Building Crypto’s Everything App

What does a crypto-native Everything App look like in practice?

As the internet becomes the new infrastructure for finance, payments, and global commerce, a new opportunity emerges to build innovative consumer products that capitalize on the open, permissionless rails of DeFi. In this report we explore DeFi App and how it aims to capture this compelling new opportunity.

The Convenience Premium: A Tradition Rooted In History

“Civilization advances by extending the number of important operations which we can perform without thinking of them.” ― Alfred North Whitehead

Throughout history, humans have relentlessly pursued convenience. Nothing illustrates this better than the convenience premium: the additional amount that a consumer is willing to pay for goods and services that save time, effort, and make their lives easier.

There has always been a market for convenience: a willing buyer and a willing seller. Roman merchants charged higher prices in busy forums than in remote markets. Before refrigerators were invented, American households paid significant premiums for ice delivery. Even money itself has evolved for convenience: from barter to coins to paper to digital assets, each step has been around making money easier to carry around and transact with.

Today, the convenience premium lies in digital experiences. Online shoppers are increasingly seeking shorter delivery windows at checkout. Hundreds of millions of people pay for an annual membership to have Amazon deliver almost anything to their door the next day. Food delivery apps continue to see record users and order numbers despite regularly charging 30-40% markups on orders.

Time has shown that while the means have changed, the ends sure haven't. People gravitate towards convenience, and they’re willing to pay the price for it. It is no wonder why, across numerous industries, application-specific solutions have historically evolved into universal, general-purpose solutions as they mature. The question then becomes who delivers convenience and captures these premiums in the digital age.

The Rise Of The Aggregator

The post-internet era has been dominated by aggregators.

Platforms like Google, Meta, Amazon, among many others, curate information, content, and services from other providers, offering consumers a simpler way to access what they are already looking for. Billions of web pages are searchable through Google. Millions of products are browsable on Amazon. Friends’ photos and life updates appear in one place on Facebook or Instagram.

Crucially, these companies do not own what they sell. They own something far more valuable: the user relationship.

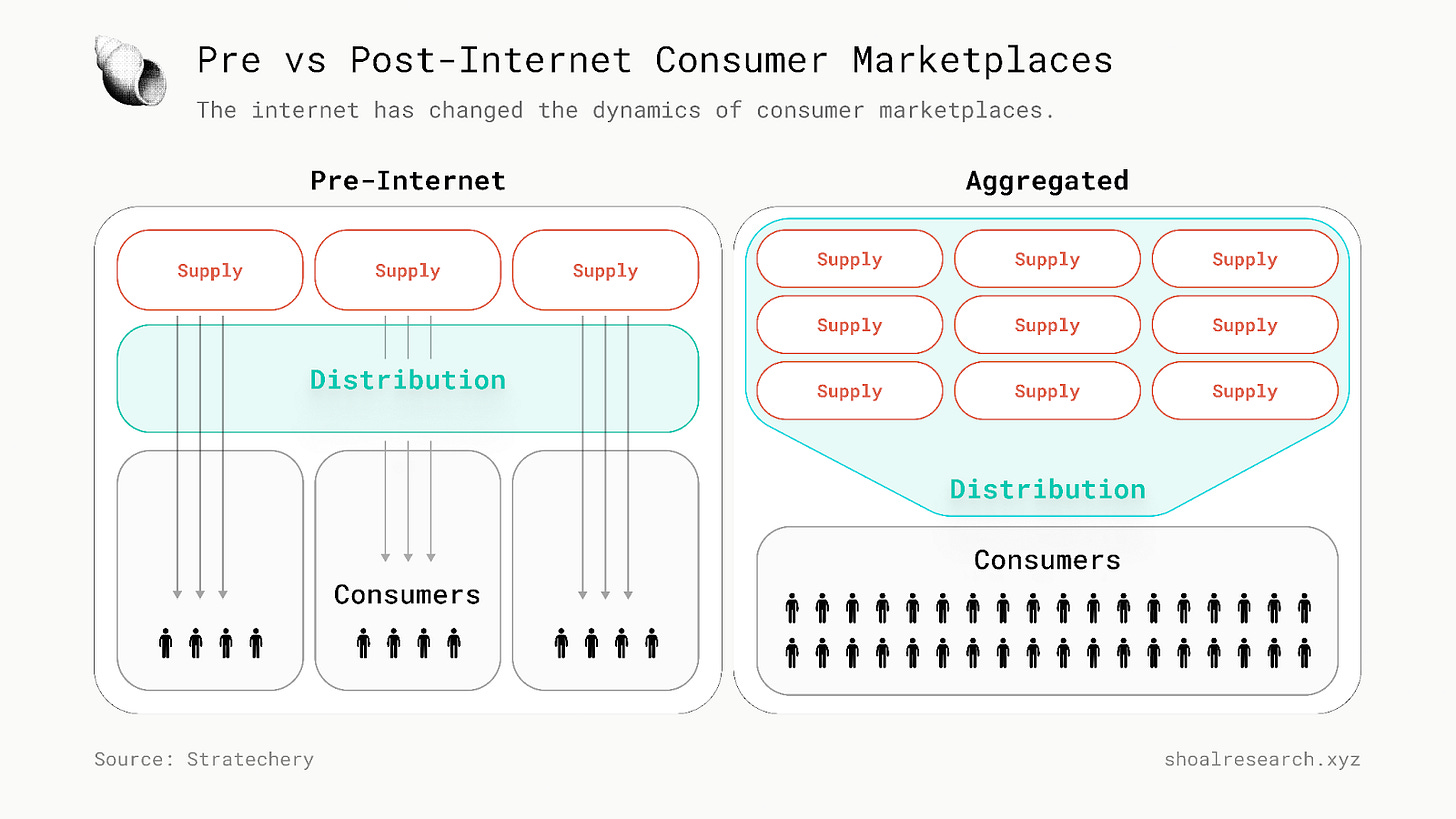

Before the internet, this would have seemed an implausible business model. Distribution was physical, therefore distribution costs were higher, supply was scarcer, and generating outsized profits required controlling most if not all of the supply chain.

The internet transformed these dynamics. The cost to distribute information about digital or physical goods to a global audience became nearly free. A single website could handle hundreds, thousands, sometimes even millions of customer transactions at once, with far less overhead than physical stores.

Ultimately this reshaped consumer marketplaces by shifting power towards the user. Owning the user relationship became key to gaining a competitive advantage and making outsized profits with the internet, and the business model revolves around user experience above all else. With abundant supply now at their fingertips, what consumers valued most was discovery and curation: finding the best goods and services in a single place.

So what lies next? As mobile becomes the new user interface, and consumers demand more integrated digital experiences, the next evolution of aggregators is evolving into Everything Apps.

