. As of July 2024, Trump had a 64% chance of winning, compared to Harris’s 34%. Trump's dominance in key swing states like Georgia, Arizona, and Pennsylvania has solidified his position as the frontrunner.

Influence on Public Perception and Media Coverage

Prediction markets like Polymarket have significantly influenced public perception and media coverage of the 2024 election. These markets offer a continuous stream of data that reflects the collective wisdom of a diverse group of participants. As such, they provide a more nuanced and real-time picture of the electoral landscape compared to traditional polling methods.

For example, Polymarket's odds tracking on the 2024 presidential race was highlighted by prominent investment research firm, Bernstein Research, due to the platform's growing influence in shaping public perception of the viability of each candidate. When Trump's odds fluctuated on platforms like Polymarket and PredictIt following various political events, media outlets readily utilized such data in their reporting on the status of the horse race. This real-time feedback loop between prediction markets and media coverage has created a more dynamic and interactive environment for political analysis.

In particular, the media has highlighted the role of prediction markets in capturing the impact of unexpected events. For instance, Polymarket accurately predicted President Joe Biden’s withdrawal from the race, with the market pricing a 66% chance of Biden dropping out, post-debate, even while he publicly denied it. This prediction was later validated when Biden officially announced his withdrawal, showcasing the market’s ability to provide accurate forecasts of future events at a pace in which mainstream political punditry and traditional polling cannot compete with.

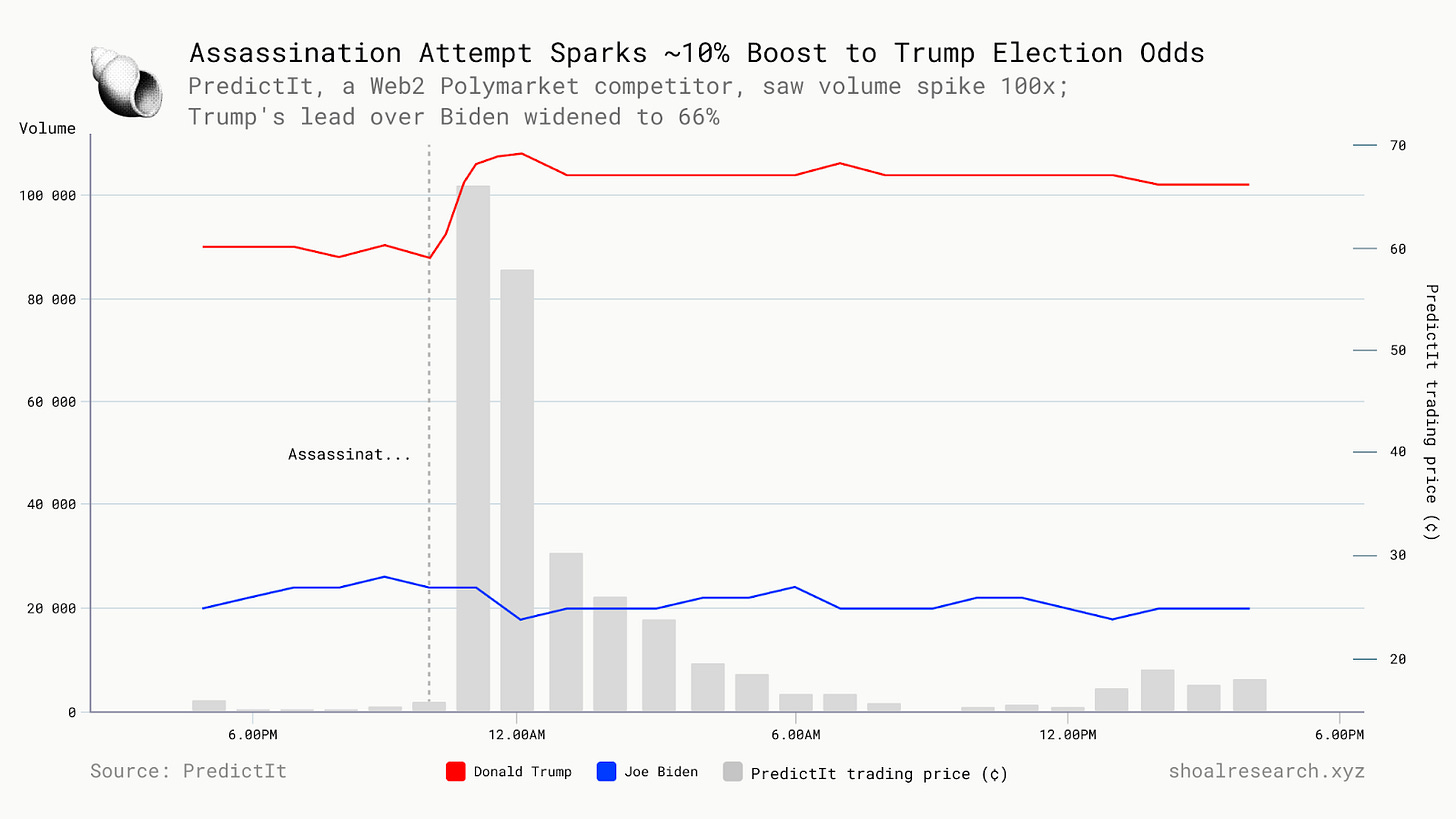

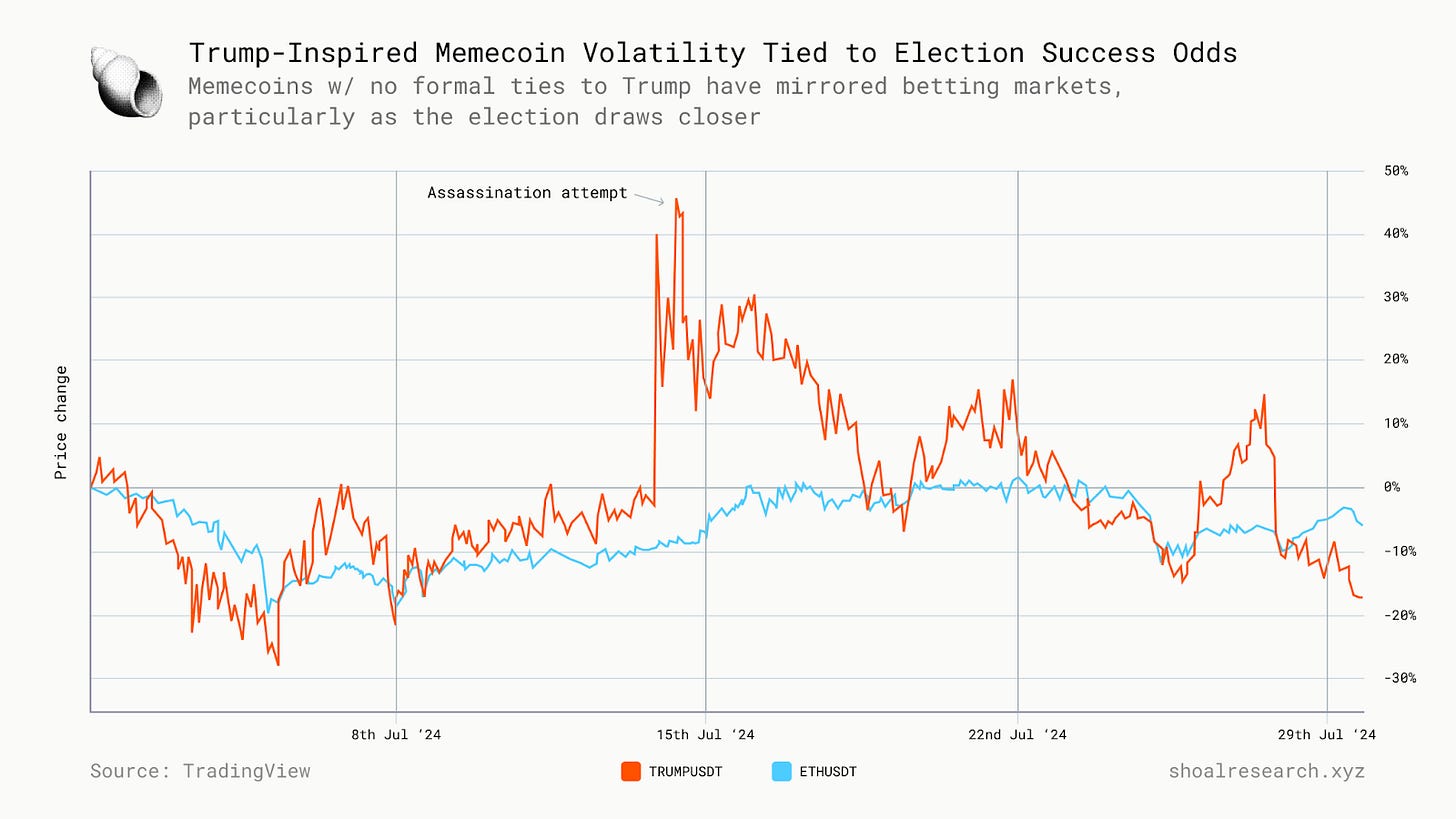

Moreover, the rise of Trump-inspired memecoins, which surged in value in the immediate aftermath of the assassination attempt (in lockstep with betting market odds of a Trump victory), further reinforces the intersection of political speculation and cryptocurrency trends. These gains have since reversed in true speculative fashion, with the price of the TRUMP ($MAGA) token ending the month of July down nearly 20% from where it began on July 1st – possibly a reflection of Kamala Harris’ growing chances of winning the race. This phenomenon is just another manifestation of the broader memecoin craze that has garnered significant media attention, and is arguably a main driver of the uptick in altcoin prices (Solana in particular) over the past ~18 months.

Growing Role of Prediction Markets in US Politics

Prominent political analysts, influencers, and data scientists have played crucial roles in shaping the activity on prediction markets. Poker-playing statistician Nate Silver’s involvement with Polymarket, following a $45 million Series B funding round led by Peter Thiel’s Founders Fund in May 2024, has been particularly noteworthy. Silver’s analytical prowess and reputation for accurate – at times contrarian – predictions have enhanced the platform’s credibility, drawing more participants and media attention. This partnership highlights the intersection of traditional political analysis and innovative prediction market technologies.

These high-profile endorsements and strategic partnerships have further solidified Polymarket’s position as a leading prediction market. The platform’s ability to attract significant volume, investments, and collaborations with influential figures has contributed to its growth and acceptance as an increasingly effective forecasting tool, particularly in regard to US politics and geopolitical events.

Specific Examples of Market Influence

One notable example of prediction markets influencing public perception is the betting activity surrounding Vice President Kamala Harris. Following endorsements from Biden and other Democratic leaders, Harris’s odds on Polymarket surged, significantly narrowing the gap with Trump within a week. This shift reflected the immediate consolidation of support around Harris and captured the renewed enthusiasm for her candidacy, demonstrated by record-breaking fundraising shortly after. Traditional polls cannot capture the impacts of sudden events in real-time, so political analysts and pundits quickly highlighted the dramatic change in betting odds. The relationship between betting markets and the media’s insatiable appetite for real-time updates creates a flywheel effect, amplifying the prominence of prediction markets in public discourse.

