RYSK Finance: Dynamically Hedged Real Yield

Uncorrelated returns leveraging RYSK low delta options vault

Traditional finance experts may be surprised to learn that many DeFi (decentralized finance) protocols are taking concepts from traditional finance and replicating them in a decentralized context. By optimizing systems for users to access them in a permissionless manner, DeFi developers have created unique two-sided markets that serve the same purpose as traditional markets but with better incentive mechanisms.

Intro, RYSK Finance

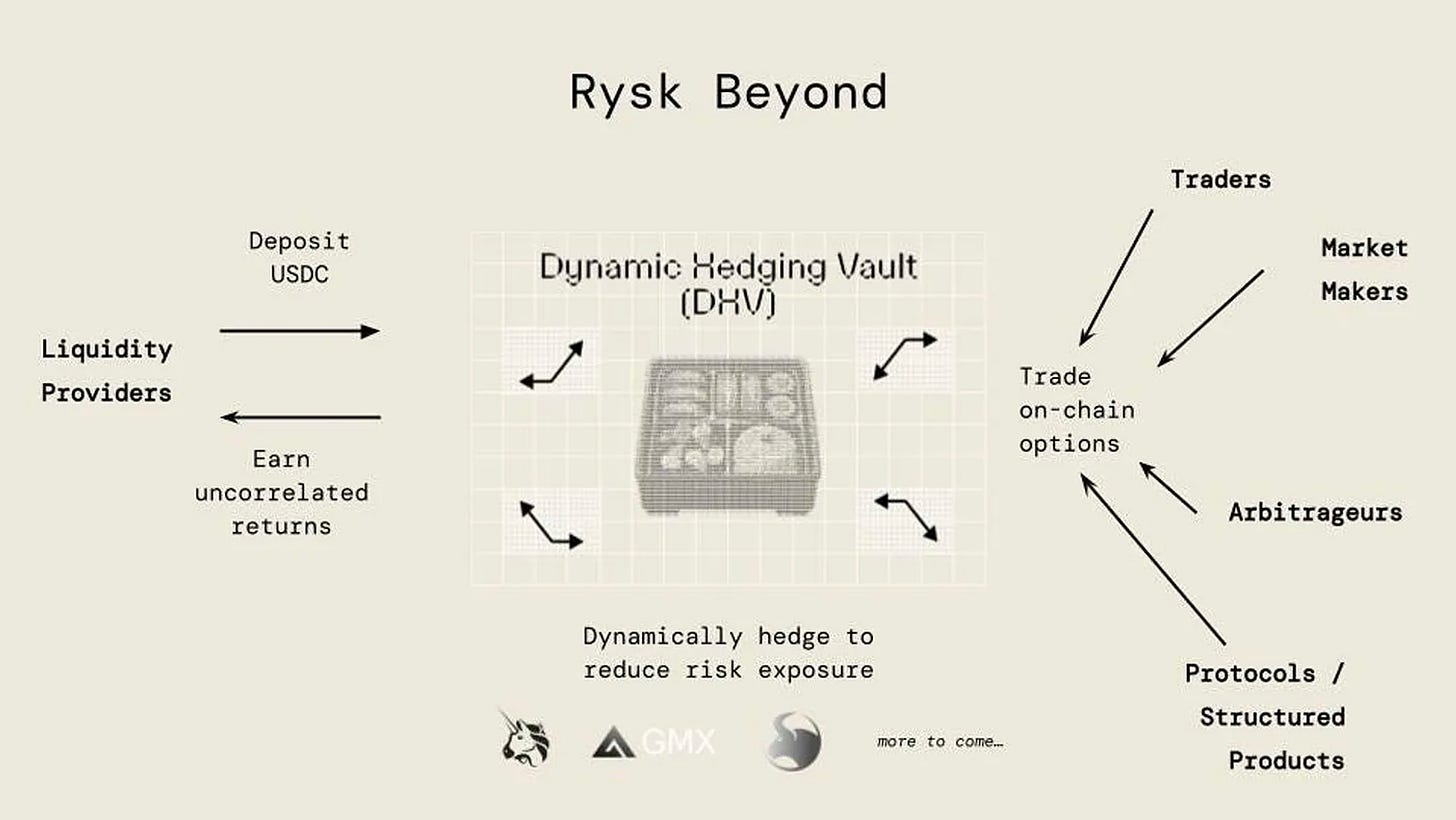

One such DeFi protocol is RYSK Finance, an innovative options trading platform that allows traders to buy or sell options using their Dynamic Hedging Vault (DHV). The DHV is a novel liquidity vault that automatically rebalances itself towards delta neutral, which means that it retains low delta (directional risk exposure) ensuring price movements have little effect on the vault. Delta is a crucial risk measurement used by traders to price options accurately. By maintaining a low delta, RYSK Finance ensures that price changes of the underlying assets do not affect the vault’s exposure. The options contained within the DHV are meticulously managed to target a delta-neutral position.

Imagine putting $100 USDC into a pot that provides liquidity for traders. As these traders engage in buying or selling options, the pool simultaneously executes the buying and selling of other DeFi assets in the open market, aiming to preserve the deposit value at $100. This protects liquidity providers' USDC deposits against market price fluctuations. Concurrently, the DHV sets different prices for buying and selling the same option, creating a price gap called a spread. Liquidity providers collect this spread as payment.

The DHV is optimized to be short volatility (price fluctuations) with a low delta to deal with high crypto volatility. In other words, it is optimized for large price swings. This is an important feature that enables better risk management and helps liquidity providers profit from high crypto implied volatility (expected magnitude of volatility). Under the hood, RYSK derives some core options functionality from battle-tested Opyn Gamma protocol, an options settlement layer.