Aggregating The Aggregators: Everything Apps

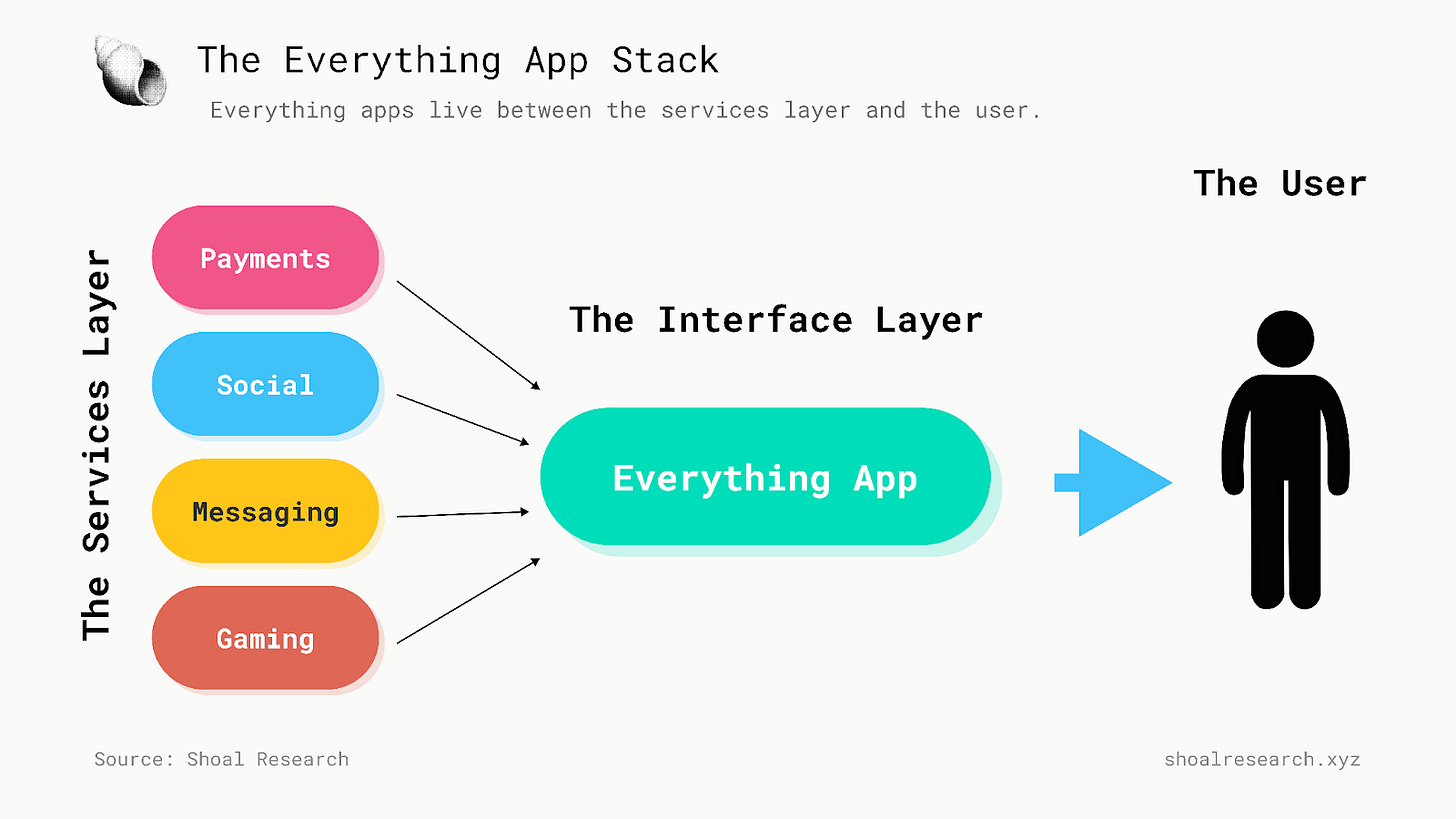

Everything Apps, also called ‘Super Apps’, are platforms that bundle multiple services and utilities into a single cohesive interface, most commonly a mobile app.

On a desktop, users could manage multiple tabs simultaneously without much friction. This doesn’t quite translate to smartphones, as smaller screens, app-switching delays, repeated logins, lost context, all create friction. History shows the pattern: whenever convenience can be improved, someone builds the solution, and someone else is willing to pay for it.

These mobile pain points point to the need for more integrated, multi-service experiences on mobile. The model benefits all participants:

For consumers, Everything Apps provide a simplified, all-in-one experience. Users can access a variety of services without having to leave the app. One login, an integrated payment system, and personalized experiences based on their user preferences.

For businesses, Everything Apps can help reduce user churn and lower Customer Acquisition Costs, while strengthening network effects and creating the opportunity to capture multiple revenue streams from the same user base.

The concept was first articulated publicly by Blackberry founder Mike Lazirdis at the Mobile World Congress in 2010, where he envisioned “everyday apps that people would use because they provided such a seamless, integrated, and efficient experience.” The first live example would come a few years later, when Tencent’s WeChat - a messaging app at the time - would launch WeChat v5.0. This update introduced a handful of new features including payments and gaming, marking WeChat’s shift from messaging to a robust multi-service platform.

Today, the most successful Everything Apps combine messaging, personal finance, payments, social networking, e-commerce, and plenty more. Unsurprisingly, they have flourished in “mobile-first” regions where smartphones are the primary - and in some cases the only - gateway to the internet.

So Why No Everything Apps In The US (Yet)?

Despite their widespread success in Asia and other mobile-first regions, Everything Apps have yet to truly take root in the US and Europe. The reason is straightforward: structural headwinds..

Digital ecosystems in the US and Europe are crowded with entrenched incumbents: specialized apps which dominate their respective fields and benefit from strong brand loyalty. Users love Venmo for payments, Uber for ride-hailing, Robinhood for trading. Habits like these are difficult to break, and app-store dynamics only further reinforce them. Platform restrictions such as Apple's notorious 30% App Store tax, and restrictive control over native capabilities, made aggregation even more difficult to build and sustain over time. Furthermore, data privacy laws like GDPR and CCPA, combined with aggressive antitrust enforcement, have created compliance burdens that actively prevented platforms from dominating multiple sectors.

But the demand IS there. The gravitational pull of convenience keeps growing. A new digital banking report recently revealed that 60% of users add a second finance app specifically because their primary app lacks essential features, while 91% would gladly consolidate to a single app if it offered all the services they needed.

And slowly, this shift is happening, in a way. Companies like Meta and Google continue layering in more messaging, shopping, and payment features to their apps. Elon Musk has openly shared his long-term vision for X as ‘the Everything App’, which recently integrated Polymarket, the kind of vertical integration that can very well be a stepping stone for future expansion.

Despite regulation, platform politics, and consumer inertia, the Everything App vision is alive in the West.

Aggregators in Finance: A Natural Evolution

If there’s any sector primed to capture this transformation next, it’s finance.

Financial services remain fragmented across thousands of banks, brokers, and financial products today. This complexity has always made aggregation valuable. Historically, banks themselves were the original aggregators, combining checking, savings, credit, and investing under one roof. However, they aggregated financial services through regulation, branches, and charters. As technology evolved though, this monopoly would start to crack.

The internet would then enable the next generation of financial aggregators. PayPal and Stripe aggregated payment processing. Plaid then followed suit by aggregating bank accounts. Robinhood aggregated trading stocks, options, and crypto assets.

From there, the ambition only grew. The following generation of financial aggregators sought to aggregate the entire financial stack. On the consumer side, apps like Revolut and Cash App bundled banking, payments, and trading. On the enterprise side, solutions like Ramp and Brex combine payments, banking, credit, payroll, and expense management under one roof.

Fintechs have proven the aggregator model works in finance: bundling services creates stickier products, stronger network effects, and captures greater market share. But they’re still boxed in by regulations, jurisdictional barriers, and the tech debt of legacy infrastructure. These pain points beg the question: today’s financial aggregators being built on the right rails? Or are we at an inflection point, a time to explore new rails, new regulations, and unlock new opportunities?

New Rails

Crypto protocols are well-suited for financial aggregators because they are composable, open, and permissionless. Unlike legacy infrastructure, integrating these protocols doesn’t take years of licensing battles or contracts to sign, just code to write and deploy. This programmability makes it easier to embed and integrate more financial services at scale. Today’s blockchains, the rails which crypto protocols live on, also enable significantly lower fees and faster speeds for financial transfers than legacy systems.

New Rules

“Plain and simple: securities intermediaries should be able to offer a broad range of products and services under one roof with a single license..” - Paul Atkins, SEC Chairman

Regulators are now dismantling the barriers that previously prevented Everything Apps from flourishing in the US. Today, a financial platform needs separate licenses for each individual service: broker-dealer license for trading, money transmitter licenses in all 50 states for payments, banking charter for deposits, and somehow, the list goes on. This is one major point the SEC's Project Crypto aims to address. As per recommendation from the White House Digital Asset report, the SEC is now actively developing a ‘Regulatory Super-App Framework’, which would allow an SEC-registered platform to offer multiple financial services under one platform or license. This extends beyond traditional securities to crypto asset staking, lending, payments and more.

New Opportunities

Altogether, crypto rails unlock access to financial services on a broader, more global scale than its legacy predecessors. Regulations are now being developed to ensure this can develop in a compliant and secure manner. But more importantly, the real unlock is the innovation that the composability of crypto protocols and transparency of blockchains enables.

