Fragmetric: Unlocking Composable Restaking with Solana’s Token-2022 Standard

Explore how Fragmetric is setting a new standard for modular, capital-efficient restaking on Solana.

A Primer on Restaking, Liquid Restaking

The adoption of Proof-of-Stake (PoS) has surged as blockchains seek more efficient and secure consensus. Ethereum’s long-awaited transition to PoS in 2022 was a milestone, slashing the network’s energy use by an estimated 99.95%. Even before this merge, major networks like Solana, Cardano, and Algorand had embraced their own variations of PoS for its eco-friendliness and security, signaling an industry-wide shift away from energy-intensive mining.

Solana’s blend of Proof-of-Stake (PoS) and Proof-of-History (PoH) consensus mechanisms illustrates how staking can secure a network while supporting lightning-fast transactions and minimal fees. In essence, holders delegate their SOL tokens to trusted validators, much like casting votes in a democratic election. Validators, in turn, ensure smooth network operations and earn rewards from transaction fees and protocol inflation.

Yet, even as staking became a popular and effective method of securing blockchain networks, it introduced a notable drawback: locked capital. Assets staked in traditional PoS are immobilized, limiting their broader economic utility and capital efficiency. Recognizing this inefficiency, many teams began exploring ways to leverage staked capital more effectively, enabling it not just to secure one blockchain but to extend its security benefits across multiple networks.

The rise of modular infrastructure and services has given way to a proliferation of new app-specific blockchains, which have historically struggled with bootstrapping their validator networks due to a lack of activity and, therefore, economic incentives for participation. As such, new mechanisms were formed to extend the utility of staked assets to help secure and bootstrap new blockchains. This is what has come to be known as restaking.

The Restaking History

Restaking extends the utility of staked assets by allowing them to simultaneously secure multiple protocols, and as a concept, it has been tested and implemented in app-specific blockchains such as Polkadot, Cosmos, and Avalanche, where security is a primary concern. A handful of different ecosystems and blockchains have implemented some form of shared security over time. The individual details may vary, but the core concept still remains the same: a larger protocol enables smaller protocols by allowing such protocols to tap into their existing vast pool of economic and computational resources to aid in their initial growth while improving capital efficiency and returns to the larger protocols.

In the Polkadot network, validators stake DOT to participate in the relay chain, which is then used to provide security to Parachains. On the Avalanche network, validators securing the C-chain (the primary hub of economic activity) can participate in subnets, which connect to a dynamic set of validators working together to secure or achieve consensus on the state of a set of chains. Subnets secure many chains on the network, but each chain is validated by one Subnet.

Cosmos, on the other hand, implements Replicated Security (formerly Interchain Security), where the top 95% of the Cosmos Hub’s validator set is replicated across “consumer chains.” These validators must run nodes for every consumer chain, effectively sharing the slashing risk and infrastructure burden. ATOM stakers can choose to opt-out of this cross-chain exposure by delegating outside the top 95%, albeit at the cost of reduced yield.

However, it was EigenLayer that truly popularized “restaking” as a standalone paradigm in 2023 on Ethereum and beyond. EigenLayer allowed Ethereum stakers to opt-in and re-stake their ETH or liquid staking tokens to secure new modules (initially dubbed Actively Validated Services, or AVSs), thereby extending Ethereum’s security to new use-cases without launching new blockchains. This innovation opened eyes to the untapped potential of leveraging existing stake for additional utility. Yet, EigenLayer’s early design also highlighted some inefficiencies, from single-asset limitations to reliance on off-chain reward distribution processes, largely due to Ethereum’s technical constraints.

Jito Restaking on Solana

On the other hand, Solana’s implementation of the Restaking concept launched on July 25th, 2024, when the Jito Foundation released their code for the Jito (Re)staking protocol, a hybrid multi-asset staking protocol on Solana enabling any new network or application to bootstrap their economic security.

Jito (Re)staking is Solana’s first-class framework for restaking, developed by Jito as a next-gen infrastructure for multi-asset staking. In simple terms, Jito’s protocol lets users stake (or re-stake) any supported asset on Solana to secure additional networks or services – called Node Consensus Networks (NCNs) – while maintaining liquidity via tokenized receipts. The protocol consists of two primary components: the Vault Program, enabling the creation and management of staked assets, and the (Re)staking Program, coordinating activities and incentives among network participants. Together, these two core programs offer developers a modular, scalable framework for streamlining staking mechanisms for any SPL asset, marking the first protocol of its kind on Solana.

Vault Program

This on-chain program manages the creation and operation of Vault Receipt Tokens (VRTs) – Solana’s flavor of liquid restaking tokens. A vault in Jito can accept any SPL asset (SOL, staked SOL like JitoSOL, or even a project’s own token) as its underlying stake. When you deposit tokens, the Vault program stakes them (either directly or via existing liquid staking tokens) and mints you VRTs in return. These VRTs act as liquid representatives of your staked position – you can hold or use them in DeFi while the vault deploys the underlying stake to earn rewards. The Vault Program handles all the heavy lifting: minting and burning VRTs, delegating the staked assets to chosen operators, and even enforcing any slashing conditions specified by the network you’re restaking to.

By design, the Jito vault supports only one asset per vault and can delegate only to node operators, not directly to NCNs. To overcome this limitation and enable multi-asset support, Fragmetric developed a wrapper program that extends the vault’s functionality. This enhancement allows for the creation of a unified restaking experience with customizable delegation strategies. For example, a vault’s stake could be spread across several node operators or even indirectly support multiple NCNs, all governed by a DAO or automated protocol logic.