Similarly, Polymarket’s handling of the Republican primaries has provided valuable insights into the fluctuating fortunes of various candidates. Trump’s dominance in these markets has often been juxtaposed with the challenges faced by other Republican contenders, offering a real-time barometer of his continued influence within the party.

Moreover, the interplay between prediction markets and social media has amplified their impact. Political influencers and analysts frequently share updates from prediction markets on platforms like Twitter, further disseminating this information and shaping public discourse. This interaction between prediction markets and social media underscores the growing integration of digital tools in political forecasting and public engagement.

The Rise of Prediction Markets

Prediction markets have a storied history, evolving from rudimentary beginnings into sophisticated, blockchain-powered platforms that leverage collective intelligence to forecast future events. This section delves into the historical development of prediction markets, the technological advancements that have propelled their growth, and case studies that highlight their impact on decision-making across various fields.

Historical Development of Prediction Markets

While there exist physical records of political wagers dating as far back as the 1503 papal elections, the emergence of modern prediction markets occurred in the late 20th century, with early experiments testing the hypothesis that markets could aggregate dispersed information more effectively than individual experts. One of the earliest and most notable examples of a prediction market that reached some mainstream appeal is the Iowa Electronic Markets (IEM), which began as the Iowa Political Stock Market in 1988. Founded by economists at the University of Iowa, this market allowed participants to buy and sell contracts based on political outcomes, such as the share of votes a candidate would receive.

The IEM quickly demonstrated its value by outperforming traditional polls in predicting election outcomes. In the 1988 presidential election, the market’s closing prices closely matched the actual vote shares of George H. W. Bush and Michael Dukakis, surpassing the accuracy of major polls. This success underscored the potential ability of prediction markets to aggregate and reflect collective intelligence more accurately than conventional methods.

Robin Hanson, a pivotal figure in the development of prediction markets, proposed the idea of "idea futures" or "policy markets" in the early 1990s. Hanson's vision was to create markets where individuals could bet on the outcomes of policy decisions, thereby generating valuable information that could inform public and private decision-making. His work laid the theoretical foundation for modern prediction markets, emphasizing their potential to provide unbiased, continuously updated estimates of future events.

Historical Examples of Prediction Markets

Several prediction markets have successfully leveraged these technological advancements to become influential tools for decision-making. Here are some notable examples:

Iowa Electronic Markets (IEM): The IEM has been a pioneer in demonstrating the predictive power of markets. It has consistently outperformed traditional polls in forecasting the outcomes of US presidential elections. A study published in the Scientific American comparing the IEM's performance from 1988 to 2004 found that the market was closer to the actual election results 74% of the time compared to major polls. The IEM has also expanded its scope to include markets on economic indicators and international elections, providing valuable insights across a range of domains.

Hollywood Stock Exchange (HSX): The HSX is a virtual market where participants trade shares in movies, actors, and other entertainment properties. The market’s prices have been shown to accurately predict box office performance and award winners, demonstrating the utility of prediction markets in the entertainment industry.

Policy Analysis Market (PAM): Developed by the Defense Advanced Research Projects Agency (DARPA), the PAM was designed to forecast geopolitical events by allowing participants to trade futures contracts based on their predictions. Although it was eventually canceled due to political controversy, the PAM highlighted the potential of prediction markets to inform national security and policy decisions. PAM aimed to aggregate dispersed information about geopolitical risks, including terrorist attacks and political instability, and provide actionable insights for policymakers. Despite its short lifespan, PAM's concept has influenced subsequent developments in prediction markets and their applications in public policy.

Intrade: Intrade, which operated from 1999 to 2013, was another significant player in the prediction market space. It allowed users to trade on various events, including political outcomes, economic indicators, and even weather forecasts. During its operation, Intrade successfully predicted the outcomes of several high-profile events, including the 2008 US presidential election, where it accurately predicted Barack Obama's victory.

Technological Advancements Enabling Growth

The rise of blockchain technology and decentralized finance (DeFi) has revolutionized prediction markets, addressing many of the limitations of earlier platforms. Blockchain technology offers several key advantages that have catalyzed the growth of prediction markets:

Decentralization: Blockchain ensures that prediction markets operate without central control, reducing the risk of manipulation and increasing trust among participants. Decentralized platforms like Augur and Gnosis enable users to create and trade on markets without relying on a central authority.

Transparency: Blockchain provides a transparent ledger of all transactions, enhancing trust and accountability. Smart contracts automate the execution of trades and the distribution of rewards, ensuring that outcomes are determined fairly and transparently.

Security: Blockchain's cryptographic security mechanisms protect against fraud and hacking, making prediction markets safer for participants.

Accessibility: Blockchain lowers barriers to entry, allowing anyone with internet access to participate in prediction markets. This democratization of access has expanded the pool of participants, enriching the information aggregated by these markets.

The integration of smart contracts has further enhanced the functionality of prediction markets. Smart contracts are self-executing agreements with the terms of the contract directly written into code. They automatically enforce the rules and distribute rewards based on the outcomes of events, reducing the need for intermediaries and increasing efficiency.

Impact on Decision-Making

Prediction markets have had a profound impact on decision-making in various fields by providing accurate, real-time forecasts based on the collective wisdom of participants. Here are some examples of their influence:

Political Forecasting: Prediction markets have become valuable tools for political analysts and campaign strategists. By aggregating diverse opinions and responding quickly to new information, these markets often provide more accurate forecasts than traditional polls. For instance, during the 2008 US presidential election, prediction markets accurately predicted the outcomes of key primaries and the general election, outperforming top expert forecasts.

Corporate Decision-Making: Companies use prediction markets to forecast product demand, assess market trends, and make strategic decisions. For example, Google has used internal prediction markets to forecast product launch dates and assess the success of new initiatives. By leveraging the insights of employees, companies can make more informed decisions and identify potential risks and opportunities.

Public Policy: Policy markets, as envisioned by Robin Hanson, have the potential to inform public policy decisions by providing unbiased estimates of the outcomes of different policy options. For example, a policy market could estimate the impact of a proposed tax change on economic growth, helping policymakers make evidence-based decisions.

Structural Factors Driving Growth of Prediction Markets

The proliferation of prediction markets is driven by several structural factors that collectively contribute to their growth and influence.

Decentralization and Trustless Systems: Prediction markets benefit from decentralization, which reduces the risk of manipulation and increases trust among participants. Decentralized platforms like Augur and Gnosis use blockchain technology to ensure that markets operate without central control. This transparency is crucial in building user confidence. Decentralization also enhances security. Blockchain’s cryptographic mechanisms protect against fraud and hacking, making these markets safer for participants.

Increased Accessibility and User Participation: User-friendly interfaces and lower barriers to entry have democratized participation in prediction markets. Blockchain lowers the technical and financial barriers, allowing anyone with internet access to participate. This broadens the pool of participants, enriching the information these markets can aggregate. For example, the Iowa Electronic Markets (IEM) demonstrated that markets could aggregate and reflect collective intelligence more accurately than traditional methods. The IEM has consistently outperformed polls in predicting US presidential elections, showing higher accuracy in 74% of cases from 1988 to 2004.

Democratization of Information: The rise of populism and public backlash against perceived elites have fueled interest in platforms that democratize access to information and decision-making. Prediction markets allow a diverse group of participants to contribute their knowledge and insights, creating a more comprehensive and inclusive forecasting tool. This democratization is evident in the growth of political prediction markets, where users can bet on election outcomes. These markets often provide more accurate forecasts than traditional polls, reflecting a broader range of perspectives.

The Financialization of Everything Era: The trend of financializing various aspects of life has extended to prediction markets, where individuals can speculate on a wide range of outcomes, from political events to cultural phenomena. This trend has attracted a new generation of users who are comfortable with the idea of financial speculation as a form of engagement and entertainment. The success of platforms like the Hollywood Stock Exchange (HSX), where participants trade shares in movies and actors, demonstrates the appeal of prediction markets beyond traditional financial sectors.

Interplay Between Structural Factors

The interplay between these structural factors creates a synergistic effect that accelerates the growth and adoption of prediction markets. For instance, decentralization enhances security and transparency, which in turn boosts user trust and participation. Increased accessibility allows more individuals to engage with these markets, enriching the pool of collective intelligence. The democratization of information ensures that a wide range of perspectives is considered, leading to more accurate predictions. Finally, the financialization trend attracts new users who bring different insights and knowledge to the markets.

Comparison to Traditional Polling

Over extended time horizons, prediction markets have demonstrated higher accuracy compared to traditional polling methods. For example, the IEM has been more accurate than polls in predicting US presidential election outcomes in 74% of cases from 1988 to 2004. In contrast, traditional polls often fail to capture the full spectrum of voter sentiment and can be influenced by various biases.

Polling methods typically rely on representative samples to gauge public opinion, but these samples can be skewed by non-response bias, sampling errors, and other factors. Prediction markets, on the other hand, aggregate the collective wisdom of a diverse group of participants who have financial incentives to provide accurate information. This leads to more reliable forecasts that reflect the true probability of outcomes.

Moreover, prediction markets and polls can complement each other to provide a more comprehensive picture of reality. While polls measure voter preferences at a specific point in time, prediction markets reflect the aggregated expectations of participants about future outcomes. By combining insights from both methods, analysts can gain a deeper understanding of electoral dynamics and public sentiment.

Role of Social Media and Online Communities

Social media and online communities play a crucial role in driving participation and engagement in prediction markets. Platforms like Twitter, Reddit, and specialized forums provide spaces for users to discuss and share information about prediction markets, influencing public perception and attracting new participants.

For example, during the 2024 US presidential election cycle, Polymarket and other prediction platforms have seen increased engagement from users sharing their market positions and discussing political developments on social media. This real-time exchange of information helps to create a dynamic feedback loop, where market prices are continuously updated based on the latest news and insights.

Online communities also foster a sense of belonging and competition among participants, encouraging them to stay engaged and contribute their knowledge. This collective participation enriches the information available to prediction markets, leading to more accurate forecasts.

dApp Spotlight: Polymarket

It’s no accident that Polymarket is well-positioned for growth. A deeper look at the evolution of the platform reveals the key backers, innovative features, and strong user engagement that propel its ongoing success.

Founding and Early Development

Polymarket was founded in 2020 by Shayne Coplan, with the vision of creating a decentralized platform for betting on real-world events. As a blockchain-enabled platform, Polymarket offers transparency, security, and permissionless accessibility, setting itself apart from traditional prediction markets often hampered by financial regulations tied to typical forms of capital flows rather than cryptocurrency. The platform successfully raised $70 million from notable investors, including Peter Thiel’s Founders Fund and Ethereum creator Vitalik Buterin. This substantial financial backing has been crucial for Polymarket's rapid growth and development.