Every new protocol becomes a building block for others, enabling products and services that are difficult for financial services to assemble on their own. Borrowing and lending, payments, trading, identity, can be integrated with one another with code. A financial system built on the internet, for the internet.

The most impressive part about this system is that it’s already live. There is already over $300 billion in value on public blockchains today. $9.5 trillion has already been traded - in a non-custodial manner - on decentralized exchanges (DEXs). Over $274 billion has been issued in stablecoins to date, which have actively surpassed Visa, Paypal, and legacy remittance systems in monthly volumes since November. Yet DeFi is still largely niche and unknown- why is that?

The Missing Ingredient: The Mobile Moment

Today, over 5 billion people use the internet, the vast majority of this activity taking place on mobile devices. Mobile has become the dominant user interfaces across the globe, and mobile apps the new pipes through which industries reach mass adoption:

We’ve seen this playbook before. The explosion of mobile in the early 2010s went hand-in-hand with the rise of social media, as mobile internet access quadrupled between 2011 and 2015. The same pattern would unfold into e-commerce, which grew from less than 5% of retail purchases in 2010 to over 18% in 2020. In 2025, smartphones are projected to account for nearly 60% of global retail e-commerce sales, or roughly $4 trillion in mobile commerce revenue.

16 years since Bitcoin’s Genesis Block, crypto’s Mobile Moment is overdue.

Signs are certainly starting to appear. A16z estimates there are now 34.4m monthly active mobile wallet users. Coinbase has previously topped all finance apps on the iOS App Store and even broke the top 10 free apps overall. Jupiter, the largest DEX aggregator on Solana and one of the largest in crypto broadly, launched its mobile app in late 2024, allowing users to onboard with familiar payment systems like Apple Pay. Solana Mobile recently shipped out over 250k orders of the Solana Seeker second-gen phone to more than 50 countries.

Across industries, mobile has been the unlock for mass adoption. Crypto will be no different. The next major opportunity to aggregate financial services is clear: a truly crypto-native Everything App.

DeFi App: The Crypto-Native Everything App

Every breakthrough technology needs its killer app. For social, it was Facebook. For AI, it was ChatGPT. DeFi App aims to be that catalyst for crypto.

Today, DeFi ultimately functions as a consortium of protocols built on top of one another. DeFi App simply aggregates these multiple layers between chains and their respective applications into a single mobile interface.

These layers make up what we call the DeFi Value Chain:

Assets: These are digital assets that live on blockchains and represent some monetary value.

Protocols: These are smart contracts that provide financial primitives and ultimately aggregate user assets together.

Protocol Aggregators: These are protocols built to aggregate other crypto protocols, optimizing to find the best rates, prices, and execution for users.

Interface aggregators: These are the applications that provide the consumer touchpoint to access all underlying layers and services.

In a sense, DeFi resembles an open set of legos. An Everything App would be the box they're packaged in. And as other industries in the post-internet era have proven, whoever controls that box - and defines how users interact with those legos - owns the user relationship and becomes crypto's ultimate aggregator.

Early Traction

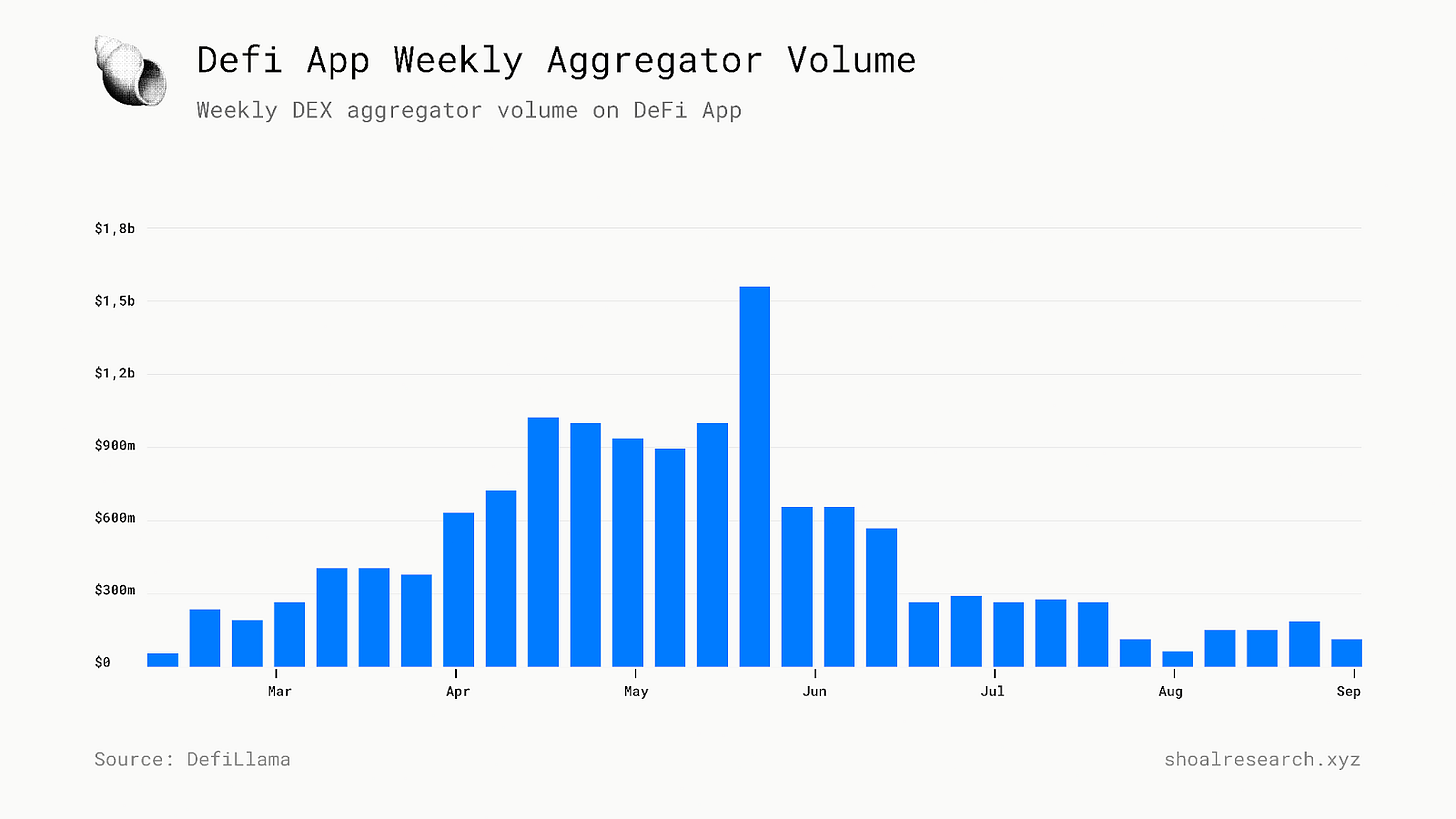

DeFi.App has achieved significant early traction since launching in February:

3.7M+ wallets created across 1.38M active users

$2.87M in protocol fees generated since April.

80M+ HOME staked by 7.7K+ unique stakers, the majority choosing 12-month lockups.

So far, the protocol generated $18.8B in total volume, with the majority ($15.2B) coming from Swaps.

