Maverick: The Dynamic Liquidity Provision AMM

A Decentralized Exchange focused on automatically rebalancing liquidity positions for LPs and providing deep liquidity for traders

Shoal Research Contributors:Gabe Tramble 0xMoe

Intro

Decentralized Exchanges (DEX) are one of the most transformative innovations in the DeFi space. Uniswap, with its Automated Market Maker (AMM) design, initiated a significant shift by enabling traders to swap assets permissionlessly, even in low-liquidity markets. AMMs create a two-sided market consisting of liquidity providers and traders. While these innovations have been groundbreaking, both traders and liquidity providers (LPs) alike still express disdain regarding fees and flexibility around the platform - intro Maverick protocol.

Maverick Protocol advances the traditional AMM model by introducing the Dynamic Distribution AMM (DDAMM), which actively adjusts liquidity in response to market prices. The DAMM design improves the AMM experience for both liquidity providers (LPs) and traders by lowering slippage for traders and adding enhanced LP strategies. The protocol also focuses heavily on liquid staking token (LST) trading, eliminating major slippage trading amongst ETH LST pairs.

Operating on both Ethereum and zkSync Era, Maverick's design also aims to improve capital efficiency and reduce impermanent losses for both liquidity providers and traders. One of the key features of Maverick is its built-in automatic rebalancing, which eliminates the need for users to spend significantly to move their liquidity position back into range so it continues to earn fees. Currently, on Uniswap V3, users can specify a price range in which their money is at work. When the price moves out of this range, their capital becomes idle, which forces them to spend gas to rebalance their capital to meet their strategy, given changes in market conditions and price. Dynamic rebalancing significantly enhances the user experience by providing superior capital efficiency and lowering the cost to service the LP.

Capital efficiency: “Effective utilization of resources to generate maximum output or returns. Prevention of idle money.” - Shoal Research

Before we delve deeper into the Maverick Protocol, it's essential to understand how an AMM works.

Automated Market Makers (AMM)

Automated Market Maker (AMM) is a term used in decentralized finance to describe a protocol that facilitates the trading of digital assets without relying on traditional order books. Instead, AMMs use mathematical algorithms to determine the prices of the assets being traded automatically.

On a conventional exchange, buyers and sellers place orders in an order book, and the exchange matches these orders to facilitate trades. However, in an AMM-based decentralized exchange, there are liquidity pools. Liquidity pools are collections of funds that users deposit to fulfill trades. Liquidity providers (LPs) get incentives, fees, and rewards for providing liquidity.

AMMs enable instant, permissionless trading and are fundamental to the functioning of decentralized exchanges. Unlike traditional exchanges, non-institutional users can take on the role of market makers by adding liquidity in exchange for fees. However, providing liquidity in an AMM can come with risks such as impermanent loss, which occurs when the prices of assets in a pool change compared to when they were deposited. Impermanent loss can also be described as the missed opportunity cost of potential value when providing liquidity versus holding the assets outright.

AMM iterations on Uniswap

Maverick AMM

Maverick's Automated Market Maker (AMM) design differs greatly from other AMMs. Maverick is centered around optimizing capital efficiency and providing flexibility for Liquidity Providers (LPs). The protocol segments liquidity into different pills called Bins, which aim to improve capital efficiency. Here's an overview of its design:

Bins

Maverick employs bins," representing a specific price range within the liquidity pool. This segmentation allows Liquidity Providers (LPs) to allocate their assets to specific price ranges, optimizing capital allocation based on market conditions. In other AMM designs, like Uniswap v2, liquidity providers provide liquidity across an infinite price range. With Mavericks bins, LPs can ensure they only provide liquidity at specific prices and/or abide by the liquidity provision rebalancing strategy.

