Tokenized Debt And The New Monetary Order

What does it take to capture the tokenization opportunity?

A Transformation Is Overdue

Innovation tends to be scarce in an environment as entrenched, risk-averse, and burdened by technical debt as the financial services sector. Yet history suggests that advances in financial infrastructure have constantly moved in tandem with periods of exponential economic growth. Double-entry bookkeeping laid the foundation for modern accounting and credit. The joint-stock corporation, introduced in the 17th century, opened the door to large-scale investment and capital formation. SWIFT and ACH helped standardize interbank transfers and cross-border payments. Since the Industrial Revolution, global GDP has only accelerated.

Naturally, this raises the question: where and how does the next opportunity for financial innovation emerge? As Blackrock and Fidelity move hundreds of billions onto blockchain rails, landmark digital-asset legislations continue to be passed, and even retirement-plan managers begin allocating capital to crypto, it’s becoming clear a growing number toward one particular direction: tokenization.

At its core, tokenization means encoding assets of economic value - cash, securities, real estate - and their associated ownership claim onto blockchains. These distributed ledgers record every transaction as a transparent and immutable event, maintaining a single source of truth synchronized across a decentralized network of nodes. Offchain assets are represented as digital tokens; when ownership changes (i.e. assets are created, transferred, or destroyed), the changes are first validated by the nodes, and then permanently stored onchain.

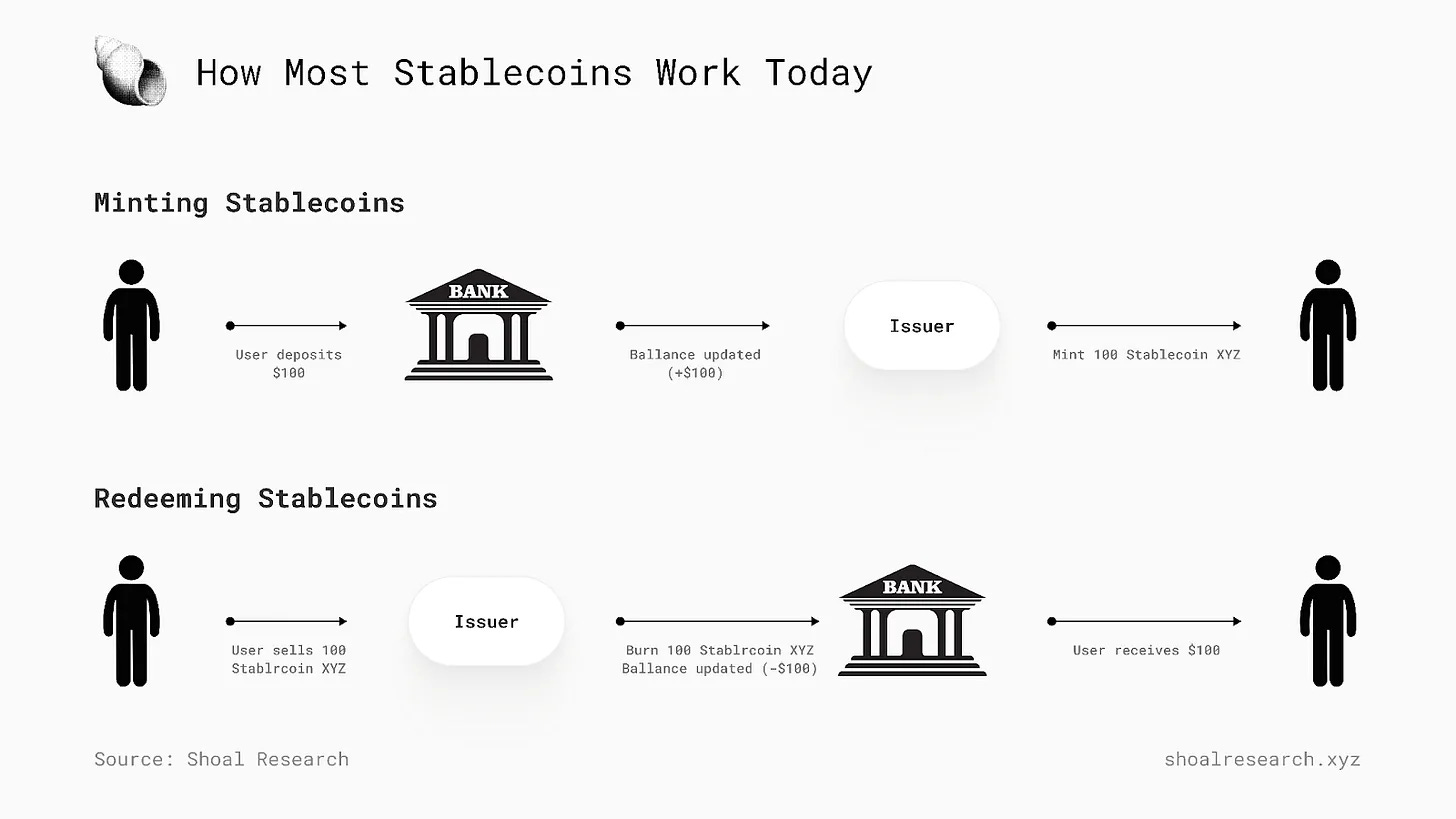

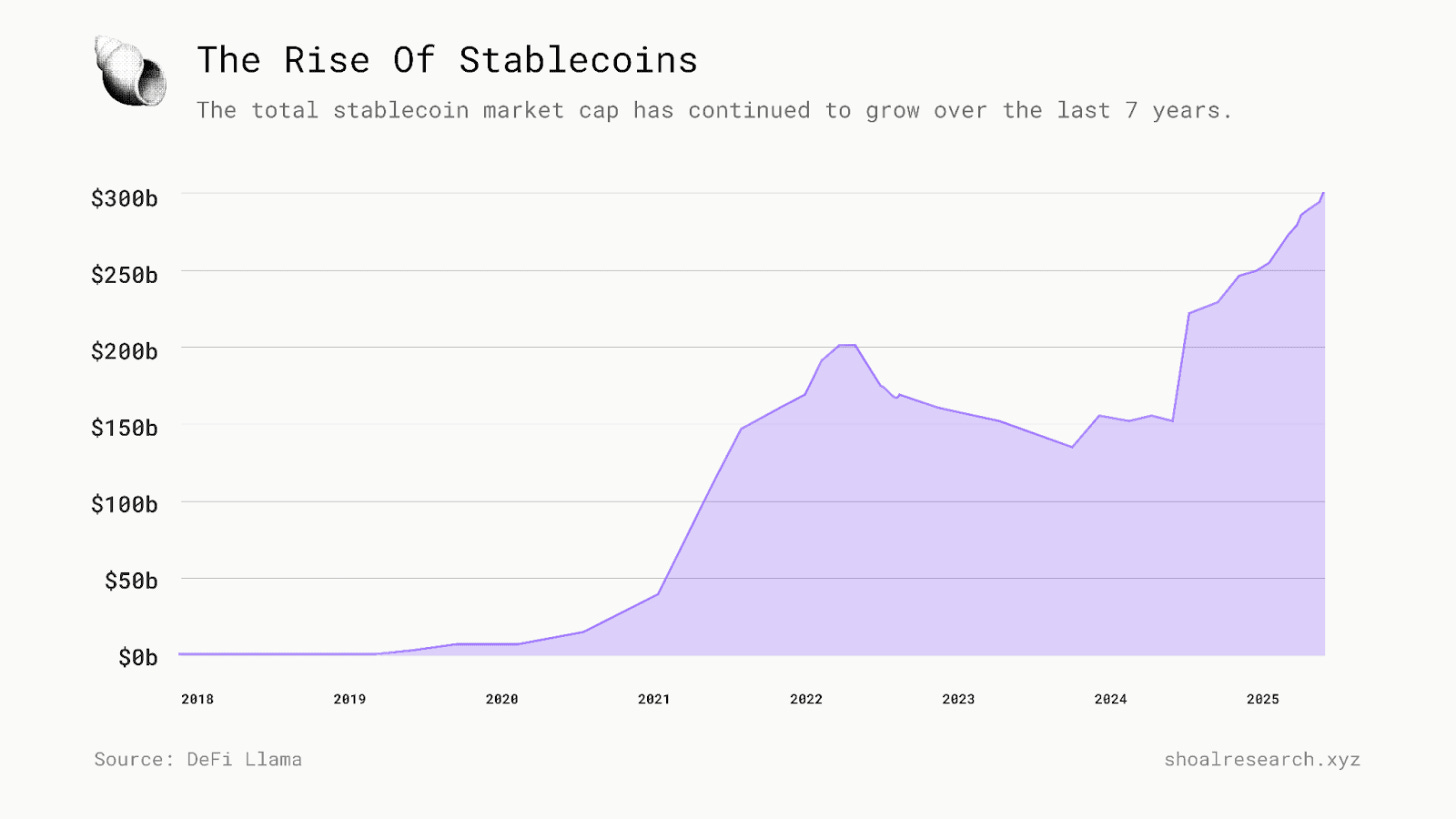

The most prominent and recognizable example of this phenomenon today is the stablecoin. Designed to represent the value of stable reference assets, most commonly the US dollar, stablecoins are digital dollars issued and transferred on blockchain rails. They provide a stable, borderless unit of exchange in digital form: just as anyone with an internet connection can use WhatsApp to message globally in seconds, anyone can move money globally with stablecoins.

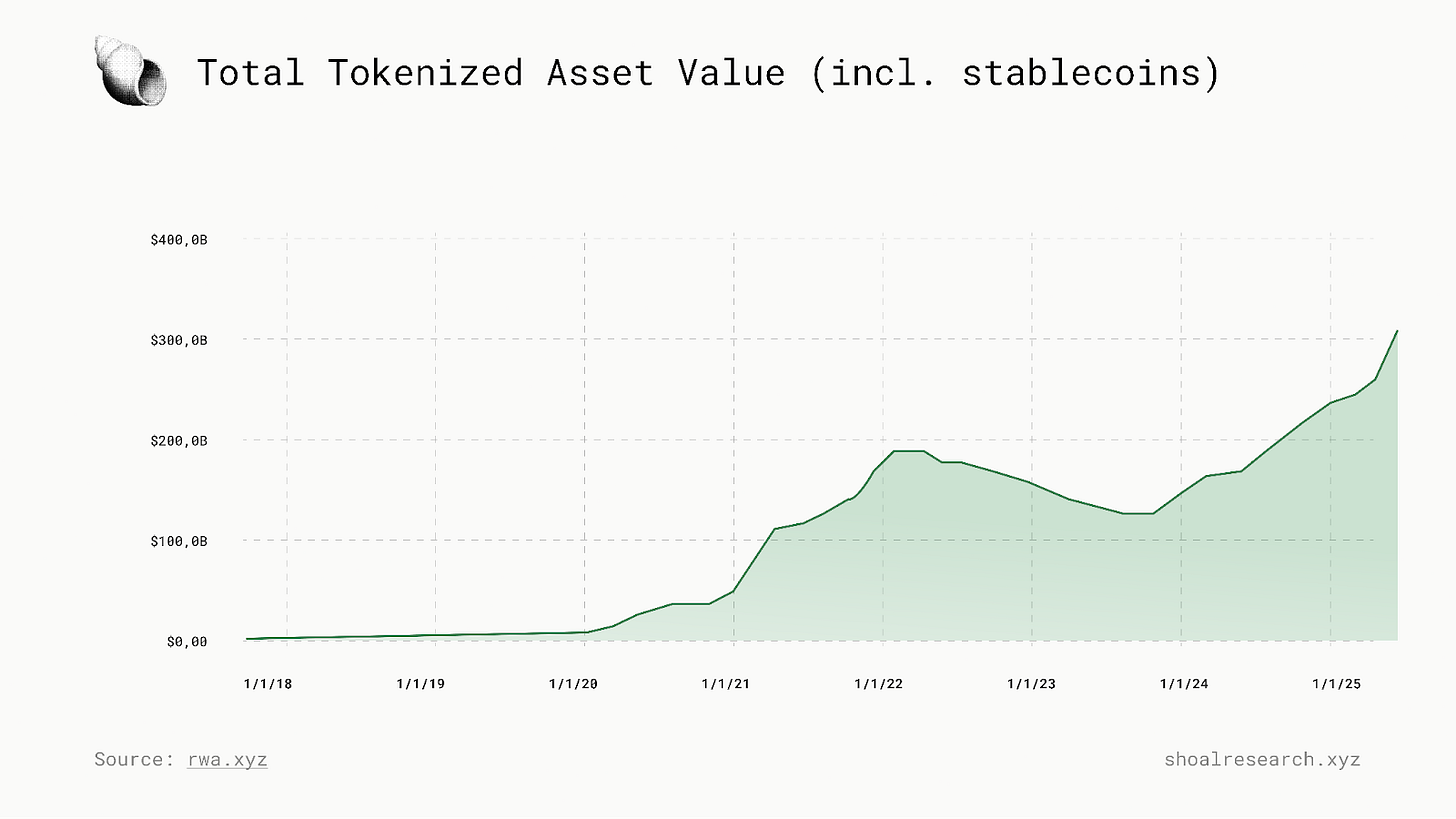

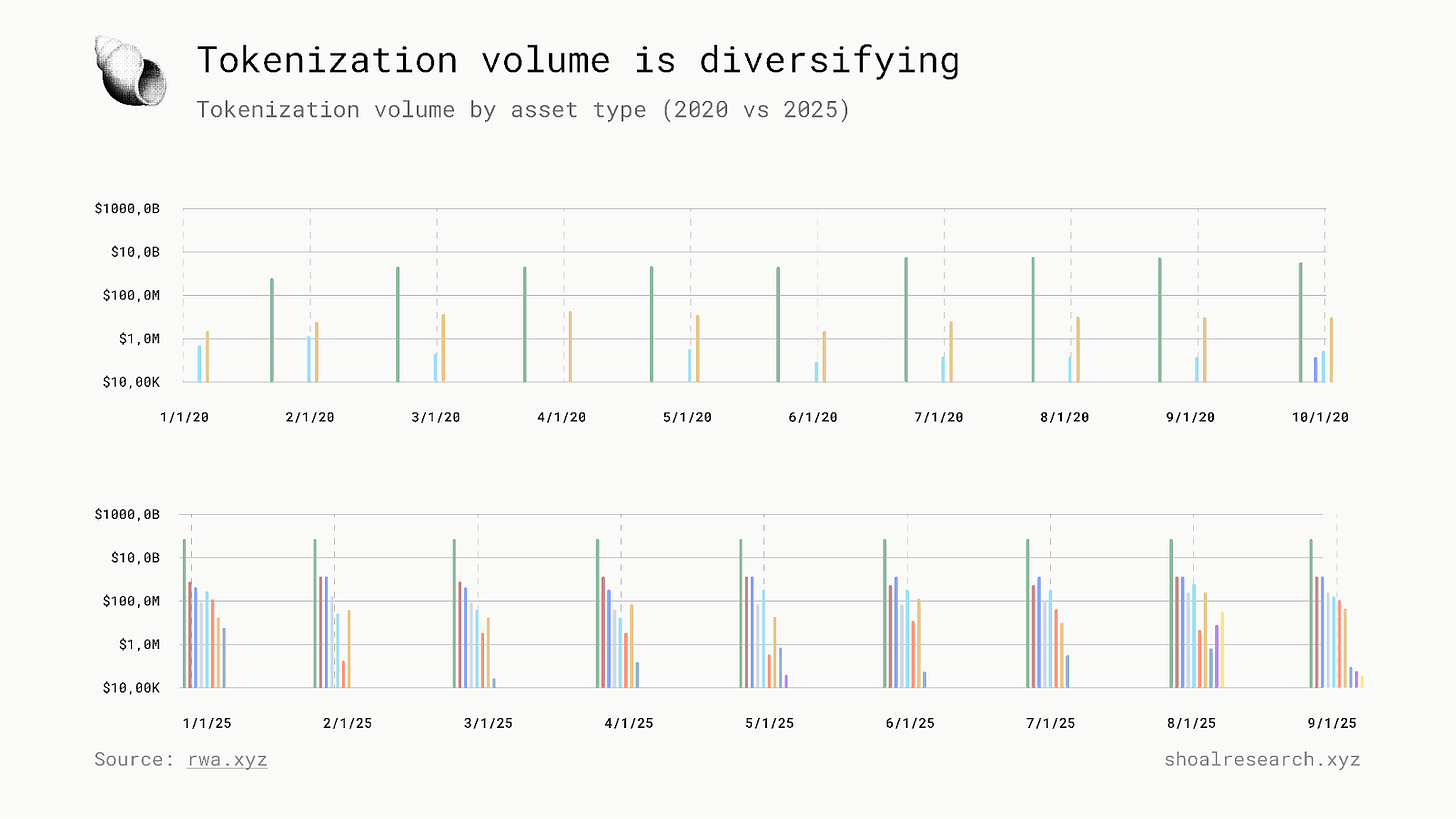

Given >99% of circulating stablecoin supply is made up of US Dollar backed stablecoins, we can effectively think of them as tokenized dollars: their supply onchain is backed 1:1 by reserves held in assets like dollars and treasuries. Stablecoins have stood the test of time and have seen remarkable growth in supply, which sits at just over $300B today. That said, if we observe monthly issuance volume of tokenized assets 5 years ago vs year-to-date, it’s clear the appetite for tokenization extends well beyond just digital dollars now.

