The Rise of Restaking on Solana — A Jito Deep Dive

Exploring Jito’s Role in Scaling Solana’s Economic Security Through Restaking

Introduction

The Web3 space is characterized by swift development fueled by its open-source and decentralized nature. This leads to hypergrowth and scale—what many call crypto composability. This composability allows for the creation of modular tech stacks where pieces can seamlessly fit in and out of the greater stack, driving unprecedented innovation. At the heart of this innovation lies the fundamental process of blockchain transactions, where the core value depends on a distributed network's ability to coordinate and agree on the system's state.

When a transaction is sent on a blockchain, a distributed network of nodes must first verify its contents and then vote on the order of the transactions, making up the next block to be added to the chain. When these nodes agree, a state known as consensus is achieved. Blockchains originally implemented Proof-of-Work (PoW) for consensus, a mechanism involving specialized nodes called miners competing to be the first to solve an encryption puzzle to add new transactions and blocks to the chain.

Though Bitcoin and a number of blockchains continue to utilize PoW consensus, a majority of blockchains today have shifted to Proof-of-Stake (PoS), adopting security through economic incentives rather than computational power. This concept was first introduced in the Peercoin whitepaper in 2012, which proposed a deterministic algorithm to select nodes based on the number of native network tokens the node operator has staked, favoring nodes with more capital.

Subsequently, Jae Kwon wrote the Tendermint BFT whitepaper in 2014, which introduced a new mechanism to reach consensus as long as less than one-third of the nodes are faulty, and went live in action with the mainnet launch of Cosmos Hub in 2019. Besides consuming significantly less energy than PoW, a key strength of Proof-of-Stake comes from the fact that, similar to PoW, a stake cannot be easily forged. Furthermore, PoS incentivizes honest behavior by enforcing penalties on stakers who act maliciously through a process called “slashing”, which incurs financial losses to the validator.

As the adoption of PoS blockchains grew, participation in staking prompted new ideas about extending the utility of staked capital to benefit as many network participants as possible, from making staked capital liquid to bootstrapping security for new products and ecosystems.

A Primer on Staking Designs

Vanilla Staking

Staking is a mechanism in which token holders deposit their tokens to a staking contract to participate in securing the underlying protocol and earning rewards for their contributions. For the sake of this paper, this can be referred to as ‘vanilla staking’ given its core utility is limited to remaining idle in a smart contract, whereas other forms of staking offer extended utilities, which will be expanded upon further below. A validator’s stake size determines its likelihood of being selected to produce blocks, wherein a higher amount of capital staked is more likely to be selected. Technically anyone can participate as a solo staker, but blockchains do impose various financial and hardware requirements for doing so, which may not be easily accessible to the average network user or token holder. For instance, Ethereum requires a 32 ETH deposit and at least 16GB of RAM, a multi-core CPU, and a 1TB SSD to participate as a validator, while Solana requires 1.1 SOL/day for voting and at least 256GB of RAM, alongside a fast multi-core CPU and high-speed SSD storage.

As such, delegation mechanisms were formed to reduce these barriers to participation, allowing token holders to participate in staking with significantly smaller capital requirements and no hardware necessary while allowing node operators running validators to grow their stake allocation, thereby increasing their block rewards. A stake can be delegated directly to a validator or via stake pools, which are smart contracts that collectively pool funds to be delegated to multiple validators. Stake pools can be operated and held in custody by a third party (i.e., CEXs offering staking services) or non-custodial via decentralized on-chain protocols such as Rocket Pool on Ethereum or Jito on Solana.

Staking also exists at the application level, wherein an application’s token holders can lock their tokens to secure the protocol (i.e, serve as a source of liquidity for covering the deficit in the case of a shortfall event on a borrowing and lending protocol), which typically earns the stakers rewards, plus additional utilities like governance rights or revenue sharing. This has even prompted various bribing markets in DeFi (i.e., Curve Wars) in which protocols would compete to accumulate a greater share of governance rights via tokens to receive a greater share of rewards in return.

That said, the simplicity of vanilla staking, a core part of its design, imposes a key limitation: staked capital that is locked up in smart contracts is illiquid, thereby diminishing the liquidity of the token and its broader ecosystem. The inherent lack of utility in vanilla staking hindered the adoption of staking services, as the rewards distributed to token holders would have to offset the price exposure risk associated with locking tokens up. A high volume of network activity could generate enough fees to provide organic returns to stakers, but this is often unsustainable and historically has not been the case across most PoS chains. Distributing rewards via native token emissions is a common alternative, but this, too, becomes unsustainable over a relatively longer period of time. This would lead to the development of liquid staking protocols.

Liquid Staking

Liquid staking emerged out of the need for a new mechanism that would allow stakers to retain the liquidity of their staked assets without compromising the security provided to the underlying protocol. This process functions similarly to vanilla staking to the extent that stakers deposit assets into a smart contract and earn a base yield for contributing to the underlying system. Liquid staking takes this one step further, however, by distributing a receipt token known as a liquid staking token (LST) to the staker, equal in value to that of the original deposit. This innovation demonstrated the importance of composability in DeFi, as LSTs could be used across various applications (i.e., liquidity provision, lending), ultimately enabling stakers to generate greater returns on their stake while growing the overall liquidity of the underlying network’s ecosystem.

