The Peking Bull

An intro to the China-led crypto bull pump to start the year

Intro

Capital flows into risk assets often lead from the West, and it's easy to understand why. Governments in the West tend to have looser capital controls than their counterparts in the East, and cash is more accessible.

But the onslaught of the crypto bear market of 2022 left a bad taste in the West. Regulators have doubled down on their commitment to pushing more controls around crypto assets. Recently, the SEC has gone after exchanges like Kraken for their yield-generating products.

SEC: “Kraken to Discontinue Unregistered Offer and Sale of Crypto Asset Staking-As-A-Service Program and Pay $30 Million to Settle SEC Charges” - Frank Chaparro

And begun to crack down on crypto pundits like Do Kwon—seemingly promising further action against the likes.

While the US has been known to lead the world in innovation often, they’ve seemingly put crypto as a backdrop and gone on the defensive. As the iron curtain closes in the West, web3 builders will be forced to participate from other regions.

The East Rises

Crypto has seen an impressive rise off the winter lows. But with all of the FUD coming out of the West and much of retail still sidelined (or benched after FTX collapse), where are the pumps coming from?

One of Crypto Twitter’s proclaimed prophets, Gigantic Rebirth (also known as GCR), had his theories:

I believe China, (and Asia in general) will fuel the next run It will take quite some time to melt Western cynicism towards this space, but the East is ascending and yearning to flex You should be hanging out in WeChat Many future pumps will be on coins none of your circle know - GCR

Innovation always finds a way. Or rather, liquidity always finds a way. Many macro-enthusiasts would attribute the crypto bull run of ‘20 - ‘22 to the US Federal Reserves jet-fueled money printer. With the Fed still tightening monetary policy, where might new liquidity come from?

Let’s Talk Liquidity

China’s central bank has performed its most significant liquidity injection this year. With China officially reopening for the first time since covid, the government began to inject the economy with liquidity to support an economic recovery. The government is highly determined to put China back in a solid economic position, even giving out 500,000 free plane tickets to Hong Kong.

Follow the money

Sometimes it's just as simple as that: follow the liquidity. Easier said than done. As many are familiar with crypto alpha, it begins in private groups—but even more so in China. Twitter is technically blocked in China (sometimes accessible from a VPN), and these groups exist in WeChat, an app that most Westerners don't have access to. We've already seen the narrative gain traction recently, with several top crypto Twitter accounts sharing "Chinese coin" watchlists. So please do your best to woe your Eastern friends next time you get dinner and ask them to help you get a WeChat account.