Restaking Program

If vaults are where users interact (depositing tokens and receiving VRTs), the Restaking Program is the coordination layer that ties everything together. It’s responsible for registering and managing the Node Consensus Networks (NCNs) themselves, as well as the node operators who run them. An NCN in Jito’s framework is analogous to EigenLayer’s AVS – it’s any service or protocol (on-chain or off-chain) that wants to leverage Solana’s staked assets for security. The Restaking Program lets these NCNs define their parameters: which vault(s) (i.e. which tokens) they accept, what the reward structure is, and what conditions would trigger slashing of misbehaving operators. This program implements opt-in/opt-out logic so that vaults or operators can choose which NCNs to participate in, and it handles the distribution of rewards and slashing penalties on-chain. In other words, when an NCN pays out rewards, the Restaking Program makes sure those rewards get routed to the right vaults and thus to VRT holders and operators; if a node operator violates the rules, the program can slash their staked assets per the NCN’s policy. All of this happens transparently on Solana’s ledger.

How do these pieces work together?

Let’s say a new protocol (call it ORCL, an oracle network) wants to use Jito (Re)staking. ORCL would register as an NCN via the Restaking Program, perhaps specifying that it will accept restaked $ORCL tokens (its governance token) and JitoSOL as collateral from stakers. Jito’s Vault Program can then set up vaults for ORCL – one for $ORCL deposits and another for JitoSOL. When users stake into these vaults, they receive, for example, rORCL and rJitoSOL VRTs (liquid tokens representing their stake in ORCL’s security). The vaults delegate the actual $ORCL and JitoSOL stake to ORCL’s node operators.

Now, ORCL’s oracle nodes are economically secured by two assets. If they try to feed wrong data, they can be slashed in either or both vaults. While the enforcement of such slashing policies, such as penalizing a portion of the operator’s rORCL and rJitoSOL stake, is defined by ORCL’s predefined rules, it is not natively handled by the Jito Restaking Program. Instead, these rules must be implemented and enforced externally through custom program logic. Meanwhile, as ORCL’s oracles perform their duties correctly, they might reward participants, including stakers, with freshly minted $ORCL tokens or fee income. These rewards are then tracked and distributed through ORCL’s own reward mechanisms, not the Jito Restaking Program, to the appropriate rORCL holders.

All the while, users who hold rORCL or rJitoSOL can use these tokens elsewhere or redeem them, just like any liquid staking token. In this way, Jito (Re)staking acts as a one-stop, on-chain platform for launching and managing a restaking-enabled service on Solana – you get secure staking, customizable slashing, and liquid tokens without building a thing from scratch.

Why Restaking Matters for Solana’s Future

Enhanced Economic Security

By allowing multiple forms of collateral to secure a service, Jito (Re)staking drastically increases the cost to attack that service. A malicious actor would need to compromise or acquire a significant amount of each staked asset to do harm, and even then they’d be financially punished via slashing. This creates a kind of insurance mechanism for Solana’s dapps and off-chain integrations. While Solana’s base layer historically leaned on high performance over heavy slashing, adding restaking gives the network strong crypto-economic guarantees where needed. Critical services (like price oracles, bridges, DePIN, or upcoming Layer-2 networks) can bootstrap security from Solana’s existing stake pool, aligning their fate with the network’s economic security. This in turn hardens the overall resilience of the ecosystem – fewer single points of failure and a higher cost to subvert core services.

MEV and Fee Distribution

Solana’s design already reduces Maximal Extractable Value (MEV) compared to some chains, but Jito is at the forefront of making sure the MEV that does exist benefits the community. In fact, the first live NCN on Jito Restaking is the Jito Tip Router. This service captures a portion of transaction fees (tips) from Solana’s MEV ecosystem and redistributes it to restakers and validators.

For example, 0.15% of all Solana tip revenue is directed to SOL restakers, and another 0.15% to Jito’s own JTO token restakers, via the Tip Router vaults. By restaking, regular SOL stakers can earn a share of MEV income that normally only validators or block producers would get.

Originally, MEV tips were intended for stakers. What’s important is that restaking has removed the single point of control and decentralized this distribution process. Prior to the introduction of Tip Router, Jito managed the entire flow of MEV rewards internally. By delegating this responsibility to a restaking-enabled mechanism, the system now ensures a more transparent and inclusive reward path, bringing MEV income to a broader set of network participants.

This fair distribution of MEV rewards strengthens incentives for staking and keeps Solana’s validator set economically healthy. It’s a prime case of how restaking can channel new value streams (like MEV or fee rebates) back to the people securing the network.

Network Scaling and Utility

Restaking opens the door for Solana to scale horizontally in terms of services. Instead of every new decentralized service launching its own token and validator set (which dilutes security and is a huge engineering lift), they can plug into Jito (Re)staking as an NCN. This is much like an “AWS for decentralized trust” – a project can quickly borrow Solana’s security by creating a vault and defining slashing rules, and voila: they have a decentralized trust layer for their app. This could accelerate innovation by lowering the barrier to launch new protocols that require trustless execution or consensus. For Solana, this means more useful services running on or adjacent to the network without compromising security. It’s a path to scale out functionality (similar to Ethereum’s rollup ecosystem) while keeping the economic security tightly coupled with the Solana ecosystem, rather than fragmenting it.