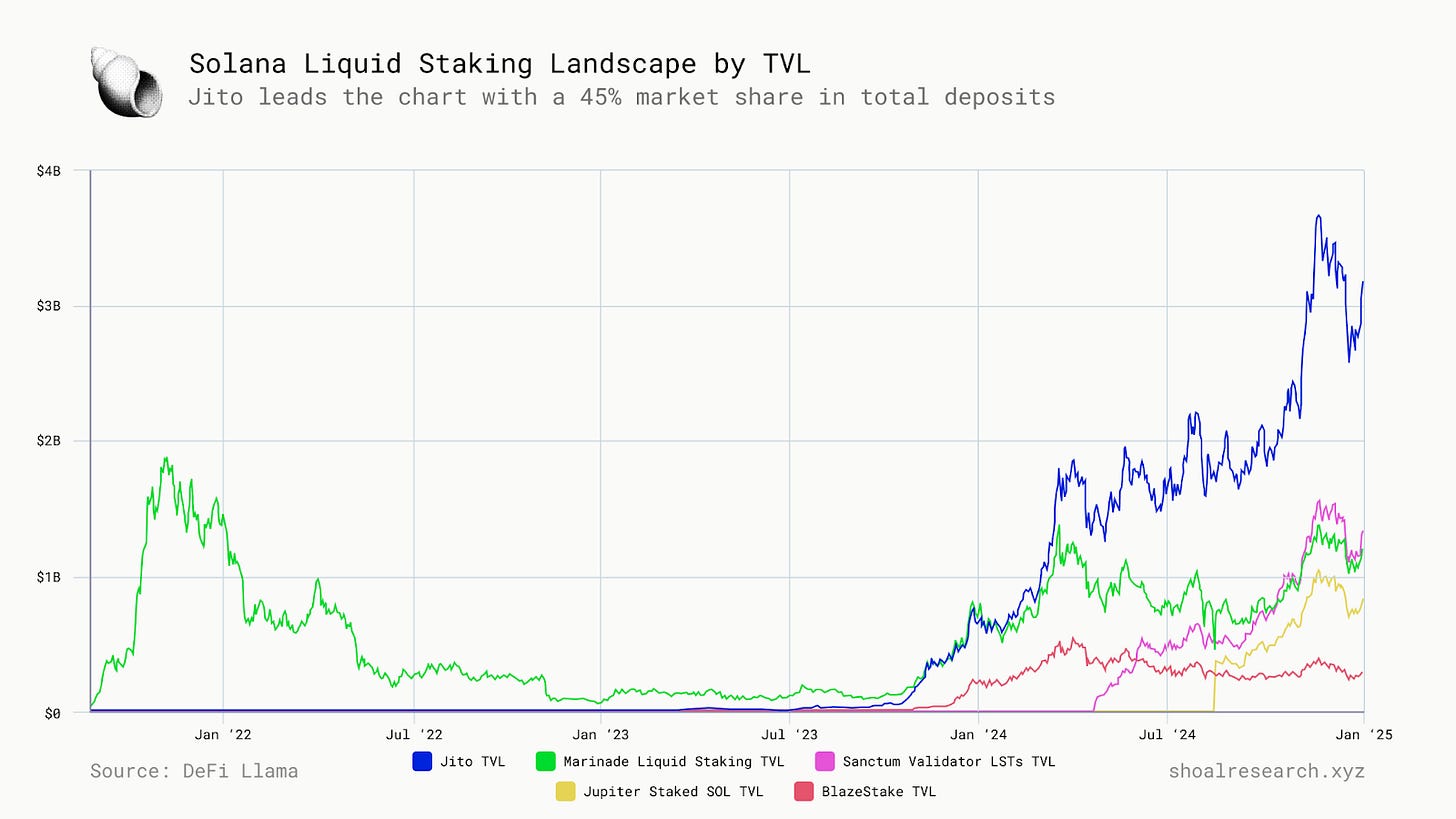

Since the first liquid staking protocols came around in late 2020, liquid staking has become the fastest-growing sector in DeFi, with over $42.3b in assets at the time of writing. Approximately 60% of this value belongs to the Lido Finance staked ETH (stETH) contract, and Ethereum is home to nearly 85% of total liquid staked assets in DeFi today. Solana’s numbers are far more modest, with just under $4B locked up in liquid staking protocols at the time of writing, 45% of which comes from Jito.

Overall, liquid staking has brought about a great deal of flexibility and capital efficiency for stakers, which in turn benefited the underlying blockchains they were supporting as well as the ecosystems built on top of them. However, the utility of staked assets has naturally evolved with the development of blockchains. The rise of modular infrastructure and services has given way to a proliferation of new app-specific blockchains, who have historically struggled with bootstrapping their own validator networks due to a lack of activity and, therefore, economic incentive for participation. As such, new mechanisms were formed to extend the utility of staked assets to help secure and bootstrap new blockchains. This is what has come to be known as restaking.

Restaking

Restaking refers to the extension of one chain’s stake and validator network to secure any number of other chains. More formally, restaking can be defined as an adaptation of shared security in the context of Proof-of-Stake blockchains, wherein a security provider chain is servicing a security consumer chain, often through an intermediary referred to as a restaking protocol.

This mechanism enables new blockchains, whether they are application-specific or general-purpose, to bootstrap their security by leveraging the economic and computational resources of a larger base layer such as Ethereum or Solana. Stakers also benefit from improved capital efficiency; by securing multiple blockchains instead of one, stakers extend the utility of their stake to generate greater returns. However, it’s important to consider that securing multiple blockchains extends the slashing risk on the staked assets - this concept will be discussed later below.

Just as anyone can either directly run a validator node on a Proof-of-Stake blockchain or deposit into a stake pool, anyone can participate in restaking through either native restaking, wherein the user operates a validator node that commits to a restaking module, or through liquid restaking, in which the user stakes with a protocol or service that restakes on their behalf. Furthermore, restaking can either be restricted to the native L1 asset, or extended to support ultimately any asset through what has become known as ‘General’ or ‘Universal’ Restaking.

Early Implementations

Though restaking is commonly associated with Eigenlayer nowadays, the concept has been tested and implemented in app-specific blockchains, where bootstrapping security is often the biggest hurdle to overcome. A number of different ecosystems and networks have implemented some form of shared security over time, and while details may vary the core concept is often the same - to enable smaller protocols to tap into an existing pool of economic and compute resources to aid in their initial growth, while improving capital efficiency and returns for stakers.

In the Polkadot ecosystem, validators stake DOT to participate in securing the Relay Chain, which is then used to provide security for approved Parachains. On Avalanche, validators securing the C-chain (the primary hub of economic activity) can participate in Subnets, which refer to a dynamic set of validators working together to secure, or achieve consensus on the state of, a set of chains. A Subnet can secure many chains, but each chain is validated by exactly one Subnet.

While these adaptations of shared security generally offer more flexibility on behalf of the validators, Cosmos utilizes a different approach in which the top 95% of stake weight and validator set of the Cosmos Hub, the economic center of the ecosystem, is effectively replicated across all ensuing Cosmos consumer chains (hence ‘Replicated Security’). Cosmos Hub validators must run nodes on all consumer chains as well, though they may run separate software and/or hardware to do so. In doing so, the Cosmos Hub validators are subject to slashing penalties in the event of misbehavior or faulty performance (i.e. downtime, double signing) on all the consumer chains they secure. ATOM stakers can choose not to subject their assets to slashing conditions on consumer Cosmos chains, by delegating stake to validators outside the top 95% threshold, though this results in lower returns generated.

Replicated security went live on the Cosmos Hub in March 2023 with the unanimous approval of the V9 Lambda upgrade in Prop 187, as the initial version of the Interchain Security protocol (“ICS”). However, there is an evident trend towards increasing the flexibility of validators and stakers. ICS v2 introduces ‘Opt-in security’, which would enable validators to select to secure a specific consumer chain or not. Looking further ahead is the proposal for Mesh Security, initially presented by Sunny Agarwal in September 2022.