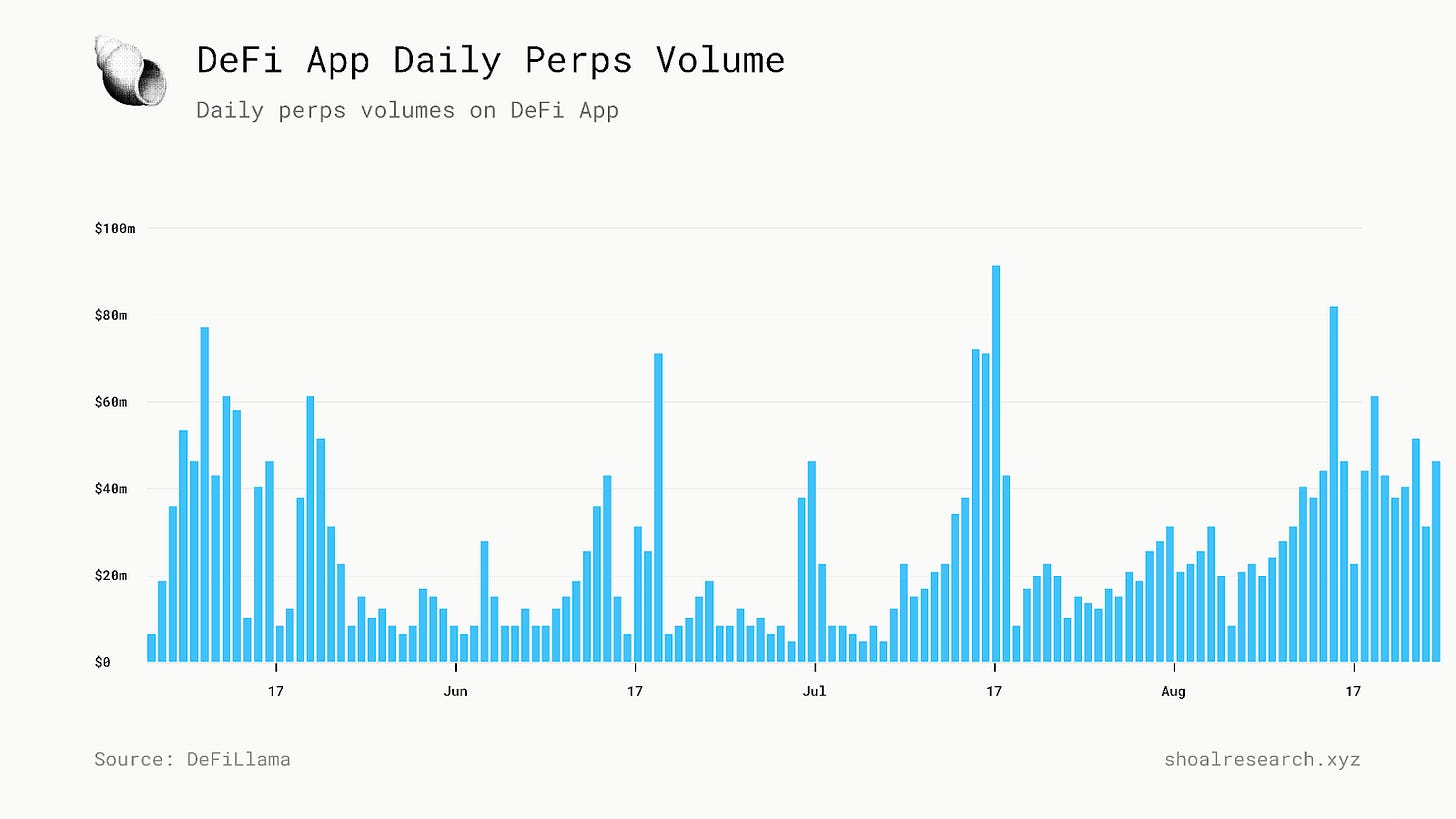

Perps meanwhile, launched in May and have already generated $3.66B in total volume.

But exactly how does it all work under the hood?

Here’s how DeFi App intends to capture this opportunity.

What does DeFi App Offer?

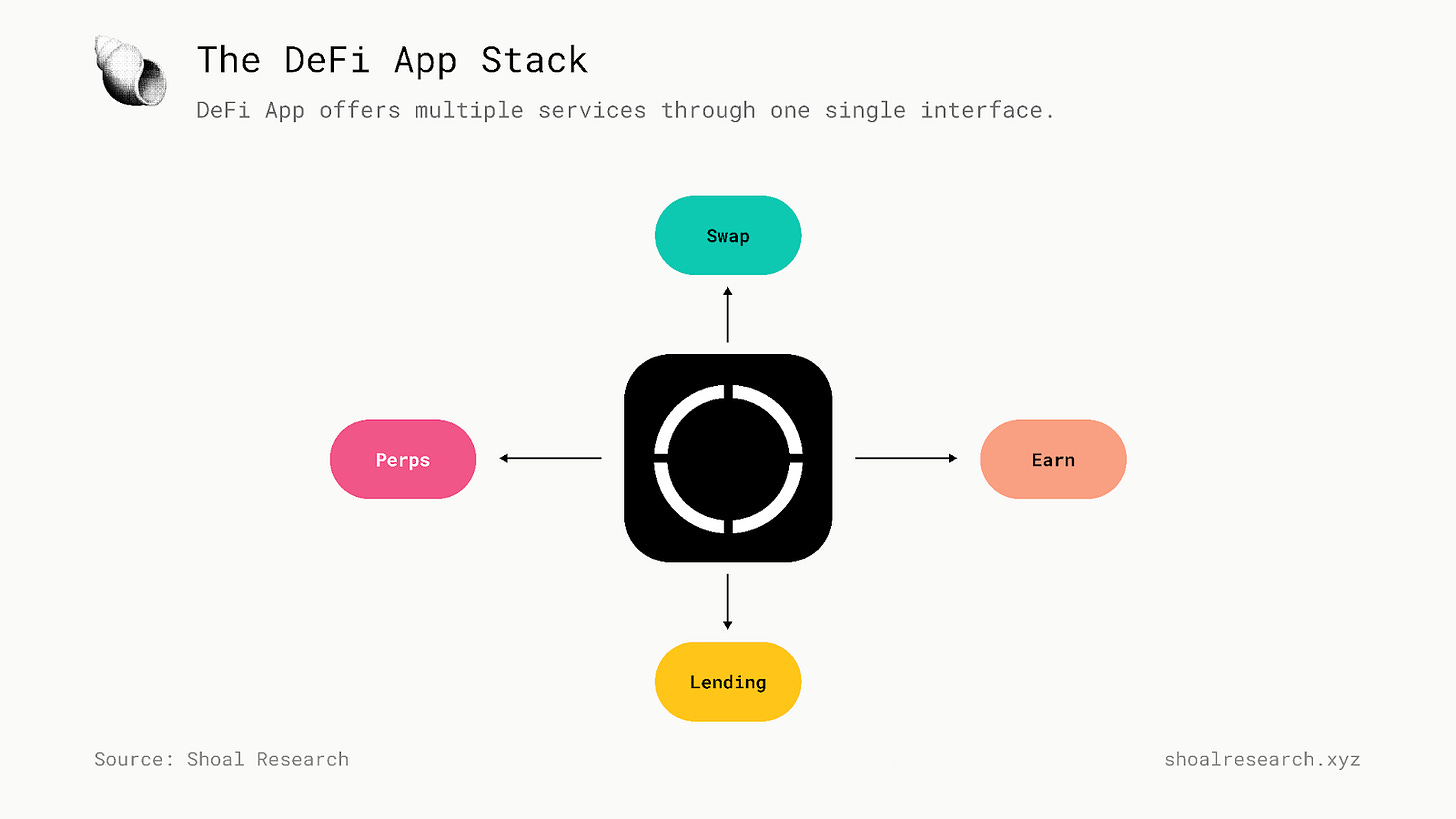

DeFi App provides a simple, cohesive interface for users to access core DeFi services:

Swapping

Spot trading across multiple DEXs on multiple chains with aggregated liquidity to find the best rates.

DeFi App users can access more assets on DEXs than on traditional CEXs, and better rates depending on the asset and its onchain liquidity.

By using an intent-based system, DeFi App users can express their swap preferences with less manual configuration.

Leverage Trading

Perpetual contracts (Perps) trading, accessible through a simple interface built on a Hyperliquid backend.

Users can access institutional-grade liquidity, transfer fees lower than on CEXs, and maintain custody of their assets.

Users get a dedicated ‘Perp Account’ which they can fund from their existing DeFi App wallets. From there, they can long or short any supported asset, and add leverage if they so choose. It’s important to note that leverage trading can be significantly riskier than spot trading.

Earn

Users can easily stake the HOME token and access various DeFi yield strategies with transparent risk assessment.

Lending/Borrowing

Users can borrow or lend supported assets through a simple interface.