Capital Efficiency & Staker Rewards

From a staker’s perspective, restaking makes Solana staking much more attractive. It layers additional rewards on top of base staking yield, essentially stacking yields from multiple sources.Instead of just earning ~7% APY from SOL inflation, a Solana staker might earn that plus oracle service fees, plus MEV tips, etc., all through one integrated platform. And they can do this while keeping their stake liquid via VRTs. This boosts participation (why sit idle with just one yield source when you can earn more, albeit with higher risk due to potential slashing?), which in turn increases the total stake securing Solana. More stake means higher economic security for the L1 as well.

Additionally, by making stake more productive, features like restaking could allow Solana to adjust its inflation down in the future without hurting validator economics, as suggested by some ecosystem researchers. In essence, restaking aligns incentives so that what’s good for the individual staker (maximizing returns) is also good for the network (strengthening security and utility).

Restaking, Liquid Restaking, & Liquid Restaking Tokens (LRTs)

Restaking allows assets staked to secure one network to be reused across multiple services, significantly boosting capital efficiency and economic security. However, just like traditional staking, restaking usually requires assets to remain locked, limiting their liquidity and usability elsewhere. This immobilization of capital reduces potential returns and restricts users' flexibility. To solve this challenge, Liquid Restaking Tokens (LRTs) were introduced, unlocking new possibilities for restakers by providing a liquid representation of their underlying restaking positions.

State of Liquid Restaking

The total amount of liquid restaked assets locked in the general liquid restaking market is $11.746b. Ether.Fi, a decentralized and non-custodial staking protocol on Ethereum, has a higher percentage of assets in the pool with a TVL of $6.543b, followed by other protocols such as Kelp, Renzo, and EigenPie, amongst others.

At the time of writing, there is $229.64m worth of actively liquid restaked assets on Solana, with Fragmetric leading the way with over 60% share of the restaked pool. Renzo, Kyros, etc account for the remaining significant portion of the pool, with Meta Pool mpSOL accounting for the least thus far.

Solana optimizes for fast execution speeds and low transaction costs at high volumes. Solana ultimately seeks to maximize performance for developers and users by fully leveraging available hardware performance capabilities, such that hardware is, in fact, the only restriction on network performance long-term. As the second-largest chain by TVL, the restaking landscape on Solana is well-poised for growth and transformation in the near to long-term future. One team seeking to propel the concept of Restaking on Solana is Fragmetric, as they are a project building the architecture needed to aggregate different staking technologies on the Solana network.

Restaking Approach: Solana vs. Ethereum

Fragmetric’s approach deliberately avoids the pitfalls observed in early Ethereum restaking. One major inefficiency in EigenLayer’s initial design was the use of single-token vaults and off-chain accounting. For instance, distributing rewards that come in many forms (imagine an oracle service paying out in its own token, plus perhaps USDC fees) is tricky on Ethereum. In practice, some Ethereum restaking projects resorted to simplifications like converting all rewards into a single token (e.g. swapping various tokens into ETH) before distributing, a clunky solution that dumps reward tokens on the market and loses granularity.

Even EigenLayer’s core system leans on off-chain processes: a “trusted” component computes each participant’s earnings off-chain and posts a Merkle root to Ethereum, which users then claim against. This off-chain reward distribution adds latency and opacity (participants have to trust the off-chain computation) and is necessary largely because doing complex, frequent calculations on Ethereum would be prohibitively expensive in gas. Similarly, Ethereum’s limited throughput makes real-time, multi-asset tracking difficult, so much so that EigenLayer is developing a separate data availability layer (EigenDA) to scale its capabilities.

Furthermore, liquid restaking protocols built on EigenLayer (e.g., Ether.fi, Swell, Renzo) experience operational friction when redistributing rewards to token holders. High Ethereum gas fees pose a challenge, making frequent or automated reward distributions economically infeasible. This often results in protocols indirectly passing gas costs onto users through manual claim processes or accumulating rewards to periodically adjust exchange rates, inadvertently creating selling pressure on AVS tokens. Solutions like King Protocol, which consolidates multiple AVS tokens into a single vault-backed token (KING), partially mitigate this but introduce new complexities, including smart contract risks, token peg stability issues, and reduced flexibility for individual reward token management.

Solana, by contrast, was built for high-frequency, on-chain computation with low fees, and Jito (Re)staking capitalizes on that. All reward distribution in Jito’s framework can happen on-chain, transparently. Because Solana can handle many transactions quickly, Fragmetric’s vaults are able to track and distribute multiple types of rewards in real time. In fact, Solana’s token infrastructure has unique features that Fragmetric leverages for it’s solana-native liquid restaking protocol. One example is the use of token extensions like the transfer hook, a program that allows attaching custom logic whenever a token is transferred. Fragmetric uses this to precisely track how long each user has held their VRT so that Node Consensus Network rewards (which might accrue over time in various tokens) can be split fairly. Every time someone moves their restaking token, the transfer hook updates an on-chain record of their “time-weighted” balance. Achieving this level of precision simply isn’t feasible on Ethereum’s ERC-20 standard without expensive workarounds.

Solana’s distinct edge stems from its recent advancements with Token-2022, the new SPL token standard that introduces sophisticated token extensions. Token-2022 maintains backward compatibility while unlocking advanced functionalities like transfer fees, transfer hooks, interest-bearing tokens, and confidential transfers via zero-knowledge proofs. These extensions offer developers an unprecedented level of customization in defining economic and operational behavior for tokens, something significantly constrained by the conventional ERC-20 standard on Ethereum.