Vitalik Buterin has been a long-time proponent of prediction markets and has often highlighted Polymarket as an example of successful user experience (UX) improvements and a product with strong market fit. These factors have driven better mainstream adoption of a Web3 decentralized application, which is rarely seen without excessive reward incentives. Buterin's endorsement of Polymarket is significant, given his reputation for predicting the evolution of technology well before the mainstream takes notice. His support provides additional confidence in Polymarket's future success.

In May 2024, Buterin participated in Polymarket's Series B funding round, further solidifying his commitment to the platform. In a reply to Polymarket’s tweet on July 19th, Buterin praised the platform's idiosyncratic successes, stating, "Really impressive showing from you guys. Not just predicting the outcomes well in advance, but also (through making conditional odds of different candidates visible) serving as an active input into collective decision making."

In July 2024, Polymarket gained significant attention by hiring Nate Silver, a renowned statistician and founder of FiveThirtyEight, as an advisor. This strategic move enhanced the platform's credibility and reinforces the overall view that prediction markets are gaining traction, while further solidifying Polymarket as the leading prediction market platform.

Operational Mechanics

Polymarket functions as a decentralized prediction market where users can trade shares on various events' outcomes, including political elections, sports, and cultural happenings. The platform employs blockchain technology to ensure a secure, non-custodial environment where transactions are transparent and immutable.

Market Curation: Users can propose new markets, which are then reviewed and curated by the platform’s moderators to ensure relevance, clear definitions, and binary outcomes.

Placing Bets: Participants buy shares in favor of or against a particular outcome. Each market operates with binary options like "Yes" or "No". Share prices reflect the market's consensus on the outcome's likelihood. For instance, if shares of the “YES” outcome option are priced at $0.60, the market estimates a 60% probability of that outcome.

Consensus and Resolution: Polymarket uses optimistic oracles via UMA Protocol to verify event outcomes. These trusted data sources provide the necessary information to settle bets by collecting data from off-chain sources (e.g., news outlets and public records). Once an event concludes, the oracle reports the outcome to the blockchain, where smart contracts automatically resolve the market and distribute winnings.

Payouts: Participants holding shares in the correct outcome receive payouts proportional to their holdings, facilitated by smart contracts that ensure fair and transparent fund distribution.

Liquidity Providers and Market Makers: Polymarket uses a Central Limit Order Book (CLOB) and Fixed Product Market Makers (FPMMs) to maintain liquidity and facilitate trading. Liquidity providers also earn rewards from the transaction fees paid by traders. When users provide liquidity for an event, they receive an economic reward of 2% of each transaction amount. The closer the liquidity provision price is to the final transaction price, the greater the reward. Users must pay an additional 2% to the pool if they close a contract before a market resolves (aka prior to a market reaching an event-driven resolution).

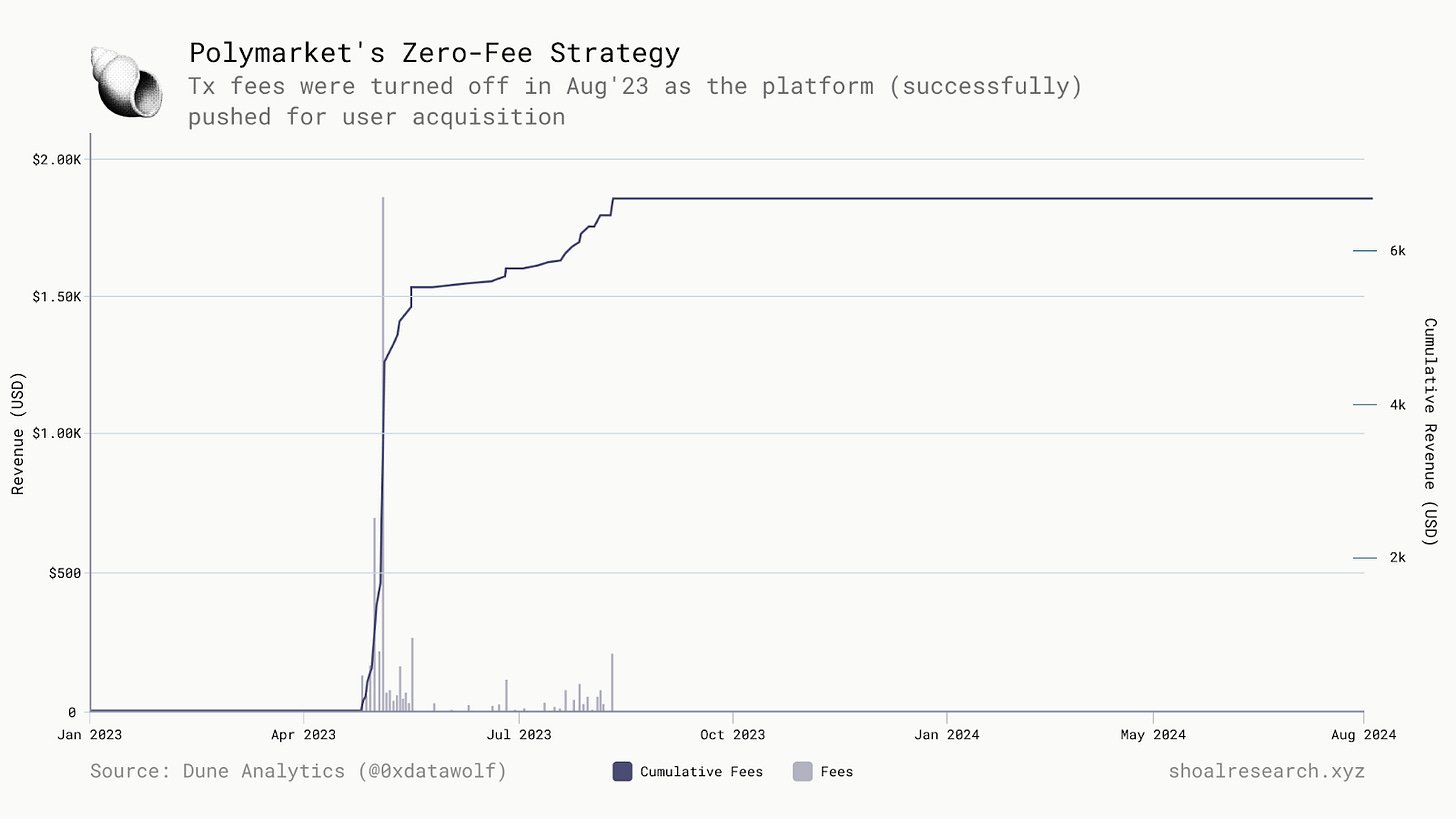

Fees: Polymarket currently does not charge additional fees for trading (as of this writing), though Polymarket states in its docs that this is subject to change. Polymarket’s business model is comparable to an AMM in that its primary revenue source would be through its dynamic fee schedule – charging fees to purchase binary options contracts on their platform. If enabled, Polymarket’s set fee would be levied on the proceeds of a contract. Polymarket did add fees to certain market pools in Q2 '23, but on-chain data shows that all fee generation has been paused since August 28th of that year.

Given it does not charge a fee directly, the platform has historically only generated revenue when it has acted as an independent liquidity provider.

Key Features and Functionalities

Outcome Tokens: Polymarket's markets utilize the Gnosis Conditional Token Framework (CTF), where binary outcomes are represented as ERC1155 tokens. These tokens can be traded on the platform, each corresponding to a specific market and outcome.

PolyLend: Introduced in 2024, PolyLend is a peer-to-peer lending protocol allowing users to borrow USDC against their conditional token positions. This feature enables participants to leverage their market positions for additional capital.

User Incentives and Reward Programs: Polymarket offers various incentive programs, including market-making rewards, referral bonuses, and trading competitions, designed to boost user engagement and liquidity.

