An Intro to LSTfi

Intro to LSTfi, growing trends in the LST space, and protocols to track

Intro

Ethereum staking, or ETH staking, has ignited a revolutionary shift, establishing a native yield within the Ethereum ecosystem that various protocols can utilize for a diverse range of applications. Over the past year, significant advancements have brought us to our present state in ETH staking, LSTs (liquid staking tokens), and LSTFi Liquid Staking Decentralized Finance).

The Shanghai Ethereum upgrade, which enabled staked ETH withdrawals, and the ETH2 merge, moving Ethereum from proof of work to proof of stake, were crucial upgrades that laid the groundwork for the long-anticipated reality of LSTFi. Both upgrades are known together as Shapella. Before introducing the Shanghai upgrade, a wave of developers began hinting at potential strategies to employ existing DeFi (decentralized finance) primitives, intending to maximize yield opportunities for LSTs. LSTs, tokens that symbolize a proportion of already staked ETH, typically trade at or near the parity value of ETH. They offer the user the benefit of retaining a claim on yield while also preserving liquidity. In essence, users can stake while also being able to use the staked position, which is typically locked until the user withdraws.

At its core, LSTFi, or LST DeFi, represents DeFi protocols that utilize LSTs to enhance yields, democratize staking service providers, and even fulfill philanthropic objectives by redirecting staking yield towards grants and developmental funding. This multifaceted capability of LSTFi is yet another testament to the dynamic evolution and potential of the Ethereum blockchain ecosystem. Let's explore LSTFi, and coax out the embedded opportunities on the horizon.

Before Diving in lets understand some key terms:

LST/LSD: Liquid staking tokens (formerly Liquid staking Derivatives)

Ex. stETH issued by Lido

LST Providers: Protocols and companies that issue LSTs

LSTFi: Liquid staking defi protocols, Ex. Lybra protocol issuing eUSD

LST Protocol Dominance

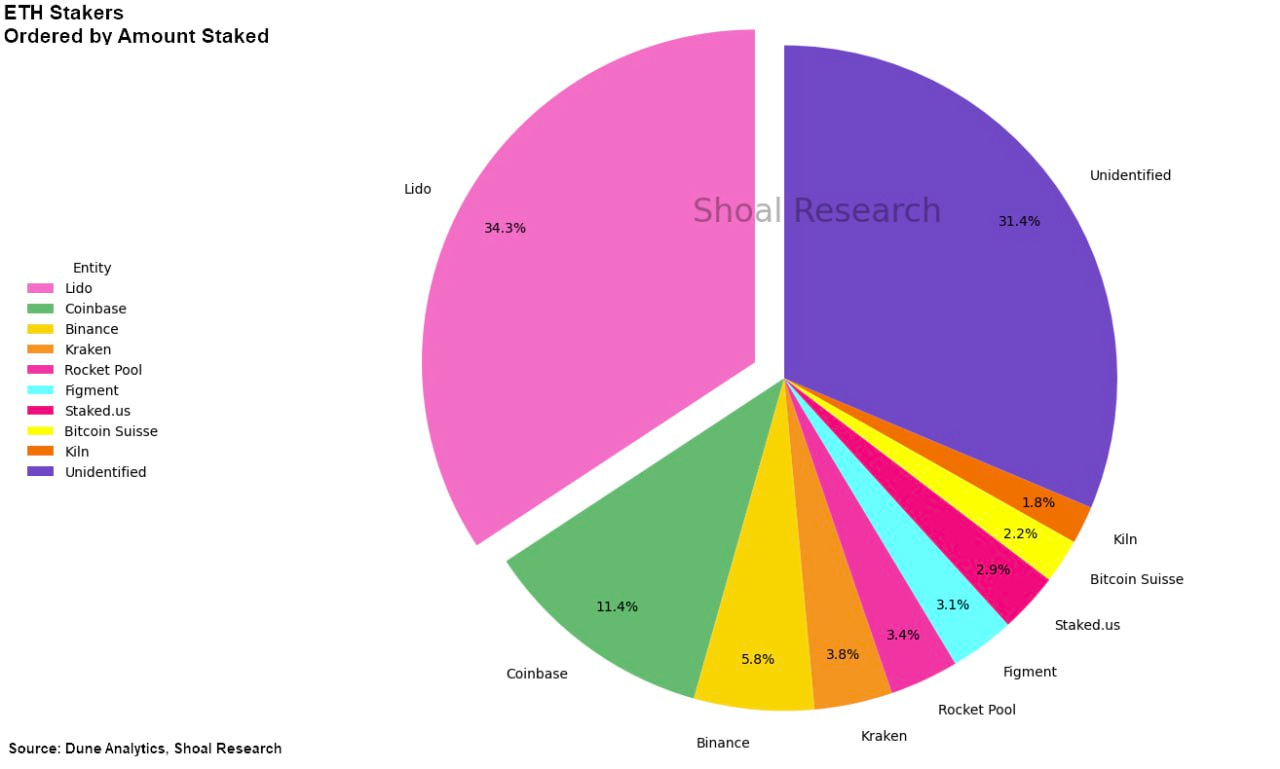

LSTs account for over 40% of all staked ETH. Staked ETH accounts include centralized exchanges, LST providers, solo stakers and other entities that deposit ETH into the staking contract.