This foundational difference in token standards brings us directly to Fragmetric. Built on Solana and integrating deeply with the Jito restaking ecosystem, Fragmetric harnesses the Token-2022 extensions to deliver uniquely tailored value accrual mechanisms. Specifically, Fragmetric issues fragSOL tokens representing deposited SOL or JitoSOL. Unlike traditional liquid staking tokens, fragSOL is a yield-bearing asset designed explicitly around Token-2022’s transfer hook functionality.

Solana’s Token-2022 standard extends the traditional SPL token model by enabling modular token functionalities without requiring separate vaults or permissioned contract layers. This is achieved through Token Extensions, a set of programmable token behaviors that allow for fine-grained control over transfers, fees, governance, and yield mechanisms.

Fragmetric fully embraces Token-2022 to create a yield-bearing, composable, and capital-efficient liquid restaking token (fragSOL) with native programmability. Unlike Ethereum’s vault-based restaking model, which requires off-chain governance and custom implementations to manage fee-sharing, Fragmetric uses on-chain, protocol-native extensions such as:

Transfer Hooks: Enables precise, programmatic control over token transfers. Fragmetric leverages this extension to track time-weighted holdings of fragSOL, enabling accurate and fair reward distribution directly on-chain. This eliminates the need for off-chain computation or vault-based reward systems.

Note: While Token-2022 supports other extensions like interest-bearing tokens and confidential transfers, Fragmetric currently utilizes only the transfer hook to implement its reward and accounting logic.

Fragmetric capitalizes on Transfer Hook extensions to ensure specific economic incentives and slashing conditions are programmatically enforced during token transfers. This sophisticated token design drastically reduces operational complexity and overhead associated with reward distribution—a challenge particularly acute in Ethereum’s ERC-20 and liquid restaking ecosystems.

In the subsequent section, we will explore Fragmetric’s technical architecture, focusing on how it distributes rewards. We will also examine how Fragmetric leverages the Token-2022 to dynamically accrue yield directly within fragSOL tokens, transparently reflecting accumulated staking and restaking rewards.

What is Fragmetric?

Fragmetric is a native liquid restaking protocol on Solana that aims to enhance Solana’s current ecosystem security as well as increase its economic potential. Through liquid restaking, the total amount of staked SOL across nodes increases, which helps to strengthen the network and improves security. Furthermore, the Token2022 extension improves capital efficiency by enabling users to restake without compromising capital efficiency.

Fragmetric is focused on building the infrastructure that is responsible for aggregating all restaking protocols on Solana. This raises an important question: What are the key objectives of Fragmetric that support its vision? The key objectives of Fragmetric are:

Establishing a Secure LRTs Standard: Fragmetric develops and maintains standards for LRTs to ensure accurate reward distribution. This allows such LRTs to be used as restaked assets across various protocols, improving capital efficiency—users earn restaking rewards and additional revenue at the same time.

Delegate Deposits to Secure Restaking Protocols: Fragmetric is developing a governance-based Risk Management Committee to verify the profitability and secureness of Node Consensus Networks (NCNs) and Autonomous Verifiable Services (AVSs).

Contribute to the growth of Solana with SANG: Through Fragmetric restaking, users become SANG—Solana Network Guard—guardians who secure Solana’s ecosystem.

With a seamless restaking experience made possible by Fragmetric, which has several features that aid in achieving economic security for Solana. This brings up the question: how does this procedure of restaking using Fragmetric work? The next section goes over how that is feasible.

The Fragmetric Restaking Process

The Fragmetric restaking process begins with the following steps:

Deposits: When a user first deposits SOL, LSTs, or other SPL Tokens into Fragmetric, they receive an equivalent amount of $fragmetric asset (e.g., fragSOL).

Normalized Token Program: This fragmetric program maintains precise conversion ratios between deposited assets and minted $fragmetric assets. Users’ combined deposits (SOL, LSTs, and other tokens) form a unified basket that Fragmetric allocates across various restaking protocols and NCN/AVS.

Rewards Distribution: Assets are delegated to partner validators who secure NCN/AVS networks. The earnings from these delegations are distributed to $fragmetric asset holders. Fragmetric serves as both a portfolio manager and a liquidity layer between users and restaking protocols.

Protocol Architecture

FRAG-22 is a novel token standard developed by Fragmetric that extends the capabilities of Solana’s Token-2022 program, particularly its transfer hook functionality. Originally designed to support Fragmetric’s liquid restaking infrastructure, FRAG-22 has evolved into a composable asset framework enabling unified management of multiple yield sources under a single token architecture.

At its core, FRAG-22 allows for multi-asset deposits, normalizing various input tokens (e.g., SOL, JitoSOL, mSOL) into a single fungible representation. This simplifies user experience while enhancing liquidity efficiency across DeFi protocols. Each FRAG-22 token captures not only the underlying asset value but also an on-chain record of contribution over time, used to calculate real-time, precise reward entitlements for each holder.

Unlike conventional token standards which rely on off-chain reward logic or inflexible vault systems, FRAG-22 embeds all reward accounting directly on-chain through programmable transfer logic. This allows FRAG-22 tokens to dynamically integrate with lending markets, liquidity pools, structured products, and yield strategies, all while maintaining transparent and predictable reward distribution.

As Solana’s DeFi ecosystem evolves, FRAG-22 sets a new bar for capital efficiency and composability, offering developers and users a powerful primitive to unlock more sophisticated and modular yield-generating applications.