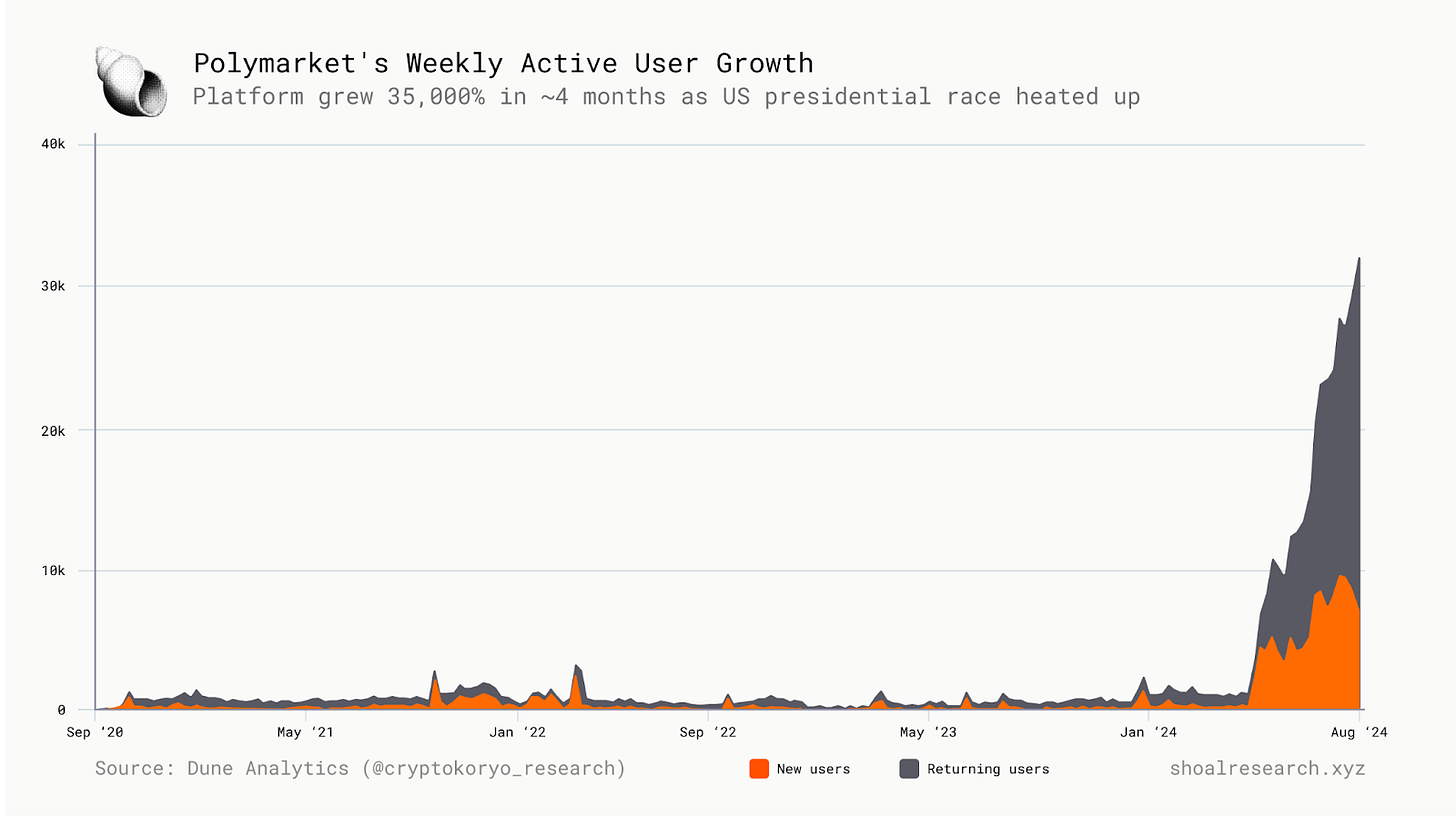

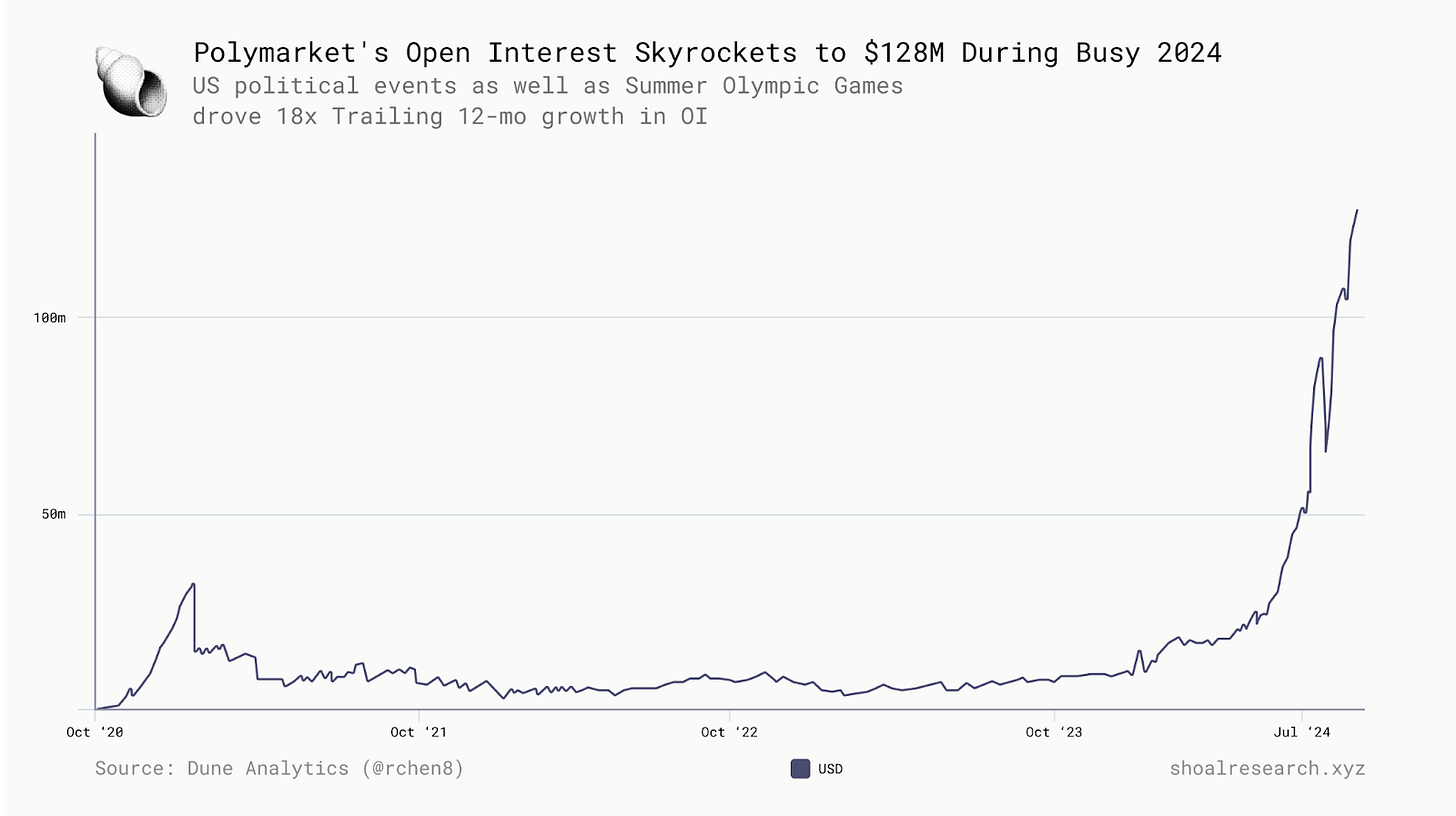

Growth and Impact

Since its launch, Polymarket has experienced rapid growth in trading volume, user base, and market activity. In July 2024, it hit an all-time high of $387 million in monthly trading volumes, tripling from the $111MM in captured volume for June. Monthly volume pushed higher to $473MM in August and peaked again in September, reaching a staggering $533MM in trades. Polymarket has also witnessed similar trends in user growth. Between May 1st, 2024 and September 9th, 2024, weekly active users on the platform have grown from ~1,000 per week to ~35,000 per week – an approximate 35,000% increase in the span of 4 months. Additionally, Polymarket experienced a substantial growth in monthly active users, reaching 90,037 in September—a 41.5% increase compared to the previous month.

Political markets have seen significant engagement. In July, more than $320 million in cumulative bets had been placed on the US presidential election winner. The decision by President Joe Biden not to seek re-election spurred record daily volumes at the time, reaching $28 million in one day.

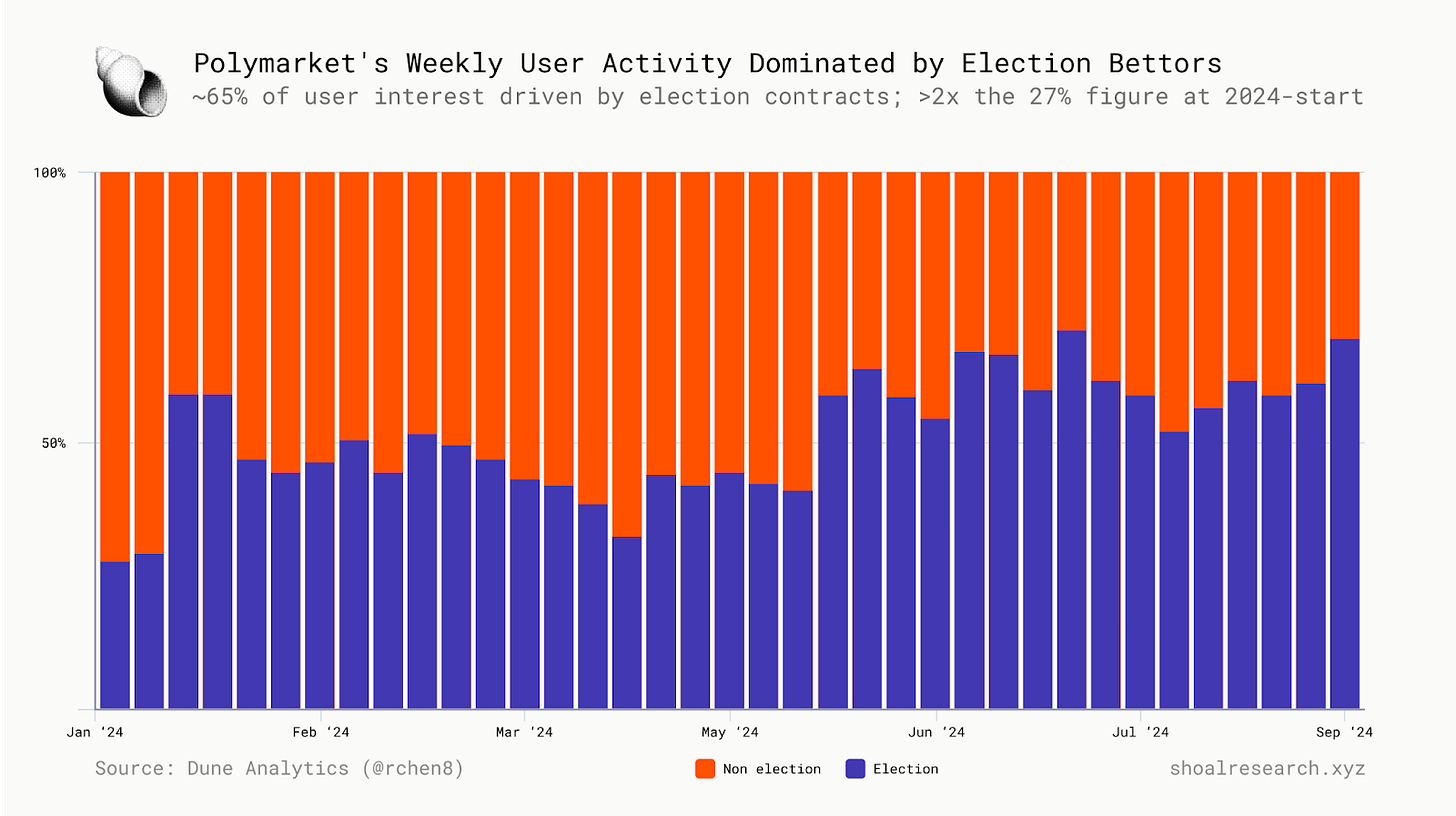

Polymarket's weekly user activity has been heavily driven by election bettors, as evidenced by the above chart, where approximately 65% of user interest is tied to election-related contracts. This is more than double the 27% recorded at the start of 2024, indicating a clear shift in user engagement toward election betting as the year has progressed. More precisely put, the new user and volume growth depicted in the previous charts is highly correlated to the US election. The dominance of election markets suggests that political events have become a key catalyst for user participation, and the platform’s overall activity is closely linked to political cycles and election-related news.

This strong correlation should not come as a surprise to those who’ve paid attention to platforms like Polymarket over the years. Every four years, prediction markets see a surge in activity due to the U.S. election cycle, as political markets become a primary driver of volume in the ~12 months leading up. While these platforms experience ebbs and flows in user participation, they rarely give back all the gains made during an election cycle. As a result, platforms like Polymarket benefit from a steady increase in mainstream prevalence over the long term, as they retain a portion of new users and liquidity, helping to fuel their continued growth beyond election seasons.