Segmented Liquidity Pools

To better understand Mavericks Bin's liquidity design, Imagine you're at a fruit market and want to sell apples. Instead of setting one price for all apples, you create different buckets where each bucket has a price range. For example, one bucket for really cheap apples, one for moderately priced apples, and one for expensive apples in Maverick's AMM; these buckets are called "bins," and they let you specify the price point you want to provide inventory to the market. Depending on the price of the apples, buyers will only pull from the bucket at the current market price. If you want to sell your apples, you have to provide liquidity within the current price range, or wait until the price reaches your bucket. Depending on the LPs strategy they might chose to provide liquidity at certain price ranges below, at, or above the current price.

Uniswap v2 is akin to allowing people to buy your apples at any price, depending on the overall market price. By using bins, LPs also have a tighter grasp on their capital risk controls, potentially limiting impermanent loss, and maximizing fees.

Boosted Pools

With incentivized pools, custom liquidity shaping (LP strategies), custom fee tiers, and directional liquidity provision, Maverick creates increased tooling for LPs to participate in the market. In addition, Maverick supports liquidity mining solutions where protocols can permissionlessly incentivize liquidity via "boosted pools." Boosting pools draws more liquidity to the pool as LPs will make more yield from increased reward incentives. Protocols are incentivized to boost their pools to ensure users can seamlessly swap between assets without significant price impact. With deeper liquidity comes a lower price impact. Furthermore, Maverick's modes offer different options for liquidity provision, allowing users to tailor their approach based on their preferences. Maverick further amplifies yield by automatically reinvesting trading fees back into the liquidity provider's position.

Maverick Modes

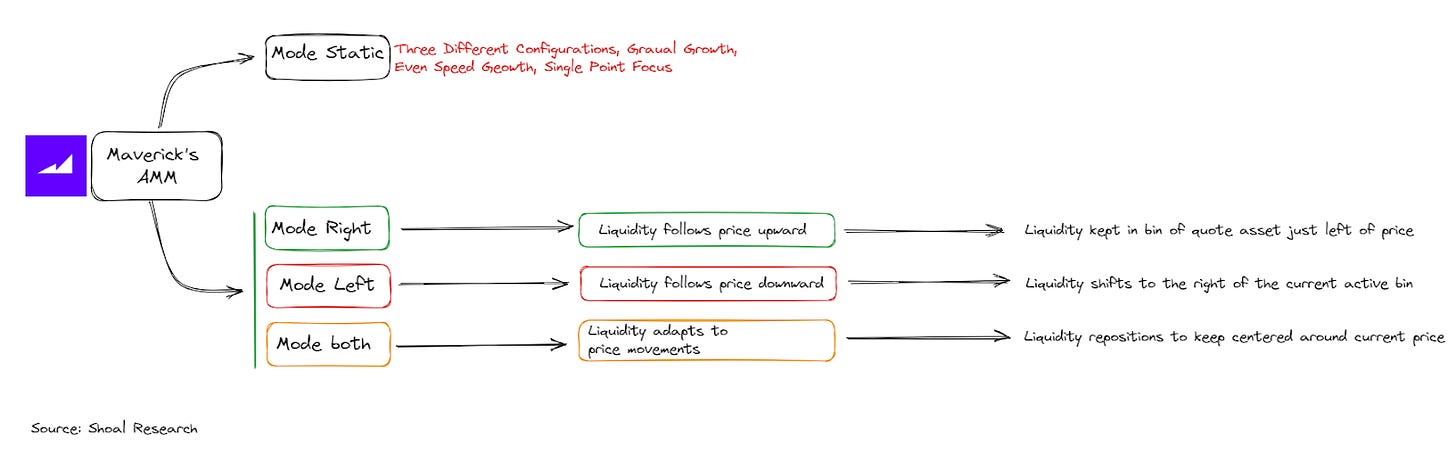

Maverick's Automated Market Maker (AMM) design offers four distinct modes for liquidity providers (LPs) to optimize strategies based on market conditions labeled Mode Static, Mode Right, Mode Left, and Mode Both. Each mode presents characteristics that tailor LP strategies for maximum fee generation; let's cover them one by one below:

Mode Static

Mode Static is the conventional mode and resembles the functionality of existing AMMs. It does not employ automated liquidity shifting. In this mode, LPs have the liberty to deploy liquidity with three default configurations:

Exponential: “Gradual Spread”: most of the liquidity is bunched up close to the current pool price, and the rest is spread out across nearby price range bins, decreasing bit by bit.