To better understand why demand for tokenization is growing, it helps to first examine the limits of today’s market infrastructure.

Why Finance Needs New Rails

Few words capture the state of today’s financial infrastructure better than archaic. The systems that move trillions each day; payment networks, clearinghouses, settlement systems, were designed more than half a century ago.

History doesn’t repeat itself, but it often rhymes. Throughout much of the 20th century, America’s pre-1935 corporate giants dominated the market. They lost ground slowly, shedding about 2.2% of value each year to rising competitors. Then came the 1970s. New technologies, oil shocks, and inflation broke that inertia, and the pace of decline nearly doubled to 3.4% annually, sometimes even spiking above 10%.

That decade marked a structural inflection. The electronic systems that replaced paper trading and manual clearing ushered in a new era of efficiency, standardization, and scale. Networks like SWIFT, ACH, and the DTCC digitized the plumbing of global markets, transforming how capital moved and was recorded. Yet half a century later, those very systems now constrain the markets they once modernized. The infrastructure that enabled global finance to operate electronically has become its primary bottleneck.

T+1, T+2 (And Counting)

Most global securities markets today rely on delayed, multi-day settlement cycles, typically one to two business days between trade and final transfer. A trade executed on Monday is not settled until Wednesday. A trade placed on Friday may not be settled until next week. It’s as outdated as it sounds; this standard emerged from the paper-certificate era when trades required physical delivery and manual reconciliation. While trades themselves can be executed electronically in seconds today, the final transfer of their ownership still takes days. Until that moment, each trade is merely an entry in another institution’s siloed private ledger.

It’s naive to downplay this structural lag as mere operational inconvenience: delayed settlement represents one of the largest hidden costs in global markets. Delays mean asset ownership remains in flux, exposing participants to credit and counterparty risk and tying up that capital that could otherwise be productively deployed. In aggregate, trillions of dollars remain effectively idle and unproductive because the underlying infrastructure has failed to adapt.

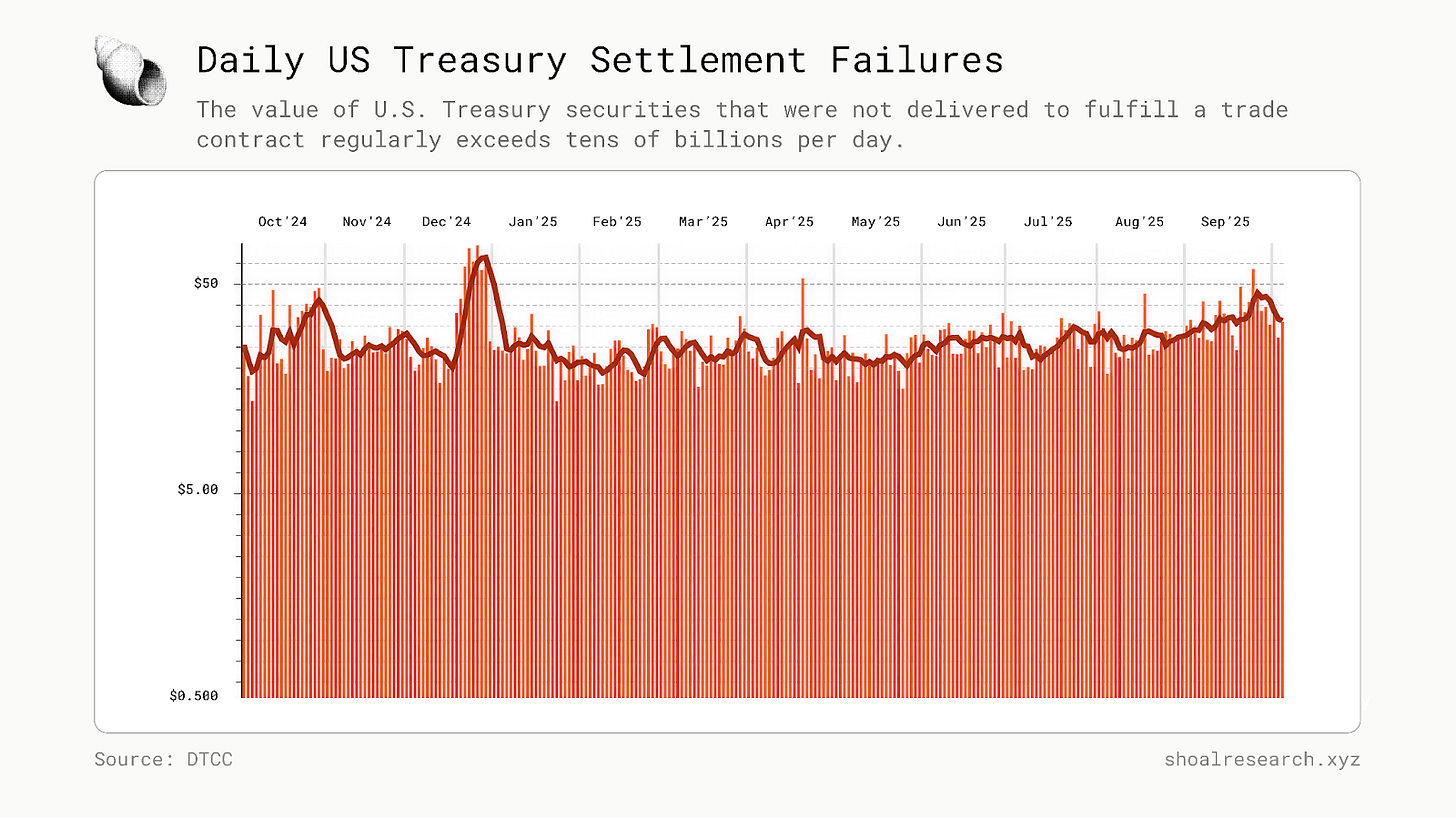

The DTCC reports that tens of billions of dollars in daily settlement failures. These failures rarely occur in isolation; when one security fails to arrive, it often has already been pledged as part of another transaction. That second trade then fails, potentially a third after it, effectively creating a cascade of failures which are only amplified in markets with high leverage and thin liquidity.

Even when trades do eventually clear, structural inefficiencies remain. The longer the settlement window, the greater the collateral required, as clearinghouses demand higher margins to account for the additional risk. Meanwhile, banks and brokers often struggle to determine which securities are truly available in real time, and settlement delays often lead to over-allocation and inventory mismanagement. On top of this, settlement systems stop when markets close, meaning their daily operating hours and operational days per week are always limited.

These frictions only amplify across borders. Different regions operate their own central securities depositories with their own rules and timelines. Transferring assets across them involves multiple intermediaries and reconciliation steps. The regulatory patchwork adds another layer of friction. Compliance requirements differ by jurisdiction, forcing firms to spend heavily on reconciliation and reporting. Market operating hours rarely align, creating dead zones where trades cannot move forward. A current example is Europe’s delayed adoption of T+1 settlement, scheduled for 2027, meaning the EU will remain out of sync with the US and other regional markets, imposing new costs on participants that operate across both markets.

With this in mind, it’s important to recognize that the evolution of financial infrastructure more often than not is a reactionary one:

In the 1960s, back-office paperwork overwhelmed Wall Street, leading to NASDAQ’s creation in 1971 as the first electronic stock market.

In 1973, the Depository Trust Company centralized recordkeeping to eliminate the physical transfer of certificates.

After 9/11, Congress passed the Check Clearing for the 21st Century Act, allowing digital images to replace paper checks.

In 2012, Hurricane Sandy flooded DTCC vaults, destroying 1.7 million certificates and accelerating the transition to fully digital records.

Infrastructure most commonly evolves when inefficiency or crisis leaves no alternative. Today, the pattern repeats. The shortcomings of today’s market infrastructure are not abstract. They translate directly into costs, UX pain points, and risks that are borne by end-users.

The internet already enables information to move globally in milliseconds. There is little reason why money and securities should remain constrained by regional ledgers and business-hour settlement when the technology for instant, continuous transfer already exists. It is only natural that value should move as freely as information: accessible globally, operating continuously, and secured by transparent, programmable infrastructure.

All Roads Lead to Tokenization

Tokenization is designed to directly address the structural lag in modern financial systems.

By recording ownership and transfer on shared ledgers, it removes the need for multiple intermediaries to reconcile the same transaction across fragmented databases. Settlement becomes a matter of redistributing balances on a digital ledger rather than routing instructions through correspondent banks and clearing houses. The primary resource consumed in this process is computing power, paid as a transaction, or gas fee, a cost that continues to decline as low-cost or near-zero gas transactions have now become table stakes for chains today. As a result, the marginal cost of value transfer for tokenized assets will continue to gravitate to zero.

By contrast, legacy payment systems remain burdened by institutional overhead. A single wire or ACH transfer may pass through several intermediaries; sending and receiving banks, correspondent institutions, and clearing houses, each extracting fees and introducing settlement latency. Global cross-border transfers still average 6.49% in transaction costs, a persistent tax on capital mobility that tokenized rails largely eliminate.

The idea of tokenizing assets is not new. It has resurfaced repeatedly over the past decade in different forms. As early as 2012, Meni Rosenfeld’s Colored Coins proposal introduced the idea of attaching metadata to fractions of Bitcoin to represent other assets such as stocks, bonds, or commodities: a digital bearer asset could embed both monetary value and an external ownership claim. A few years later, DigixDAO in Singapore sought to bring physical assets like gold onchain. Built on Ethereum and IPFS, it introduced a Proof of Provenance model that allowed anyone to verify an asset’s existence through its custody chain. Digix was among the first to combine asset-backed tokens with decentralized governance via a DAO.

The broader environment, however, was not ready to scale. Between 2017 and 2020, onchain liquidity was scarce. Average daily volumes on many exchanges were under $10 million, and quoted bid-ask spreads in smaller tokens often exceeded 4-8%, setting up for unreliable price discovery and therefore limited adoption.

The supporting infrastructure for tokenization, across custody, settlement, and compliance, was equally immature. In 2018, only a handful of licensed custodians operated globally, and most lacked regulatory clarity. The SEC noted that few met depositary standards under Rule 206(4)-2 of the Advisers Act, leaving persistent uncertainty around asset segregation and safekeeping. On/off-ramps between banks and blockchains were also unreliable. Until 2020, fiat-crypto conversion failure rates averaged nearly 50 percent across major providers, driven by inconsistent KYC processes and recurring payment rejections. Infrastructure diversity was minimal: early entrants like MoonPay, Ramp, and Transak collectively supported fewer than 60 fiat currencies globally, excluding a good portion of emerging markets and locales.

The concept of tokenized finance was sound, but the market lacked the architecture, incentives, and trust mechanisms to sustain institutional participation. It would take another half-decade, driven by advances in compliant custody, the rise of stablecoin liquidity, and the emergence of cross-chain settlement frameworks, before tokenization began to take form at the scale it was once envisioned to.

At the foundation of this shift is a principle of fluidity. In any monetary system, assets that are highly divisible and low-friction tend to circulate rather than sit idle. Tokenized assets follow that same logic: they are designed to move, integrate, and settle across networks in real time. Blockchains function as public digital ledgers, and automated reconciliation reduce the cost of movement, while fractional ownership lowers participation thresholds and deepens liquidity.

The Tokenization Landscape Today

Total tokenized value now sits at just over $320 billion, spanning more than 220 issuers and roughly 400,000 onchain addresses. Still, only a fraction of that value circulates actively within DeFi protocols. The difference highlights a key point: much of tokenized value today remains in custodial or permissioned environments rather than freely composable onchain.

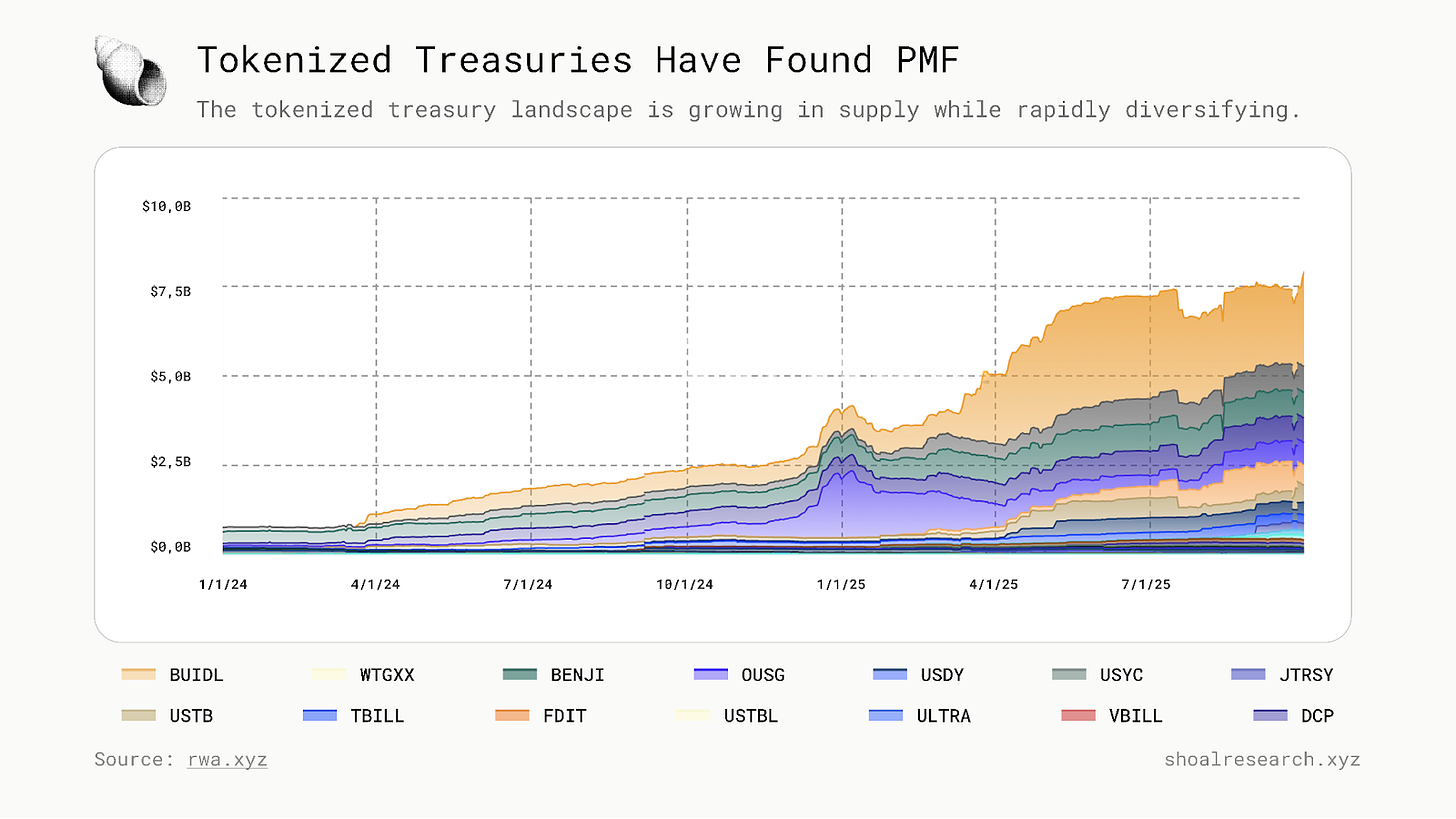

That definitional caveat aside, the trendline is clear: while still small relative to the $100T+ traditional markets, tokenized asset value has grown sharply in the past year. The rise of tokenized assets has been most present in two particular asset classes: stablecoins and tokenized Treasuries.

The State of Stablecoins

Stablecoins remain the clearest proof of concept for tokenization. With a circulating supply of more than $300 billion, they show that there is demand and utility for programmable, globally transferable, always-on cash works at scale.

Over the past five years, stablecoin adoption has accelerated sharply. Tens of trillions of dollars in value have already moved through stablecoin rails, and supply continues to set new all-time highs.