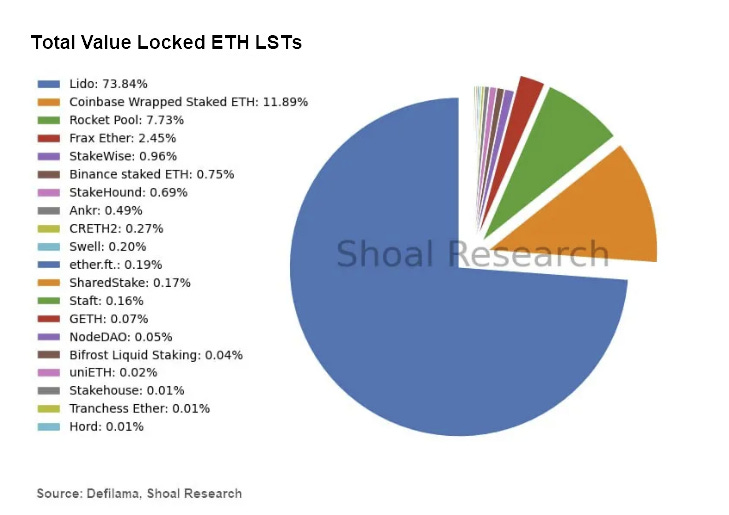

Of the LST providers, Lido, Coinbase, and Rocketpool lead the liquid staking market with a combined share over 90%. Notably, sfrxETH has experienced substantial growth in the past week, indicating increasing popularity. sfrxETH, while lagging at 11%, still represents more than 10% of all sfrxETH used in LSTFi.

Currently, only 15.6% of all ETH is being staked. Other top staking chains such as Cardano, Solana, and Aptos have over 60% of tokens in circulation, vastly less than competing proof of stake blockchains. Not only do we see a significant opportunity for LSTFi, but even LSTs have substantial market potential. Compared to other chains, we may expect ETH staking to accelerate to at least 30% in the near future.