DeFi App aggregates multiple borrowing and lending protocols to offer users the best rates across the DeFi ecosystems and chains it supports.*

To address common pain points in the onchain user experience, the platform offers:

Self-custodial Wallet Management

DeFi App creates a wallet for users on all its supported chains to eliminate new wallet set-up hassle for users. This is especially useful for chains that operate on different VMs, like Ethereum and Solana, both of which DeFi App supports.

While CEXs provide this service for users, they custody the assets held in those accounts. Though it’s been almost 3 years since FTX imploded, the principle hasn’t changed much. Not your keys, not your crypto.

With DeFi App, users avoid wallet set-up hassle but still maintain custody of their assets.

Easy onboarding/on-off ramping

Users can easily fund their DeFi App accounts using familiar payment methods like Apple or Google Pay.

Gasless Transactions

Users don’t pay gas fees when transacting. Gas fees are either sponsored by DeFi App directly or swapped from other tokens on the user's behalf.

Integrated Cross-chain UX

All swaps are executed for users “behind the scenes”, including those involving different assets on different chains. This helps eliminate the need for users to manually bridge their assets, which could involve multiple steps and transactions otherwise.

*Note: this feature is not live yet.

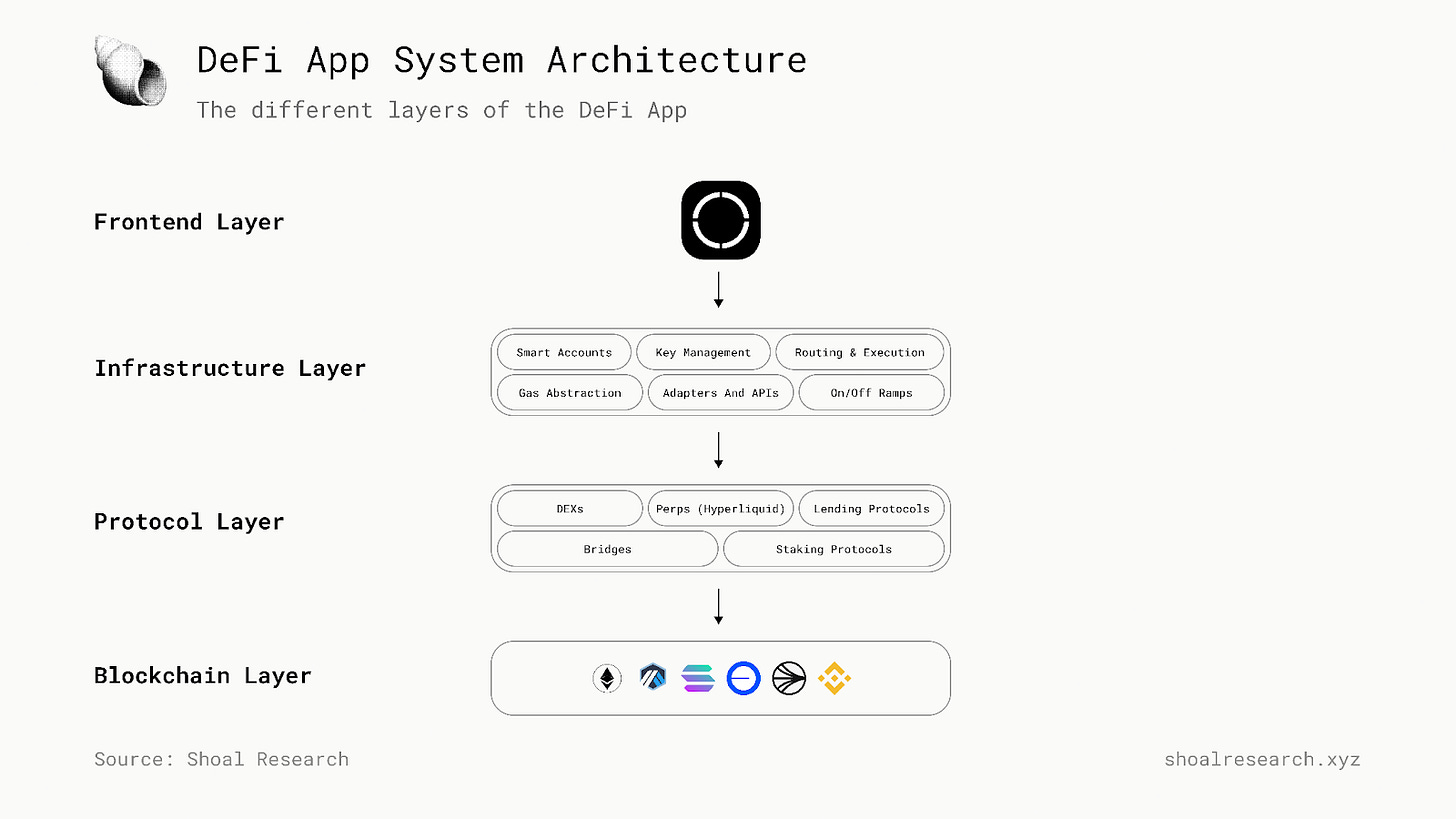

System Architecture

Stripped down to its purest elements, DeFi App is a crypto-native interface aggregator. It combines and integrates different smart contracts, Solvers, Smart Account infrastructure, APIs, and adapters through a single cohesive interface layer.

Smart Accounts: Creates seedless wallets on user’s behalf through AA

Gas Abstraction: A paymaster to sponsor gas fees for transactions.

Transaction Execution: An aggregator system for routing transactions using intents.

Frontend interface: Combines multiple DEXs, lending protocols, and yield sources into one interface.

