Unlocking Capital Efficiency Beyond Restaking with YieldNest

Beyond restaking—unifying DeFi and restaking to deliver sustainable, risk-adjusted on-chain yields with YieldNest's MAX LRTs

Introduction – The Foundation of Productive Capital

Investors have long debated the merits of productive versus non-productive assets. Historically, productive assets—such as equities, real estate, and business ownership—have consistently outperformed inflation, while non-productive assets—such as gold—have primarily served as stores of value.

As the restaking narrative began unfolding last year, it became important to revisit the concept through first principles thinking. This approach underscores the fundamental shift toward maximizing capital productivity and efficiency by unlocking new utility and yield-generation opportunities.

The fundamental distinction lies in the ability of productive assets to generate returns independent of price speculation. Productive assets create value through dividends, rental income, interest payments, or intrinsic business growth. Non-productive assets, on the other hand, rely on market demand to appreciate in value.

Many parallels have been drawn to analyze the impact of productive versus non-productive assets. Let’s take a look at one such example from a Blockworks article, which goes back to ancient Roman times to examine how productive and non-productive assets behave in traditional markets.

A Roman centurion in the time of Augustus earned about 38.58 ounces of gold per year—an amount that, when converted to today’s gold prices, is equivalent to $86,342. If you look closely, this mirrors the salary of a modern U.S. Army captain (around $85,000). This eerie precision highlights gold’s ability to hedge against inflation but also underscores its limitations—it merely preserves value rather than growing it. By contrast, productive assets like equities have historically compounded wealth, turning modest investments into massive fortunes over time.

Had Roman equities existed in 24 BCE and generated even a modest 1% return above inflation annually, an investor’s portfolio would be worth over a trillion dollars today after almost 2,000 years. This illustrates the power of compounding—the driving force behind why equities, real estate, and income-generating businesses vastly outperform non-productive assets over long time horizons.

Yield in productive assets stems from multiple mechanisms:

Income Generation – Rental yields, dividends, staking rewards (in case of crypto).

Capital Appreciation – Business expansion, property value growth.

Leveraged Reinvestment – Using returns to generate further gains, such as reinvesting dividends or compounding staking rewards.

Non-productive assets like gold do not generate wealth; they only preserve purchasing power. Scarcity alone does not ensure growth, making productive assets structurally superior for long-term wealth creation.

Blockchains aren’t companies in the traditional sense. Protocols like Ethereum are decentralized rule sets encoded in software and executed by independent operators in a permissionless manner. They function as distributed networks, not corporate entities, and typically don’t meet the legal definition of a common enterprise.

The native assets of most blockchains (e.g., BTC, ETH) don’t grant governance rights, distinguishing them from traditional equity-based financial structures. Unlike businesses, these networks don’t generate revenue or incur losses—they exist as neutral infrastructure.

Concepts like “income” and “expenses” imply a counterpart, but blockchains lack a central entity to accumulate or distribute value. Defining “network profit” for Bitcoin or Ethereum is as impractical as measuring the profitability of the internet—value flows through them but isn’t captured by a single party.

When discussing productive assets in crypto, the key question is: How can capital be made productive in a secure (or relatively secure) way? In other words, what mechanisms exist beyond price speculation to generate yield?

Ethereum has long stood apart as the only truly productive asset among major blockchains. One of the reasons is its functioning fee market and deflationary burn mechanism, introduced with EIP-1559. Under this model, Ethereum’s transaction fees consist of a base fee (burned) and a priority tip (paid to validators). This ensures that ETH holders benefit from network activity through fee burns, which reduce the total ETH supply, creating deflationary pressure. Additionally, staked ETH earns rewards for securing the network, making ETH both a yield-bearing and deflationary asset—a unique combination absent in other blockchain ecosystems.

Beyond this, several other mechanisms exist in crypto for making capital more productive, ranging from traditional DeFi strategies to emerging restaking models. These include:

Lending/ Borrowing protocols like Aave and Compound, where users supply assets to liquidity pools and earn yield from borrowers.

Proof-of-Stake (PoS) staking rewards, where validators secure blockchain networks and earn rewards in return.

Restaking is an advanced evolution of PoS, allowing assets to secure multiple layers and applications, unlocking yield opportunities beyond the base network.

Yield farming and liquidity provisioning, where users supply assets to decentralized exchanges (DEXs) and automated market makers (AMMs) like Uniswap or Curve, earning rewards through trading fees and incentives.

Emerging Structured DeFi products, including automated vaults, leveraged staking, and cross-chain liquidity strategies, further optimizing yield generation.

While multiple yield-generation strategies exist, Ethereum's fee burn mechanism, combined with staking rewards and emerging structured DeFi products, makes ETH the (only) truly productive native asset in crypto today.

In this report, we revisit first principles thinking about making capital more efficient in a secure and (relatively) simple way.

We will build a strong foundation by exploring productive asset classes and what makes crypto assets productive.

We will trace the evolution of crypto asset productivity, using Ethereum as a case study, delving into the rise of DeFi, on-chain AI agents, and their role in reshaping DeFi 2.0.

We will explore (re)staking, critical risks, and LRTs, specifically examining YieldNest as an enabler of efficient capital deployment with secure, risk-adjusted yields.

Finally, we will dive into the architecture of YieldNest, its MAX LRTs, and how it seamlessly integrates the best of both DeFi and restaking to unlock new capital efficiencies for users.

Productivity of crypto assets

Cryptocurrencies, particularly Bitcoin and Ethereum, have sparked renewed debate over this dichotomy of productive vs non-productive asset classes. Bitcoin, much like gold, has long been considered a non-productive asset, appreciated for its scarcity and decentralized nature but lacking inherent yield-generation mechanisms. However, with the advent of Bitcoin Layer 2 solutions and (re)staking protocols like Babylon, DeFi on Bitcoin is expanding. BTC, as an asset class, is gradually shifting towards productivity, offering users the ability to earn yield rather than relying solely on price appreciation.

The total value locked (TVL) on Bitcoin has increased significantly, rising from $100 million in January 2023 to approximately $5.7 billion today (peaking at $7 billion in December 2024) —representing more than a 60x increase in just two years.

Ethereum, on the other hand, has significantly evolved (and continues to evolve) as a productive asset class, primarily due to its programmable smart contract functionality. Unlike Bitcoin, which was designed primarily as a decentralized store of value, Ethereum introduced the concept of programmable money, enabling Decentralized Finance (DeFi), a sector that has redefined traditional financial services by removing intermediaries and enabling trustless, permissionless finance.

Source: DeFi 201 by Amadeo Brands - 2020

Ethereum’s smart contracts allow developers to create self-executing agreements that operate without the need for a centralized authority. This innovation laid the foundation for decentralized applications (dApps) that replicate and enhance traditional financial services, including lending, borrowing, trading, and asset management. The launch of MakerDAO in 2017, a decentralized lending platform that introduced an algorithmic stablecoin (DAI) was a pivotal moment in DeFi’s growth.

Since then, Ethereum has powered some of the largest DeFi protocols, including:

Decentralized Lending Platforms (e.g., Aave, Compound) – Allow users to lend and borrow crypto assets without intermediaries, earning interest in a trustless manner.

Decentralized Exchanges (DEXs) (e.g., Uniswap, SushiSwap) – Facilitate peer-to-peer trading through automated market makers (AMMs), eliminating reliance on centralized exchanges.

Yield Aggregators (e.g., Yearn Finance) – Optimize returns by moving user funds between the highest-yielding DeFi strategies.

Synthetic Assets & Tokenization (e.g., Synthetix) – Enable the creation of blockchain-based representations of real-world assets, allowing global access to financial markets and the creation of decentralized stablecoins.

DeFi’s core services can be broken down into three categories: stablecoins, liquidity systems, and lending markets. It's that simple, and everything around is just a combination of these categories.

DeFi applications and protocols currently have around $150 billion in total value locked (TVL) across hundreds of chains, with Ethereum alone accounting for over $100 billion+. This explosion of financial innovation has transformed Ethereum into the backbone of DeFi and the main settlement layer for on-chain finance.

DeFi has not only enhanced Ethereum’s utility but has also established ETH as a highly productive asset, fundamentally differentiating it from traditional non-productive stores of value like gold.

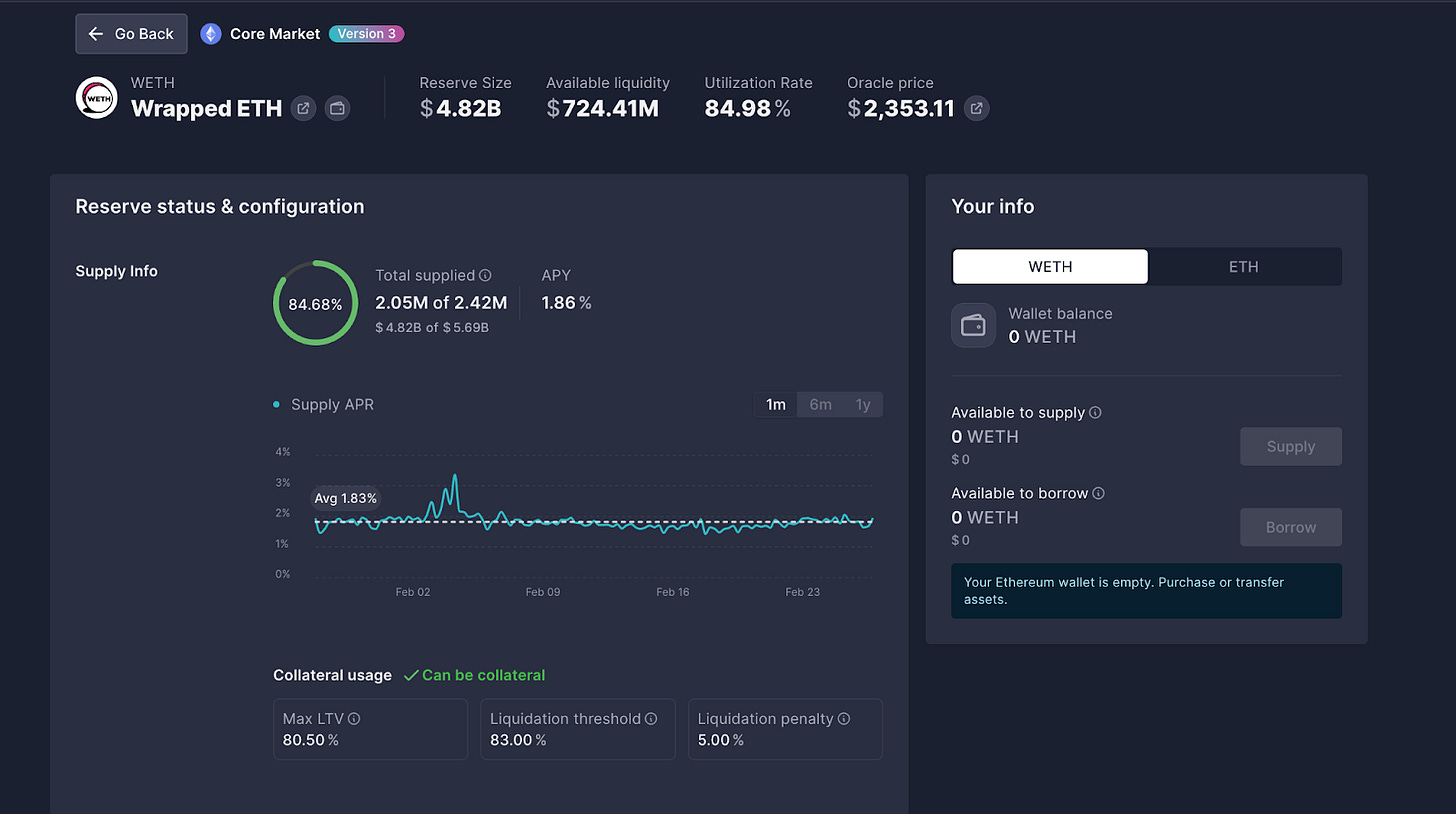

For example, users can take their ETH and deposit it into Aave’s Wrapped Ether pool, earning a stable ~2% APY today.

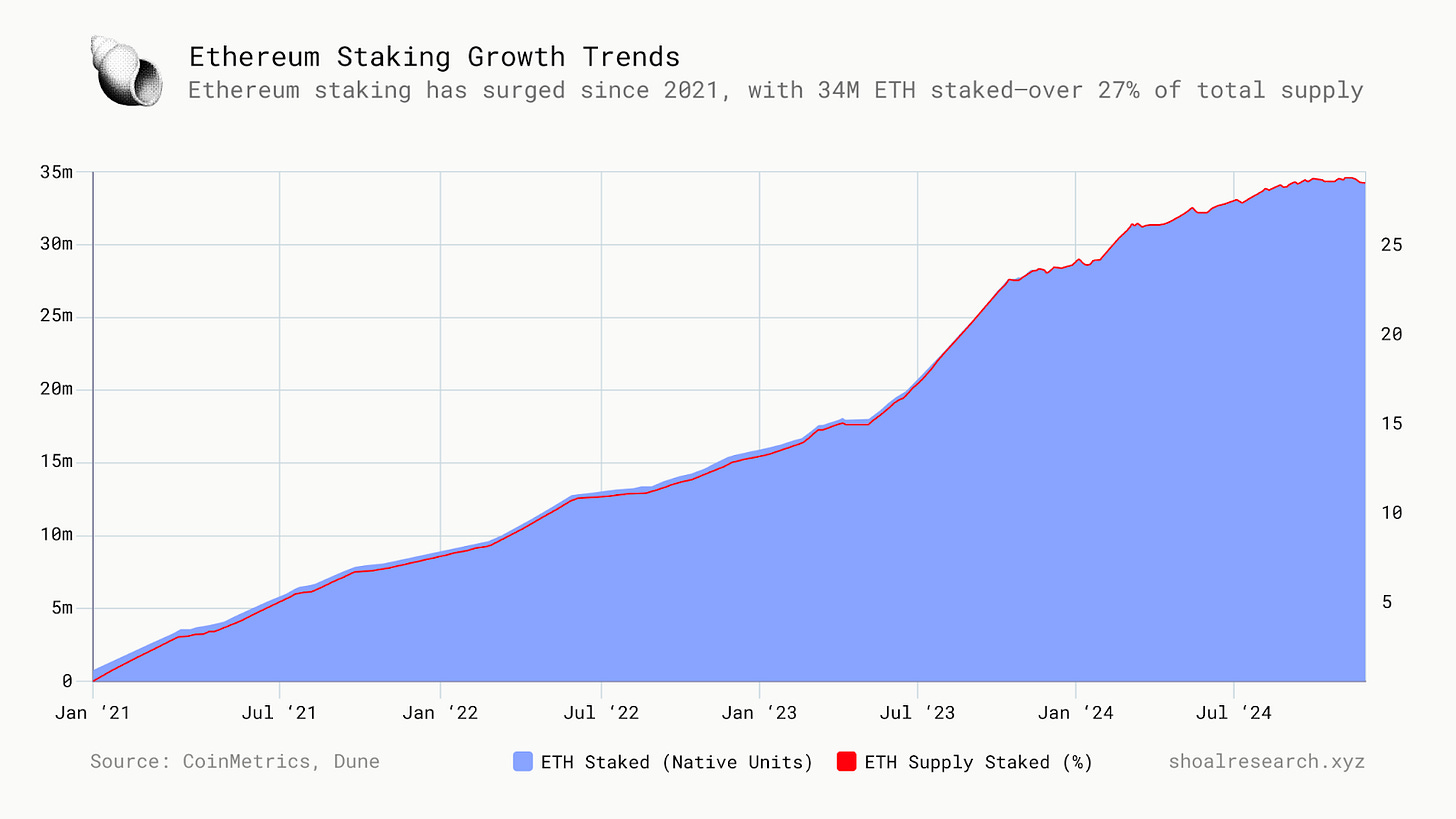

Ethereum’s transition to Proof of Stake (PoS) with the Merge marked a fundamental shift in how the network secures itself, giving ETH holders an additional yield for securing the network with their capital in terms of staking rewards. Since the introduction of the Beacon Chain in December 2020, Ethereum staking has grown rapidly, with around 34M ETH now staked, accounting for over 27% of the total ETH supply (120.4M). This staking ratio doubled post-Shapella but has since stabilized as demand cooled.