To provide the infrastructure needed to aggregate all restaking protocols on Solana, the Fragmetric comprises the Fund, Operator, Reward, and Normalized Token Pool.

Fund, Operator, and Reward

In the Fragmetric ecosystem, the seamless management of user assets and precise distribution of staking rewards form the cornerstone of its value proposition. Three core modules—Fund, Operator, and Reward—coordinate closely to deliver an intuitive, secure, and transparent user experience. Let’s explore how these modules interact, followed by a simplified working example to illustrate exactly how rewards are managed and distributed within Fragmetric.

The Fund is the foundational module responsible for managing user deposits and withdrawals. Users deposit assets such as SOL or supported Liquid Staking Tokens (LSTs), including JitoSOL, mSOL, BNSOL, and bbSOL, directly into the Fund. Upon deposit, the Fund mints an equivalent value of fragSOL tokens for users. The quantity of fragSOL minted is dynamically determined using accurate, real-time price data sourced from the Normalized Token Pool (further detailed in subsequent sections).

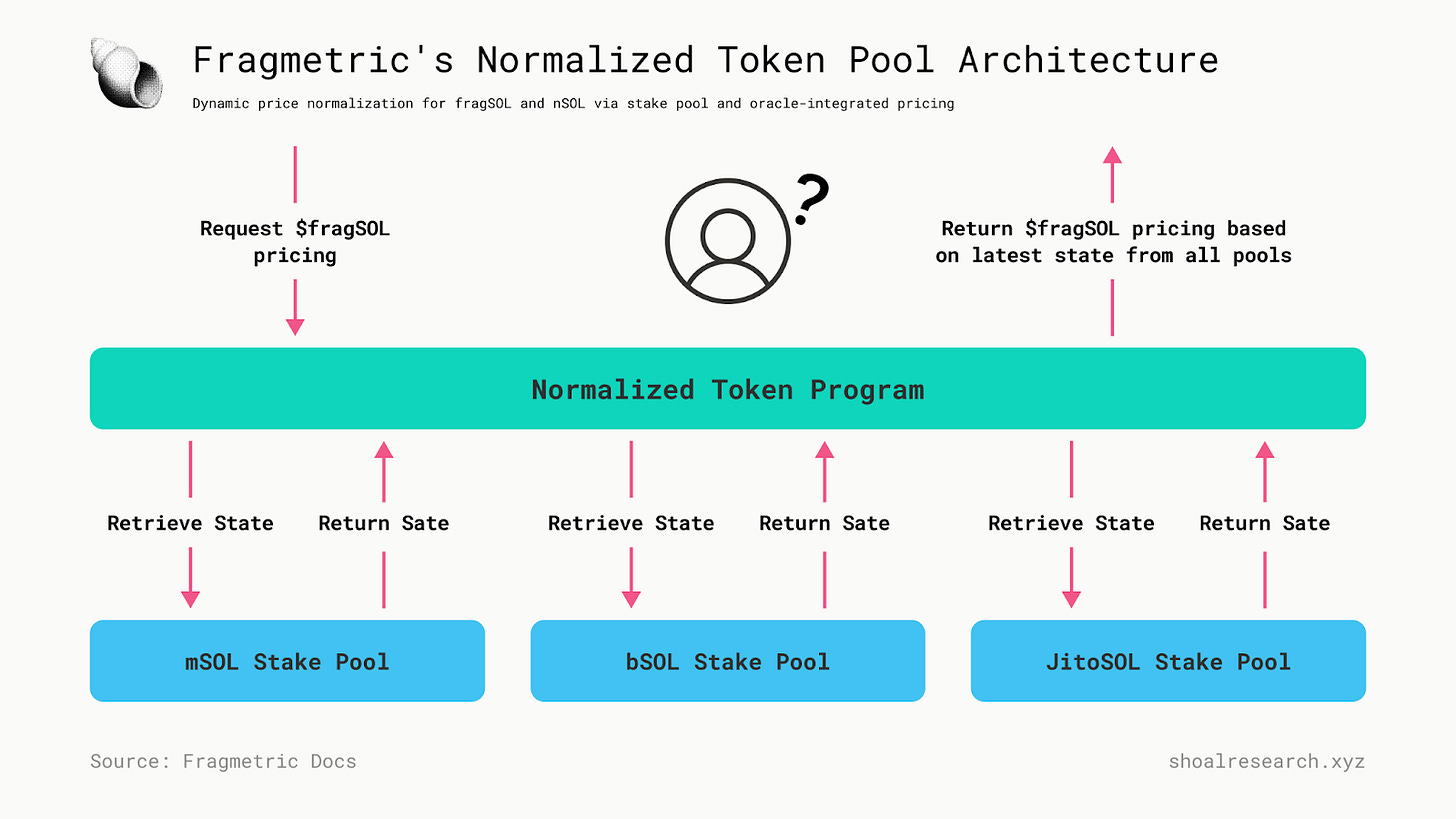

The following diagram demonstrates the interaction between users, the $fragSOL Fund, and the Oracle systems:

Deposits: Users deposit SOL or supported LSTs (including JitoSOL, mSOL, BNSOL, bbSOL) into the Fund.

Minting fragSOL: Upon receiving a deposit, the Fund mints fragSOL for the user. The number of tokens minted is determined by the current price data, reflecting the combined value of the underlying assets.