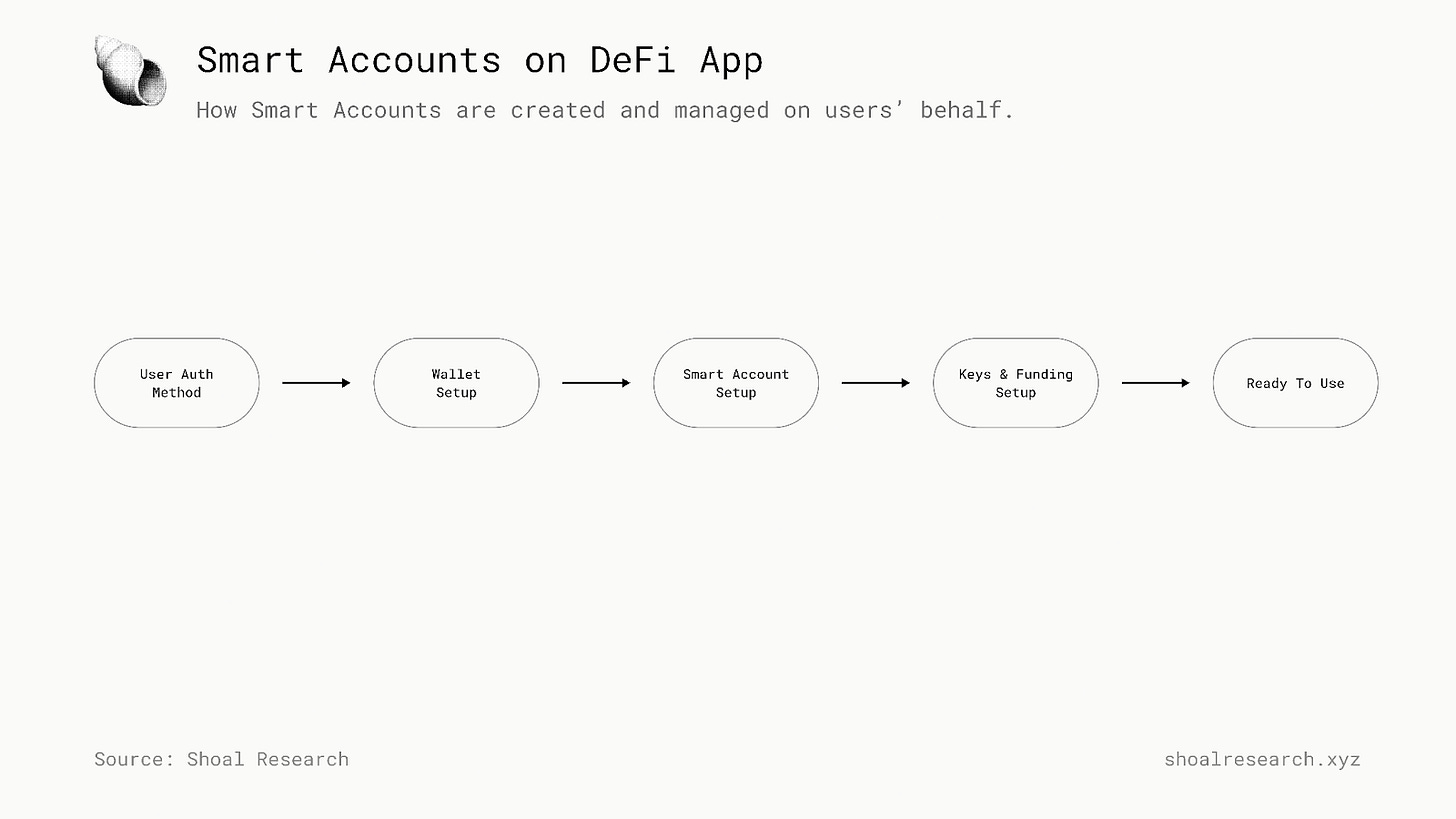

Smart Accounts

DeFi.App lets users sign up and manage crypto wallets on their behalf using familiar authentication methods like email and social apps. Instead of directly managing private keys and gas fees on multiple chains, embedded Smart Accounts let DeFi.App handle gas, bridging, and signing under the hood for users.

Smart Accounts are built on the principle of Account Abstraction. The core principle is to separate how an account is verified from how its transactions are actually processed on Ethereum. In simpler terms, it means a public key (a wallet address) is no longer tied to a single private key. Instead, smart contracts can be written to define custom rules for verification, recovery, and fee payment.

The vision has been around for a while now, dating back to Vitalik Buterin’s EIP-86. The core concept was to make wallets more flexible by allowing accounts to operate like smart contracts rather than just externally owned accounts (EOAs) controlled by private keys. The first major implementation was realized through multi-signature (multi-sig) wallets pioneered by Safe, which demonstrated early forms of AA by separating asset custody from transaction authorization. Instead of just one signature with a single private key, protocols could set up contracts to require multiple signatures before a transaction is approved. This proved beneficial for protocols and teams, but less tangible to retail.

With ERC-4337, AA resurfaced strongly as a key upgrade concept: an additional layer, though not one that altered the core Ethereum protocol. ERC-4337 wrapped user transactions into a higher-level construct known as a ‘UserOp’, short for UserOperation. Any transaction generated from an ERC-4337 enabled wallet would be a UserOp, and UserOps had their own Mempool. From there, Bundlers would aggregate UserOps into regular transactions to be posted to Ethereum mainnet.

A core UX unlock that was long envisioned with AA was gas abstraction. EIP-4337 enabled this through the use of Paymasters, specialized smart contracts which can be programmed to either sponsor fees on behalf of an account or accept gas fees in any ERC20 token besides native ETH.

ERC-4337 provided the toolkit for advanced Smart Account logic, but it did not standardize it in a way that was more universally applicable. It also required that users create a new Smart Account instead of being able to import their old Externally Owned Address (EOA). This would change with EIP-7702, as part of the Pectra upgrade. EIP-7702 allowed any existing EOA to temporarily function as a Smart Account with additional features like transaction batching, gas sponsorship, alternative gas fee payment.

In short, Smart Accounts enable apps like DeFi.App to sponsor gas fees for users, let users pay gas in any ERC20 tokens, and support alternative and more familiar verification mechanisms beyond the standard ECDSA commonly used in crypto today. And central to Smart Accounts and Account Abstraction is proper and secure key management.

Key Management

DeFi.App integrates several providers for secure key management of newly-generated user accounts. The implementation varies slightly between EVM and SVM environments, but together create a smooth onboarding and transaction flow for users:

Turnkey

Turnkey is the custody and signing provider that underpins account creation on both Solana and EVM chains.

On Solana, Turnkey directly manages the user’s wallet where assets are actually held. Because funds live in this wallet, importing the key into another wallet provider, like Phantom, would display a balance.

On EVM chains, Turnkey generates a signer key for each user. This signer key doesn’t hold any funds itself - but it does authorize transactions via a linked smart account. In practice, Turnkey provides the signature layer while funds themselves live in a generated smart contract.

Zerodev

ZeroDev provides DeFi.App’s Smart Account infrastructure for EVM chains.

User funds on EVM chains are stored in an EIP-4337 smart contract wallet managed by ZeroDev.

The wallet is controlled by the Turnkey signer (described above), but custody of assets lives entirely within the ZeroDev smart contract.

Effectively, ZeroDev handles the vault and execution layer for EVM assets, while Turnkey supplies the signer that secures it.

Dynamic

Dynamic is the wallet connector and onboarding layer that ties the system together, managing user authentication mechanisms.

When a new user signs up, Dynamic provisions two embedded wallets:

A Solana wallet (Turnkey-managed, holds funds directly).

An EVM Wallet consisting of a Turnkey signer + ZeroDev smart account (signer controls, smart account holds funds).

Dynamic also allows users to export their keys. For Solana, this means exporting the Turnkey wallet. For EVM, users can export the signer key, but balances won’t appear in a standard EOA wallet since funds live in the ZeroDev contract.

Besides simpler user onboarding, Smart Accounts also enable another major UX breakthrough for DeFi.App: the ability to pay transaction fees in any token.

Gas Abstraction

It’s critical to understand that users still pay a fee to DeFi.App when transacting. Transactions and blocks cannot be uploaded to a blockchain without a fee to cover the associated computational costs. These fees are paid in the native token of that blockchain, which in itself is a core part of the token’s utility. While it is not possible to avoid gas fees, it is possible for application developers to make sure their users don’t need to worry about them.

DeFi.App enables gas abstraction across all its supported chains, though the implementation varies by the execution environment (VM) of that chain.

On EVM chains, gas fees are sponsored by ZeroDev architecture and funded by Defi App transaction fees.On Solana, this is handled by a custom paymaster contract. The gas fee is quoted to the user transaction, and swapped from the paying token into SOL.

Intent-based Execution

DeFi.App implements an intent-based system for transaction execution, designed to give users a simple experience with optimal pricing.

An “intent” has no formal definition, but it functions similarly to a transaction, only instead of specifying the exact execution path, the user specifies their desired outcome. This approach focuses on removing the complicated parts of the onchain transaction experience like sourcing liquidity, ensuring sufficient gas, and bridging if another chain is required. For example, a user may want to swap 100 USDC for SOL, but doesn’t know if the best prices are on Orca, Raydium, or elsewhere.

How does this work on DeFi.App?

DeFi.App runs a Solver transaction aggregator that taps into multiple liquidity sources across chains and protocols, presenting users with the best available price. The platform integrates with 0x, 1inch, Bebop, Debridge, Dodo, Enso, Jupiter, LiFi, Odos, Open Ocean, Paraswap, Relay, and Stable. Proprietary routing logic in the backend evaluates these options in real time, ensuring users see a single, streamlined execution flow.

Cross-chain support is native to this system. Traditionally, swapping USDC on chain A into USDC on chain B (or even USDC → USDT across chains) would require multiple bridging steps. With DeFi.App’s solver network and routing logic, cross-chain swaps are presented to the user as a single transaction, no different from a same-chain swap.

MEV-Protection with Jito

One particular underrated feature DeFi.App enables is to let users opt-in to protect themselves from MEV on Solana.

MEV is often captured through sandwiching/arbitraging unsuspecting users.

Jito built the Jito-Solana Validator Client to help mitigate this on Solana. Users can submit transaction bundles to Solana validators running the Jito client. These transactions get executed atomically, in order, therefore either they all execute or fail altogether. Tips (bonus fees) are attached to bundles to incentivize validators, priority going to the highest bidder.