The Rise of LSTFi Projects After Ethereum's Shapella Upgrade

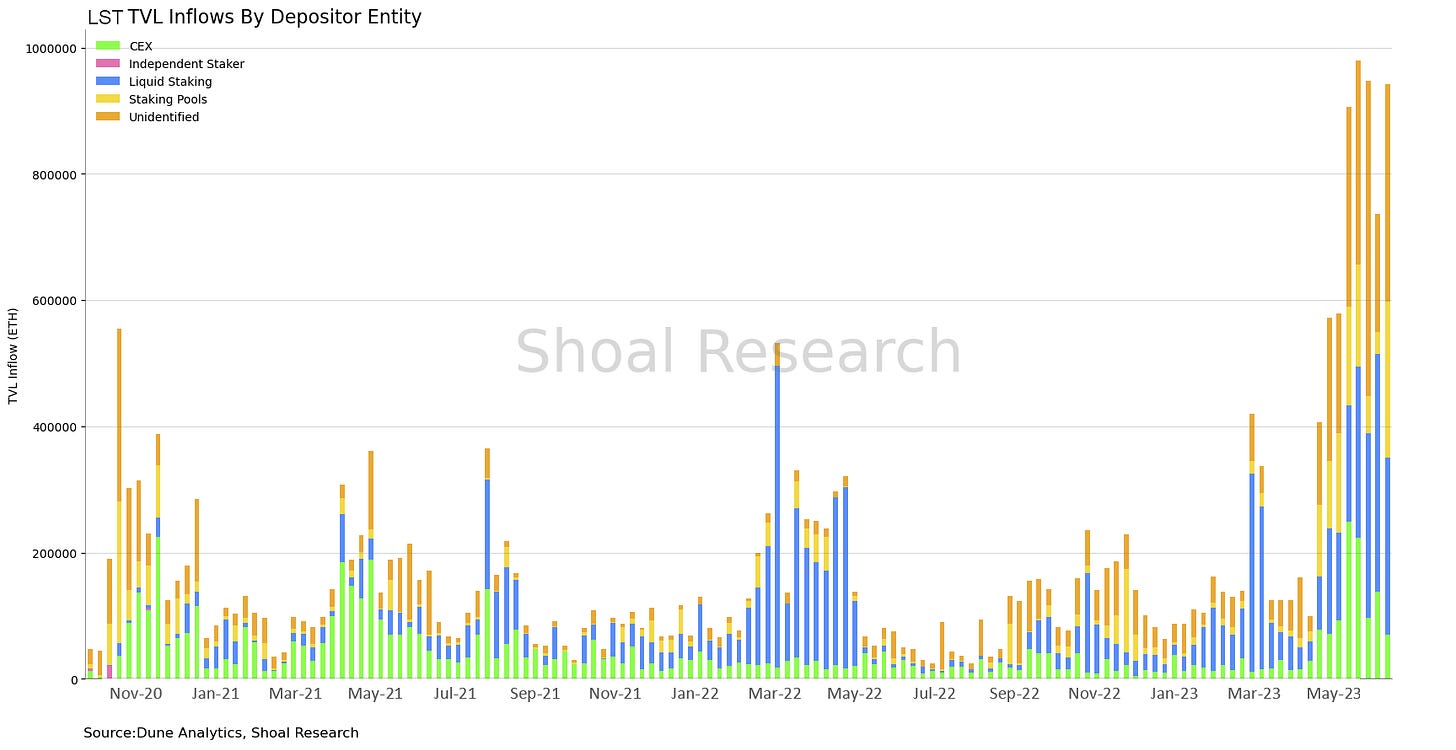

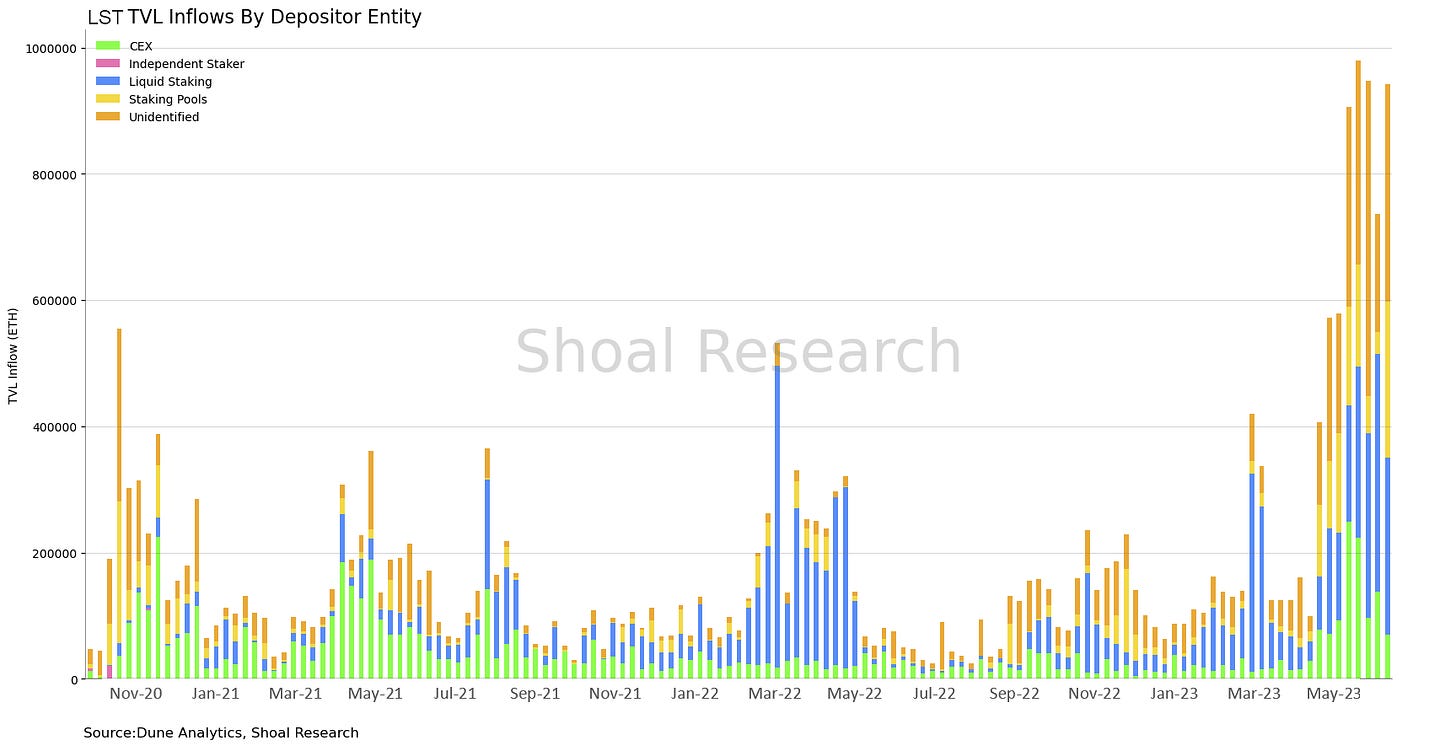

After the Shapella upgrade, there has been a surge in ether (ETH) deposits for staking, reaching the highest level since the upgrade. Over 200,000 ETH have been deposited to the network since the start of the week, pushing the amount of ether locked for staking purposes to over 19 million tokens - about 15% of the total circulating supply. This has catalyzed a boom in new LST/LSTFi projects.

With StETH (Lido staked ETH), cbETH (Coinbase staked ETH), and rETH (rocketpool staked ETH) commanding over 90% of the LST+LSTFi market - who can create meaningful value in the vertical? Some of the top LSTFi projects, Lybra Finance, unshETH, Pendle, 0xAcid, and Gravita Finance, offer unique features that could give even the liquid staking a double take in their direction.

The figure below shows the explosion of ETH staking deposits post-Shanghai.

LST and LSTFi Ecosystem

As a refresher, LSTFi refers to a set of protocols that leverage LSTs to conduct financial operations within the DeFi ecosystem. LSTFi is perhaps one of the most underdeveloped and underexplored areas in all of crypto, given the total value locked and opportunities on the horizon. Towards the end of 2022 LSTFi projects have struggled mightily to attract liquidity and have seemingly been forgotten. However, since the Shanghai upgrade, there has been a surge in focus on these protocols now that the withdrawal risk on staked ETH has been mitigated.