Flat: “Even Spread”: liquidity is spread out evenly across different price ranges, centered on the current pool price, similar to how Uniswap v2 works.

Single Bin: “Single Spot Focus” means all the liquidity is put into one spot, the active price range. The Single Bin is like putting all your eggs in one basket, similar to Uniswap v3.

Mode Right

Mode Right operates as a dynamic range order that tracks the price in an upward direction. It is particularly beneficial for LPs looking to capitalize on the positive price action of the base asset. In this mode, liquidity is kept in a bin of the quote asset just to the left of the price as it ascends, poised to capture fees whenever the price falls within the range. Essentially, Mode Right is tailored for scenarios where the LP anticipates an upward price trajectory.

Trading Pair Example: ETH/USDC

Base Asset: Or basis, is the asset to be purchased or sold, ex. $ETH

Quote asset: the payment asset for the base asset, ex. $USDC

Mode right in practice: Imagine you have two assets, A and B. If the price of asset A starts to rise, Mode Right ensures that your liquidity is concentrated just below the current price. This allows you to earn fees when the price dips slightly. It's like riding the wave of an asset's price as it goes up.

Mode Left

Mode Left is essentially the inverse of Mode Right. It continuously shifts liquidity to the right of the current active bin when the base asset is trending downward. This mode is advantageous for LPs who anticipate a decline in the price of the base asset. In Mode Left, an LP aims to maintain a bin of base assets directly to the right of the price as it moves left in the pool, ready to match orders once the price rebounds.

Mode Left in Practice: If the price of asset A starts to fall, Mode Left ensures that your liquidity is concentrated just above the current price. This allows you to earn fees when the price slightly rises before continuing its downward trend.

Mode Both

Mode Both is the all-around Mode that enables liquidity to adapt to price movements dynamically, be they upward or downward. LPs have the option to allocate liquidity to the currently active price range as well as the ones immediately next to it. As the price sways in any direction, Mode Both smartly repositions the liquidity to keep it centered around the current price. This Mode is somewhat like having an auto-adjusting focus in a camera that keeps the subject sharp regardless of movements. However, it's crucial to be mindful that Mode Both comes with increased susceptibility to impermanent loss, particularly in markets that have a lot of price fluctuations.

Incentives

Maverick's incentive structure is designed to reward liquidity providers (LPs) based on their market prediction, participation,, and risk tolerance.

Predicting Price Movements: Maverick's Mode Left or Mode Right allows LPs to automatically adjust their liquidity to follow the price movement, keeping their capital active and efficient.

Stable Price Expectations: Mode Both are ideal for LPs who expect minor price fluctuations, allowing them to keep their liquidity active and collect as many fees as possible.

Exponential Distributions: In Mode Static, LPs can place most of their liquidity at the current price, spreading the rest across surrounding price ranges and balancing liquidity concentration and risk.

A few more strategies and ways to earn fees and maximize returns from Maverick are:

Limit order strategies

Dollar-Cost Averaging (DCA) strategies

Buy-Sell Ramp

Even Distribution

Stake to earn

Maverick’s Go-to-Market Approach

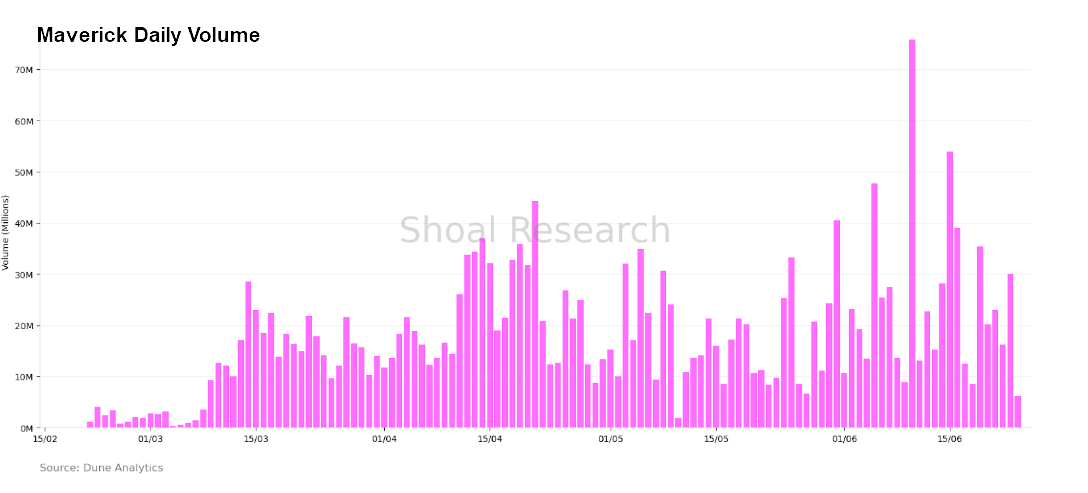

Maverick has adopted a distinctive approach for its go-to-market strategy. Instead of solely launching on Ethereum, the protocol is a pioneer in the zkSync Era. This multi-platform approach allows Maverick to take advantage of each platform's unique features and benefits, providing a more robust and versatile service to its users. The zkSync Era officially launched in March, and while the ecosystem is still in its early stages, there has been a steady increase in volume. Furthermore, Maverick's DEX volume continues to climb, securing a position among the top 500 DEX platforms. Currently, it stands at number 5 among Ethereum DEXs. In comparison, Uniswap, a prominent player in the space, boasts a volume of over 700 million and ranks number one on the Ethereum chain. Maverick also chose to launch their token on Binance launchpad which has a considerable list of successful projects. By launching on Binance they were able to bootstrap initial token liquidity and holder diversification.

Examining the Metrics

Maverick is not only excelling in terms of volume but also fee generation. The platform has consistently set new all-time highs in volume since its launch, with an ATH of $20,000 on June 1st and currently reaching over $13,000. This growth can be attributed to users' ongoing migration to new DEXs, driven by the desire for improved incentives and diversified risk exposure.

Mavericks Total Value Locked (TVL) is also pushing all-time highs on the Ethereum chain, currently at $35 million. In addition, it has marked a TVL of roughly $7 million on zkSync Era. This substantial TVL, mirroring the trading volume, signifies the robust growth and deepening trust in the Maverick protocol.