Withdrawals: Users may request withdrawals, prompting the Fund to burn the corresponding fragSOL and reserve the equivalent amount of SOL for them to claim. These withdrawal requests are processed on a periodic schedule.

Pricing fragSOL: The price of fragSOL is dynamically calculated based on the overall value of the LSTs managed by the Fund, ensuring that the tokens accurately represent each user’s share of the pooled assets.

The Operator comes next in line as it manages staking, restaking, withdrawal operations, and the execution of restaking strategies. It handles all asset flows from the fund and rewards that configure the investment strategy through integration with various staking and restaking protocols. The operator in Protocol is responsible for managing asset movements according to dynamically changing configurations. These configurations are adjusted based on withdrawal requests and the governance-driven restaking portfolio.

The Operator ensures the reconciliation of asset amounts between the fund, reserved fund, restaking protocols, and staking protocols. Its tasks include setting target amounts for the reserved fund account (to handle withdrawal requests) and determining unstaking and restaking amounts to maintain these targets. It configures investment allocations and delegates funds to the NCN Node operator based on the latest configurations.

The Reward Module is the core system of Fragmetric, designed to accurately distribute various rewards earned through restaking. By leveraging Solana's Token Program 2022—transfer hook, the program detects changes in the amount of fragSOL in user wallets, allowing the system’s internal logic to function seamlessly on-chain. Since all reward-related data is stored on-chain, users can easily predict the rewards they are entitled to receive. In traditional restaking systems, especially when using LRT, the user’s restaking reward tends to be diluted within the pool, making accurate participation calculations difficult. Fragmetric has overcome this issue by utilizing an Only Possible On Solana solution that ensures precise calculation of the user’s reward and equitable reward distribution.

Normalized Token Pool

Although Fragmetric operates similarly to other liquid staking protocols on Solana by exchanging SOL and LSTs for fragSOL and nSOL, it takes a unique approach by supporting restaking across multiple LSTs through the Normalized Token Program.

Other LSTs like jitoSOL, mSOL, and bnSOL all hold different values due to varying differences in staking yield, protocol fees, and reward distributions. This further pushes the need to issue fragSOL at an equivalent rate before minting. To tackle this, the Oracle-based approach was employed, where oracle systems like Switchboard and Pyth Network ensure that fragSOL is priced. Conversely, despite the Oracle-based approach offering higher security and serving as a reliable fallback system, their involvement in this process is unreliable as they provide price feeds that reflect the broader market conditions for these LSTs and are further used to determine the price of fragSOL. At the time of writing, Fragmetric's Normalized Token Pool holds over 760K+ LSTs, including more than 750K JitoSOL.

Fragmetric brings a new approach as it directly taps into their respective stake pool, giving access to the on-chain state data like the current value of staked assets, rewards distributed, or performance metrics. By using all the on-chain data, the system accurately accesses the value of SOL-based LSTs and calculates the fragSOL issuance rate. This provides users with a reliable and transparent pricing mechanism.