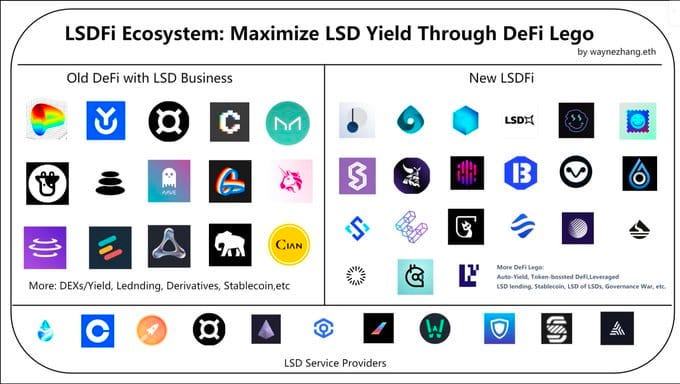

LST providers like Lido and Coinbase have laid the bedrock for LSTFi, providing the foundational building blocks for developing more advanced and innovative products. The principle of composability in DeFi, often likened to 'financial legos', allows protocols to leverage the features built by others without the need to reconstruct the entire system. LSTs, with their increasing popularity, have emerged as the dominant category in terms of Total Value Locked (TVL), and projects like Lido have been at the forefront of this trend. LSTs now play a pivotal role in propelling the overall expansion of the DeFi ecosystem. Within the LST landscape, LSTFi can be broken down into a few verticles: LST Service Providers, Old DeFi with LST Business, and New LSTFi seen in the protocols Fig below;

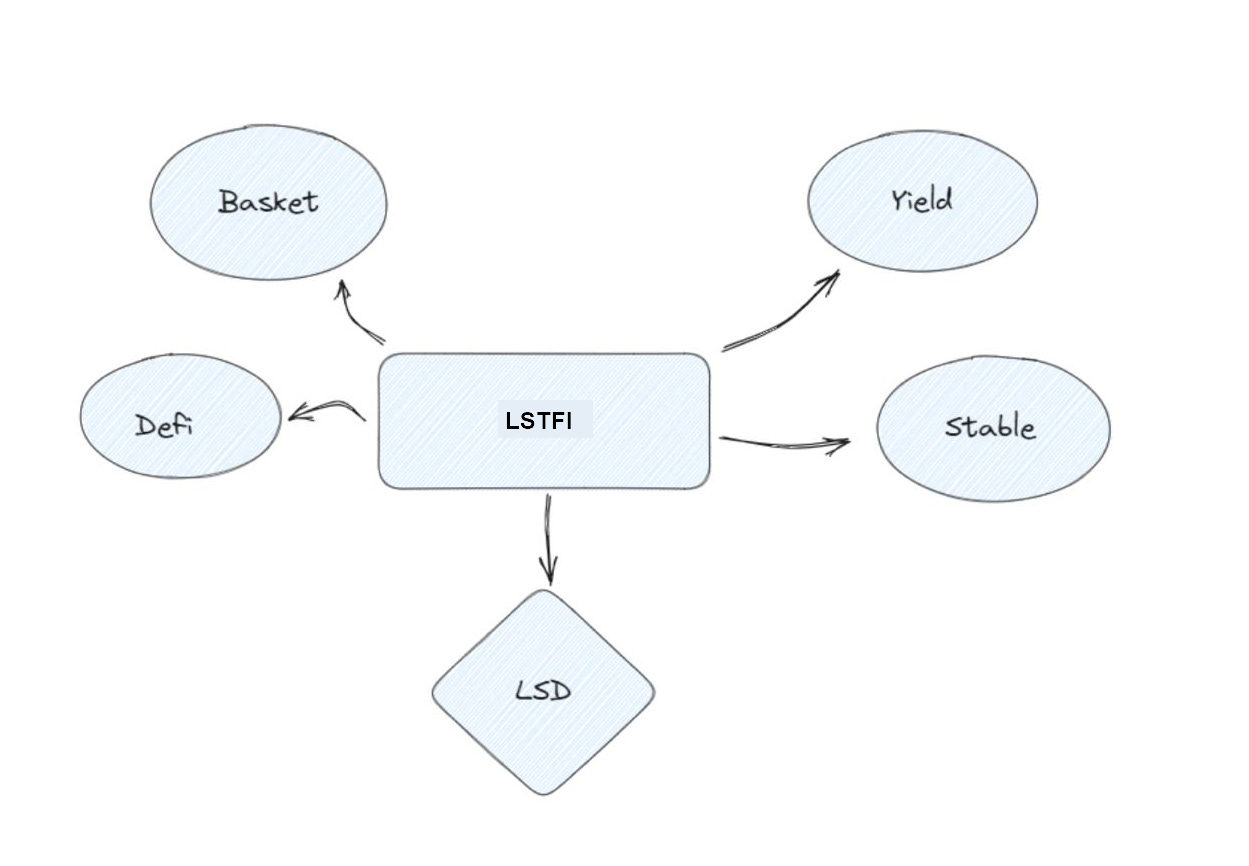

LSTFi 2023 Narrative

If you are an active participant on Crypto Twitter, you might have caught the slogan, LSTFi Summer, referring to the percolating narrative around LSTFi. LSTs had a significant run-up earlier in the year, with LSTs such as LDO surging over 2x in just a few months.