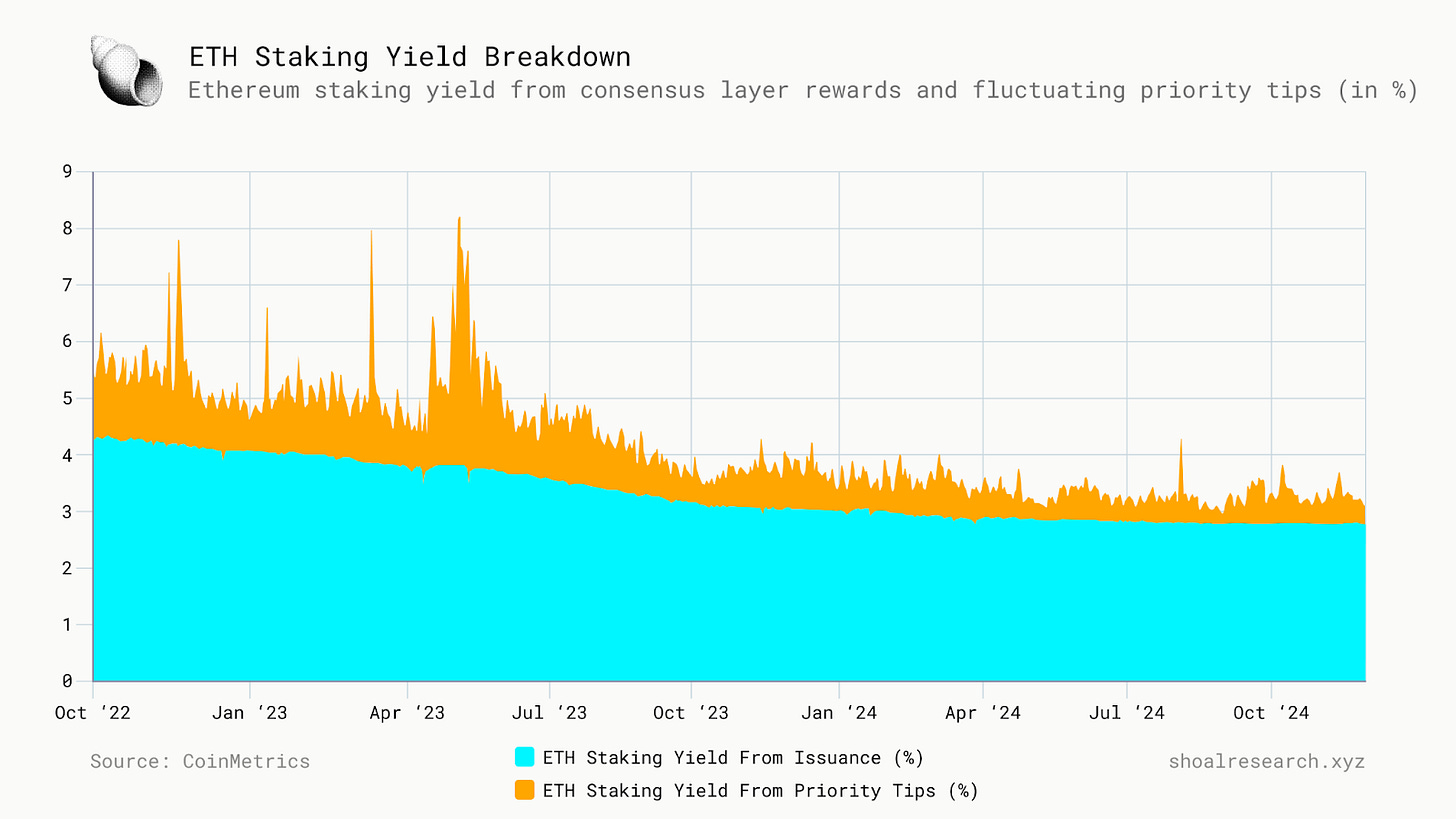

To participate in staking, validators must deposit 32 ETH as collateral into the beacon chain to spin up a validator node and perform certain duties for securely running the network. And this staking of ETH generates yield from two primary sources:

Consensus Layer Rewards: Validators earn ETH for attesting and proposing blocks, funded through newly issued ETH (network inflation).

Execution Layer Rewards: Includes priority fees and Maximal Extractable Value (MEV), which fluctuate based on network demand.

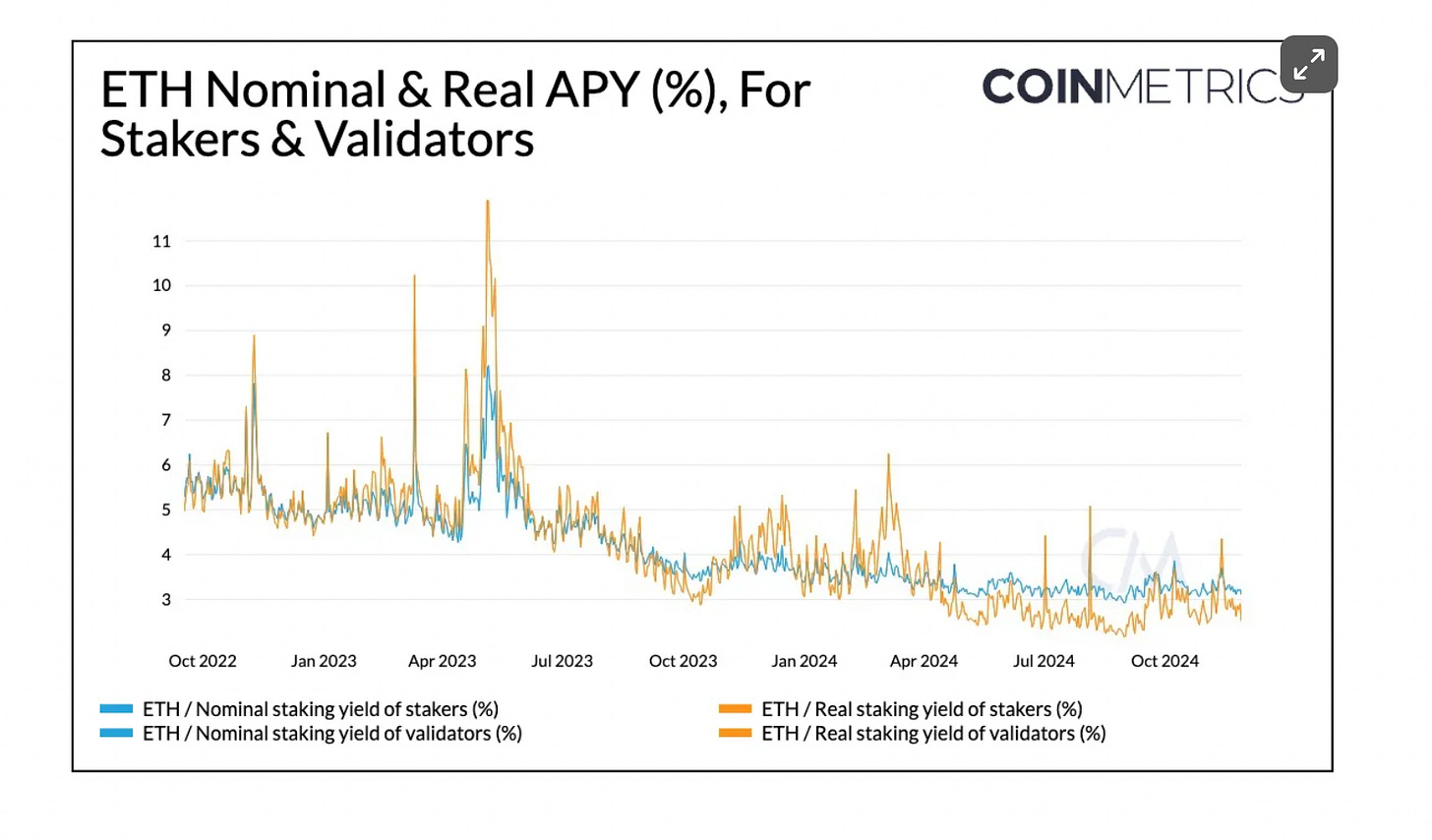

Currently, Ethereum’s nominal staking yield stands at 3.08%, while the real (inflation-adjusted) yield is 2.73%. During periods of heightened activity, staking APY has spiked to over 6.2%, as seen in March and August 2024.

Source: Coinmetrics

However, when Ethereum first launched staking through the Beacon Chain in 2020, it came with a major tradeoff—staked ETH was locked with no withdrawals until the Shapella upgrade in 2023.

This posed a dilemma for ETH holders during the DeFi Summer of 2020 when capital efficiency was paramount. DeFi protocols were offering high-yield opportunities through lending, trading, and liquidity provisioning. ETH holders had to choose:

Stake ETH into the Beacon Chain, earning a stable 3-4% staking yield but with funds locked indefinitely.

Deploy ETH in DeFi, where lending and liquidity pools could offer higher yields but carried increased risk.

To tackle this, Lido introduced the first —Liquid Staking Token (LST) back in 2020—allowing ETH holders to stake while retaining liquidity. Instead of locking ETH directly into the Beacon Chain, users could stake through Lido and receive stETH, a 1:1 tokenized representation of staked ETH. This allowed ETH holders to:

Continue earning staking rewards.

Use stETH in DeFi protocols for lending, trading, and additional yield generation.

Participate in staking with as little ETH as they have, instead of the minimum 32 ETH deposit required in “traditional” (Vanila) staking

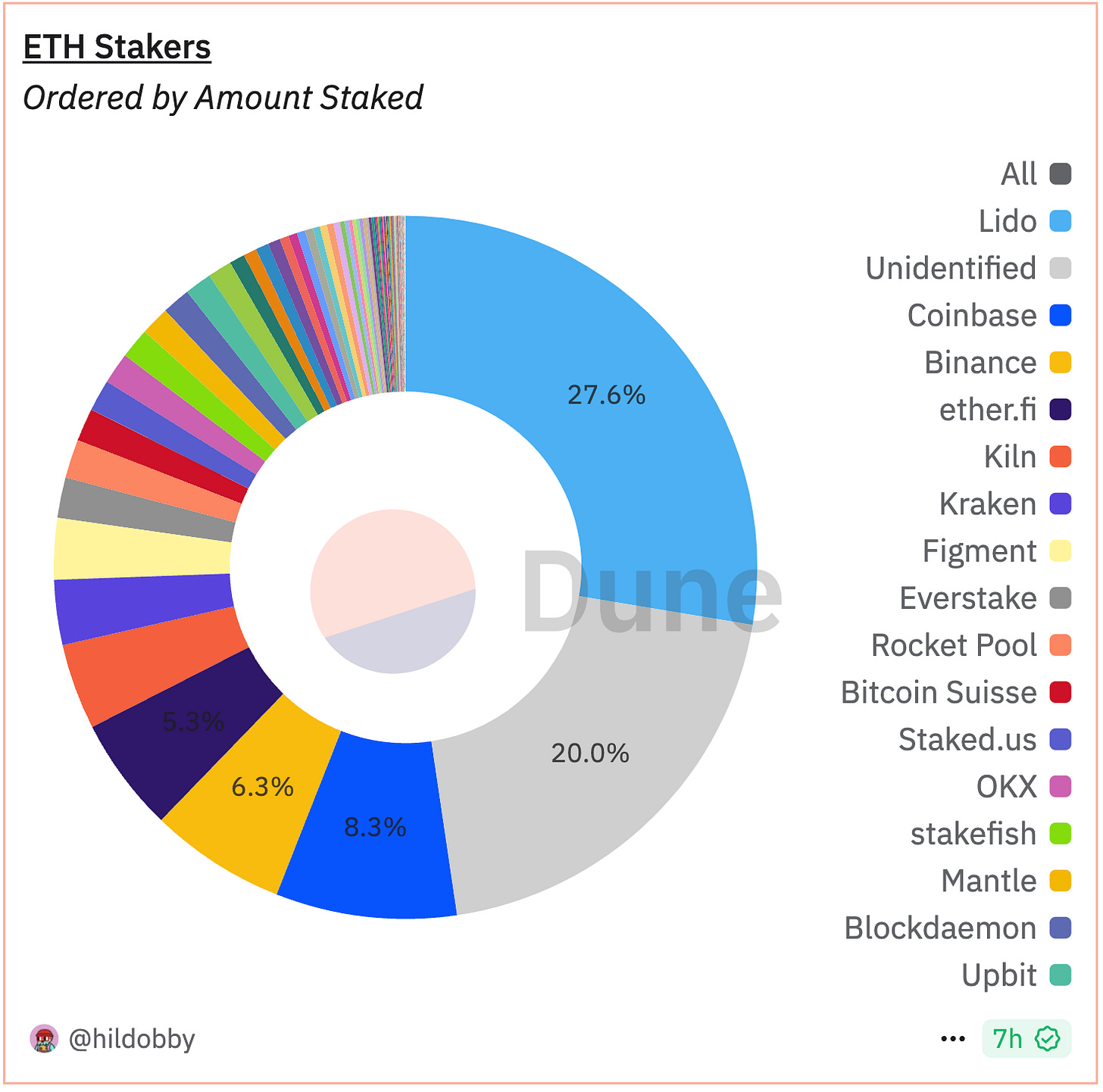

This early capital efficiency breakthrough for the largest PoS asset significantly boosted staking participation, with Lido capturing over 30% of all staked ETH at its peak.

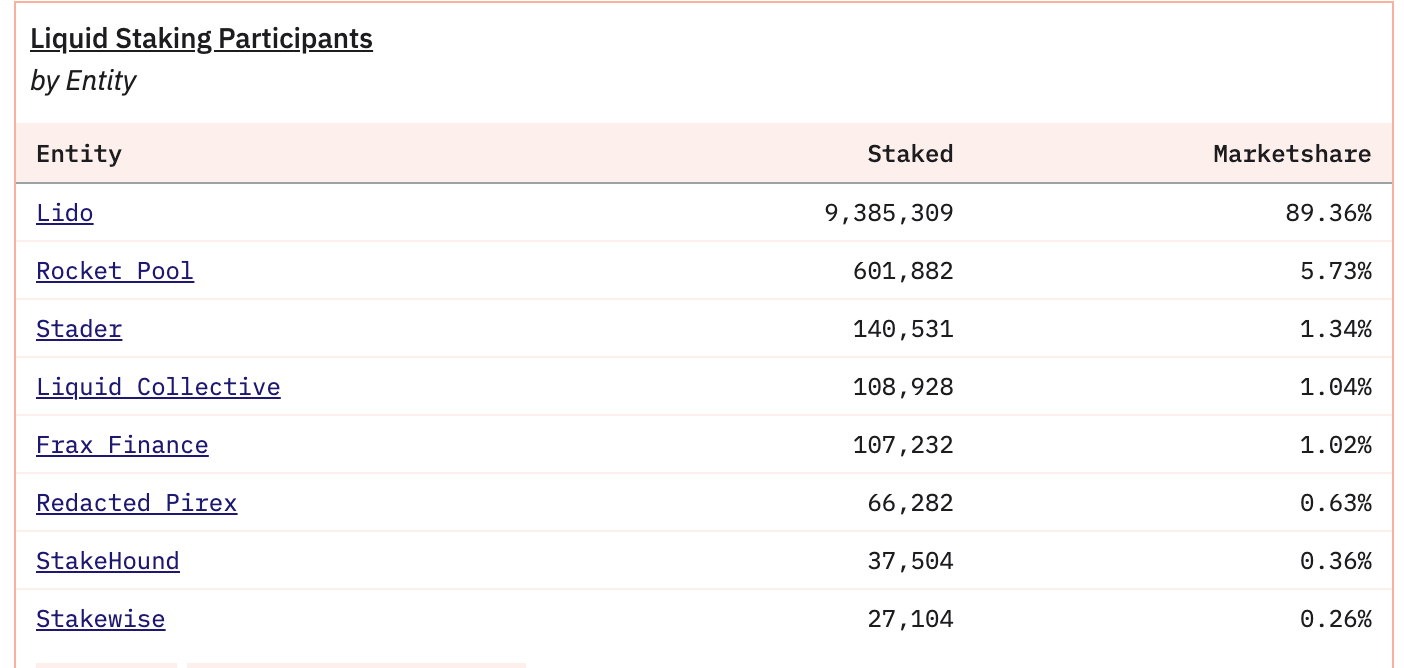

Today, liquid staking dominates Ethereum staking, accounting for over 40% of all staked ETH. Leading protocols include:

Restaking

Restaking, particularly through protocols like EigenLayer, has redefined Ethereum’s capital efficiency by enabling the same assets to secure multiple protocols simultaneously. This concept became the dominant narrative in late 2023 and continues to shape Ethereum’s broader economic landscape. By allowing staked ETH to generate additional yield and utility, restaking has positioned itself as a fundamental financial primitive—one that extends beyond pure network security.

However, as we explore in the following sections, the 2025 restaking ecosystem presents significant challenges. Basic mechanisms such as reward distribution, slashing enforcement, and incentive alignment between stakers, operators, and AVSs remain unresolved. The gap between vision and execution has slowed the maturation of restaking into a fully reliable yield-generation mechanism.

A brief on Restaking

Restaking extends the utility of staked assets by allowing them to secure multiple RAs (restaked applications) simultaneously—without compromising decentralized trust guarantees. While still early in adoption, restaking has found strong initial product-market fit in rollup infrastructure, where modular components such as transaction ordering, DA layers, or proof aggregation rely on restaked assets for enhanced security.