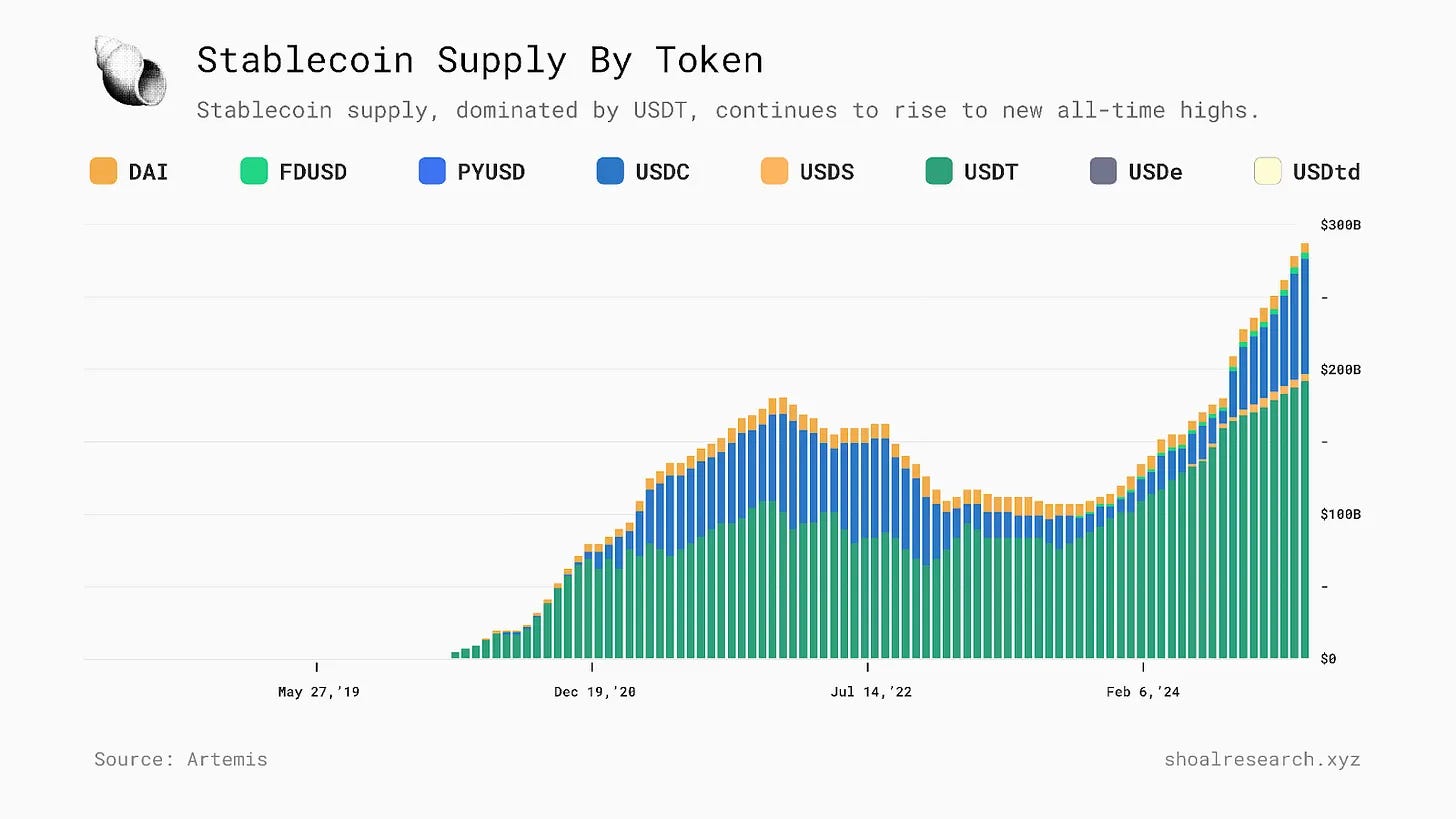

By token, issuance remains concentrated in USDT and USDC, which together account for the vast majority of supply. New entrants such as FDUSD and PYUSD, backed by major exchanges and payment networks, signal a gradual institutional pivot toward regulated issuance, while DAI, USDS, and USDe demonstrate persistent demand for decentralized, DeFi ‘native’ stablecoins.

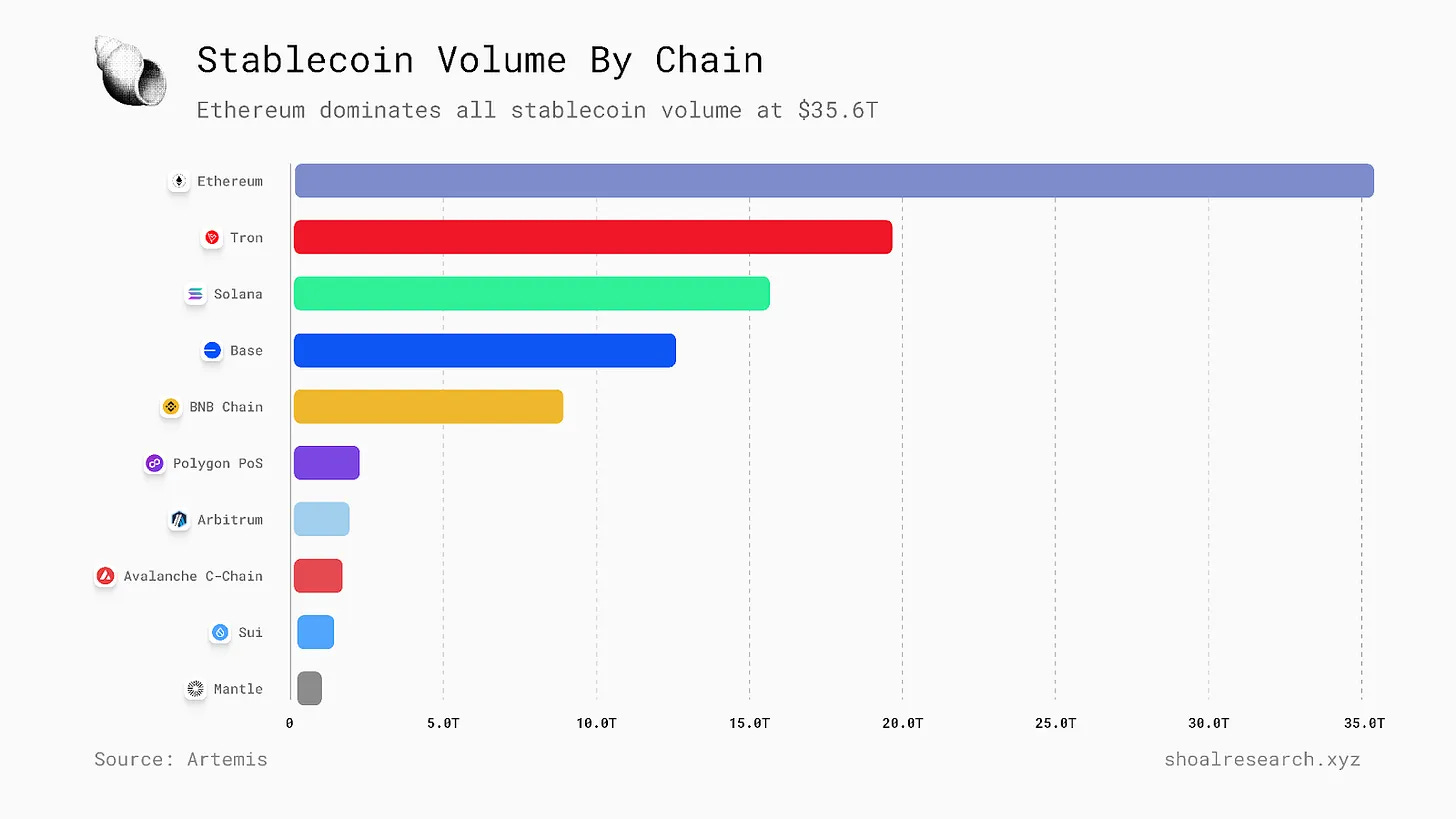

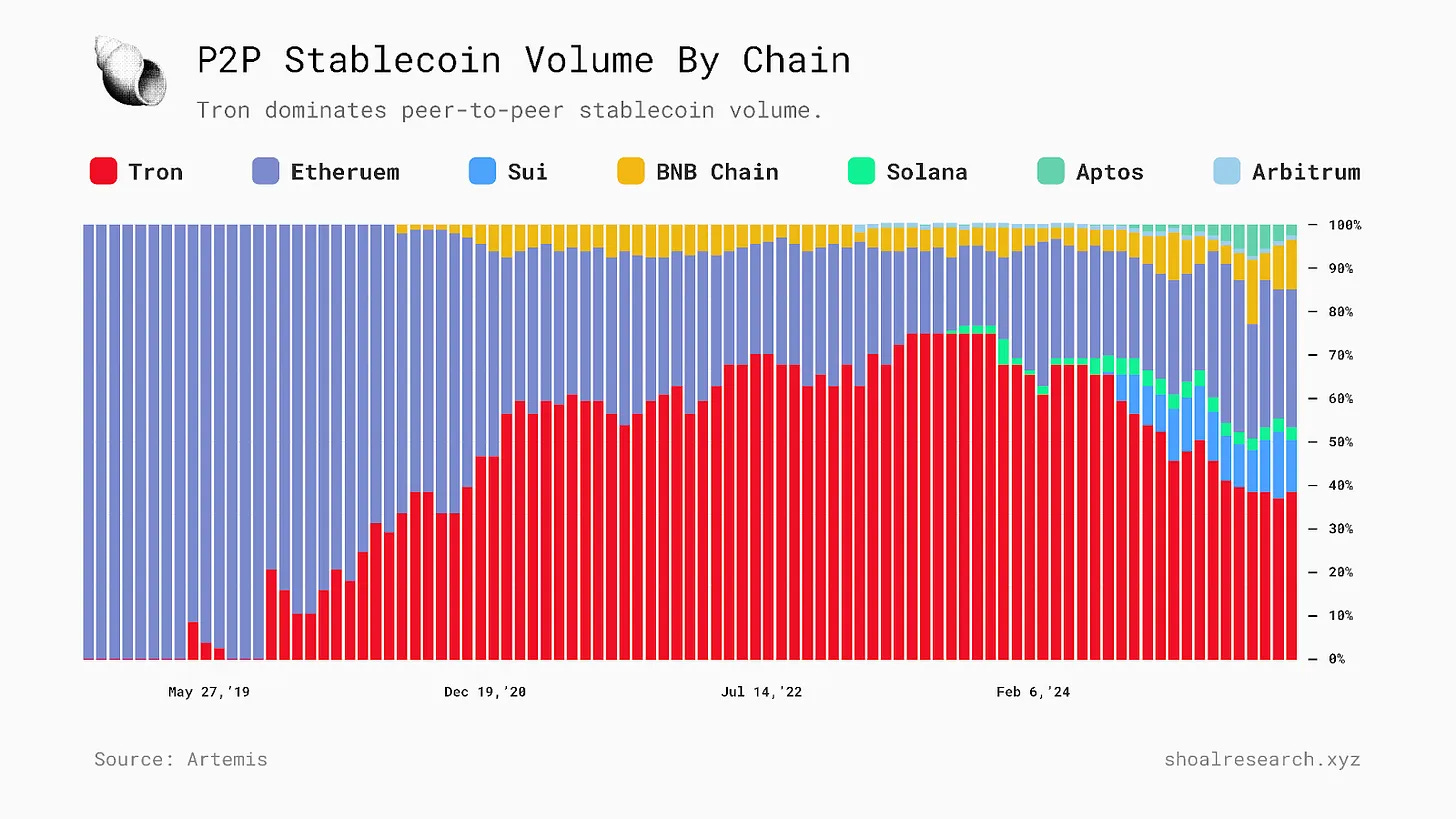

By chain, Ethereum still leads in aggregate supply and transaction value, but Tron, Solana, and Base have grown rapidly.

These distributions reveal two different types of utility. Ethereum dominates in DeFi-related usage (i.e. liquidity pools, lending markets, and settlement) while Tron leads in peer-to-peer transfer volume, especially across emerging markets where low fees and quick confirmations make it ideal for payments and remittances.

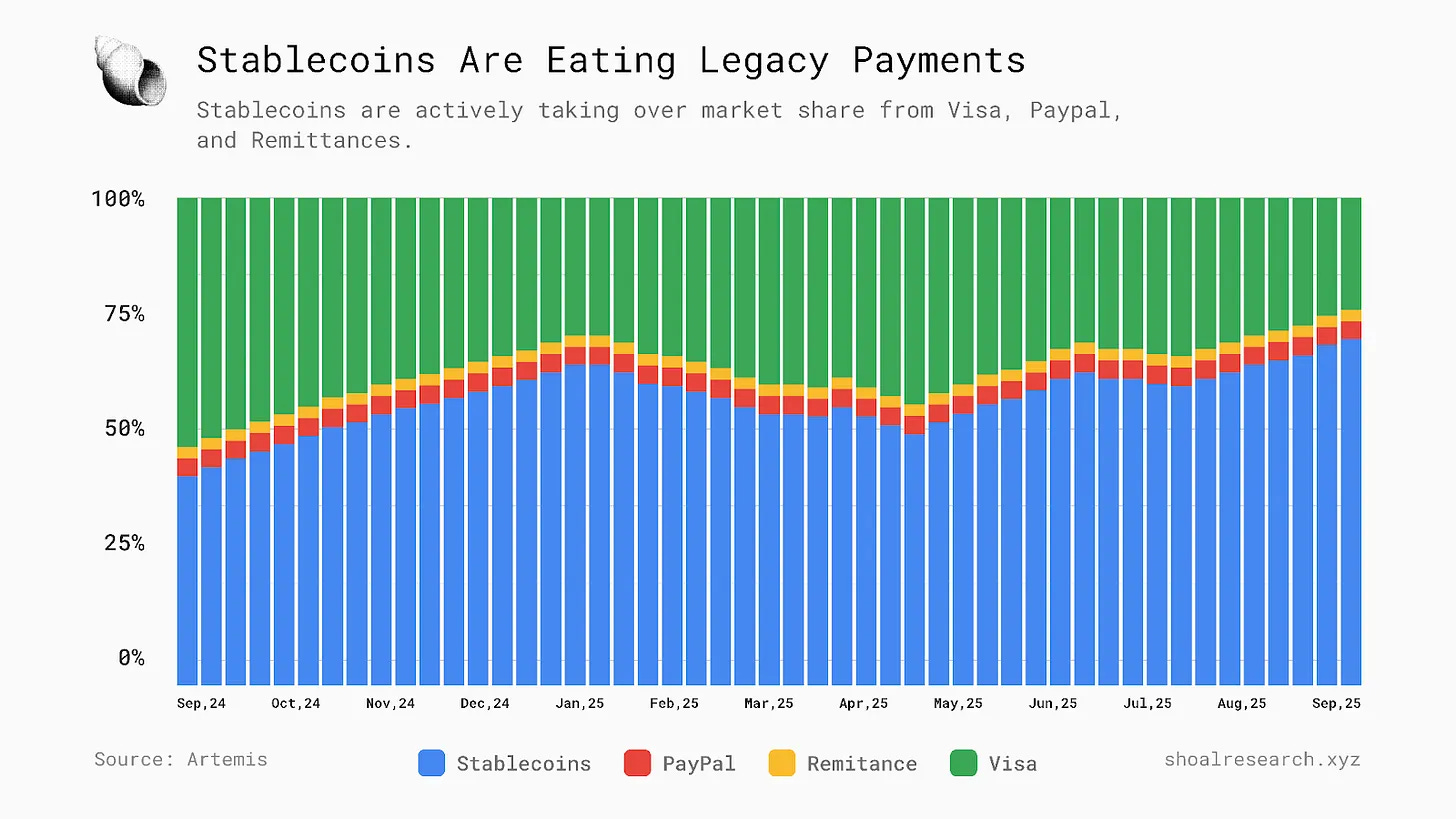

More impressively, though, stablecoins are already eroding legacy payment networks. Aggregate transfer volumes now reach into the trillions per month, rivaling networks like Visa, Mastercard, and SWIFT, but with near-instant settlement and materially lower transaction costs.

The regulatory landscape around stablecoins is evolving in tandem. A new class of regulated money-market fund (MMF) tokens, including names like BUIDL, BENJI, USDtb, and Cap Money (which aggregates them), illustrates how stablecoin design is converging with traditional cash-management structures. In effect, these instruments merge the accessibility of stablecoins with the yield of Treasuries, hinting at the next phase in tokenized assets.

A Rising Phoenix: Tokenized Treasuries

If stablecoins effectively functioned as a blueprint for tokenization, treasuries are emerging as the rising phoenix. At the time of writing, tokenized Treasuries have reached upwards of $8B marking more than an 80% increase YTD. That growth has well outpaced the early trajectory of stablecoins, reflecting growing demand for yield-bearing, low-risk assets that can serve as collateral and liquidity instruments across global markets.