A perfect storm is generated within the sector given the latest surge and trend around LSTs has shined enhanced visibility on LSTFi, coupled with increased staking rewards, access to liquidity, and capital efficiency. By harnessing the native blockchain yield protocols, there is an open landscape for innovation.

Fig below

Market Share Breakdown & Comparison

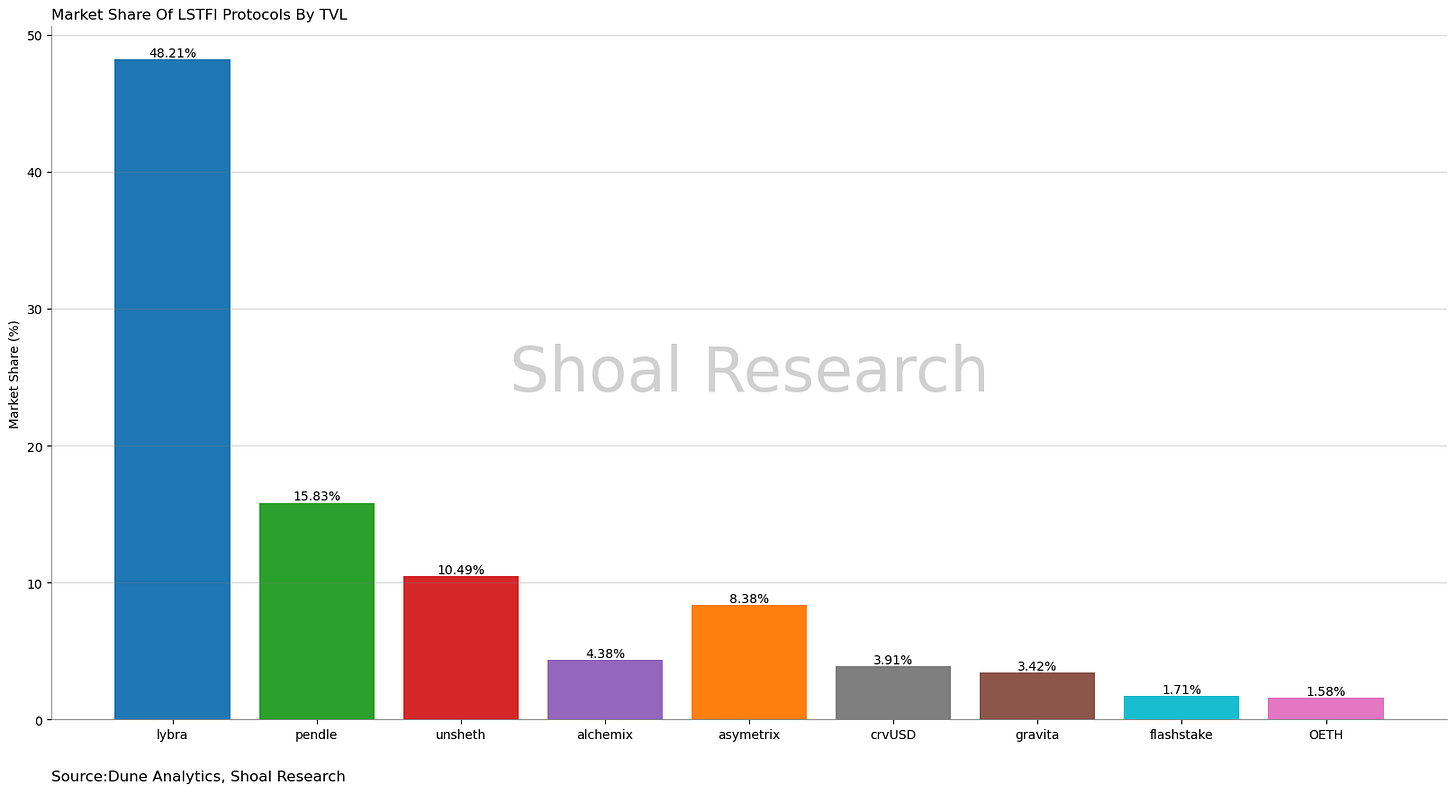

In the highly competitive LSTFi market, Lybra Finance stands out, securing over 45% of the Total Value Locked (TVL) within just a month. Alongside Lybra's dominant position, other players like Flashstake, Curve Finance, and OriginDeFi have shown consistent growth, expanding their influence post the initial wave of adoption.

Significant contributions to utilizing LST tokens also come from several renowned LSTFi protocols, including Pendle Finance, Unsheth, and Alchemix Finance. Lybra Finance, with its high TVL, continues to lead the LSTFi landscape, significantly outperforming other protocols in acquiring liquidity

.

Source Dune

However, the current total value locked (TVL) in these protocols is over $400m which represents less than 2% of the $16 billion worth of LSTs in circulation. This indicates considerable potential for growth and wider adoption within the LST ecosystem materializing the LSTFi Summer narrative!