Restaking isn’t the first attempt at extending a blockchain’s security guarantees. Early concepts like merged mining allowed Bitcoin miners to secure multiple blockchains simultaneously using auxiliary proof-of-work (AuxPoW), without splitting computational power. This provided miners with diversified income streams at negligible additional cost—requiring only an extra full node. Other shared security models, such as Polkadot’s Parachains (2020) and Cosmos’ Interchain Security (2023), attempted to extend economic security across multiple chains. The true inflection point arrived with EigenLayer, which introduced Ethereum-native restaking, leveraging the network’s deep trust base and massive validator set.

However, current implementations largely focus on reinforcing network security—leaving the broader opportunity for economic security underutilized.

YieldNest envisions restaking as more than just an extension of shared security networks. Future DeFi protocols may leverage restaking across multiple layers—like lending platforms that restake collateral in multiple protocols (e.g., Resupply) or AMMs that enable cross-chain liquidity provisioning.

As we will uncover in the later sections, YieldNest’s MAX LRT architecture is built to capture this emerging layer. By merging restaking with DeFi-native strategies—liquidity provisioning, lending, and yield farming—it transforms passive assets into actively managed, yield-generating portfolios. AI-driven automation dynamically rebalances exposure across RAs and DeFi strategies, optimizing capital deployment in real-time.

With over $100 billion in staked ETH and more than 1 million validators, Ethereum provided the ideal foundation for a new era of capital-efficient security. EigenLayer repurposed this stake to secure Actively Validated Services (AVSs)—such as bridges, oracles, rollups, and data availability layers—without requiring validators to unstake from Ethereum’s consensus layer.

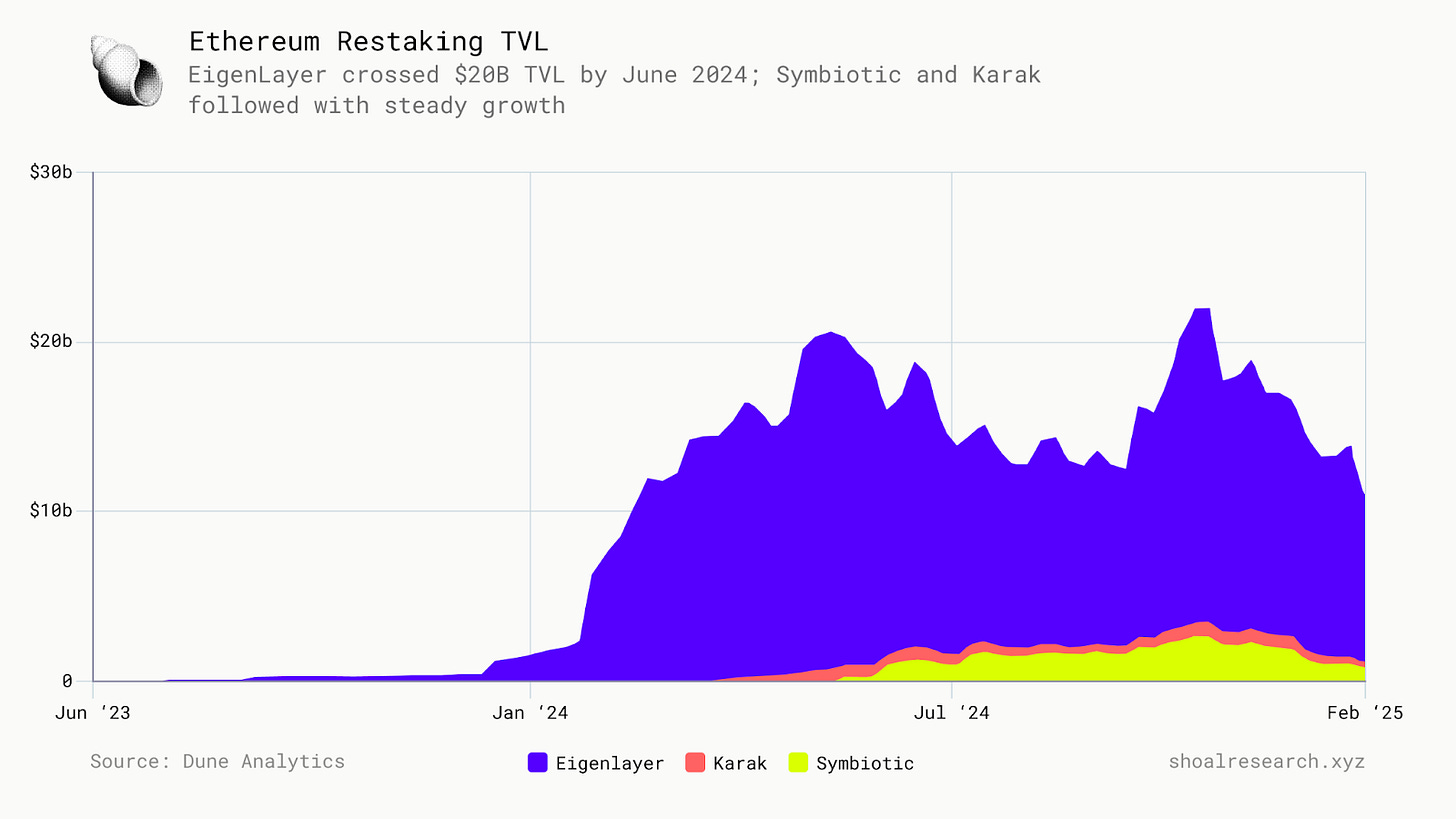

The impact has been massive. The TVL on EigenLayer surpassed $20.14B in June 2024, just three months after its mainnet launch. Currently, the total ETH restaking ratio is around 10%, with over $10B restaked on EigenLayer, $900M on Symbiotic, and $300M+ on Karak.

The demand for restaking has skyrocketed, with $18.3B in deposits made just in 2024, highlighting the growing appetite for yield beyond “traditional” staking rewards. While Solana’s Picasso and Solayer ($58.5M) and wrapped BTC restaking via Pell Network and Karak ($223.3M) are emerging, Ethereum dominates the restaking market by a wide margin.

Remember the massive growth in Bitcoin TVL we analyzed earlier? Much of this surge is attributed to Babylon, a restaking protocol for Bitcoin, which alone accounts for over $4.5 billion in restaked assets.

Restaking fundamentally changes Ethereum’s security model. “Traditional” or “vanilla” staking earns validators rewards through network inflation and transaction fees, but restaking introduces additional yield streams, including AVS security fees, execution layer rewards, and MEV revenue. Instead of ETH being locked into securing only Ethereum, it can generate additional yield across multiple protocols, making Ethereum’s security model capital-efficient and composable.

A common misconception surrounding restaking is the belief that it operates similarly to rehypothecation, a high-risk practice in traditional finance (TradFi) and DeFi. However, the two are fundamentally different. Rehypothecation involves using pledged assets as collateral for multiple loans, creating multiple claims on the same underlying asset. This practice amplifies systemic risk, leading to over-leverage, reduced transparency, and contagion effects—where a single failure can trigger cascading liquidations. The 2008 financial crisis showcased how excessive rehypothecation contributed to market instability by obscuring real collateral levels and interdependencies.

By contrast, restaking does not multiply claims on ETH but instead extends its economic security to new applications. Validators must explicitly opt-in to securing additional Actively Validated Services (AVSs), and slashing risks remain AVS-specific, meaning failures in one protocol do not affect Ethereum’s base security. EigenLayer aggregates ETH into a shared staking pool, allowing AVSs to benefit from Ethereum’s vast validator set. Unlike over-leveraged rehypothecation, restaking maintains a direct ownership structure, ensuring capital efficiency while preserving trust-minimized security.

Let me share a famous analogy explained by Sreeram Kannan, founder of EigenLayer, that might help clarify the concept.

Imagine you enter a mall where the main store requires you to put down a $100 deposit before you can shop. This deposit is a safeguard against theft—if you steal, you lose the deposit. Now, imagine I suggest that since you've already committed this deposit for the main store, why not extend this promise to not steal from any other stores in the mall? This approach puts the responsibility squarely on you not to commit theft anywhere in the mall.

It's a different kind of risk management compared to other financial strategies like margin lending. In restaking, the risk is endogenous to the staker, meaning that validators explicitly opt-in to securing additional networks, and their risk is confined to the AVSs they choose to support. The core Ethereum staking security remains uncompromised. However, smart contract vulnerabilities remain a universal challenge across all blockchains, including restaking protocols.

Restaking has emerged as an evolving primitive for capital efficiency rather than solely an economic security mechanism. While early implementations like EigenLayer pioneered shared security by enabling staked ETH to secure multiple protocols, this represents only a narrow slice of restaking’s full potential. Restaking has been facing several significant execution hurdles, including:

Tracking and enforcing operator behavior remains unreliable.

Technical tooling lacks robust SDKs or standardized frameworks.

Slashing controls are still immature, making shared security indistinguishable from shared risk.

To remain competitive, restaking must evolve up the risk curve—beyond passive delegation to actively supporting dynamic capital flows and more complex economic systems. EigenLayer’s restaking model alone cannot sustain long-term capital attraction. Adaptive primitives like YieldNest’s MAX LRT strategy enhance this model with yield aggregation, providing a more sustainable approach.

To overcome the execution limitations of restaking, YieldNest is building next-generation restaking infrastructure while simultaneously optimizing yield generation through DeFi. The fundamental thesis is: build sustainable yield infrastructure that works today while maintaining strategic optionality for future opportunities.

Let’s take a look at the reality of restaking rewards today.

Restaking Yields: Unpacking the Reality of EigenLayer Rewards

EigenLayer has undoubtedly cemented itself as the leader in the restaking space with over $10 billion in ETH restaked and an additional $700 million in EIGEN tokens. To its credit, the protocol has done a remarkable job reintroducing and popularizing the restaking narrative—unlocking a new design space for cryptoeconomic coordination. We’ve seen a surge in innovative use cases, ranging from rollup infrastructure to oracle networks and AVS experimentation, all enabled by EigenLayer’s shared security model.

However, when it comes to actual economic incentives, the picture is less impressive.

Despite the massive TVL, restakers today are primarily rewarded in EIGEN incentives, with no established path toward sustainable, protocol-level yield. This diverges from the protocol’s original vision outlined in its whitepaper, which promised cryptoeconomic guarantees through dynamic slashing, proof-based security, and robust risk markets. The idea was to build real yield through active underwriting and meaningful service validation—yet most of these mechanisms remain theoretical, with little implementation to date.

As of now, EigenLayer’s restaking incentives are still speculative. Without clear monetization flows from AVSs or SDKs that enable service-based yield models, there’s a growing gap between the initial thesis and the current execution.

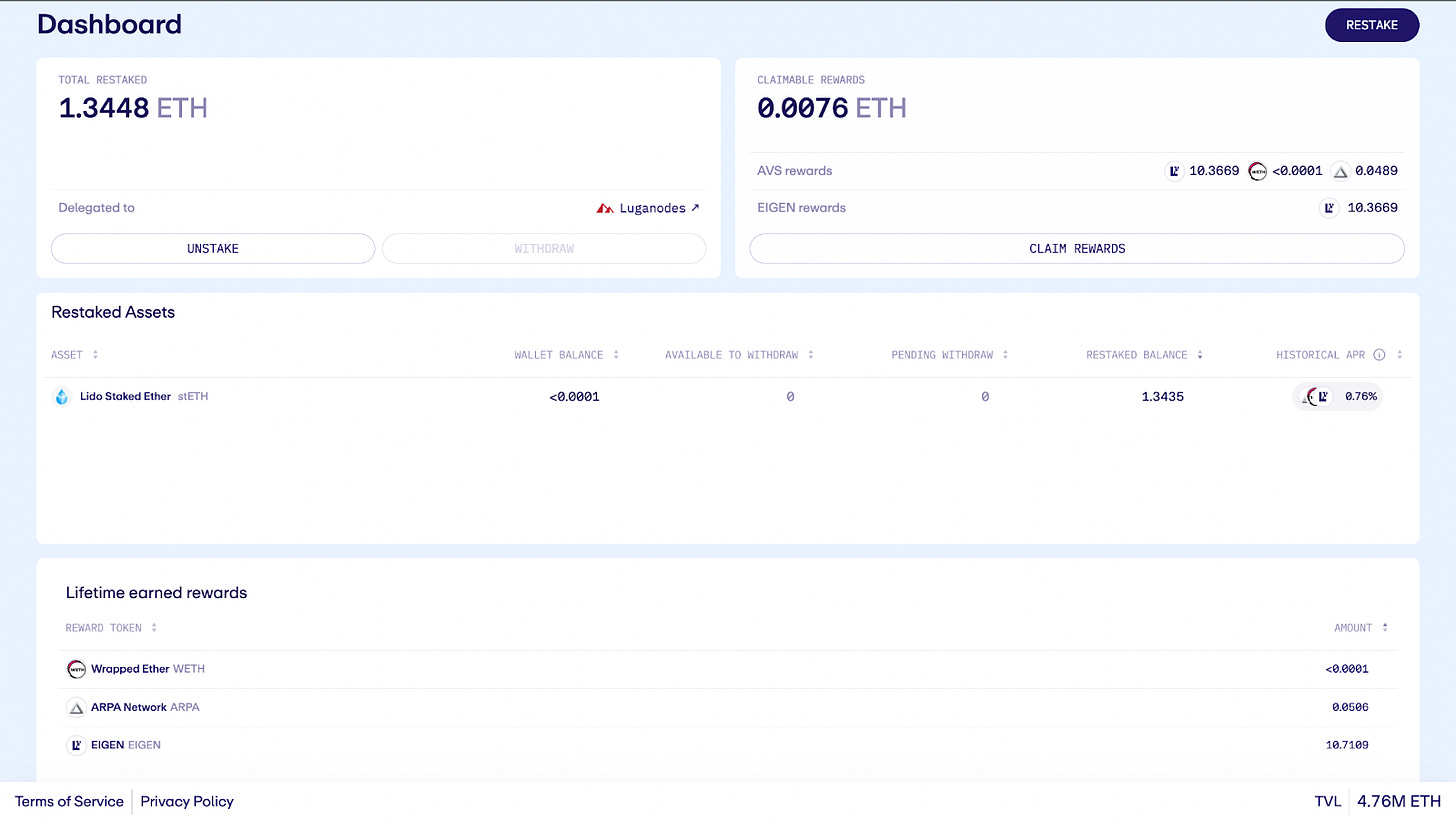

Members of the Shoal Research team have been actively involved in the staking industry for several years. Early research into restaking led to further exploration, including a 1.33 ETH restake into EigenLayer through a leading validator last year. To date, this position has yielded an average APR of approximately 0.77%—roughly five times lower than Ethereum mainnet’s staking APR. Notably, a significant portion of the rewards has come from staking EIGEN tokens rather than ETH itself.

Even factoring in those rewards, my earnings have barely covered the gas fees I paid to restake, let alone provided any actual profit.

That said, before criticizing EigenLayer too much, most early restakers have earned far more than just gas fees—but mostly thanks to EigenLayer’s airdrop (“stakedrop”). Additionally, some contributors have also received a social drop as an early content contributor, which significantly boosted the total gains. But let’s be honest, these aren’t sustainable yield mechanisms—they're one-off bootstrapping incentives.

Relying on airdrops and points has created a skewed perception of value in the restaking economy. The influx of deposits driven by airdrop farming rather than genuine demand for economic security has inflated the supply of restaked assets well beyond what current AVSs actually need. This mismatch not only risks capital inefficiency but also warps the product design lifecycle. Developers, pressured to align with hype cycles and point metas, often rush apps to mainnet without proper infrastructure or core features like withdrawals, transfers, or meaningful usage.

Ultimately, this creates phantom demand—AVSs that serve more as point sinks than as services generating actual value. The consequence? A system saturated with restaked capital that has nowhere productive to go.

If we want to “slay Ouroboros”—the cycle of empty yield chasing itself, we must shift toward building trustless infrastructure that enables real yield. That means maturing AVS designs, enabling proper slashing frameworks, and creating value flows where restaked ETH secures applications that generate sustained, fee-based revenue. Until then, we’re still in the bootstrapping phase—powered more by speculation than utility.