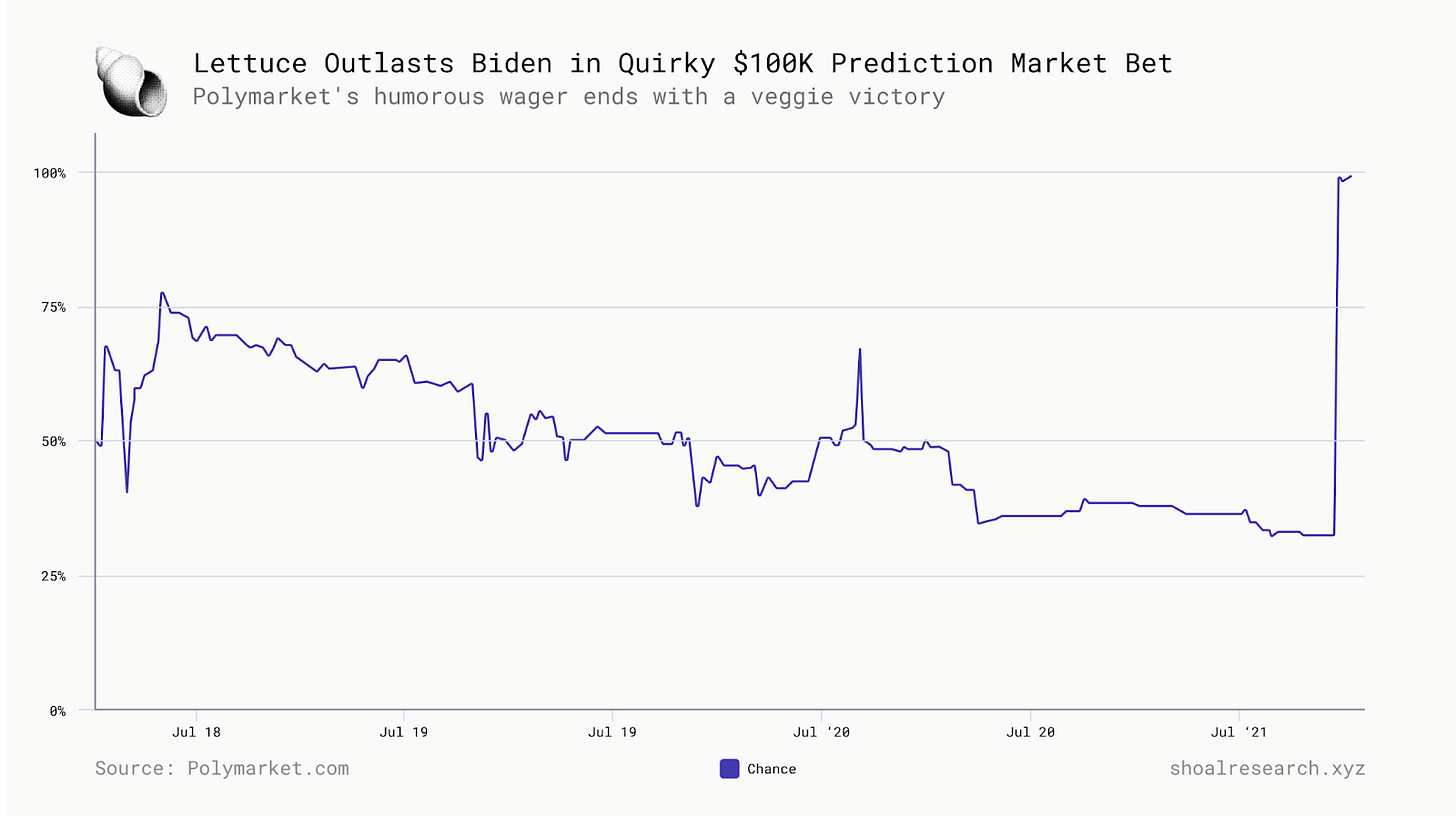

One final intriguing example of the kinds of markets that gain traction on Polymarket comes from July 18th, when a quirky market emerged following President Biden’s rough debate performance. The market posed a humorous question: “Lettuce vs. Biden - Who lasts longer?” From its creation, “Lettuce” led with a 63% probability, and just three days later, Biden announced his withdrawal from the race. Polymarket’s ability to engage with internet culture, memes, and Twitter humor allows it to craft playful, unique, and timely markets that resonate with the current zeitgeist, keeping the platform fresh and closely aligned with its user base. This “internet-native” persona has and will likely continue to be a strategic advantage that competitors may struggle to replicate.

Cultural Relevance and Market Curation

Polymarket distinguishes itself by curating markets resonant with current cultural and political events. The platform’s moderators ensure markets are relevant and timely, often revolving around major news events, elections, and popular culture. This approach not only attracts participants but also enhances the platform's utility as a forecasting tool.

For instance, Polymarket has created markets on the 2024 US presidential election, Federal Reserve rate cuts, and significant global events like the COVID-19 pandemic. By offering markets on various topics, Polymarket caters to diverse interests and leverages its user base's collective intelligence to provide valuable future insights.

User Testimonials and Platform Impact

User testimonials highlight Polymarket's appeal and impact. Many users praise its transparency, ease of use, and the opportunity to profit from their knowledge and insights. The addition of high-profile figures like Nate Silver has further bolstered user confidence in the platform’s accuracy and reliability.

One user noted, "Polymarket has revolutionized the way I think about forecasting. The ability to bet on real-world events and see the market's consensus in real-time provides a level of insight that traditional polls just can't match."

Overall, the support and investment from influential figures like Vitalik Buterin, combined with Polymarket's innovative features and strong user engagement, position the platform for continued growth and success in the prediction market space.

Other Industry Players & Honorable Mentions

In addition to Polymarket, several other prediction market platforms have made significant contributions to the field. This section provides condensed profiles of these platforms, highlighting their unique features, market focus, and user base. We will also compare and contrast these platforms with Polymarket, discussing their strengths, weaknesses, and market positioning, as well as exploring the potential for collaboration or competition between these platforms and Polymarket.

PredictIt

PredictIt is a well-known political prediction market platform based in the United States, operating under an academic exemption granted by the CFTC. Founded in 2014, PredictIt allows users to bet on political events such as elections, policy outcomes, and legislative developments. PredictIt’s detailed political markets and academic focus provide it with a niche market of politically engaged users and researchers. However, the academic exemption limits the scale of its operations, including restrictions on the number of participants and the amount of money that can be bet on each market.

Kalshi

Kalshi is a regulated prediction market platform based in the United States, offering a wide range of markets on events such as economic indicators, weather outcomes, and political events. Founded in 2018 by Tarek Mansour and Luana Lopes Lara, Kalshi operates under the regulatory oversight of the Commodity Futures Trading Commission (CFTC), which provides it with a unique positioning in the market. Kalshi’s regulatory approval and focus on non-political markets provide a distinct advantage in attracting users who prioritize security and regulatory compliance, although this focus may limit its market diversity compared to decentralized platforms like Polymarket.

Gnosis (Web3)

Gnosis is one of the pioneering platforms in the decentralized prediction market space, founded in 2015 by Martin Köppelmann and Stefan George. It operates on the Ethereum blockchain and has expanded its functionalities beyond prediction markets to include decentralized trading and wallet services. Gnosis leverages the Conditional Token Framework (CTF) to tokenize outcomes and offers a robust infrastructure for creating and trading prediction markets. With its native token, GNO, used for governance and staking, Gnosis has built a comprehensive ecosystem that supports a wide range of use cases. The platform's innovative use of decentralized oracles and its focus on enhancing user experience through intuitive interfaces have made it a notable player in the industry. Gnosis's emphasis on security and transparency, combined with its diverse range of successful Web3 products, positions it as a strong competitor to platforms like Polymarket. However, its broader focus on various blockchain applications means it may appeal to a different segment of users compared to more specialized prediction market platforms.

Augur (Web3)

Launched in 2018, Augur is one of the pioneering blockchain-based prediction markets. Initially built on Ethereum’s mainnet, Augur operates as a permissionless platform that allows users to create their own markets using its native utility token, REP, for rewards, market creation, and dispute resolution. Augur supports binary, categorical, and scalar markets, catering to a wide range of prediction events. In 2021, Augur introduced a dedicated sportsbook platform called Augur Turbo on the Polygon network, adopting a layer-2 approach similar to Polymarket, while other markets remained on Ethereum Mainnet under the new name "Augur Pro." Augur's reliance on the REP token and Ethereum L1 transaction fees has led to higher costs for users. However, its commitment to decentralization, flexibility, and diverse market options continues to attract a dedicated user base.

Azuro (Web3)

Azuro is a decentralized prediction market protocol launched in 2021, designed to improve liquidity and user experience through a peer-to-pool model. Azuro’s unique liquidity model allows users to pool their funds, which are then used to provide liquidity across various markets. Built on blockchain technology, Azuro ensures transparency and security for its users while emphasizing an intuitive and user-friendly interface. As a newer platform, Azuro may lack the market diversity and user base size of more established platforms like Polymarket but offers innovative liquidity management and scalability solutions.

Predict.fun (Web3)

Predict.fun is an upcoming prediction market platform set to launch on the emerging Blast blockchain. Similar to how pump.fun revolutionized memecoins, predict.fun’s name implies an aim to bring gamification and accessibility to the forefront of prediction markets. Similar to Polymarket, the platform will utilize the UMA protocol for oracle services and dispute resolution, however, it will also notably offer users a native yield, thanks to the unique capabilities of the Blast blockchain. Advocates of the new platform note that the yield incentives will enhance capital efficiency and improve price discovery. With its innovative approach and the growing momentum in both prediction markets and the Blast ecosystem, predict.fun is well-positioned to attract early adopters and speculators eager for the next big opportunity in the space. However, whether it can capture and sustain the trading volumes necessary to create efficient markets remains to be seen. I expect this platform is one worth watching in the months ahead.

Other Notable Platforms

Manifold (formerly Manifold Markets): A prediction market platform that uses a play-money system to lower barriers to entry, offering an accessible and gamified experience. Manifold’s user-friendly interface and social features have fostered strong community engagement, making it popular among casual users and those new to prediction markets.

HedgeHog.markets: A decentralized prediction market platform focused on sports and entertainment events, offering unique betting opportunities within niche markets. Polymarket’s broader market offerings may attract a more diverse user base.

InsightPrediction: Offers markets on political and financial events with a focus on integrating market data with predictive analytics. Its integration of predictive analytics could complement Polymarket’s market data, offering potential for collaboration.

Futuur: An international prediction market platform with a focus on a wide range of topics, including politics, sports, and entertainment. Futuur’s global reach and market diversity align closely with Polymarket, suggesting potential competition for international users.

SX.Bet: A sports-focused crypto market that allows users to bet on various sports outcomes using blockchain technology to ensure transparency. While SX.Bet focuses on sports, Polymarket’s broader range of markets may appeal to users interested in non-sports events.

Summary: Competitive Landscape

The landscape of prediction markets is diverse, with each platform offering unique features and catering to different user interests. Kalshi’s regulatory compliance, PredictIt’s political focus, and Azuro’s innovative liquidity model highlight the variety within the industry. While each platform has its strengths and weaknesses, they collectively contribute to the growth and evolution of prediction markets.

The prediction markets on PredictIt, Kalshi, and Polymarket are most often cited by traditional media outlets, thus garnering more mainstream appeal than the other platforms listed (though Augur and Gnosis are both well-respected within the crypto industry). Of the three, Polymarket stands out as the only Web3 platform, leveraging its decentralized approach, broad market offerings, and intuitive UX to attract a diverse and engaged user base. Comparing these platforms with Polymarket reveals both opportunities for collaboration and areas of competition. The well-executed strategic differentiators that fueled the platform’s mainstream breakout underscore a competent leadership team capable of maintaining its position at the forefront of the industry.

Broad Impacts

Prediction markets extend far beyond political betting, with significant implications for sectors like finance, sports, entertainment, and public policy. While niche platforms may excel in specialized areas, the future of prediction markets likely follows a 'winner-takes-most' trajectory. This is driven by the clear correlation between increased trading volume and market efficiency, resulting in superior predictive ability. When all is said and done, the platforms with the greatest liquidity and user base will maintain a competitive advantage in delivering reliable forecasts across multiple domains – as well as capture the lionshare of media attention.