DHV Real Yield and Uncorrelated Returns

In addition to benefiting traders, liquidity providers will also appreciate RYSK’s uncorrelated returns by receiving fees on spreads (payment) for market making options for traders generating real yield.

Uncorrelated Returns & Defi Composability

RYSK prioritizes the generation of uncorrelated returns, which refers to the capacity to yield consistent returns irrespective of market conditions. In the context of crypto, the price of Bitcoin going up or down does not affect the constant yield. With uncorrelated returns, investors and LPs can diversify their portfolios. RYSK is a permissionless on-chain protocol, allowing anyone to access this investment vehicle through existing crypto infrastructure such as a Coinbase wallet. This approach not only promotes the availability of decentralized financial tools but also empowers individuals beyond the core team to enhance the protocol's utility through DeFi composability. Composability refers to the ability to take one protocol and build on top of it or expand its utility due to the open-source code. The combination of composability and uncorrelated real yield establishes a fertile environment for the development of innovative financial applications.

Real Yield protocols like GMX and Gains Network have attractive tokenomics and incentive mechanisms to ensure liquidity. Instead of relying on token emissions (printing tokens), the protocols harness the core business model of trading derivatives, distributing the fees (payments) generated to LPs and token holders. Similarly, RYSK employs a tokenless model for value accrual. LPs (Liquidity providers) simply need to deposit USDC into the DHV pool for returns.

Learn more about Defi real yield in the GMX: A Real Yield & Defi Primitives Launchpad article.