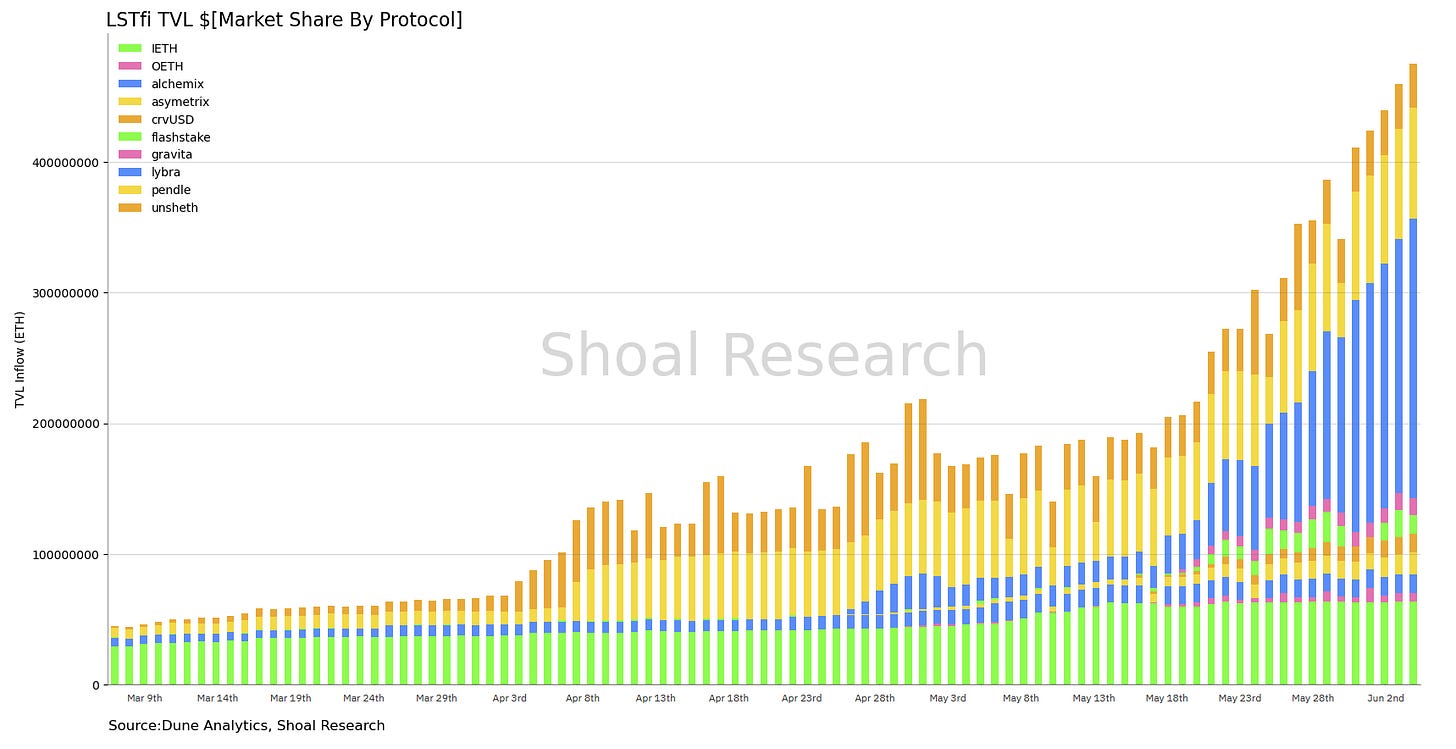

TVL and Netflows

Nearly all the major LSTFi protocols witnessed significant increases in their TVL over the past few months. Among the notable protocols, Unsheth and Pendle Finance stood out as early movers, attracting substantial inflows due to their unique offerings,

Fig below

LSTFi Wars: The War of Market Share

With the increased ease for users to switch between Liquid Staking tokens (LST), new competition arises among protocols to attract and retain stakers. Two major factors will drive this competition:

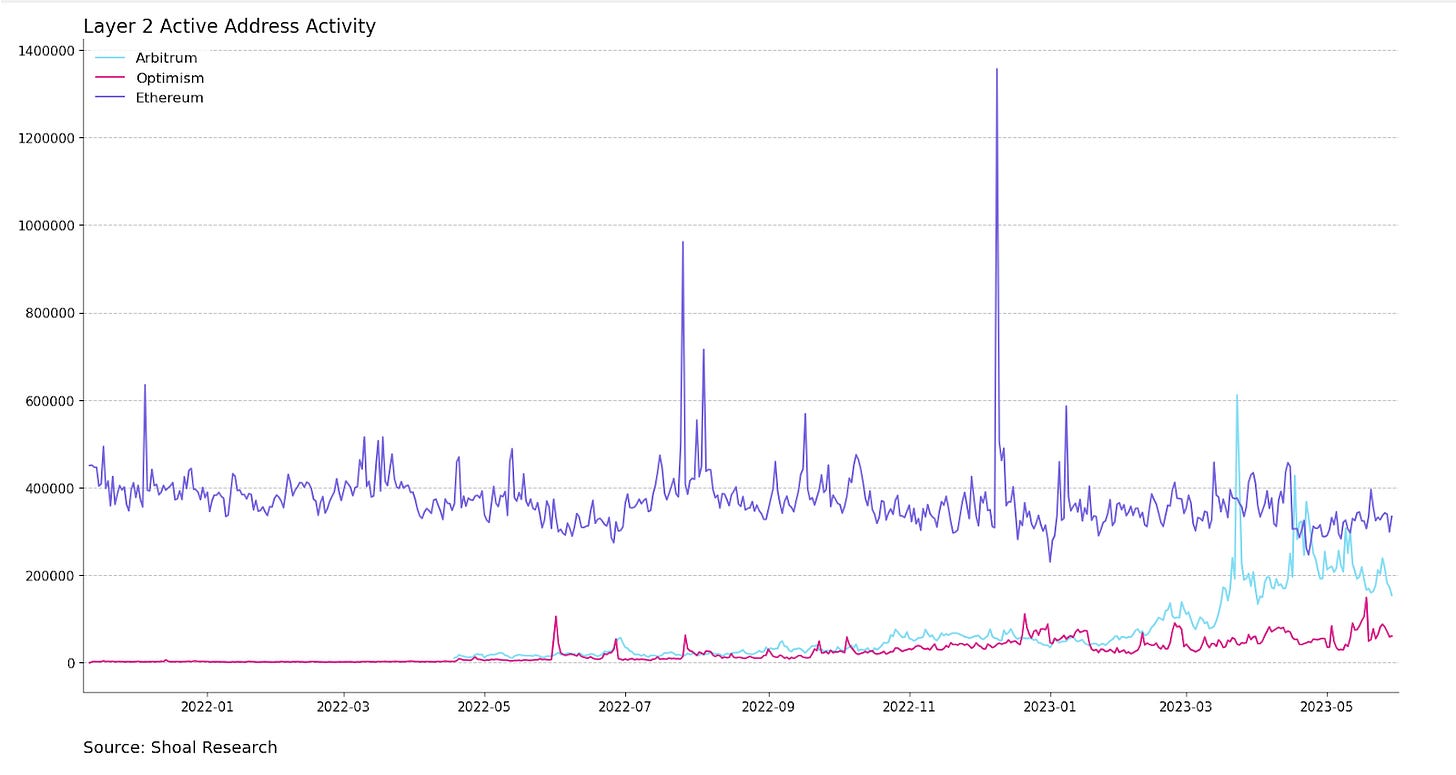

Adoption and Activity

The role of adoption and activity will continue to be significant in the competition between LSTs, particularly in the short term for protocols that have not yet enabled withdrawals. Additionally, as transactions and volume on Layer-2 (L2) chains surpass those on the mainnet, there will be more competition to become the primary LST on L2s. To ensure enough liquidity for protocols on L2 chains and prioritize adoption, strong incentives are necessary to encourage users to migrate from the mainnet (Ethereum Mainnet) to layer 2 protocols such as Arbitrum or Optimism.

(Layer-2 Active Addresses Activity Fig Shown Below)