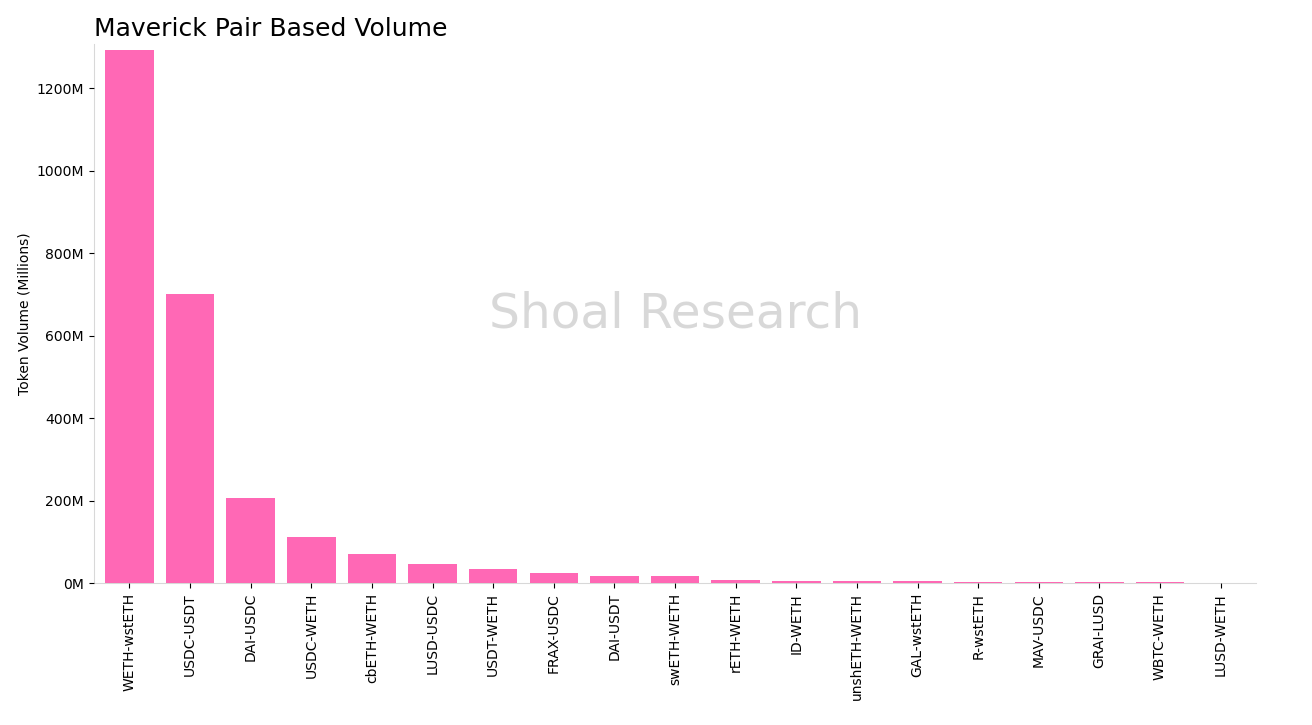

Currently, the majority of pools on Maverick are utilized by users who are primarily focused on stablecoins and LSTs, which both typically have lower price deviation. With the inclusion of stablecoins and liquid staking assets, trading volume typically comes from the WETH/wstETH and USDC/UST pools.

It is worth noting that users may require some time to familiarize themselves with the AMM (Automated Market Maker) and Maverick's liquidity strategies, which may impact the pace of adoption and utilization. AMM complexity for liquidity provision is not a new issue. Many users voiced concerns about Uniswp v3's design complexity for users. Given general LP complexity, Mavericks volume metrics are impressive.

While many Decentralized Exchanges (DEXs) typically employ attractive reward strategies like yield farming or liquidity incentives to draw user traffic and boost trading volume, Maverick emphasizes low-slippage trading. This unique strategy is gradually earning Maverick recognition among other market entrants.

From its inception, Maverick has shown a propensity to be favorable towards large-scale investors, often referred to as 'whales.' Analysis of the trade data reveals that the majority of trades are above $100k, placing them at the top of the transaction size spectrum. This is followed by smaller trades and retail activity. On the Ethereum mainnet, a significant portion of Maverick's trading volume, over 75%, is derived from transactions exceeding $10,100, with very few transactions happening below this threshold.