Implications by Sector

By taking a longer-term view, it isn’t difficult to recognize how prediction markets may demonstrate their utility across a wide range of sectors in the future, offering valuable insights and influencing decision-making processes.

Finance: Prediction markets can offer real-time forecasts on economic indicators, stock prices, and other financial metrics. By aggregating diverse opinions and leveraging crowd wisdom, these markets can provide early warnings of economic shifts, helping investors and policymakers make informed decisions. Many popular platforms now offer markets on US Federal Reserve rate decisions, as well as other key economic indicators. One of the most actively traded markets globally is the CME Group’s 30-day Federal Funds Futures contract, which functions similarly to a prediction market and is visualized through the CME FedWatch Tool, allowing traders to assess the likelihood of upcoming rate changes.

Sports: In the sports industry, prediction markets can be used to forecast game outcomes, player performance, and other related events. Platforms like SX.Bet specialize in sports betting, providing a decentralized and transparent way for fans to engage with their favorite sports. These markets can also offer insights into team strategies and player conditions, potentially influencing coaching decisions and team management.

Entertainment: The Hollywood Stock Exchange (HSX) is a prime example of how prediction markets can be applied to the entertainment industry. By allowing participants to trade shares in movies, actors, and other entertainment properties, the HSX has accurately predicted box office performance and award winners. This information can be valuable for studios and investors when deciding which projects to greenlight and how to allocate resources.

Public Policy: Prediction markets have significant potential in the realm of public policy. For example, policy markets, as envisioned by Robin Hanson, could estimate the outcomes of various policy decisions, providing data-driven insights to policymakers. By betting on policy outcomes, participants can help forecast the effectiveness of different policy options, aiding in the formulation of more effective and evidence-based public policies.

Societal Impact of Widespread Adoption

The widespread adoption of prediction markets could have profound societal impacts, particularly in how public opinion is formed and how decisions are made.

Changes in Public Opinion Formation: Prediction markets offer a real-time and dynamic reflection of public sentiment, which can significantly influence how opinions are formed and disseminated. Traditional polls provide static snapshots, whereas prediction markets continuously update, incorporating the latest information and participant insights. This dynamic nature can lead to a more informed and engaged public, as individuals have access to constantly evolving data reflecting collective expectations.

Enhanced Decision-Making Processes: The integration of prediction markets into decision-making processes can lead to more informed and rational decisions. By aggregating the diverse opinions and knowledge of participants, prediction markets can provide more accurate forecasts and identify potential risks and opportunities. This capability can be particularly valuable in areas such as corporate strategy, public policy, and investment decisions, where accurate predictions are crucial.

Democratization of Information: Prediction markets democratize access to information by allowing anyone with internet access to participate. This inclusivity can lead to a broader range of perspectives being considered, enhancing the quality and reliability of the forecasts generated. As more people engage with these markets, the collective intelligence of the crowd becomes a powerful tool for forecasting and decision-making.

Efficiency and Accuracy: The Case for Winner-Take-Most

The accuracy of prediction markets is closely tied to their liquidity. Higher liquidity ensures that markets are more resilient to manipulation and can better aggregate diverse opinions, leading to more accurate forecasts. This dynamic creates a potential "winner-take-most" scenario, where a few platforms dominate the market due to their superior liquidity and accuracy.

Polymarket's success exemplifies this trend. With substantial trading volumes and a broad user base, Polymarket has established itself as a leading platform for political betting markets. Its ability to attract significant liquidity has enhanced its predictive accuracy, making it a trusted source for forecasting political outcomes. As the industry matures, it is likely that a small number of well-capitalized and liquid platforms will emerge as the dominant players, shaping the future of prediction markets.

The Arguments Against Prediction Markets

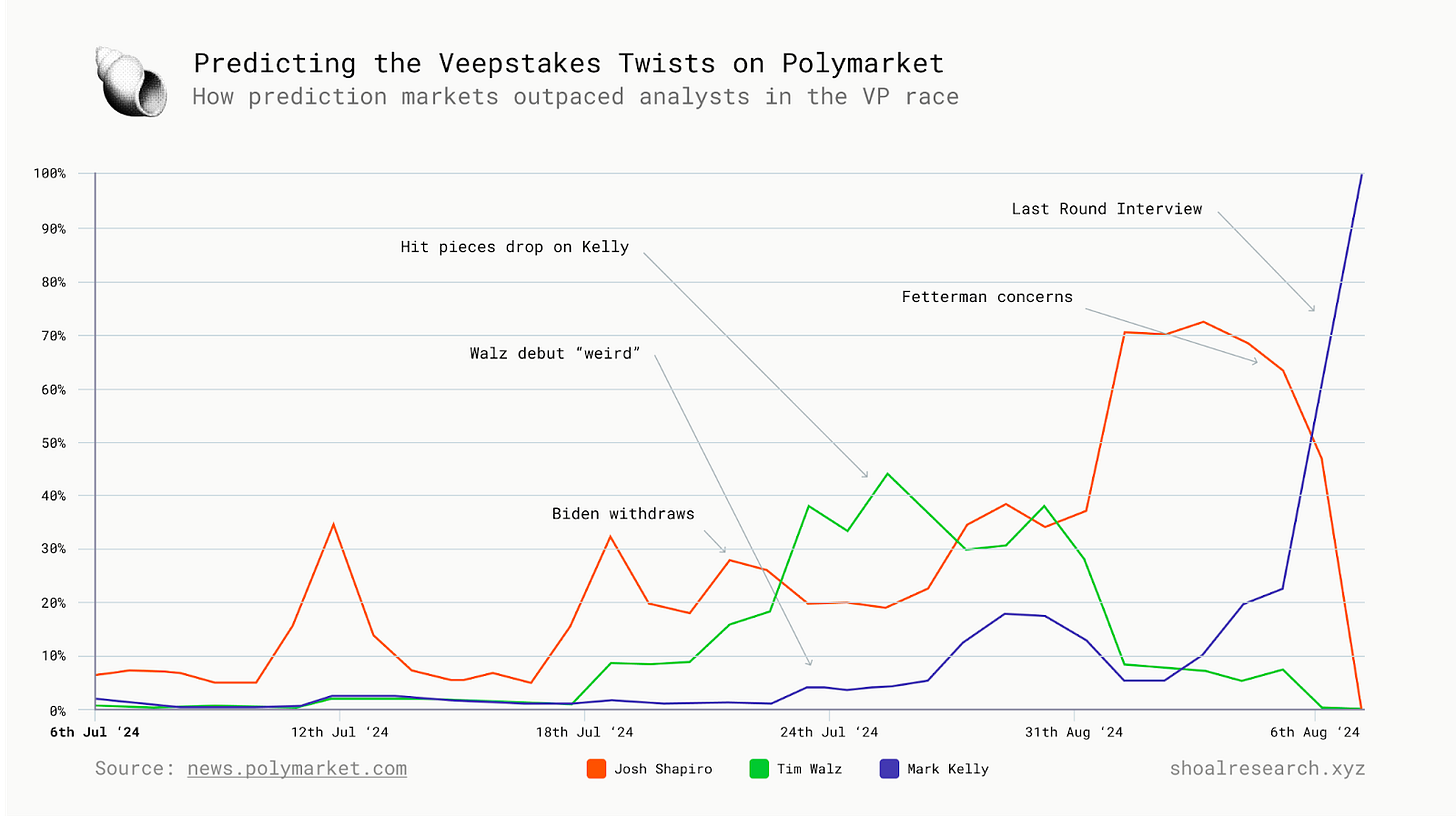

Critics of prediction markets often cite specific instances where these platforms have failed to accurately predict political outcomes, using these examples to argue against their overall predictive power. Below are two public criticisms that have emerged in recent weeks, in response Kamala Harris’ selection of Tim Walz – considered a true “dark-horse” in the VP race – as her running mate:

Walz's Unexpected Selection: One user pointed out that Polymarket had Minnesota Governor Tim Walz at just 3% odds of being chosen as Kamala Harris's running mate mere days before the official announcement. This led the user to suggest that "degenerate gamblers" might not be the best at predicting future political outcomes, implying that prediction markets are fundamentally flawed as forecasting tools.

Reactionary Nature of Prediction Markets: Another user criticized prediction markets more broadly, arguing that these platforms are not truly predictive but rather reactive to news developments. The user stated that unless there is widespread insider trading (which is unlikely to occur at scale in high-stakes markets due to the risks involved), prediction markets merely mirror the prevailing news narratives rather than providing forward-looking insights.

Rebuttal: Why These Critiques Are Misleading

While these critiques are understandable given the unexpected nature of Tim Walz's selection, they fail to account for the inherent challenges in predicting vice-presidential picks and overlook the broader utility of prediction markets.

Inherent Uncertainty in VP Picks & Limited Data: Vice-presidential selections are notoriously difficult to predict due to the highly secretive nature of the decision-making process. Typically, only a small circle of advisors is involved, and the final choice rests solely with the presidential candidate. This decision can be influenced by personal preferences, strategic considerations, or external factors that are not publicly known or easily anticipated. Furthermore, the decision-making process often prioritizes factors unrelated to swing state advantages, making it even harder for prediction markets to accurately narrow down a list of potential running mates. The challenge is compounded by the limited access to reliable data. Unlike larger political events, such as elections that involve millions of participants and more prescient polling data.

As recently highlighted in the well-respected UVA political publication, Sabato's Crystal Ball, Kamala Harris's selection of Tim Walz was shaped by a constrained timeline and specific political considerations, many of which could not be effectively defined and disseminated to the broader public in such a short amount of time.

The Role of Gut Instincts in Decision-Making: Presidential candidates may prioritize different factors when selecting their running mates. Some may rely heavily on data and polling, while others might follow their instincts or prioritize personal relationships. This variability further complicates the predictive process, making it difficult for markets to accurately forecast such decisions. In Walz's case, his selection may have been influenced by factors that were not visible to the public or easily quantifiable, such as his background, compatibility with Harris, or his ability to appeal to centrist voters.

Prediction Markets as a Complementary Tool: Prediction markets should not be viewed as standalone predictors of specific events like VP picks, which are shrouded in secrecy. Instead, they are most valuable when used as part of a broader analytical toolkit, providing insights into the collective sentiment of informed participants. While they may not always get it right in cases of high uncertainty, they are effective at aggregating diverse opinions and adjusting quickly to new information.

Outlier Events Do Not Define Predictive Power: Finally, it's important to recognize that outlier events, such as an unexpected VP pick, do not invalidate the broader predictive power of markets. In many cases, prediction markets have accurately forecasted complex political outcomes, outperforming traditional polls and expert analyses. The failure to predict Walz's selection is a reminder of the limitations that all forecasting tools face when dealing with low-information, high-uncertainty scenarios, rather than a wholesale indictment of prediction markets.