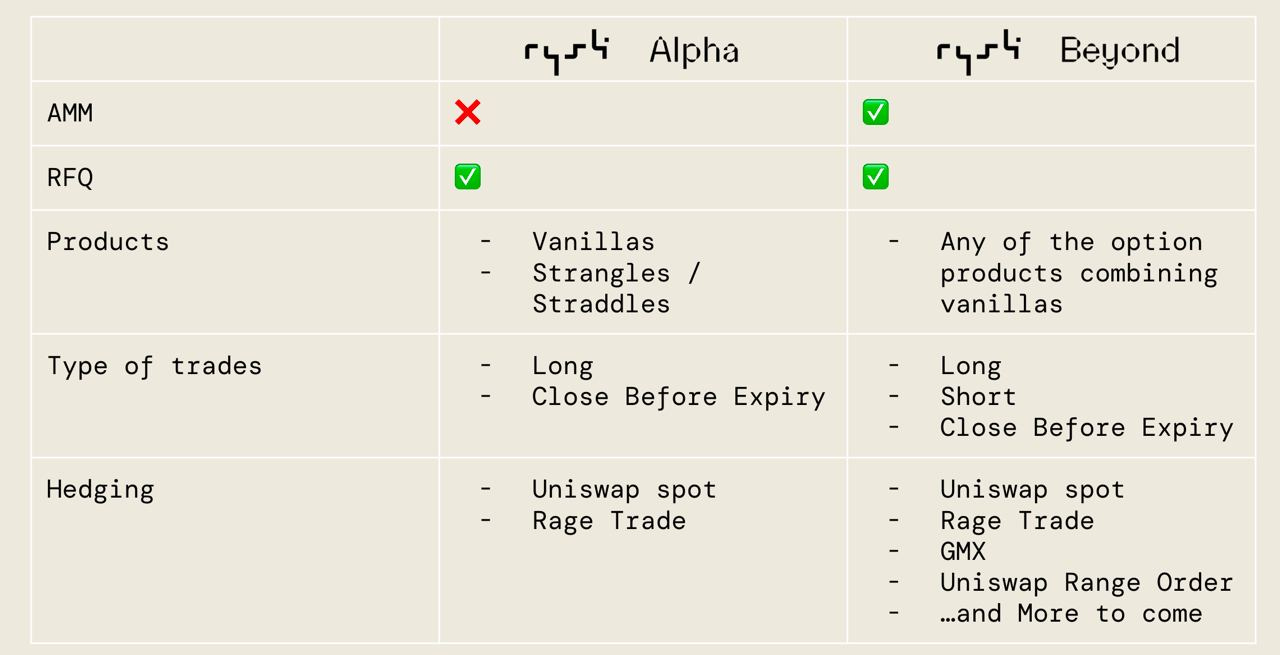

RYSK Beyond

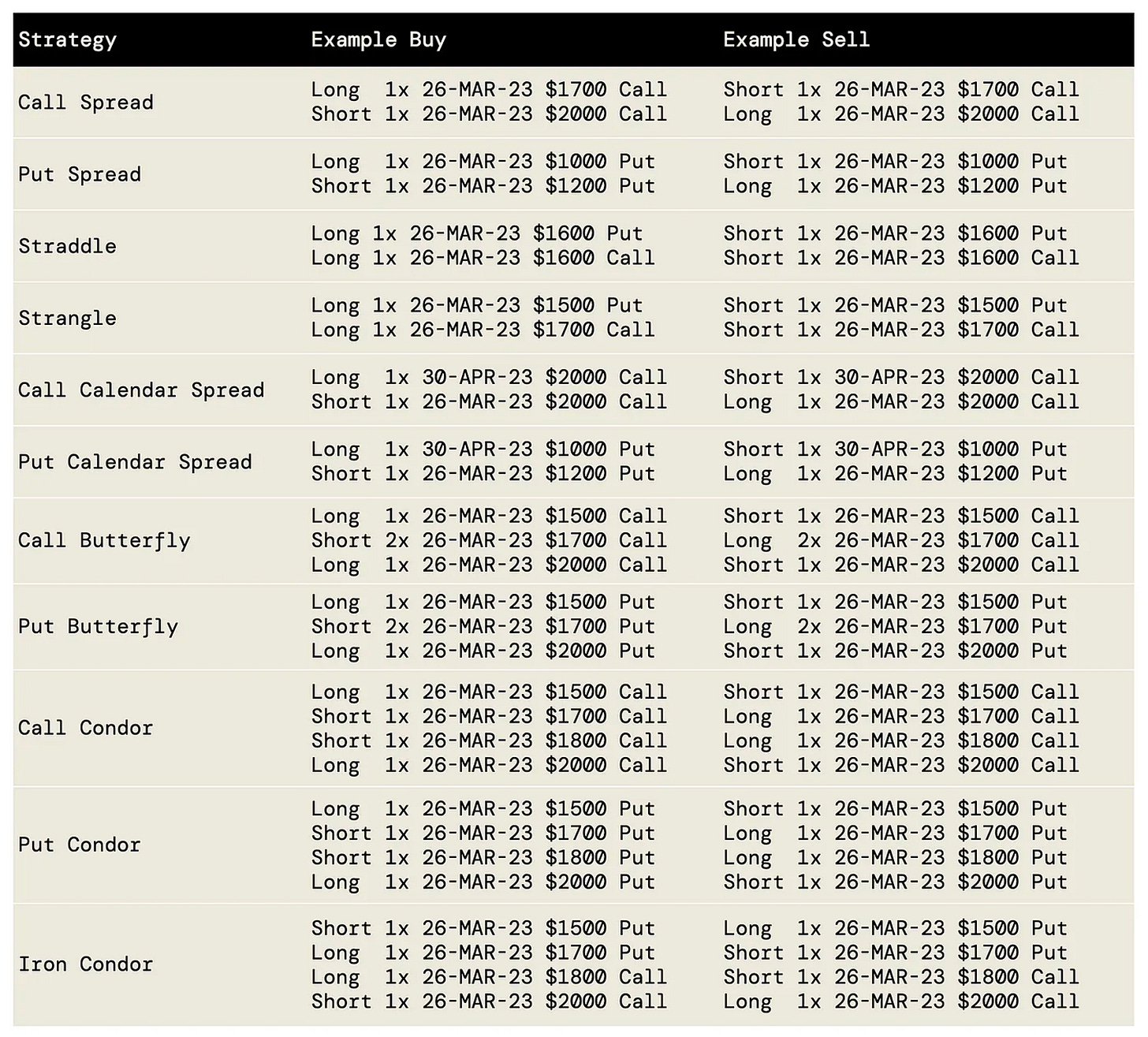

RYSK finance is currently in its proof of concept stage, RYSK Alpha, which focuses on selling options and hedging. However, there’s more good news for LPs and traders. The anticipated RYSK Beyond upgrade will enable the DHV to both purchase and sell options, leading to better uncorrelated returns. By servicing both sides of the options market, the DHV fundamentally operates as an on-chain, decentralized market-maker. Drawing parallels with its centralized crypto counterparts such as Jump, GSR, Wintermute, and even SBF’s treacherous Alameda. As an automated on-chain counterparty for traders, RYSK will enable a wide range of strike prices and expiry dates for hedging, speculation, or filling arbitrage opportunities. The DHV also targets market neutrality by pricing options cheaply to attract buyers. If the delta moves away too far from 0, the DHV will buy spot, leverage perpetuals, and implement other strategies to maintain low delta.