Instead of using the validator set of a provider chain to secure a consumer chain, Mesh Security would ultimately allow chains to provide and consume security simultaneously. Operators would be able to choose whether to run a Cosmos chain or not, while stakers can choose to restake their staked assets to secure another Cosmos chain or not. Lastly, a proposal was published in early May 2024 which, if passed, would allow Cosmos Hub validators to receive BTC stake via the Babylon staking protocol, paving the way for any asset to be used for economic security on Cosmos.

Restaking was introduced to Ethereum in June 2023 through the Eigenlayer protocol, a set of middleware smart contracts on Ethereum that enables the restaking of ETH on the consensus layer to bootstrap security for consumer chains referred to as Actively Validated Services (AVS). Eigenlayer ultimately functions as an open marketplace seeking to connect AVSs looking to lease security (a validator set and/or a staking asset) with stakers and node operators providing said security. ETH and supported ETH LSTs can be staked with a set of smart contracts that extends, or restakes economic security to AVSs on their behalf.

By leasing out security to AVSs, operators and stakers extend the utility of their assets and therefore increase their returns. This, however, comes at a risk given their stake is now subject to any slashing conditions that the AVS may enforce in addition to slashing on Ethereum, the underlying chain. Eigenlayer is an out-of-protocol solution on Ethereum, meaning Beacon Chain validators can opt-in to participate as Eigenlayer node operators.

At the time, there are no current slashing conditions or restaking rewards enforced on Eigenlayer, though this is set to change after the EIGEN token becomes transferable in late September 2024. Furthermore, Eigenlayer recently announced Permissionless Token Support to enable any ERC-20 token to be utilized as a restakable asset in the future.

Universal Restaking

Universal restaking, or ‘Generalized’ Restaking, implements an asset and chain-agnostic approach to distributing security resources from a set of providers to a set of consumers. This approach enables the pooling of various staked assets across multiple chains, expanding accessibility for participants and diminishing dependencies on any one particular base layer. Similar to Eigenlayer, universal restaking protocols function as intermediary layers between the security provider chains and consumer AVSs.

Liquid Restaking

Liquid restaking allows for restaked assets to be represented as liquid restaking tokens (LRTs). Liquid staking and liquid restaking protocols work towards a similar end goal: to provide restakers and stakers with a liquid representation of their underlying position. As such, LRTs can be defined formally as derivative assets of restaking positions. LRT providers are ultimately responsible for portfolio management on behalf of restakers, managing the delegation of stake across various yield positions to maximize returns while minimizing risk for depositors. For a more thorough breakdown of LRTs, see Shoal Research’s previous report.

Current State of Restaking

At the time of writing, there is $28.14B worth of actively restaked assets. Eigenlayer accounts for 60% of this total, and overall Ethereum accounts for roughly 80% of restaking TVL. Eigenlayer, Babylon, Symbiotic, and Karak are the only restaking protocols to touch the $1B mark in TVL thus far.

Meanwhile, liquid restaking protocols have also been seeing considerable growth alongside restaking, with total TVL reaching nearly $15.62b or roughly 57% of restaking total TVL at the time of writing.

Liquid restaking has been a much more competitive sector relative to restaking, as several different protocols have taken turns leading the race since June 2023. At the time of writing, EtherFi currently accounts for roughly 50% of all liquid restaking deposits, and most liquid restaking TVL is on Ethereum, in line with restaking totals.