Global M2 supply growth

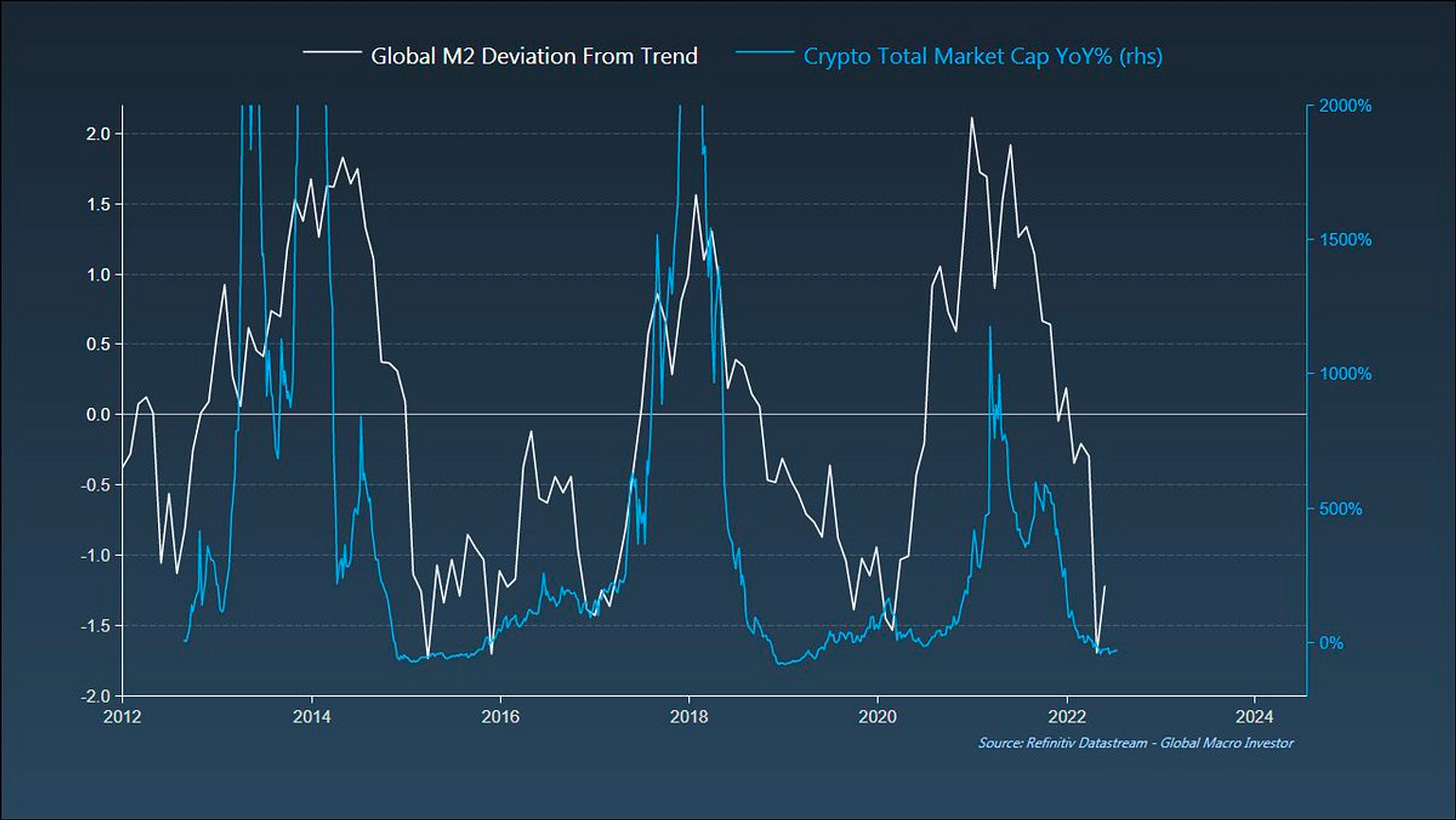

Let's consider the global M2 supply growth % YoY vs. the crypto market cap. We can see below a strong correlation between the bull run phases of crypto assets and the global money supply.

“M2 is a measurement of the nation's money supply that estimates all the cash everyone has in hand or short-term bank deposits.” - investopedia

In essence, M2 tracks the amount of excess money people have worldwide. Hard to stay away from the “greatest casino on Earth” when you've got a little spare change.

Conclusion

While the US still juggles deciding its acceptance of crypto, last week, Hong Kong laid out plans to set up a licensing regime to allow crypto asset trading. Less we do not forget China seemingly banning crypto in 2021 as well. So this is a massive leap for the East regarding crypto adoption (or speculation).

New liquidity and supportive regulation could be the perfect recipe for a bull run starting in the East. The signals between East and West are clear.

Interesting Commentary on the China Crypto Push:

I believe China, (and Asia in general) will fuel the next run

Let me tell you the economy of China is 10x and so are their pumps

There is a lot of talk out there currently about how bullish China is for crypto.

China's central bank performed it's single-largest liquidity injection on Friday,

On June 1st, 2023, Hong Kong will officially make crypto fully legal for all of its citizens

Western and Chinese traders connecting for the first time both on twitter+ in other chats

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are my own, not the views of my employer.