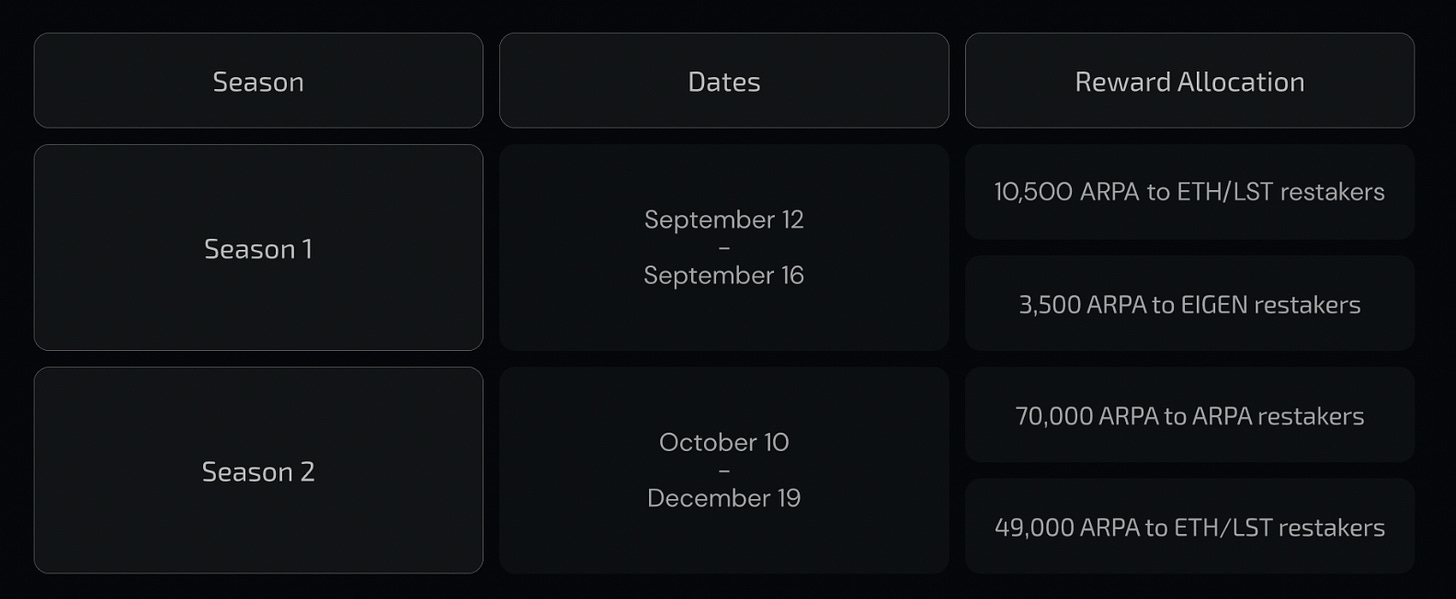

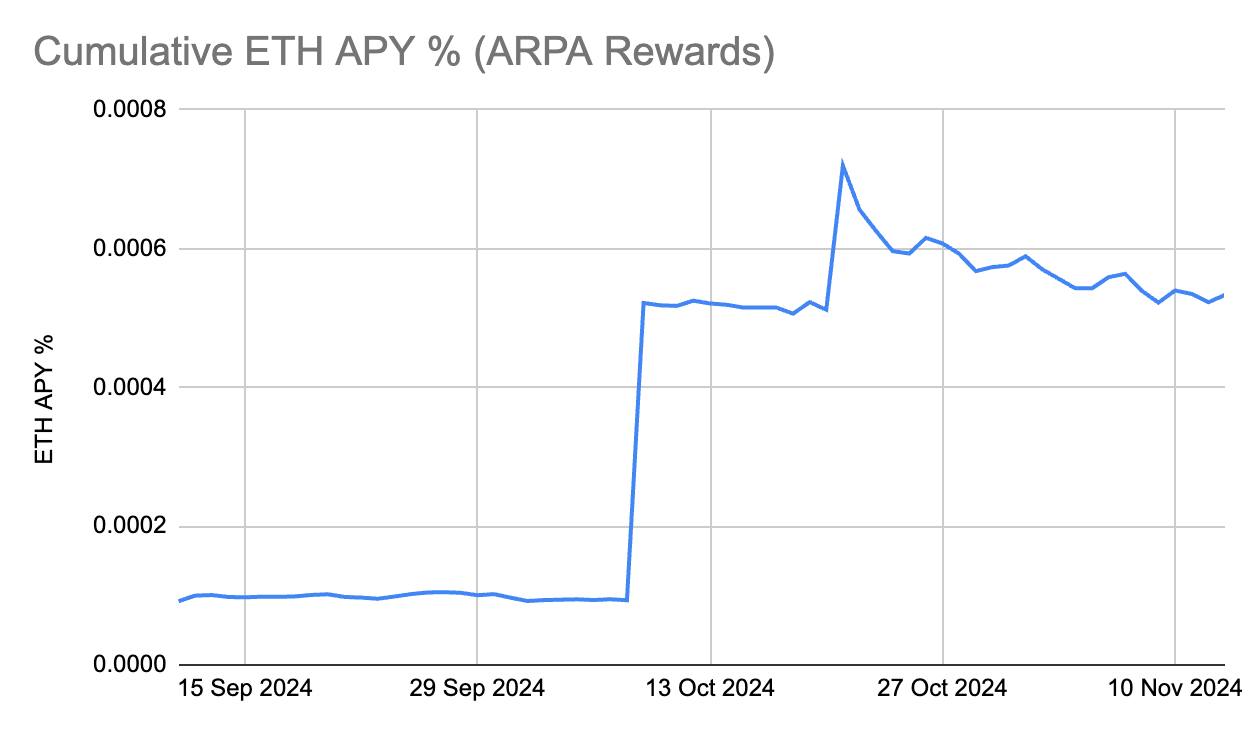

Now, considering the real yield from restaking ETH, things look far less attractive. The largest AVS on EigenLayer mainnet today (in terms of number of stakers) is ARPA (we’re excluding EigenDA for this example), and it was the first to make rewards live on the mainnet back in September 2024.

Let’s do some quick paper napkin math to estimate the APY for ETH restaked in ARPA.

At the time of writing:

ARPA’s EIGEN Restaked: 57.82M EIGEN

ARPA’s ETH Restaked: 2.15M ETH

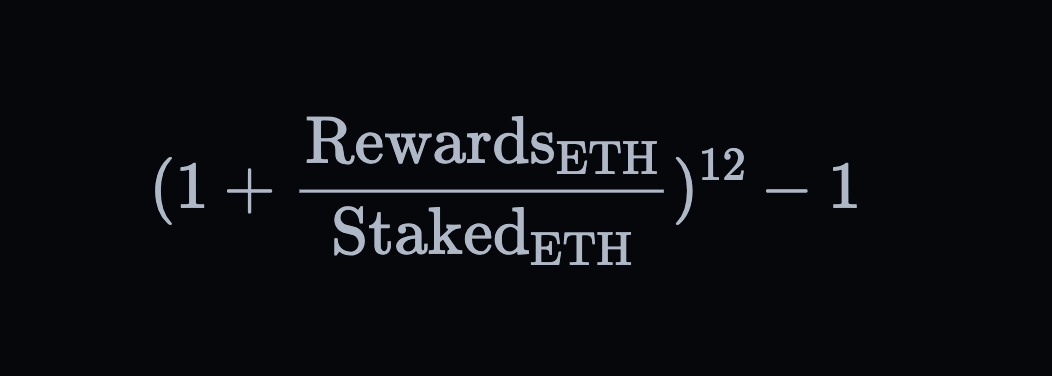

We will use the following formula to calculate the annualised APY:

Step 1: Total ETH Value Restaked

With ETH’s current market price at ~$2,400, the total value of ETH restaked on ARPA is:

2.15M × 2400 = 5.16B (Total value in USD)

Step 2: Weekly Rewards in ARPA Tokens

According to the EigenLayer dashboard, ARPA is distributing 7,000 ARPA tokens weekly. At ARPA’s current price of $0.034, the total weekly rewards in USD are:

7000 * 0.034 = 238 (or let's round up to $240)

Step 3: Annualizing the Rewards

240 × 52 = 12,480 (Total annual rewards in USD)

Step 4: Calculating the APY for ETH

( 1 + (12,480 / 5.16B) ^ 12 ) - 1 = 0.00267%

Wait, is this correct?

If you don’t believe this is the current bull case, let’s examine a recent AVS rewards analysis done by the Nethermind team.

The ARPA Network rewards structure reveals that ETH restakers receive only a small fraction of the total AVS incentives. Season 1 Community Rewards have concluded, and Season 2 is set to continue until mid-December, with ARPA tokens distributed to node operators meeting specific conditions. However, when focusing on ETH/LST restakers, the actual yield derived from ARPA token rewards remains minimal.

When plotting cumulative ARPA rewards converted to ETH against the total ETH staked, the resulting yield for restakers is estimated at less than 0.0006% APY per ETH restaked.

This figure highlights the challenge of relying solely on AVS incentives for meaningful yield generation. Without supplemental rewards from EigenLayer’s Programmatic Incentives or additional staking incentives, ARPA restakers today are unlikely to see competitive returns compared to alternative restaking strategies.

Liquid Restaking Protocols and Liquid Restaking Tokens (LRTs)

Over the course of 2024, we saw the evolution of liquid staking protocols as yet another attempt to increase the productivity of restaked ETH, allowing users to stack additional yields on their restaked positions—possibly by utilizing them in DeFi. This became necessary because restaking into protocols like EigenLayer alone has not been particularly rewarding. Liquid restaking protocols address this gap by managing operator selection and AVS risk assessment while simultaneously providing liquidity.

Similar to how Lido simplified staking by handling validator selection for Ethereum stakers, Liquid Restaking Tokens (LRTs) aim to offer an accessible way to restake ETH while maintaining liquidity. However, restaking carries significantly higher risks, making robust risk management essential.

When users deposit ETH or LSTs into a liquid restaking protocol, they receive a derivative Liquid Restaking Token (dLRT), representing their share of the staked capital. These dLRTs are fully liquid and can be traded or used across DeFi applications for lending, borrowing, and liquidity provisioning—enhancing capital efficiency beyond basic restaking yields.

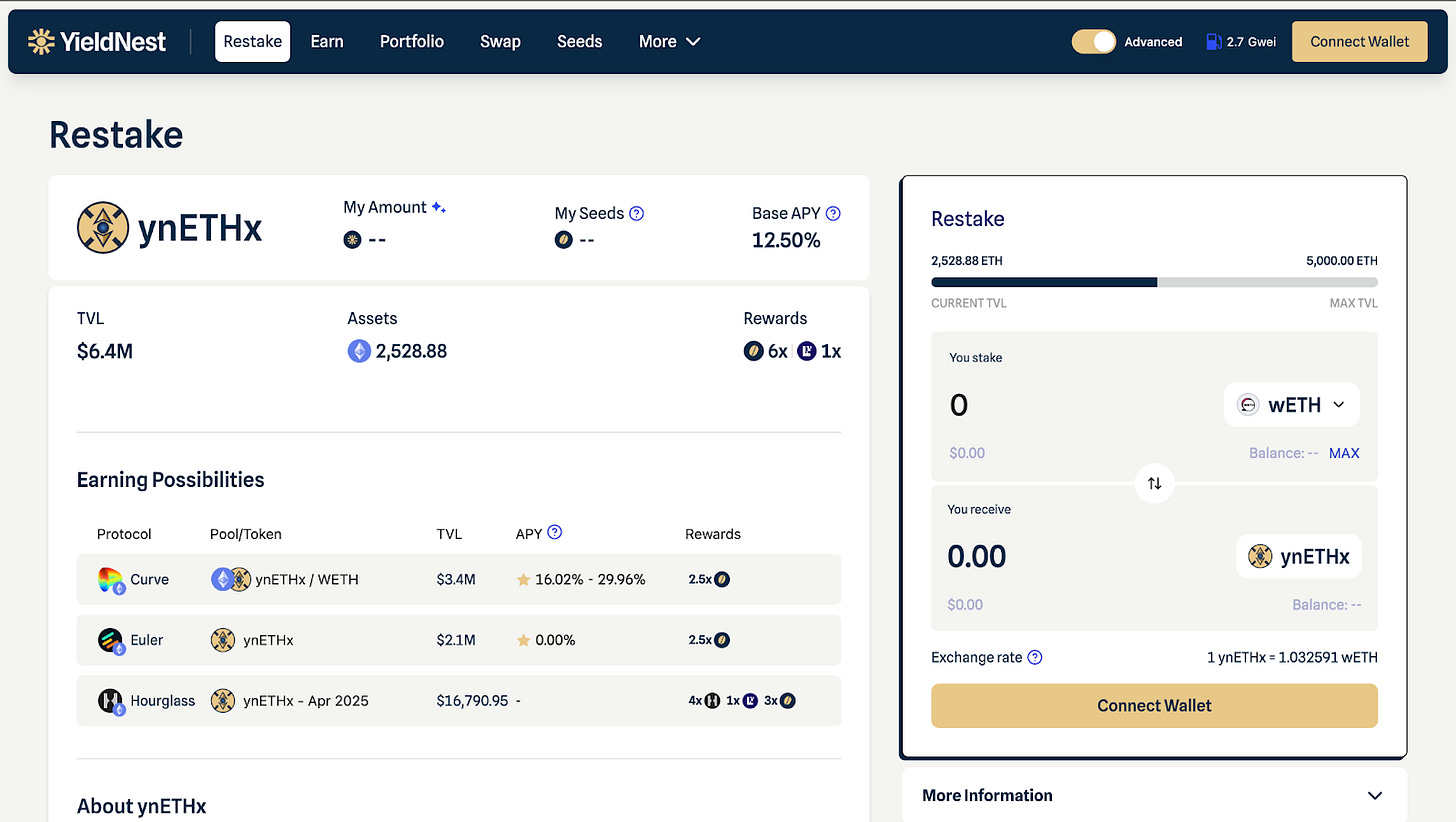

For example, if you restake your ETH (wETH, ynETH, ynLSDe) into YieldNest’s latest Ethereum MAX LRT vault, ynETHx, you receive a base APY of 12.50% along with a liquid restaking derivative token, ynETHx, which represents your 1:1 deposited asset. This token can then be utilized in DeFi to further optimize yield. For instance, depositing ynETHx into the Curve ynETHx/WETH pool can generate an additional APY of up to 29.9%, compounding returns beyond the base restaking rewards.

Source: https://app.yieldnest.finance/restake/ynETHx

LRTs act as intermediaries between ETH holders and restaking, allocating deposits across various AVSs and node operators while charging a percentage of rewards. Users could manually select operators and AVSs, but most prefer the convenience of LRTs managing this allocation. This model mirrors traditional banks—user deposits (liabilities) must be accounted for, while LRTs actively manage risks tied to operator selection, AVS exposure, and unbonding periods (assets).

In simple terms, LRTs offer:

Enhanced capital efficiency – Users can extract more value from staked assets without locking up their capital.

Operator Risk Assessment – LRT platforms vet, monitor, and select operators based on their performance, reliability, infrastructure capabilities, and governance practices. Since not all operators are equal, this prevents users from staking with bad actors or under-resourced validators.

AVS Risk Evaluation – LRTs assess the risks associated with each AVS, considering factors such as:

Economic sustainability (i.e., is the AVS business model viable?)

Slashing conditions (how risky is the restaking contract?)

Historical performance (has the AVS consistently paid rewards?)

Security risks (is the AVS vulnerable to smart contract exploits?)

LRTs are designed to optimize restaking rewards while reducing complexity for users, making them an attractive solution as EigenLayer and restaking grow.

The LRT market is evolving rapidly, with about 20 providers competing for dominance in what many are calling the next "Lido moment" for DeFi. As Ethereum staking expands and yields compress, LRTs are positioning themselves as the next logical step for maximizing rewards.

However, liquid restaking also introduces some systemic risks like, slashing cascades, depegging events, and liquidity mismatches. Some providers are addressing these risks through insurance mechanisms, buffer strategy, and curated AVS selections.

Challenges associated with the current state of Restaking (beyond lack of real substantial yield)

Despite the excitement and massive capital inflow, restaking platforms still lack critical infrastructure needed for broad market fit. For example, EigenLayer’s vision, as outlined in its whitepaper, hinges on the ability to provision cryptoeconomic security via diverse, customizable slashing mechanisms. But today, slashing frameworks remain underdeveloped, and proof submission processes are still largely manual or absent. Without robust SDKs, standardized tooling, and verifiable slashing systems, meaningful growth in shared security will remain bottlenecked.

Moreover, from the perspective of profit-seeking capital allocators, these gaps represent not just risks, but opportunity costs. Capital deployed into restaking protocols without clear mechanisms for enforcement or yield distribution may end up idle or misallocated. YieldNest addresses these limitations by designing architecture that benefits from restaking’s upside—while maintaining the flexibility to dynamically pivot capital across multiple strategies. In this way, restaking is treated not as a siloed endpoint but as one layer in a broader, adaptive yield strategy designed to maximize long-term capital efficiency.

In this section, let’s take a closer look at some of the key challenges associated with restaking, including slashing risks, AVS-specific failures, governance concerns, and economic concentration risks,etc. Given the rapid adoption of EigenLayer, Symbiotic, Karak, and other restaking platforms, these concerns are no longer theoretical but require immediate scrutiny.

1. Base Layer Security Risks & Slashing Cascades

Restaking allows ETH to secure multiple AVSs, meaning a single validator misstep can trigger slashing across multiple protocols. Currently, ~15% of all staked ETH is restaked, with about 9% being natively restaked via EigenPods—a major slashing event could destabilize Ethereum’s validator set and economic security.