At a high level, the tokenized treasury landscape today already has:

$8.3B total value

50 total assets

52.7k total holders

*As per rwa.xyz

Treasuries are debt instruments issued by the U.S. Department of the Treasury to finance government spending. Backed by the U.S. government, they occupy a central position in global markets, functioning as cash equivalents for banks, corporations, and sovereigns. The four main categories - Treasury Bills, Notes, Bonds, and TIPS - differ in maturity but share two defining traits: liquidity and yield.

While stablecoins provide price stability, Treasuries offer something GENIUS-compliant stablecoins cannot: interest income. With short-term yields above 5% since the Federal Reserve’s tightening cycle in 2022/23, onchain investors have increasingly sought exposure to the U.S. risk-free rate. The logic is simple: idle capital held in stablecoins can instead earn yield through tokenized Treasuries without sacrificing liquidity or transparency.

Demand has also been shaped by broader structural forces. The rise in rates ended the ‘easy-money’ era that defined much of DeFi Summer. Liquidity mining returns fell sharply as incentives disappeared and the unsustainable yields of prior cycles collapsed. Tokenized Treasuries emerged as an alternative source of yield which itself stems from interest-bearing government securities with clear legal protections and transparent collateral.

It’s worth noting tokenized Treasuries come with a distinct limitation: they are legally classified as securities, which restricts their composability across open DeFi systems. Compliance requirements, investor whitelisting, and regulated custody frameworks introduce friction that prevents them from circulating as freely as stablecoins. Even so, the pace of growth speaks for itself. Tokenized Treasuries surpassed $7 billion in supply far faster than stablecoins did in their early years.

A Deep Dive Into OpenEden

OpenEden represents one of the first credible attempts to build a functioning framework for institutional-grade tokenization. Its mission is straightforward: to provide investors with continuous, regulated access to U.S. Treasuries onchain, combining the legal protections of traditional markets with the operational efficiency of blockchain infrastructure.

Founded in 2023, OpenEden is a tokenization protocol providing structured access to short-duration U.S. Treasuries. It is the first tokenized-Treasury issuer to receive independent third-party bond ratings, earning an “A-bf” from Moody’s and “AA+f / S1+” from S&P Global Ratings.

OpenEden Digital (OED), a licensed subsidiary of the OpenEden Group, serves as the platform’s regulated issuer. Operating under a Digital Assets Business License granted by the Bermuda Monetary Authority, OED is authorized to issue, sell, and redeem digital assets within a clearly defined legal framework.

Growth and Adoption

OpenEden’s footprint has expanded steadily since launch, though adoption has notably accelerated in 2025.

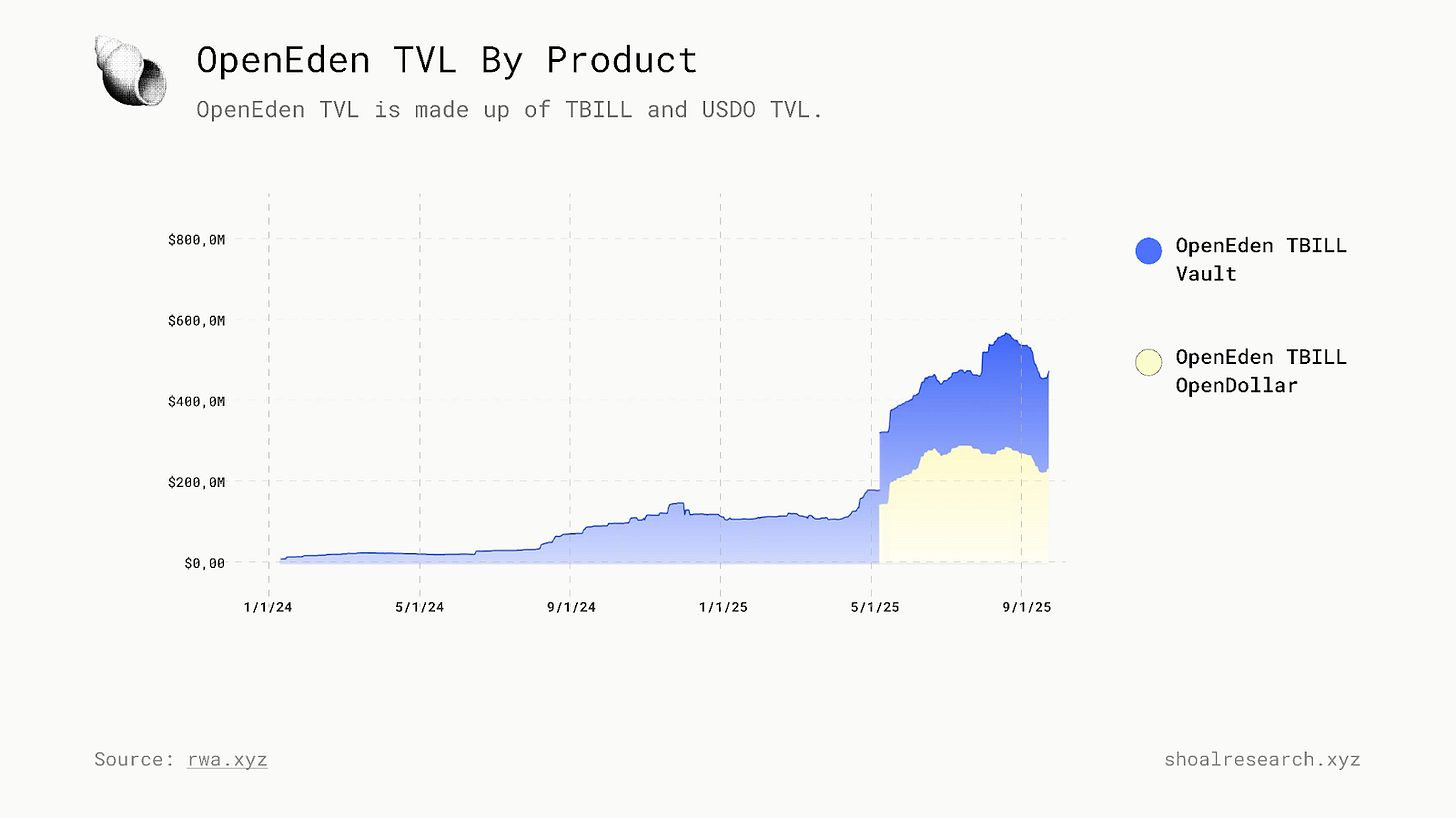

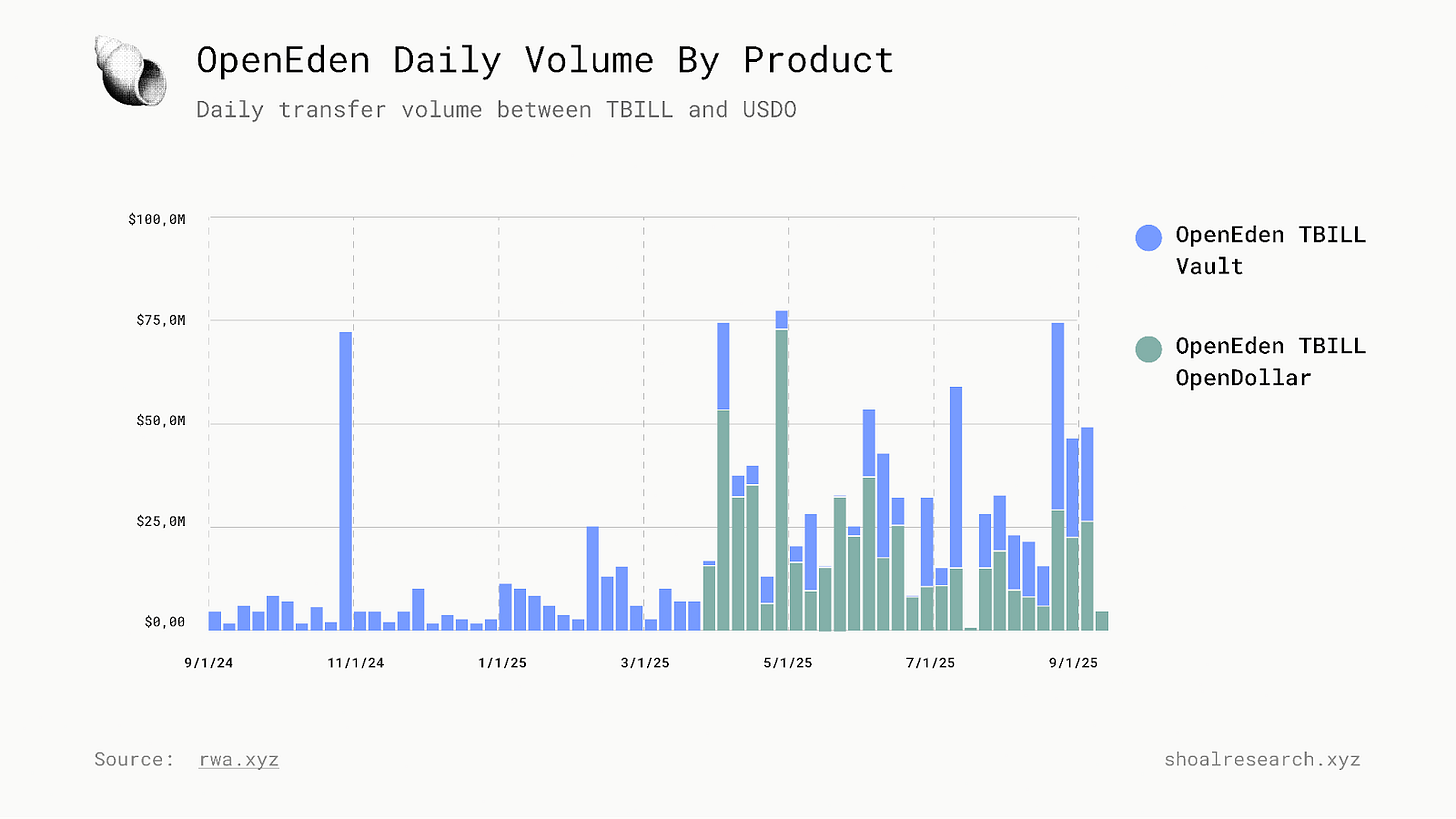

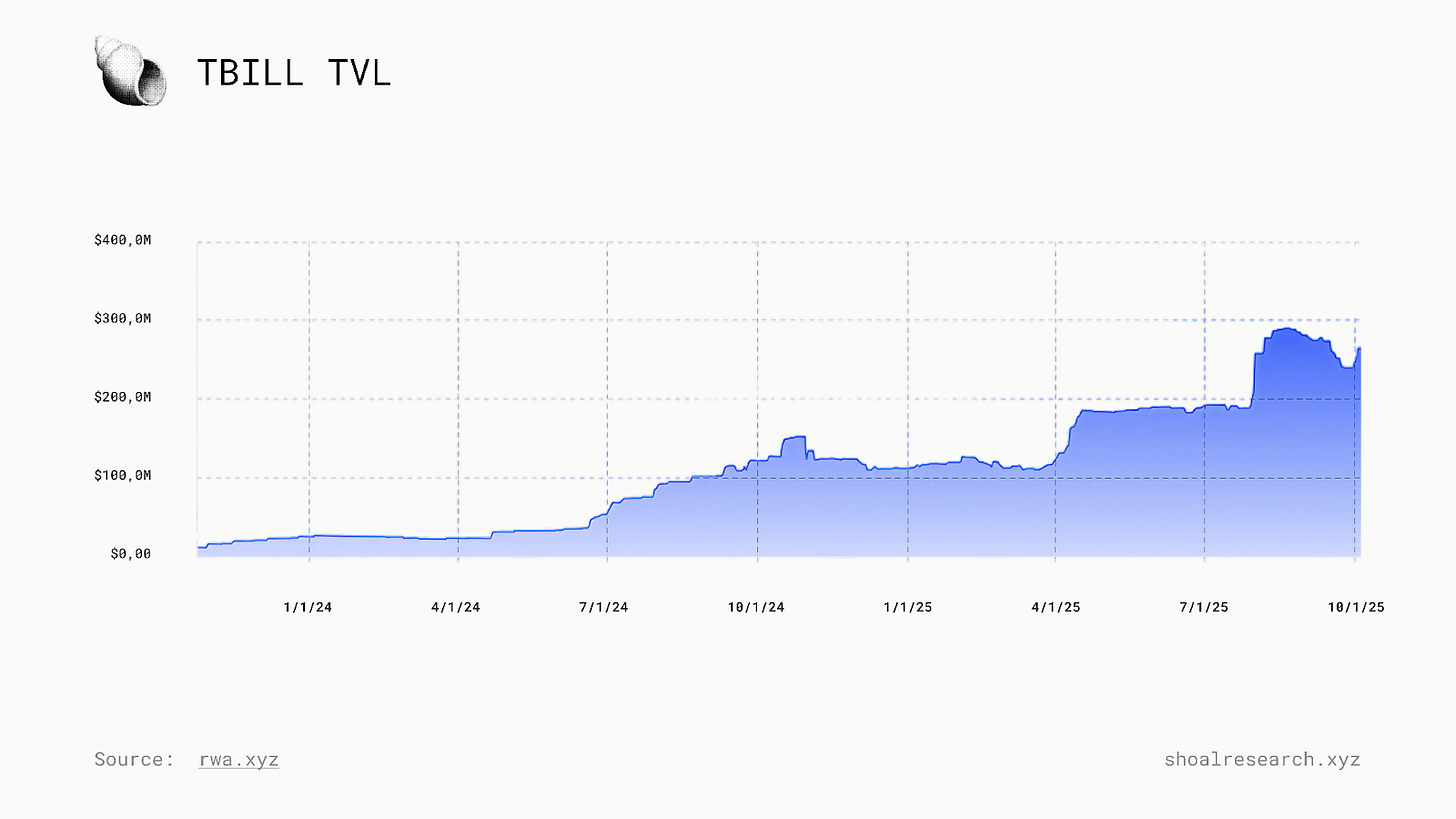

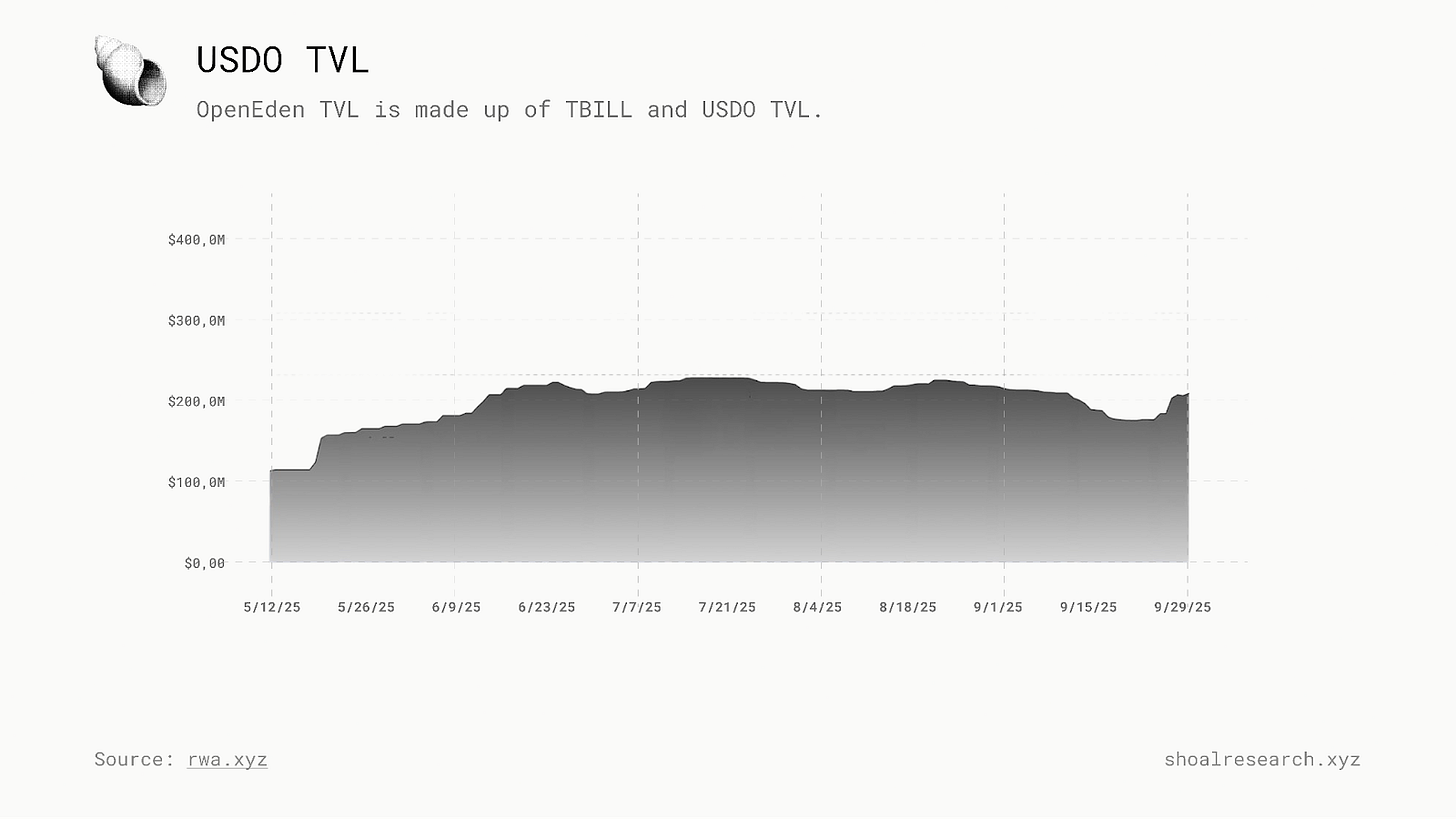

Total value locked, which currently sits at $531M, has climbed sharply YTD, driven by consistent inflows into TBILL, OpenEden’s tokenized Treasury product, and USDO, its stablecoin, which each have amassed ~$266M and ~$264M in TVL respectively.