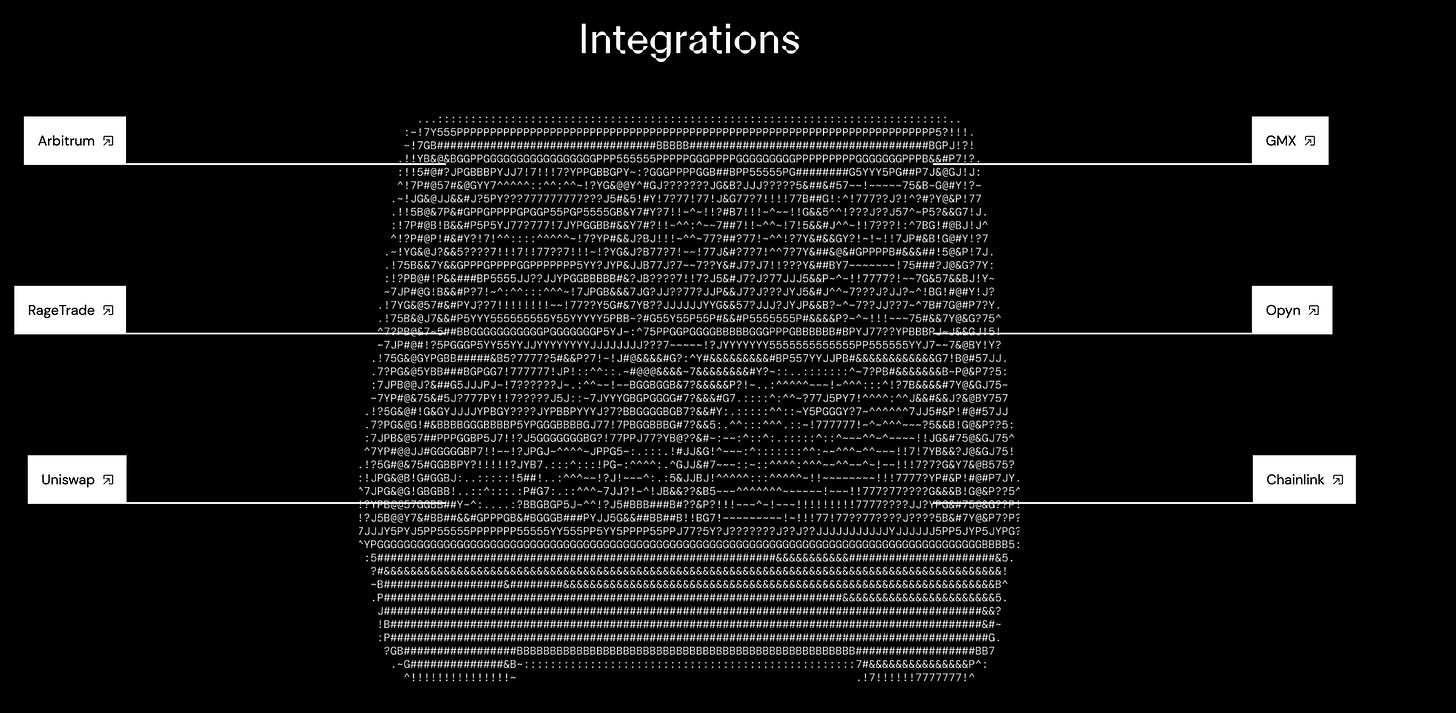

The RYSK Beyond DHV is integrated with several other DeFi protocols, including GMX, Rage Trade, Uniswap, and Opyn, with more to come. This integration allows the vault to automatically rebalance itself when traders interact with it, making it a more efficient and effective tool for traders and liquidity providers alike. In its current version the DHV at times does require manual hedging by the team. The team inputs variables into the contract and the contract automatically hedges using different integration tools.

With GMX, the DHV can trade perps on a highly liquid market without being impacted by slippage.

With Uniswap Range Orders, the DHV can place spot limit orders enabling hedges with a variable time of execution and a fixed price - RYSK Finance

With one-click options strategies traders can buy and soon sell options on the RYSK platform. In addition, RYSK will offer multi-collateral partial collateralization, meaning option writers can use different types of collateral, including USDC and ETH. The options produced by the vault are priced using a few inputs including the Black-Scholes model, which is a mathematical options pricing model.

Risks

Being a part of the Defi ecosystem, Protocols like RYSK finance, introduce a new level of permissionless financial tooling to traders and liquidity providers. However, with this level of freedom comes a degree of risk. As with any financial product, risks are inherent, and it is important to understand them before depositing.

When it comes to RYSK finance, there are two main types of risks:

Financial risks: Possibility that the vault can not maintain a low delta, causing significant losses to liquidity providers.

Smart contract risks: Possibility of attacks on the on-chain smart contracts or vulnerabilities in the vault mechanisms.