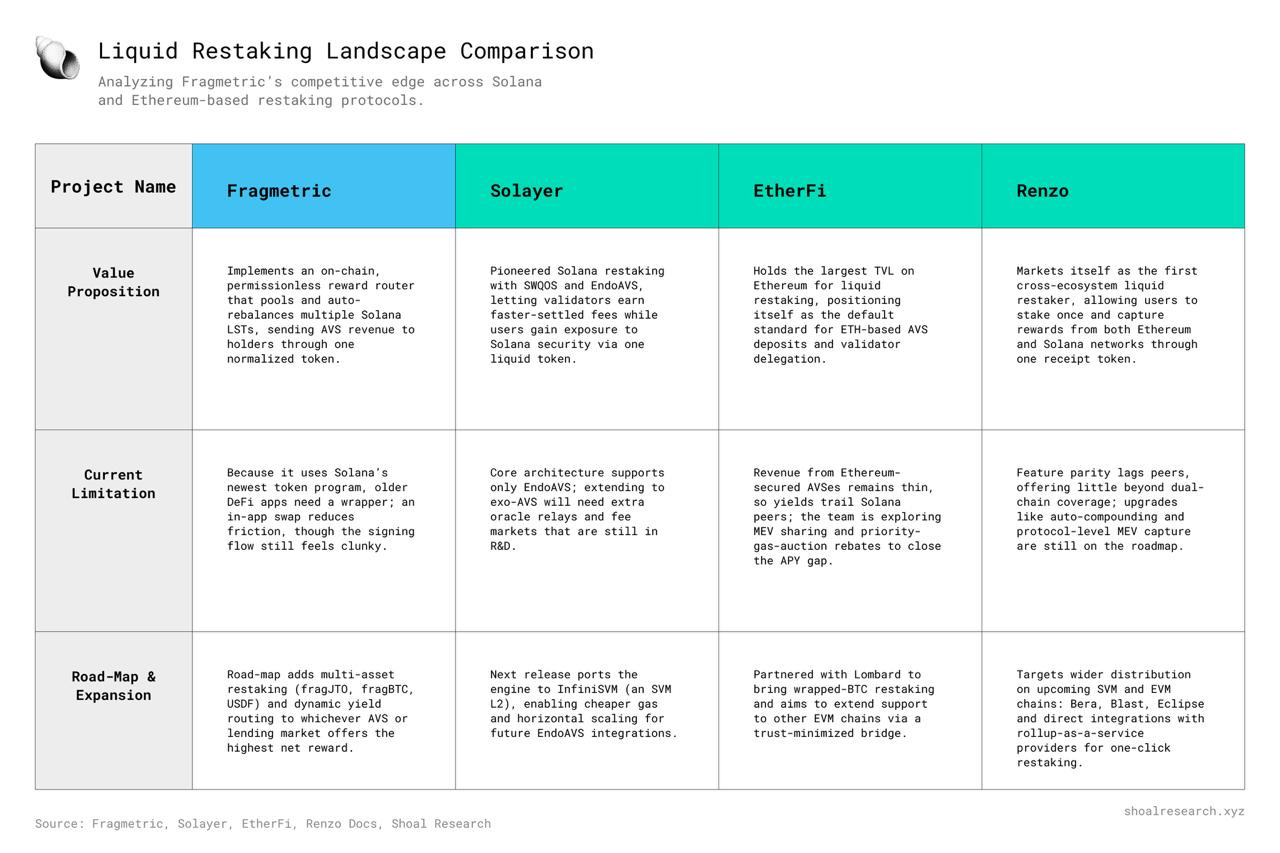

Competitive Landscape

Fragmetric enters a competitive landscape that includes crypto-restaking upstarts. Key players include crypto-native platforms like Renzo and Kyros.

Fragmetric’s edge lies in its token mechanics, multi-asset staking approach, and real-time on-chain pricing. Unlike Renzo and Kyros, Fragmetric goes all-in on Token-2022, letting rewards accrue natively and cutting out the manual vault swaps. While Renzo and Kyros keep it simple with single-asset restaking, Fragmetric aggregates multiple LSTs—JitoSOL, mSOL, BNSOL, and bbSOL—into fragSOL, making it more capital-efficient, which is possible via its Normalized Token Program. Then there’s pricing, for eg, Renzo rely on its oracles, which can lag behind real staking rewards. Fragmetric pulls data straight from Solana’s stake pools, meaning more accurate pricing and smoother reward distribution. The result? A smarter, more composable restaking model that actually fits the way Solana works.

Tokenomics

fragSOL and fragJTO

fragSOL is Solana’s first Liquid Restaking Token (LRT) and the culmination of Fragmetric’s technological innovation. By restaking SOL or other Liquid Staking Tokens (JitoSOL, mSOL, BNSOL, or bbSOL) through the Fragmetric protocol, you receive fragSOL, which represents your restaked SOL or LST and entitles you to:

Solana Staking Yield: Fragmetric collaborates with top-tier yield-focused protocols, aiming to deliver competitive returns to fragSOL holders.

MEV Rewards: All SOL and LSTs deposited into Fragmetric are used to secure TipRouter, the first Node Consensus Network (NCN) under Jito Restaking. MEV tips generated from these activities are distributed to fragSOL holders, boosting overall APY.

Additional Restaking Revenue: With integrations on the Jito (Re)staking Protocol, including collaborations with NCNs, Fragmetric efficiently redistributes extra restaking rewards to fragSOL holders.

fragJTO is the first non-SOL Liquid Restaking Token (LRT) introduced by Fragmetric. By staking JTO, the governance token of the Jito Protocol, you receive fragJTO, which represents your staked JTO and entitles you to:

MEV Rewards: The JTO is utilized to secure TipRouter, a core component of the MEV ecosystem on Solana. The MEV tips generated here are shared with fragJTO holders, enhancing overall APY.

Additional Restaking Revenue: With integrations on the Jito (Re)staking Protocol, including collaborations with NCNs, Fragmetric efficiently redistributes extra restaking rewards to fragJTO holders.

wfragSOL and wfragJTO

wfragJTO are wrapped versions of fragJTO, designed for broader DeFi compatibility. Some DeFi protocols do not support Token Extension (also known as Token-2022), an advanced token program on the Solana blockchain. To address this, wfragSOL and wfragJTO were created as DeFi-compatible versions of fragSOL and fragJTO, with the wrapped tokens pegged to their respective tokens.

Partners

Switchboard is launching its external Jito Node Consensus Network (NCN) on Solana, in collaboration with Fragmetric, its exclusive Vault Receipt Token (VRT) provider. This partnership enhances the security, efficiency, and decentralization of Switchboard’s oracle services. Fragmetric enables users to restake SOL, JitoSOL, and other LSTs, earning additional rewards on top of existing restaking and MEV yields.

Switchboard’s decision to exclusively partner with Fragmetric for its Jito Node Consensus Network (NCN) restaking launch is rooted in the protocol’s deep technical alignment with Solana’s architecture and its unique ability to optimize staking capital across assets. While Switchboard could have opted for generalized VRT solutions, Fragmetric offers a specialized, purpose-built infrastructure that addresses the specific demands of decentralized oracle networks.

Fragmetric’s Restaking Vaults are engineered to support a diverse basket of LSTs such as JitoSOL, mSOL, and bSOL, and seamlessly convert them into normalized restaking collateral via its proprietary Normalized Token Program. This system ensures efficient and fair restaking value attribution. This is critical for oracle security where precision in capital allocation and slashing guarantees are non-negotiable.

More importantly, Fragmetric’s integration with Token-2022 and use of transfer hooks allows Switchboard to track user-level contributions with time-weighted precision, all on-chain. This real-time reward infrastructure drastically reduces the operational overhead associated with reward tracking and MEV distribution. These are two of the most critical value flows for oracle participants.