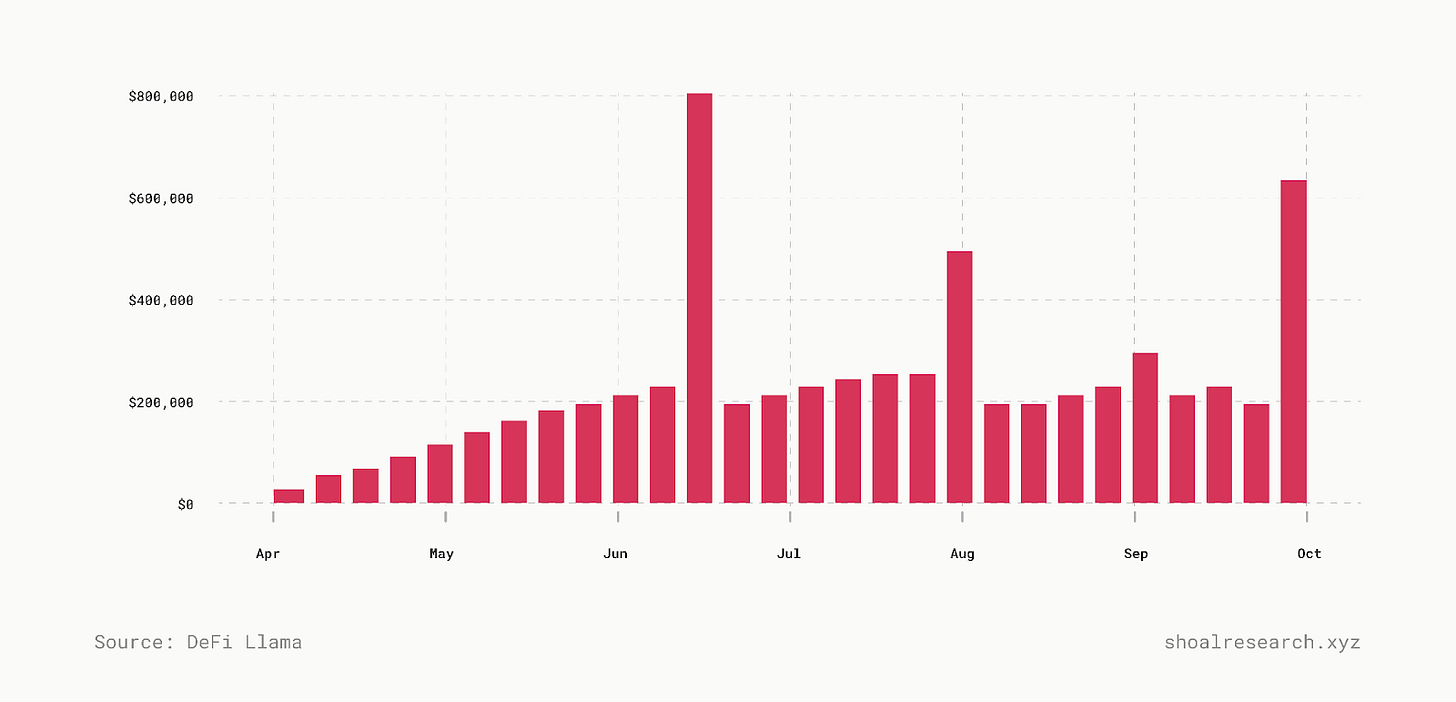

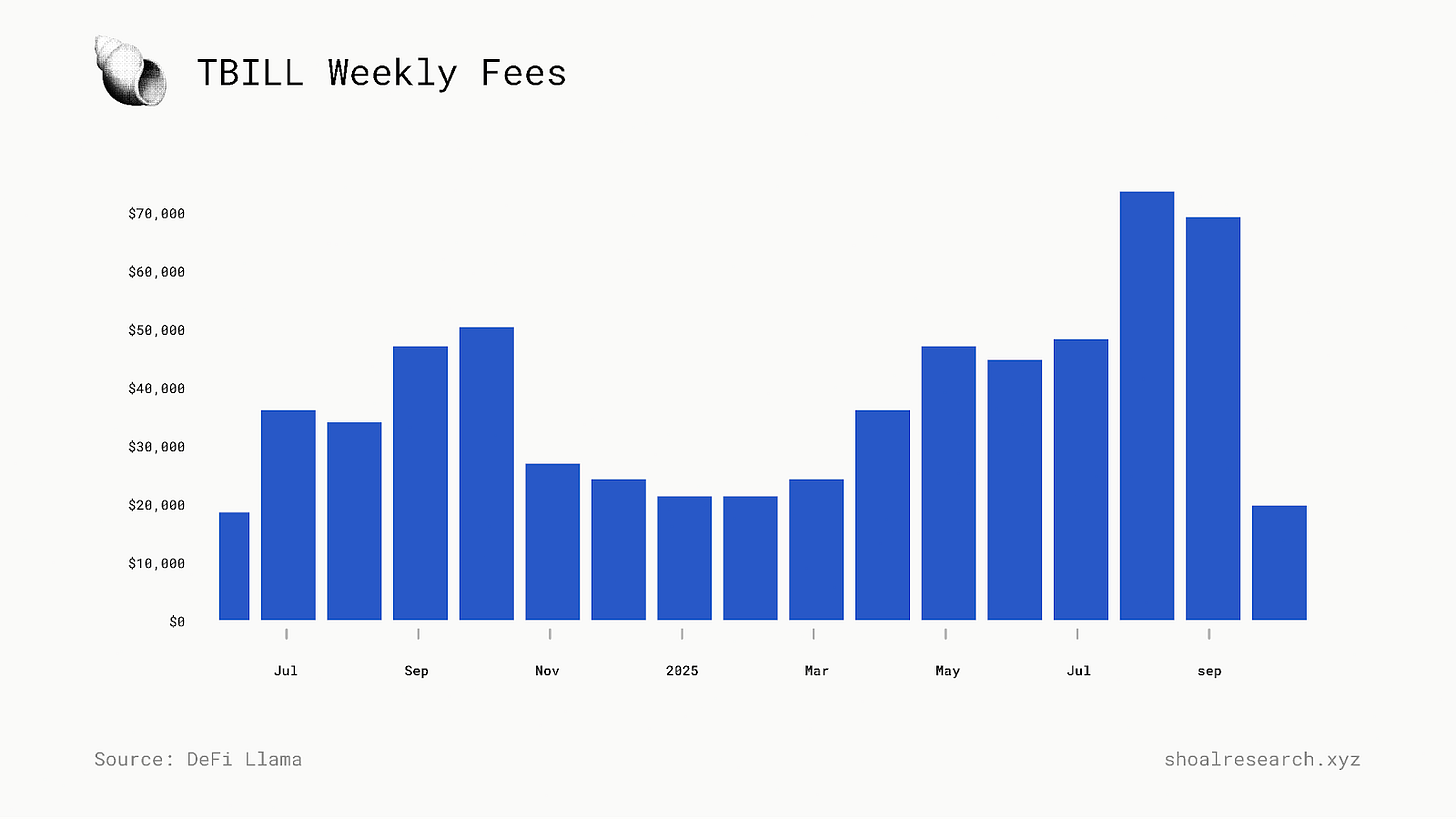

To date, OpenEden has generated $7.29M in total fees, which thus far has amounted to $1.79M in protocol revenue.

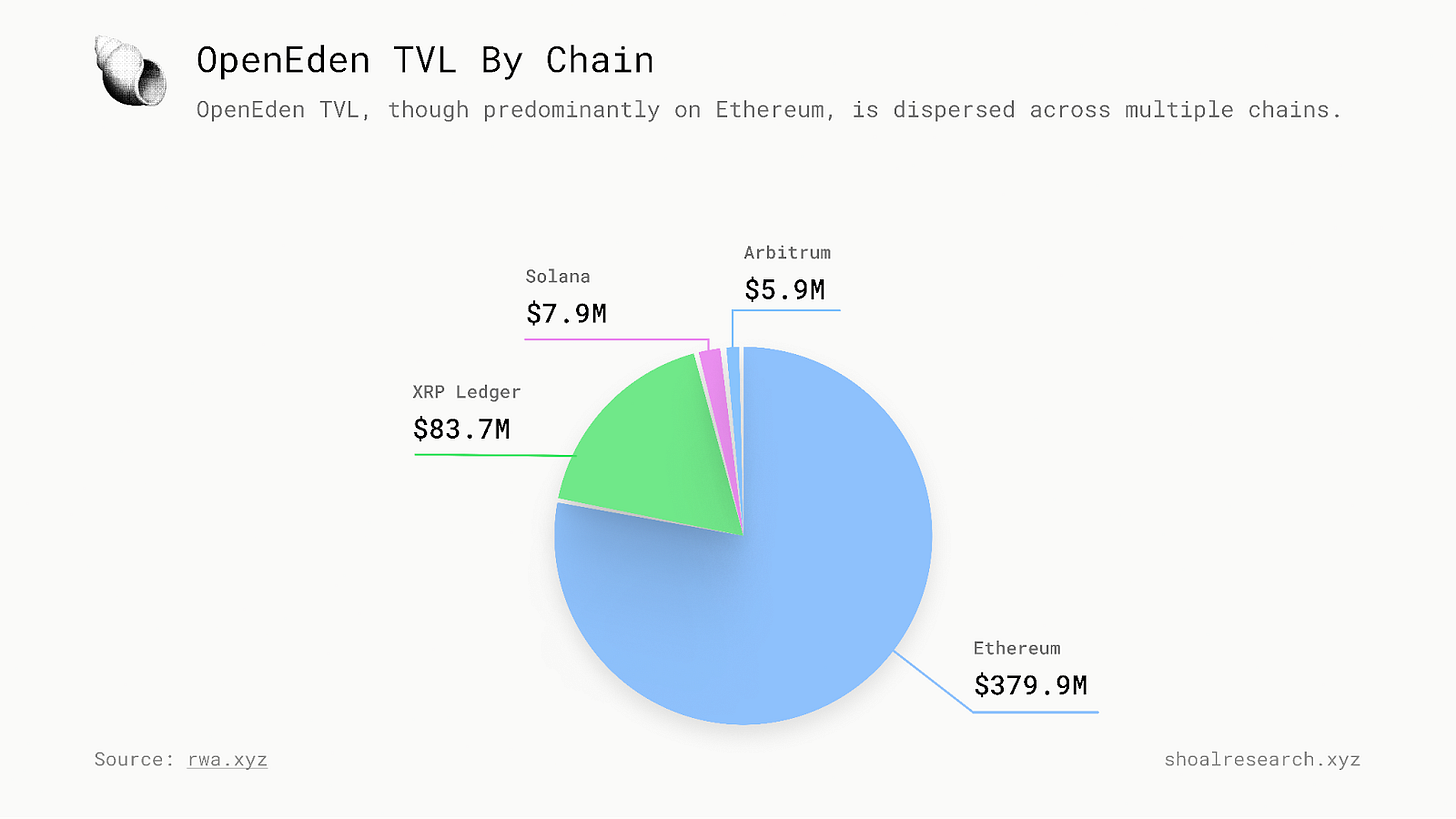

Most OpenEden assets reside on Ethereum, however, liquidity is also growing across other chains like Solana, Arbitrum, and XRPL.

Transaction data shows a steady rise in usage, with daily transfer volumes across OpenEden’s products now reaching parity between TBILL and USDO, the latter of which was notably launched at a later time.

Key Features

OpenEden’s framework is designed to combine the reliability of regulated financial structures with the efficiency and transparency of onchain settlement. The TBILL fund’s underlying assets are custodied by The Bank of New York Mellon (BNY), while the fund itself is investment-managed by BNY Investment Management (BNYIM), marking the first time BNY is managing a tokenised fund on a public blockchain. Each tokenized instrument represents a verifiable claim on a corresponding pool of short-term U.S. Treasuries, and the protocol automates issuance, redemption, and settlement through smart contracts while maintaining regulatory compliance.

OpenEden’s model rests on several core principles:

Regulated and licensed issuance: OpenEden assets are backed by real U.S. Treasuries held by qualified custodians under a BMA–licensed framework.

Self-custody: Investors hold their OpenEden assets directly onchain.

Low-cost, programmable settlement: Onchain rails minimize reconciliation costs and enable cheaper, faster, and more transparent settlement.

Smart contract automation: Core fund operations, namely minting, burning, and exchange-rate calculation, are governed by verifiable smart contracts.

DeFi Composability: ERC-20 compatibility allows OpenEden assets to integrate across broader DeFi ecosystems.

Multichain deployment: Multichain support for assets expands accessibility and network reach including Ethereum, Solana, Base, Arbitrum, BNB Chain, and XRPL.

In practice, these design choices allow OpenEden to combine the trust and governance of traditional markets within an onchain environment, where issuance, custody, and settlement are managed programmatically under a regulated framework.

OpenEden Core Products

TBILL

OpenEden’s flagship product, TBILL, provides tokenized access to short-duration U.S. Treasury Bills. It is available on Ethereum and Arbitrum, and is backed 1:1 by a pool of short-term U.S. T-Bills and dollar reserves held with regulated custodians.

Growth and Fees

Since launch, TBILL has seen consistent growth in both deposits and fees generated. At the time of writing, TBILL TVL sits at $264M, up over 130% YTD and 2300% since launching in 2023 ($11M).

TBILL has also consistently generated tens of thousands in fees since early 2024, amassing $624K total fees to date.

Structure and Issuance

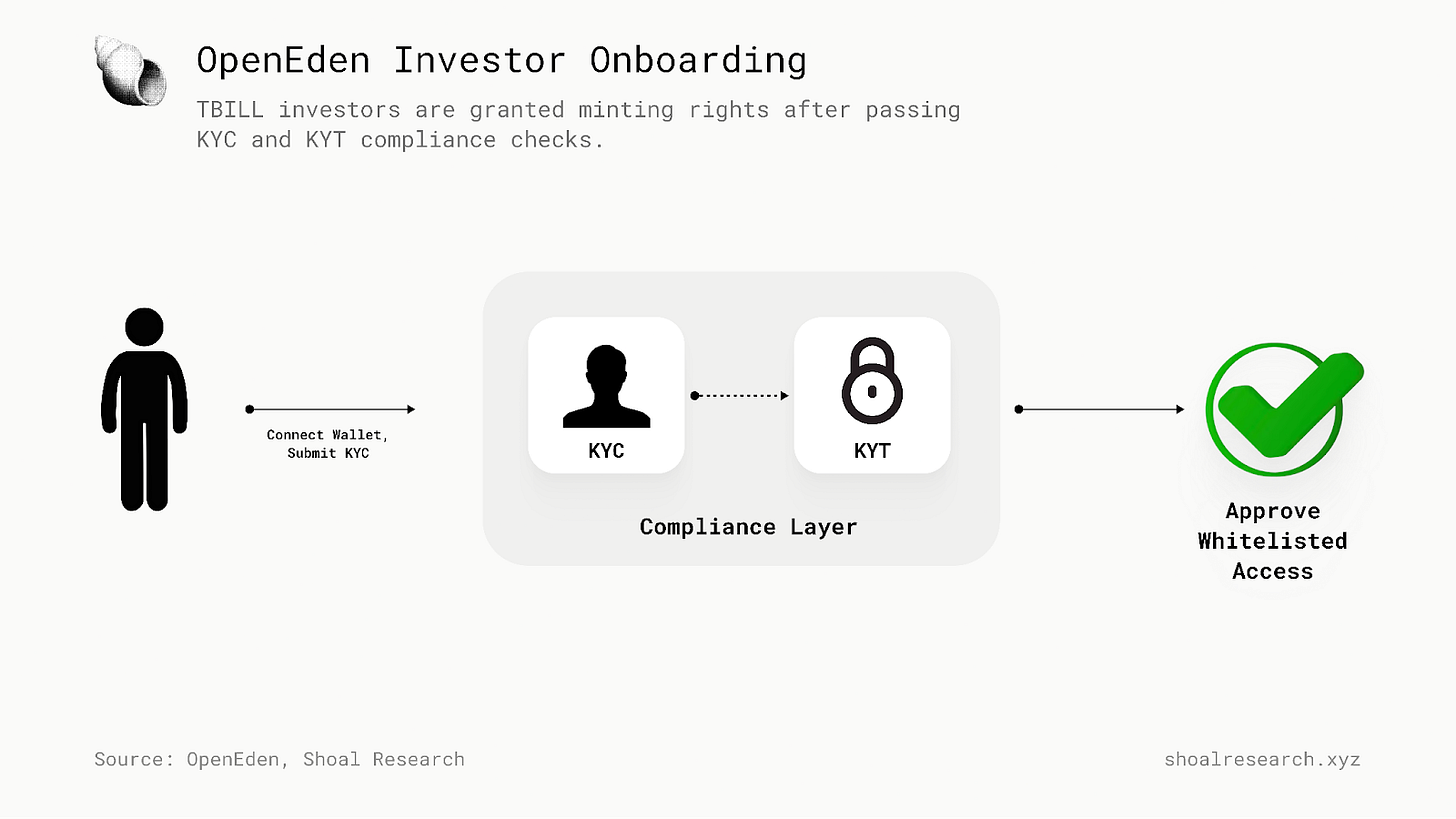

TBILL is issued through the TBILL Vault, a permissioned smart-contract that governs how investors onboard, deposit capital, and receive tokenized exposure to short-term U.S. Treasuries.