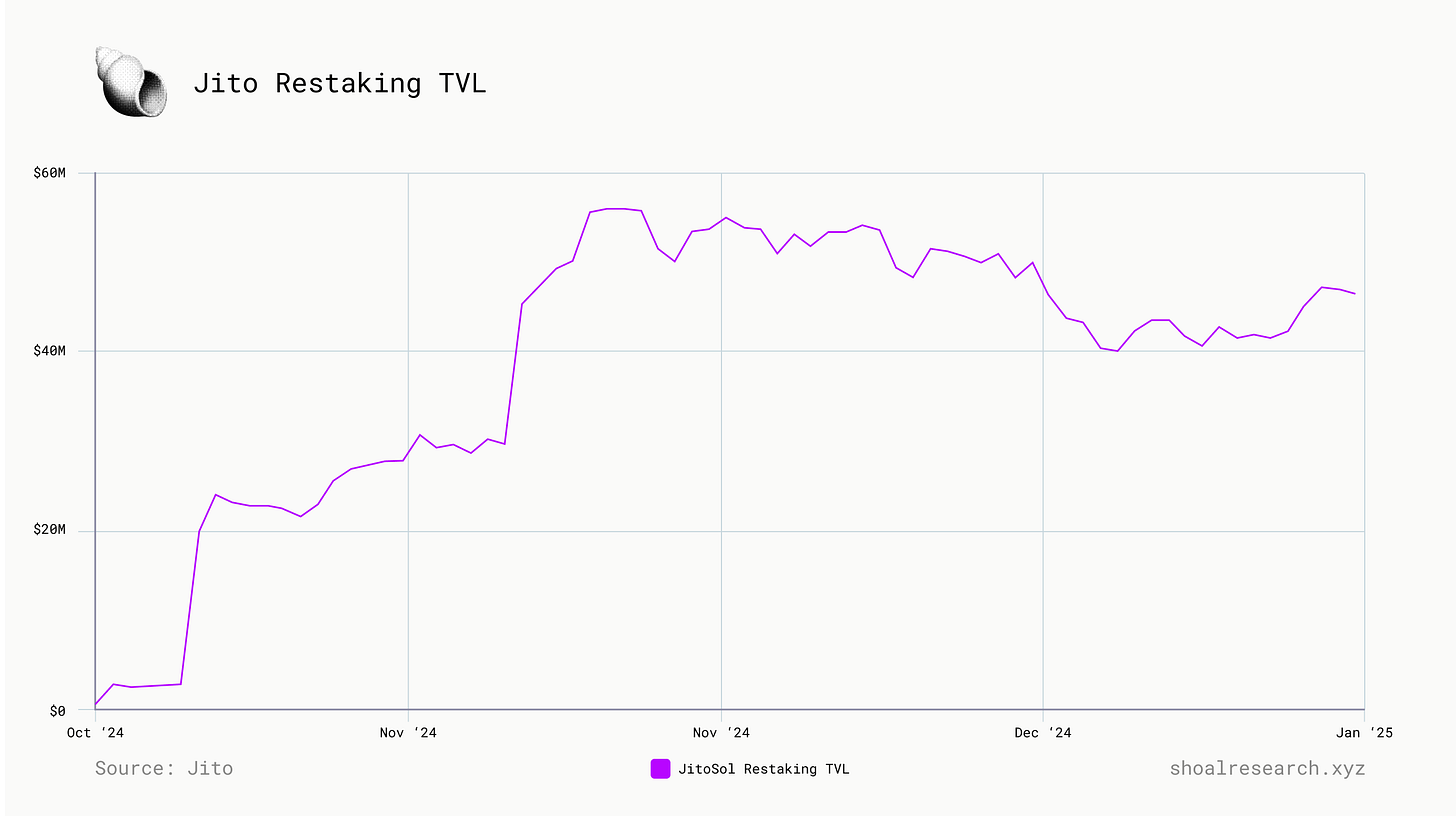

Meanwhile, restaking on Solana has been slower to develop: Picasso Network first introduced their restaking vault on Solana back in late January, which has seen 3,507 SOL, or roughly $729k in deposits thus far; currently, the total restaking TVL on Solana sits around $371m, most of which has emerged in the past few months with the launch of Solayer. Now, restaking on Solana is heating up as Jito enters the space with its own Jito (Re)staking protocol.

Bringing Restaking To Solana

Built with unique architecture from the ground up, Solana optimizes for fast execution speeds and low transaction costs at high volumes. Solana ultimately seeks to maximize performance for developers and users by fully leveraging available hardware performance capabilities, such that hardware is, in fact the only restriction on network performance long-term. As the second-largest chain by TVL, the restaking landscape on Solana is well-poised for growth and transformation in the near to long-term future. One team seeking to take advantage of the opportunity to bring restaking to Solana by building on its growing history of successful product developments in the ecosystem is Jito.

A Primer on Jito

Founded in 2021 by Lucas Bruder and Zano Sherwani, Jito Labs is a US-based Solana infrastructure company offering a suite of MEV products and services. Jito Labs represents the core developer team focused on product development and deployment, while the Jito Foundation facilitates JTO token governance and strategic oversight of Jito Network’s products and services, including the JitoSOL liquid staking token and the Jito (Re)staking protocol.

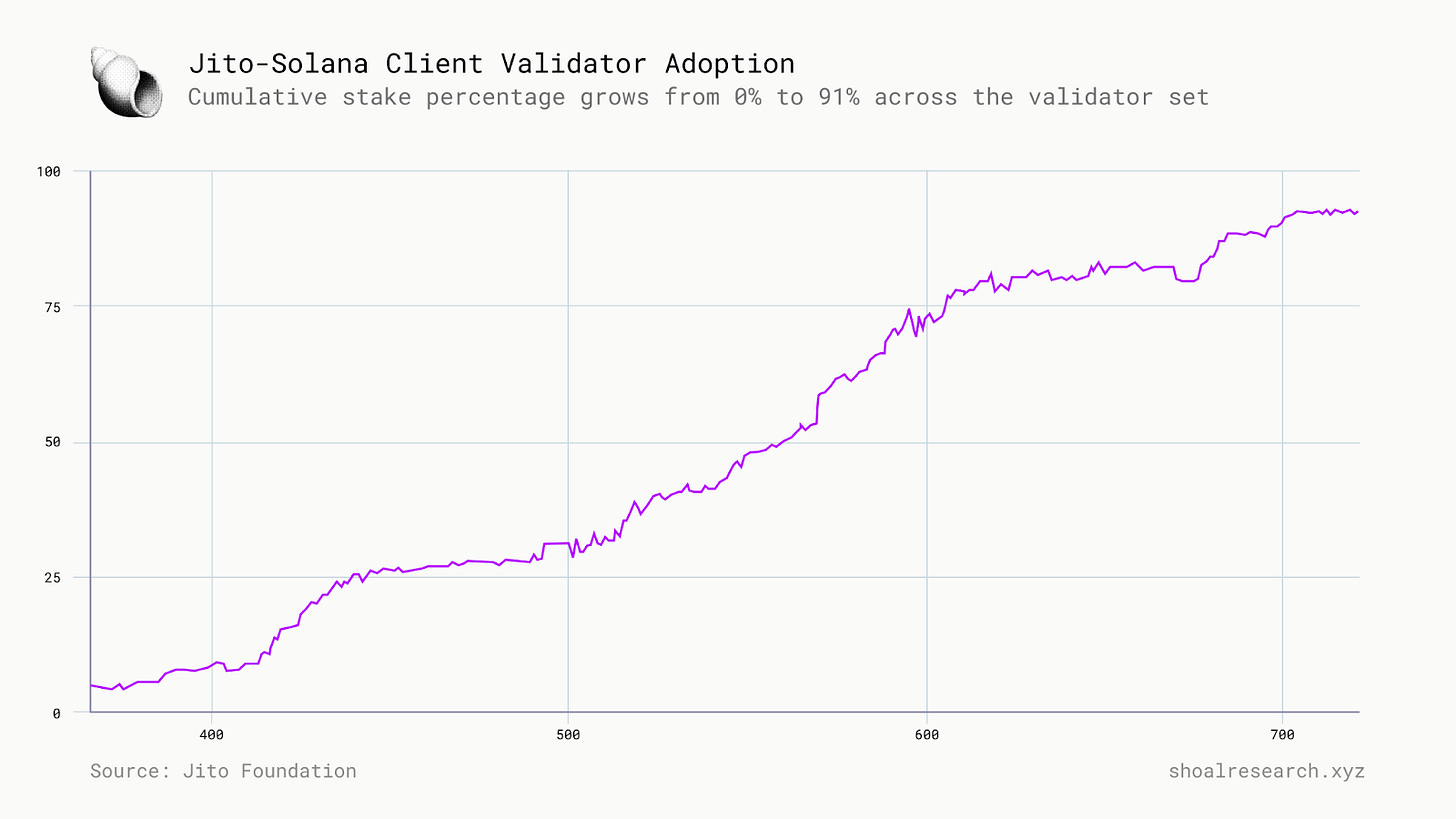

Jito Labs first introduced their MEV dashboard in July 2022 as a way of helping illuminate the MEV landscape on Solana, a largely unexplored topic at the time. A few months later, the team open-sourced Jito-Solana, the first validator client on Solana designed to capture MEV profits and redistribute them to validators and stakers. Jito-Solana was ultimately built as a fork of the Solana Labs client with roughly ~1000 lines of code added for enabling MEV rebates for validators, with a broader goal of combating network spam and optimizing Solana performance. In conjunction with the client, the Jito Block Engine enables an off-chain blockspace auction in which searchers submit lists of transactions executing sequentially and atomically, known as bundles. Upon simulating every transaction combination in the submitted bundles, the engine forwards the highest-paying bundles to the leader for block inclusion. The Jito Relayer functions as a transaction processing unit (TPU) proxy, filtering and verifying transactions off-chain and submitting verified transactions to the Block Engine and validator.