For node operators, this magnifies operational complexity. They must comply with different uptime requirements and cryptographic proofs across multiple AVSs. The major problem is a slashing cascade – a failure in one AVS can punish the same validators that secure Ethereum’s core. If a large operator or popular AVS experiences a bug or attack causing mass misbehavior, all the validators restaking there could be slashed in unison. Industry observers warn that if a significant amount of ETH is tied up in EigenLayer and such an event occurs, it “could lead to a cascade of slashing damage” and even compromise Ethereum’s base network security. In a worst-case scenario, a slashing cascade could force a huge chunk of validators offline, undermining the economic security of Ethereum’s beacon chain. Historically, slashing on Ethereum has been exceedingly rare (only about 470 validators ever slashed, <0.04% of the set), so a large-scale event would be unprecedented.

The correlated slashing penalties in Ethereum also mean that when many validators are slashed together, each one loses more stake – potentially up to their entire 32 ETH if the event is severe. Thus, restaking introduces a new systemic risk: an outage or exploit in an AVS could recursively punish Ethereum’s consensus layer, shredding validators’ deposits and confidence.

2. Centralization Pressures on Ethereum & Operators

Restaking protocols like EigenLayer also pose centralization risks for Ethereum’s validator set. If only a few large staking operators can effectively run the required infrastructure for many AVSs, they may attract outsized delegations of restaked ETH. EigenLayer allows permissionless participation (any solo staker can join via EigenPods), but in practice AVS creators often choose specific operators to secure their services.

A recent report predicts AVSs will gravitate to validators with the largest pooled stake and best performance, such as big professional node operators or those running popular liquid restaking projects. This creates a rich-get-richer dynamic, where a handful of operators accumulate a disproportionate share of economic security. If, say, five operators end up controlling most EigenLayer stake, the restaking ecosystem could recentralize trust rather than diffusing it. Large operators capture most restaking rewards, making it harder for smaller validators to compete. This centralizes economic security in a handful of entities, leading to risks similar to Lido’s dominance in Ethereum staking.

For AVSs, this creates a reliance on a handful of powerful node operators. If one colludes or goes offline, multiple AVSs could be compromised simultaneously, leading to slashing events and weakened network security.

3. Financial Risks: Liquidity Crisis and Depegging

Beyond technical and concentration issues, restaking introduces new financial contagion risks in the Ethereum DeFi ecosystem. If a large LRT (e.g., eETH, rstETH, or ezETH) faces a mass-slashing event, the value of these tokens could rapidly depeg, triggering cascading liquidations in DeFi lending markets.

A similar event happened in the 2022 Ankr exploit, where a hacker gained control of a compromised key and used it to mint 6 quadrillion aBNBc tokens—a derivative of Ankr Reward Bearing Staked BNB. Since these tokens were meant to represent a claim on underlying BNB, the exploit effectively created counterfeit BNB at scale. As the hacker offloaded the fake aBNBc, the price of liquid staking tokens like BNBx and stkBNB plummeted. Exploiting the chaos, the attacker used the counterfeit tokens as collateral to borrow stablecoins from Helio, ultimately draining the protocol and leaving it financially crippled. Ankr acknowledged a $5M direct loss.

Some proponents argue that LRTs could act as a buffer by allowing trading out of restaked positions without touching the underlying staked ETH. In theory, if users can sell an LRT quickly, it might reduce the need to withdraw or panic on the beacon chain itself.

YieldNest has implemented a buffer strategy to mitigate liquidity risks and ensure instant withdrawals for MAX LRT users. These are ERC-4626-compliant vault mechanisms that maintain a portion of assets in readily accessible, yield-generating strategies, ensuring that users can exit their positions without delays. By keeping a liquidity buffer, YieldNest reduces reliance on long withdrawal queues and helps prevent sudden depegging events by allowing users to trade out of their positions swiftly. In extreme market conditions, where mass liquidations could threaten DeFi stability, YieldNest’s buffer strategy acts as a safeguard against contagion risks, preventing capital inefficiencies and maintaining protocol resilience.

4. Social Consensus and Governance Risks

Perhaps the most far-reaching risk of all is the strain restaking could put on Ethereum’s social consensus and governance. Ethereum famously relies on a robust social layer – the community of node operators, developers, and users – to uphold the chain’s integrity in extreme scenarios. Ethereum’s social consensus could be challenged if a catastrophic restaking failure leads to demands for a bailout or chain fork. Vitalik Buterin has warned against “overloading Ethereum’s consensus” with external security promises, arguing that a restaking collapse could pressure the Ethereum community to intervene, threatening its neutrality. With EigenLayer now securing 8% of all staked ETH, a major failure could trigger the first real “too big to fail” moment in crypto.

Vitalik Buterin warned that protocols should not design systems assuming Ethereum will fork to save them. In his words, we must avoid “recruiting Ethereum’s social consensus for your application’s own purposes”. He gave the example that while reusing the validator set (as restaking does) has risks, it might be acceptable – but expecting Ethereum to step in and fix external failures crosses a red line.

This was a clear response to the idea that if a major restaking project broke down, the community might be compelled to intervene. EigenLayer’s team echoes this stance.

CEO Sreeram Kannan noted that one should “not assume that because you’re too big to fail, Ethereum will fork to bail you out.”

Instead, any protocol built on restaking must internalize its own risks. In other words, if an AVS collapse leads to massive losses, those losses should be borne by the restakers and not socialized across Ethereum via contentious forks or emergency changes.

Restaking is a double-edged sword—while it unlocks capital efficiency and shared security, its unchecked expansion could amplify systemic risks. Each of these risk areas – from slashing cascades and centralization to liquidity crunches and social fallout – underscores that EigenLayer and similar restaking initiatives must proceed with extreme care. The promise of boosting Ethereum’s utility and yield comes with non-trivial dangers. Managing these risks requires strict AVS selection, well-designed slashing policies, and robust risk frameworks to prevent cascading failures.

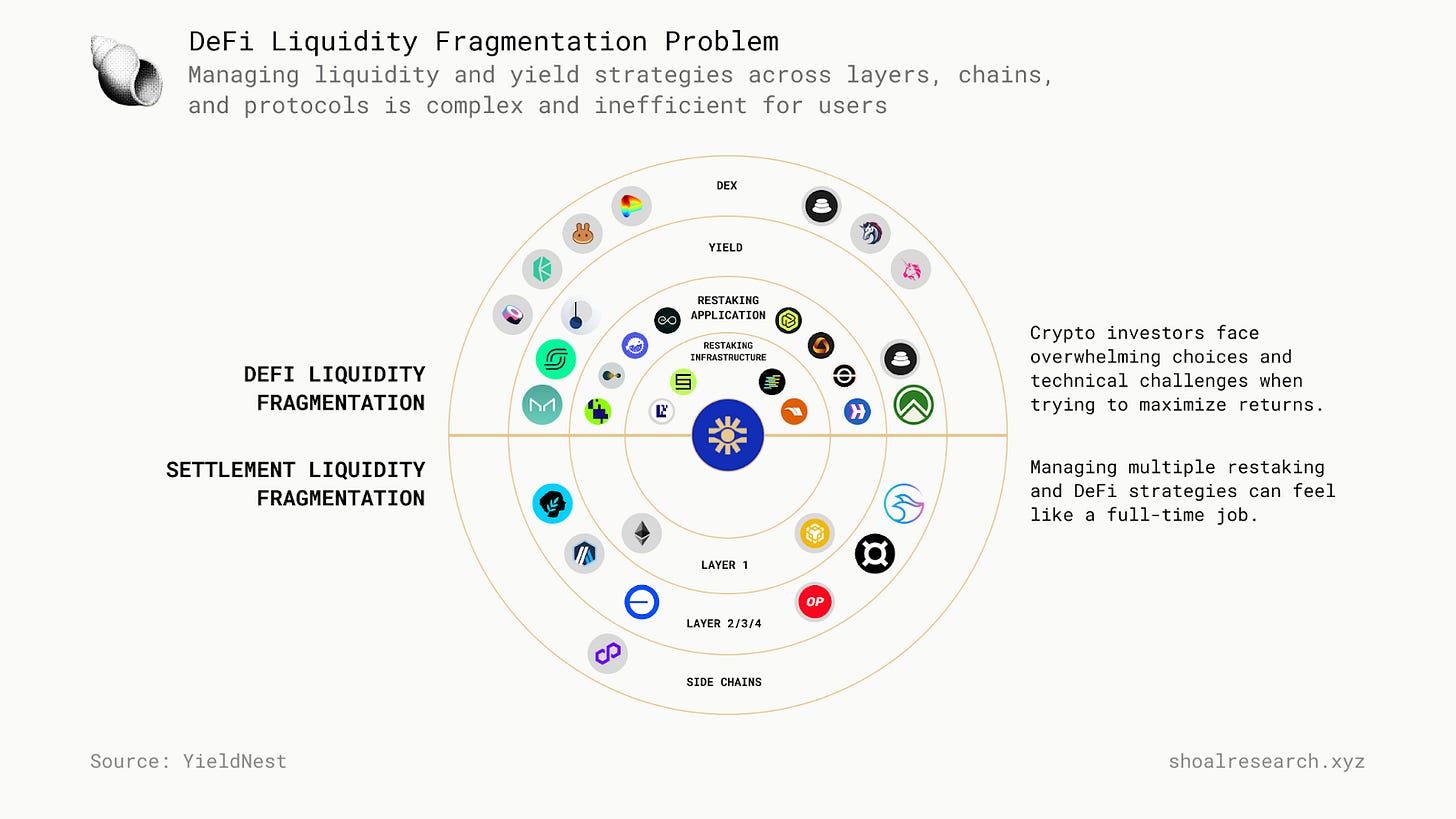

5. Fragmented Liquidity: A Fundamental Constraint on Restaking and DeFi Efficiency

One of the biggest challenges facing restaking and DeFi today is liquidity fragmentation across multiple ecosystems. While Ethereum dominates the restaking market, protocols like Babylon (Bitcoin), Picasso (Solana), and Karak are expanding the concept beyond Ethereum. However, this cross-chain growth introduces a structural liquidity problem—each ecosystem operates in isolation, securing only its native applications while liquidity remains locked within fragmented economic zones.

Liquidity fragmentation leads to inefficiencies in capital deployment, yield compression, and systemic risks, preventing restaking from reaching its full potential:

Capital Inefficiency – Restaked assets are underutilized as they cannot freely move across chains, limiting DeFi yield opportunities.

DeFi Liquidity Risks – Liquidity silos increase slippage and price volatility, making DeFi markets vulnerable to inefficiencies.

Yield Compression – Isolated capital pools force protocols to compete for liquidity, reducing available yields for restakers.

Projects like MoreMarkets are developing global liquidity marketplace to aggregate and unify liquidity across multiple blockchains, allowing applications to tap into external capital sources without relying on centralized bridges.

However, these solutions are still in their early stages. The long-term solution requires a unified restaking framework integrated with DeFi, enabling seamless capital allocation, reducing fragmentation, and enhancing yield efficiency across all ecosystems. For restaking to scale sustainably, a global liquidity coordination mechanism must emerge to bridge isolated economies into a single, composable financial layer.

YieldNest: Leading in Capital Efficiency and DeFi Innovation

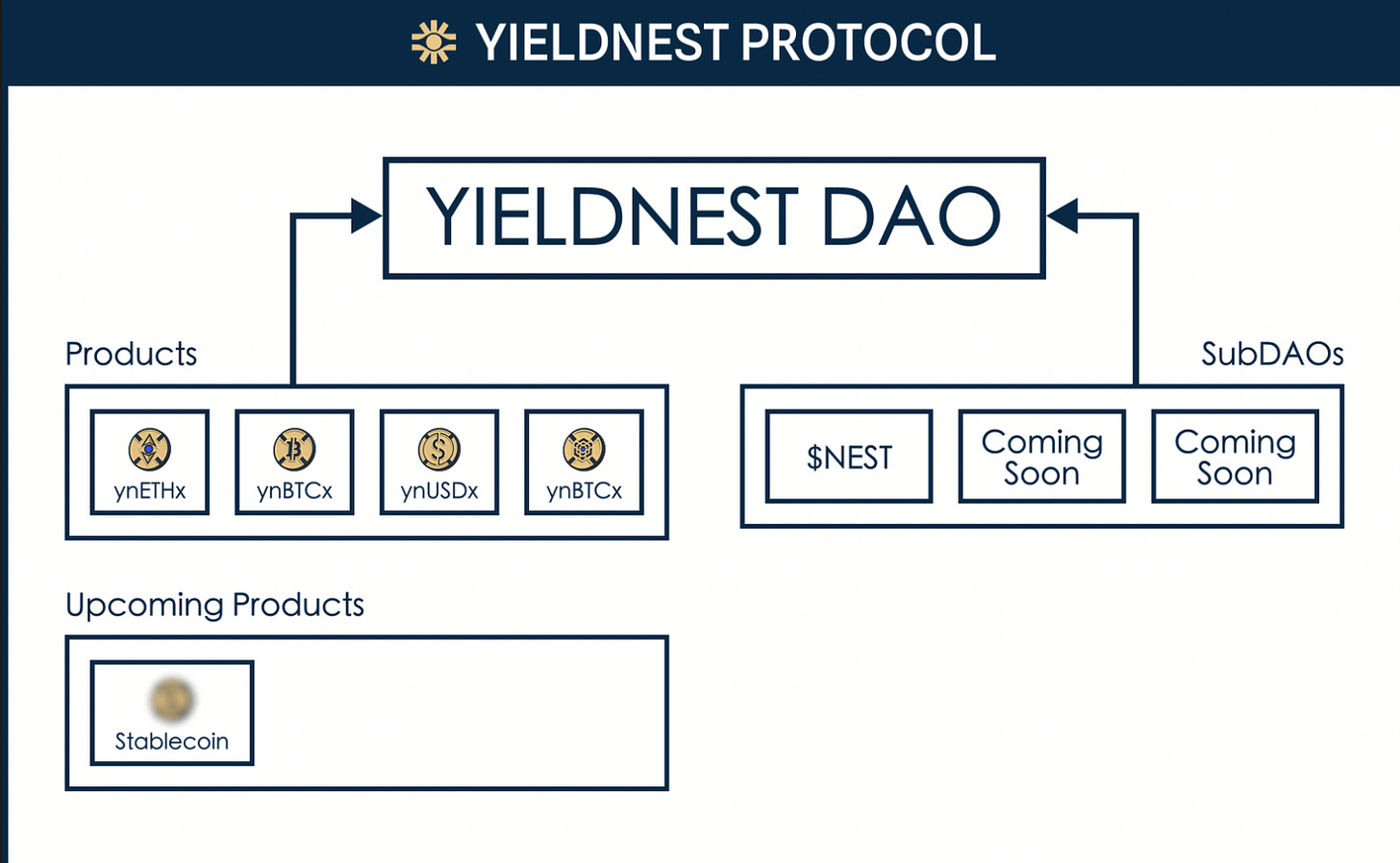

YieldNest is a next-generation DeFi platform that consolidates multiple yield strategies into single, liquid assets. While initially emerging as a liquid restaking protocol, YieldNest’s vision extends far beyond validator staking alone – it has a broader mission to unlock capital efficiency and redefine what’s possible in decentralized finance. The protocol offers a suite of four flagship yield tokens, each designed to dynamically rebalance across restaking and various DeFi strategies to maximize risk-adjusted returns:

ynETH MAX (ynETHx): Ethereum-based strategies

ynBTC MAX (ynBTCx): Bitcoin-focused strategies

ynUSD MAX (ynUSDx): Stablecoin-based strategies

ynBNB MAX (ynBNBx): Innovative BNB strategies

By abstracting away complexity, YieldNest democratizes access to advanced yield opportunities without compromising security or capital efficiency.

Beyond “Traditional” Restaking

Early restaking protocols like EigenLayer focused primarily on reinforcing network security by allowing staked assets to secure additional services. YieldNest takes this concept further, transforming restaking into just one component of a more comprehensive DeFi strategy. Unlike first-generation restaking solutions limited to shared security mechanisms (e.g., EigenLayer), YieldNest envisions restaking as a broader category encompassing liquidity optimization, capital efficiency, and composable financial strategies. In practice, this means YieldNest uses restaked assets not just to secure networks, but to boost liquidity and productivity across the DeFi ecosystem – effectively turning passive staked tokens into active, yield-generating capital.

To overcome restaking’s execution limitations at the current stage, YieldNest is building tomorrow’s restaking infrastructure while simultaneously enabling yield generation through DeFi’s current optimization capabilities. The fundamental thesis is: build sustainable yield infrastructure that works today while maintaining strategic optionality for tomorrow’s opportunities.

Unified Multi-Strategy Yield Generation

Integrating multiple DeFi layers

YieldNest combines “traditional” staking yields with opportunities in lending markets, automated market makers (AMMs), liquidity pools, and more. By bridging these layers of DeFi, YieldNest expands the scope of what staked assets can achieve, transforming them from a passive security mechanism into an active engine for maximizing yield and capital utility.