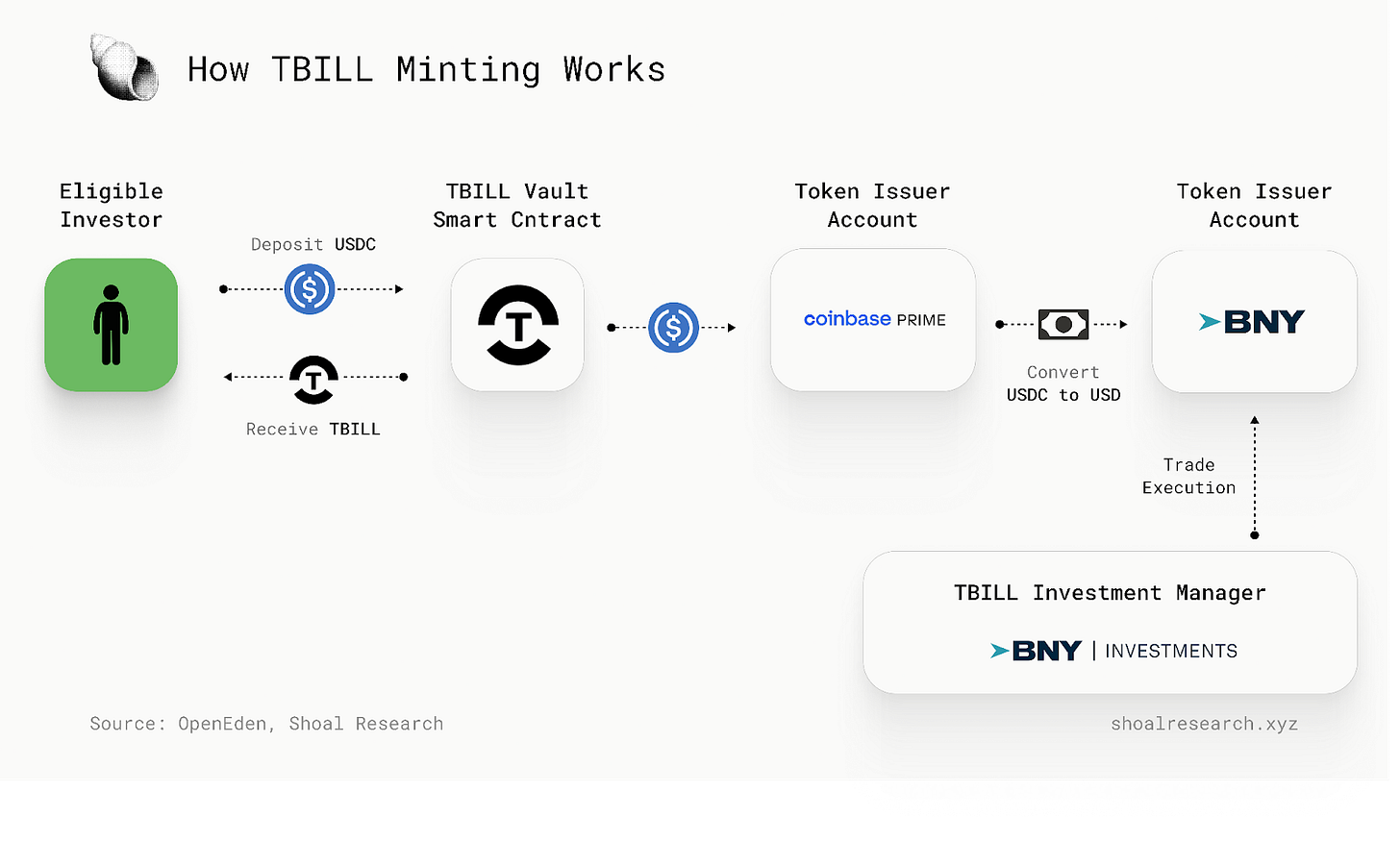

The vault is investment-managed by BNY Investment Management (BNY IM), while the underlying assets, namely U.S. Treasury Bills, are custodied by BNY, ensuring that collateral remains fully auditable and compliant with global custody standards.

The investor onboarding process begins once investors complete full verification. Whitelisted wallets are granted permission to interact with the vault, allowing them to deposit USDC and receive tokenized exposure to short-term Treasuries.

TBILL is minted and redeemed through the TBILL Vault smart contract. USDC deposits on supported chains are converted into TBILL, while redemptions are processed back into USDC. Each TBILL token represents a proportional claim on the net asset value (NAV) of the underlying fund. Minting and burning are handled automatically by the vault’s smart contract, which updates circulating supply onchain in real time.

All issuance and redemption activity is publicly verifiable onchain, while underlying assets remain secured through traditional custodians

Subscriptions (Aka Minting)

Onboarded investors can “subscribe” to receive TBILL tokens by depositing USDC; which can be done through the standard interface or manually through the smart contract.

Subscriptions begin once USDC has been deposited. TBILL tokens are minted and delivered to the investor; the exact number is determined as a function of the TBILL/USDC price, fetched from TBILL’s price oracle contract, as well as the amount of USDC deposited.

tbillMinted=usdcDeposit/tbillusdcExchangeRate

Initial deposits must be at least 100,000 USDC, with subsequent deposits at least 1,000 USDC.

Redemptions

Investors may redeem TBILL for USDC at any time. Redemption requests are placed in a First-In-First-Out (FIFO) queue. During redemption, TBILL tokens are burned, and the corresponding USDC amount is minted and returned to the investor’s whitelisted wallet.

usdcReceived=tbillRedeemed*tbillusdcExchangeRate-TransactionFee

This process ensures redemptions are orderly and transparent, with NAV-based pricing enforced by the vault oracle.

Vault Strategy

The fund managing TBILL maintains a portfolio of short-term U.S. Treasury Bills with a weighted-average maturity of less than three months.

T-Bills are issued at a discount to par value. For instance, an investor might spend $950 to buy a $1,000 bill and redeem it at maturity for a ~5% yield. For TBILL holders, this structure translates to a predictable, low-risk yield that accrues through the vault’s automated portfolio management.

Fees

Two primary fees apply to TBILL: the Total Expense Ratio (TER) and the protocol transaction fee.

Total Expense Ratio (3 bps or 0.03%)

The TER is charged daily on the fund’s total value (TVL) and represents the cost of managing the underlying T-Bill portfolio. It covers:

Maintaining the portfolio’s weighted-average maturity below three months.

Rolling over matured Treasuries into new issues and compounding generated yield.

Meeting regulatory and reporting obligations for the BVI fund.

Commissioning third-party audits for both fund assets and smart contracts.

Custodian and banking fees charged by BNY Mellon and affiliated institutions.

Transaction Fee (5 bps or 0.05%)

Applied during minting and redemption, this fee is calculated in USDC and processed onchain. It offsets operational costs such as gas usage, bank wire fees, and offramping costs associated with fiat conversion.

Together, these fees sustain both the onchain and offchain components of the TBILL system, ensuring the vault remains compliant, functional, and capital-efficient.

Token Price

The TBILL token price reflects the Net Asset Value (NAV) per token, tracking the appreciation of the underlying T-Bills as they approach par value:

tokenPrice=totalAssets - feeClaimable/ circulatingTokenSupply

At launch, TBILL was priced at 1.0000, appreciating gradually as underlying assets accrue yield.

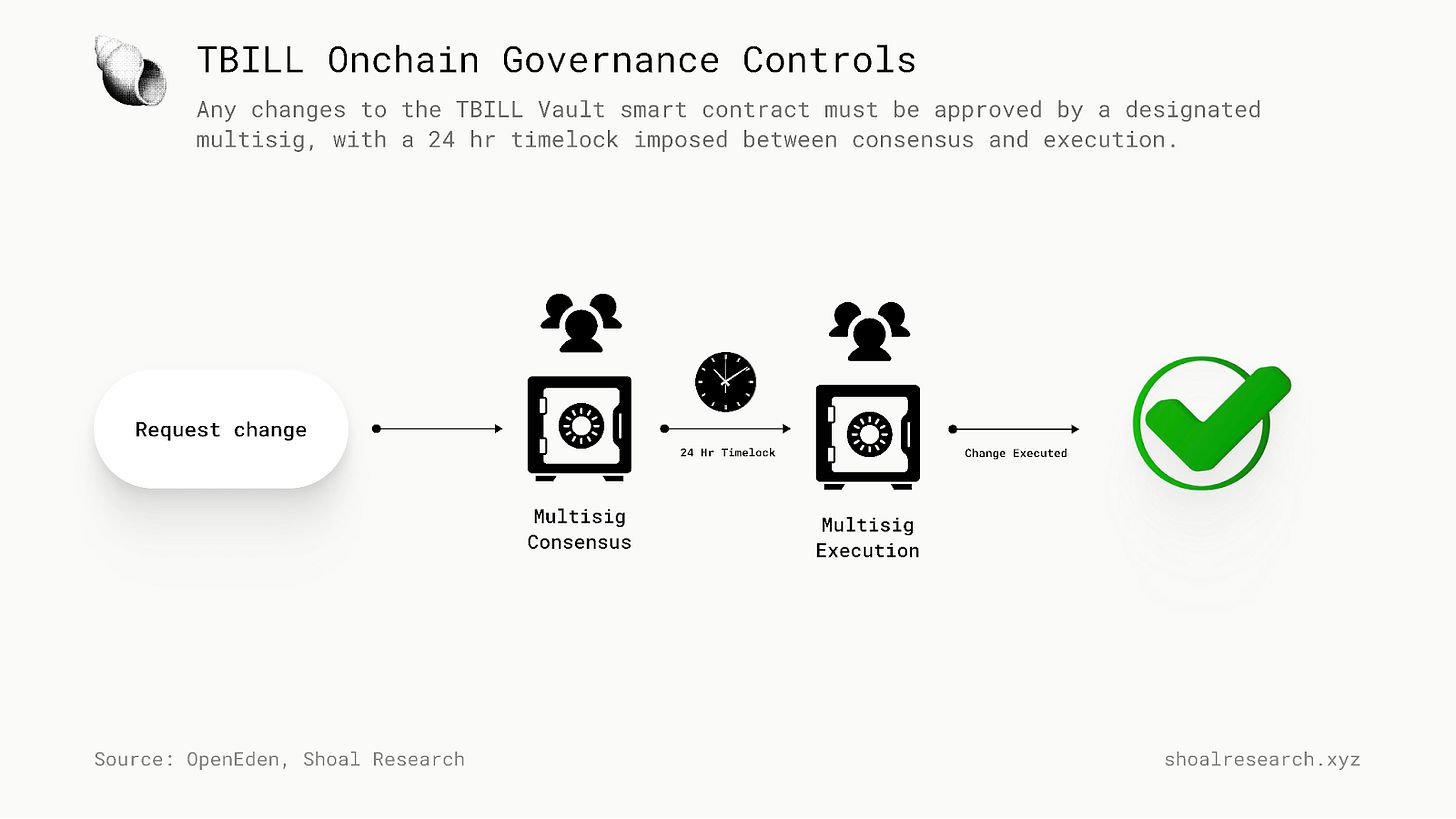

Price Oracle and Governance Controls

OpenEden has implemented a set of onchain mechanisms to ensure the security of the TBILL Vault. To start, OpenEden uses an in-house price feed that transmits NAV data to an onchain oracle, safeguarded by a price guard that halts minting or redemption if deviations exceed predefined thresholds.

Timelock: Whenever the TBILL Vault’s treasury wallet address [changes], a 24-hour window is implemented to [allow admins to offramp funds if the change in address is unintended].

Multisig: The TBILL Vault uses a multi-signature (multi-sig) mechanism to authorize onchain transactions (i.e. minting/redeeming TBILL).

Price Guard: A circuit-breaker mechanism designed to track the TBILL token price and respond when needed, namely when the price deviates beyond predefined thresholds. In the case of attempted oracle manipulation attacks or failures, this mechanism halts minting/redeeming of assets via the TBILL Vault.

Onchain, TBILL Vault smart contracts are publicly viewable and verifiable on Etherscan. Offchain, the TBILL Vault’s U.S. T-Bills are held in custody by regulated custodians. Any remaining USD fiat currency reserves will be held in regulated custodians or be in transit between the on/off service providers, the prime broker, and the custodian account.

USDO: The OpenDollar

Another core component of OpenEden’s product suite is the OpenDollar, or USDO.

USDO is a regulated, yield-bearing stablecoin issued by OpenEden Digital (OED). The rebasing yield is distributed directly in the form of additional USDO to holders’ balances, and is available on Ethereum, Base, and BNB Chain.

USDO has seen faster growth than TBILL, both in supply and adoption. TVL has climbed steadily since launch, nearly mirroring that of TBILL with $264M of its own.

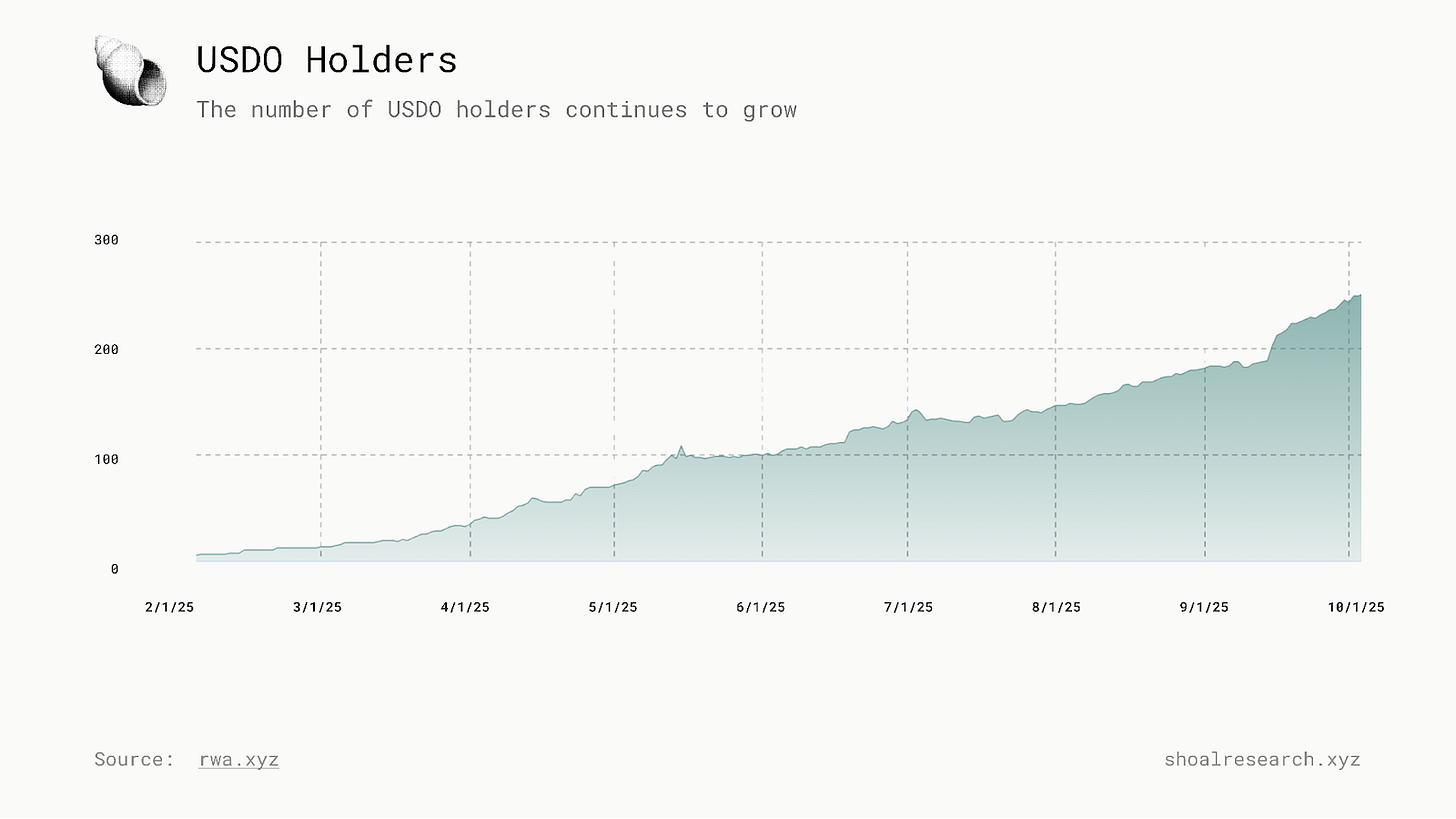

The number of USDO holders has also increased rapidly, surpassing TBILL’s user base within months of launch (400 USDO holders vs 59 TBILL holders).