Note that in March 2024, Jito Labs announced the suspension of the mempool functionality of the Jito Block Engine, due to growing concerns among the Solana ecosystem that the infrastructure was being exploited by actors running MEV bots to conduct sandwich attacks. Today, the Block Engine remains operational; continuing to process and forward transactions from relayers to searchers, as well as performing bundle simulations, albeit without the mempool component.

This mechanism ultimately enforces a cost on activities that contribute to network spam and hinder performance. Validators running Jito-Solana then capture the MEV profits generated from the bundles submitted during their leader slots. The launch of the JitoSOL LST enabled stakers to delegate to validators running the Jito-Solana client, increasing stake supply for Jito-Solana validators while allowing stakers to earn MEV rewards in addition to baseline staking yield. In December 2023, Jito Foundation also rolled out StakeNet, a network of on-chain keepers and steward programs offering two primary components: a Validator History Program storing up to 3 years of history for every validator on the network; and a Steward Program calculating scores based on validator performance and managing stake distribution to ensure delegation to the best-performing validators.

Building on their prior efforts and development in MEV and liquid staking infrastructure services, Jito is now introducing a new framework for applications and networks to leverage any SPL token on Solana for security.

Jito (Re)staking

On July 25th, the Jito Foundation released the code for Jito (Re)staking, a hybrid multi-asset staking protocol on Solana enabling any new network or application to bootstrap their economic security. The protocol consists of two primary components: the Vault Program, enabling the creation and management of staked assets, and the (Re)staking Program, coordinating activities and incentives among network participants. Together, these two core programs offer developers a modular, scalable framework for streamlining staking mechanisms for any SPL asset, marking the first protocol of its kind on Solana.

With this in mind, it’s worth reviewing some key terms before diving deeper:

A Node simply refers to a piece of software operating as specified by its associated network.

Node Consensus Networks (NCNs) refer to a distributed set of nodes working together to achieve consensus and provide services to a particular protocol or network. This includes general-purpose L1s and app-chains, cross-chain bridges, co-processor networks, DeFi applications, solver networks, and oracle networks.

An Operator is an entity that manages one or more nodes in the node consensus network.

Vault Receipt Tokens (VRTs) refer to derivative tokens representing underlying restaking positions, similar to the way LRTs function.

In short, Jito (Re)staking enables NCNs to bootstrap economic security by tokenizing staked SPL assets as VRTs for enhanced liquidity and composability. NCNs are able to configure staking parameters, slashing conditions, and other economic incentives to suit their specific preferences or requirements.

Vault Program

The Vault Program is the module responsible for managing the creation and operation of Vault Receipt Tokens (VRTs). At a high-level, this involves staking a token and receiving a derivative token representing the liquid position of the stake, which can then be used to secure the underlying NCN. Jito (Re)staking enables any SPL asset, or any combination of SPL assets, to be used as the underlying asset, which in turn allows for stakers to diversify their VRT holdings more effectively, create more balanced risk-reward profiles, and participate in the Solana ecosystem with a wider range of assets overall.

The Vault Program enables NCNs to manage operational aspects of VRTs (minting, burning, delegation), as well as enforcing their own slashing conditions and deposit/withdrawal caps. This is important as not every SPL asset is equally secure, and security requirements and conditions among NCNs can vary greatly by their underlying function. The Vault Program also enables NCNs to enforce customizable delegation strategies of VRTs across multiple operators, DAOs, multi-sigs, or onchain automation protocols (i.e. the StakeNet Steward Program).

Restaking Program

While the Vault Program manages VRTs, the Restaking Program is responsible for managing NCNs and their respective operators. This includes implementing various opt-in mechanisms, as well as managing the distribution and enforcement of slashing conditions.

Together, the Vault and Restaking Programs help create a modular framework for bootstrapping economic security with any SPL asset. Jito (Re)staking further simplifies the process for developers and NCNs by offering a simple and customizable interface for the management of VRTs and operators.

Key Benefits of Jito (Re)Staking

Jito (Re)staking aims to help mitigate the cold start problem plaguing much of the onchain economy today by providing a modular, asset-agnostic framework for NCNs to achieve consensus and gain economic security.

For starters, Jito (Re)staking enables anyone to create a VRT using any SPL asset or assets, streamlining the process of tokenomics and token utility design; any token can become a liquid staked or restaked asset while maintaining governance compatibility and enforcing necessary security parameters. Furthermore, Jito (Re)staking allows for multi-asset staking, meaning NCNs can also leverage an existing asset with deeper liquidity and wider token distribution alongside their native token for greater market accessibility.

Complementary to this, another core benefit of Jito (Re)staking is the ability for NCNs to configure and fine-tune risk parameters. NCNs building on Jito (Re)staking are capable of implementing more nuanced risk management and security models tailored to their unique needs, such as multi-tiered slashing penalties or multi-asset slashing for deeper economic security.

Meanwhile, vaults, operators and NCNs can select who they integrate with based on risk tolerance; vaults can select which operators and NCNs to delegate to, while operators and NCNs can select which vaults and assets they want to support. Vaults can also opt-in to specific slashing conditions determined by NCNs to better manage the amount of assets at risk at a given time. For user and asset safety, all program funds are securely stored within the Vault Program and can only be withdrawn through user actions or slashing incidents.

Roadmap / Adoption

Since the introduction of Jito (Re)staking, several teams and protocols have announced partnerships and integrations to look forward to:

Switchboard - Switchboard, a decentralized oracle network on Solana, plans to leverage multi-tiered slashing and customizable staking parameters to enhance their economic security which will allow for improvements in the quality and performance of their data feeds. This will make Switchboard the first Node Consensus Network to integrate with Jito (Re)staking.

Squads - Squads Protocol, a decentralized treasury management protocol on Solana, is integrating Jito (Re)staking into their upcoming Squads Policy Network (SPN) for coordinating and incentivizing activity between network participants and enhancing reliability and performance. The SPN will provide advanced security and flexibility for digital asset management by enabling granular and general-purpose transaction policies for smart accounts.