Each MAX LRT (YieldNest’s proprietary Maximum Liquid Restaking Token) acts as an adaptive, AI-enhanced asset that unifies diverse yield streams – from restaking rewards to DeFi protocol fees – into one seamless, capital-efficient ecosystem

Omnichain liquidity and reach

YieldNest’s multi-strategy approach is not confined to a single network. MAX LRTs operate across multiple blockchains, aggregating yield opportunities on Ethereum mainnet, Layer-2 networks, and other chains (such as BNB Chain, Solana, and Cosmos) into a single high-yielding asset.

This cross-chain integration allows YieldNest to serve as a liquidity backbone that bridges strategies on different platforms while still preserving the security assurances of the underlying Layer-1 settlements

In essence, a YieldNest token holder gains exposure to a spectrum of DeFi opportunities spanning many ecosystems, all through one unified asset.

YieldNest’s Three Core Objectives

YieldNest is designed to address the inefficiencies of existing liquid restaking protocols by prioritizing three fundamental goals:

Risk-Adjusted Returns – Unlike “traditional” staking, YieldNest optimizes for sustainable, long-term returns, ensuring stable earnings even amid market fluctuations.

Security & Flexibility – Through AI-driven monitoring and autonomous risk management, assets are safeguarded against slashing risks, exploits, and systemic failures.

Capital Efficiency & Innovation – YieldNest maximizes every dollar of staked capital, ensuring that no asset sits idle by dynamically reallocating between restaking and DeFi strategies.

By treating restaking as just one layer of a broader DeFi strategy, YieldNest adapts fluidly to evolving market conditions, offering users not just staking rewards, but structured, sustainable yield opportunities.

Unlike other LRTs that simply enable EigenLayer restaking, YieldNest's MAX LRT vaults integrate DeFi lending, staking, and liquidity provisioning alongside restaking strategies. This approach enables:

Higher risk-adjusted returns by diversifying yield sources beyond EigenLayer.

Auto-compounding strategies that optimize restaking rewards while enhancing DeFi participation.

Other LRTs provide blanket exposure to all AVSs, but YieldNest introduces isolated AVS categories—allowing users to customize risk and reward profiles. Users can choose:

Safe, high-liquidity AVSs

AI-driven, high-yield strategies

Diversified DeFi-restaking hybrid exposure

YieldNest is built to enhance capital efficiency by integrating restaking with DeFi while maintaining a risk-adjusted approach to yield optimization. Unlike conventional liquid restaking protocols that passively allocate capital, YieldNest employs an active asset management framework to dynamically rebalance liquidity across restaking platforms such as EigenLayer, Symbiotic, and Nektar. By dynamically optimizing risk-adjusted returns, YieldNest’s MAX LRTs enable users to earn an additional 8–10% yield on top of base staking rewards without relying on excessive leverage or high-risk strategies, making it one of the most efficient yield-generation mechanisms in the market.

In the coming sections, we will explore the technical architecture of MAX LRTs and LRT vaults, examining how YieldNest structures its restaking and risk management mechanisms to deliver scalable, secure, and high-performance liquid restaking solutions.

But, before diving into this, let’s step back and revisit DeFi—the most widely used application of crypto today. At its core, DeFi was built on the first principles of open, secure, borderless, and permissionless finance, operating 24/7 without intermediaries. However, DeFi as we know it today faces several structural challenges, inefficiencies, and limitations. That said, new and innovative use cases are emerging, and protocols are leveraging novel mechanisms to push the boundaries of what’s possible. In the next section, we will discuss some of these developments in detail.

DeFi meets AI

Decentralized Finance (DeFi) has unlocked open, secure, and permissionless financial services, but the user experience remains complex, requiring manual interactions, deep technical knowledge, and constant monitoring.

We saw the first renaissance of DeFi during the "DeFi Summer" of 2020, where trading volumes and user adoption surged. During this period, many fundamental DeFi primitives like lending, borrowing, and stablecoin yields—gained significant traction. By the end of 2021, the total value locked in DeFi reached its all-time high of over $170 billion.

Several key factors contributed to this growth, including significant improvements in Automated Market Makers (AMMs) like Uniswap, with the release of its V2, which introduced enhancements such as improved liquidity provision and reduced impermanent loss for traders and liquidity providers. The rise of Liquid Staking Tokens (LSTs) like Lido and substantial capital inflows also played a crucial role. These breakthroughs laid the foundation for the DeFi ecosystem as we know it today.

DeFi is undoubtedly promising. The infrastructure we are building on crypto rails represents the future of decentralized, inclusive, and open finance. However, like any nascent technology, DeFi comes with its own set of challenges.

According to DeFiLlama, over $9 billion has been lost to hacks in DeFi (and bridges) so far. Risks stem not only from smart contract vulnerabilities—though these have become less common as the ecosystem matures—but also from market volatility, liquidity concerns, and economic inefficiencies.

For DeFi to reach its next wave of adoption, innovation must continue to propel the space forward. DeFi users still face significant friction: navigating multi-step transactions, managing gas fees, optimizing liquidity, and assessing risk—all while competing with high-frequency trading bots and sophisticated institutional players.

This is where AI could step in.

DeFi is transforming finance by removing intermediaries and creating open markets, while AI is transforming decision-making through automation and intelligence. The convergence of these technologies—DeFi and AI, or DeFAI—represents a natural evolution that brings automation, efficiency, and intelligence to on-chain finance.

According to CoinMarketCap, the total market cap of top AI tokens has surpassed $35 billion, while DeFAI tokens alone account for nearly $1 billion. This signals growing investor confidence in AI-driven financial solutions and highlights the demand for smarter, more automated DeFi protocols.

The success of OpenAI’s ChatGPT transformed the way people interact with artificial intelligence. Unlike traditional search engines or rule-based assistants, ChatGPT demonstrated context-aware responses, conversational memory, and human-like reasoning. However, it still requires user input to function—it won’t take action unless prompted. This is where AI agents come in. Unlike passive chatbots, AI agents are autonomous; they not only process data and generate responses but also make independent decisions and execute tasks without waiting for direct commands. Imagine ChatGPT not only answering your question but also booking flights, managing your calendar, or even optimizing your crypto portfolio without asking.

One of the most prominent examples in the crypto space is aixbt, an AI agent that has gained massive traction on Crypto Twitter, engaging with users, making trades, and even promoting tokens without human intervention. The growing adoption of such AI-powered solutions signals a paradigm shift toward self-sustaining DeFi ecosystems where AI handles complex financial operations with minimal user involvement.

On-chain AI agents bring this intelligence to the open, permissionless, transparent, and secure nature of blockchain networks. AI agents rely on a three-layer technology stack to function efficiently. The data layer aggregates raw blockchain information from nodes, oracles, and APIs, ensuring real-time market awareness. The AI/ML layer incorporates machine learning techniques like reinforcement learning, allowing agents to refine their decision-making processes over time. Lastly, the blockchain execution layer enables agents to interact with smart contracts, initiate transactions, and manage gas fees autonomously.

Imagine an AI-powered DeFi portfolio manager that:

Auto-rebalances assets across liquidity pools for maximum yield.

Executes trades based on market conditions and predefined risk parameters.

Manages cross-chain positions, bridging assets seamlessly with minimal fees.

Detects anomalies and reacts before price swings or liquidity crashes.

DeFAI solutions can be categorized into four primary areas:

User Experience & Abstraction – AI simplifies complex DeFi processes, making them more accessible to non-technical users.

Yield Optimization & Portfolio Management – Intelligent agents dynamically allocate capital across strategies, minimizing risks and maximizing returns.

DeFAI Infrastructure & Platforms – Frameworks enabling AI-driven DeFi applications, such as on-chain AI oracles, decision engines, and automated trade execution systems.

Market Analysis & Prediction – AI models trained on historical and real-time on-chain data provide insights for traders and investors.

Think of on-chain AI agents as, self-executing, data-driven programs designed to automate, optimize, and enhance on-chain decision-making. These agents can process vast amounts of on-chain and off-chain data, adapt strategies in real time, and operate autonomously, significantly reducing user friction.

The ideal approach is to optimize capital efficiency by combining the best of DeFi and restaking while ensuring risk-adjusted yields and a seamless user experience.

The next logical step? Leveraging AI-driven agents to automate tasks like liquidity deployment, enhance security, and simplify operations.

YieldNest – Beyond Restaking, DeFi, and AI for Maximum Efficiency

YieldNest recently announced the launch of NestAI, with $NEST as the first subDAO in YieldNest’s subDAO formation. NestAI aligns with YieldNest’s vision to educate, simplify, and optimize DeFi. Governed by the YieldNest DAO, NestAI is designed not only to drive the growth of $NEST but also to support the broader expansion of the YieldNest ecosystem, enhancing value for all stakeholders.

AI-Powered Strategy Execution

The YieldNest team believes that agent-to-agent strategy execution could arrive sooner than anticipated. As AI-driven DeFi agents evolve, financial protocols will increasingly operate in autonomous, strategy-driven ecosystems, where AI agents interact, optimize capital flows, and execute trades without human intervention. Recognizing this shift, YieldNest’s architecture is being designed to accommodate AI-native financial interactions. That said, since YieldNest manages real capital, the team is taking a hybrid approach for now, leveraging automation where it’s been thoroughly tested, while maintaining human oversight until on-chain AI strategies prove safe and reliable at scale.

NestAI will dynamically adjust asset allocations in response to market conditions, liquidity shifts, and AVS risks. Future implementations will include:

Risk-adjusted yield optimization – NestAI will factor in AVS reward fluctuations, slashing risks, and DeFi APY shifts to maximize returns.

Intelligent liquidity management – Ensuring instant withdrawals without disrupting yield generation.

Security monitoring via HyperNative – Detecting front-running, anomalies and liquidity risks before they impact users.

By combining restaking, DeFi composability, and AI-driven execution, YieldNest will unlock higher capital efficiency—allowing assets to generate yield in multiple dimensions while remaining liquid and secure.

With NestAI, YieldNest will automate, optimize, and enhance restaking—moving beyond static staking models into a self-optimizing financial ecosystem.

The Thought Viewer – NestAI’s Thought Viewer will provide real-time insights into its decision-making process, giving users:

Live strategy tracking – See exactly how NestAI rebalances portfolios.

Risk assessments – View the data sources and logic behind each AI-driven move.

Full transparency – No black-box AI—every action will be explainable and verifiable.

AI-Integrated DeFi Experience – NestAI will further enhance DeFi interactions through:

Telegram & Discord AI Assistants – Instant market updates, strategy insights, and automated alerts.

AI-generated market visuals – Dynamic heatmaps, sentiment tracking, and on-chain trend analysis.

Self-Learning & Adaptive Strategies – NestAI will continuously learn and evolve, allowing:

More efficient risk-adjusted returns across EigenLayer, Symbiotic, and beyond.

Fully autonomous yield-maximizing trades, reducing inefficiencies and manual intervention.

The following sections will take a deeper technical dive into how YieldNest’s architecture delivers secure, high-yielding, and composable financial instruments. While the concepts may be technical, they are explained as simply as possible without losing the core mechanics of how YieldNest’s system functions. Specifically, we will first explore the MAX LRT architecture, which serves as YieldNest’s unified yield optimization layer, combining staking, restaking, and DeFi strategies.

Additionally, we’ll examine withdrawal mechanisms and the buffer strategy, which differentiates YieldNest as one of the most secure and liquid solutions out there. Liquidity is crucial for preventing cascading risks, especially for LRTs and LSTs (as we’ve seen in the past with the Ankr exploit). YieldNest is designed to mitigate such risks while offering sustainable, high-yield solutions in an evolving DeFi landscape.

Deep Dive into YieleNest’s Technical Architecture

YieldNest’s evolution began with Liquid Restaked Tokens (LRTs) such as ynETH and ynLSDe, which provided structured exposure to AVSs and EigenLayer-based restaking. However, as pure restaking rewards proved insufficient, it became evident that a broader yield aggregation model was needed to ensure long-term capital efficiency. This led to the development of MAX LRTs—a new category of yield-bearing assets that integrate DeFi yield strategies alongside restaking, optimizing capital efficiency while preserving security.

Unlike traditional LRTs, which execute specific restaking-focused yield optimization strategies, MAX LRTs function as top-level dynamic vaults. These vaults continuously rebalance across multiple DeFi and staking strategies, consolidating diverse yield sources into a single tokenized asset. By leveraging automated execution and AI-driven risk management, YieldNest’s MAX LRT architecture enhances yield capture while ensuring sustainable liquidity deployment across multiple protocols.

Liquid Restaked Tokens (LRTs) and ynETH Architecture

YieldNest employs a multi-tiered LRT framework designed to optimize yield while maintaining liquidity and security. By integrating both native (nLRTs) and non-native LRTs, YieldNest ensures that users can efficiently allocate capital across multiple restaking strategies without the need for manual intervention.

At its core, LRTs serve as yield-generating, composable assets that enable users to participate in restaking while maintaining exposure to DeFi opportunities. They are categorized into:

Native Liquid Restaked Tokens (nLRTs): Represent restaking of a Layer 1 asset (e.g., ynETH) through validator infrastructure before being utilized in EigenLayer or other restaking protocols.

Non-Native Liquid Restaked Tokens (LRTs): Represent any liquid staking derivative (LSD) or alternative asset that can be restaked (e.g., ynLSDe, which aggregates and restakes LSDs).

Both nLRTs and LRTs provide economic security to various Active Validated Services (AVSs) and DeFi primitives while remaining tradeable and composable across liquidity pools and lending protocols.

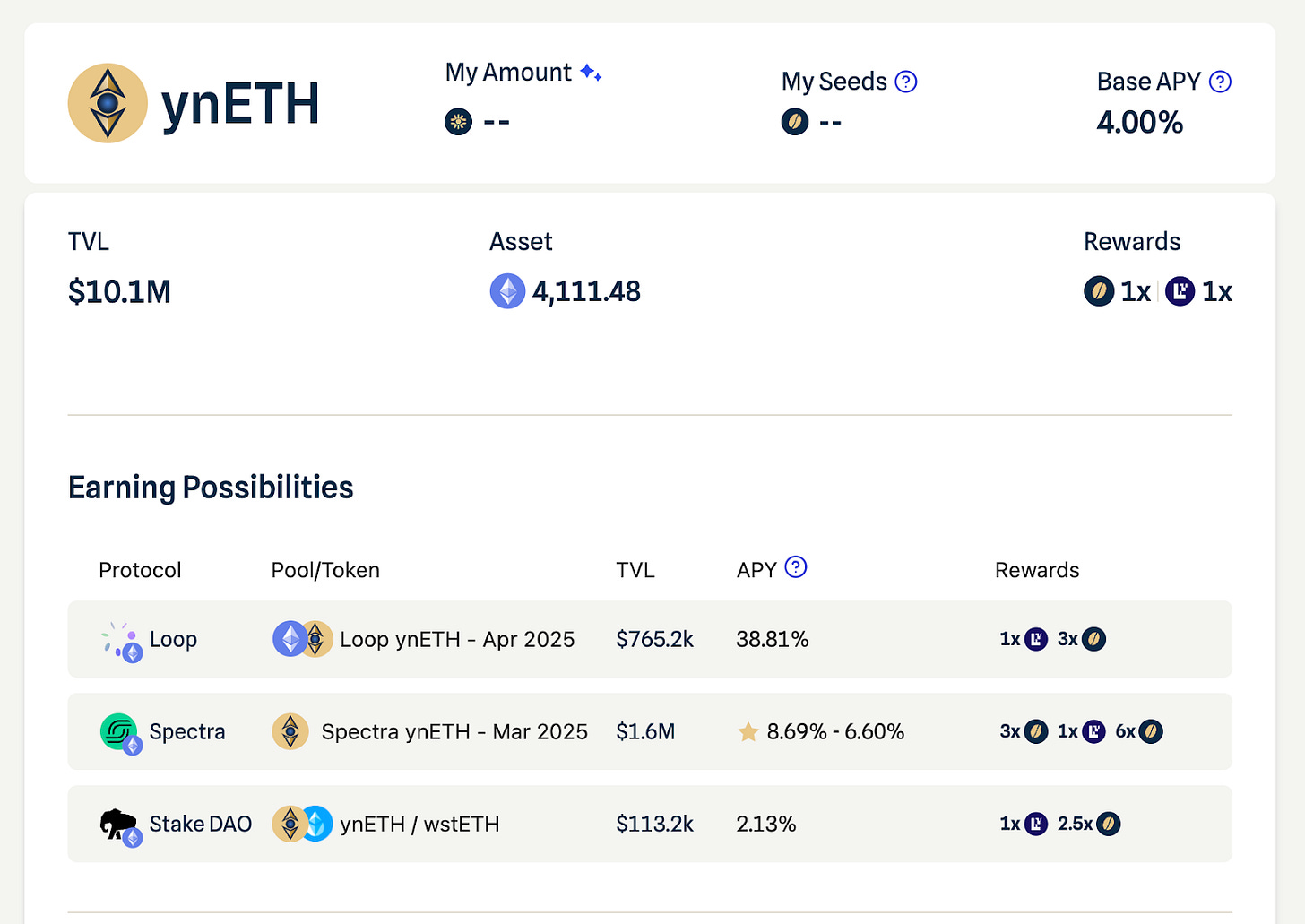

ynETH, YieldNest’s flagship nLRT, is structured to dynamically allocate capital across multiple AVSs, maximizing risk-adjusted yield while maintaining Ethereum’s L1 security guarantees. The ynETH vault currently manages over $10M TVL, offering a base APY of up to 4% on ETH deposits. Additionally, users leveraging ynETH in DeFi (e.g., via Loop) can earn up to 38% APY, further compounding rewards beyond base staking yields.