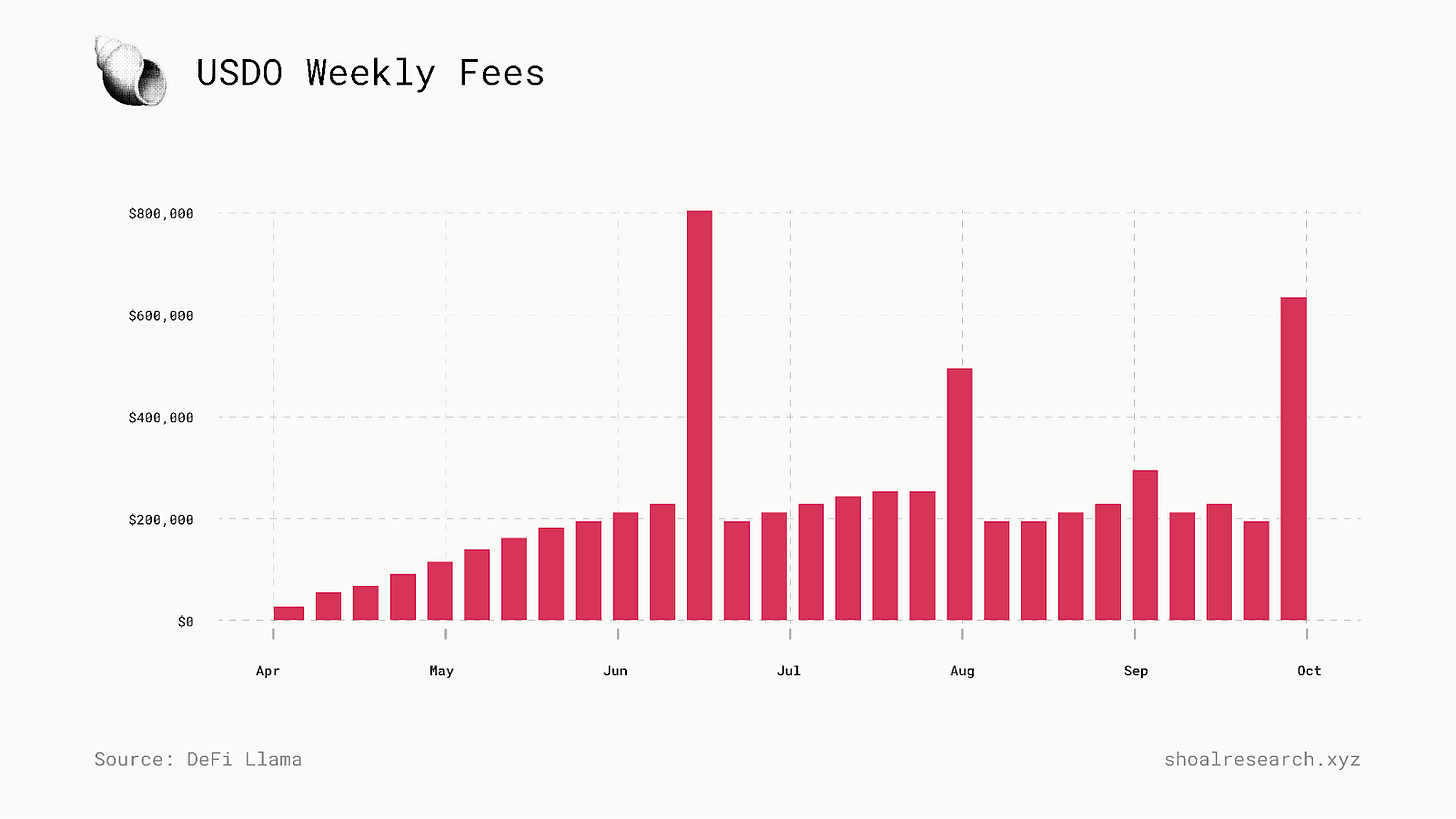

As a result, USDO is also generating fees and revenue at a much greater rate than TBILL, its $6.6m in fees accounting for >90% of OpenEden’s aggregate total fees ($7.29m).

Rebasing mechanism

USDO rebases daily while maintaining a fixed $1 price. This rebasing mechanism allows holders to earn yield generated from reserves backed by U.S. Treasury Bills and reverse repurchase agreements (repos).

Yield is distributed directly in the form of additional USDO, meaning holders see their balance increase daily, rather than the price changing.

The rebase is governed by a bonus multiplier, which updates automatically each day (including weekends):

usdoBalance=shares*bonusMultiplier

Like traditional fixed-income products, USDO’s yield is predetermined by OpenEden Digital and may be periodically adjusted to reflect prevailing market conditions. For instance, if short-term Treasury yields rise, USDO’s rate may be increased accordingly; if they decline, the protocol may lower it to maintain parity with underlying asset performance.

USDO Minting & Redemption

At a high-level, USDO can be minted against either USDC or TBILL collateral deposits. Similar to the TBILL token, USDO can only be minted by authorized users who pass KYC and KYT checks.

To mint USDO, an authorized user initiates the Instant Mint function, selecting their collateral token.

The USDO smart contract calculates the equivalent amount of USDO to be minted.

USDO minted at a 1:1 rate to USDC

USDO minted based on the prevailing TBILL exchange rate at the time.

The Liquidity Manager contract then mints and transfers USDO tokens to the authorized recipient’s wallet address.

USDO redemptions follow the same logic in reverse. Tokens are first burned, and the equivalent amount of USDC is transferred back to the redeemer’s wallet.

Two redemption modes exist:

Manual Redemption, wherein USDO is transferred to OED’s wallet and processed on a First-In-First-Out (FIFO) basis. Requests settle during U.S. business hours, typically within 1–2 business days

Instant Redemption: The USDO Liquidity Manager contract sends the underlying TBILL to the TBILL Vault, which redeems USDC from Circle’s BUIDL contract using its BUIDL allocation. The resulting USDC is transferred to the redeemer’s wallet onchain

USDO Reserves

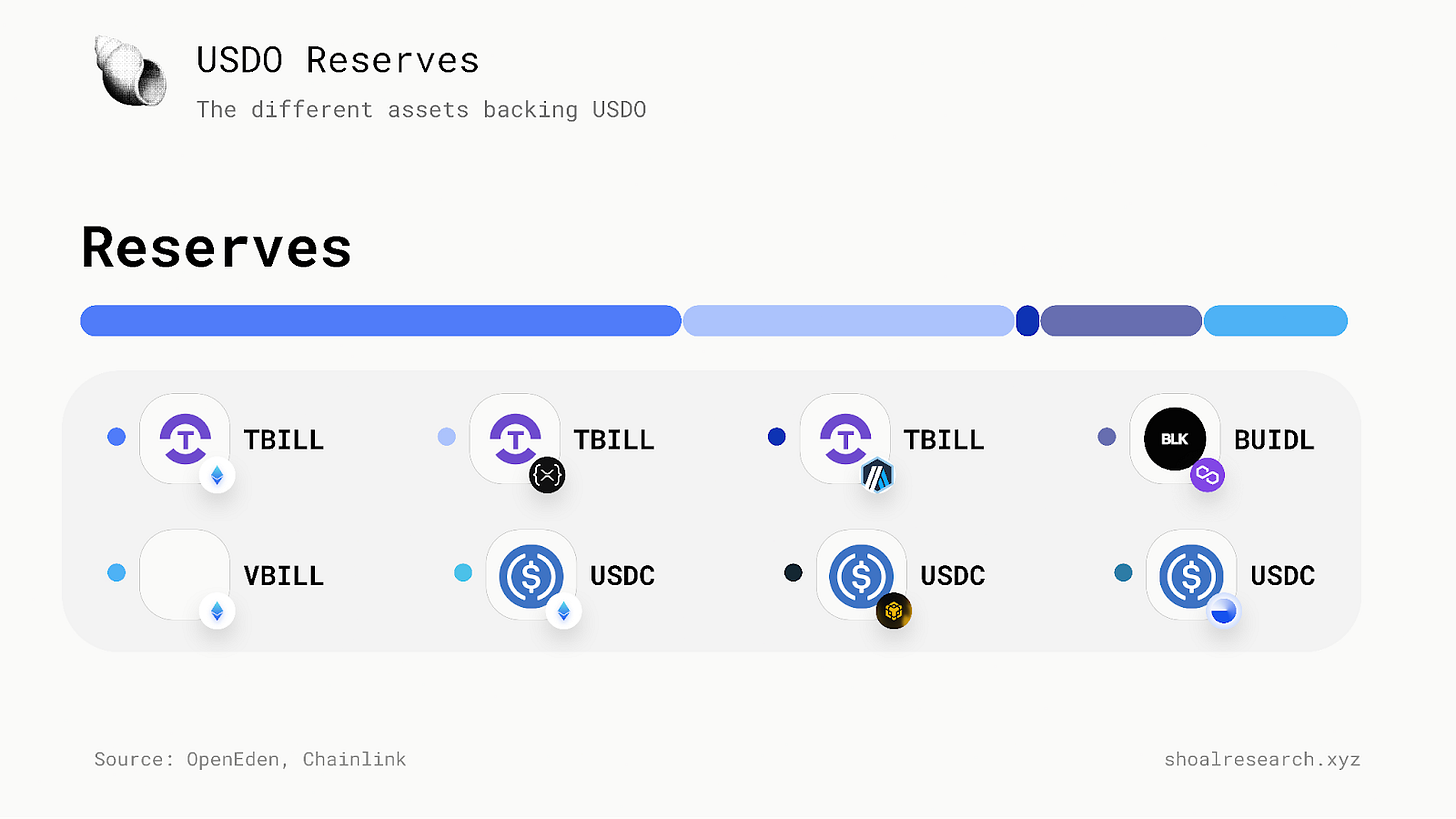

USDO is backed by a diversified pool of regulated tokenized Treasuries issued by major financial institutions:

TBILL (OpenEden)

BUIDL (BlackRock)

BENJI (Franklin Templeton)

VBILL (VanEck)

These assets are backed by short-duration U.S. Treasuries themselves. OpenEden integrates Chainlink Proof-of-Reserves for real-time, onchain verification of collateral holdings. As of the latest data, USDO reserves sit at ~273,196,076.72, with over 99 % of circulating USDO residing on Ethereum.

Fees are charged on all transactions involving the minting and redemption of USDO:

Minting Fee: 3 bps (0.03%)

Redemption Fee: 10 bps (0.10%)

These fees are calculated in USDO and deducted directly from the total USDO amount being minted or redeemed.

They are designed to cover the Vault’s operational costs, including:

Onchain gas usage

Bank wire fees

Off-ramping and fiat conversion costs

Together, these transaction fees are designed to sustain both the onchain and offchain components of USDO’s infrastructure, while preserving the asset’s liquidity and peg stability.

cUSDO

USDO is designed to provide secure, regulated yield. However, its structure as a rebasing token makes it difficult to integrate with a broader range of DeFi protocols. As such, OpenEden introduced cUSDO, a wrapped and compounding version of USDO.

cUSDO represents the same underlying exposure as USDO but accumulates yield internally, causing the token’s price to increase over time rather than its balance. Each cUSDO token reflects an increasing claim on the underlying pool, ensuring it remains fully composable across DeFi protocols. Conversion between USDO and cUSDO is permissionless and handled through a public smart contract, allowing users to wrap or unwrap at any time.

Available on Ethereum, Base, and BNB Chain, cUSDO extends the reach of USDO’s regulated yield into the broader DeFi ecosystem.

Collateralization ratio

To ensure each USDO token remains redeemable at $1, OpenEden maintains a real-time onchain collateralization ratio that compares the total value of reserves to circulating supply:

CR=ReserveNAV/usdoCirculating

As of the latest reporting period, USDO is 103.7719% collateralized, implying a 0.37719% over-collateralization buffer. This margin accounts for operational frictions, such as price movements or settlement delays, while ensuring full redemption coverage.

The collateral ratio is continuously updated and verified through Chainlink’s Proof-of-Reserves integration, which tracks the real-time Net Asset Value (NAV) of the underlying Treasury and repo instruments. Should the ratio approach parity, the system is designed to restrict new issuance or trigger rebalancing actions to maintain full coverage.

EDEN and Economics

OpenEden’s business model is built on the fee revenue generated from its products, primarily TBILL and USDO. These fees, derived from minting, redemption, and ongoing management, are collected as protocol revenue by OpenEden Group, the platform’s operating entity. This is made up of TBILL’s Total-Expense-Ratio (TER) and transaction fees (0.03% and 0.05%), plus USDO’s minting and redemption fees (0.03% and 0.10% respectively).

To date, OpenEden has generated $7.29 million in total fees and $1.79 million in revenue, according to DeFiLlama. The revenue base grows in tandem with product adoption and transaction activity, as both TBILL and USDO generate recurring volume-driven fees tied to their respective vaults. Again, it’s worth recalling that USDO has generated a more meaningful portion of these fees ($6.6m in fees or >90%) and despite having been around less than TBILL, which has generated $624K in fees respectively.

The EDEN token sits at the center of OpenEden’s ecosystem across several functions:

Staking, to support protocol operations and economic security

Governance, allowing holders to participate in decision-making on upgrades and parameters

Incentives and emissions, to bootstrap liquidity and adoption of new products

Utility features, such as fee discounts or rebates for active participants

The OpenEden Group is also exploring mechanisms such as buyback-and-burn programs, funded through a portion of protocol revenue or treasury reserves, to reinforce token value capture over time.