Broadly speaking, DeFi.App supports three transaction modes: Classic, Jito, and Auto. Classic mode provides standard routing to validators running the Agave validator client. Jito mode routes transactions to validators running the Jito-Solana client, while Auto mode selects the best option for the user at the time.

DeFi.App Users can opt-in to MEV protection by simply toggling “Jito Mode”, which will then route their transactions through Jito-enabled validators, leveraging the bundling and tipping system.

Capturing The Convenience Premium: DeFi.App’s Business Model

Earlier, we highlighted the impact of the convenience premium throughout history: people are willing to pay a premium for goods and services that make their lives easier, plain and simple. Aggregators dominated the post-internet era by focusing on owning the user relationship and experience. In an increasingly mobile-first world, the next evolution of this model is the Everything App.

The next question that follows is how exactly do the aggregators, the harbingers of convenience that don’t own what they sell, actually generate and accrue value?

Let’s examine DeFi.App’s business model.

The HOME Token

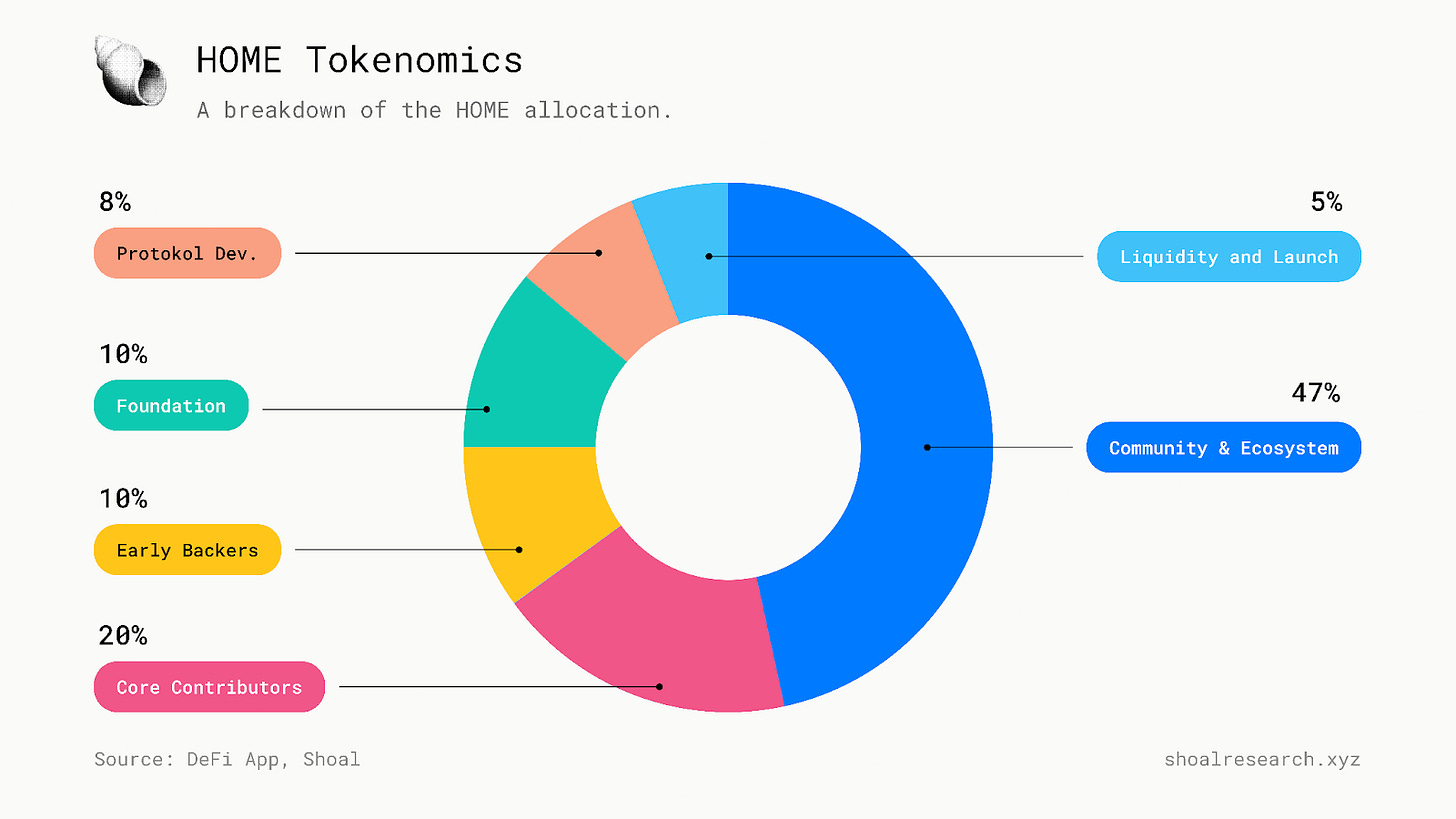

DeFi.App and its ecosystem is powered by the $HOME token. HOME launched on June 10, 2025, and currently lives on Solana, Base, and BNB Chain. There are 10 billion HOME tokens in total.

Token Utility

HOME plays several key roles across the DeFi.App ecosystem:

Governance: HOME stakers can create and vote on any proposals that come up around the DeFi App protocol, whether it’s revenue sharing models, token buybacks or yield to $HOME stakers, which feature comes next for the platform, and so on. Companies can also buy and stake HOME to accelerate their own integrations into the ecosystem. Over 5.9k votes have been cast over the first 5 proposals.

Gas Abstraction: Users who hold HOME in their DeFi.App wallets can transact on any supported chain and pay gas fees in HOME. Defi.App’s treasury automatically purchases HOME from the user at open market rates and uses that HOME to subsidize that user’s gas fees on their behalf. This is facilitated through the HOME Staking contract, which provides collateral to support gas subsidies and conversions.

Incentive Coordination: Users can lock HOME to earn XP, which accrues on a daily basis and may be a qualifying criteria for future HOME airdrops. Locking HOME can activate up to a 3x multiplier on XP gains, with more XP for longer lockups.

Data shows that the majority of HOME token holders are on Base (83k holders), with ownership on BNB Chain (6.4k) and Solana (1.9k) notably lower.

DeFi.App’s Business Model

DeFi.App generates revenue through protocol fees. Every swap, deposit, leveraged trade - any user action that generates a transaction - generates a protocol fee. Think of this fee as the convenience premium that DeFi.App charges.

The business model is designed to work the following way:

A user joins DeFi.App.

Each time they swap, borrow, lend - each action generates a protocol fee.

Fees are allocated however governance sees best fit.

Fees are distributed, often through buybacks or allocated for future incentives.

As more HOME is staked, token supply decreases, interest grows, and…

A new user joins DeFi.App.

DeFi App charges 0.02% on swaps, and 0.01% on perps. Today, as much as 80% of DeFi App’s net fee revenue is allocated towards HOME buybacks for its treasury reserve, as was recently voted on in DIP-004.

Analysis

It’s time to unpack what we just learned and reflect on the challenges and opportunities Shoal Research sees ahead for DeFi.App.

Challenges And Considerations

DeFi.App is building a solution to a very real problem: a lack of simple, beginner-friendly access to DeFi. This isn’t a new problem by any means though, and the DeFi.App team are not the only ones actively building to solve this problem.

The biggest, high-level challenge we foresee DeFi.App facing is competing with bigger “crypto-adjacent” firms that have a strong distribution advantage and bigger user-base. Firms like Coinbase and Robinhood come to mind. This may even extend beyond crypto firms: major fintechs and even banks can push for their own Everything App, incorporating crypto and DeFi alongside other non-crypto services.

Still, most of these firms require users to fill out KYC verification beforehand, which can be a major onboarding pain and bottleneck. DeFi.App has an upper-hand here: users can quickly sign up with their email and fund their account with Apple Pay. However, this is where major wallet providers like Phantom and Metamask, who also very much stand to benefit from launching their own ‘Everything App’, stand to be a bigger threat and concern. In a way, these apps already function as “crypto-native Everything Apps” and offer multiple integrated services similar to DeFi.App. Therefore, non-custodial wallets are currently the biggest competitors to DeFi.App we see as of today as they can provide similar offerings relatively easily. That said, while there may be less room to compete on service offerings, there will always be room to compete on pricing and execution rates against wallet providers and other protocols. After that, it becomes a race to who can support more chains, more assets, and offer more services to users.