It’s true that on August 1st, Polymarket had Tim Walz’s odds of being chosen as Kamala Harris’s VP at only 5%, just five days before the official announcement on August 6th. However, by the day before the announcement, August 5th, those odds had shifted dramatically, with Walz’s odds effectively matching the longstanding frontrunner, Josh Shapiro (who had peaked at ~77% on July 31st).

Throughout the day of August 5th, the odds for Walz and Shapiro fluctuated, reflecting the uncertainty and subjectivity inherent to the VP selection process. Notably, Walz’s odds eventually peaked at 60% that afternoon, at one point overtaking Shapiro’s, which is significant because it suggests that the market was able to anticipate the shift in Harris’s thinking in favor of Walz before she had even finalized her decision. This flip was driven by a mix of subjective data, including positive reports about Walz’s interview performance, coinciding with negative signals regarding Shapiro. The market's ability to reflect these dynamics highlights its strength in processing and responding to nuanced information, even in situations where the decision-maker has not yet reached a conclusion.

For a more detailed analysis of Polymarket's data and its predictive power of the VP selection process, be sure to check out their recent post in their newsletter. It includes insights that highlight the value of prediction markets – especially, the value of using the graphical trends as indicators, rather than simply the headline numbers. An excerpt:

“Looking back at the chart, we can see several key moments where the Polymarket odds were ahead of the conventional wisdom. They:

Took Walz seriously at a time when many pundits were focusing on Shapiro or Kelly, showing him moving up as 'weird' went viral

Called out the decline of Mark Kelly amid the barrage of oppo research

Flagged the serious last-minute troubles with Shapiro and the final Walz surge.”

The True Weaknesses and Shortcomings Faced by Prediction Markets

In many respects, prediction markets are subject to challenges that mirror those in AI, where bias, technical, and regulatory issues combine to present significant barriers to entry.

Demographic Pool Biases and Emotional Influence

Prediction markets are often influenced by the demographic makeup of their participants, particularly in highly emotional contexts like US presidential elections. These markets, similar to the most intense sporting events, are driven by partisan emotions, leading to outcomes that may reflect more of the participants' biases rather than objective probabilities. This emotional bias is further amplified by the fact that many market participants may be more motivated by their hopes or fears rather than dispassionate analysis, leading to distorted market outcomes.

Copy-Trading, Recency Bias, and Speculation

Prediction markets are also susceptible to the pitfalls of copy-trading, recency bias, and speculative behavior. Participants often follow the crowd, leading to exaggerated trends and price swings. This behavior can cause the market to overreact to recent events or prevailing sentiments, pushing prices too far in one direction and creating inefficiencies. Unless there is ample liquidity and active market-making to counterbalance these trends, the market's predictive accuracy can be significantly compromised.

Dispute Resolution in Nuanced Political Events and Bias in Oracle Decisions

One of the critical weaknesses in prediction markets is the challenge of resolving disputes in complex or nuanced political events. A recent example is the contested Venezuelan election, where the UMA protocol resolved the market in favor of the opposition political party after ample evidence showed the initial election results had been falsified, despite ongoing disputes and no indication that President Maduro will ultimately step down. This decision illustrates the difficulty in adjudicating such events, where outcomes are complicated by unforeseen circumstances. Moreover, oracles like UMA, designed to provide unbiased resolutions during disputes through tokenholder votes, can still be influenced by the human biases of stakeholders, potentially undermining the integrity of prediction markets. This bias in oracle decisions, which accumulate news data off-chain, can lead to dissatisfaction among participants and erode confidence in the fairness and accuracy of these platforms.

Product Headwinds & Risks Faced by Prediction Markets

Prediction markets, despite their growing popularity and utility, face several significant challenges. These challenges range from technical and operational issues to regulatory and legal hurdles. This section will explore the primary challenges, focusing on regulatory actions taken by government agencies against various prediction markets, and compare the regulatory landscape in the United States with the generally more favorable international environment.

Technical and Operational Challenges

Prediction markets rely heavily on technology to operate efficiently and securely. Key technical challenges include:

Scalability: As the number of users and transactions increases, prediction markets must scale their infrastructure to handle the load without compromising performance. After all, Prediction Markets could one day compete with sports betting platforms as well as traditional options exchanges.

Security: Ensuring the security of user funds and data is paramount. Prediction markets are attractive targets for hackers, making robust security measures essential.

User Interface and Experience: Simplifying the user interface and improving user experience can help attract and retain participants. Complex interfaces can deter potential users from engaging with the platform, particularly as these platforms push towards more casual betting markets and broader user bases.

Regulatory and Legal Hurdles

One of the most significant challenges facing prediction markets is navigating the complex regulatory landscape. This section will detail specific examples of regulatory actions and compare the regulatory environments in the United States and internationally.

United States Regulatory Landscape

In the United States, prediction markets face stringent regulatory scrutiny, primarily from the Commodity Futures Trading Commission (CFTC). Several key regulatory actions highlight the challenges these markets face:

Polymarket:

In January 2022, the CFTC ordered Polymarket to pay a $1.4 million civil monetary penalty for offering off-exchange event-based binary options contracts without the necessary registration as a designated contract market (DCM) or swap execution facility (SEF). The CFTC's order required Polymarket to wind down all non-compliant markets on its platform and cease violating the Commodity Exchange Act (CEA) and applicable CFTC regulations.

PredictIt:

PredictIt, a popular political prediction market, operated under a no-action letter issued by the CFTC in 2014, allowing it to function as a not-for-profit event contract market for educational purposes. However, in 2022, the CFTC withdrew this no-action letter, citing violations of its conditions. The withdrawal significantly impacted PredictIt's operations and its ability to offer political event contracts in the US.

Kalshi:

Kalshi is the only prediction market currently approved by the CFTC to operate a contract market. Despite this approval, Kalshi faced significant regulatory hurdles when it sought to expand into political event markets. In 2023, the CFTC denied Kalshi's request to offer event contracts on congressional control, following pushback from legislators who argued that such contracts could undermine the democratic process.

These examples illustrate the cautious approach US regulators take toward prediction markets, particularly those involving political events. The primary concerns include the potential for market manipulation, ethical issues, and the influence of financial incentives on democratic processes. The wary reluctance expressed by US regulators is nothing new, as noted earlier when covering the history of prediction markets. However, there is a general belief that the US is on a path towards greater acceptance of these types of contracts and derivatives as public interest continues to grow. The massive rise in the US sports betting industry highlights that there is precedence for such a shift in policy.

International Regulatory Landscape

In contrast to the US, the international regulatory environment for prediction markets is generally more favorable. Several countries have adopted a more progressive stance, recognizing the potential benefits of these markets:

United Kingdom:

The UK has a more lenient regulatory approach towards prediction markets, particularly those operated by established betting firms. Platforms like Smarkets and Betfair offer political betting markets with fewer regulatory constraints compared to their US counterparts.

New Zealand:

The University of Wellington operates the New Zealand-based prediction market, iPredict, which has faced fewer regulatory challenges than similar markets in the US. This more relaxed regulatory environment has allowed iPredict to offer a wide range of event contracts, including political outcomes, without significant interference.

Estonia:

Estonia has emerged as a hub for innovative fintech and blockchain projects, including prediction markets. The country's supportive regulatory framework encourages the development and operation of decentralized platforms, making it an attractive destination for prediction market startups.

The international regulatory landscape's relative friendliness towards prediction markets allows these platforms to innovate and expand more freely. This contrast highlights the challenges US-based prediction markets face in achieving similar growth and acceptance.

Future Prospects for Prediction Markets

As prediction markets continue to evolve, they’re likely to see more community-based curation, improvements in data quality from oracles, and continued feature evolution, including increased use of AI.

User-Sourced Market Curation

One of the most exciting prospects for prediction markets is user-sourced market curation. Platforms like Polymarket are already seeking new market requests from their community, but this process could become more decentralized and user-driven. By leveraging the collective intelligence and interests of users, platforms can offer a wider variety of markets, ensuring they remain relevant and engaging. Users could vote on proposed markets or even create and manage their own, incentivizing active participation and enhancing the platform's relevance.

Improvements in Oracle Technologies

Oracles, which provide the data needed to resolve prediction markets, are critical for their accuracy and reliability. Advances in oracle technologies, such as decentralized oracles and improved data verification methods, could significantly enhance the trustworthiness of prediction markets. Enhanced data verification methods, including cross-referencing multiple data sources and using advanced machine learning algorithms to detect anomalies, can improve the accuracy and reliability of oracle data. These advancements will ensure market outcomes are based on accurate and unbiased data, further solidifying the role of prediction markets as reliable forecasting tools.

New Features and Services

The introduction of new features and services can also drive the growth of prediction markets. For example, PolyLend, a peer-to-peer lending protocol that allows users to borrow against their conditional token positions, represents a significant innovation. By enabling users to leverage their market positions for additional liquidity, platforms can offer more flexibility and financing options while generating new revenue streams in the process.

Additionally, innovative financial services such as hedging tools, insurance products, and fractional ownership of market positions, can attract more sophisticated users and investors to prediction markets. By offering adjacent services, platforms focused on differentiating through a decentralized operating model can both draw in a wider user base while also showcasing the inherent advantages of democratized systems.

The Impact of Artificial Intelligence

AI has the potential to revolutionize prediction markets by enhancing various aspects of their operation and user experience. The integration of AI can lead to the creation of markets at a microscopic scale, making them more personalized and relevant to individual users.

Content Creator AIs: AI can assist in creating content beyond human capabilities. By analyzing trends from news, social media, and financial data, AI can suggest timely and relevant event topics. This can lead to the creation of highly relevant markets that attract niche audiences and drive participation and volume. Community feedback enhances the AI’s understanding, making it an iteratively improving content creation engine that bonds content creators and their audiences.

Event Recommendation AIs: AI can tailor event suggestions to users based on their interests, trading history, and specific needs. By focusing on recommending events ripe for debate and trading opportunities, AI can adapt to users’ behaviors across different regions, cultural contexts, and times, leading to a highly targeted feed of events, free from irrelevant content.

Liquidity Allocator AIs: AI can optimize liquidity injections to narrow the bid-ask spread and minimize risk. By implementing the logarithmic market scoring rule (LMSR) AMM model, AI can manage event liquidity from a general LP pool, rewarding contributions with accrued fee revenue or platform tokens. This reduces slippage and ensures better price stability.

Information Aggregation AIs: AI can harness data from various indicators (e.g., on-chain data, historical data, news, sentiment indicators) to provide a comprehensive understanding of events. This enables players to make confident bets based on well-rounded projections. Information aggregation AIs can turn prediction markets into the go-to source for informed decision-making, with potential projects to token-gate access to AI-generated insights.

AI as Arbiters: In cases of disputes in prediction markets, AI can serve as impartial arbiters. Using multi-round dispute systems similar to Kleros, AI can resolve disputes efficiently and without bias, reducing the need for human arbitration, which can be slow, expensive, and subject to biases.