Influence on LSTs

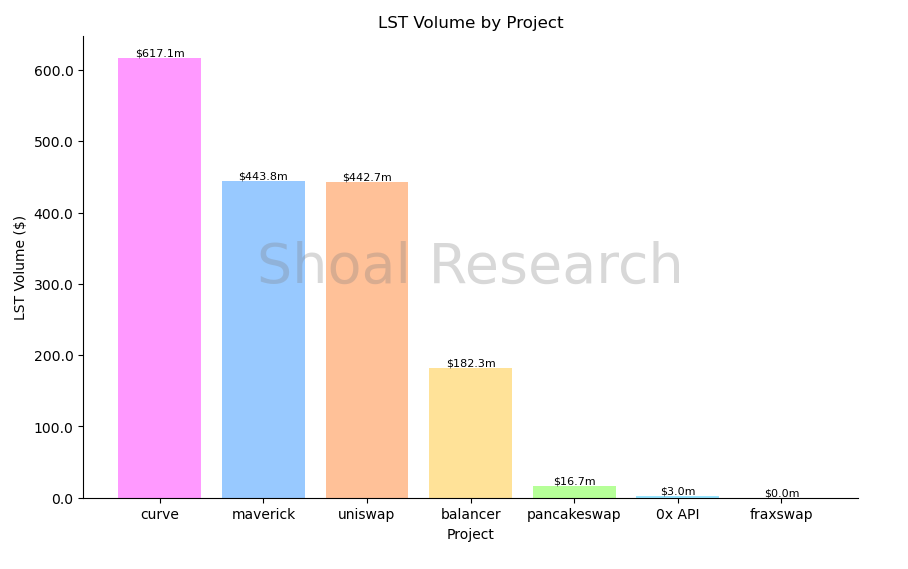

LST's protocols are attracting increasing attention, and their narrative is growing stronger daily. The narrative surrounding LST is anticipated to gain momentum in the coming months and extend into the next year, solidifying its position as a potential leader in AMM and CDP-based protocols. While several DEXs are already consuming LST and CDP volumes, Maverick currently captures approximately 24% of the LST volume compared to other top venues. Nevertheless, the path ahead will undoubtedly be challenging as competition intensifies.

LST Trading Volume

Maverick has quickly established itself as a formidable competitor, currently holding a 26% market share volume, in the last 30, on par with Uniswap. This achievement is particularly impressive considering Maverick's relatively recent launch. The rapid growth and strong metrics exhibited by Maverick within a short time is remarkable.

Dex Trading Volume

Considering the global view of DEX trading volume over the past 30 days, Maverick currently represents only around 2% of the total DEX volume. Notably, a significant portion of this 2% is attributed to the LST volume.

DEX Aggregator Routing

One of the most interesting metrics around Maverick is 99% of transaction volume comes from DEX aggregators. DEX aggregators sit on top of AMMs and route customer trades to the most efficient swap destination. Since Maverick is highly capital efficient, large swaps for LSTs and stablecoins often route to Maverick from services like 1inch, Cowswap, Metamask, and others.

Maverick's volume origination highlights DeFi compatibility, which refers to decentralized applications (Dapps) as building blocks that can be replicated or built on top of. In the case of Maverick, the underlying architecture speaks for itself, and trade aggregators automatically route transactions to the platform.

Market Competition

Trader Joe's was one of the first DEXs, to utilize liquidity bins. Many market participants often draw comparisons between Trader Joe's and Maverick's design implementations due to the similarities in architecture.

Differentiating from Trader Joe, Mavericks provides various modes or strategies for liquidity management based on directional bets. These modes enable the dynamic adjustment of liquidity in response to price fluctuations.

Challenging the AMM King, Uniswap

The primary challenge for most newly launched decentralized exchanges (DEXs) is attracting user traffic and volume from established DEXs like Uniswap and Curve. Many of these new protocols initially succeed in attracting a user base. Still, users often revert to the more prominent players when the new projects fail to deliver on their initial promises or user incentives dry up.

Despite the launch of Uniswap v3 and anticipated v4, Maverick stands out due to its ability to provide efficient incentives and liquidity strategies for protocols and users. Its unique features make it attractive for both LPs and traders alike. We are already seeing early signs of success from DEX aggregator order routing.

Conclusion

Maverick Protocol is a novel entrant in the DeFi sector, where most AMM implementations are forks of existing systems, introducing unique liquidity provision strategies that enhance trading efficiency. Despite the dominance of established DEXs, Maverick has shown promising growth due to its increased capital efficiency. Its recent launch on Ethereum and zkSync is a testament to its work-based design with strong fundamentals and growth metrics. As LPs and traders continue to seek better LP solutions and AMMs with high incentives, low fees, and minimal slippage, we believe Maverick could become one of the go-to platforms.

Sources

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are my own, not the views of my employer.