Top Projects building on Arbitrum

Comprehensive list of the top Arbitrum native protocols and emerging players

Preface

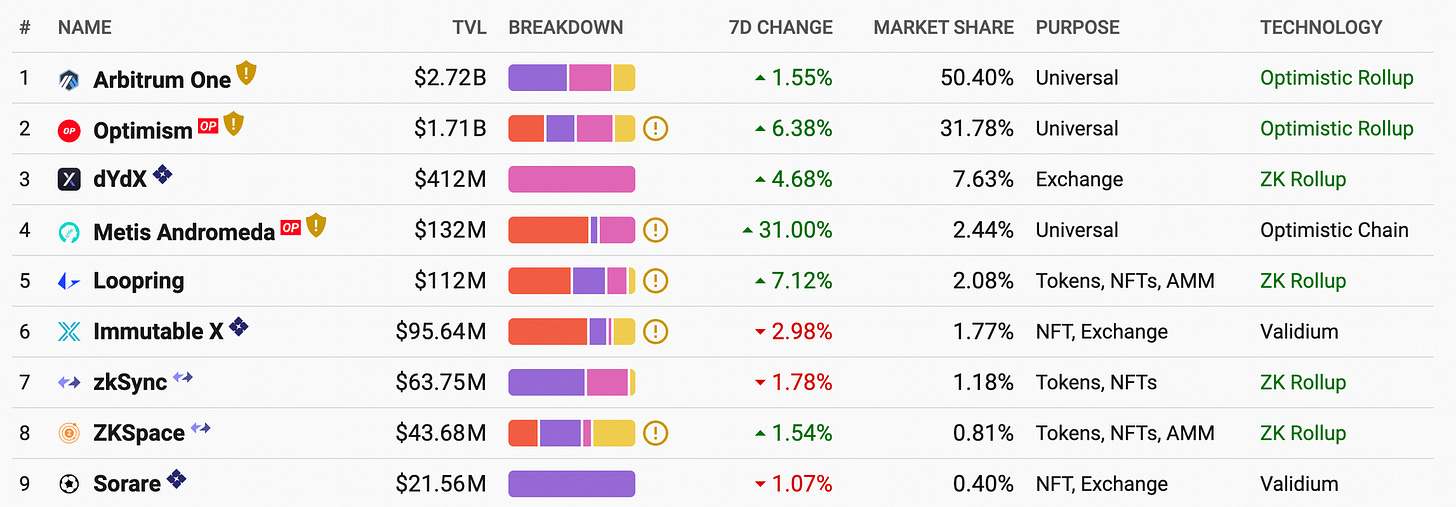

The Arbitrum ecosystem has seen considerable organic growth since its launch in 2021. Currently, it is the number one L2 with over $2B in TVL. Many talented developers are building the ecosystem with derivative exchanges, games, and other dapps. Since Arbitrum is an L2, gas is cheap, and transactions are speedy. A typical transaction might cost a few cents to execute. Cost and speed have also attracted builders, specifically in Defi. Arbitrum employs optimistic rollup technology, which requires gas payment in ETH. Some crypto exchanges, such as Coinbase, support ETH deposits and withdrawals on the Arbitrum network, making it easy for liquidity to enter the ecosystem. Over the next two years, I expect the Arbitrum ecosystem to continue to grow due to early network effects. This report outlines a few Dapps that could experience hyper-growth.

Token Incentives

Arbitrum's growth and adoption are significant because it does not have a native token. Token incentives and emissions often attract network activity, making Arbitrum unique and exciting since it does not incentivize ecosystem growth through protocol emissions. Optimism, on the other hand, uses its governance token to reward certain activities on the chain. Token incentives are a common GTM strategy to bootstrap network usage in crypto. Arbitrum projects might receive ecosystem grants to build protocols.

By the numbers

Arbitrum has maintained solid network usage even throughout a bear market. The numbers continue to grow on both the daily user side and transactions.