Incentives

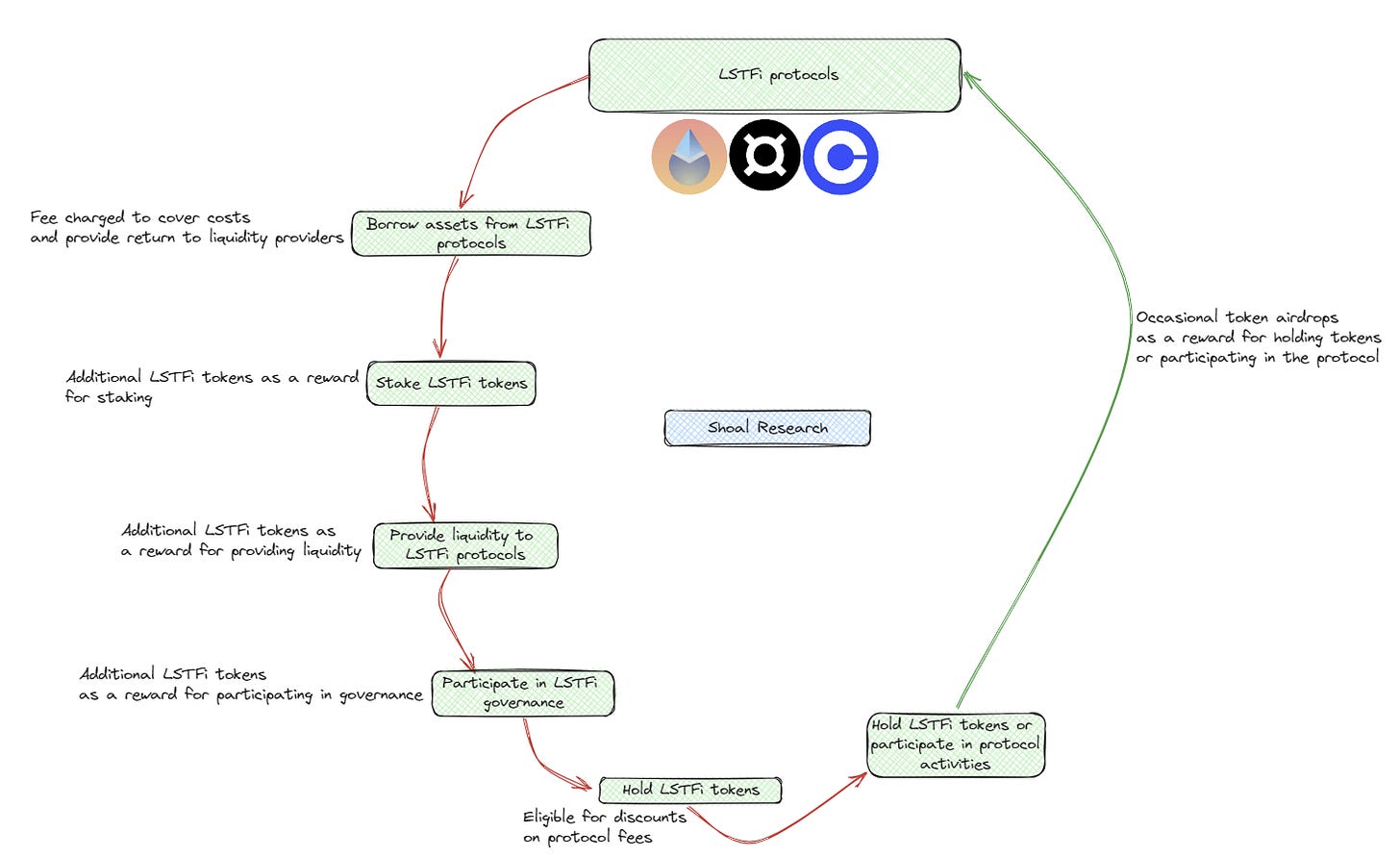

LST protocols have always provided various incentives to their users. Before Shapella, many LST protocols focused on getting users to provide liquidity on AMMs (Decentralized Exchanges). By providing liquidity, users received a higher reward, thus incentivizing them to stake ETH with an LST provider, which they might not have done in the first place. Higher rewards or incentives make staking more appealing, allowing users to earn additional benefits or generate passive income. Prior to Shanghai, the LST marketing strategy was deepening AMM liquidity as a means to incentivize users to stake.

Fast forward to today, other tools (LSTFi protocols) in the market can incentivize users to stake their ETH and receive an LST. Expanding LSTFi coupled with the ability to redeem LSTs with staked ETH has created a ripe opportunity for users to accept risks for rewards they might not have previously.

LST and LSTFi protocols develop progressively sophisticated incentive structures encompassing borrowing/lending, protocol staking, liquidity provision, governance, and protocol fee discounts. These mechanisms aim to amplify user rewards and attract more liquidity by distributing enhanced benefits. Since users can transition between LSTs within the ecosystem, LST protocols are compelled to stay competitive by proposing attractive annual percentage rates (APRs) for staking.

The figure below shows how different LSTFi protocols provide additional incentives and attract users.

LSTFi Implementations

LSTs inherently offer a range of opportunities for yield generation within the LSTFi ecosystem. Various protocols implement innovative strategies, such as AcidDAO, parallaxfin, Pendle.fi, and asymetrix_eth, enabling users to maximize their earnings within the LSTFi space.

LSTFi Case Studies

Lybra

Lybra aims to provide stability in the volatile cryptocurrency industry by allowing users to mint eUSD, an interest-bearing, omnichain stablecoin backed by LSTs. Specifically, Lybra is backed by ETH and staked Ethereum stETH. The platform allows users to borrow against their deposited ETH and stETH assets, effectively generating a regular stable income from the LST income of the deposited assets.

Pendle.fi

Pendle.fi takes a unique approach by providing a platform for purchasing futures, allowing users to buy ETH at a discount and receive it later. At the same time, it's invested in designated LSTs (Liquid Staking Tokens). This innovative feature provides users with additional flexibility and potential for enhanced returns.

AcidDAO and parallaxfin

AcidDAO and parallaxfin allow users to invest in diverse baskets derived from original LSTs, opening up opportunities for different yield strategies. Users can explore various investment options and implement strategies tailored to their preferences within these platforms.

These emerging products and protocols built on LST protocols introduce novel objectives and mechanisms distinct from traditional DeFi primitives.

CDP Market Share and Future Outlook

In the landscape of Collateralized Debt Positions (CDPs) for LSTs, Lybra Finance firmly holds its ground with a commanding 88% market share. A CDP refers to a smart contract that enables users to deposit assets as collateral in return for a debt denominated in a stablecoin or other assets. Simply put, users can deposit crypto and receive a stablecoin with their crypto as collateral. The limited competition currently consists of Gravita Protocol, Prisma, and Gusher, the latter of which is still awaiting the release of its token.

Within the last few days, Prisma finance has shared its plans to launch a CDP with the backing of Curve, Convex, Frax, and other battle-tested protocols. CDPs allow even further utility for LSTs and will be an exciting space to watch as these protocols grow in TVL.

Conclusion

Bluechip LSTs in the DeFi space have shown remarkable performance, with notable growth, surges in Total Value Locked (TVL), Netflows, and changes in market share dynamics. Projects such as Lybra Finance, Pendle Finance, and Flashstake have captured user interest and established themselves as leaders in specific niches. As the industry continues to evolve, it will be crucial for these projects to maintain their positions by continually innovating and meeting the changing demands of users within the competitive DeFi landscape. Additionally, it is worth keeping an eye on upcoming LSTFI blue chips like Gusher, Gravita, and others, as it will be interesting to see how these protocols aim to capture market share from the established leaders.

Sources

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are my own, not the views of my employer.