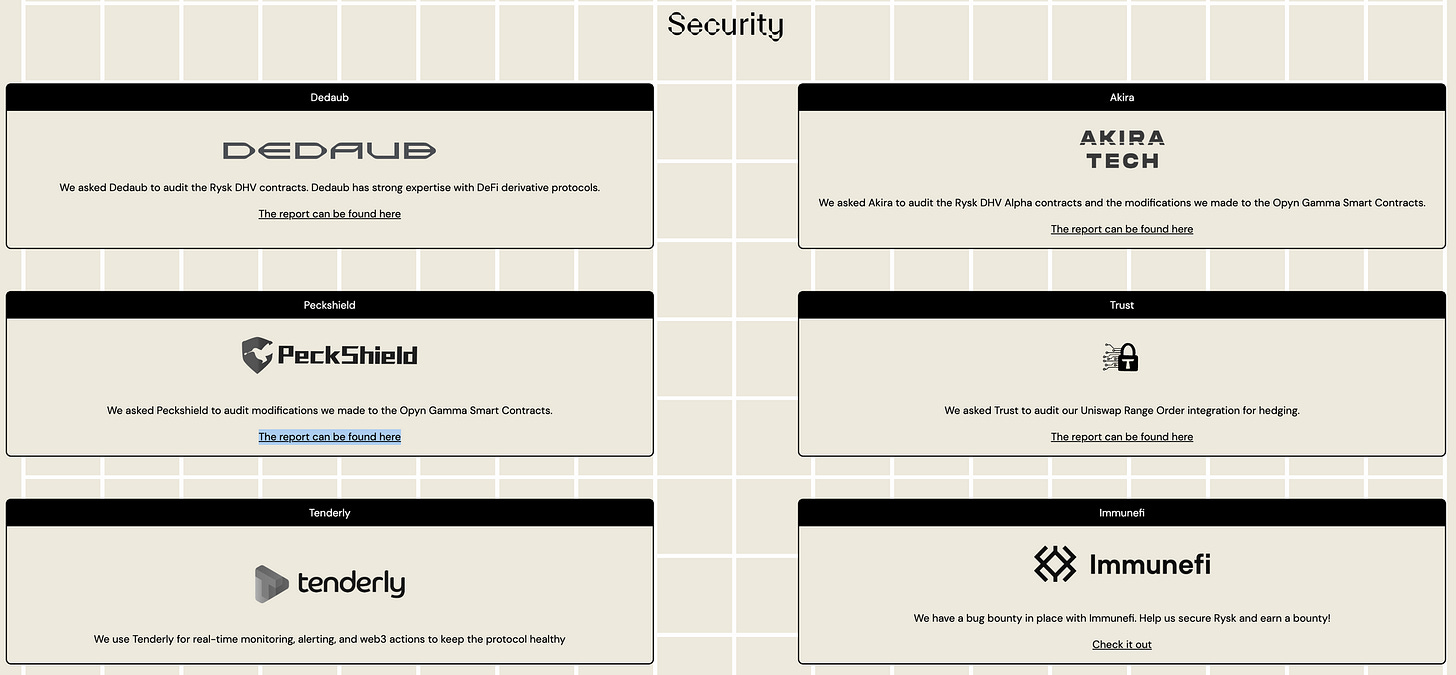

Despite the potential risks, users are still able to operate with confidence, as the RYSK team has taken the necessary precautions to minimize risk through code audit. They have even highlighted these risks in their documentation, which shows the audits from firms like Dedaub and others.

Fin

RYSK Finance's Dynamic Hedging Vault (DHV) provides traders and liquidity providers with another tool in their arsenal. Both traders and LPs anticipate the upgrade as it should result in larger LP returns and expanded out-of-the-box trading strategies. Overall, RYSK Finance's DHV is an exciting innovation in the DeFi ecosystem, offering a novel approach to options trading while providing real yields and uncorrelated returns to liquidity providers.

Sources:

Not financial or tax advice. The purpose of this newsletter is purely educational and should not be considered as investment advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosure. All of my posts are my own, not the views of my employer.