Renzo - Renzo, a leading liquid restaking protocol strategy manager on Ethereum, will be leveraging Jito (Re)staking to launch their ezSOL as a VRT. Anyone will be able to mint ezSOL by staking JitoSOL, earning yield from a combination of staking rewards, restaking rewards, and MEV tip revenues.

Sonic - Sonic, the first gaming SVM on Solana, will integrate Jito (Re)staking for their upcoming HyperGrid Shared State Network and HyperGrid Bridge. Jito (Re)staking's Node Consensus Network (NCN) model will add an economic security layer for validators to prevent state collisions securely within the HSSN, and leverage multi-tiered slashing and customizable staking parameters for the core bridging infrastructure to enhance atomic SVM <> Solana swaps.

Fragmetric - Fragmetric has launched FragSOL, the first Solana native Liquid Restaking Token as a VRT with Jito (Re)staking. FragSOL will leverage Solana's token extension functionality for precise distribution of Node Consensus Network (NCN) rewards, and introduces a Normalized Token Program to manage multi-asset staking and slashing effectively.

Ping Network (Prev. Twilight) - Twilight, an upcoming privacy DePIN on Solana, will leverage Jito (Re)staking for enhancing the decentralization and economic security of its validator network. Twilight will leverage multi-level slashing and customizable staking parameters for ensuring robust protection for Twilight's privacy infrastructure.

Kyros - kySOL combines staking, MEV, and restaking rewards into one token for optimized returns. Users can mint kySOL using JitoSOL or SOL. Kyros is also collaborating with Jito, Kamino, and Raydium to introduce an incentivized liquidity pool. This will enhance the liquidity for kySOL which opens up more opportunities in the DeFi ecosystem.

Jito (Re)staking is entering audit and formal verification. The source code can be reviewed here. Projects interested in building on the Jito (Re)staking platform are encouraged to contact through this form. This includes NCNs, VRTs, and node operators.

Key Risks & Considerations

Before outlining the case for restaking on Solana and assessing Jito’s position, it’s worth reviewing the critical risks involved. Restaking introduces several interconnected risks that affect various participants in the ecosystem, as does liquid restaking.

The crux of Proof-of-Stake blockchains is their ability to provide security assurances through slashing. Slashing enforces penalties, namely the confiscation of a portion of stake, for validators who violate the protocol’s rules (i.e. censor blocks) or underperform over a given period of time (i.e. excessive downtime). This risk is magnified when applied to restaking protocols, as operators are now subject to additional slashing risk on whichever app or NCN they are securing.

This risk is meant to be accommodated by higher returns for stakers and operators, but there is a broader economic impact to consider at a higher scale of adoption of pooled security. Slashing penalizes validators as well as any stakers delegating capital to them, who subsequently earn less rewards due to less stake available. In restaking protocols, the more concentrated the distribution of stake is (i.e. majority of stake is held by a small set of operators), the greater the overall slashing risk.

This stands to impact the security of the base chain being utilized to secure NCNs, particularly if a significant portion of the network stake is restaked and then slashed, potentially lowering the cost of controlling a majority of the network stake. The price of the underlying asset also has a role to play, as greater price volatility poses an increased risk to the underlying protocol or NCN.

However, it’s important to note slashing is not yet live on most (if not all) restaking protocols today. Therefore, the absence of a deterrent against malicious behavior or poor performance by operators currently poses a greater risk towards stakers and NCNs, who likely have less capital resources and are more impacted by financial loss.

Some restaking protocols, like Eigenlayer, have laid out frameworks for dealing with intersubjective faults - that is, issues that cannot be easily verified on-chain. While objective faults apply to offenses which are mathematically and cryptographically provable on-chain (i.e., double signatures, prolonged downtime), intersubjective faults must be resolved off-chain through some form of social consensus among network participants.

This raises questions about transparency and trust assumptions involved in these systems, and off-chain resolutions may be arduous processes that may even result in a fork of the base layer if there is enough contention and disagreement about the correct state of an NCN. Eigenlayer plans to mitigate this risk by leveraging the EIGEN token to enable validators to enforce slashing penalties for intersubjective faults by forking the token rather than the base layer.

Lastly, it’s worth considering the impact of market-driven incentives for operators and stakers. In order to strengthen the economic security of an NCN, staked capital must be sticky, meaning it is dependable in the long term. However, without a mechanism enforcing some form of long-term commitment via lock ups (which conversely pose risks to operators and stakers), there is little assurance that operators do not move their stake around to pursue the highest possible returns.

Incentivizing NCNs to compete for operators by offering higher returns, which would likely be through inflationary token emissions, does not benefit the broader ecosystem in the long run and only stands to repeat previous mistakes in incentive mechanism design for crypto protocols (i.e. revenue vs expenses for protocols participating in liquidity mining).

There are important considerations to make around liquid restaking dynamics as well. In a previous report, Shoal Research unpacked a number of these key risks, including:

Supported Deposit Assets Risk -Vault Receipt Tokens (VRTs) ) bear the risks of their underlying assets. Natively restaked tokens pose different risks than Liquid Staking Tokens (LSTs).

Access To Liquidity - Some restaking protocols employ an escrow period for unstaking assets (i.e 7-days on Eigenlayer). This mechanism raises concerns about duration risk and potential liquidity issues that can be introduced. Without sufficient secondary market liquidity, investors may face challenges in selling VRTs at a fair market price. With Jito (Re)staking, unstaking takes two epochs (approx 4-5 days) of a cool-down period before your assets will be ready for withdrawal. The time to redemption and availability of liquidity offered by VRT providers plays a key role in the impact of this risk. However, protocols are taking steps towards mitigating this concern.

For instance, Eigenlayer announced their EigenPod upgrade, aimed at improving the performance of their restaking contracts (Eigenpods) by granting users greater flexibility in harvesting or reinvesting staking rewards.Smart Contract Risk - It’s critical to assess the protocol architecture risks of the VRTs. This includes the reward distribution mechanism, the fee structure, and the role of administrative multi-sig permissions, which could affect asset transfers and the ability to pause withdrawals.

Oracle Risk - Reliable price feeds are crucial for maintaining accurate VRT pricing. Inaccuracies in oracle data can lead to mispricing, which may result in systemic risk via financial losses during redemptions or collateral liquidation.

Governance - The mechanism for choosing how an NCN is secured plays an important role in ensuring its long-term stability. Tradeoffs must be made between granting power to a large number of stakeholders, which can be a time-consuming process, vs granting power to a small set of actors (i.e. ⅗ multisig) who hold ultimate authority over that NCN.