The OpenEden Ecosystem

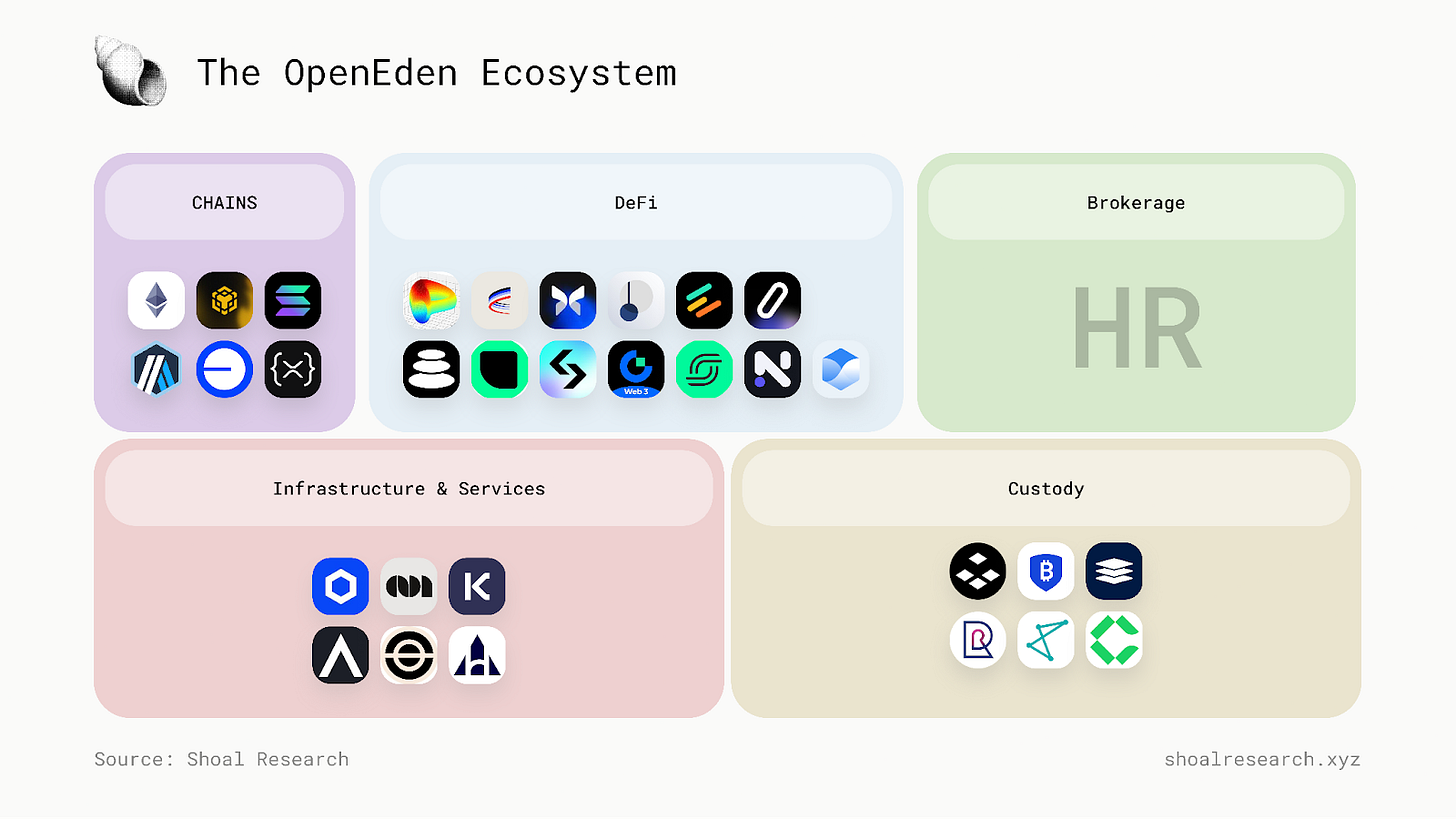

OpenEden’s ecosystem combines onchain integrations that extend the usability of its tokenized Treasuries with offchain partnerships that provide regulated market access and infrastructure support. The design reflects a dual objective: to make short-duration U.S. Treasuries operable within DeFi while ensuring the legal, custodial, and compliance standards required by institutional investors remain intact.

Onchain Integrations

OpenEden’s onchain footprint spans the main environments where DeFi activity occurs today. Its assets are deployed across Ethereum, Base, BNB Chain, Solana, Arbitrum, and XRPL, designed to maximize distribution by allowing broader user access from different ecosystems.

Within the broader DeFi landscape, OpenEden has integrated a number of bluechip liquidity venues including Curve, Balancer, Aerodrome, and money market protocols including Pendle, Morpho and Euler among others. These integrations allow cUSDO (and therefore indirectly USDO) to operate as productive collateral or yield-bearing components within existing financial primitives including liquidity pools, vaults, and structured yield products, offering USDO investors a way to maximize the productivity of their capital.

Offchain Partners

Offchain, OpenEden’s network centers on custodial, brokerage, and infrastructure providers that establish the operational and regulatory base for its products. Custodians including Binance, BitGo, Fireblocks, Hex Trust, and Propine handle storage and segregation of client assets within regulated frameworks, while HiddenRoad handles OpenEden’s brokerage needs, This ensures institutional holders can manage exposure through their existing compliance and risk channels.

The infrastructure and services layer, spanning providers including Chainlink, Kaiko, and Archblock, and supports data integrity, market transparency, and pricing reliability. Together, these integrations form the scaffolding that allows OpenEden’s assets to operate in both regulated and onchain environments.

Binance Banking TriParty

OpenEden has partnered with Binance Institutional through Binance’s Banking Triparty framework, allowing cUSDO to be used as yield-bearing collateral within Binance’s trading environment. The setup lets institutional clients hold cUSDO with approved custodians while using those balances on Binance for trading and settlement purposes.

The arrangement preserves segregated custody, wherein assets remain off-exchange with custodians such as BitGo, Fireblocks, and Hex Trust, while Binance mirrors the positions internally for operational use. This reduces the need to move assets between custodians and the exchange, lowering counterparty and settlement risk.

In effect, the partnership connects OpenEden’s tokenized Treasury products to existing exchange infrastructure without altering their underlying regulatory or custodial structure. It offers a straightforward mechanism for institutions to deploy tokenized Treasuries as collateral with institutional-grade compliance and risk management.

Analysis & Outlook

Having detailed OpenEden’s design and ecosystem, the next step is to evaluate how its hybrid structure, anchored by regulated issuance and DeFi composability, shapes its prospects in the growing market for tokenized Treasuries and beyond.

Competitive Landscape

The tokenized-asset market has grown crowded in a short period of time. Growth accelerated notably after late 2024, when renewed institutional optimism and a post-election risk-on environment drove inflows into yield-bearing digital products. Unlike prior cycles dominated by crypto-native experiments, today’s competition includes some of the largest names in global finance, with over 115 tokenization platforms in production today.

In tokenized Treasuries, OpenEden competes most directly with Securitize, Ondo, Backed, and Matrixdock, alongside institutional entrants such as BlackRock (BUIDL), Franklin Templeton (BENJI), and WisdomTree (WUSDY). Each offers exposure to short-duration U.S. government debt through regulated structures and onchain issuance.

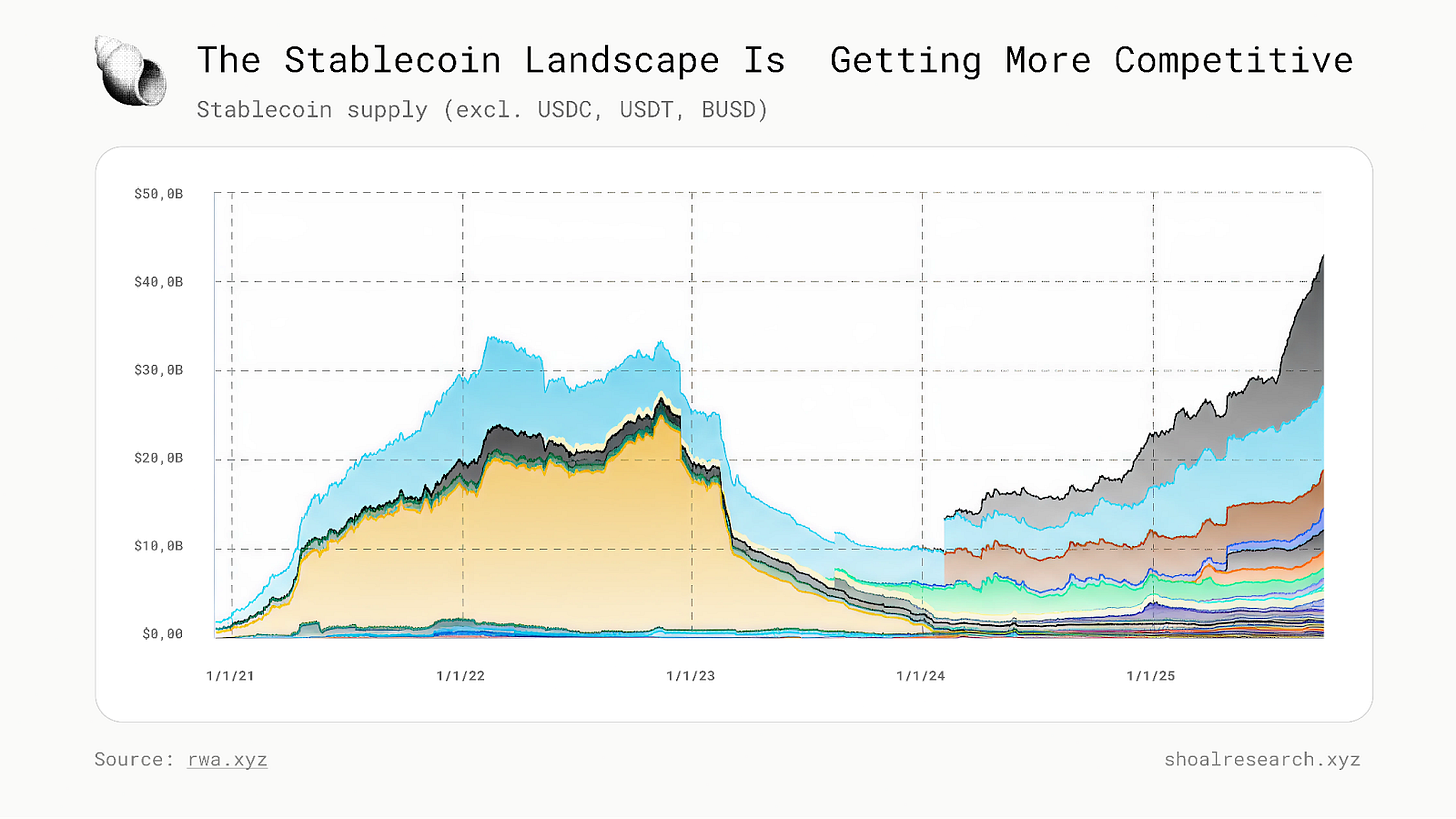

Stablecoins present a different challenge. Supply remains highly concentrated in a few dominant issuers (USDT, USDC) which together account for well over 90 percent of circulating volume. However, zooming out, if we exclude USDT, USDC, and BUSD supply, it’s becoming evident that stablecoins, like treasuries and the rest of the tokenization landscape, is only going to become more competitive soon.

How Does OpenEden Differentiate?

With $531M in TVL and $7.29M in fees thus far, OpenEden’s raw numbers, albeit notable, are not reflective of its positioning. OpenEden’s strength lies in the overall quality of its protocol structure and how it merges together institutional-grade regulatory compliance with onchain programmability and DeFi composability.

Importantly, OpenEden is the first tokenized Treasury issuer to receive third-party credit ratings, (an A-bf from Moody’s and AA+f / S1+ from S&P Global) attesting to the institutional standards of its fund structure and custody model. In a sector still dominated by self-reported audits, third-party credit ratings mark a meaningful step toward formal institutional adoption.

Investor onboarding follows a permissioned framework: wallets must complete KYC and KYT checks before interacting with vaults. Once approved, all transactions (i.e. mints, redemptions, and fee accruals) are visible onchain. This setup combines regulatory traceability with public transparency, creating a model where compliance and verifiability reinforce each other rather than conflict.

At the same time, OpenEden’s assets are built for interoperability. Both TBILL and USDO follow the ERC-20 standard, allowing them to move freely across DeFi protocols. TBILL functions as a yield-bearing Treasury asset, while USDO extends that yield into a rebasing stablecoin format. Regulated issuance with open integration illustrates how tokenized securities can exist within DeFi infrastructure without compromising oversight requirements.

OpenEden’s roadmap points toward a shift from individual product issuance to a standardized infrastructure model. The aim is to simplify how institutions bring regulated assets onchain, abstracting the operational and compliance overhead behind tokenization itself. In this sense, its long-term vision resembles a “Shopify for tokenization”: a modular framework that enables others to issue and manage tokenized products within defined regulatory and technical boundaries.

Where We Suggest OpenEden Focus Next

There are several key emerging catalysts could strengthen OpenEden’s position within the tokenization landscape:

DeFi-Nativitiy as a Differentiator

As institutional capital becomes more comfortable operating on public blockchains, the expectation will shift from passive exposure to productive onchain deployment. Assets like Treasuries, which already serve as low-risk collateral in traditional markets, can increasingly be used within DeFi to generate incremental yield or support liquidity provision.

OpenEden’s architecture is already compatible with major DeFi protocols, and as the regulatory perimeter around tokenized assets expands, this interoperability will matter more. Institutions will likely prefer frameworks that allow their assets to circulate safely across lending markets, structured vaults, or automated liquidity systems, without losing compliance guarantees. In that environment, composability becomes a form of capital efficiency, and OpenEden is positioned to benefit from that shift.

Privacy: The Next Institutional Unlock

The next major frontier for institutional adoption is likely transaction privacy. Institutions are unlikely to transact meaningfully on public blockchains until confidentiality, data protection, and counterparty privacy can be guaranteed. Zero-knowledge proofs, encrypted state systems, and privacy-preserving chains are quickly maturing, and the first regulated issuers to adopt them will gain a substantial lead in onboarding capital that cannot move through transparent rails today.

For OpenEden, integrating privacy infrastructure, or even pursuing strategic partnerships or acquisitions in that domain, could become a defining differentiator. Privacy-enabled settlement would allow institutions to interact with tokenized assets while maintaining compliance and auditability through selective disclosure. The ability to conduct verifiable yet confidential transactions would mark a decisive step toward large-scale institutional use.

Closing Thoughts

Tokenization has momentum, but its footprint remains small: tokenized assets including government bonds, credit, and equities still represent only a fraction of global financial markets, estimated at less than 0.2% of the roughly $500 trillion in total assets worldwide. Stablecoins continue to dominate onchain liquidity, with over $300 billion in aggregate supply dwarfing the combined value of all tokenized assets on public chains. The advantages of tokenization are clear: operational efficiency, near-instant settlement, 24/7 access, transparency, and programmability for functions like automated compliance or dynamic asset management.

However, though magnitudes more efficient than legacy financial rails, tokenization still encounters its fair share of structural limits. Derivative markets such as perpetual futures protocols already offer efficient onchain exposure to the price or yield of offchain assets without requiring direct ownership or custody. These instruments capture much of the same demand that tokenization seeks to serve, often with greater capital efficiency and fewer regulatory constraints.

Furthermore, value capture remains uncertain. John Pfeffer argued that much of the economic benefit from tokenization will flow to users rather than intermediaries. Open systems are difficult to monopolize. The same qualities that make blockchains effective in coordination and record-keeping also make them incompatible with business models built on control and opacity.

Even so, the catalysts on which today’s surge in tokenization adoption hinge on suggest it really may be different this time. The ICO period lacked regulatory guardrails; that foundation now exists. Institutional trust and adoption, while still unfolding, is being accelerated by major asset managers like BlackRock, Franklin Templeton, and WisdomTree deploying and issuing regulated onchain funds. Tokenized assets are now used as collateral in protocols including Aave and Maple Finance, demonstrating the composability that yield-bearing instruments can get from DeFi rails. As adoption grows, capital is likely to move up the onchain yield curve, from stablecoins to Treasuries and eventually into tokenized credit and equity, expanding the potential tokenized asset value well into the trillions.

At Shoal, we think it’s clear by now that tokenization is no longer a matter of “If?” or “When?” but rather “How?” The more pressing question now becomes what kind of products and services prove to be the most useful over time, which hinges on a) the quality and efficacy of their underlying structure; b) the exogenous value they provide to users, DeFi, and the broader DeFi and financial services sectors; and c) their ability to capture value from the services they provide and redistribute to investors and token holders in a sustainable way.

In practice, this resembles a tokenization platform which manages to efficiently integrate compliant, regulated financial services with smart contracts and onchain rails; lower barriers to entry for institutions to bring regulated assets onchain by abstracting the operational and compliance overhead; and coordinate and align value capture from the organic demand for the services it provides through a native token.

OpenEden offers one of the most practical attempts to build this exact framework. Its regulated structure, emphasis on short-duration Treasuries, and institutional custody integrations anchor it within existing financial infrastructure, and independent credit ratings reinforce its credibility. A growing presence among the broader DeFi ecosystem ensures its assets are composable, productive, and scalable. OpenEden wasn’t the first attempt, nor will it be the last, but we believe it is one of the best-positioned teams to capture the tokenization opportunity ahead.

Sources

Data is sourced from DeFi Llama, Rwa.xyz, and Artemis Analytics.

Dune Analytics, RWA Report 2025 Dashboard. Retrieved from https://dune.com/rwareport2025

Theia Research, Internet Finance. Retrieved from https://x.com/theiaresearch/status/1876618725547233417?s=46

Modern Treasury, History of ledgers. Retrieved from https://www.moderntreasury.com/journal/history-of-ledgers

Gresham Technologies, Why trades fail: Understanding the cost of reconciliation errors. Retrieved from https://www.greshamtech.com/blog/why-trades-fail-reconciliation

TD Securities, Cross-border implications of T+1 settlement. Retrieved from https://www.tdsecurities.com/ca/en/cross-border-implication-of-t-1-settlement

John Pfeffer, An investor’s take on cryptoassets. Retrieved from https://hostingfilesonline.co.uk/An%20Investor’s%20Take%20on%20Cryptoassets%20v6.pdf

Teej Ragsdale, Jack Chong, Mukund Venkatakrishnan, An Unreal Primer on Real World Assets https://docsend.com/view/u53utyp2j4ycg7r6

Carter, Nic, The Stablecoin Duopoly Is Ending. Retrieved from https://x.com/nic__carter/status/1973399535092171216

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author’s own, not the views of their employer. This post has been created in collaboration with the OpenEden team. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research.

Amazing sir

Amazing report