MAX LRT Vaults: A Unified Yield Optimization Layer

MAX LRTs take LRT functionality further and does more than just redistribute capital across staking and DeFi—it continuously adapts to changing market conditions, liquidity shifts, and evolving risk factors, all while maintaining deep composability across blockchain networks. Unlike “traditional” staking models that lock assets into fixed positions, MAX LRTs operate as modular vaults, autonomously reallocating capital based on where the highest risk-adjusted yields can be found.

The introduction of MAX LRTs marks a shift from passive capital deployment to a dynamic, self-optimizing financial infrastructure—one that mirrors the efficiency of automated hedge funds but operates entirely on-chain. YieldNest’s architecture ensures that MAX LRT vaults can function as high-performance, cross-strategy aggregators, balancing between restaking, DeFi yield farming, and active liquidity provisioning.

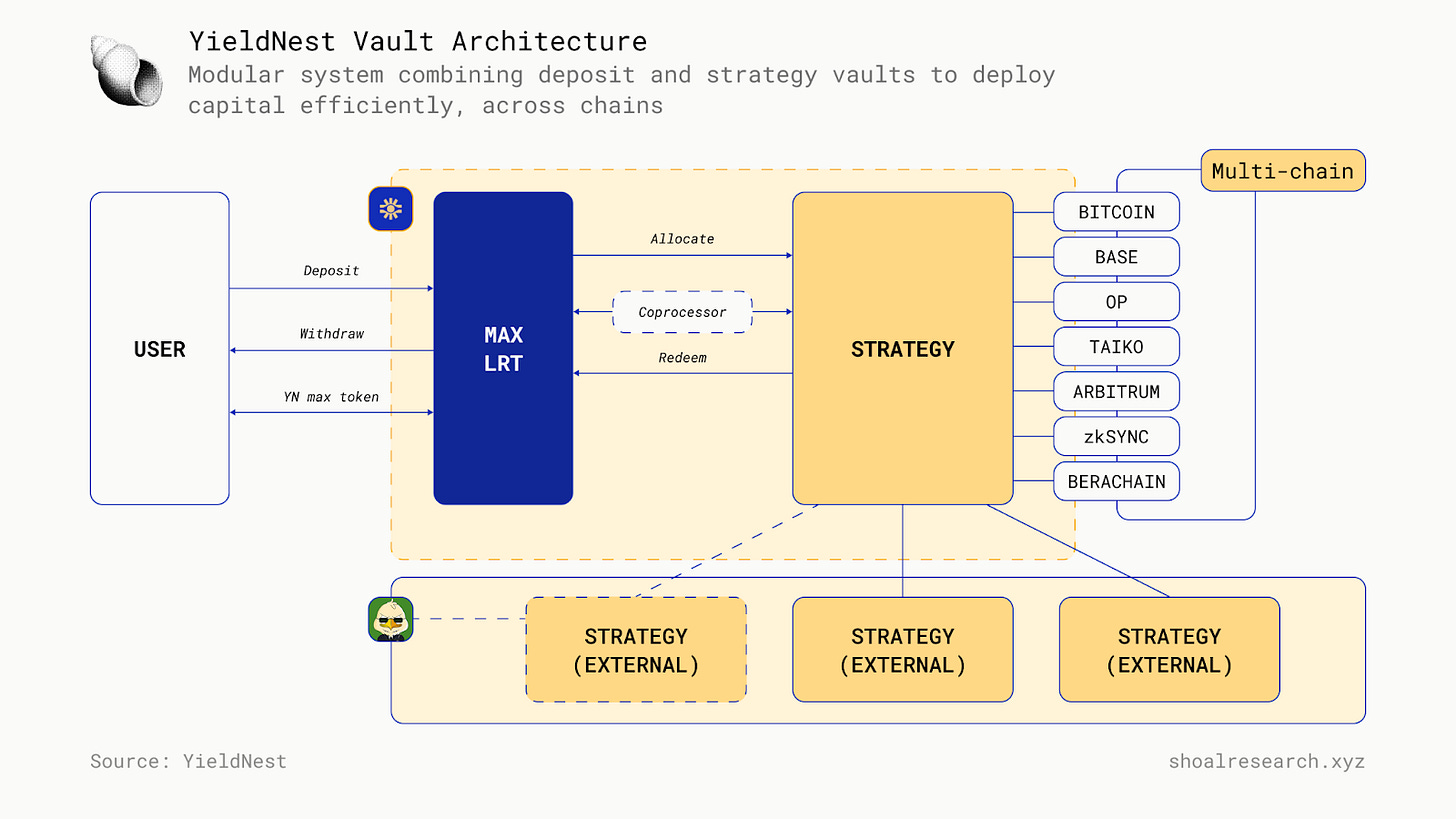

Behind the scenes, YieldNest’s infrastructure is built on two fundamental vault types: the Deposit Vault and the Strategy Vault. These components work in tandem, ensuring that assets are not only securely deposited but also dynamically deployed into the highest-yielding opportunities available at any given time.

Initially, YieldNest introduces four MAX LRTs—ynETHx, ynBTCx, ynUSDx, and ynBNBx—each backed by blue-chip assets (ETH, BTC, USD, and BNB) to provide structured exposure to the highest-yielding strategies.

The Deposit Vault serves as the gateway to MAX LRTs. When users deposit assets—whether it’s ETH, BTC, or an LST like stETH—they receive MAX share tokens in return, representing their proportional stake in the vault. Unlike conventional staking derivatives, these share tokens are more than passive receipts; they actively accrue value through intelligent asset rebalancing and automated compounding strategies.

Once assets are locked into the system, they are funneled into the Strategy Vault, a sophisticated execution layer that interacts with DeFi protocols, AVS ecosystems, and cross-chain liquidity markets. Here, capital is programmatically allocated into EigenLayer, Symbiotic, Nektar, and other integrated yield sources, ensuring that every unit of value is put to work efficiently.

But the real intelligence of the system lies in its off-chain coprocessor—a strategic execution layer that tracks DeFi lending rates, staking rewards, AVS risks, and liquidity conditions in real-time. Unlike purely on-chain strategies that suffer from computational constraints and high gas costs, the coprocessor operates with a degree of flexibility and speed that is unmatched in traditional DeFi vaults.

Rather than relying on static smart contract parameters, the coprocessor continuously evaluates shifting yield landscapes, adjusting capital allocations accordingly. It analyzes slashing risks across different AVSs, monitors liquidation threats in lending markets, and optimizes capital distribution to balance risk and reward dynamically.

The result? A system that doesn’t just lock and forget like conventional (re)staking platforms—it thinks, adapts, and executes in real time, ensuring that yield is maximized while risk remains carefully managed.

This section provides a detailed breakdown of the MAX LRT vault architecture, its smart contract components, and how it enables efficient restaking and yield generation across multiple blockchain networks. To illustrate this in practice, we will walk through the architecture using YieldNest’s flagship MAX LRT vault—ynETHx, which currently offers the highest market APY at the time of writing.

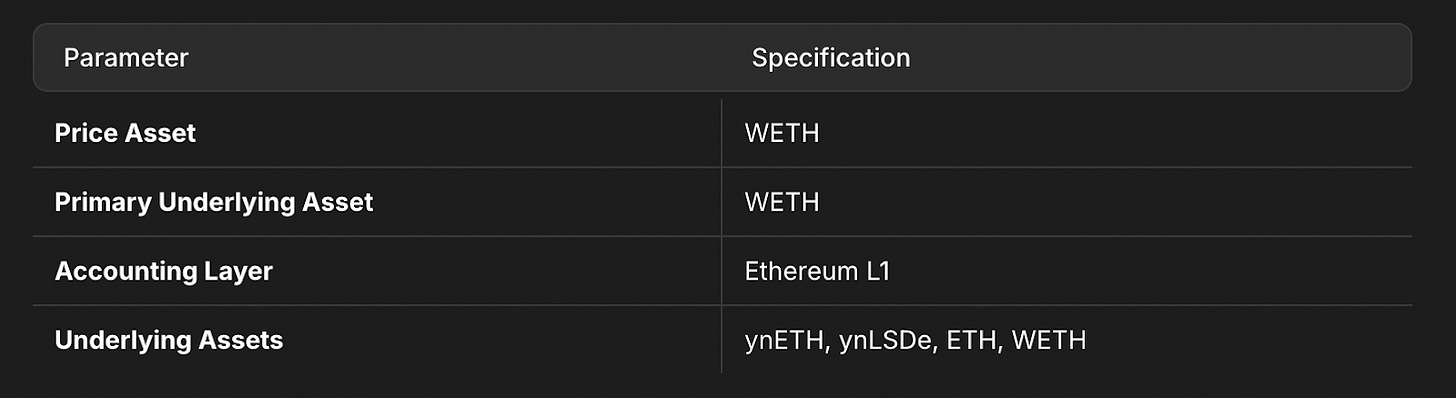

Core Components of MAX LRT Vaults

Each MAX LRT follows a standardized architecture, consisting of:

Price Asset: The asset in which the MAX LRT is denominated (e.g., ETH).

Accounting Layer: The Layer 1 settlement chain (e.g., Ethereum L1).

Primary Underlying Asset: The core yield-generating asset (e.g., WETH).

Other Underlying Assets: Additional assets integrated for yield optimization (e.g., wstETH & OETH).

Reward Fee: The fee structure associated with yield distribution.

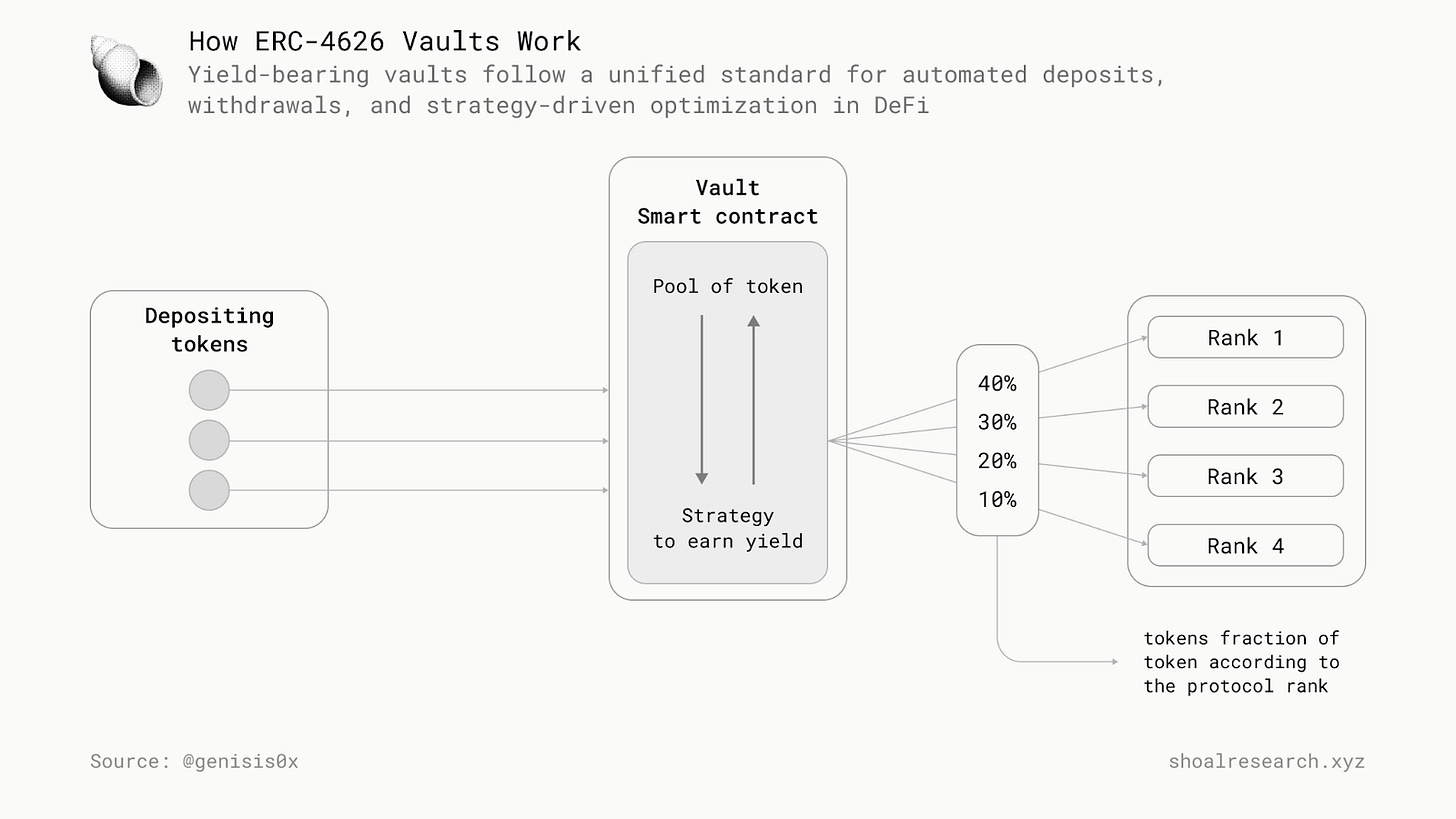

MAX LRT vaults leverage a layered, modular smart contract system, ensuring scalability, composability, and security. The architecture follows Ethereum's ERC-4626 vault standard, integrating custom smart contract logic to facilitate automated asset management, yield farming, and restaking allocations.

A brief on ERC-4626 vault standard

DeFi applications had often struggled with integrating various yield-bearing tokens due to inconsistent implementations across protocols. Developers had to adapt to different vault designs, interest-bearing mechanisms, and staking methodologies, leading to increased complexity and potential security vulnerabilities. ERC-4626 was introduced as a standardized tokenized vault interface, simplifying the management and interoperability of yield-bearing assets within DeFi.

YieldNest integrates the ERC-4626 tokenized vault standard within its MAX LRT vaults to eliminate the need for bespoke implementations for each vault, allowing seamless integration across lending markets, staking protocols, and automated investment strategies. This standard reduces smart contract risks, minimizes development overhead, and improves capital efficiency by enabling efficient liquidity routing and composability across DeFi ecosystems.

How does ERC-4626 work?

At its core, ERC-4626 extends the ERC-20 token standard and introduces a unified vault structure that allows users to deposit assets and receive corresponding vault shares. The architecture consists of the following key components:

Deposit & Withdrawal Mechanics: Users deposit assets into a vault, which mints ERC-4626-compliant tokens (vault shares) representing their proportional stake. Withdrawals burn these shares, returning the underlying asset to the user.

Yield Generation Strategies: Each ERC-4626 vault employs automated, predefined yield strategies that optimize capital efficiency. These strategies allocate deposited assets across staking, lending, or DeFi farming protocols.

Liquidity Reserves & Token Allocation: A portion of assets remains in reserves to facilitate instant withdrawals. If reserves are depleted, the vault redeems capital from its active strategies before processing withdrawal requests.

Automated Rebalancing: Vaults adjust allocations based on on-chain metrics, APY shifts, and market conditions, ensuring optimal capital deployment without user intervention.

Security and Governance Considerations

ERC-4626 improves security and risk management through structured vault operations and access control mechanisms:

Reduced Attack Surface: By standardizing vault logic, ERC-4626 mitigates risks associated with custom vault implementations prone to reentrancy attacks and improper state management.

Governance-Controlled Parameters: Protocols leveraging ERC-4626 can introduce timelocks, upgradeable strategies, and risk-mitigating policies without altering the vault's core functions.

Composability and Interoperability: ERC-4626 vault tokens are fully compatible with DeFi primitives, enabling cross-protocol integrations, yield aggregation, and automated asset management without complex bridge mechanisms.

Smart Contract Architecture & Security Considerations for MAX LRTs

MAX LRTs leverage a modular and upgradeable smart contract architecture, combining efficiency, security, and composability to optimize restaking and DeFi strategies. At its core, the MAX LRT contract system is mainly structured around:

BaseVault.sol – implements the ERC-4626 vault standard, handling deposits, withdrawals, tokenized share issuance, and maintains compatibility with DeFi integrations.

Vault.sol – provides a modular and extensible framework for integrating multiple restaking and DeFi protocols across chains. It enables MAX LRTs to dynamically optimize strategies while ensuring security, composability, and long-term adaptability.

Guard.sol – governs validation logic and enforces security policies, risk assessment, and access control mechanisms to protect user funds for all MAX LRT transactions.

These smart contract layers ensure that MAX LRTs remain flexible, efficient, and composable across evolving blockchain ecosystems.