Top Arbitrum Projects

GMX

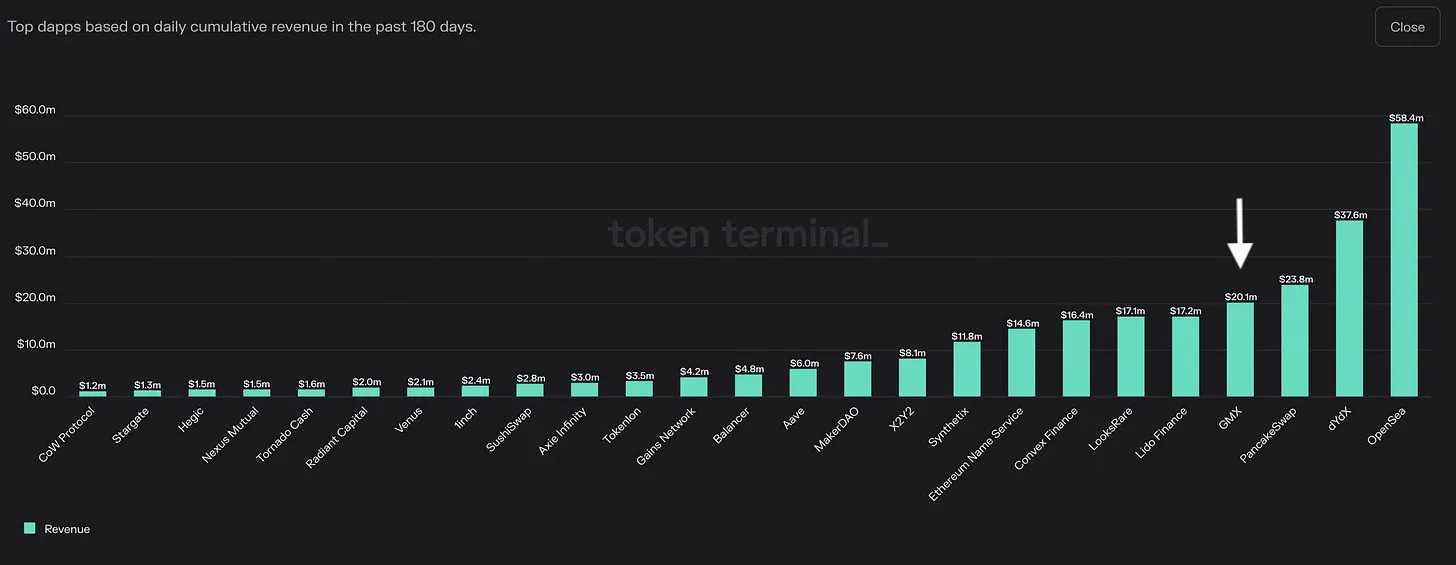

Decentralized perpetual exchange, GMX, is one of the most prominent protocols on Arbitrum. Using the platform is simple, and traders can long or short assets with just a few clicks. The protocol has facilitated nearly 100 billion dollars in total trading volume. GMX protocol generated over 2 million dollars in fees paid to holders on a record day.

Revenue Generating Tokens

GMX is available on both Arbitrum and Avalanche. The protocol uses a two-token model which returns fees to token holders. $GMX is the governance token with a claim to 30% of protocol fees captured. $GLP is the liquidity index token for trades. $GLP holders finance profitable trades and receive 70% of trader losses. When a trader loses, $GLP holders earn 70% of fees, incentivizing them to participate and hold GLP as liquidity providers.

TreasureDAO

TreasureDao is the largest NFT and gaming ecosystem on Arbitrum and positions its economy around the $MAGIC token. Magic is the ecosystem token that game developers can build upon and integrate into their games. There will likely be tremendous value accrual to $MAGIC if one game becomes viral in their growing ecosystem. TreasureDao has 10+ integrated games.

Dopex

Dopex is a decentralized options exchange aiming to maintain liquidity and reduce exposure. Dopex has multiple financial products that users can take advantage of, including options, straddles, and insured perps. Dopex also has a strong team backed by defi influencers like Tetranode and DefiGod.

Revenue Generating Tokens

Like GMX, Dopex also shares a two-token model utilizing $DPX and $rDPX. $DPX is used for governance and accrues fees from the protocol. Holders of staked DPX or veDPX have a claim to all of the fees generated by the Dopex products. The platform employs $rDPX (Dopex Rebate) as a rebate token for writing options, incentivizing liquidity provision with rebates. In January 2023, they introduced an updated version of $rDPXv2 to address previous concerns about the token model. The new token model will include a deflationary mechanism and more utility.