Bridge Security Risk - For cross-chain VRTs, risks arise around the underlying bridging mechanisms being employed. Native bridges and third-party bridges each introduce their own set of tradeoffs and risks to be considered.

Looping Risk - In lending markets, the use of VRTs in recursive borrowing (looping) can lead to cascading liquidations during periods of high volatility, similar to the 2022 stETH depeg event. However, this risk is specific to lending markets, not posing a critical risk without widespread adoption.

The Case for Restaking on Solana

Research and development efforts around restaking have picked up significantly since the introduction of Eigenlayer on Ethereum, which currently boasts the third-highest TVL on the network. Meanwhile, Solana has re-established its positioning as a leading base layer for application development, only second to Ethereum in terms of TVL. Though a great deal of the momentum seen in Q4 2023, largely bolstered by a surge in memecoin trading activity, has cooled off since then, there are a number of new products and services being developed on Solana, with several key infrastructure developments coming as well. Furthermore, developments such as Anza’s new SVM API now enable developers to build SVM-based projects using components that operate live on Solana mainnet-beta, giving rise to a new era of SVM L2s and app-chains that stand to become key sources of demand for Jito (Re)staking.

Some of the key considerations that come to mind when comparing restaking on Ethereum vs Solana:

Ethereum has significantly more liquidity (9-10x the TVL) than Solana, which helps position it as a stronger base layer of economic security.

With that in mind, Solana has more room for growth and development from this point in time, and restaking incentives can play a big role in growing the network’s TVL.

Liquid restaking strategy management requires constant reallocation of capital, constantly incurring gas fees. This management is significantly cheaper and more capital efficient with Solana than Ethereum today.

The Solana ecosystem has a lot more teams building applications than infrastructure. This raises questions around sources of demand for restaking protocols on Solana, as apps can have different structural demands than NCNs today. For instance, an AMM like Raydium does not actually need to bootstrap its own validator set to function in its current state.

However, a tide of SVM-L2s and app-chains is rising, presenting a new stream of demand for economic security through Solana, and creating a compelling opportunity for restaking solutions to meet that demand.

Jito’s Role

At the time of writing, roughly 93% of Solana validators are running the Jito-Solana client, with 2.5k SOL in total tips distributed across 6.5m bundles.

JitoSOL has grown to 14.5m SOL, or $3.14b, in deposits and has generated $644m in fees to this day. Over time, the LST has steadily climbed up the ranks of the Solana liquid staking sector, capturing roughly 45% of the total TVL today.

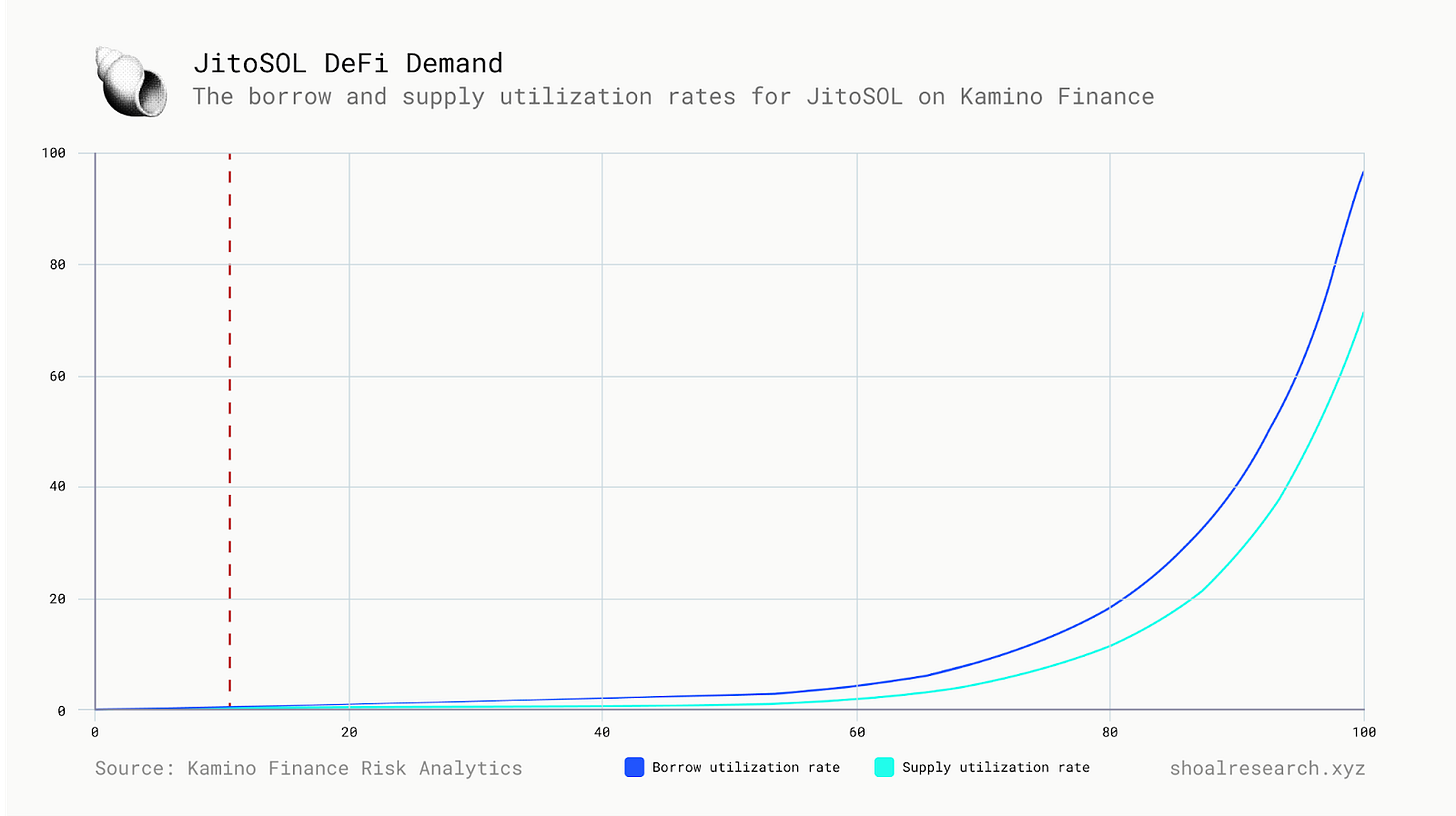

Meanwhile, demand for borrowing and lending JitoSOL on Kamino Finance has consistently grown as utilization rates are near 100%.