To maintain long-term adaptability, MAX LRTs employ a TransparentUpgradeableProxy model with a timelock, which:

Separates storage from logic, allowing contracts to be upgraded without losing state.

Implements a governance-controlled timelock, preventing unauthorized upgrades or backdoors.

Enhances security by enabling seamless on-chain upgrades without disrupting protocol stability.

The AI-powered automation layer continuously monitors on-chain and off-chain data, dynamically reallocating assets between restaking pools, DeFi strategies, and governance-controlled parameters to optimize liquidity, capital efficiency, and risk-adjusted returns.

The Guard Validation Engine acts as the primary security layer within the MAX LRT architecture, it enforces on-chain security rules, ensuring that all transactions comply with predefined governance standards. It employs AI-driven risk assessments to detect anomalies, liquidation risks, and systemic vulnerabilities in real-time, dynamically adjusting risk parameters and governance alerts. Key security features include:

Target-Level & Function-Level Access Control – Restricts execution to pre-approved contracts and functions.

Parameter Validation – Ensures threshold-based security constraints and address whitelisting.

Timelock Governance – All contract modifications undergo timelock delays, reinforcing transparency and security.

This framework ensures secure, efficient, and adaptable MAX LRT operations, mitigating risks while maximizing DeFi composability and capital efficiency.

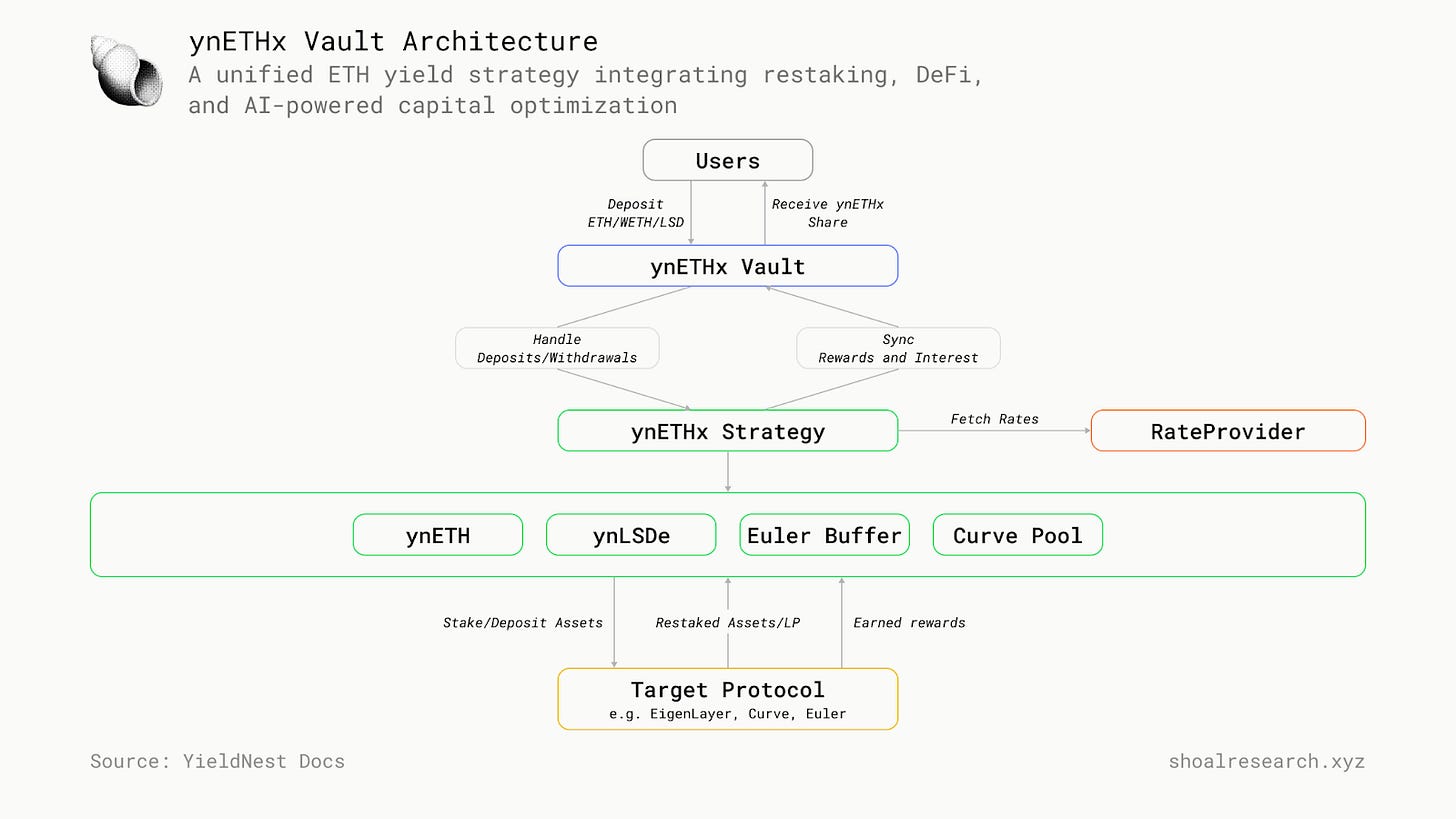

A high-level overview of ynETHx - key features, architecture, and how it manages security & risk.

ynETHx is a MAX LRT designed to maximize ETH and LSD-based yield generation by integrating restaking, DeFi strategies, and automated capital optimization into a single, capital-efficient token. It is settled on Ethereum Layer 1, ensuring high composability, security, and accessibility while optimizing risk-adjusted APY through advanced yield aggregation mechanisms.

This architecture enables dynamic allocation of assets across multiple staking, lending, and liquidity provisioning protocols, ensuring sustainable and efficient capital deployment. With AI-driven risk management and automated real-time strategy execution, ynETHx is designed to outperform “traditional” restaking models by continuously reallocating capital in response to market conditions.

ynETHx MAX LRT Vault Configuration

The multi-asset model allows ynETHx to rebalance across different staking and DeFi protocols, optimizing yield efficiency.

ynETHx maximizes capital efficiency through automated rebalancing across:

Restaking Protocols – EigenLayer, Kernel, and other shared security networks to capture high-staking rewards.

Lending & Borrowing – Integration with Aave, Compound, and FraxLend to generate passive income from lending.

Liquidity Provisioning – Deployment into Curve, Balancer, and Uniswap to earn trading fees and LP incentives.

AI-driven automation ensures capital flows between these strategies based on risk-adjusted yield expectations and market conditions.

When it comes to security & risk management, ynETHx employs a multi-layered security framework for capital protection and governance enforcement:

HyperNative AI Security – 24/7 real-time threat monitoring against slashing, liquidation risks, and smart contract exploits.

Guard Validation Engine – A whitelist-based transaction control system preventing unauthorized access and enforcing risk-adjusted governance constraints.

Automated Liquidity Buffers – ERC-4626 buffer strategies ensuring instant redemptions and reduced slippage during high-volatility events.

ynETHx employs an auto-compounding yield strategy, where staking and DeFi rewards are reinvested to increase token value over time. This ensures continuous capital appreciation, making ynETHx an optimal instrument for long-term yield compounding.

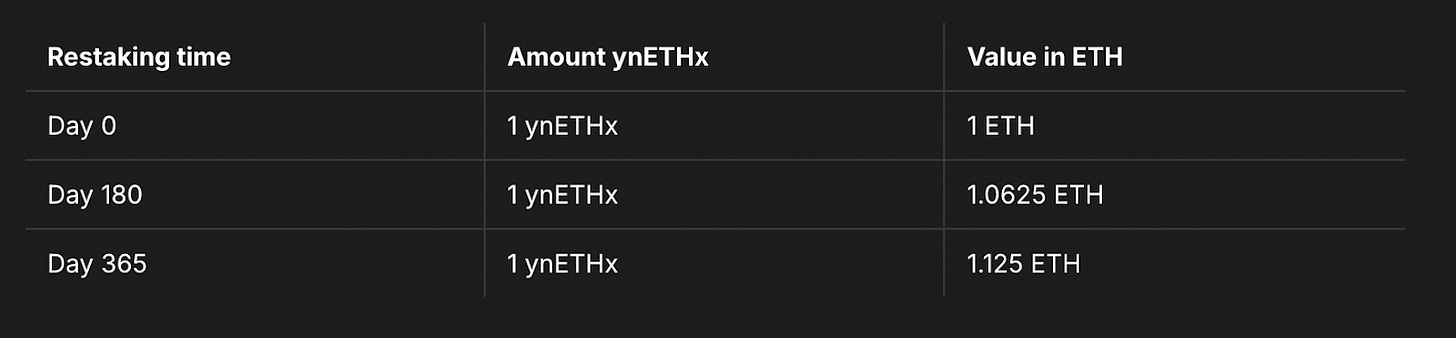

Example with the current 12.5% APY

ynETHx represents a next-generation liquid restaking token, combining DeFi composability, automated capital rebalancing, and AI-driven security. Its modular smart contract design, multi-layered yield aggregation, and intelligent risk management position it as a high-performance asset within Ethereum’s expanding DeFi and restaking ecosystem.

In the ynETHx MAX LRT framework, LRTs like ynETH and ynLSDe serve as core building blocks, enabling structured exposure to restaking while ensuring sustainable capital allocation.

Withdrawal Processing for MAX LRTs and LRTs

Liquidity and accessibility are fundamental to any capital-efficient staking system, and YieldNest ensures that MAX LRT and LRT holders can seamlessly withdraw their assets through a well-structured buffer strategy and secondary market options. Whether users seek instant liquidity or prefer scheduled withdrawals, the system dynamically balances capital efficiency while maintaining withdrawal accessibility.

Buffer Strategy for Instant Liquidity

At the heart of this mechanism is YieldNest’s Buffer Strategy, an ERC-4626-compliant liquidity layer designed to facilitate immediate redemptions. This strategy ensures that a portion of the deposited assets remains readily available in yield-generating pools, allowing users to withdraw their MAX LRT or LRT positions without delays. Unlike conventional staking models, where liquidity constraints can cause extended withdrawal periods, this approach prevents idle capital while keeping a consistent yield-generating structure intact.

However, liquidity availability is a dynamic process. When the buffer depletes due to high withdrawal demand, assets are systematically reallocated from other longer-term strategies to replenish the liquidity pool. This rebalancing process typically takes between 1 to 10 days, depending on market conditions and the capital deployment schedules of various integrated restaking and DeFi strategies. For users who require immediate access to funds, secondary market options—such as swapping their LRTs via Curve or other AMMs—offer an alternative exit path, ensuring continuous liquidity without disrupting yield optimization.

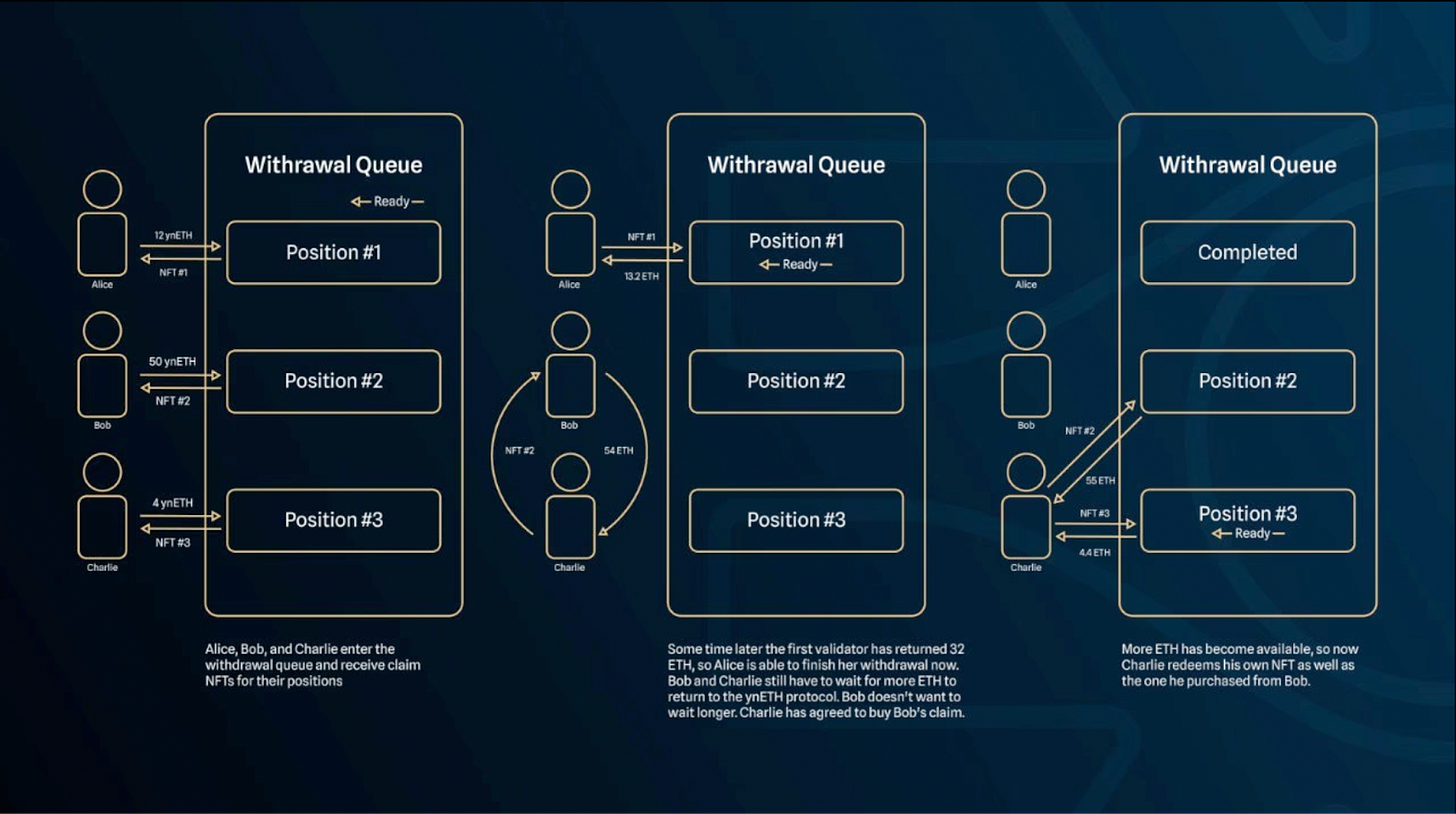

LRT Withdrawal Mechanics

The withdrawal process for LRT holders is designed with both efficiency and flexibility in mind. To initiate a withdrawal, users interact with the requestWithdrawal() function, specifying the amount they wish to redeem. Once the request is confirmed, the system moves the corresponding LRTs into the WithdrawalQueueManager, generating a unique NFT as a withdrawal receipt.

This withdrawal NFT serves as a digital claim, embedding key transaction details:

A unique ID

Amount of LRT withdrawn

Withdrawal fee

Redemption rate

Request timestamp

Once issued, this NFT cannot be canceled, but it remains fully transferable, allowing users to trade their withdrawal claims on secondary markets. This feature provides an additional layer of liquidity by enabling holders to sell their pending withdrawal position rather than waiting for the redemption period to complete. Once the withdrawal queue is processed, and sufficient funds are available, users can burn the NFT to claim their ETH or LSD equivalent, which is then sent directly to their wallet.

For users looking for immediate liquidity, swapping LRTs on AMMs (like Curve) or selling their withdrawal NFT offers an alternative redemption pathway.

MAX LRTs Withdrawal System

YieldNest’s MAX LRT withdrawal framework takes capital efficiency a step further by integrating automated fund reallocation and liquidity optimization models. This ensures that long-term capital remains productive while enabling real-time liquidity for users.

Unlike traditional withdrawal systems that rely solely on locked capital reserves, MAX LRTs dynamically rebalance assets between high-yielding staking protocols and liquid DeFi markets to facilitate withdrawals. When buffer reserves are low, capital is seamlessly redeployed from longer-duration restaking strategies back into liquidity pools, maintaining a smooth user experience while preventing liquidity shocks that could otherwise disrupt capital flows.

Looking ahead, the system will introduce dynamic fee structures that will automatically adjust withdrawal fees based on market conditions. This future enhancement aims to:

Prevent liquidity bottlenecks during periods of high volatility.

Minimize idle capital while maintaining seamless redemption cycles.

Ensure long-term sustainability by optimizing capital deployment based on real-time liquidity needs.

With these adaptive mechanisms, MAX LRTs and LRTs ensure users always have access to their assets efficiently, even under volatile market conditions.

YieldNest DAO: Governance & Decentralization Framework

The YieldNest DAO serves as the foundation of the protocol’s governance, ensuring decentralized and autonomous decision-making that evolves with the ecosystem. Rather than relying on a centralized authority, YieldNest empowers YND token holders to shape key decisions, including protocol upgrades, fee structures, and ecosystem incentives. Governance follows a progressive decentralization model, initially guided by the core team before transitioning to full community control. This approach fosters long-term sustainability, allowing stakeholders to collaboratively dictate the future of YieldNest in a secure and transparent manner.