Moving on to more crypto-native challenges, DeFi.App, like many other crypto protocols, need to make sure they can scale to keep up with the expanding multichain landscape. There are currently 300 chains, some believe we will have 1000s. DeFi.App currently only serves 6. While many of these chains are not active or have not generated any real sustained activity, users are continuously traveling to different chains and ecosystems. Corporations like Circle and Stripe are launching their own chains. Who knows who else will follow. As an “aggregator of aggregators”, it’s in DeFi.app’s best interest to be able to serve their users wherever they want to go.

This is a hard problem to solve, but if users can access virtually any chain through DeFi.App’s simple interface, this can be a major advantage and differentiator. Conversely, if DeFi.App chooses to keep their overall chains and ecosystems limited, someone else will expand to serve users of any asset on any chain. It even becomes advantageous for infrastructure-focused teams, such as those building interoperability protocols, to create their own user-facing application to let users access any asset on any chain. The easiest solution for DeFi.App to hedge against this risk is to integrate a major interoperability protocol, like Hyperlane or LayerZero, and tap into their existing distribution and scale with them. A much more difficult approach will be to build a proprietary solution. Either way, we believe DeFi.App needs to dream big, and embrace aggregating “everything”. This starts with providing users access to any asset on any chain.

Exciting Opportunities and Outlook

Overcoming these challenges will be critical for DeFi.App’s short and long-term success, but there is plenty to be excited for. By building around aggregation and the mobile-first experience, DeFi.App is following the same playbook that has kickstarted major growth and adoption cycles in other digital industries as it sets out to build the first crypto-native Everything App.

Consumers have expressed a strong preference for mobile-first experiences in today’s age. DeFi.App is building a mobile app for that. Interest in crypto will likely continue to grow as enterprises and major institutions continue to either experiment with or fully embrace blockchain solutions. And they’re actively piling in because for the first time in crypto’s history, the US is actively developing pro-innovation guidelines and regulations to legitimize this technology. This alone won’t bring “the next million users” onchain, but the path to mass adoption all starts from there.

It doesn’t hurt that aggregators have done quite well overall, either. Once Google had integrated search results with user data, they were able to offer targeted advertising, and have made hundreds of billions in revenue over the years. Meta had a similar approach, integrating their feed with user’s data to unlock targeted advertising, and generates over $100b annually, with most (97%) of that revenue coming from targeted ads. WeChat, the poster child for Everything Apps today, has earned hundreds of billions over the years from in-app purchases and more.

In DeFi, numerous protocols have already demonstrated the revenue potential of frontend applications. Photon and Pump Fun have both seen upwards of $6m in daily fees before. Axiom hit over $250m revenue in 8 months.

Though maybe not all apples-to-apples comparisons, these examples demonstrate there is lots of demand and value to capture in frontends and aggregators.

Ideas And Suggestions from Shoal

Some ideas and suggestions Shoal Research believes could help contribute to DeFi.App’s success moving forward:

Expand to support more chains and assets over time. Dream big: every asset, every chain should be accessible through DeFi.App’s mobile interface.

Integrate an underlying cross-chain messaging protocol so DeFI.App’s chain coverage can easily scale with them.

Integrate an AI chatbot UX to let users type out their preferred action. Bonus points for voice mode to make it even more convenient.

Enable non-users to onboard easily via text message. Text your friend some money through a link. They sign up for DeFi.App in seconds.

Enable a “Privacy Mode”: Integrate a proven privacy solution like Railgun to let users transact privately when they want to, the same way they can toggle “Jito Mode”. This may be trickier to manage from a legal perspective, but can be a massive benefit and differentiator for DeFi.App long-term.

Offer MEV protection on all chains, not just Solana. Integrate a Flashbots/MevBlocker RPC endpoint for EVM chains.

Productize (or even better - open source!) a plug-in that teams can use to easily add their protocol or service to DeFi.App’s interface.

Importantly, these are merely ideas we suggest the DeFi.App team take into consideration. Some of these ideas are more practical and urgent than others. Some may not make sense right now, but may become critical in a few months or a year. Time will tell.

Closing Thoughts

History has repeatedly shown us that the convenience premium is timeless. In 2025, aggregators have captured this premium and dominate consumer marketplaces by delivering superior user experiences. Mobile devices have taken over the majority of internet traffic as they have evolved to offer more services and information than desktops, conveniently fitting in everyone’s pocket.

At Shoal, we believe the same plot will inevitably unfold on crypto rails. Fintechs have proven the demand for convenient, aggregated access to financial services, but they still face centralization risks and remain barred to geographical barriers. Crypto protocols are open, programmable, and permissionless to integrate, and have already moved upwards of twelve figures in value across the globe. Major enterprises and institutions are adopting stablecoins for payments. Countries like the US are actively pushing to establish pro-crypto and pro-innovation regulatory frameworks. It’s becoming clear that the time to build crypto’s everything app is now.

Sources

Aggregating the Aggregators.” Fintech Takes, 14 June 2024, fintechtakes.com/articles/2024-06-14/aggregating-the-aggregators/. Accessed 24 Oct. 2025.

“Convenience Premium: Consumer Trends 2024.” Morgan Stanley, www.morganstanley.com/ideas/consumer-trends-2024-convenience-premium. Accessed 24 Oct. 2025.

DeFi App. DefiLlama, defillama.com/protocol/defi-app. Accessed 24 Oct. 2025.

DeFi App Staking. Dune, dune.com/defiapp/defiapp-staking. Accessed 24 Oct. 2025.

de la Mano, Matías. Open Platforms and Innovation: The Case of the Linux Operating System. London School of Economics, 1999, eprints.lse.ac.uk/22471/1/wp20.pdf. Accessed 24 Oct. 2025.

‘“Digital Assets.” The White House, www.whitehouse.gov/crypto/. Accessed 24 Oct. 2025.

ERC-4337 Documentation. docs.erc4337.io/. Accessed 24 Oct. 2025.

EIP-7702 Documentation. eip7702.io/. Accessed 24 Oct. 2025.

“New Study Reveals Using Multiple Financial Apps Is Necessity, Not Choice, for Most Users.” Nordic Fintech Magazine, nordicfintechmagazine.com/new-study-reveals-using-multiple-financial-apps-is-necessity-not-choice-for-most-users/. Accessed 24 Oct. 2025.

“Statistics That Prove How Your Delivery Speed Impacts Your Business.” Meteor Space, 13 Feb. 2025, meteorspace.com/2025/02/13/statistics-that-prove-how-your-delivery-speed-impacts-your-business/. Accessed 24 Oct. 2025.

Thompson, Ben. “Aggregation Theory.” Stratechery, 17 July 2015, stratechery.com/2015/aggregation-theory/. Accessed 24 Oct. 2025.

Thompson, Ben. “Defining Aggregators.” Stratechery, 24 Apr. 2017, stratechery.com/2017/defining-aggregators/. Accessed 24 Oct. 2025.

“Uber Eats Statistics.” Business of Apps, www.businessofapps.com/data/uber-eats-statistics/. Accessed 24 Oct. 2025.

“10 Years of WeChat History.” Eggsist, www.eggsist.com/en/insights/10-years-wechat-history/. Accessed 24 Oct. 2025.

Super App Market in United States. Research and Markets, www.researchandmarkets.com/reports/6105712/super-app-market-in-united-states. Accessed 24 Oct. 2025.

“Superapps.” Venture Vine, Medium, medium.com/venturevine/superapps-6a425de7db87. Accessed 24 Oct. 2025.

“The Era of Provable Software.” Succinct Writings, writings.succinct.xyz/provable. Accessed 24 Oct. 2025.

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author's own, not the views of their employer. This post has been created in collaboration with the DeFi App team. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research.

If someone could create an everything app it would be Amazon or another cloud company with existing physical infrastructure that can handle apple fees and the numerous transactions Americans users make