Competitive Landscape for Jito (Re)staking

Despite Jito’s widespread presence throughout Solana, there are a number of key catalysts and protocols which pose a credible challenge to the adoption of Jito (Re)staking. For starters, there is already another restaking protocol on Solana in Solayer, which launched in June 2024 and has already amassed up to $168m in deposits. Solayer features a restaking architecture and a shared validator network aimed at providing Solana apps with increased capabilities for securing block space and prioritizing transaction inclusion.

Second, there is competition with other Solana-native teams, particularly liquid staking protocols, who may be well-positioned and incentivized to build their own restaking products. For instance, Sanctum positions itself as a unified liquidity layer for Solana LSTs, enabling all LSTs—large or small— to share a deep pool of liquidity and be operational with minimal liquidity constraints. Thus far, Sanctum has attracted over $1B+ in TVL across its Reserve, Infinity, and Validator LSTs. Helius, a core RPC provider on Solana, launched their hSOL LST with Sanctum and currently has over 13m SOL staked. Binance’s BNSOL is currently leading with 6.77M SOL staked on the platform. Another notable Solana-native competitor is Marinade Finance. Marinade launched its liquid staking protocol back in 2021, and currently sits at just over $1.8B in TVL and $181m in lifetime fees. Though there is no mention of restaking from either team just yet, it’s not too far-fetched to imagine these teams developing their own competing restaking products. The launch of Karak seems to have opened the floodgates for restaking competitors on Ethereum, and it’s likely something of a similar effect will play out on Solana.

Lastly, there is competition with Universal Restaking protocols, such as Symbiotic and Karak, if they choose to pursue chain-agnostic approaches with support for SOL and SPL/Token2022 assets. Even Eigenlayer has started to shift their tune with the launch of Permissionless Token Support, which will enable any ERC-20 asset to be used for restaking collateral. Thinking beyond Ethereum, though, Eigenlayer ultimately positions itself as a “coordination engine for innovation”. If application development and value accrual on Solana one day outweighs that of Ethereum’s, there is no inherent reason Eigenlayer shouldn’t follow the demand and set up shop on Solana in this case. This is a long-term hypothetical scenario, however, and there is no guarantee that Eigenlayer will always be the leading restaking protocol and, therefore, it is unclear how much of a threat it would pose to Jito (Re)staking.

With this in mind, it’s important that Jito leans on its successful track record within the Solana ecosystem and that the Jito Foundation remains vigilant about improving their restaking protocol and responding to real-time feedback and demand from various NCNs, operators, and other protocol participants.

Use Cases and Applications for Jito (Re)staking

Restaking protocols benefit from a rise in middleware solutions requiring some form of a coordination mechanism to meet their business needs and goals. The landscape for NCNs is still largely unexplored and can extend across a number of sectors. A few interesting use cases for Jito (Re)staking come to mind:

Decentralized Solver Networks

The rising adoption of intent-centric architectures leveraging Solvers to fulfill user requests has created a concentration of market share and power amongst a small set of Solvers. DEXs and other liquidity venues could launch their own decentralized solver networks to democratize access to participating as a solver, which could feature mechanisms to distribute revenue back to users or token holders. Slashing penalties could be enforced to incentivize solvers to execute user trades at the best possible price.

SVM L2s

As Solana-native applications seek more custom blockspace, whether for faster block confirmation times or custom economic incentives, SVM L2s are beginning to emerge.

These networks are bound to usher in a new stream of demand for economic security through Solana, thereby creating new demand for Jito (Re)staking.

Order Flow Auctions and MEV-Redistribution Protocols

Solana DEXs can implement order flow auctions, and other mechanisms can be built to distribute value captured through MEV on token swaps back to traders or token holders, akin to CoWSwap on Ethereum.

Closing Thoughts

Although there is still a significant gap to bridge between ideas and reality in the restaking landscape, restaking is still widely believed to be a key development for enabling on-chain applications to thrive by bolstering their economic security and capital efficiency. An analogy that can be drawn is the impact of Amazon Web Services (AWS): by providing a cloud computing platform for renting computing resources on-demand, AWS helped proliferate the rise of web application development.

By outsourcing compute resources and infrastructure efforts, web developers could allocate more time and resources into creating valuable products and services and understanding customer demands. Similarly, restaking protocols enable blockchain-native applications and networks to outsource economic security and therefore focus on developing valuable products and services while inheriting the key characteristics and benefits of blockchains.

Restaking is on Solana, and Jito (Re)staking is well-positioned to become the go-to protocol for bootstrapping new innovative products and services.

References

Data used in this report was gathered from various sources, including DeFi Llama, Dune Analytics, and Stakenet. Some of the metrics cited in this report may not reflect the latest numbers, which can change as frequently as on a day-to-day basis.

Chainalysis Team. (2024, April 22). Crypto staking overview: How it works, benefits, risks, and future. Chainalysis. https://www.chainalysis.com/blog/crypto-staking/

Ethereum Foundation. (2024, November 10). Pooled staking. Ethereum. https://ethereum.org/en/staking/pools/

Cong, L. W., He, Z., & Tang, K. (2022, March 16). The tokenomics of staking. SSRN. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4059460

Gupta, S., Katharaki, A. H., Xu, Y., Krishnamachari, B., & Gupta, R. (2024, January 16). Forecasting cryptocurrency staking rewards. arXiv. https://arxiv.org/abs/2401.10931

Kwon, J. (2014). Tendermint: Consensus without mining (Draft v.0.6). Tendermint. https://tendermint.com/static/docs/tendermint.pdf

King, S., & Nadal, S. (2012, August 19). PPCoin: Peer-to-peer crypto-currency with proof-of-stake. https://people.cs.georgetown.edu/~clay/classes/fall2017/835/papers/peercoin-paper.pdf

Pokorny, Z. (2024, July 15). Restaking: Costs & benefits. Galaxy. https://www.galaxy.com/insights/research/the-risks-and-rewards-of-restaking

Chorus One. (2024, June 28). The evolution of shared security. Chorus One. https://chorus.one/articles/the-evolution-of-shared-security

Cosmos. (2023, May 17). Interchain security begins a new era for Cosmos. Interchain Ecosystem Blog. https://blog.cosmos.network/interchain-security-begins-a-new-era-for-cosmos-a2dc3c0be63

Jito Foundation. (2024, August 20). Understanding node consensus networks. Jito Foundation. https://www.jito.network/blog/understanding-node-consensus-networks/

Blockworks Research. (n.d.). Solana analytics. Solana by Blockworks Research. https://solana.blockworksresearch.com/

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author's own, not the views of their employer. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research.