Product Suite

SSOVs (sell covered options to earn yields)

Yield Farms(earn rewards for liquidity staking)

Atlantic Straddles (apply a straddle strategy on ETH, DPX, and rDPX)

Option Liquidity Pools (purchase SSOV options at a discounted IV)

Atlantic Insured Perps (open GMX long positions, liquidation free)

Governance (lock DPX to earn protocol fees & rewards)

Other Tools/Products (TzWAP, portfolio page, etc.)

Radiant Capital

Radiant is a cross-chain lending platform natively on Arbitrum. Leveraging Layerzero, Radiant plans to allow users to deposit and borrow funds across multiple chains. They aim to become the first "omnichain money market" by consolidating fragmented liquidity across different blockchains.

Revenue Generating Token

The $RDNT token serves as governance for the Radiant protocol. By locking the token, holders can contribute to voting in the Radiant DAO. Holders can also receive protocol fees from locking on the platform. RDNT Lockers receive platform fees from interest, early exit penalties, and liquidations.

Rage Trade

Rage trade is another vault strategy protocol aiming to build liquid ETH perp strategies on Arbitrum. The protocol doesn't have a token government system yet, but some researchers speculate they might launch one in 2023.

Rage trade offers a few core products:

Delta neutral Vaults

Recycled Liquidity

ETH Perps

Rage Trade is built on top of GMX, allowing users to take advantage of a risk-On Delta Neutral GLP vault. $GLP holders can deposit USDC to earn a stable yield.

Jones DAO

During defi summer of 2020, Yearn finance became famous for creating vault yield strategies. This trend has continued and is now becoming cross-chain. Jones DAO provides one-click options yield and strategy vaults. They have some of the highest #realyield APYs in defi. Jones DAO is built on the decentralized options exchange, Dopex. The protocol is an excellent tool for users who want to avoid actively managing investment strategies and maintaining liquidity. Jones DAO also services protocol treasuries that wish to earn additional yield on holdings.

Gains Network

Gains network is one of the hottest protocols to enter Arbitrum. Gains network is a one-click decentralized leveraged trading platform. Their platform users to enter leveraged positions on crypto, forex, and stocks. Lately, Gains has nearly flipped GMX trading volume. In January, Gains saw a surge in trading volume from launching on Arbitrum. This strategic move has propelled their revenue-capturing flywheel.

Protocol Profitability

Gains is one of the most profitable protocols in crypto. The protocol takes fees from trading and distributes them back to $GNS holders in $DAI stablecoin. Unlike many token ecosystems with many token emissions, gains have a profitable business model.

Umami Finance

Umami finance is no restaurant but serves delicious Institutional-Grade DeFi Yields on its platform. Umami manages risk-hedged defi vaults where users can deposit core assets like USDC, Bitcoin, and ETH for real yield. Users can marinate their Umami to receive 50% of all protocol rewards paid out in WETH. Umami plans to launch their yield Vaults in March of 2023.

Trending Arbitrum Projects

Camelot DEX: Arbitrum native Dex and token launchpad.

Buffer Finance: Non-custodial, options trading platform.

GMDprotocol: Smart Vault and Yield Aggregator.

STFX: Social trading platform.

y2kfinance: Hedge or speculate on volatility in the stablecoin markets.

GammaStrategies: Active liquidity management and automated LP pool rebalancing.

Vela Exchange: perpetuals decentralized exchange

PlutusDAO: Governance token black hole, "convex finance of Arbitrum ecosystem."

Vesta Finance: Stablecoin protocol providing lending services using collateralized assets.

Sperax: 100% collateralized stablecoin protocol that generates yield

Trending Arbitrum Projects: Without Tokens

Vertex Protocol: Cross-margin spot, perps & money market DEX.

Contango: Long or short without having to pay funding rates

Gamma Swap: An oracle-free Arbitrum native volatility trading DEX

Sentiment: Permissionless undercollateralized Borrowing protocol

Orbital: An Arbitrum native created by the PlutusDAO team

Conclusion

In conclusion, the Arbitrum ecosystem has grown significantly, surpassing $2B in TVL to become the leading L2. Particularly in the Defi sphere, its quick and inexpensive transactions and cheap gas have drawn creative developers and liquidity to the ecosystem. A few of the top projects in the ecosystem that have seen growth were highlighted in the research, including GMX, TreasureDAO, Dopex, Radiant Capital, and Rage Trade, which all provide a range of products and revenue-generating tokens. The Arbitrum ecosystem is anticipated to experience continued growth over the next two years as the network presents intriguing options for users and builders.

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are my own, not the views of my employer.