Unlike general-purpose liquid restaking solutions that are built for simplicity or cross-chain compatibility, Fragmetric is Solana-native by design. This enables it to plug directly into Switchboard’s high-throughput oracle layer and deliver capital-efficient security without compromising decentralization or composability. The collaboration ensures that restakers can participate with minimal friction, while Switchboard gains robust security guarantees, transparent economic alignment, and a predictable pathway for incentivizing reliable oracle node operators.

By leveraging Fragmetric’s advanced infrastructure, Switchboard becomes the first external NCN on Jito Restaking to implement decentralized and economically driven oracle security. This sets a new standard for how oracle networks are bootstrapped in the Solana ecosystem.

Protocol Usecases

Let’s explore some of the use cases of Fragmetric:

Liquidity Provision on Orca

Fragmetric integrates with Orca’s Concentrated Liquidity Automated Market Maker (CLAMM) to enhance capital efficiency for liquidity providers. By allocating liquidity within specific price ranges, providers can maximize yield compared to traditional AMMs. Users supplying liquidity to pools such as wfragSOL-JitoSOL or wfragJTO-JTO earn a share of trading fees, ensuring continuous rewards from asset swaps. These fees are distributed proportionally among liquidity providers.

Automated Liquidity Vaults on Kamino

Kamino's liquidity vaults are an automated liquidity solution that allows users to earn yields on their crypto assets by providing liquidity to concentrated liquidity market makers (CLMMs).

Fragmetric utilizes Kamino’s automated liquidity vaults to simplify liquidity provision in concentrated liquidity market makers (CLMMs). These vaults deploy liquidity into Orca pools, allowing users to deposit assets like wfragSOL or wfragJTO while simultaneously earning fragAsset-based yield and trading fees. This automation optimizes capital deployment and enhances returns for liquidity providers.

Yield Trading on Exponent

Exponent is a yield exchange protocol on Solana for fixed-rate and leveraged yield farming. Users can exchange their productive yield assets (e.g., Jito’s VRTs, lending positions, yield-bearing tokens) for a fixed return or amplified exposure to their yield.

Fragmetric enables users to participate in yield trading through Exponent. Users can trade yield-bearing assets (e.g., Jito’s VRTs) for fixed returns or amplified exposure to yield fluctuations. High-risk, high-return traders can maximize F Point exposure by taking a long position on yield through YT-fragAsset, while liquidity providers earn staking rewards, swap fees, fixed yield, and additional point boosts.

Yield Trading on RateX

RateX Protocol is a decentralized exchange (DEX) built on Solana, specializing in leveraged yield trading. On RateX, users can trade synthetic Yield Tokens (YT) of various yield-bearing assets (YBA) with leverage, benefiting from yield movements in a capital-efficient way.

By integrating with RateX, Fragmetric leverages yield trading on synthetic Yield Tokens (YT) of various yield-bearing assets. Users can capitalize on yield fluctuations in a capital-efficient manner while also accessing fixed-yield and liquidity farming options. Those seeking high-risk, high-reward strategies can increase F Point exposure, while liquidity providers benefit from staking rewards, swap fees, and special point incentives.

Whitelisting and Liquidity Expansion

While DeFi liquidity pools and vaults are permissionless, Fragmetric initially whitelists only Orca and Kamino, ensuring F Points rewards remain exclusive to these platforms. As liquidity deepens and stabilizes, Fragmetric plans to expand its whitelist, increasing accessibility and optimizing incentives across additional DeFi protocols.

Wrapping Up

Fragmetric effectively addresses significant challenges within the Ethereum-based restaking ecosystem by leveraging Solana's powerful Token-2022 extension. This innovative extension enables Fragmetric to seamlessly perform all reward calculations directly on-chain, storing reward-related data transparently and ensuring accurate, predictable reward distributions. Users benefit from this design as it provides clear, verifiable reward tracking and allows them to directly claim their rewards on-chain, enhancing both transparency and user confidence.

With the Token-2022 extension, Fragmetric can dynamically calculate rewards based entirely on on-chain contribution data, simplifying the tracking process and ensuring equitable distribution without off-chain intermediaries. This streamlined approach significantly reduces operational complexities and the selling pressure commonly observed in Ethereum's liquid restaking protocols, resulting in a healthier overall ecosystem.

Fragmetric currently maintains a robust Total Value Locked (TVL) exceeding $210 million and continues to experience rapid growth. As its ecosystem expands, it has attracted notable protocol partnerships, including Switchboard Oracle and Sonic’s HyperGrid, further validating the effectiveness and appeal of its reward distribution model.

As Solana's restaking landscape continues to evolve and expand, Fragmetric is well-positioned to become the industry standard, setting a benchmark in transparency, operational efficiency, and user experience. If this trajectory continues, Fragmetric could redefine the liquid restaking market, making it more predictable, secure, and beneficial for both users and participating protocols alike.

References

Fragmetric Documentation

Shoal Research Articles on Restaking and Yield Strategies

EigenLayer Documentation

Solana Token-2022 Resources

Not financial or tax advice. The purpose of this post is purely educational and should not be considered as investment advice, legal advice, a request to buy or sell any assets, or a suggestion to make any financial decisions. It is not a substitute for tax advice. Please consult with your accountant and conduct your own research.

Disclosures. All posts are the author's own, not the views of their employer. This post has been created in collaboration with the Fragmetric team. At Shoal Research, we aim to ensure all content is objective and independent. Our internal review processes uphold the highest standards of integrity, and all potential conflicts of interest are disclosed and rigorously managed to maintain the credibility and impartiality of our research.