Wrapping Up

Prediction markets have come a long way from their experimental days of the '90s through early aughts, evolving into sophisticated platforms that leverage collective intelligence to provide accurate forecasts across various domains. As we look to the future, the growth and impact of decentralized prediction market platforms like Polymarket suggest their significant potential to become mainstream tools for forecasting and decision-making. Their ability to aggregate diverse opinions and provide real-time insights makes them powerful tools for both individuals and organizations. The potential for user-sourced market curation, advances in oracle technologies, new financial services like PolyLend, and the transformative impact of AI will further enhance the value and relevance of prediction markets.

Reflecting on the words of Ben Graham – the “father of value investing” – as cited by his protégé, Warren Buffet in his 1987 letter to Berkshire Hathaway shareholders: “The market may ignore business success for a while, but eventually will confirm it. As Ben said: ‘In the short run, the market is a voting machine but in the long run it is a weighing machine.’”

While the minute-by-minute movements in prediction markets may at times be fairly cast aside as “noise” driven by overreaction, speculation, and copy-trades, these markets can help better ascertain “truth” by looking at the directional moves when zoomed out to a daily, weekly, or monthly chart. Trying to analyze a handful of bets, much like analyzing a small polling sample, is a fool's errand, given that those bets are not representative of the collective. But, by zooming out, one unleashes the power of the internet – the power of crowdsourced information.

In short, prediction markets represent a powerful tool for aggregating collective wisdom and providing real-time insights into future events. As the internet continues to facilitate the proliferation of these markets, their role in shaping public perception, influencing decision-making, and forecasting outcomes will only grow. By understanding the dynamics driving their growth and addressing the challenges they face, we can unlock the full potential of prediction markets and harness their power to predict the future.

References

Roeder, O. (2023, November 10). Prediction Markets Can Tell the Future: Why is the US So Afraid of Them? FT Magazine. https://www.ft.com/content/9108f393-6a45-41a3-bd76-20581b19288e

Unknown. (2024, August 12). Hedging Bets. Rekt. https://rekt.news/hedging-bets/

Whitaker, N., & Mazlish, J. Z. (2024, May 17). Why Prediction Markets Aren’t Popular. Works in Progress. https://worksinprogress.co/issue/why-prediction-markets-arent-popular/

Piper, K. (2024, July 12). Can a Betting Market Tell Us What Will Happen to Joe Biden? Vox. https://www.vox.com/future-perfect/360104/betting-markets-2024-election-joe-biden-donald-trump-kamala-harris-polls

ParaFi Capital. (2024). @paraficapital_ Thread on Polymarket Performance. Twitter. https://x.com/paraficapital/status/123456789

Goldstein, J. K. (2024, August 8). In Passing on a Swing State VP, Harris Makes a Pick That Fits Recent History. Sabato's Crystal Ball. https://centerforpolitics.org/crystalball/in-passing-on-a-swing-state-vp-harris-makes-a-pick-that-fits-recent-history/

Bump, P. (2024, August 6). Almost No One Knows Who Tim Walz Is. The Washington Post. https://www.washingtonpost.com/politics/2024/08/06/how-harris-decided-on-walz-as-vp

Griffy. (2024, May 23). From Augur to Polymarket: A Comparative Analysis of Leading Prediction Market Platforms. Medium. https://medium.com/@griffycommunity/from-augur-to-polymarket-a-comparative-analysis-of-leading-prediction-market-platforms-48c2f75bab91

Gnosis. (2024, July 29). Meet Gnosis AI. Gnosis Chain. https://www.gnosis.io/blog/meet-gnosis-ai

Hunt, J. (2024, May 14). Polymarket Raises $45 Million from Peter Thiel’s Founders Fund, Vitalik Buterin, and Others. The Block. https://www.theblock.co/post/294367/polymarket-raises-45-million-from-peter-thiels-founders-fund-vitalik-buterin-and-others

Sinclair, S. (2024, June 30). Polymarket Bettors Give Biden a 46% Chance of Dropping Out by November. Decrypt. https://decrypt.co/237758/polymarket-bettors-biden-46-chance-dropping-out-november

Reynolds, S., & Malwa, S. (2024, July 22). Biden's Exit Spurs Record $28M Daily Volume on Polymarket as Election Enters Uncharted Territory. CoinDesk. https://www.coindesk.com/markets/2024/07/22/polymarket-trading-explodes-as-2024-election-enters-uncharted-territory

Ross, K. (2024, May 19). Funding Wrap: Polymarket Gets Backing from Vitalik Buterin, Founders Fund in $70M Raise. Blockworks. https://blockworks.co/news/polymarket-funding-backed-by-vitalik-buterin

Peters, K. (2023, September 19). Prediction Market: Overview, Types, Examples. Investopedia. https://www.investopedia.com/terms/p/prediction-market.asp

Unknown. (2024, August 7). Insider Trading: Political Prediction Markets. Political Prediction Markets. https://politicalpredictionmarkets.com/insider-trading/

Gratton, P. (2024, May 3). Event Contracts: What They Are, How They Are Used. Investopedia. https://www.investopedia.com/events-contracts-8601422

Fernando, J. (2022, June 27). Political Futures Defined. Investopedia. https://www.investopedia.com/terms/p/political-futures.asp

Rothschild, D. M., & Sethi, R. (2015, November 22). Trading Strategies and Market Microstructure: Evidence from a Prediction Market. Social Science Research Network. https://ssrn.com/abstract=2322420

Wright, L. A. (2024, July 24). Exploring Polymarket: US Election Crypto Prediction Market. CryptoSlate. https://cryptoslate.com/how-does-polymarkets-364-million-us-election-crypto-prediction-market-work/

Gnosis. (2024, August 6). Gnosis Conditional Tokens Framework: A Short Primer on Conditional Tokens. Gnosis Developer Portal. https://docs.gnosis.io/conditionaltokens/docs/introduction1

Arnesen, S., & Bergfjord, O. J. (2014, January). Prediction Markets vs. Polls: An Examination of Accuracy for the 2008 and 2012 US Elections. The Journal of Prediction Markets, 8(3), 24-33. https://www.researchgate.net/publication/282123487_PREDICTION_MARKETS_VS_POLLS_-_AN_EXAMINATION_OF_ACCURACY_FOR_THE_2008_AND_2012_US_ELECTIONS

DeWees, B., & Minson, J. A. (2018, December 20). The Right Way to Use the Wisdom of Crowds. Harvard Business Review. https://hbr.org/2018/12/the-right-way-to-use-the-wisdom-of-crowds

van Zwanenburg, J. (2018, July 29). Decentralized Prediction Markets: The Opportunities, the Threats, and the Platforms. Invest in Blockchain. https://www.investinblockchain.com/decentralized-prediction-markets

Frontier Lab. (2024, July). Polymarket: The Premier Platform for “Event Trading”. Medium. https://frontierlab.medium.com/polymarket-the-premier-platform-for-event-trading-b5f0bc0cf1a4

Commodity Futures Trading Commission. (2022, January 3). Order Instituting Proceedings Pursuant to Section 6(c) and (d) of the Commodity Exchange Act, Making Findings, and Imposing Remedial Sanctions Against Blockratize, Inc. CFTC. https://www.cftc.gov/sites/default/files/2022-01/enfblockratizeorder010322.pdf

Commodity Futures Trading Commission. (2022, January 3). CFTC Enforcement: Polymarket. CFTC. https://www.cftc.gov/PressRoom/PressReleases/8475-22

Antonovici, A. (2024, February 26). What is Polymarket and How Does It Work? 2024 Guide. Tastycrypto. https://www.tastycrypto.com/blog/polymarket

Unknown. (2022, October 18). In Passing on a Swing State VP, Harris Makes a Pick That Fits Recent History. Polymarket Media. https://www.polymarket.com/document/VP-Selection-Insight.pdf

Dale, B. (2024, July 17). Big Names Move into and out of Crypto Media. Axios. https://www.axios.com/2024/07/17/big-names-move-into-and-out-of-crypto-media-crypto

Armani, F. (2024, July 8). Polymarket's Rise: A New Era in Prediction Markets. Dune Analytics Blog. https://dune.com/blog/polymarkets-rise-a-new-era-in-prediction-markets

Pennock, D. M. (2006, October 30). Implementing Hanson’s Market Maker. Oddhead Blog. http://blog.oddhead.com/2006/10/30/implementing-hansons-market-maker/

Othman, A., & Sandholm, T. (2010, June). A Practical Liquidity-Sensitive Automated Market Maker. ACM Conference on Electronic Commerce (EC). https://www.cs.cmu.edu/~sandholm/OPRS10.pdf

Tomaino, N. (2017, April 10). Improving the Flow of Information in the World. The Control. https://thecontrol.co/improving-the-flow-of-information-in-the-world-87396ca2d776

Tomaino, N. (2020, August). Polymarket Investment Memo. 1confirmation.

Dr. OneAudio. (2024, July 24). The Prediction Market Primitive: Using AIs to Create Prediction Markets at Microscopic Scale. HackerNoon. https://hackernoon.com/the-prediction-market-primitive-using-ais-to-create-prediction-markets-at-microscopic-scale

Buterin, V. (2024, January 30). The Promise and Challenges of Crypto + AI Applications. Vitalik's Blog. https://vitalik.eth.limo/general/2024/01/30/cryptoai.html

Choy, D. (2024, July 22). Polymarket Hits New All-Time High in July Trading Volumes. Blockworks. https://blockworks.co/news/polymarket-hits-new-all-time-high-in-july-trading-volumes

0xfuje. (2022, March 4). How to Use Polymarket: A Beginner-Friendly Guide. Coinmonks. https://medium.com/coinmonks/how-to-use-polymarket-9ee1577fd671

Polymarket. (2024, June 28). PolyLend. Mirror.xyz. https://mirror.xyz/polymarket.eth/8t4zhQlAza5M52dV4lVvh94NDhbJr2Dos4qvih80flU

Walgenbach, S. (2024, January 15). Polymarket Analysis: The Future of Predictive Market Platforms. Coinpaper. https://coinpaper.com/3047/polymarket-analysis-the-future-of-predictive-market-platforms

Polymarket. (2024). Polymarket Documentation. Polymarket Docs. https://polymarket.docs.io/polymarket-docs

Knight, O. (2024, July 17). Polymarket Hires Nate Silver After Taking in $265M of Bets on U.S. Election: Report. CoinDesk. https://www.coindesk.com/business/2024/07/17/polymarket-hires-nate-silver-after-taking-in-265m-of-bets-on-us-election-report

Polymarket. (2023, March 15). A Detailed Look at Polymarket’s Outcome Tokens. Mirror.xyz. https://mirror.xyz/polymarket.eth/txFHoXVU1QAsXCZQj6H_ag3kXv1QTcnbLVI8cL9CFYg

Polymarket. (2023, March 15). An In-Depth Overview of Polymarket's Market Making Rewards Program. Mirror.xyz. https://mirror.xyz/polymarket.eth/TOHA3ir5R76bO1vjTrKQclS9k8Dygma53OIzHztJSjk

KuCoin. (2024, July 1). What Is Polymarket Decentralized Prediction Market, and How Does It Work? KuCoin Learn. https://www.kucoin.com/learn/crypto/what-is-polymarket-and-how-does-it-work